The orthopedic navigation systems were initially used in orthopedic spinal surgery more than a decade ago to improve the efficiency of pedicle screw insertion. Since then, it has gained broad recognition among orthopedic surgeons, and has become an invaluable tool for some orthopedic procedures, such as reconstructive hip and knee, sports injury, trauma, spine, and tumor surgery. Presently, orthopedic navigation systems are designed to offer surgeons real-time feedback on the surgical field, enabling them to adjust the surgical technique to improve postoperative outcomes and decrease intraoperative errors. Moreover, conventional and regular traditional techniques can lack accuracy, precision, and reproducibility. Thus, the need for the development of a novel orthopedic navigation system has increased. This is likely to increase the growth rate for the global orthopedic navigation systems market.

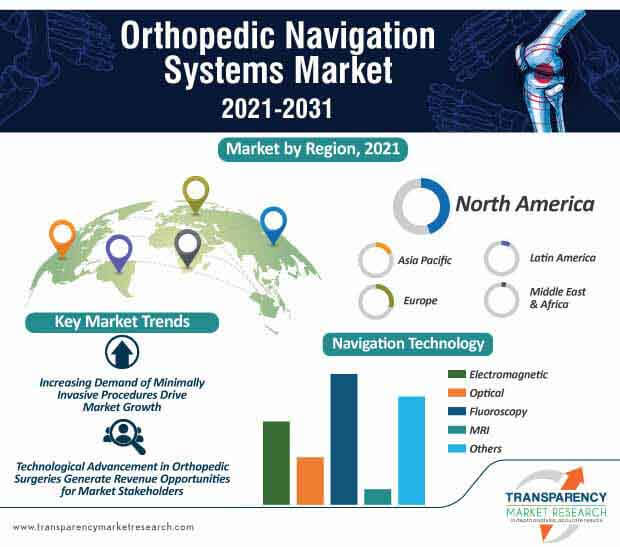

The orthopedic navigation systems market is primarily driven by factors such as increasing adoption of minimally invasive surgical procedures, rising number of mergers and acquisitions among market players, and increasing incidence of orthopedic and neurological disorders. Additionally, increasing government funding initiatives for research and development activities for surgical navigation systems are also contributing as an incentive for the growth of this market. However, the high cost of surgical navigation systems and product recalls are likely to create a negative impact on the growth of the orthopedic navigation systems market.

The coronavirus disease of 2019 (COVID-19) has impacted several industries around the world, with global restrictions for supply chain and trade. The COVID-19 pandemic has led to many cases of this contagious disease, varying in severity from extremely mild to life threatening. Concerns about developing the infection have decreased outpatient visits with healthcare providers. Even without symptoms, patients are sometimes required to demonstrate negative test results for COVID-19 before they are allowed to undergo certain surgical procedures. Moreover, the government implemented lockdowns resulted in a lack of resources in hospitals that may face a sudden patient influx resulting in the removal of elective procedures and reorganization of ICU beds.

In addition, as the risk of infectious spread among patients and healthcare providers is high, several treatments were delayed or cancelled to ensure patient and staff safety. However, the use of surgical robots to efficiently face these challenges and perform time-efficient surgery over extensive operative hours and minimize infectious spread was increased. Presently, as the pandemic is nearing its end in most countries, the hospital industry is expected to witness an increasing number of cases that were delayed or postponed amidst the pandemic. This is most likely to fuel the growth of the orthopedic navigation systems market during the forecast period.

Businesses are focusing on increasing awareness among healthcare professionals and patients about the usage and benefits of orthopedic navigation systems. Producers of surgical navigation systems in advanced countries have begun to reach local areas by offering Continual Medical Education (CME) classes. This leads to an increase in consciousness among physicians and specialists about the availability and practice of orthopedic navigation systems. Moreover, commercially available orthopedic navigation systems have a six to seven-year warranty, making the product sales cycle seven years. Thus, with the growing need for technological assistance for orthopedic treatments, the orthopedic navigation systems market is expected to grow during the forecast period.

Currently, several newer technologies are expected to enter the market in the shortcoming future. Hence, hospitals are more likely to look for a better alternative in the next seven years. Thus, hospitals avoid the repeated purchase of an orthopedic navigation system. Thus, manufacturers of orthopedic navigation systems are incapable to reach new customers, which is hampering the market growth. Currently, the orthopedic navigation systems market has matured in North America and Europe. Hence, businesses in these regions are unable to maintain themselves in the competitive market. However, the global orthopedic navigation systems market is projected to expand at a CAGR of 4.3% from 2021 to 2031.

Analysts' Viewpoint

The nature of orthopedic navigation systems, i.e., one-time purchase commodity and expensive equipment are restraining the orthopedic navigation systems market. Technologically, the optical navigation systems have advantages over EM systems such as reduced radiation exposure and accuracy provided during complex surgeries, which enable surgeons to navigate properly through a patient’s anatomy. North America is most likely to dominate the global orthopedic navigation systems market during the forecast period.

Orthopedic navigation systems market to reach valuation of US$ 472.5 Mn by 2031

Orthopedic navigation systems market is projected to expand at a CAGR of 4.3% from 2021 to 2031

Orthopedic navigation systems market is driven by increasing adoption of minimally invasive surgical procedures

North America accounted for a major share of the global orthopedic navigation systems market

Key players in the global Orthopedic Navigation System market include B. Braun Melsungen AG., Amplitude SAS, Brainlab, DePuy Synthes (Johnson & Johnson), Fiagon (Intersect ENT, INC.)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Orthopedic Navigation Systems Market

4. Market Overview

4.1. Introduction & Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Orthopedic Navigation Systems Market Analysis and Forecast, 2017–2031

5. Market Outlook

5.1. COVID-19 Pandemics Impact on Industry

5.2. New Product Launch and Regulatory Approvals by Region/globally

5.3. Key Mergers and Acquisitions

5.4. Strategies Adopted by Market Players (partnerships, collaborations, etc.)

5.5. Regulatory Scenario, by Country/Region

5.6. Prevalence & Incidence Rate globally with key countries

5.7. Value Chain Analysis

5.8. Volume of orthopedic surgeries

6. Global Orthopedic Navigation Systems Market Analysis and Forecast, by Navigation Technology

6.1. Introduction & Definition

6.2. Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

6.2.1. Electromagnetic

6.2.2. Optical

6.2.3. Fluoroscopy

6.2.4. MRI

6.2.5. Others

6.3. Global Orthopedic Navigation Systems Market Attractiveness Analysis, by Application

7. Global Orthopedic Navigation Systems Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

7.2.1. Knee surgery

7.2.2. Spine surgery

7.2.3. Hip surgery

7.2.4. Replacement surgeries

7.2.5. Others

7.3. Global Orthopedic Navigation Systems Market Attractiveness Analysis, by Application

8. Global Orthopedic Navigation Systems Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

8.2.1. Hospitals

8.2.2. Ambulatory Surgical Centers

8.2.3. Others

8.3. Global Orthopedic Navigation Systems Market Attractiveness Analysis, by End-user

9. Global Orthopedic Navigation Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Orthopedic Navigation Systems Market Attractiveness Analysis, by Region

10. North America Orthopedic Navigation Systems Market Analysis and Forecast

10.1. Introduction

10.2. North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

10.2.1. Electromagnetic

10.2.2. Optical

10.2.3. Fluoroscopy

10.2.4. MRI

10.2.5. Others

10.3. North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

10.3.1. Knee surgery

10.3.2. Spine surgery

10.3.3. Hip surgery

10.3.4. Replacement surgeries

10.3.5. Others

10.4. North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. North America Orthopedic Navigation Systems Market Attractiveness Analysis

10.6.1. By Navigation Technology

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Orthopedic Navigation Systems Market Analysis and Forecast

11.1. Introduction

11.2. Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

11.2.1. Electromagnetic

11.2.2. Optical

11.2.3. Fluoroscopy

11.2.4. MRI

11.2.5. Others

11.3. Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

11.3.1. Knee surgery

11.3.2. Spine surgery

11.3.3. Hip surgery

11.3.4. Replacement surgeries

11.3.5. Others

11.4. Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Orthopedic Navigation Systems Market Attractiveness Analysis

11.6.1. By Navigation Technology

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Orthopedic Navigation Systems Market Analysis and Forecast

12.1. Introduction

12.2. Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

12.2.1. Electromagnetic

12.2.2. Optical

12.2.3. Fluoroscopy

12.2.4. MRI

12.2.5. Others

12.3. Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

12.3.1. Knee surgery

12.3.2. Spine surgery

12.3.3. Hip surgery

12.3.4. Replacement surgeries

12.3.5. Others

12.4. Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others

12.5. Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Orthopedic Navigation Systems Market Attractiveness Analysis

12.6.1. By Navigation Technology

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Orthopedic Navigation Systems Market Analysis and Forecast

13.1. Introduction

13.2. Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

13.2.1. Electromagnetic

13.2.2. Optical

13.2.3. Fluoroscopy

13.2.4. MRI

13.2.5. Others

13.3. Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

13.3.1. Knee surgery

13.3.2. Spine surgery

13.3.3. Hip surgery

13.3.4. Replacement surgeries

13.3.5. Others

13.4. Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Orthopedic Navigation Systems Market Attractiveness Analysis

13.6.1. By Navigation Technology

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Orthopedic Navigation Systems Market Analysis and Forecast

14.1. Introduction

14.2. Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

14.2.1. Electromagnetic

14.2.2. Optical

14.2.3. Fluoroscopy

14.2.4. MRI

14.2.5. Others

14.3. Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

14.3.1. Knee surgery

14.3.2. Spine surgery

14.3.3. Hip surgery

14.3.4. Replacement surgeries

14.3.5. Others

14.4. Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Orthopedic Navigation Systems Market Attractiveness Analysis

14.6.1. By Navigation Technology

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Position Analysis, by Company, 2020

15.2. Company Profiles

15.2.1. B. Braun Melsungen AG

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Growth Strategies

15.2.1.3. SWOT Analysis

15.2.2. Amplitude SAS

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Growth Strategies

15.2.2.3. SWOT Analysis

15.2.3. Brainlab

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Growth Strategies

15.2.3.3. SWOT Analysis

15.2.4. DePuy Synthes (Johnson & Johnson)

15.2.4.1. Company Overview (HQ, Business Segments)

15.2.4.2. Growth Strategies

15.2.4.3. SWOT Analysis

15.2.5. Fiagon

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Growth Strategies

15.2.5.3. SWOT Analysis

15.2.6. GE Healthcare

15.2.6.1. Company Overview (HQ, Business Segments)

15.2.6.2. Growth Strategies

15.2.6.3. SWOT Analysis

15.2.7. Intellijoint Surgical

15.2.7.1. Company Overview (HQ, Business Segments)

15.2.7.2. Growth Strategies

15.2.7.3. SWOT Analysis

15.2.8. Karl Storz GmbH & Co. KG

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Growth Strategies

15.2.8.3. SWOT Analysis

15.2.9. MicroPort Scientific Corporation

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Growth Strategies

15.2.9.3. SWOT Analysis

15.2.10. Orthokey Italia SRL

15.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2. Growth Strategies

15.2.10.3. SWOT Analysis

15.2.11. Stryker Corporation

15.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.11.2. Growth Strategies

15.2.11.3. SWOT Analysis

15.2.12. Siemens Healthineers

15.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.12.2. Growth Strategies

15.2.12.3. SWOT Analysis

15.2.13. Zimmer Biomet

15.2.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.13.2. Growth Strategies

15.2.13.3. SWOT Analysis

List of Tables

Table 01: Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

Table 02: Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

Table 07: North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

Table 11: Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

Table 15: Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

Table 19: Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Remote Patient Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Navigation Technology, 2017–2031

Table 23: Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 1: Global Orthopedic Navigation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 2: Global Orthopedic Navigation Systems Market Value Share, by Navigation Technology (2020)

Figure 3: Global Orthopedic Navigation Systems Market Value Share, by Application (2020)

Figure 4: Global Orthopedic Navigation Systems Market Value Share, by End-user (2020)

Figure 5: Global Orthopedic Navigation Systems Market Value Share Analysis, by Navigation Technology, 2020 and 2031

Figure 6: Global Orthopedic Navigation Systems Market Attractiveness Analysis, by Navigation Technology, 2021–2031

Figure 7: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Electromagnetic, 2017–2031

Figure 8: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Optical, 2017–2031

Figure 9: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Fluoroscopy, 2017–2031

Figure 10: Global Orthopedic Navigation Systems Market Value (US$ Mn), by MRI, 2017–2031

Figure 11: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Others, 2017–2031

Figure 12: Global Orthopedic Navigation Systems Market Value Share Analysis, by Application, 2020 and 2031

Figure 13: Global Orthopedic Navigation Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 14: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Knee surgery, 2017–2031

Figure 15: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Spine surgery, 2017–2031

Figure 16: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Hip surgery, 2017–2031

Figure 17: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Replacement surgery, 2017–2031

Figure 18: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Others, 2017–2031

Figure 19: Global Orthopedic Navigation Systems Market Value Share Analysis, by End-user, 2020 and 2031

Figure 20: Global Orthopedic Navigation Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 21: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Hospital, 2017–2031

Figure 22: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 23: Global Orthopedic Navigation Systems Market Value (US$ Mn), by Others, 2017–2031

Figure 24: Global Orthopedic Navigation Systems Market Value Share Analysis, by Region, 2020 and 2031

Figure 25: Global Orthopedic Navigation Systems Market Attractiveness Analysis, by Region, 2021–2031

Figure 26: North America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 27: North America Orthopedic Navigation Systems Market Value Share (%), by Country, 2020 and 2031

Figure 28: North America Orthopedic Navigation Systems Market Attractiveness, by Country, 2021–2031

Figure 29: North America Orthopedic Navigation Systems Market Value Share (%), by Navigation Technology, 2020 and 2031

Figure 30: North America Orthopedic Navigation Systems Market Attractiveness, by Navigation Technology, 2021–2031

Figure 31: North America Orthopedic Navigation Systems Market Value Share (%), by Application, 2020 and 2031

Figure 32: North America Orthopedic Navigation Systems Market Attractiveness, by Application, 2021–2031

Figure 33: North America Orthopedic Navigation Systems Market Value Share (%), by End-user, 2020 and 2031

Figure 34: North America Orthopedic Navigation Systems Market Attractiveness, by End-user, 2021–2031

Figure 35: Europe Orthopedic Navigation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 36: Europe Orthopedic Navigation Systems Market Value Share, by Country/Sub-region, 2020–2031

Figure 37: Europe Orthopedic Navigation Systems Market Attractiveness, by Country/Sub-region, 2020–2031

Figure 38: Europe Orthopedic Navigation Systems Market Value Share (%), by Navigation Technology, 2020 and 2031

Figure 39: Europe Orthopedic Navigation Systems Market Attractiveness, by Navigation Technology, 2021–2031

Figure 40: Europe Orthopedic Navigation Systems Market Value Share (%), by Application, 2020 and 2031

Figure 41: Europe Orthopedic Navigation Systems Market Attractiveness, by Application, 2021–2031

Figure 42: Europe Orthopedic Navigation Systems Market Value Share (%), by End-user, 2020 and 2031

Figure 43: Europe Orthopedic Navigation Systems Market Attractiveness, by End-user, 2021–2031

Figure 44: Asia Pacific Orthopedic Navigation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 45: Asia Pacific Orthopedic Navigation Systems Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 46: Asia Pacific Orthopedic Navigation Systems Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 47: Asia Pacific Orthopedic Navigation Systems Market Value Share (%), by Navigation Technology, 2020 and 2031

Figure 48: Asia Pacific Orthopedic Navigation Systems Market Attractiveness, by Navigation Technology, 2021–2031

Figure 49: Asia Pacific Orthopedic Navigation Systems Market Value Share (%), by Application, 2020 and 2031

Figure 50: Asia Pacific Orthopedic Navigation Systems Market Attractiveness, by Application, 2021–2031

Figure 51: Asia Pacific Orthopedic Navigation Systems Market Value Share (%), by End-user, 2020 and 2031

Figure 52: Asia Pacific Orthopedic Navigation Systems Market Attractiveness, by End-user, 2021–2031

Figure 53: Latin America Orthopedic Navigation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 54: Latin America Orthopedic Navigation Systems Market Value Share, by Country/Sub-region, 2020–2031

Figure 55: Latin America Orthopedic Navigation Systems Market Attractiveness, by Country/Sub-region, 2020–2031

Figure 56: Latin America Orthopedic Navigation Systems Market Value Share (%), by Navigation Technology, 2020 and 2031

Figure 57: Latin America Orthopedic Navigation Systems Market Attractiveness, by Navigation Technology, 2021–2031

Figure 58: Latin America Orthopedic Navigation Systems Market Value Share (%), by Application, 2020 and 2031

Figure 59: Latin America Orthopedic Navigation Systems Market Attractiveness, by Application, 2021–2031

Figure 60: Latin America Orthopedic Navigation Systems Market Value Share (%), by End-user, 2020 and 2031

Figure 61: Latin America Orthopedic Navigation Systems Market Attractiveness, by End-user, 2021–2031

Figure 62: Middle East & Africa Orthopedic Navigation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 63: Middle East & Africa Remote Patient Monitoring Devices Market Value Share, by Country/Sub-region, 2020–2031

Figure 64: Middle East & Africa Remote Patient Monitoring Devices Market Attractiveness, by Country/Sub-region, 2020–2031

Figure 65: Middle East & Africa Orthopedic Navigation Systems Market Value Share (%), by Navigation Technology, 2020 and 2031

Figure 66: Middle East & Africa Orthopedic Navigation Systems Market Attractiveness, by Navigation Technology, 2021–2031

Figure 67: Middle East & Africa Orthopedic Navigation Systems Market Value Share (%), by Application, 2020 and 2031

Figure 68: Middle East & Africa Orthopedic Navigation Systems Market Attractiveness, by Application, 2021–2031

Figure 69: Middle East & Africa Orthopedic Navigation Systems Market Value Share (%), by End-user, 2020 and 2031

Figure 70: Middle East & Africa Orthopedic Navigation Systems Market Attractiveness, by End-user, 2021–2031

Figure 71: Global Orthopedic Navigation Systems Market Share Analysis, by Company, 2020