Analysts’ Viewpoint

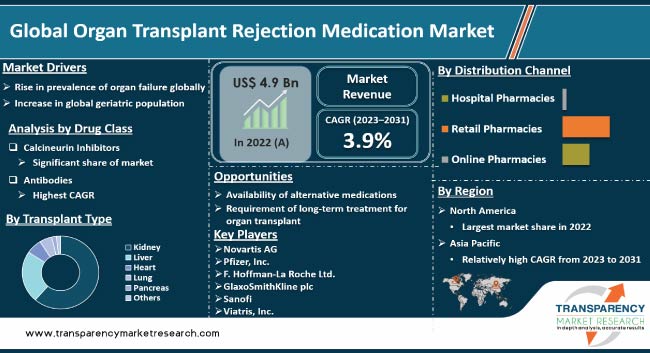

Rise in prevalence of chronic diseases and increase in incidence of organ failure, which requires organ transplantation, are driving the global organ transplant rejection medication market. Advancements in transplant technology and aging population have led to a surge in the number of transplant procedures, which is driving demand for immunosuppressive drugs. Furthermore, increase in awareness about the benefits of organ transplantation, favorable reimbursement policies, and rise in number of organ donors are propelling market development.

Research & development in new and more effective immunosuppressive drugs offers lucrative opportunities to market players. Companies are focusing on expanding to emerging economies, such as China, India, Brazil, and South Africa, in order to increase market share and revenue.

Organ transplantation has emerged as a promising therapeutic option for patients suffering from organ failure, offering them an extended lifespan and improved quality of life. Despite advances in transplantation techniques and development of immunosuppressive drugs, organ rejection remains a significant concern.

Organ rejection occurs when the recipient's immune system recognizes the transplanted organ as foreign and mounts an attack against it, leading to graft failure. In order to prevent rejection and ensure long-term success of transplantation, patients are required to take immunosuppressive medications that dampen their immune system's response to the transplant.

The organ transplant rejection medication industry includes drugs that are used to prevent and treat organ rejection in transplant recipients. The market has witnessed significant developments in the past few years, including development of newer immunosuppressive agents with improved efficacy and safety profiles, and introduction of novel treatment modalities such as cell-based therapies and gene editing.

Increase in demand for organ transplantation and continued research to advance the field of transplantation medicine are expected to propel global organ transplant rejection medication market value.

Organ failure is a serious medical condition that occurs when one or more vital organs in the body stop functioning correctly. This can happen due to reasons such as illness, injury, or genetic disorders, and is a leading cause of death globally. Incidence of organ failure is increasing due to factors such as an aging population, unhealthy lifestyle choices, and environmental pollution.

Demand for organ transplantation is rising owing to surge in cases of organ failure. In 2017, the World Health Organization (WHO) estimated that 10% of the world's population suffered from chronic kidney disease, putting over 700 million people at risk of developing kidney failure. In the U.S., more than 112,000 people are waiting for an organ transplant, with the majority of them waiting for a kidney transplant.

The Global Observatory on Donation and Transplantation reported that over 140,000 organ transplants were performed worldwide in 2019, with kidneys being the most commonly transplanted organ due to factors such as aging population, diabetes, high blood pressure, obesity, and unhealthy lifestyle factors, such as smoking.

Heart failure is another factor fueling global organ transplant rejection medication market demand. According to WHO, an estimated 17.9 million people succumb to cardiovascular disorders (CVD) each year.

Aging increases the need for health care, as it renders people prone to cardiovascular diseases, such as coronary heart disease, respiratory diseases, such as TB and pneumonia, dental caries, oral cancer, and orthopedic conditions, such as osteoporosis. Rise in prevalence of these diseases is likely to widen the target patient pool for organ transplant.

According to the WHO, the global geriatric population is likely to reach around 2 billion (22% of global population) by 2050, as against 524 million in 2010. Hence, rapidly aging global population is anticipated to augment global organ transplant rejection medication market size.

According to WHO estimates, the geriatric population is expected to rise at a rapid pace in developed countries such as the U.S., the U.K., and Japan. Around 82% of people who succumb to a coronary artery disease are aged 65 years and above.

Access to several diagnostic and treatment services has improved due to favorable healthcare policies and advancements in healthcare facilities in countries such as the U.S., Japan, the U.K., and other countries in Western Europe, which in turn has increased the life expectancy of the population.

Hence, surge in the geriatric population is anticipated to propel global organ transplant rejection medication market development during the forecast period.

In terms of drug class, the calcineurin inhibitors segment accounted for the largest global organ transplant rejection medication market share in 2022. Rise in preference for calcineurin inhibitors due to adequate immunosuppression and less side-effects compared to other classes is likely to propel the segment during the forecast period.

Calcineurin inhibitors (CNIs) have been the cornerstone of immunosuppressive therapy for organ transplant recipients for over 30 years. CNIs, including cyclosporine and tacrolimus, work by inhibiting the activity of calcineurin, a key enzyme in the T-cell signaling pathway that triggers the immune response.

The primary reason for widespread usage of CNIs is their effectiveness in preventing acute rejection of transplanted organs. These significantly reduce the incidence of acute rejection episodes, thereby improving the long-term outcome of organ transplantation. Furthermore, CNIs have been associated with improved graft survival rates compared to other organ transplant immunosuppressants, also known as transplantation immunosuppressants.

Another advantage of CNIs is broad spectrum of activity against both T- and B-cell-mediated immune responses, which makes them useful for a range of organ transplant types. These are also available in various formulations, including oral and injectable versions, making them easy to administer to patients.

Based on transplant type, the kidney transplant segment dominated the global market in 2022. Kidney transplant is the most common type of organ transplant performed globally, with a high success rate. Availability of living donors, including family members and unrelated donors, has increased the number of kidney transplants performed.

Living donor transplants have higher success rates, and the risk of rejection is lower compared to deceased donor transplants. This has contributed to the popularity of kidney transplantation.

Advances in medical technology have made kidney transplantation safer and more successful. New surgical techniques, immunosuppressive drugs, and better diagnostic tools have contributed to rise in successful kidney transplants.

According to WHO, 144,302 transplant surgeries were performed in 2021, with the majority being kidney transplant (92,532), followed by liver transplant (34,694), heart transplant (8,409), lung transplant (6,470), pancreas transplant (2,025), and small bowel transplant (172).

In terms of distribution channel, the retail pharmacies segment accounted for the largest share of the global market 2022.

Several patients prefer retail pharmacies due to timely availability and convenience in terms of purchase of medications associated with retail pharmacies. Rise in number of patients opting for retail pharmacies due to large number of product brands available at discounted prices is likely to drive the segment during the forecast period.

Staff at retail pharmacies is trained and knowledgeable about medications, providing patients with advice and information about their prescriptions. These pharmacies often have established relationships with healthcare providers and insurance companies, facilitating smooth processing of prescriptions and insurance claims.

Retail pharmacies can benefit from economies of scale by purchasing medications in bulk, which can translate into lower prices for patients.

According to organ transplant rejection medication market trends, North America dominated the global industry in 2022. This is ascribed to presence of large number of living as well as deceased donors and better organ-preserving practices in the region.

The market in North America is driven by high incidence of chronic diseases. Rapid adoption of advanced treatment options in the health care sector for treating various diseases is also expected to propel the market in the region during the forecast period. However, high cost and complex procedures are likely to hamper the market in the region during the forecast period.

Increase in the geriatric population is a major concern in Europe, as elderly individuals are more prone to organ dysfunction. The European Commission (Eurostat) has estimated that the geriatric population in Europe could reach 525 million by 2035. Rise in the geriatric population is likely to propel the demand for organ transplant rejection medications in the region during the forecast period.

Developing countries in Asia Pacific are generic-driven markets due to cost-constraints. Increase in competition from generic drugs leading to reduced drug prices and rise in affordability and awareness among patients are expected to propel the organ transplant rejection medications market in the region.

The global market is fragmented, with the presence of large number of players. Companies in the organ transplant rejection medication market are Pfizer, Inc., Astellas Pharma, Inc., Novartis AG, F. Hoffmann-La Roche Ltd., Sanofi, Bristol-Myers Squibb Company, GlaxoSmithKline plc, AbbVie, Inc., Hansa Biopharma, WOCKHARDT, Viatris, Inc., Glenmark, Biocon, Hikma Pharmaceuticals plc, Teva Pharmaceutical U.S.A, Inc., and Zydus Pharmaceuticals.

Each of these players has been profiled in the organ transplant rejection medication market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 4.9 Bn |

|

Forecast Value in 2031 |

More than US$ 7.0 Bn |

|

CAGR |

3.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 4.9 Bn in 2022

It is projected to reach more than US$ 7.0 Bn by 2031

The market is anticipated to grow at a CAGR of 3.9% from 2023 to 2031

The kidney segment held more than 60.0% share in 2022

North America is expected to account for largest market share from 2022 to 2031

Pfizer, Inc., Astellas Pharma, Inc., Novartis AG, F. Hoffmann-La Roche Ltd., Sanofi, Bristol-Myers Squibb Company, GlaxoSmithKline plc, AbbVie, Inc., Hansa Biopharma, WOCKHARDT, Viatris, Inc., Glenmark, Biocon, Hikma Pharmaceuticals plc, Teva Pharmaceutical U.S.A Inc., and Zydus Pharmaceuticals are the prominent players operating in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Organ Transplant Rejection Medication Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Organ Transplant Rejection Medication Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Current Global Scenario: Organ Donation for Transplantation

5.2. Key Product/Brand Analysis

5.3. Pipeline Analysis

5.4. COVID-19 Impact Analysis

6. Global Organ Transplant Rejection Medication Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Class, 2017-2031

6.3.1. Antibodies

6.3.1.1. Thymoglobulin

6.3.1.2. Alemtuzumab

6.3.1.3. Belatacept

6.3.1.4. Muromonab-CD3

6.3.1.5. Basiliximab

6.3.1.6. Eculizumab

6.3.2. Antimetabolites

6.3.2.1. Azathioprine

6.3.2.2. Mycophenolate Mofetil

6.3.2.3. Mycophenolate sodium, MPA

6.3.3. Calcineurin Inhibitors

6.3.3.1. Cyclosporine

6.3.3.2. Tacrolimus

6.3.4. mTOR Inhibitors

6.3.4.1. Sirolimus

6.3.4.2. Everolimus

6.3.5. Steroids

6.3.5.1. Prednisolone

6.3.5.2. Methylprednisolone

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Organ Transplant Rejection Medication Market Analysis and Forecast, by Transplant Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Transplant Type, 2017-2031

7.3.1. Kidney

7.3.2. Liver

7.3.3. Heart

7.3.4. Lung

7.3.5. Pancreas

7.3.6. Others

7.4. Market Attractiveness Analysis, by Transplant Type

8. Global Organ Transplant Rejection Medication Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2017-2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Organ Transplant Rejection Medication Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Organ Transplant Rejection Medication Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017-2031

10.2.1. Antibodies

10.2.1.1. Thymoglobulin

10.2.1.2. Alemtuzumab

10.2.1.3. Belatacept

10.2.1.4. Muromonab-CD3

10.2.1.5. Basiliximab

10.2.1.6. Eculizumab

10.2.2. Antimetabolites

10.2.2.1. Azathioprine

10.2.2.2. Mycophenolate Mofetil

10.2.2.3. Mycophenolate sodium, MPA

10.2.3. Calcineurin Inhibitors

10.2.3.1. Cyclosporine

10.2.3.2. Tacrolimus

10.2.4. mTOR Inhibitors

10.2.4.1. Sirolimus

10.2.4.2. Everolimus

10.2.5. Steroids

10.2.5.1. Prednisolone

10.2.5.2. Methylprednisolone

10.3. Market Value Forecast, by Transplant Type, 2017-2031

10.3.1. Kidney

10.3.2. Liver

10.3.3. Heart

10.3.4. Lung

10.3.5. Pancreas

10.3.6. Others

10.4. Market Value Forecast, by Distribution Channel, 2017-2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Transplant Type

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Organ Transplant Rejection Medication Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017-2031

11.2.1. Antibodies

11.2.1.1. Thymoglobulin

11.2.1.2. Alemtuzumab

11.2.1.3. Belatacept

11.2.1.4. Muromonab-CD3

11.2.1.5. Basiliximab

11.2.1.6. Eculizumab

11.2.2. Antimetabolites

11.2.2.1. Azathioprine

11.2.2.2. Mycophenolate Mofetil

11.2.2.3. Mycophenolate sodium, MPA

11.2.3. Calcineurin Inhibitors

11.2.3.1. Cyclosporine

11.2.3.2. Tacrolimus

11.2.4. mTOR Inhibitors

11.2.4.1. Sirolimus

11.2.4.2. Everolimus

11.2.5. Steroids

11.2.5.1. Prednisolone

11.2.5.2. Methylprednisolone

11.3. Market Value Forecast, by Transplant Type, 2017-2031

11.3.1. Kidney

11.3.2. Liver

11.3.3. Heart

11.3.4. Lung

11.3.5. Pancreas

11.3.6. Others

11.4. Market Value Forecast, by Distribution Channel, 2017-2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Transplant Type

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Organ Transplant Rejection Medication Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017-2031

12.2.1. Antibodies

12.2.1.1. Thymoglobulin

12.2.1.2. Alemtuzumab

12.2.1.3. Belatacept

12.2.1.4. Muromonab-CD3

12.2.1.5. Basiliximab

12.2.1.6. Eculizumab

12.2.2. Antimetabolites

12.2.2.1. Azathioprine

12.2.2.2. Mycophenolate Mofetil

12.2.2.3. Mycophenolate sodium, MPA

12.2.3. Calcineurin Inhibitors

12.2.3.1. Cyclosporine

12.2.3.2. Tacrolimus

12.2.4. mTOR Inhibitors

12.2.4.1. Sirolimus

12.2.4.2. Everolimus

12.2.5. Steroids

12.2.5.1. Prednisolone

12.2.5.2. Methylprednisolone

12.3. Market Value Forecast, by Transplant Type, 2017-2031

12.3.1. Kidney

12.3.2. Liver

12.3.3. Heart

12.3.4. Lung

12.3.5. Pancreas

12.3.6. Others

12.4. Market Value Forecast, by Distribution Channel, 2017-2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Transplant Type

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Organ Transplant Rejection Medication Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017-2031

13.2.1. Antibodies

13.2.1.1. Thymoglobulin

13.2.1.2. Alemtuzumab

13.2.1.3. Belatacept

13.2.1.4. Muromonab-CD3

13.2.1.5. Basiliximab

13.2.1.6. Eculizumab

13.2.2. Antimetabolites

13.2.2.1. Azathioprine

13.2.2.2. Mycophenolate Mofetil

13.2.2.3. Mycophenolate sodium, MPA

13.2.3. Calcineurin Inhibitors

13.2.3.1. Cyclosporine

13.2.3.2. Tacrolimus

13.2.4. mTOR Inhibitors

13.2.4.1. Sirolimus

13.2.4.2. Everolimus

13.2.5. Steroids

13.2.5.1. Prednisolone

13.2.5.2. Methylprednisolone

13.3. Market Value Forecast, by Transplant Type, 2017-2031

13.3.1. Kidney

13.3.2. Liver

13.3.3. Heart

13.3.4. Lung

13.3.5. Pancreas

13.3.6. Others

13.4. Market Value Forecast, by Distribution Channel, 2017-2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Transplant Type

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Organ Transplant Rejection Medication Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017-2031

14.2.1. Antibodies

14.2.1.1. Thymoglobulin

14.2.1.2. Alemtuzumab

14.2.1.3. Belatacept

14.2.1.4. Muromonab-CD3

14.2.1.5. Basiliximab

14.2.1.6. Eculizumab

14.2.2. Antimetabolites

14.2.2.1. Azathioprine

14.2.2.2. Mycophenolate Mofetil

14.2.2.3. Mycophenolate sodium, MPA

14.2.3. Calcineurin Inhibitors

14.2.3.1. Cyclosporine

14.2.3.2. Tacrolimus

14.2.4. mTOR Inhibitors

14.2.4.1. Sirolimus

14.2.4.2. Everolimus

14.2.5. Steroids

14.2.5.1. Prednisolone

14.2.5.2. Methylprednisolone

14.3. Market Value Forecast, by Transplant Type, 2017-2031

14.3.1. Kidney

14.3.2. Liver

14.3.3. Heart

14.3.4. Lung

14.3.5. Pancreas

14.3.6. Others

14.4. Market Value Forecast, by Distribution Channel, 2017-2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Transplant Type

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Pfizer, Inc.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Astellas Pharma, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Novartis AG

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. F. Hoffmann-La Roche Ltd.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Sanofi

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Bristol-Myers Squibb Company

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. GlaxoSmithKline plc

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. AbbVie, Inc.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Hansa Biopharma

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. WOCKHARDT

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.2. Product Portfolio

15.3.10.3. Business Strategies

15.3.10.4. Recent Developments

15.3.11. Viatris, Inc.

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Glenmark

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Biocon

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Hikma Pharmaceuticals plc

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Teva Pharmaceutical U.S.A Inc.

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

15.3.16. Zydus Pharmaceuticals, Inc.

15.3.16.1. Company Overview

15.3.16.2. Financial Overview

15.3.16.3. Product Portfolio

15.3.16.4. Business Strategies

15.3.16.5. Recent Developments

List of Tables

Table 01: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 02: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antibodies, 2017‒2031

Table 03: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antimetabolites, 2017‒2031

Table 04: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Calcineurin Inhibitors, 2017‒2031

Table 05: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by mTOR Inhibitors, 2017‒2031

Table 06: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Steroids, 2017‒2031

Table 07: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Transplant Type, 2017-2031

Table 08: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 09: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 10: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 11: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antibodies, 2017‒2031

Table 12: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antimetabolites, 2017‒2031

Table 13: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Calcineurin Inhibitors, 2017‒2031

Table 14: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by mTOR Inhibitors, 2017‒2031

Table 15: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Steroids, 2017‒2031

Table 16: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Transplant Type, 2017-2031

Table 17: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 18: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 19: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 20: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antibodies, 2017‒2031

Table 21: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antimetabolites, 2017‒2031

Table 22: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Calcineurin Inhibitors, 2017‒2031

Table 23: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by mTOR Inhibitors, 2017‒2031

Table 24: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Steroids, 2017‒2031

Table 25: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Transplant Type, 2017-2031

Table 26: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 27: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 28: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 29: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antibodies, 2017‒2031

Table 30: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antimetabolites, 2017‒2031

Table 31: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Calcineurin Inhibitors, 2017‒2031

Table 32: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by mTOR Inhibitors, 2017‒2031

Table 33: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Steroids, 2017‒2031

Table 34: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Transplant Type, 2017-2031

Table 35: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 36: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 37: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 38: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antibodies, 2017‒2031

Table 39: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antimetabolites, 2017‒2031

Table 40: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Calcineurin Inhibitors, 2017‒2031

Table 41: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by mTOR Inhibitors, 2017‒2031

Table 42: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Steroids, 2017‒2031

Table 43: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Transplant Type, 2017-2031

Table 44: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 45: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 46: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 47: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antibodies, 2017‒2031

Table 48: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Antimetabolites, 2017‒2031

Table 49: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Calcineurin Inhibitors, 2017‒2031

Table 50: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by mTOR Inhibitors, 2017‒2031

Table 51: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Steroids, 2017‒2031

Table 52: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Transplant Type, 2017-2031

Table 53: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 54: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

List of Figures

Figure 01: Global Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Organ Transplant Rejection Medications Market Value Share, by Drug Class, 2022

Figure 03: Global Organ Transplant Rejection Medications Market Value Share, by Transplant Type, 2022

Figure 04: Global Organ Transplant Rejection Medications Market Value Share, by Distribution Channel, 2022

Figure 05: Global Organ Transplant Rejection Medications Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 06: Global Organ Transplant Rejection Medications Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 07: Global Organ Transplant Rejection Medications Market Value (US$ Mn), by Antibodies, 2017‒2031

Figure 08: Global Organ Transplant Rejection Medications Market Value (US$ Mn), by Antimetabolites, 2017‒2031

Figure 09: Global Organ Transplant Rejection Medications Market Value (US$ Mn), by Calcineurin Inhibitors, 2017‒2031

Figure 10: Global Organ Transplant Rejection Medications Market Value (US$ Mn), by mTOR Inhibitors, 2017‒2031

Figure 11: Global Organ Transplant Rejection Medications Market Value (US$ Mn), by Steroids, 2017‒2031

Figure 12: Global Organ Transplant Rejection Medications Market Value Share Analysis, by Transplant Type, 2022 and 2031

Figure 13: Global Organ Transplant Rejection Medications Market Attractiveness Analysis, by Transplant Type, 2023-2031

Figure 14: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Kidney, 2017-2031

Figure 15: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Liver, 2017-2031

Figure 16: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Heart, 2017-2031

Figure 17: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Lung, 2017-2031

Figure 18: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Pancreas, 2017-2031

Figure 19: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Others, 2017-2031

Figure 20: Global Organ Transplant Rejection Medications Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 21: Global Organ Transplant Rejection Medications Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 22: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 23: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 24: Global Organ Transplant Rejection Medications Market Revenue (US$ Mn), by Online Pharmacies, 2017-2031

Figure 25: Global Organ Transplant Rejection Medications Market Value Share Analysis, by Region, 2022 and 2031

Figure 26: Global Organ Transplant Rejection Medications Market Attractiveness Analysis, by Region, 2023-2031

Figure 27: North America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, 2017-2031

Figure 28: North America Organ Transplant Rejection Medications Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 29: North America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 30: North America Organ Transplant Rejection Medications Market Value Share Analysis, by Transplant Type, 2022 and 2031

Figure 31: North America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Transplant Type, 2023-2031

Figure 32: North America Organ Transplant Rejection Medications Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 33: North America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 34: North America Organ Transplant Rejection Medications Market Value Share Analysis, by Country, 2022 and 2031

Figure 35: North America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Country, 2023-2031

Figure 36: Europe Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, 2017-2031

Figure 37: Europe Organ Transplant Rejection Medications Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 38: Europe Organ Transplant Rejection Medications Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 39: Europe Organ Transplant Rejection Medications Market Value Share Analysis, by Transplant Type, 2022 and 2031

Figure 40: Europe Organ Transplant Rejection Medications Market Attractiveness Analysis, by Transplant Type, 2023-2031

Figure 41: Europe Organ Transplant Rejection Medications Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 42: Europe Organ Transplant Rejection Medications Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 43: Europe Organ Transplant Rejection Medications Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Europe Organ Transplant Rejection Medications Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 45: Asia Pacific Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, 2017-2031

Figure 46: Asia Pacific Organ Transplant Rejection Medications Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 47: Asia Pacific Organ Transplant Rejection Medications Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 48: Asia Pacific Organ Transplant Rejection Medications Market Value Share Analysis, by Transplant Type, 2022 and 2031

Figure 49: Asia Pacific Organ Transplant Rejection Medications Market Attractiveness Analysis, by Transplant Type, 2023-2031

Figure 50: Asia Pacific Organ Transplant Rejection Medications Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 51: Asia Pacific Organ Transplant Rejection Medications Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 52: Asia Pacific Organ Transplant Rejection Medications Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 53: Asia Pacific Organ Transplant Rejection Medications Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 54: Latin America Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, 2017-2031

Figure 55: Latin America Organ Transplant Rejection Medications Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 56: Latin America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 57: Latin America Organ Transplant Rejection Medications Market Value Share Analysis, by Transplant Type, 2022 and 2031

Figure 58: Latin America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Transplant Type, 2023-2031

Figure 59: Latin America Organ Transplant Rejection Medications Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 60: Latin America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 61: Latin America Organ Transplant Rejection Medications Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 62: Latin America Organ Transplant Rejection Medications Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 63: Middle East & Africa Organ Transplant Rejection Medications Market Value (US$ Mn) Forecast, 2017-2031

Figure 64: Middle East & Africa Organ Transplant Rejection Medications Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 65: Middle East & Africa Organ Transplant Rejection Medications Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 66: Middle East & Africa Organ Transplant Rejection Medications Market Value Share Analysis, by Transplant Type, 2022 and 2031

Figure 67: Middle East & Africa Organ Transplant Rejection Medications Market Attractiveness Analysis, by Transplant Type, 2023-2031

Figure 68: Middle East & Africa Organ Transplant Rejection Medications Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 69: Middle East & Africa Organ Transplant Rejection Medications Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 70: Middle East & Africa Organ Transplant Rejection Medications Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 71: Middle East & Africa Organ Transplant Rejection Medications Market Attractiveness Analysis, by Country/Sub-region, 2023-2031