Various factors have catalyzed innovations in labelling machines. With growing awareness about the hazardous effects of plastic on the environment, companies are increasing research to remove all plastic from their label product packaging. As such, labelling, decorating, and coding machines product segment is estimated to lead the packaging machinery market, in terms of volume. Moreover, the global packaging machinery market is projected to reach an output of ~2,573,400 units by 2026. Hence, manufacturers in the market for packaging machinery are innovating in peel and reveal labels.

Companies in the packaging machinery market are increasing their efficacy in novel technologies that can insert unique codes on the inside page to help stakeholders drive traffic to their website. On the other hand, embossed and laminated labels are being created on different substrates. Stakeholders in various end markets are investing in automatic labelling systems to cater to Radio Frequency Identification (RFID) and barcode scanning applications.

Innovative packaging machinery has helped manufacturers to save cost on time and manpower. Companies in the packaging machinery market are introducing latest technologies for sterile filling. For instance, special manufacturer of primary packaging Lameplast, presented their new machinery Pentafill A25- an automatic sealing and filling machine designed to function in sterile environments.-Dedicated and appealing products require innovations in filling and dosing machines. As such, the filling & dosing machines product segment of the packaging machinery market is expected to account for the highest revenue by the end of 2026. Hence, manufacturers are increasing R&D in filling & dosing machines to diversify their packaging services.

Currently, there is a growing demand for single-dose unit packaging in the market for packaging machinery. Companies are increasing research to induce versatility in these novel filling & dosing machines. Stakeholders in various end markets are benefitting from the advantages of compact machines that fit in small rooms and are easy to maintain.

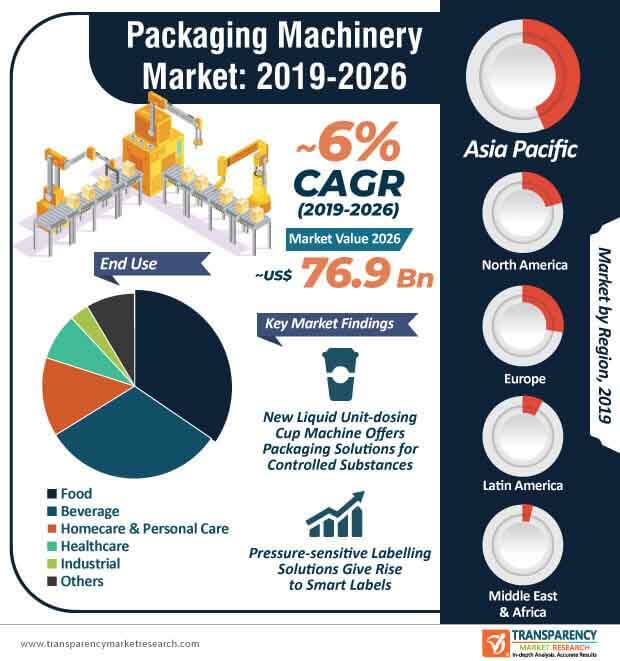

The packaging machinery market is expected to grow at a CAGR of ~6% during the forecast period. Technological innovations are likely to boost market growth. However, challenges of floorspace and accuracy of machines act as a barrier for packaging companies, especially in the pharmaceutical landscape. Hence, companies are introducing new liquid unit-dosing cup machines that ensure accuracy in packaging of controlled substance without sacrificing the floorspace. These novel machines are being manufactured to target small pharmaceutical manufacturers and contract development & manufacturing organizations (CDMOs).

Since the beverage end use segment is anticipated to account for a significant share of the packaging machinery market, companies are increasing their production capacities to manufacture coffee capsule packaging machine. They are aiming to transform the operational procedures by introducing virtual operation in the machines. Multilane sachet packaging systems are growing popular in the market for packaging machinery. Companies are increasing the availability of end-to-end automated packaging solutions using the vertical form-fill-seal technology. On the basis of this technology, companies in the market for packaging machinery are making it possible to group and package sachets in tamper evident cartons.

The ever-growing packaging machinery market is undergoing a change with the introduction of software-controlled pick & place case packing solutions. For instance, Blueprint Automation-a provider of innovative packaging automation solutions, has gained expertise in vision-guided robotic case and tray loading. Companies in the packaging machinery market are leveraging these robotic machines with cameras that are used as sensors to handle packages of any dimension. This attribute of robotic machines has helped stakeholders in the value chain to reach high production levels. Thus, stakeholders are receiving value for money, as these automatic systems are highly adaptive in functionality.

Likewise, companies in the market for packaging machinery are increasing R&D in cost-efficient automated box packaging technology. Multiple functions in a single system, such as opening, folding the flaps, and sealing in one go are gaining the attention of stakeholders in various end markets. This novel technology is acquiring popularity, since it helps to save secondary packaging time and efforts, especially for shipping large volume of goods.

Analysts’ Viewpoint

There is a growing demand for packaging machinery that aligns with the existing packaging line. Since food end use segment is projected to lead the packaging machinery market, in terms of value and volume, companies are developing flow wrapper machines built using the cold-seal technology.

Smart labels are gaining prominence in the packaging sector. However, risks of allergies and deaths caused due to incomplete labelling poses as a restraint for companies. Hence, companies should create awareness about full-ingredient labelling to avoid risk to health of consumers. As technology becomes more scalable, medium and large-scale end user manufacturers are anticipated to increasingly opt for automated product packaging.

According to Transparency Market Research's latest report on the packaging machinery market for the historical period of 2013-2018 and forecast period of 2019-2026, demand for machinery automation and renovation is anticipated to boost demand for packaging machinery services. Globally, the packaging machinery market was valued at ~US$ 49 Bn in 2018 and is anticipated to witness a CAGR of ~6% during the forecast period of 2019-2026.

The Packaging Machinery Market is studied from 2019 - 2026.

The global packaging machinery market is projected to reach an output of ~2,573,400 units by 2026.

Packaging Machinery Market Look To Incorporate Coding System To Boost Demand, Valuation Set To Rise At CAGR Of 6% During 2019-2026

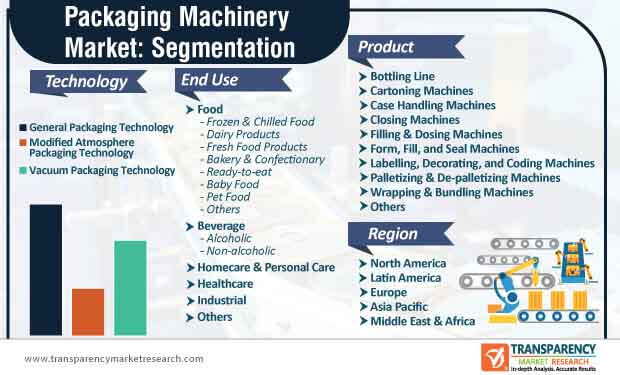

The global Packaging Machinery Market is segmented on basis of application, types , product and key regions.

Some of the important players in the packaging machinery market are Tetra Pak International S.A., Coesia S.p.A, Marchesini Group S.p.A., I.M.A. Industria Macchine Automatiche SpA, and Robert Bosch GmBH.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Viewpoint

2.1. Market Definition

2.1.1. Product Definition

2.1.2. Technology Definition

2.2. Market Taxonomy

2.3. Macro-Economic Overview

2.3.1. Global Economic Outlook

2.3.2. Global Packaging Industry Outlook

2.3.2.1. Global Flexible Packaging Industry Outlook

2.3.2.2. Global Rigid Packaging Industry Outlook

2.3.3. Global Food & Beverages Industry Overview

2.3.4. Macro-Economic Factors

2.3.5. Global Packaging Trends

2.4. Opportunity Analysis

3. Packaging Machinery Market Overview

3.1. Introduction

3.2. Packaging Machinery Market and Y-o-Y Growth

3.3. Packaging Machinery Market (US$ Mn) and Forecast

3.4. Packaging Machinery Market Value Chain Analysis

3.4.1. Profitability Margins

3.4.2. List of Active Participants

3.4.2.1. Component and Parts Suppliers

3.4.2.2. Manufacturers

3.4.2.3. Distributors

3.4.2.4. End-Users

3.4.2.5. List of Key Market Participants, by Machine Type

3.4.3. Top 20 Food Companies in the World

3.4.4. Top 30 Beverage Companies in the World

4. Packaging Machinery Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Value (US$ Mn) and Forecast

4.2.1. Market Value and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Packaging Machinery Market Dynamics

5.1. Packaging Machinery Quality & Cost Comparison, by Key Countries

5.2. Italy Packaging Machinery Market Outlook

5.3. China Packaging Machinery Market Outlook

5.4. Germany Packaging Machinery Market Outlook

5.5. India Packaging Machinery Market Outlook

5.6. Drivers

5.6.1. Supply Side

5.6.2. Demand Side

5.7. Restraints

5.8. Industry Trends and Recent Developments

5.8.1. Design Level Trends and Market Developments

5.8.2. End-Use Industry Trends and Market Developments

5.8.3. Business Level Trends and Market Developments

5.9. Opportunity

5.10. Challenges

6. Global Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026, by Product Type

7. (Comprehensive revenue (US$ Mn) and volume (Units) analysis on global Packaging Machinery market, By Product Type)

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis By Product Type

7.1.2. Y-o-Y Growth Projections By Product Type

7.2. Market Value (US$ Mn) and Volume (Units) Forecast, By Product Type

7.2.1. Bottling Line

7.2.2. Cartoning Machines

7.2.3. Case Handling

7.2.4. Closing

7.2.5. Filling and Dosing

7.2.6. Form, Fill, and Seal

7.2.7. Labelling, Deco., and Coding

7.2.8. Palletizing & De-palletizing

7.2.9. Wrapping & Bundling

7.2.10. Others

7.3. Market Attractiveness Analysis By Product Type

7.4. Prominent Trends

8. Global Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026, by Packaging Technology

9. (Comprehensive revenue (US$ Mn) and volume (Units) analysis on global Packaging Machinery market, By Packaging Technology)

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By Packaging Technology

9.1.2. Y-o-Y Growth Projections By Packaging Technology

9.2. Market Value (US$ Mn) and Volume (Units) Forecast, By Packaging Technology

9.2.1. General Packaging Tech.

9.2.2. MAP Technology

9.2.3. Vacuum Packaging

9.3. Market Attractiveness Analysis By Packaging Technology

9.4. Prominent Trends

10. Global Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026, by End Use Industry

11. (Comprehensive revenue (US$ Mn) and volume (Units) analysis on global Packaging Machinery market, By End Use Industry)

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis By End Use Industry

11.1.2. Y-o-Y Growth Projections By End Use Industry

11.2. Market Value (US$ Mn) and Volume (Units) Forecast, By End Use Industry

11.2.1. Food

11.2.1.1. Frozen and Chilled Food

11.2.1.2. Dairy Products

11.2.1.3. Fresh Food Products

11.2.1.4. Bakery & Confectionary

11.2.1.5. Ready-to-Eat

11.2.1.6. Baby Food

11.2.1.7. Pet Food

11.2.1.8. Others

11.2.2. Beverages

11.2.2.1. Alcoholic Beverages

11.2.2.2. Non-Alcoholic Beverages

11.2.3. Homecare & Personal Care

11.2.4. Healthcare

11.2.5. Industrial

11.2.6. Others

11.3. Market Attractiveness Analysis By End Use Industry

11.4. Prominent Trends

12. Global Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026, by Region

13. (This section provides region-wise forecast to readers)

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis By Region

13.1.2. Y-o-Y Growth Projections By Region

13.2. Market Value (US$ Mn) and Volume (Units) Forecast By Region

13.2.1. North America

13.2.2. Europe

13.2.3. Asia Pacific

13.2.4. Latin America

13.2.5. Middle East and Africa (MEA)

13.3. Market Attractiveness Analysis By Region

13.4. Prominent Trends

14. North America Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026

15. (This section contains comprehensive revenue (US$ Mn) and volume (Units) analysis on North America Packaging Machinery market)

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.2. Market Value (US$ Mn) and Volume (Units) Forecast By Country

15.2.1. U.S.

15.2.2. Canada

15.3. Market Value (US$ Mn) and Volume (Units) Forecast By Product Type

15.3.1. Bottling Line

15.3.2. Cartoning Machines

15.3.3. Case Handling

15.3.4. Closing

15.3.5. Filling and Dosing

15.3.6. Form, Fill, and Seal

15.3.7. Labelling, Deco., and Coding

15.3.8. Palletizing & De-palletizing

15.3.9. Wrapping & Bundling

15.3.10. Others

15.4. Market Value (US$ Mn) and Volume (Units) Forecast By Packaging Technology

15.4.1. General Packaging Tech.

15.4.2. MAP Technology

15.4.3. Vacuum Packaging

15.5. Market Value (US$ Mn) and Volume (Units) Forecast By End Use Industry

15.5.1. Food

15.5.1.1. Frozen and Chilled Food

15.5.1.2. Dairy Products

15.5.1.3. Fresh Food Products

15.5.1.4. Bakery & Confectionary

15.5.1.5. Ready-to-Eat

15.5.1.6. Baby Food

15.5.1.7. Pet Food

15.5.1.8. Others

15.5.2. Beverages

15.5.2.1. Alcoholic Beverages

15.5.2.2. Non-Alcoholic Beverages

15.5.3. Homecare & Personal Care

15.5.4. Healthcare

15.5.5. Industrial

15.5.6. Others

15.6. Market Attractiveness Analysis

15.6.1. By Country

15.6.2. By Product Type

15.6.3. By Packaging Technology

15.6.4. By End Use Industry

15.7. Prominent Trends

15.8. Drivers and Restraints: Impact Analysis

16. Latin America Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026

17. (This section contains comprehensive revenue (US$ Mn) and volume (Units) analysis on Latin America Packaging Machinery market)

17.1. Introduction

17.1.1. Market share and Basis Points (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.2. Market Value (US$ Mn) and Volume (Units) Forecast By Country

17.2.1. Brazil

17.2.2. Mexico

17.2.3. Rest of Latin America

17.3. Market Value (US$ Mn) and Volume (Units) Forecast By Product Type

17.3.1. Bottling Line

17.3.2. Cartoning Machines

17.3.3. Case Handling

17.3.4. Closing

17.3.5. Filling and Dosing

17.3.6. Form, Fill, and Seal

17.3.7. Labelling, Deco., and Coding

17.3.8. Palletizing & De-palletizing

17.3.9. Wrapping & Bundling

17.3.10. Others

17.4. Market Value (US$ Mn) and Volume (Units) Forecast By Packaging Technology

17.4.1. General Packaging Tech.

17.4.2. MAP Technology

17.4.3. Vacuum Packaging

17.5. Market Value (US$ Mn) and Volume (Units) Forecast By End Use Industry

17.5.1. Food

17.5.1.1. Frozen and Chilled Food

17.5.1.2. Dairy Products

17.5.1.3. Fresh Food Products

17.5.1.4. Bakery & Confectionary

17.5.1.5. Ready-to-Eat

17.5.1.6. Baby Food

17.5.1.7. Pet Food

17.5.1.8. Others

17.5.2. Beverages

17.5.2.1. Alcoholic Beverages

17.5.2.2. Non-Alcoholic Beverages

17.5.3. Homecare & Personal Care

17.5.4. Healthcare

17.5.5. Industrial

17.5.6. Others

17.6. Market Attractiveness Analysis

17.6.1. By Country

17.6.2. By Product Type

17.6.3. By Packaging Technology

17.6.4. By End Use Industry

17.7. Prominent Trends

17.8. Drivers and Restraints: Impact Analysis

18. Europe Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026

19. (This section contains comprehensive revenue (US$ Mn) and volume (Units) analysis on Europe Packaging Machinery market)

19.1. Introduction

19.1.1. Market share and Basis Points (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.2. Market Value (US$ Mn) and Volume (Units) Forecast By Country

19.2.1. Germany

19.2.2. Spain

19.2.3. Italy

19.2.4. France

19.2.5. U.K.

19.2.6. BENELUX

19.2.7. Russia

19.2.8. Rest of Europe

19.3. Market Value (US$ Mn) and Volume (Units) Forecast By Product Type

19.3.1. Bottling Line

19.3.2. Cartoning Machines

19.3.3. Case Handling

19.3.4. Closing

19.3.5. Filling and Dosing

19.3.6. Form, Fill, and Seal

19.3.7. Labelling, Deco., and Coding

19.3.8. Palletizing & De-palletizing

19.3.9. Wrapping & Bundling

19.3.10. Others

19.4. Market Value (US$ Mn) and Volume (Units) Forecast By Packaging Technology

19.4.1. General Packaging Tech.

19.4.2. MAP Technology

19.4.3. Vacuum Packaging

19.5. Market Value (US$ Mn) and Volume (Units) Forecast By End Use Industry

19.5.1. Food

19.5.1.1. Frozen and Chilled Food

19.5.1.2. Dairy Products

19.5.1.3. Fresh Food Products

19.5.1.4. Bakery & Confectionary

19.5.1.5. Ready-to-Eat

19.5.1.6. Baby Food

19.5.1.7. Pet Food

19.5.1.8. Others

19.5.2. Beverages

19.5.2.1. Alcoholic Beverages

19.5.2.2. Non-Alcoholic Beverages

19.5.3. Homecare & Personal Care

19.5.4. Healthcare

19.5.5. Industrial

19.5.6. Others

19.6. Market Attractiveness Analysis

19.6.1. By Country

19.6.2. By Product Type

19.6.3. By Packaging Technology

19.6.4. By End Use Industry

19.7. Prominent Trends

19.8. Drivers and Restraints: Impact Analysis

20. Asia Pacific Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026

21. (This section contains comprehensive revenue (US$ Mn) and volume (Units) analysis on Asia Pacific Packaging Machinery market)

21.1. Introduction

21.1.1. Market share and Basis Points (BPS) Analysis By Country

21.1.2. Y-o-Y Growth Projections By Country

21.2. Market Value (US$ Mn) and Volume (Units) Forecast By Country

21.2.1. China

21.2.2. India

21.2.3. Japan

21.2.4. ASEAN

21.2.5. Australia and New Zealand

21.2.6. Rest of APAC

21.3. Market Value (US$ Mn) and Volume (Units) Forecast By Product Type

21.3.1. Bottling Line

21.3.2. Cartoning Machines

21.3.3. Case Handling

21.3.4. Closing

21.3.5. Filling and Dosing

21.3.6. Form, Fill, and Seal

21.3.7. Labelling, Deco., and Coding

21.3.8. Palletizing & De-palletizing

21.3.9. Wrapping & Bundling

21.3.10. Others

21.4. Market Value (US$ Mn) and Volume (Units) Forecast By Packaging Technology

21.4.1. General Packaging Tech.

21.4.2. MAP Technology

21.4.3. Vacuum Packaging

21.5. Market Value (US$ Mn) and Volume (Units) Forecast By End Use Industry

21.5.1. Food

21.5.1.1. Frozen and Chilled Food

21.5.1.2. Dairy Products

21.5.1.3. Fresh Food Products

21.5.1.4. Bakery & Confectionary

21.5.1.5. Ready-to-Eat

21.5.1.6. Baby Food

21.5.1.7. Pet Food

21.5.1.8. Others

21.5.2. Beverages

21.5.2.1. Alcoholic Beverages

21.5.2.2. Non-Alcoholic Beverages

21.5.3. Homecare & Personal Care

21.5.4. Healthcare

21.5.5. Industrial

21.5.6. Others

21.6. Market Attractiveness Analysis

21.6.1. By Country

21.6.2. By Product Type

21.6.3. By Packaging Technology

21.6.4. By End Use Industry

21.7. Prominent Trends

21.8. Drivers and Restraints: Impact Analysis

22. Middle East and Africa Packaging Machinery Market Historical 2013-2018 and Forecast 2019-2026

23. (This section contains comprehensive revenue (US$ Mn) and volume (Units) analysis on Middle East and Africa Packaging Machinery market)

23.1. Introduction

23.1.1. Market share and Basis Points (BPS) Analysis By Country

23.1.2. Y-o-Y Growth Projections By Country

23.2. Market Value (US$ Mn) and Volume (Units) Forecast By Country

23.2.1. North Africa

23.2.2. South Africa

23.2.3. GCC countries

23.2.4. Rest of MEA

23.3. Market Value (US$ Mn) and Volume (Units) Forecast By Product Type

23.3.1. Bottling Line

23.3.2. Cartoning Machines

23.3.3. Case Handling

23.3.4. Closing

23.3.5. Filling and Dosing

23.3.6. Form, Fill, and Seal

23.3.7. Labelling, Deco., and Coding

23.3.8. Palletizing & De-palletizing

23.3.9. Wrapping & Bundling

23.3.10. Others

23.4. Market Value (US$ Mn) and Volume (Units) Forecast By Packaging Technology

23.4.1. General Packaging Tech.

23.4.2. MAP Technology

23.4.3. Vacuum Packaging

23.5. Market Value (US$ Mn) and Volume (Units) Forecast By End Use Industry

23.5.1. Food

23.5.1.1. Frozen and Chilled Food

23.5.1.2. Dairy Products

23.5.1.3. Fresh Food Products

23.5.1.4. Bakery & Confectionary

23.5.1.5. Ready-to-Eat

23.5.1.6. Baby Food

23.5.1.7. Pet Food

23.5.1.8. Others

23.5.2. Beverages

23.5.2.1. Alcoholic Beverages

23.5.2.2. Non-Alcoholic Beverages

23.5.3. Homecare & Personal Care

23.5.4. Healthcare

23.5.5. Industrial

23.5.6. Others

23.6. Market Attractiveness Analysis

23.6.1. By Country

23.6.2. By Product Type

23.6.3. By Packaging Technology

23.6.4. By End Use Industry

23.7. Prominent Trends

23.8. Drivers and Restraints: Impact Analysis

24. Competitive Landscape

24.1. Competition Dashboard

24.2. Company Market Share Analysis

24.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

24.4. Global Players

24.4.1. Robert Bosch GmbH

24.4.1.1. Overview

24.4.1.2. Financials

24.4.1.3. Strategy

24.4.1.4. Recent Developments

24.4.1.5. SWOT analysis

24.4.2. I.M.A. Industria Macchine Automatiche SpA

24.4.2.1. Overview

24.4.2.2. Financials

24.4.2.3. Strategy

24.4.2.4. Recent Developments

24.4.2.5. SWOT analysis

24.4.3. Tetra Pak International S.A.

24.4.3.1. Overview

24.4.3.2. Financials

24.4.3.3. Strategy

24.4.3.4. Recent Developments

24.4.3.5. SWOT analysis

24.4.4. Coesia S.p.A.

24.4.4.1. Overview

24.4.4.2. Financials

24.4.4.3. Strategy

24.4.4.4. Recent Developments

24.4.4.5. SWOT analysis

24.4.5. Marchesini Group S.p.A.

24.4.5.1. Overview

24.4.5.2. Financials

24.4.5.3. Strategy

24.4.5.4. Recent Developments

24.4.5.5. SWOT analysis

24.4.6. OPTIMA Packaging Group GmbH

24.4.6.1. Overview

24.4.6.2. Financials

24.4.6.3. Strategy

24.4.6.4. Recent Developments

24.4.6.5. SWOT analysis

24.4.7. Omori Machinery Co. Ltd.

24.4.7.1. Overview

24.4.7.2. Financials

24.4.7.3. Strategy

24.4.7.4. Recent Developments

24.4.7.5. SWOT analysis

24.4.8. ProMach, Inc.

24.4.8.1. Overview

24.4.8.2. Financials

24.4.8.3. Strategy

24.4.8.4. Recent Developments

24.4.8.5. SWOT analysis

24.4.9. Herma GmbH

24.4.9.1. Overview

24.4.9.2. Financials

24.4.9.3. Strategy

24.4.9.4. Recent Developments

24.4.9.5. SWOT analysis

24.4.10. Videojet Technologies, Inc.

24.4.10.1. Overview

24.4.10.2. Financials

24.4.10.3. Strategy

24.4.10.4. Recent Developments

24.4.10.5. SWOT analysis

24.4.11. Muller Load Containment Solutions

24.4.11.1. Overview

24.4.11.2. Financials

24.4.11.3. Strategy

24.4.11.4. Recent Developments

24.4.11.5. SWOT analysis

24.4.12. Premier Tech Chronos Ltd.

24.4.12.1. Overview

24.4.12.2. Financials

24.4.12.3. Strategy

24.4.12.4. Recent Developments

24.4.12.5. SWOT analysis

24.4.13. Ishida Co. Ltd.

24.4.13.1. Overview

24.4.13.2. Financials

24.4.13.3. Strategy

24.4.13.4. Recent Developments

24.4.13.5. SWOT analysis

24.4.14. PFM Group

24.4.14.1. Overview

24.4.14.2. Financials

24.4.14.3. Strategy

24.4.14.4. Recent Developments

24.4.14.5. SWOT analysis

24.4.15. GEA Group Aktiengesellschaft

24.4.15.1. Overview

24.4.15.2. Financials

24.4.15.3. Strategy

24.4.15.4. Recent Developments

24.4.15.5. SWOT analysis

24.4.16. Sidel S.A.

24.4.16.1. Overview

24.4.16.2. Financials

24.4.16.3. Strategy

24.4.16.4. Recent Developments

24.4.16.5. SWOT analysis

24.4.17. Serac Inc.

24.4.17.1. Overview

24.4.17.2. Financials

24.4.17.3. Strategy

24.4.17.4. Recent Developments

24.4.17.5. SWOT analysis

24.4.18. Nissei ASB Machine Co., Ltd.

24.4.18.1. Overview

24.4.18.2. Financials

24.4.18.3. Strategy

24.4.18.4. Recent Developments

24.4.18.5. SWOT analysis

24.4.19. Krones AG

24.4.19.1. Overview

24.4.19.2. Financials

24.4.19.3. Strategy

24.4.19.4. Recent Developments

24.4.19.5. SWOT analysis

24.4.20. MULTIVAC

24.4.20.1. Overview

24.4.20.2. Financials

24.4.20.3. Strategy

24.4.20.4. Recent Developments

24.4.20.5. SWOT analysis

24.4.21. Reynolds Group Holding Limited

24.4.21.1. Overview

24.4.21.2. Financials

24.4.21.3. Strategy

24.4.21.4. Recent Developments

24.4.21.5. SWOT analysis

24.4.22. Hitachi America, Ltd.

24.4.22.1. Overview

24.4.22.2. Financials

24.4.22.3. Strategy

24.4.22.4. Recent Developments

24.4.22.5. SWOT analysis

24.4.23. Markem-Imaje Corporation

24.4.23.1. Overview

24.4.23.2. Financials

24.4.23.3. Strategy

24.4.23.4. Recent Developments

24.4.23.5. SWOT analysis

24.4.24. Fromm Packaging Systems, Inc.

24.4.24.1. Overview

24.4.24.2. Financials

24.4.24.3. Strategy

24.4.24.4. Recent Developments

24.4.24.5. SWOT analysis

24.4.25. Hangzhou Youngsun Intelligent Equipment Co. Ltd.

24.4.25.1. Overview

24.4.25.2. Financials

24.4.25.3. Strategy

24.4.25.4. Recent Developments

24.4.25.5. SWOT analysis

24.4.26. Fres-co System USA, Inc.

24.4.26.1. Overview

24.4.26.2. Financials

24.4.26.3. Strategy

24.4.26.4. Recent Developments

24.4.26.5. SWOT analysis

24.4.27. Fuji Machinery Co. Ltd.

24.4.27.1. Overview

24.4.27.2. Financials

24.4.27.3. Strategy

24.4.27.4. Recent Developments

24.4.27.5. SWOT analysis

25. Assumptions and Acronyms Used

26. Research Methodology

List of Tables

Table 01: Global Packaging Machinery Market Value (US$ Mn) and Volume (Units) 2017-2026, By Product Type

Table 02: Global Packaging Machinery Market Value (US$ Mn) and Volume (Units) 2017-2026, By Packaging Technology

Table 03: Global Packaging Machinery Market Value (US$ Mn) and Volume (Units) 2017-2026, By End Use

Table 04: Global Packaging Machinery Market Value (US$ Mn) and Volume (Units) 2017-2026, By Country

Table 05: North America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2018(A) – 2026(F)

Table 06: North America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Product Type, 2018(A) – 2026(F)

Table 07: North America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Technology Type, 2018(A) – 2026(F)

Table 08: North America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by End Use, 2018(A) – 2026(F)

Table 09: Latin America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2018(A) – 2026(F)

Table 10: Latin America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Product Type, 2018(A) – 2026(F)

Table 11: Latin America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Technology Type, 2018(A) – 2026(F)

Table 12: Latin America Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by End Use, 2018(A) – 2026(F)

Table 13: Europe Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2018(A) – 2026(F)

Table 14: Europe Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Product Type, 2018(A) – 2026(F)

Table 15: Europe Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Technology Type, 2018(A) – 2026(F)

Table 16: Europe Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by End Use, 2018(A) – 2026(F)

Table 17: Asia-Pacific Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2018(A) – 2026(F)

Table 18: Asia-Pacific Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Product Type, 2018(A) – 2026(F)

Table 19: Asia-Pacific Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Technology Type, 2018(A) – 2026(F)

Table 20: Asia-Pacific Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by End Use, 2018(A) – 2026(F)

Table 21: MEA Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2018(A) – 2026(F)

Table 22: MEA Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Product Type, 2018(A) – 2026(F)

Table 23: MEA Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by Technology Type, 2018(A) – 2026(F)

Table 24: MEA Packaging Machinery market Value (US$ Mn) and Volume (Units) Forecast, by End Use, 2018(A) – 2026(F)

List of Figures

Figure 01: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, 2017-2026

Figure 02: Global Packaging Machinery Market Absolute $ Opportunity, 2018-2026

Figure 03: Global Packaging Machinery Market Value Share and BPS Analysis, By Product Type, 2018 & 2026

Figure 04: Global Packaging Machinery Market Y-o-Y growth, By Product Type 2018 & 2026

Figure 05: Global Packaging Machinery Market Attractiveness Analysis, by Product Type, 2018

Figure 06: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Bottling Line Segment, 2017-2026

Figure 07: Global Packaging Machinery Market Absolute $ Opportunity, By Bottling Line Segment, 2018-2026

Figure 08: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Cartoning Machines Segment, 2017-2026

Figure 09: Global Packaging Machinery Market Absolute $ Opportunity, By Cartoning Machines Segment, 2018-2026

Figure 10: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Case Handling Machines Segment, 2017-2026

Figure 11: Global Packaging Machinery Market Absolute $ Opportunity, By Case Handling Machines Segment, 2018-2026

Figure 12: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Closing Machines Segment, 2017-2026

Figure 13: Global Packaging Machinery Market Absolute $ Opportunity, By Closing Machines Segment, 2018-2026

Figure 14: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Filling and Dosing Machines Segment, 2017-2026

Figure 15: Global Packaging Machinery Market Absolute $ Opportunity, By Filling and Dosing Machines Segment, 2018-2026

Figure 16: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Form, Fill, and Seal Machines Segment, 2017-2026

Figure 17: Global Packaging Machinery Market Absolute $ Opportunity, By Form, Fill, and Seal Machines Segment, 2018-2026

Figure 18: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Labelling, Decorating, and Coding Machines Segment, 2017-2026

Figure 19: Global Packaging Machinery Market Absolute $ Opportunity, By Labelling, Decorating, and Coding Machines Segment, 2018-2026

Figure 20: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Palletizing & De-palletizing Machines Segment, 2017-2026

Figure 21: Global Packaging Machinery Market Absolute $ Opportunity, By Palletizing & De-palletizing Machines Segment, 2018-2026

Figure 22: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Wrapping & Bundling Machines Segment, 2017-2026

Figure 23: Global Packaging Machinery Market Absolute $ Opportunity, By Wrapping & Bundling Machines Segment, 2018-2026

Figure 24: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Other Machinery Segment, 2017-2026

Figure 25: Global Packaging Machinery Market Absolute $ Opportunity, By Other Machinery Segment, 2018-2026

Figure 26: Global Packaging Machinery Market Value Share and BPS Analysis, By Packaging Technology, 2018 & 2026

Figure 27: Global Packaging Machinery Market Y-o-Y growth, By Packaging Technology 2018 & 2026

Figure 28: Global Packaging Machinery Market Attractiveness Analysis, by Packaging Technology, 2018

Figure 29: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By General Packaging Technology Segment, 2017-2026

Figure 30: Global Packaging Machinery Market Absolute $ Opportunity, By General Packaging Technology Segment, 2018-2026

Figure 31: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By MAP Technology Segment, 2017-2026

Figure 32: Global Packaging Machinery Market Absolute $ Opportunity, By MAP Technology Segment, 2018-2026

Figure 33: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Vacuum Packaging Technology Segment, 2017-2026

Figure 34: Global Packaging Machinery Market Absolute $ Opportunity, By Vacuum Packaging Technology Segment, 2018-2026

Figure 35: Global Packaging Machinery Market Value Share and BPS Analysis, By End Use, 2018 & 2026

Figure 36: Global Packaging Machinery Market Y-o-Y growth, By End Use 2018 & 2026

Figure 37: Global Packaging Machinery Market Attractiveness Analysis, by End Use, 2018

Figure 38: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Food Segment, 2017-2026

Figure 39: Global Packaging Machinery Market Absolute $ Opportunity, By Food Segment, 2018-2026

Figure 40: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Beverages Segment, 2017-2026

Figure 41: Global Packaging Machinery Market Absolute $ Opportunity, By Beverages Segment, 2018-2026

Figure 42: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Homecare & Personal Care Segment, 2017-2026

Figure 43: Global Packaging Machinery Market Absolute $ Opportunity, By Homecare & Personal Care Segment, 2018-2026

Figure 44: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Healthcare Segment, 2017-2026

Figure 45: Global Packaging Machinery Market Absolute $ Opportunity, By Healthcare Segment, 2018-2026

Figure 46: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Industrial Segment, 2017-2026

Figure 47: Global Packaging Machinery Market Absolute $ Opportunity, By Industrial Segment, 2018-2026

Figure 48: Global Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, By Others Segment, 2017-2026

Figure 49: Global Packaging Machinery Market Absolute $ Opportunity, By Others Segment, 2018-2026

Figure 50: Global Packaging Machinery Market Value Share and BPS Analysis, By Region, 2018 & 2026

Figure 51: Global Packaging Machinery Market Y-o-Y growth, By Region 2018 & 2026

Figure 52: Global Packaging Machinery Market Attractiveness Analysis, by Region, 2018

Figure 53: North America Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, 2017-2026

Figure 54: North America Packaging Machinery Market Absolute $ Opportunity, 2018-2026

Figure 56: North America Packaging Machinery Market Value Share 2017, by Product Type

Figure 58: North America Packaging Machinery Market Value Share 2017, by End Use

Figure 55: North America Packaging Machinery Market Value Share 2017, by Country

Figure 57: North America Packaging Machinery Market Value Share 2017, by Packaging Technology

Figure 59: North America Packaging Machinery Market Value Share and BPS Analysis, by Country, 2018 & 2026

Figure 60: North America Packaging Machinery Market Attractiveness Index, by Country, 2018–2026

Figure 61: North America Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 62: North America Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 63: North America Packaging Machinery Market Attractiveness Index, by Product Type, 2018–2026

Figure 64: North America Packaging Machinery Market Y-o-Y growth, By Product Type, 2018 & 2026

Figure 65: North America Packaging Machinery Market Attractiveness Index, by Technology Type, 2018–2026

Figure 66: North America Packaging Machinery Market Y-o-Y growth, By Technology Type, 2018 & 2026

Figure 67: North America Packaging Machinery Market Attractiveness Index, by End Use, 2018–2026

Figure 68: North America Packaging Machinery Market Y-o-Y growth, By End Use, 2018 & 2026

Figure 69: Latin America Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, 2017-2026

Figure 70: Latin America Packaging Machinery Market Absolute $ Opportunity, 2018-2026

Figure 72: Latin America Packaging Machinery Market Value Share 2017, by Product Type

Figure 74: Latin America Packaging Machinery Market Value Share 2017, by End Use

Figure 71: Latin America Packaging Machinery Market Value Share 2017, by Country

Figure 73: Latin America Packaging Machinery Market Value Share 2017, by Packaging Technology

Figure 76: Latin America Packaging Machinery Market Attractiveness Index, by Country, 2018–2026

Figure 77: Latin America Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 78: Latin America Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 79: Latin America Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 80: Latin America Packaging Machinery Market Attractiveness Index, by Product Type, 2018–2026

Figure 81: Latin America Packaging Machinery Market Y-o-Y growth, By Product Type, 2018 & 2026

Figure 82: Latin America Packaging Machinery Market Attractiveness Index, by Technology Type, 2018–2026

Figure 83: Latin America Packaging Machinery Market Y-o-Y growth, By Technology Type, 2018 & 2026

Figure 84: Latin America Packaging Machinery Market Attractiveness Index, by End Use, 2018–2026

Figure 85: Latin America Packaging Machinery Market Y-o-Y growth, By End Use, 2018 & 2026

Figure 86: Europe Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, 2017-2026

Figure 87: Europe Packaging Machinery Market Absolute $ Opportunity, 2018-2026

Figure 89: Europe Packaging Machinery Market Value Share 2017, by Product Type

Figure 91: Europe Packaging Machinery Market Value Share 2017, by End Use

Figure 88: Europe Packaging Machinery Market Value Share 2017, by Country

Figure 90: Europe Packaging Machinery Market Value Share 2017, by Packaging Technology

Figure 93: Europe Packaging Machinery Market Attractiveness Index, by Country, 2018–2026

Figure 94: Europe Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 95: Europe Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 96: Europe Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 97: Europe Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 98: Europe Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 99: Europe Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 100: Europe Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 101: Europe Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 102: Europe Packaging Machinery Market Attractiveness Index, by Product Type, 2018–2026

Figure 103: Europe Packaging Machinery Market Y-o-Y growth, By Product Type, 2018 & 2026

Figure 104: Europe Packaging Machinery Market Attractiveness Index, by Technology Type, 2018–2026

Figure 105: Europe Packaging Machinery Market Y-o-Y growth, By Technology Type, 2018 & 2026

Figure 106: Europe Packaging Machinery Market Attractiveness Index, by End Use, 2018–2026

Figure 107: Europe Packaging Machinery Market Y-o-Y growth, By End Use, 2018 & 2026

Figure 108: Asia-Pacific Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, 2017-2026

Figure 109: Asia-Pacific Packaging Machinery Market Absolute $ Opportunity, 2018-2026

Figure 111: Asia-Pacific Packaging Machinery Market Value Share 2017, by Product Type

Figure 113: Asia-Pacific Packaging Machinery Market Value Share 2017, by End Use

Figure 110: Asia-Pacific Packaging Machinery Market Value Share 2017, by Country

Figure 112: Asia-Pacific Packaging Machinery Market Value Share 2017, by Packaging Technology

Figure 115: Asia-Pacific Packaging Machinery Market Attractiveness Index, by Country, 2018–2026

Figure 116: Asia-Pacific Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 117: Asia-Pacific Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 118: Asia-Pacific Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 119: Asia-Pacific Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 120: Asia-Pacific Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 121: Asia-Pacific Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 122: Asia-Pacific Packaging Machinery Market Attractiveness Index, by Product Type, 2018–2026

Figure 123: Asia-Pacific Packaging Machinery Market Y-o-Y growth, By Product Type, 2018 & 2026

Figure 124: Asia-Pacific Packaging Machinery Market Attractiveness Index, by Technology Type, 2018–2026

Figure 125: Asia-Pacific Packaging Machinery Market Y-o-Y growth, By Technology Type, 2018 & 2026

Figure 126: Asia-Pacific Packaging Machinery Market Attractiveness Index, by End Use, 2018–2026

Figure 127: Asia-Pacific Packaging Machinery Market Y-o-Y growth, By End Use, 2018 & 2026

Figure 128: MEA Packaging Machinery Market Value (US$ Mn), and volume (Units) analysis, 2017-2026

Figure 129: MEA Packaging Machinery Market Absolute $ Opportunity, 2018-2026

Figure 131: MEA Packaging Machinery Market Value Share 2017, by Product Type

Figure 133: MEA Packaging Machinery Market Value Share 2017, by End Use

Figure 130: MEA Packaging Machinery Market Value Share 2017, by Country

Figure 132: MEA Packaging Machinery Market Value Share 2017, by Packaging Technology

Figure 135: MEA Packaging Machinery Market Attractiveness Index, by Country, 2018–2026

Figure 136: MEA Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 137: MEA Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 138: MEA Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 139: MEA Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 140: MEA Packaging Machinery Market Attractiveness Index, by Product Type, 2018–2026

Figure 141: MEA Packaging Machinery Market Y-o-Y growth, By Product Type, 2018 & 2026

Figure 142: MEA Packaging Machinery Market Attractiveness Index, by Technology Type, 2018–2026

Figure 143: MEA Packaging Machinery Market Y-o-Y growth, By Technology Type, 2018 & 2026

Figure 144: MEA Packaging Machinery Market Attractiveness Index, by End Use, 2018–2026

Figure 145: MEA Packaging Machinery Market Y-o-Y growth, By End Use, 2018 & 2026