Analysts’ Viewpoint

Increase in number of patients requiring orthopedic implant surgery is expected to drive the global orthopedic implants market during the forecast period. Rise in number of hospitals & ambulatory surgical centers and increase in geriatric population are the prominent factors augmenting the demand for orthopedic devices.

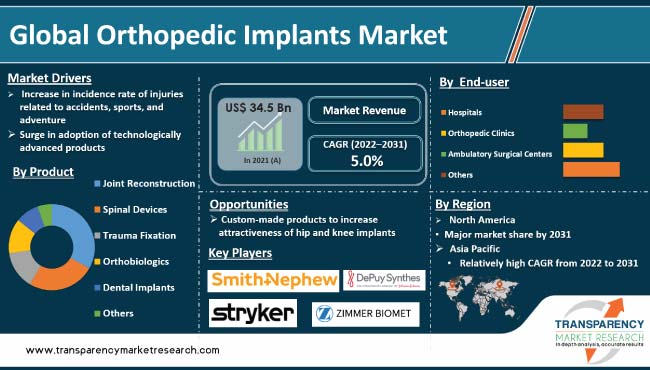

Surge in incidence rate of injuries related to accidents, sports, and adventure; increase in adoption of technologically advanced products; and rise in government initiatives to address unmet medical needs are the other factors driving the global market. Prominent players' market strategy for orthopedic implants includes developing and launching innovative products. Furthermore, strategic alliances between companies is fueling the global market.

Orthopedic implant is a medical device manufactured to replace a missing joint or bone, or to support a damaged bone. For instance, a woman may want a bone implant or bone replacement to make it easier to do a weight bearing operation. A surgeon could also use an implant to assist in strengthening or entirely changing the joints in a patient’s bone or region. Pain in the joints and bones could be triggered due to damage or deformity, which could require repairing. Some sufferers with the issue could use an implant to beef up or completely replace joints or bones.

Orthopedic implants/orthopedic prostheses are made of various materials such as metal alloys ceramics and polymers. Metal alloys, such as titanium, are the most common materials used to make implants. Bioceramics is a class of material that aids surgeons in replacing a degenerative tissue and bone due to osteoporosis. Polymers are useful in mimicking cartilage or ligaments that may have degenerated over time or after significant trauma. According to the Centers for Disease Control and Prevention, 78 million adults in the U.S. aged 18 or older are estimated to suffer from doctor-diagnosed arthritis by 2040.

Injuries caused during sports, driving, and adventure have increased over the last decade. According to the Johns Hopkins Medicine, around 30 million children and youth participate in organized sports in the U.S., and every year, participants suffer over 3.5 million injuries that result in some time lost in participation. Around one-third of all childhood injuries are sports related. Sprains and strains are the most common injuries. According to the American Academy of Pediatrics, every year, more than 3.5 million children under the age of 14 are injured while playing sports or engaging in recreational activities, and nearly 50% of head injuries in sports or leisure occur while cycling, skateboarding, or skating.

According to the WHO, road traffic injuries are the leading cause of death among children and young people aged five to 29. Traffic accidents account for around 1.3 million deaths every year. The number of hip fractures has increased over the last decade. According to the Geriatric Orthopedic Surgery & Rehabilitation (GOS), the number of hip fractures in the U.S. is likely to rise to 840,000 by 2040. As per global orthopedic implants market trends, surge in number of accidents and bone disorders such as joint pain, instability in the joint, bone loss, and infection is anticipated to drive the demand for orthopedic implants/orthopedic prostheses during the forecast period.

Large numbers of global manufacturers with technical expertise and core competencies are striving to develop and manufacture novel orthopedic prostheses products. Demand for improved biomaterial-based implants with high strength and low wear is high in the orthopedic biomaterials industry and the orthopedic implants industry in both developed and developing countries. Technologies such as minimally invasive surgery (MIS), navigation technology, 3D bioprinting & tissue engineering, custom-made implants, computer-aided implant fixation, and the development of variable axis screw systems have witnessed rapid adoption. Key manufacturers are entering into collaborations and partnerships with emerging market players offering novel product pipelines. This combination of key players' technical expertise and new players’ novel product techniques or materials ensures the launch of new products with enhanced functionalities.

In terms of product, the global market for orthopedic implants has been classified into joint reconstruction, spinal devices, trauma fixation, orthobiologics, dental implants, and others. The joint reconstruction segment accounted for major market share in 2021. This can be ascribed to the large number of joint replacement procedures performed such as knee replacements and hip replacements. Non cement knee replacement surgery is the most common, as it does not require cement to be added between the prostheses and bone. The orthobiologics market segment is also likely to grow steadily during the forecast period.

Based on end-user, the hospitals segment is projected to account for significant share of the global orthopedic implants market during the forecast period. This can be ascribed to easy availability of instruments and facilities required for orthopedic procedures in hospitals, and favorable reimbursement policies. The orthopedic clinics segment is anticipated to grow at a high CAGR due to changing preference from hospitals to orthopedic clinics owing to advancements in clinics in terms of facility requirements. Shorter hospital stay, quality of procedures & care, and availability of emergency minimal invasive surgeries and advanced implants are likely to propel the segment during the forecast period.

North America dominated the global orthopedic implants market in 2021. The market in the region is projected to grow at a high CAGR from 2022 to 2031. This can be ascribed to the rise in demand for technologically advanced orthopedic implants and orthopedic procedures in the region. According to the Canadian Joint Replacement Registry (CJRR), hip and knee replacements are the third and second most common surgeries in Canada, with over 123,000 surgeries performed each year. Around 110,000 joint replacements were performed during 2020–2021; more than 7,300 were performed in day clinics, which is four times more than that in the previous year.

The market in Asia Pacific is expected to grow at a rapid pace from 2022 to 2031, led by the high number of orthopedic diseases and improving economy in China, India, and other countries in Southeast Asia, which has resulted in high per capita health care expenditure. According to the International Osteoporosis Foundation, more than 50% of all osteoporotic hip fractures are expected to occur in Asia by 2050. Osteoporosis is substantially underdiagnosed and undertreated in Asia, even in the most highly susceptible patients who have already suffered a fracture. Countries such as China and India, wherein the bulk of the population lives in rural regions, have less access to diagnosis and treatment compared to urban areas. This suggests that the number of people with osteoporosis in rural countries in Asia could be underestimated.

The orthopedic implants industry is consolidated, with the presence of a small number of large companies. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by the leading players. Prominent players operating in the global industry are Stryker, DePuy Synthes, Zimmer Biomet, Orthopedic Implant Company, Smith & Nephew, Evonik, Medtronic Spinal, DJO Global, Arthrex, Inc., NuVasive, Inc., Globus Medical, KYOCERA Medical Technologies, Inc., Health Canada, Teijin Nakashima Medical Co., Ltd., and HCM Orthocare Pvt. Ltd.

Each of these players has been profiled in the orthopedic implants market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 34.5 Bn |

|

Market Forecast Value in 2031 |

More than US$ 56.3 Bn |

|

Growth Rate (CAGR) |

5.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 34.5 Bn in 2021

The global market is projected to reach more than US$ 56.3 Bn by 2031

The global market contracted at a CAGR of 3.0% from 2017 to 2021

The global market is anticipated to grow at a CAGR of 5.0% from 2022 to 2031

Surge in adoption of technologically advanced products and increase in incidence rate of injuries related to accidents, sports, and adventure

North America is expected to account for the largest share of the global market during the forecast period

Stryker, DePuy Synthes, Zimmer Biomet, Orthopedic Implant Company, Smith & Nephew, Evonik, Medtronic Spinal, DJO Global, Arthrex, Inc., NuVasive, Inc., Globus Medical, Kyocera Medical Technologies, Inc., Health Canada, Teijin Nakashima Medical Co., Ltd. and HCM Orthocare Pvt. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Orthopedic Implants Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Orthopedic Implants Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key industry events (mergers & acquisitions, product launches, partnerships, etc.)

5.2. Technological advancements

5.3. Regulatory Scenario by Region/globally

5.4. Covid-19 Pandemic impact on the industry

6. Global Orthopedic Implants Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Joint Reconstruction

6.3.1.1. Hip Replacement

6.3.1.2. Knee Replacement

6.3.1.3. Shoulder Replacement

6.3.1.4. Others

6.3.2. Spinal Devices

6.3.2.1. Spinal Fusion Devices

6.3.2.2. Spinal Non-fusion Devices

6.3.3. Trauma Fixation

6.3.3.1. Metal Plates & Screws

6.3.3.2. Pins/Wires

6.3.3.3. Nails & Rods

6.3.3.4. Others

6.3.4. Orthobiologics

6.3.5. Dental Implants

6.3.6. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Orthopedic Implants Market Analysis and Forecast, by End user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End user, 2017–2031

7.3.1. Hospitals

7.3.2. Orthopedic Clinics

7.3.3. Ambulatory Surgery Centers

7.3.4. Others

7.4. Market Attractiveness Analysis, by End user

8. Global Orthopedic Implants Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Orthopedic Implants Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. Joint Reconstruction

9.2.1.1. Hip Replacement

9.2.1.2. Knee Replacement

9.2.1.3. Shoulder Replacement

9.2.1.4. Others

9.2.2. Spinal Devices

9.2.2.1. Spinal Fusion Devices

9.2.2.2. Spinal Non-fusion Devices

9.2.3. Trauma Fixation

9.2.3.1. Metal Plates & Screws

9.2.3.2. Pins/Wires

9.2.3.3. Nails & Rods

9.2.3.4. Others

9.2.4. Orthobiologics

9.2.5. Dental Implants

9.2.6. Others

9.3. Market Value Forecast, by End user, 2017–2031

9.3.1. Hospitals

9.3.2. Orthopedic Clinics

9.3.3. Ambulatory Surgery Centers

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End user

9.5.3. By Country

10. Europe Orthopedic Implants Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Joint Reconstruction

10.2.1.1. Hip Replacement

10.2.1.2. Knee Replacement

10.2.1.3. Shoulder Replacement

10.2.1.4. Others

10.2.2. Spinal Devices

10.2.2.1. Spinal Fusion Devices

10.2.2.2. Spinal Non-fusion Devices

10.2.3. Trauma Fixation

10.2.3.1. Metal Plates & Screws

10.2.3.2. Pins/Wires

10.2.3.3. Nails & Rods

10.2.3.4. Others

10.2.4. Orthobiologics

10.2.5. Dental Implants

10.2.6. Others

10.3. Market Value Forecast, by End user, 2017–2031

10.3.1. Hospitals

10.3.2. Orthopedic Clinics

10.3.3. Ambulatory Surgery Centers

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End user

10.5.3. By Country/Sub-region

11. Asia Pacific Orthopedic Implants Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Joint Reconstruction

11.2.1.1. Hip Replacement

11.2.1.2. Knee Replacement

11.2.1.3. Shoulder Replacement

11.2.1.4. Others

11.2.2. Spinal Devices

11.2.2.1. Spinal Fusion Devices

11.2.2.2. Spinal Non-fusion Devices

11.2.3. Trauma Fixation

11.2.3.1. Metal Plates & Screws

11.2.3.2. Pins/Wires

11.2.3.3. Nails & Rods

11.2.3.4. Others

11.2.4. Orthobiologics

11.2.5. Dental Implants

11.2.6. Others

11.3. Market Value Forecast, by End user, 2017–2031

11.3.1. Hospitals

11.3.2. Orthopedic Clinics

11.3.3. Ambulatory Surgery Centers

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End user

11.5.3. By Country/Sub-region

12. Latin America Orthopedic Implants Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Joint Reconstruction

12.2.1.1. Hip Replacement

12.2.1.2. Knee Replacement

12.2.1.3. Shoulder Replacement

12.2.1.4. Others

12.2.2. Spinal Devices

12.2.2.1. Spinal Fusion Devices

12.2.2.2. Spinal Non-fusion Devices

12.2.3. Trauma Fixation

12.2.3.1. Metal Plates & Screws

12.2.3.2. Pins/Wires

12.2.3.3. Nails & Rods

12.2.3.4. Others

12.2.4. Orthobiologics

12.2.5. Dental Implants

12.2.6. Others

12.3. Market Value Forecast, by End user, 2017–2031

12.3.1. Hospitals

12.3.2. Orthopedic Clinics

12.3.3. Ambulatory Surgery Centers

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End user

12.5.3. By Country/Sub-region

13. Middle East & Africa Orthopedic Implants Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Joint Reconstruction

13.2.1.1. Hip Replacement

13.2.1.2. Knee Replacement

13.2.1.3. Shoulder Replacement

13.2.1.4. Others

13.2.2. Spinal Devices

13.2.2.1. Spinal Fusion Devices

13.2.2.2. Spinal Non-fusion Devices

13.2.3. Trauma Fixation

13.2.3.1. Metal Plates & Screws

13.2.3.2. Pins/Wires

13.2.3.3. Nails & Rods

13.2.3.4. Others

13.2.4. Orthobiologics

13.2.5. Dental Implants

13.2.6. Others

13.3. Market Value Forecast, by End user, 2017–2031

13.3.1. Hospitals

13.3.2. Orthopedic Clinics

13.3.3. Ambulatory Surgery Centers

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share/Ranking Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Stryker

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. DePuy Synthes

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. Zimmer Biomet

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. Smith & Nephew

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. Orthopedic Implant Company

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. Medtronic Spinal

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. DJO Global

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Arthrex, Inc.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. NuVasive, Inc.

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. Evonik

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

14.3.11. Globus Medical

14.3.11.1. Company Overview

14.3.11.2. Product Portfolio

14.3.11.3. SWOT Analysis

14.3.11.4. Strategic Overview

14.3.12. Health Canada

14.3.12.1. Company Overview

14.3.12.2. Product Portfolio

14.3.12.3. SWOT Analysis

14.3.12.4. Strategic Overview

14.3.13. Kyocera Medical Technologies, Inc.

14.3.13.1. Company Overview

14.3.13.2. Product Portfolio

14.3.13.3. SWOT Analysis

14.3.13.4. Strategic Overview

14.3.14. Teijin Nakashima Medical Co., Ltd.

14.3.14.1. Company Overview

14.3.14.2. Product Portfolio

14.3.14.3. SWOT Analysis

14.3.14.4. Strategic Overview

14.3.15. HCM Orthocare Pvt. Ltd.

14.3.15.1. Company Overview

14.3.15.2. Product Portfolio

14.3.15.3. SWOT Analysis

14.3.15.4. Strategic Overview

List of Tables

Table 01: Global Orthopedic Implants Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Orthopedic Implants Market Value (US$ Mn) Forecast, by Product - Joint Reconstruction, 2017-2031

Table 03: Global Orthopedic Implants Market Value (US$ Mn) Forecast, by Spinal implant, 2017-2031

Table 04: Global Orthopedic Implants Market Value (US$ Mn) Forecast, by Trauma Implants, 2017-2031

Table 05: Global Orthopedic Implants Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 06: Global Orthopedic Implants Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Orthopedic Implants Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Orthopedic Implants Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 09: North America Orthopedic Implants Market Value (US$ Mn) Forecast, by Joint Reconstruction, 2017-2031

Table 10: North America Orthopedic Implants Market Value (US$ Mn) Forecast, by Spinal implant, 2017-2031

Table 11: North America Orthopedic Implants Market Value (US$ Mn) Forecast, by Trauma Fixation, 2017-2031

Table 12: North America Orthopedic Implants Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Europe Orthopedic Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Europe Orthopedic Implants Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 15: Europe Orthopedic Implants Market Value (US$ Mn) Forecast, by Joint Reconstruction, 2017-2031

Table 16: Europe Orthopedic Implants Market Value (US$ Mn) Forecast, by Spinal implant, 2017-2031

Table 17: Europe Orthopedic Implants Market Value (US$ Mn) Forecast, by Trauma Fixation, 2017-2031

Table 18: Europe Orthopedic Implants Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 19: Asia Pacific Orthopedic Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 20: Asia Pacific Orthopedic Implants Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 21: Asia Pacific Orthopedic Implants Market Value (US$ Mn) Forecast, by Joint Reconstruction, 2017-2031

Table 22: Asia Pacific Orthopedic Implants Market Value (US$ Mn) Forecast, by Spinal implant, 2017-2031

Table 23: Asia Pacific Orthopedic Implants Market Value (US$ Mn) Forecast, by Trauma Fixation, 2017-2031

Table 24: Asia Pacific Orthopedic Implants Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 25: Latin America Orthopedic Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Latin America Orthopedic Implants Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 27: Latin America Orthopedic Implants Market Value (US$ Mn) Forecast, by Joint Reconstruction, 2017-2031

Table 28: Latin America Orthopedic Implants Market Value (US$ Mn) Forecast, by Spinal implant, 2017-2031

Table 29: Latin America Orthopedic Implants Market Value (US$ Mn) Forecast, by Trauma Fixation, 2017-2031

Table 30: Latin America Orthopedic Implants Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 31: Middle East & Africa Orthopedic Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 32 Middle East & Africa Orthopedic Implants Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 33: Middle East & Africa Orthopedic Implants Market Value (US$ Mn) Forecast, by Joint Reconstruction, 2017-2031

Table 34: Middle East & Africa Orthopedic Implants Market Value (US$ Mn) Forecast, by Spinal implant, 2017-2031

Table 35: Middle East & Africa Orthopedic Implants Market Value (US$ Mn) Forecast, by Trauma Fixation, 2017-2031

Table 36: Middle East & Africa Orthopedic Implants Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Orthopedic Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Orthopedic Implants Market Value Share Analysis (%), by Product (2017)

Figure 03: Global Orthopedic Implants Market Value Share Analysis (%), by End-user (2017)

Figure 04: Global Orthopedic Implants Market Value Share Analysis (%), by Region (2017)

Figure 05: Global Orthopedic Implants Market Value Share Analysis (%), by Product, 2017 and 2021

Figure 06 Global Orthopedic Implants Market Attractiveness Analysis, by Product, 2022-2031

Figure 07: Global Orthopedic Implants Market Value Share Analysis (%), by Joint Reconstruction, 2021 and 2031

Figure 08: Global Orthopedic Implants Market Attractiveness Analysis, by Joint Reconstruction, 2022-2031

Figure 09: Global Orthopedic Implants Market Value Share Analysis (%), by Spinal implant, 2021 and 2031

Figure 10: Global Orthopedic Implants Market Attractiveness Analysis, by Spinal implant, 2022-2031

Figure 11: Global Orthopedic Implants Market Value Share Analysis (%), Trauma Implants, 2021 and 2031

Figure 12: Global Orthopedic Implants Market Attractiveness Analysis, Trauma Implants, 2022-2031

Figure 13: Global Orthopedic Implants Market Value Share Analysis (%), by End-user, 2021 and 2031

Figure 14: Global Orthopedic Implants Market Attractiveness Analysis, by End-user, 2022-2031

Figure 15: Global Orthopedic Implants Market Value Share Analysis (%), by Region, 2021 and 2031

Figure 16: Global Orthopedic Implants Market Attractiveness Analysis, by Region, 2022-2031

Figure 17: North America Orthopedic Implants Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, 2016–2026

Figure 18: North America Orthopedic Implants Market Value Share Analysis (%), by Country, 2021 and 2031

Figure 19: North America Orthopedic Implants Market Attractiveness Analysis, by Country, 2022-2031

Figure 20: North America Orthopedic Implants Market Value Share Analysis (%), by Product, 2021 and 2031

Figure 21: North America Orthopedic Implants Market Attractiveness Analysis, by Product, 2022-2031

Figure 22: North America Orthopedic Implants Market Value Share Analysis (%), by End-user, 2021 and 2031

Figure 23: North America Orthopedic Implants Market Attractiveness Analysis, by End-user, 2022-2031

Figure 24: Europe Orthopedic Implants Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, 2016–2026

Figure 25: Europe Orthopedic Implants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 26: Europe Orthopedic Implants Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 27: Europe Orthopedic Implants Market Value Share Analysis (%), by Product, 2021 and 2031

Figure 28: Europe Orthopedic Implants Market Attractiveness Analysis, by Product, 2022-2031

Figure 29: Europe Orthopedic Implants Market Value Share Analysis (%), by End-user, 2021 and 2031

Figure 30: Europe Orthopedic Implants Market Attractiveness Analysis, by End-user, 2022-2031

Figure 31: Asia Pacific Orthopedic Implants Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, 2016–2026

Figure 32: Asia Pacific Orthopedic Implants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 33: Asia Pacific Orthopedic Implants Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 34: Asia Pacific Orthopedic Implants Market Value Share Analysis (%), by Product, 2021 and 2031

Figure 35: Asia Pacific Orthopedic Implants Market Attractiveness Analysis, by Product, 2022-2031

Figure 36: Asia Pacific Orthopedic Implants Market Value Share Analysis (%), by End-user, 2021 and 2031

Figure 37: Asia Pacific Orthopedic Implants Market Attractiveness Analysis, by End-user, 2022-2031

Figure 38: Latin America Orthopedic Implants Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, 2016–2026

Figure 39: Latin America Orthopedic Implants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 40: Latin America Orthopedic Implants Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 41: Latin America Orthopedic Implants Market Value Share Analysis (%), by Product, 2021 and 2031

Figure 42: Latin America Orthopedic Implants Market Attractiveness Analysis, by Product, 2022-2031

Figure 43: Latin America Orthopedic Implants Market Value Share Analysis (%), by End-user, 2021 and 2031

Figure 44: Latin America Orthopedic Implants Market Attractiveness Analysis, by End-user, 2022-2031

Figure 45: Middle East & Africa Orthopedic Implants Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, 2016–2026

Figure 46: Middle East & Africa Orthopedic Implants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 47: Middle East & Africa Orthopedic Implants Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 48: Middle East & Africa Orthopedic Implants Market Value Share Analysis (%), by Product, 2021 and 2031

Figure 49: Middle East & Africa Orthopedic Implants Market Attractiveness Analysis, by Product, 2022-2031

Figure 50: Middle East & Africa Orthopedic Implants Market Value Share Analysis (%), by End-user, 2021 and 2031

Figure 51: Middle East & Africa Orthopedic Implants Market Attractiveness Analysis, by End-user, 2022-2031