Analysts’ Viewpoint on Optical Sensor Market Scenario

Penetration of technologies such as Industry 4.0, artificial intelligence (AI), cloud computing, big data analytics, IoT, 5G, and cyber security is driving the global optical sensor market. Adoption of optical sensors is rising in consumer electronic, healthcare, lighting, crop management, and road signaling devices due to their flexibility and reliability. This is also augmenting the global optical sensor market size. Furthermore, optical sensors are being used increasingly in display management, automotive cleaning system, access control and security, and smart surfaces. This is expected to fuel the global optical sensor market in the near future. Key players operating in the market are striving to introduce novel and innovative technologies such as smart/intelligent sensors in automation, precision, and electronics industry verticals to broaden their revenue streams.

Optical sensor is used in diverse applications across industries such as consumer electronics, aerospace & defense, automotive, healthcare, oil & gas, food & beverage, and media & entertainment due to its prominent features such as contactless installation, high spatial resolution, and relatively easier detection. Optical sensors have been broadly segmented into five types: fiber optic sensors, image sensors (CMOS and CC), photoelectric sensors, ambient light sensors, and others (infrared sensors, optical proximity sensors, etc.) The usage of fiber optic sensors has been rising in various applications such as measurement of chemical parameters, liquid flow and level, and gas detection owing to their compact form and immunity to electromagnetic interference. Expansion in fiber network across the globe is expected to create lucrative opportunities for manufacturers of fiber optic sensors. Rise in penetration of consumer electronic devices such as smartphones, tablets, smart wearables, and cameras is the primary factor driving the demand for different types of optical sensors and applications.

Of late, demand for photoelectric sensors has been rising in industries such as life sciences, pharmaceutical, food and beverage, and household and personal care due to the increase in need for high image resolution sensors and easy-to-apply sensing solutions. The photoelectric line of sensor offers features such as high-performance and adaptability to deliver excellent detection capabilities. These sensors offer a full range of sensing modes in a sealed, compact, cavity-free housing that minimizes the collection of dust and debris while allowing for easy sensor cleanup. Manufacturers of photoelectric sensor are focusing on the development of cost-effective products with wide range of features. For instance, in August 2022, Rockwell Automation released the new Allen-Bradley 42EA RightSight S18 and 42JA VisiSight M20A photoelectric sensors, which are economical and easy-to-apply sensing solutions that offer a wide range of sensing modes and mounting options.

Fiber optical sensors, also known as optical fiber sensors, are employed to sense parameters such as pressure, vibration, temperature, displacement, rotation, and concentration of chemical species. Extrinsic type of fiber optical sensor is used to measure vibrations. The fiber optical sensing technology is based on white light polarization interferometry (WLPI). The technology offers higher benefits over the fiber optics technology. Fiber optical sensors offer various advantages such as easy deployment and adoption, increased stability, enhanced safety for data transmission, high reliability, low maintenance, light weight, small size, and resistance to high voltages. Therefore, demand for fiber optical sensors is expected to increase significantly in the near future. Manufacturers are focusing on research and development activities to come up with innovative products in fiber optics. For instance, in February 2021, Scientific Bioprocessing, Inc. (SBI), a subsidiary of publicly-owned Scientific Industries, Inc., launched Intelligent Dynamic (ID) Fiber Optic Kit, which is an all-in-one pH and dissolved oxygen sensing solution that delivers real-time, non-invasive, and highly adaptable data from the smallest cell culture systems.

North America is expected to hold prominent share of the global optical sensor market during the forecast period due to the increase in demand for optical sensors in medical imaging, material processing, indoor & outdoor lighting, dynamic & static signaling, testing & measurement, and authentication & visualization applications in the region. Rise in urbanization & digitalization; increase in penetration of the Internet of Things (IoT); running investment in 4G & 5G communication & advanced factory automation; and dependence of research labs and businesses on fiber optic communication for simulation and modeling in diverse applications are some of the other factors boosting the optical sensor market in North America.

The optical sensor market in Asia Pacific and Europe is expected to grow at a significant pace during the forecast period due to the rise in adoption for online education, remote working, cloud technology, big data, artificial intelligence-driven mechanisms, and enterprise-grade networks in the region. Germany, Spain, Italy, the U.K., China, India, South Korea, Singapore, and Japan are the leading countries of the market in Europe and Asia Pacific.

The global optical sensor is fragmented, with the presence of large numbers of players. Market players are adopting various organic and inorganic strategies such as collaborations, partnerships, product launches, and mergers & acquisitions to enhance their market share. Top optical sensor manufacturers include ams-OSRAM AG, Analog Devices, Inc., Hamamatsu Photonics K.K., KEYENCE CORPORATION, OMRON Corporation, Opsens Solutions, Panasonic Corporation, Renesas Electronics Corporation, and ROHM CO., LTD.

Key players have been profiled in the optical sensor market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 24.2 Bn |

|

Market Forecast Value in 2031 |

US$ 53.2 Bn |

|

Growth Rate (CAGR) |

8.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

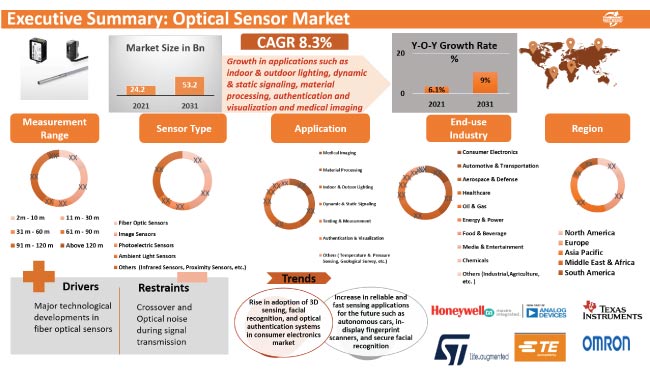

The optical sensor market stood at US$ 24.2 Bn in 2021.

The optical sensor is expected to grow at a CAGR of 8.3% from 2022 to 2031.

The optical sensor market is likely to reach US$ 53.2 Bn by 2031.

Rise in adoption of 3D sensing, facial recognition, and optical authentication systems in consumer electronics market; and increase in reliable and fast sensing applications for the future such as autonomous cars, in-display fingerprint scanners, and secure facial recognition.

Europe is a more lucrative region of the global optical sensor market.

ams-OSRAM AG, Analog Devices, Inc., Hamamatsu Photonics K.K., Honeywell, KEYENCE CORPORATION, OMRON Corporation, Opsens Solutions, and Panasonic Corporation.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Optical Sensor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macroeconomic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Optical Sensing Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Sensor Type Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Global Optical Sensor Market Analysis By Measurement Range

5.1. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Measurement Range, 2017–2031

5.1.1. 2m - 10 m

5.1.2. 11 m - 30 m

5.1.3. 31 m - 60 m

5.1.4. 61 m -90 m

5.1.5. 91 m -120 m

5.1.6. Above 120 m

5.2. Market Attractiveness Analysis, By Measurement Range

6. Global Optical Sensor Market Analysis By Sensor Type

6.1. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Sensor Type, 2017–2031

6.1.1. Fiber Optic Sensors

6.1.2. Image Sensors

6.1.2.1. CMOS

6.1.2.2. CCD

6.1.3. Photoelectric Sensors

6.1.4. Ambient Light Sensors

6.1.5. Others

6.2. Market Attractiveness Analysis, By Sensor Type

7. Global Optical Sensor Market Analysis By Application

7.1. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

7.1.1. Medical Imaging

7.1.2. Material Processing

7.1.3. Indoor & Outdoor Lighting

7.1.4. Dynamic & Static Signaling

7.1.5. Testing & Measurement

7.1.6. Authentication & Visualization

7.1.7. Others

7.2. Market Attractiveness Analysis, By Application

8. Global Optical Sensor Market Analysis By End-use Industry

8.1. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

8.1.1. Consumer Electronics

8.1.2. Automotive & Transportation

8.1.3. Aerospace & Defense

8.1.4. Healthcare

8.1.5. Oil & Gas

8.1.6. Energy & Power

8.1.7. Food & Beverage

8.1.8. Media & Entertainment

8.1.9. Chemicals

8.1.10. Others

8.2. Market Attractiveness Analysis, By End-use Industry

9. Global Optical Sensor Market Analysis and Forecast, By Region

9.1. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Optical Sensor Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Measurement Range, 2017–2031

10.3.1. 2m - 10 m

10.3.2. 11 m - 30 m

10.3.3. 31 m - 60 m

10.3.4. 61 m -90 m

10.3.5. 91 m -120 m

10.3.6. Above 120 m

10.4. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Sensor Type, 2017–2031

10.4.1. Fiber Optic Sensors

10.4.2. Image Sensors

10.4.2.1. CMOS

10.4.2.2. CCD

10.4.3. Photoelectric Sensors

10.4.4. Ambient Light Sensors

10.4.5. Others

10.5. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

10.5.1. Medical Imaging

10.5.2. Material Processing

10.5.3. Indoor & Outdoor Lighting

10.5.4. Dynamic & Static Signaling

10.5.5. Testing & Measurement

10.5.6. Authentication & Visualization

10.5.7. Others

10.6. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

10.6.1. Consumer Electronics

10.6.2. Automotive & Transportation

10.6.3. Aerospace & Defense

10.6.4. Healthcare

10.6.5. Oil & Gas

10.6.6. Energy & Power

10.6.7. Food & Beverage

10.6.8. Media & Entertainment

10.6.9. Chemicals

10.6.10. Others

10.7. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Measurement Range

10.8.2. By Sensor Type

10.8.3. By Application

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Optical Sensor Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Measurement Range, 2017–2031

11.3.1. 2m - 10 m

11.3.2. 11 m - 30 m

11.3.3. 31 m - 60 m

11.3.4. 61 m -90 m

11.3.5. 91 m -120 m

11.3.6. Above 120 m

11.4. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Sensor Type, 2017–2031

11.4.1. Fiber Optic Sensors

11.4.2. Image Sensors

11.4.2.1. CMOS

11.4.2.2. CCD

11.4.3. Photoelectric Sensors

11.4.4. Ambient Light Sensors

11.4.5. Others

11.5. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

11.5.1. Medical Imaging

11.5.2. Material Processing

11.5.3. Indoor & Outdoor Lighting

11.5.4. Dynamic & Static Signaling

11.5.5. Testing & Measurement

11.5.6. Authentication & Visualization

11.5.7. Others

11.6. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.6.1. Consumer Electronics

11.6.2. Automotive & Transportation

11.6.3. Aerospace & Defense

11.6.4. Healthcare

11.6.5. Oil & Gas

11.6.6. Energy & Power

11.6.7. Food & Beverage

11.6.8. Media & Entertainment

11.6.9. Chemicals

11.6.10. Others

11.7. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. The U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Measurement Range

11.8.2. By Sensor Type

11.8.3. By Application

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific Optical Sensor Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Measurement Range, 2017–2031

12.3.1. 2m - 10 m

12.3.2. 11 m - 30 m

12.3.3. 31 m - 60 m

12.3.4. 61 m -90 m

12.3.5. 91 m -120 m

12.3.6. Above 120 m

12.4. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Sensor Type, 2017–2031

12.4.1. Fiber Optic Sensors

12.4.2. Image Sensors

12.4.2.1. CMOS

12.4.2.2. CCD

12.4.3. Photoelectric Sensors

12.4.4. Ambient Light Sensors

12.4.5. Others

12.5. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

12.5.1. Medical Imaging

12.5.2. Material Processing

12.5.3. Indoor & Outdoor Lighting

12.5.4. Dynamic & Static Signaling

12.5.5. Testing & Measurement

12.5.6. Authentication & Visualization

12.5.7. Others

12.6. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.6.1. Consumer Electronics

12.6.2. Automotive & Transportation

12.6.3. Aerospace & Defense

12.6.4. Healthcare

12.6.5. Oil & Gas

12.6.6. Energy & Power

12.6.7. Food & Beverage

12.6.8. Media & Entertainment

12.6.9. Chemicals

12.6.10. Others

12.7. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Measurement Range

12.8.2. By Sensor Type

12.8.3. By Application

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa Optical Sensor Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Measurement Range, 2017–2031

13.3.1. 2m - 10 m

13.3.2. 11 m - 30 m

13.3.3. 31 m - 60 m

13.3.4. 61 m -90 m

13.3.5. 91 m -120 m

13.3.6. Above 120 m

13.4. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Sensor Type, 2017–2031

13.4.1. Fiber Optic Sensors

13.4.2. Image Sensors

13.4.2.1. CMOS

13.4.2.2. CCD

13.4.3. Photoelectric Sensors

13.4.4. Ambient Light Sensors

13.4.5. Others

13.5. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

13.5.1. Medical Imaging

13.5.2. Material Processing

13.5.3. Indoor & Outdoor Lighting

13.5.4. Dynamic & Static Signaling

13.5.5. Testing & Measurement

13.5.6. Authentication & Visualization

13.5.7. Others

13.6. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.6.1. Consumer Electronics

13.6.2. Automotive & Transportation

13.6.3. Aerospace & Defense

13.6.4. Healthcare

13.6.5. Oil & Gas

13.6.6. Energy & Power

13.6.7. Food & Beverage

13.6.8. Media & Entertainment

13.6.9. Chemicals

13.6.10. Others

13.7. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Measurement Range

13.8.2. By Sensor Type

13.8.3. By Application

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Optical Sensor Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Measurement Range, 2017–2031

14.3.1. 2m - 10 m

14.3.2. 11 m - 30 m

14.3.3. 31 m - 60 m

14.3.4. 61 m -90 m

14.3.5. 91 m -120 m

14.3.6. Above 120 m

14.4. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Sensor Type, 2017–2031

14.4.1. Fiber Optic Sensors

14.4.2. Image Sensors

14.4.2.1. CMOS

14.4.2.2. CCD

14.4.3. Photoelectric Sensors

14.4.4. Ambient Light Sensors

14.4.5. Others

14.5. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

14.5.1. Medical Imaging

14.5.2. Material Processing

14.5.3. Indoor & Outdoor Lighting

14.5.4. Dynamic & Static Signaling

14.5.5. Testing & Measurement

14.5.6. Authentication & Visualization

14.5.7. Others

14.6. Optical Sensor Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

14.6.1. Consumer Electronics

14.6.2. Automotive & Transportation

14.6.3. Aerospace & Defense

14.6.4. Healthcare

14.6.5. Oil & Gas

14.6.6. Energy & Power

14.6.7. Food & Beverage

14.6.8. Media & Entertainment

14.6.9. Chemicals

14.6.10. Others

14.7. Optical Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Measurement Range

14.8.2. By Sensor Type

14.8.3. By Application

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Optical Sensor Market Competition Matrix - a Dashboard View

15.1.1. Global Optical Sensor Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. 3M Company

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Amphenol Corporation

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. BizLink Group

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Broadcom Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Cisco Systems, Inc.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Coherent Corp. ((II-VI Incorporated)

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Datatronix

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Dell Inc

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Eaton Corporation plc

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. FS.COM Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Hitachi Cable, Ltd

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Molex, LLC

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. NVIDIA Corporation

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Samtec

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. Siemon Company

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. Sumitomo Electric Industries, Ltd (Sumitomo Electric Group)

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

16.17. T&S Communication Co, Ltd.

16.17.1. Overview

16.17.2. Product Portfolio

16.17.3. Sales Footprint

16.17.4. Key Subsidiaries or Distributors

16.17.5. Strategy and Recent Developments

16.17.6. Key Financials

16.18. Tyco Electronics Corporation (TE Connectivity Ltd)

16.18.1. Overview

16.18.2. Product Portfolio

16.18.3. Sales Footprint

16.18.4. Key Subsidiaries or Distributors

16.18.5. Strategy and Recent Developments

16.18.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Bit Rate

17.1.2. By Form Factor

17.1.3. By Application

17.1.4. By End-use Industry

17.1.5. By Country/Sub-region

List of Tables

Table 01: Global Optical Sensor Market Size & Forecast, by Measurement Range, Value (US$ Mn), 2017–2031

Table 02: Global Optical Sensor Market Size & Forecast, by Measurement Range, Volume (Million Units), 2017–2031

Table 03: Global Optical Sensor Market Size & Forecast, by Sensor Type (US$ Mn), 2017–2031

Table 04: Global Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 05: Global Optical Sensor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 06: Global Optical Sensor Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 07: North America Optical Sensor Market Size & Forecast, by Measurement Range, Volume (Million Units), 2017–2031

Table 08: North America Optical Sensor Market Size & Forecast, by Sensor Type (US$ Mn), 2017–2031

Table 09: North America Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 10: North America Optical Sensor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 11: North America Optical Sensor Market Size & Forecast, by Country, Value (USD Million), 2017–2031

Table 12: Europe Optical Sensor Market Size & Forecast, by Measurement Range, Value (US$ Mn), 2017–2031

Table 13: Europe Optical Sensor Market Size & Forecast, by Measurement Range, Volume (Million Units), 2017–2031

Table 14: Europe Optical Sensor Market Size & Forecast, by Sensor Type (US$ Mn), 2017–2031

Table 15: Europe Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 16: Europe Optical Sensor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 17: Europe Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 18: Asia Pacific Optical Sensor Market Size & Forecast, by Measurement Range, Value (US$ Mn), 2017–2031

Table 19: Asia Pacific Optical Sensor Market Size & Forecast, by Measurement Range, Volume (Million Units), 2017–2031

Table 20: Asia Pacific Optical Sensor Market Size & Forecast, by Sensor Type (US$ Mn), 2017–2031

Table 21: Asia Pacific Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 22: Asia Pacific Optical Sensor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 23: Asia Pacific Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 24: Middle East & Africa Optical Sensor Market Size & Forecast, by Measurement Range, Value (US$ Mn), 2017–2031

Table 25: Middle East & Africa Optical Sensor Market Size & Forecast, by Measurement Range, Volume (Million Units), 2017–2031

Table 26: Middle East & Africa Optical Sensor Market Size & Forecast, by Sensor Type (US$ Mn), 2017–2031

Table 27: Middle East & Africa Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 28: Middle East & Africa Optical Sensor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 29: Middle East & Africa (MEA) Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 30: South America Optical Sensor Market Size & Forecast, by Measurement Range, Value (US$ Mn), 2017–2031

Table 31: South America Optical Sensor Market Size & Forecast, by Measurement Range, Volume (Million Units), 2017–2031

Table 32: South America Optical Sensor Market Size & Forecast, by Sensor Type (US$ Mn), 2017–2031

Table 33: South America Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 34: South America Optical Sensor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 35: South America Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

List of Figures

Figure 01: Global Optical Sensor Price Trend Analysis (Average Price, US$) (Million Dollars)

Figure 02: Global Optical Sensor Market, Y-O-Y Growth 2017–2031

Figure 03: Global Optical Sensor Market, Value (US$ Mn), 2017–2031

Figure 04: Global Optical Sensor Market, Volume (Million Units), 2017–2031

Figure 05: Global Optical Sensor Market Projections, by Measurement Range, Value (US$ Mn), 2017–2031

Figure 06: Global Optical Sensor Market, Incremental Opportunity, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 07: Global Optical Sensor Market Share, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 08: Global Optical Sensor Market Projections, by Sensor Type, Value (US$ Mn), 2017–2031

Figure 09: Global Optical Sensor Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 10: Global Optical Sensor Market Share, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 11: Global Optical Sensor Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 12: Global Optical Sensor Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 13: Global Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 14: Global Optical Sensor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 15: Global Optical Sensor Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 16: Global Optical Sensor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 17: Global Optical Sensor Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 18: Global Optical Sensor Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 19: Global Optical Sensor Market Size & Forecast, by Region, Value (US$ Mn), 2022 – 2031

Figure 20: North America Optical Sensor Market, Y-O-Y Growth, 2017–2031

Figure 21: North America Optical Sensor Market, Value (US$ Mn), 2017–2031

Figure 22: North America Optical Sensor Market, Volume (Million Units), 2017–2031

Figure 23: North America Optical Sensor Market, Price Trend, 2017–2031

Figure 24: North America Optical Sensor Market Projections, by Measurement Range, Value (US$ Mn), 2017–2031

Figure 25: North America Optical Sensor Market, Incremental Opportunity, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 26: North America Optical Sensor Market Share, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 27: North America Optical Sensor Market Projections, by Sensor Type, Value (US$ Mn), 2017–2031

Figure 28: North America Optical Sensor Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 29: North America Optical Sensor Market Share, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 30: North America Optical Sensor Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 31: North America Optical Sensor Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 32: North America Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 33: North America Optical Sensor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 34: North America Optical Sensor Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 35: North America Optical Sensor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 36: North America Optical Sensor Market Size & Forecast, by Country, Revenue (US$ Mn), 2017–2031

Figure 37: North America Optical Sensor Market Attractiveness, by Country, Value (US$ Mn), 2022 – 2031

Figure 38: North America Optical Sensor Market Size & Forecast, by Country, Value (US$ Mn), 2022 – 2031

Figure 39: Europe Optical Sensor Market, Y-O-Y Growth, 2017–2031

Figure 40: Europe Optical Sensor Market, Value (US$ Mn), 2017–2031

Figure 41: Europe Optical Sensor Market, Volume (Million Units), 2017–2031

Figure 42: Europe Optical Sensor Market, Price Trend

Figure 43: Europe Optical Sensor Market Projections, by Measurement Range, Value (US$ Mn), 2017–2031

Figure 44: Europe Optical Sensor Market, Incremental Opportunity, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 45: Europe Optical Sensor Market Share, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 46: Europe Optical Sensor Market Projections, by Sensor Type, Value (US$ Mn), 2017–2031

Figure 47: Europe Optical Sensor Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 48: Europe Optical Sensor Market Share, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 49: Europe Optical Sensor Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 50: Europe Optical Sensor Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 51: Europe Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 52: Europe Optical Sensor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 53: Europe Optical Sensor Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 54: Europe Optical Sensor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 55: Europe Optical Sensor Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 56: Europe Optical Sensor Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 57: Europe Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 58: Asia Pacific Optical Sensor Market, Y-O-Y Growth, 2017–2031

Figure 59: Asia Pacific Optical Sensor Market, Value (US$ Mn), 2017–2031

Figure 60: Asia Pacific Optical Sensor Market, Volume (Million Units), 2017–2031

Figure 61: Asia Pacific Optical Sensor Market, Price Trend

Figure 62: Asia Pacific Optical Sensor Market Projections, by Measurement Range, Value (US$ Mn), 2017–2031

Figure 63: Asia Pacific Optical Sensor Market, Incremental Opportunity, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 64: Asia Pacific Optical Sensor Market Share, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 65: Asia Pacific Optical Sensor Market Projections, by Sensor Type, Value (US$ Mn), 2017–2031

Figure 66: Asia Pacific Optical Sensor Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 67: Asia Pacific Optical Sensor Market Share, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 68: Asia Pacific Optical Sensor Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 69: Asia Pacific Optical Sensor Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 70: Asia Pacific Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 71: Asia Pacific Optical Sensor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 72: Asia Pacific Optical Sensor Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 73: Asia Pacific Optical Sensor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 74: Asia Pacific Optical Sensor Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 75: Asia Pacific Optical Sensor Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 76: Asia Pacific Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 77: Middle East & Africa Optical Sensor Market, Y-O-Y Growth, 2017–2031

Figure 78: Middle East & Africa Optical Sensor Market, Value (US$ Mn), 2017–2031

Figure 79: Middle East & Africa Optical Sensor Market, Volume (Million Units), 2017–2031

Figure 80: Middle East & Africa Optical Sensor Market, Price Trend

Figure 81: Middle East & Africa Optical Sensor Market Projections, by Measurement Range, Value (US$ Mn), 2017–2031

Figure 82: Middle East & Africa Optical Sensor Market, Incremental Opportunity, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 83: Middle East & Africa Optical Sensor Market Share, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 84: Middle East & Africa Optical Sensor Market Projections, by Sensor Type, Value (US$ Mn), 2017–2031

Figure 85: Middle East & Africa Optical Sensor Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 86: Middle East & Africa Optical Sensor Market Share, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 87: Middle East & Africa Optical Sensor Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 88: Middle East & Africa Optical Sensor Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 89: Middle East & Africa Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 90: Middle East & Africa Optical Sensor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 91: Middle East & Africa Optical Sensor Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 92: Middle East & Africa Optical Sensor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 93: Middle East & Africa (MEA) Optical Sensor Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 94: Middle East & Africa (MEA)Optical Sensor Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 95: Middle East & Africa (MEA) Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 96: South America Optical Sensor Market, Y-O-Y Growth, 2017–2031

Figure 97: South America Optical Sensor Market, Value (US$ Mn), 2017–2031

Figure 98: South America Optical Sensor Market, Volume (Million Units), 2017–2031

Figure 99: South America Optical Sensor Market, Price Trend

Figure 100: South America Optical Sensor Market Projections, by Measurement Range, Value (US$ Mn), 2017–2031

Figure 101: South America Optical Sensor Market, Incremental Opportunity, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 102: South America Optical Sensor Market Share, by Measurement Range, Value (US$ Mn), 2022 – 2031

Figure 103: South America Optical Sensor Market Projections, by Sensor Type, Value (US$ Mn), 2017–2031

Figure 104: South America Optical Sensor Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 105: South America Optical Sensor Market Share, by Sensor Type, Value (US$ Mn), 2022 – 2031

Figure 106: South America Optical Sensor Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 107: South America Optical Sensor Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 108: South America Optical Sensor Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 109: South America Optical Sensor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 110: South America Optical Sensor Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 111: South America Optical Sensor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 112: South America Optical Sensor Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 113: South America Optical Sensor Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 114: South America Optical Sensor Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031