Analysts’ Viewpoint on Oral Rehydration Solution (ORS) Market Scenario

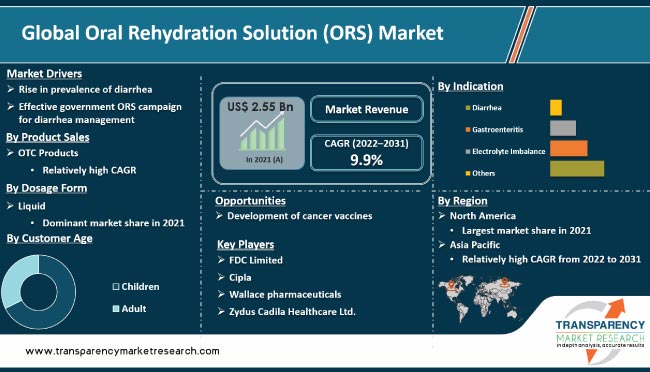

Rise in burden of diarrhea, effective government ORS campaigns for diarrhea management, and increase in significance & adoption of ORS in sports are driving the global oral rehydration solution market size. Diarrhea is one of the prominent causes of morbidity and mortality across the globe, especially in children. A large proportion of diarrheal diseases can be treated through adequate sanitation and ORS. The World Health Organization (WHO) and UNICEF recommend ORS and zinc to treat diarrhea. Government institutions across the globe are coming up with effective campaigning programs to reduce childhood mortality. Manufacturers in the market are investing significantly in R&D activities to provide effective and safe ORS products.

Oral rehydration solution (ORS) is an oral formulation mixture of sodium chloride, glucose, sodium citrate, glucose-salt solution, and potassium chloride. Various forms of electral such as powder, liquid, and tablet are intended for the treatment or prevention of dehydration owing to diarrhea. ORS is inexpensive, allows people to be treated away from hospitals including the home, and is easy to consume. It helps bring energy levels back up to normal when an individual suffers from dehydration. The United Nations Children’s Education Fund (UNICEF) has proved that the ORS packet could be manufactured for as little as US$ 0.05 per life-saving packet and administered by someone with zero medical training whatsoever. It has significantly minimized the burden on healthcare professionals (HCPs) by providing a treatment that mothers or other caregivers could give to their children. The WHO adopted ORS in 1978 as its major diarrhea medication. ORS has proven to avert 93% of deaths due to diarrhea infection. Zinc supplementation can reduce deaths from diarrhea by 23%. Large number of studies have been undertaken over the last two decades to develop an ‘improved ORS’. The aim was to introduce a product that is effective and safe for treating/preventing dehydration from all types of diarrhea.

The communal transmission of COVID-19 virus challenged international and national healthcare infrastructure. According to the WHO, as of August 2022, more than 585.0 million confirmed cases of COVID-19 have been reported globally, including around 6.4 million deaths. The outbreak has increased the demand for health-oriented products, including ORS in general. Some of the most common symptoms of COVID-19 are vomiting and diarrhea, even in relatively mild cases. The issue of dehydration brought on by the pandemic can be resolved efficiently with the proper use of ORS, which offers significant benefits over other rehydration methods. ORS is non-invasive, does not require any special equipment to administer, and can be combined with other essential nutrients. It is quite effective in treating dehydration and related issues. Therefore, the COVID-19 pandemic is expected to present new opportunities for the global ORS market during the forecast period.

In terms of product sales, the OTC products segment dominated the global oral rehydration solution (ORS) market in 2021. The segment's dominance can be ascribed to the increase in availability of all forms of ORS products, including flavored liquid and effervescent tablets. Rise in trend among individuals to consume OTC ORS for mild diarrhea is projected to contribute to the growth of the OTC products segment during the forecast period. E-commerce is one of the larger and the rapidly-growing distribution segments for key manufacturers of ORS operating across the globe. The segment is driven by large third-party e-commerce platforms such as Amazon. The COVID-19 pandemic has led to a shift toward e-commerce for multiple health and wellness consumer products categories, and OTC ORS products are no exception, especially in developed countries.

Based on dosage form, the liquid segment dominated the global market in 2021. Energy drink and ORS consumption has risen significantly over the last two decades, particularly among adolescents and young adults. Dehydration is a common problem that many people face. Excessive stress, exercise, running, or usage of the body could cause sweating and breathing issues, resulting in the loss of essential body components and fluids.

In term of customer age, the adult segment accounted for major share of the global oral rehydration solution (ORS) market in 2021. ORS is promoted as the first line of treatment for dehydration and diarrhea among adults. It can also be consumed by healthy adults suffering from mild diarrhea. Furthermore, elderly adults with co-morbidities are as vulnerable to dehydration as children; therefore, ORS therapy plays a significant role in all such cases.

Based on indication, the diarrhea segment dominated the global oral rehydration solution (ORS) market in 2021. The trend is projected to continue during the forecast period. Oral rehydration solution (ORS) is the cornerstone of treatment for dehydration secondary to acute infectious diarrhea. The World Health Organization estimates that nearly 1.7 billion cases of pediatric diarrheal disease are recorded globally each year and oral rehydration therapy is the most rational tool in the fight against diarrheal diseases.

In terms of distribution channel, the retail pharmacies segment dominated the global market, with 45.8% share in 2021. The trend is projected to continue during the forecast period. Electrolyte imbalance (EI) is common in both hospitalized patients and general population. It is associated with increased morbidity and mortality. Retail pharmacies sell ORS powder and electrolyte drinks, which are OTC approved products. Moreover, oral rehydration solutions or electrolyte drinks fall under the OTC product sales; hence, local manufacturers or leading players introduce products with suitable packaging size. This is likely to drive the retail pharmacies segment.

As per global oral rehydration solution market trends, North America is projected to be a major region of the global ORS market during the forecast period. This can be ascribed to the presence of leading ORS hydration solution manufacturers such as Abbott, Gatorade, and SOS Hydration in the region.

The market in Asia Pacific is anticipated to grow at a high CAGR during the forecast period due to the rise in focus on malnutrition among children, increase in number of non-government organizations working for child health, and high investment in children’s healthcare programs in countries such as India. These factors are anticipated to augment the oral rehydration solution market growth in the region during the forecast period.

The oral rehydration solution (ORS) market report includes vital information about leading players in the global market. Companies are adopting product launch, divestiture, merger & acquisition, and partnership strategies to increase their market share. FDC Limited, Cipla, Wallace Pharmaceuticals, Liquid I.V., Zydus Cadila Healthcare Ltd., Shereya Life Sciences, Mankind Pharma, Intas Pharmaceuticals Ltd., Sun Pharma, Dr Reddy's, Alkem, Lupin, Cadila, RPG Life Sciences, Casca Remedies Pvt. Ltd., Halewood Laboratories Pvt. Ltd., Healthy Life Pharma Private Limited, and Okasa Pharma Pvt. Ltd. are prominent players operating in the global market.

Key players have been profiled in the oral rehydration solution (ORS) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.55 Bn |

|

Market Forecast Value in 2031 |

More than US$ 6.71 Bn |

|

Growth Rate (CAGR) for 2022–2031 |

9.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global oral rehydration solution (ORS) market was valued at US$ 2.55 Bn in 2021

The global market is projected to reach more than US$ 6.71 Bn by 2031

The global oral rehydration solution (ORS) market is anticipated to advance at a CAGR of 9.9% from 2022 to 2031

Effective government ORS campaigns for diarrhea management and rise in prevalence of diarrhea

North America is expected to account for major share of the global oral rehydration solution (ORS) market during the forecast period

FDC Limited, Cipla, Wallace Pharmaceuticals, Liquid I.V., Zydus Cadila Healthcare Ltd., Shereya Life Sciences, Mankind Pharma, Intas Pharmaceuticals Ltd., Sun Pharma, Dr Reddy's, Alkem, Lupin, Cadila, RPG Life Sciences, Casca remedies Pvt. Ltd., Halewood Laboratories Pvt. Ltd., Healthy Life Pharma Private Limited, and Okasa Pharma Pvt. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Oral Rehydration Solution (ORS) Market

4. Market Overview

4.1. Introduction

4.1.1. Product Sales Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, 2017–2031

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Raw material and Pricing trends

5.2. Regulatory Scenario by Region/globally

5.3. COVID-19 Impact Analysis

5.4. ORS campaigns by global institutions/NGOs

6. Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, By Product Sales

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Sales, 2017–2031

6.3.1. OTC Products

6.3.2. Prescription

6.4. Market Attractiveness Analysis, By Product Sales

7. Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, By Dosage Form

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Dosage Form, 2017–2031

7.3.1. Powder

7.3.2. Liquid

7.3.3. Tablet

7.4. Market Attractiveness Analysis, By Dosage Form

8. Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, By Customer Age

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Customer Age, 2017–2031

8.3.1. Children

8.3.2. Adult

8.4. Market Attractiveness Analysis, By Customer Age

9. Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, By Indication

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Indication, 2017–2031

9.3.1. Diarrhea

9.3.2. Gastroenteritis

9.3.3. Electrolyte Imbalance

9.3.4. Others

9.4. Market Attractiveness Analysis, By Indication

10. Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, By Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Attractiveness Analysis, By Distribution Channel

11. Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, By Region

11.1. Key Findings

11.2. Market Value Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, By Region

12. North America Oral Rehydration Solution (ORS) Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Sales, 2017–2031

12.2.1. OTC Products

12.2.2. Prescription

12.3. Market Value Forecast, by Dosage Form, 2017–2031

12.3.1. Powder

12.3.2. Liquid

12.3.3. Tablet

12.4. Market Value Forecast, by Customer Age, 2017–2031

12.4.1. Children

12.4.2. Adult

12.5. Market Value Forecast, by Indication, 2017–2031

12.5.1. Diarrhea

12.5.2. Gastroenteritis

12.5.3. Electrolyte Imbalance

12.5.4. Others

12.6. Market Value Forecast, by Distribution Channel, 2017–2031

12.6.1. Hospital Pharmacies

12.6.2. Retail Pharmacies

12.6.3. Online Pharmacies

12.7. Market Value Forecast, by Country, 2017–2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Product Sales

12.8.2. By Dosage Form

12.8.3. By Customer Age

12.8.4. By Indication

12.8.5. By Distribution Channel

12.8.6. By Country

13. Europe Oral Rehydration Solution (ORS) Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Sales, 2017–2031

13.2.1. OTC Products

13.2.2. Prescription

13.3. Market Value Forecast, by Dosage Form, 2017–2031

13.3.1. Powder

13.3.2. Liquid

13.3.3. Tablet

13.4. Market Value Forecast, by Customer Age, 2017–2031

13.4.1. Children

13.4.2. Adult

13.5. Market Value Forecast, by Indication, 2017–2031

13.5.1. Diarrhea

13.5.2. Gastroenteritis

13.5.3. Electrolyte Imbalance

13.5.4. Others

13.6. Market Value Forecast, by Distribution Channel, 2017–2031

13.6.1. Hospital Pharmacies

13.6.2. Retail Pharmacies

13.6.3. Online Pharmacies

13.7. Market Value Forecast, by Country/Sub-region, 2017–2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Spain

13.7.5. Italy

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Product Sales

13.8.2. By Dosage Form

13.8.3. By Customer Age

13.8.4. By Indication

13.8.5. By Distribution Channel

13.8.6. By Country/Sub-region

14. Asia Pacific Oral Rehydration Solution (ORS) Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Sales, 2017–2031

14.2.1. OTC Products

14.2.2. Prescription

14.3. Market Value Forecast, by Dosage Form, 2017–2031

14.3.1. Powder

14.3.2. Liquid

14.3.3. Tablet

14.4. Market Value Forecast, by Customer Age, 2017–2031

14.4.1. Children

14.4.2. Adult

14.5. Market Value Forecast, by Indication, 2017–2031

14.5.1. Diarrhea

14.5.2. Gastroenteritis

14.5.3. Electrolyte Imbalance

14.5.4. Others

14.6. Market Value Forecast, by Distribution Channel, 2017–2031

14.6.1. Hospital Pharmacies

14.6.2. Retail Pharmacies

14.6.3. Online Pharmacies

14.7. Market Value Forecast, by Country/Sub-region, 2017–2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Product Sales

14.8.2. By Dosage Form

14.8.3. By Customer Age

14.8.4. By Indication

14.8.5. By Distribution Channel

14.8.6. By Country/Sub-region

15. Latin America Oral Rehydration Solution (ORS) Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Sales, 2017–2031

15.2.1. OTC Products

15.2.2. Prescription

15.3. Market Value Forecast, by Dosage Form, 2017–2031

15.3.1. Powder

15.3.2. Liquid

15.3.3. Tablet

15.4. Market Value Forecast, by Customer Age, 2017–2031

15.4.1. Children

15.4.2. Adult

15.5. Market Value Forecast, by Indication, 2017–2031

15.5.1. Diarrhea

15.5.2. Gastroenteritis

15.5.3. Electrolyte Imbalance

15.5.4. Others

15.6. Market Value Forecast, by Distribution Channel, 2017–2031

15.6.1. Hospital Pharmacies

15.6.2. Retail Pharmacies

15.6.3. Online Pharmacies

15.7. Market Value Forecast, by Country/Sub-region, 2017–2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Product Sales

15.8.2. By Dosage Form

15.8.3. By Customer Age

15.8.4. By Indication

15.8.5. By Distribution Channel

15.8.6. By Country/Sub-region

16. Middle East & Africa Oral Rehydration Solution (ORS) Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Product Sales, 2017–2031

16.2.1. OTC Products

16.2.2. Prescription

16.3. Market Value Forecast, by Dosage Form, 2017–2031

16.3.1. Powder

16.3.2. Liquid

16.3.3. Tablet

16.4. Market Value Forecast, by Customer Age, 2017–2031

16.4.1. Children

16.4.2. Adult

16.5. Market Value Forecast, by Indication, 2017–2031

16.5.1. Diarrhea

16.5.2. Gastroenteritis

16.5.3. Electrolyte Imbalance

16.5.4. Others

16.6. Market Value Forecast, by Distribution Channel, 2017–2031

16.6.1. Hospital Pharmacies

16.6.2. Retail Pharmacies

16.6.3. Online Pharmacies

16.7. Market Value Forecast, by Country/Sub-region, 2017–2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Product Sales

16.8.2. By Dosage Form

16.8.3. By Customer Age

16.8.4. By Indication

16.8.5. By Distribution Channel

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of companies)

17.2. Market Share Analysis, by Company, 2021

17.3. Company Profiles

17.3.1. FDC Limited

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Product Portfolio

17.3.1.3. SWOT Analysis

17.3.1.4. Strategic Overview

17.3.2. Cipla

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Product Portfolio

17.3.2.3. SWOT Analysis

17.3.2.4. Strategic Overview

17.3.3. Wallace Pharmaceuticals

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Product Portfolio

17.3.3.3. SWOT Analysis

17.3.3.4. Strategic Overview

17.3.4. Zydus Cadila Healthcare Ltd.

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Product Portfolio

17.3.4.3. SWOT Analysis

17.3.4.4. Strategic Overview

17.3.5. Shereya Life Sciences

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Product Portfolio

17.3.5.3. SWOT Analysis

17.3.5.4. Strategic Overview

17.3.6. Mankind Pharma

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Product Portfolio

17.3.6.3. SWOT Analysis

17.3.6.4. Strategic Overview

17.3.7. Intas Pharmaceuticals Ltd.

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Product Portfolio

17.3.7.3. SWOT Analysis

17.3.7.4. Strategic Overview

17.3.8. Sun Pharma

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Product Portfolio

17.3.8.3. SWOT Analysis

17.3.8.4. Strategic Overview

17.3.9. Dr Reddy's

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Product Portfolio

17.3.9.3. SWOT Analysis

17.3.9.4. Strategic Overview

17.3.10. Alkem

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Product Portfolio

17.3.10.3. SWOT Analysis

17.3.10.4. Strategic Overview

17.3.11. Lupin

17.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.11.2. Product Portfolio

17.3.11.3. SWOT Analysis

17.3.11.4. Strategic Overview

17.3.12. Cadila

17.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.12.2. Product Portfolio

17.3.12.3. SWOT Analysis

17.3.12.4. Strategic Overview

17.3.13. RPG Life Sciences

17.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.13.2. Product Portfolio

17.3.13.3. SWOT Analysis

17.3.13.4. Strategic Overview

17.3.14. Casca remedies Pvt. Ltd.

17.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.14.2. Product Portfolio

17.3.14.3. SWOT Analysis

17.3.14.4. Strategic Overview

17.3.15. Halewood Laboratories Pvt. Ltd.

17.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.15.2. Product Portfolio

17.3.15.3. SWOT Analysis

17.3.15.4. Strategic Overview

17.3.16. Liquid I.V.

17.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.16.2. Product Portfolio

17.3.16.3. SWOT Analysis

17.3.16.4. Strategic Overview

List of Table

Table 01: Global Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Product Sales, 2017–2031

Table 02: Global Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by OTC Products, 2017–2031

Table 03: Global Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 04: Global Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Customer Age, 2017–2031

Table 05: Global Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 06: Global Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 07: Global Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Product Sales, 2017–2031

Table 09: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by OTC Products, 2017–2031

Table 10: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 11: North America Oral Rehydration Solution (ORS) Market Volume (No. of Units) Forecast, by Dosage Form, 2017–2031

Table 12: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Customer Age, 2017–2031

Table 13: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 14: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 16: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Product Sales, 2017–2031

Table 17: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by OTC Products, 2017–2031

Table 18: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 19: Europe Oral Rehydration Solution (ORS) Market Volume (No. of Units) Forecast, by Dosage Form, 2017–2031

Table 20: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Customer Age, 2017–2031

Table 21: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 22: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 23: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Product Sales, 2017–2031

Table 25: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by OTC Products, 2017–2031

Table 26: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 27: Asia Pacific Oral Rehydration Solution (ORS) Market Volume (No. of Units) Forecast, by Dosage Form, 2017–2031

Table 28: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Customer Age, 2017–2031

Table 29: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 30: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 31: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Product Sales, 2017–2031

Table 33: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by OTC Products, 2017–2031

Table 34: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 35: Latin America Oral Rehydration Solution (ORS) Market Volume (No. of Units) Forecast, by Dosage Form, 2017–2031

Table 36: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Customer Age, 2017–2031

Table 37: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 38: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 39: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 40: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Product Sales, 2017–2031

Table 41: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by OTC Products, 2017–2031

Table 42: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 43: Middle East & Africa Oral Rehydration Solution (ORS) Market Volume (No. of Units) Forecast, by Dosage Form, 2017–2031

Table 44: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Customer Age, 2017–2031

Table 45: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 46: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 47: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Oral Rehydration Solution (ORS) (CKD) Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Oral Rehydration Solution (ORS) Market Value Share, by Product Sales (2021)

Figure 03: Global Oral Rehydration Solution (ORS) Market Value Share, by Dosage Form (2021)

Figure 04: Global Oral Rehydration Solution (ORS) Market Value Share, by Customer Age (2021)

Figure 05: Global Oral Rehydration Solution (ORS) Market Value Share, by Indication (2021)

Figure 06: Global Oral Rehydration Solution (ORS) Market Value Share, by Distribution Channel (2021)

Figure 07: Global Oral Rehydration Solution (ORS) Market Value Share, by End-user (2021)

Figure 08: Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Product Sales, 2021 and 2031

Figure 09: Global Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Product Sales, 2022–2031

Figure 10: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by OTC Products, 2017–2031

Figure 11: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Prescription, 2017-2031

Figure 12: Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Dosage Form, 2021 and 2031

Figure 13: Global Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 14: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Powder, 2017–2031

Figure 15: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Liquid, 2017-2031

Figure 16: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Tablet, 2017-2031

Figure 17: Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Customer Age, 2021 and 2031

Figure 18: Global Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Customer Age, 2022–2031

Figure 19: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Children, 2017–2031

Figure 20: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Adult, 2017-2031

Figure 21: Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Indication, 2021 and 2031

Figure 22: Global Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Indication, 2022–2031

Figure 23: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Diarrhea, 2017–2031

Figure 24: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Gastroenteritis, 2017-2031

Figure 25: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Electrolyte Imbalance, 2017–2031

Figure 26: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Others, 2017-2031

Figure 27: Global Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 28: Global Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 29: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 30: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 31: Global Oral Rehydration Solution (ORS) Market (US$ Mn), by Online Pharmacies, 2017-2031

Figure 32: Global Oral Rehydration Solution (ORS) Market Value Share Analysis, by Region, 2021 and 2031

Figure 33: Global Oral Rehydration Solution (ORS) Market Attractiveness, by Region, 2022-2031

Figure 34: North America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: North America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Product Sales, 2021 and 2031

Figure 36: North America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Product Sales, 2022–2031

Figure 37: North America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Dosage Form, 2021 and 2031

Figure 38: North America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 39: North America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Customer Age, 2021 and 2031

Figure 40: North America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Customer Age, 2022–2031

Figure 41: North America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Indication, 2021 and 2031

Figure 42: North America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Indication, 2022–2031

Figure 43: North America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 44: North America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 45: North America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Country, 2021 and 2031

Figure 46: North America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Country, 2022–2031

Figure 47: Europe Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, 2017–2031

Figure 48: Europe Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Product Sales, 2021 and 2031

Figure 49: Europe Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Product Sales, 2022–2031

Figure 50: Europe Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Dosage Form, 2021 and 2031

Figure 51: Europe Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 52: Europe Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Customer Age, 2021 and 2031

Figure 53: Europe Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Customer Age, 2022–2031

Figure 54: Europe Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Indication, 2021 and 2031

Figure 55: Europe Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Indication, 2022–2031

Figure 56: Europe Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 57: Europe Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 58: Europe Oral Rehydration Solution (ORS) Market Analysis and Forecast, Country/Sub-region, 2021 and 2031

Figure 59: Europe Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 60: Asia Pacific Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, 2017–2031

Figure 61: Asia Pacific Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Product Sales, 2021 and 2031

Figure 62: Asia Pacific Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Product Sales, 2022–2031

Figure 63: Asia Pacific Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Dosage Form, 2021 and 2031

Figure 64: Asia Pacific Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 65: Asia Pacific Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Customer Age, 2021 and 2031

Figure 66: Asia Pacific Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Customer Age, 2022–2031

Figure 67: Asia Pacific Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Indication, 2021 and 2031

Figure 68: Asia Pacific Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Indication, 2022–2031

Figure 69: Asia Pacific Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 70: Asia Pacific Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 71: Asia Pacific Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 72: Asia Pacific Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 73: Latin America Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, 2017–2031

Figure 74: Latin America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Product Sales, 2021 and 2031

Figure 75; Latin America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Product Sales, 2022–2031

Figure 76: Latin America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Dosage Form, 2021 and 2031

Figure 77: Latin America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 78: Latin America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Customer Age, 2021 and 2031

Figure 79: Latin America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Customer Age, 2022–2031

Figure 80: Latin America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Indication, 2021 and 2031

Figure 81: Latin America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Indication, 2022–2031

Figure 82: Latin America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 83: Latin America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 84: Latin America Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 85: Latin America Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 86: Middle East & Africa Oral Rehydration Solution (ORS) Market Value (US$ Mn) Forecast, 2017–2031

Figure 87: Middle East & Africa Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Product Sales, 2021 and 2031

Figure 88: Middle East & Africa Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Product Sales, 2022–2031

Figure 89: Middle East & Africa Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Dosage Form, 2021 and 2031

Figure 90: Middle East & Africa Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 91: Middle East & Africa Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Customer Age, 2021 and 2031

Figure 92: Middle East & Africa Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Customer Age, 2022–2031

Figure 93: Middle East & Africa Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Indication, 2021 and 2031

Figure 94: Middle East & Africa Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Indication, 2022–2031

Figure 95; Middle East & Africa Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 96: Middle East & Africa Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 97: Middle East & Africa Oral Rehydration Solution (ORS) Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 98: Middle East & Africa Oral Rehydration Solution (ORS) Market Attractiveness Analysis, by Country/Sub-region, 2022–2031