Adapting to different circumstances and opting for a flexible approach are helping companies in the optical metrology market gain buoyancy during the coronavirus crisis. Optical Metrology Services Ltd. - a provider of innovative inspection, measurement, analysis, and verification for the energy industry, is adopting new methods of work to remain fully operational amid the COVID-19 outbreak. The successful remote working with the help of robots in the context of conducting the survey of an underground pipe is transforming the market landscape.

Though poor market sentiments are causing a slowdown in the global optical metrology market, innovations are grabbing the attention of stakeholders. AMS - a designer and manufacturer of sensors & sensing solutions, has announced to provide its latest sensor technology to ELDIM - a France-based provider of the optical metrology technology to develop COVID-19 professional rapid testing. This testing is found to have benefits over the polymerase chain reaction (PCR) testing.

The journey toward the Industry 4.0 environment is continuously evolving, and its evolution is linked with improvements in optical metrology solutions. Such trends are contributing to the growth of the optical metrology market. However, it has been found that the demand from users of optical metrology tools for greater data density in applications is often extreme complex. This prohibits the use of some conventional metrology solutions due to vibration or turbulence. Stakeholders are increasing their R&D to overcome this issue, since extracting maximum data possible from each scan is critical to enabling superior metrology on a wide range of samples.

Solutions today are being developed and evolved with a combination of hardware and software to correct vibration during a measurement.

The automotive sector is anticipated to dictate the highest revenue share among all end use-industries in the optical metrology market. This explains why companies such as Precitec - a provider of automated laser technology & 3D measurement technology, is increasing its focus in automotive metrology, since e-mobility is bringing a significant change in the market landscape. Companies in the optical metrology market are increasing the availability for state-of-the-art optical technologies that the automotive industry needs, owing to its ever-changing nature.

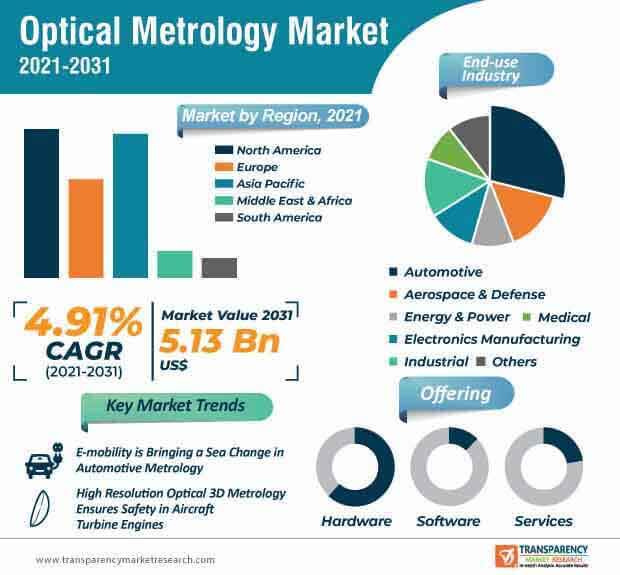

The market is projected to surpass valuation of US$ 5.13 Bn by the end of 2031. Semiconductor companies are providing non-contact optical technologies for automotive metrology. These involve automated inline inspection of automotive glass i.e. windscreens through high-speed measurements of glass thickness, shape, and topography.

After the automotive industry, companies in the optical metrology market establishing stable revenue streams from the aerospace & defense industry, which is predicted to dominate the second highest revenue among all end-use industries. High resolution, optical 3D metrology helps stakeholders ensure safety requirements in turbine engines, since they are highly specialized aircraft components. Bruker Alicona - a specialist in dimensional metrology and surface roughness measurement, is building its portfolio in aerospace applications with the help of high-resolution optical 3D metrology and collaborative robots.

The dimensional metrology is helping to increase the efficiency and safety of turbine engine components. Such findings are adding to the credibility of stakeholders in the optical metrology market. Non-contact, dimensional measurement combined with industrial automation capabilities delivers a number of time saving measures in quality assurance in turbine engines and other aerospace applications.

The 3D optical metrology is being publicized as a versatile tool for advanced manufacturing in electronics, automotive, medical, and semiconductor sectors, among others. AMETEK, Inc. - a U.S. global manufacturer of electronic instruments and electromechanical devices, is increasing conversation about 3D optical metrology in the field of electronics manufacturing through its blogs. The growing demand for smaller and more complex components in electronic devices is translating into revenue opportunities for companies in the optical metrology market.

Companies in the optical metrology market are constantly improving in non-contact optical metrology solutions and developing touchless dimensional measurement devices to help manufacturers advance in electronics innovations. Extreme precision and measurement repeatability are fueling the demand for 3D optical metrology in electronics manufacturing.

Optical 3D scanners are suited for quality control of complex freeform surfaces. Companies in the optical metrology market are unlocking growth opportunities in construction and inspection analysis of energy and power components & equipment. Right from design to operation of a thermal power turbine, optical 3D scanners help to note the smallest details. These scanners are necessary, since poor quality affects safety, efficiency, and service life or turbines. GOM, a company of the ZEISS Group, specializes in industrial 3D coordinate measuring technology, and is helping stakeholders in the energy & power industry to meet high requirements and accelerate production of machines & components.

Companies in the optical metrology market are providing optical 3D scanners to help stakeholders predict the service life of gas and steam turbines to ensure that components do not fail prematurely.

Robust optical metrology services allow customers to achieve the desired performance in their optical systems. Syntec Optics - a provider of optics assemblies and electronics assemblies, among other solutions, is gaining recognition for its optical metrology services that help to meet high requirements for plastic molded optics, diamond turned optics, and glass molded optics. Companies in the optical metrology market are increasing efforts to accommodate vertically integrated in-house optical metrology services to ensure high precision and accuracy in a range of optical systems.

Since quality is becoming the forefront of a superior product, companies are improving their optical metrology services to increase the availability of precision optics and optomechanics systems that play a crucial role in medical and defense applications. Service providers are adopting the custom optical metrology approach to develop high quality optical systems.

Analysts’ Viewpoint

Companies in the optical metrology market are increasing their focus in essential industries such as medical, defense, and energy & power to support mission-critical projects and applications. The optical metrology market is expected to clock a modest CAGR of 4.9% during the forecast period. However, vibration has been one of the biggest challenges for achieving the robust metrology with 3D optical metrology instruments. Hence, companies should introduce solutions with a combination of hardware and software systems to detect & correct vibration or turbulence during a measurement. E-mobility in the automotive sector is creating future growth opportunities for companies. High resolution, optical 3D metrology should be deployed in aerospace and power generation sectors.

The Optical Metrology Market is studied from 2021 - 2031.

Optical Metrology Market To Surpass Valuation Of US$ 5.13 Bn By 2031

The global optical metrology market is estimated to expand at a CAGR of 4.9% during the forecast period.

The automotive sector is anticipated to dictate the highest revenue share among all end use-industries in the optical metrology market.

Key players operating in the global optical metrology market are Nikon Instruments Inc., Carl Zeiss Industrial Metrology LLC, FARO Technologies, Hexagon AB, KLA-Tencor Corporation, Micro-Vu, Mitutoyo Corporation., Nanometrics Inc., Nova Measuring Instruments, S-T Industries, Inc., and Quality Vision International.

1. Global Optical Metrology Market - Executive Summary

1.1. Global Optical Metrology Market Country Analysis

1.2. Competition Blueprint

1.3. Technology Time Line Mapping

1.4. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.4. Market Trends

3.5. Trend Analysis- Impact on Time Line (2021-2031)

3.6. Key Regulations By Regions

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.2.1. Profitability and Gross Margin Analysis, by Competition

4.2.2. List of Active Participants, by Region

4.2.2.1. Raw Material Suppliers

4.2.2.2. Key Manufacturers

4.2.2.3. Integrators

4.2.2.4. Key Distributor/Retailers

4.3. Technology Roadmap Analysis

4.4. Porter Five Forces Analysis

5. Global Optical Metrology Market Pricing Analysis

5.1. Price Point Assessment, by Product System Type

5.2. Regional Average Pricing Analysis

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East & Africa

5.2.5. South America

5.3. Price Forecast till 2030

5.4. Factors Influencing Pricing

6. Global Optical Metrology Market Analysis and Forecast

6.1. Market Size Analysis (2017-2020) and Forecast (2021-2031)

6.1.1. Market Value (US$ Mn) and Y-o-Y Growth

6.2. Global Optical Metrology Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

6.2.1. Forecast Factors and Relevance of Impact

6.2.2. Regional Optical Metrology Market Business Performance Summary

7. Global Optical Metrology Market Analysis, by Offerings

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison, by Offerings

7.2. Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Offerings, 2017-2031

7.2.1. Hardware

7.2.1.1. Cameras

7.2.1.2. Lenses and Sensors

7.2.1.3. Light Sources

7.2.1.4. Others

7.2.2. Software

7.2.3. Services

7.3. Global Optical Metrology Market Attractiveness Analysis, by Offerings

8. Global Optical Metrology Market Analysis, by Equipment

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By Equipment

8.2. Global Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Equipment, 2017-2031

8.2.1. Autocollimators

8.2.2. Measuring Microscopes

8.2.3. Profile Projectors

8.2.4. Optical Digitizers and Scanners (ODSs)

8.2.4.1. 3D Laser Scanners

8.2.4.2. Structured Light Scanners

8.2.4.3. Laser Trackers

8.2.5. Multi-sensor CMM

8.2.6. Video Measuring Machines (VMMs)

8.2.7. Others

8.3. Global Optical Metrology Market Attractiveness Analysis, by Equipment

9. Global Optical Metrology Market Analysis, by End-use Industry

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison, by End-use Industry

9.2. Global Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

9.2.1. Automotive

9.2.2. Aerospace & Defense

9.2.3. Energy and Power

9.2.4. Electronics Manufacturing

9.2.5. Industrial

9.2.6. Medical

9.2.7. Others

9.3. Global Optical Metrology Market Attractiveness Analysis, by End-use Industry

10. Global Optical Metrology Market Analysis and Forecast, by Region

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis, by Region

10.2. Global Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

10.3. Global Optical Metrology Market Attractiveness Analysis, by Region

11. North America Optical Metrology Market Analysis and Forecast

11.1. Introduction

11.2. Drivers and Restraints: Impact Analysis

11.3. North America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Offerings, 2017-2031

11.3.1. Hardware

11.3.1.1. Cameras

11.3.1.2. Lenses and Sensors

11.3.1.3. Light Sources

11.3.1.4. Others

11.3.2. Software

11.3.3. Services

11.4. North America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Equipment, 2017-2031

11.4.1. Autocollimators

11.4.2. Measuring Microscopes

11.4.3. Profile Projectors

11.4.4. Optical Digitizers and Scanners (ODSs)

11.4.4.1. 3D Laser Scanners

11.4.4.2. Structured Light Scanners

11.4.4.3. Laser Trackers

11.4.5. Multi-sensor CMM

11.4.6. Video Measuring Machines (VMMs)

11.4.7. Others

11.5. North America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

11.5.1. Automotive

11.5.2. Aerospace & Defense

11.5.3. Energy and Power

11.5.4. Electronics Manufacturing

11.5.5. Industrial

11.5.6. Medical

11.5.7. Others

11.6. North America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.6.3. Rest of North America

11.7. North America Optical Metrology Market Attractiveness Analysis

11.7.1. Offerings

11.7.2. Equipment

11.7.3. End-use Industry

11.7.4. Country

12. Europe Optical Metrology Market Analysis and Forecast

12.1. Introduction

12.2. Drivers and Restraints: Impact Analysis

12.3. Europe Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Offerings, 2017-2031

12.3.1. Hardware

12.3.1.1. Cameras

12.3.1.2. Lenses and Sensors

12.3.1.3. Light Sources

12.3.1.4. Others

12.3.2. Software

12.3.3. Services

12.4. Europe Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Equipment, 2017-2031

12.4.1. Autocollimators

12.4.2. Measuring Microscopes

12.4.3. Profile Projectors

12.4.4. Optical Digitizers and Scanners (ODSs)

12.4.4.1. 3D Laser Scanners

12.4.4.2. Structured Light Scanners

12.4.4.3. Laser Trackers

12.4.5. Multi-sensor CMM

12.4.6. Video Measuring Machines (VMMs)

12.4.7. Others

12.5. Europe Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

12.5.1. Automotive

12.5.2. Aerospace & Defense

12.5.3. Energy and Power

12.5.4. Electronics Manufacturing

12.5.5. Industrial

12.5.6. Medical

12.5.7. Others

12.6. Europe Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Country/Sub-region, 2017-2031

12.6.1. U.K.

12.6.2. Germany

12.6.3. France

12.6.4. Italy

12.6.5. Russia

12.6.6. Rest of Europe

12.7. Europe Optical Metrology Market Attractiveness Analysis

12.7.1. Offerings

12.7.2. Equipment

12.7.3. End-use Industry

12.7.4. Country/Sub-region

13. Asia Pacific Optical Metrology Market Analysis and Forecast

13.1. Introduction

13.2. Drivers and Restraints: Impact Analysis

13.3. Asia Pacific Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Offerings, 2017-2031

13.3.1. Hardware

13.3.1.1. Cameras

13.3.1.2. Lenses and Sensors

13.3.1.3. Light Sources

13.3.1.4. Others

13.3.2. Software

13.3.3. Services

13.4. Asia Pacific Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Equipment, 2017-2031

13.4.1. Autocollimators

13.4.2. Measuring Microscopes

13.4.3. Profile Projectors

13.4.4. Optical Digitizers and Scanners (ODSs)

13.4.4.1. 3D Laser Scanners

13.4.4.2. Structured Light Scanners

13.4.4.3. Laser Trackers

13.4.5. Multi-sensor CMM

13.4.6. Video Measuring Machines (VMMs)

13.4.7. Others

13.5. Asia Pacific Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

13.5.1. Automotive

13.5.2. Aerospace & Defense

13.5.3. Energy and Power

13.5.4. Electronics Manufacturing

13.5.5. Industrial

13.5.6. Medical

13.5.7. Others

13.6. Asia Pacific Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. South Korea

13.6.5. ASEAN

13.6.6. Rest of Asia Pacific

13.7. Asia Pacific Optical Metrology Market Attractiveness Analysis

13.7.1. Offerings

13.7.2. Equipment

13.7.3. End-use Industry

13.7.4. Country

14. Middle East & Africa (MEA) Optical Metrology Market Analysis and Forecast

14.1. Introduction

14.2. Drivers and Restraints: Impact Analysis

14.3. Middle East & Africa Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Offerings, 2017-2031

14.3.1. Hardware

14.3.1.1. Cameras

14.3.1.2. Lenses and Sensors

14.3.1.3. Light Sources

14.3.1.4. Others

14.3.2. Software

14.3.3. Services

14.4. Middle East & Africa Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Equipment, 2017-2031

14.4.1. Autocollimators

14.4.2. Measuring Microscopes

14.4.3. Profile Projectors

14.4.4. Optical Digitizers and Scanners (ODSs)

14.4.4.1. 3D Laser Scanners

14.4.4.2. Structured Light Scanners

14.4.4.3. Laser Trackers

14.4.5. Multi-sensor CMM

14.4.6. Video Measuring Machines (VMMs)

14.4.7. Others

14.5. Middle East & Africa Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

14.5.1. Automotive

14.5.2. Aerospace & Defense

14.5.3. Energy and Power

14.5.4. Electronics Manufacturing

14.5.5. Industrial

14.5.6. Medical

14.6. Middle East & Africa Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Country/Sub-region, 2017-2031

14.6.1. GCC

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Middle East & Africa Optical Metrology Market Attractiveness Analysis

14.7.1. Offerings

14.7.2. Equipment

14.7.3. End-use Industry

14.7.4. Country

15. South America Optical Metrology Market Analysis and Forecast

15.1. Introduction

15.2. Drivers and Restraints: Impact Analysis

15.3. South America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Offerings, 2017-2031

15.3.1. Hardware

15.3.1.1. Cameras

15.3.1.2. Lenses and Sensors

15.3.1.3. Light Sources

15.3.1.4. Others

15.3.2. Software

15.3.3. Services

15.4. South America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Equipment, 2017-2031

15.4.1. Autocollimators

15.4.2. Measuring Microscopes

15.4.3. Profile Projectors

15.4.4. Optical Digitizers and Scanners (ODSs)

15.4.4.1. 3D Laser Scanners

15.4.4.2. Structured Light Scanners

15.4.4.3. Laser Trackers

15.4.5. Multi-sensor CMM

15.4.6. Video Measuring Machines (VMMs)

15.4.7. Others

15.5. South America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

15.5.1. Automotive

15.5.2. Aerospace & Defense

15.5.3. Energy and Power

15.5.4. Electronics Manufacturing

15.5.5. Industrial

15.5.6. Medical

15.5.7. Others

15.6. South America Optical Metrology Market Value (US$ Mn) Analysis & Forecast, by Country, 2017-2031

15.6.1. Brazil

15.6.2. Rest of South America

15.7. South America Optical Metrology Market Attractiveness Analysis

15.7.1. Offerings

15.7.2. Equipment

15.7.3. End-use Industry

15.7.4. Country

16. Competition Assessment

16.1. GlobalOptical Metrology Market Competition - a Dashboard View

16.2. GlobalOptical Metrology Market Structure Analysis

16.3. GlobalOptical Metrology Market Company Share Analysis, by Value (2020)

16.4. Key Participants Market Presence (Intensity Mapping) by Region

17. Competition Deep-dive (Manufacturers/Suppliers)

17.1. Nikon Instruments Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Channel Footprint

17.1.4.1. Distributors List

17.1.5. Strategy Overview

17.1.5.1. Marketing Strategy

17.1.5.2. Culture Strategy

17.1.5.3. Channel Strategy

17.1.6. SWOT Analysis

17.1.7. Financial Analysis

17.1.8. Revenue Share

17.1.8.1. By Region

17.1.9. Key Clients

17.1.10. Analyst Comments

17.2. Carl Zeiss Industrial Metrology LLC

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Channel Footprint

17.2.4.1. Distributors List

17.2.5. Strategy Overview

17.2.5.1. Marketing Strategy

17.2.5.2. Culture Strategy

17.2.5.3. Channel Strategy

17.2.6. SWOT Analysis

17.2.7. Financial Analysis

17.2.8. Revenue Share

17.2.8.1. By Region

17.2.9. Key Clients

17.2.10. Analyst Comments

17.3. FARO Technologies

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Channel Footprint

17.3.4.1. Distributors List

17.3.5. Strategy Overview

17.3.5.1. Marketing Strategy

17.3.5.2. Culture Strategy

17.3.5.3. Channel Strategy

17.3.6. SWOT Analysis

17.3.7. Financial Analysis

17.3.8. Revenue Share

17.3.8.1. By Region

17.3.9. Key Clients

17.3.10. Analyst Comments

17.4. Hexagon AB

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Channel Footprint

17.4.4.1. Distributors List

17.4.5. Strategy Overview

17.4.5.1. Marketing Strategy

17.4.5.2. Culture Strategy

17.4.5.3. Channel Strategy

17.4.6. SWOT Analysis

17.4.7. Financial Analysis

17.4.8. Revenue Share

17.4.8.1. By Region

17.4.9. Key Clients

17.4.10. Analyst Comments

17.5. KLA-Tencor Corporation

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Channel Footprint

17.5.4.1. Distributors List

17.5.5. Strategy Overview

17.5.5.1. Marketing Strategy

17.5.5.2. Culture Strategy

17.5.5.3. Channel Strategy

17.5.6. SWOT Analysis

17.5.7. Financial Analysis

17.5.8. Revenue Share

17.5.8.1. By Region

17.5.9. Key Clients

17.5.10. Analyst Comments

17.6. Micro-Vu

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Channel Footprint

17.6.4.1. Distributors List

17.6.5. Strategy Overview

17.6.5.1. Marketing Strategy

17.6.5.2. Culture Strategy

17.6.5.3. Channel Strategy

17.6.6. SWOT Analysis

17.6.7. Financial Analysis

17.6.8. Revenue Share

17.6.8.1. By Region

17.6.9. Key Clients

17.6.10. Analyst Comments

17.7. Mitutoyo Corporation

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Channel Footprint

17.7.4.1. Distributors List

17.7.5. Strategy Overview

17.7.5.1. Marketing Strategy

17.7.5.2. Culture Strategy

17.7.5.3. Channel Strategy

17.7.6. SWOT Analysis

17.7.7. Financial Analysis

17.7.8. Revenue Share

17.7.8.1. By Region

17.7.9. Key Clients

17.7.10. Analyst Comments

17.8. Nanometrics Inc.

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Channel Footprint

17.8.4.1. Distributors List

17.8.5. Strategy Overview

17.8.5.1. Marketing Strategy

17.8.5.2. Culture Strategy

17.8.5.3. Channel Strategy

17.8.6. SWOT Analysis

17.8.7. Financial Analysis

17.8.8. Revenue Share

17.8.8.1. By Region

17.8.9. Key Clients

17.8.10. Analyst Comments

17.9. Nova Measuring Instruments

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Channel Footprint

17.9.4.1. Distributors List

17.9.5. Strategy Overview

17.9.5.1. Marketing Strategy

17.9.5.2. Culture Strategy

17.9.5.3. Channel Strategy

17.9.6. SWOT Analysis

17.9.7. Financial Analysis

17.9.8. Revenue Share

17.9.8.1. By Region

17.9.9. Key Clients

17.9.10. Analyst Comments

17.10. Quality Vision International

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Channel Footprint

17.10.4.1. Distributors List

17.10.5. Strategy Overview

17.10.5.1. Marketing Strategy

17.10.5.2. Culture Strategy

17.10.5.3. Channel Strategy

17.10.6. SWOT Analysis

17.10.7. Financial Analysis

17.10.8. Revenue Share

17.10.8.1. By Region

17.10.9. Key Clients

17.10.10. Analyst Comments

17.11. S-T Industries, Inc.

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Channel Footprint

17.11.4.1. Distributors List

17.11.5. Strategy Overview

17.11.5.1. Marketing Strategy

17.11.5.2. Culture Strategy

17.11.5.3. Channel Strategy

17.11.6. SWOT Analysis

17.11.7. Financial Analysis

17.11.8. Revenue Share

17.11.8.1. By Region

17.11.9. Key Clients

17.11.10. Analyst Comments

18. Recommendation- Critical Success Factors

19. Research Methodology

20. Assumptions & Acronyms Used

List of Tables

Table 1: Global Optical Metrology Market Value (US$ Mn) Forecast, by Offering, 2017–2031

Table 2: Global Optical Metrology Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 3: Global Optical Metrology Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2031

Table 4: Global Optical Metrology Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 5: North America Optical Metrology Market Value (US$ Mn) Forecast, by Offering, 2017–2031

Table 6: North America Optical Metrology Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 7: North America Optical Metrology Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2031

Table 8: North America Optical Metrology Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 9: Europe Optical Metrology Market Value (US$ Mn) Forecast, by Offering, 2017–2031

Table 10: Europe Optical Metrology Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 11: Europe Optical Metrology Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2031

Table 12: Europe Optical Metrology Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 13: Asia Pacific Optical Metrology Market Value (US$ Mn) Forecast, by Offering, 2017–2031

Table 14: Asia Pacific Optical Metrology Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 15: Asia Pacific Optical Metrology Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2031

Table 16: Asia Pacific Optical Metrology Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 17: Middle East & Africa (MEA) Optical Metrology Market Value (US$ Mn) Forecast, by Offering, 2017–2031

Table 18: Middle East & Africa (MEA) Optical Metrology Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 19: Middle East & Africa (MEA) Optical Metrology Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2031

Table 20: Middle East & Africa (MEA) Optical Metrology Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 21: South America Optical Metrology Market Value (US$ Mn) Forecast, by Offering, 2017–2031

Table 22: South America Optical Metrology Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 23: South America Optical Metrology Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2031

Table 24: South America Optical Metrology Market Value (US$ Mn) Forecast, by Country, 2017–2031

List of Figures

Figure 1: Global Optical Metrology Market Value (US$ Mn) Forecast, 2021–2031

Figure 2: Global Optical Metrology Market Size Analysis (2017-2019) and Forecast (2021-2031)

Figure 3: Global Optical Metrology Market, by Hardware

Figure 4: Global Optical Metrology Market, by Software

Figure 5: Global Optical Metrology Market, by Services

Figure 6: Global Optical Metrology Market Comparison Matrix, by Offering

Figure 7: Global Optical Metrology Market Attractiveness Analysis, by Offering

Figure 8: Global Optical Metrology Market, by Autocollimators

Figure 9: Global Optical Metrology Market, by Measuring Microscopes

Figure 10: Global Optical Metrology Market, by Profile Projectors

Figure 11: Global Optical Metrology Market, by Optical Digitizers and Scanners (ODSs)

Figure 12: Global Optical Metrology Market, by Multi-sensor CMM

Figure 13: Global Optical Metrology Market, by Video Measuring Machines (VMMs)

Figure 14: Global Optical Metrology Market, by Others

Figure 15: Global Optical Metrology Market Comparison Matrix, by Equipment

Figure 16: Global Optical Metrology Market Attractiveness Analysis, by Equipment

Figure 17: Global Optical Metrology Market, by Automotive

Figure 18: Global Optical Metrology Market, by Aerospace & Defense

Figure 19: Global Optical Metrology Market, by Energy and Power

Figure 20: Global Optical Metrology Market, by Electronics Manufacturing

Figure 21: Global Optical Metrology Market, by Industrial

Figure 22: Global Optical Metrology Market, by Medical

Figure 23: Global Optical Metrology Market, by Others

Figure 24: Global Optical Metrology Market Comparison Matrix, By End-use Industry

Figure 25: Global Optical Metrology Market Attractiveness Analysis, by End-use Industry

Figure 26: Global Optical Metrology Market Value Share Analysis, by Region (2021E)

Figure 27: Global Optical Metrology Market Value Share Analysis, by Region (2031F)

Figure 28: Global Optical Metrology Market Attractiveness Analysis, by Region

Figure 29: North America Optical Metrology Market Revenue Projection and Y–O–Y Growth, 2017-2031 (US$ Mn and %)

Figure 30: North America Optical Metrology Market Value Share Analysis, by Offering (2021)

Figure 31: North America Optical Metrology Market Value Share Analysis, by Offering (2031)

Figure 32: North America Optical Metrology Market Value Share Analysis, by Equipment (2021)

Figure 33: North America Optical Metrology Market Value Share Analysis, by Equipment (2031)

Figure 34: North America Optical Metrology Market Value Share Analysis, by End-use Industry (2021)

Figure 35: North America Optical Metrology Market Value Share Analysis, by End-use Industry (2031)

Figure 36: North America Optical Metrology Market Value Share Analysis, by Country (2021)

Figure 37: North America Optical Metrology Market Value Share Analysis, by Country (2031)

Figure 38: North America Optical Metrology Market Attractiveness Analysis, by Offering

Figure 39: North America Optical Metrology Market Attractiveness Analysis, by Equipment

Figure 40: North America Optical Metrology Market Attractiveness Analysis, by End-use Industry

Figure 41: North America Optical Metrology Market Attractiveness Analysis, by Country

Figure 42: Europe Optical Metrology Market Revenue Projection and Y–O–Y Growth, 2017-2031 (US$ Mn and %)

Figure 43: Europe Optical Metrology Market Value Share Analysis, by Offering (2021)

Figure 44: Europe Optical Metrology Market Value Share Analysis, by Offering (2031)

Figure 45: Europe Optical Metrology Market Value Share Analysis, by Equipment (2021)

Figure 46: Europe Optical Metrology Market Value Share Analysis, by Equipment (2031)

Figure 47: Europe Optical Metrology Market Value Share Analysis, by End-use Industry (2021)

Figure 48: Europe Optical Metrology Market Value Share Analysis, by End-use Industry (2031)

Figure 49: Europe Optical Metrology Market Value Share Analysis, by Country/Sub-region (2021)

Figure 50: Europe Optical Metrology Market Value Share Analysis, by Country/Sub-region (2031)

Figure 51: Europe Optical Metrology Market Attractiveness Analysis, by Offering

Figure 52: Europe Optical Metrology Market Attractiveness Analysis, by Equipment

Figure 53: Europe Optical Metrology Market Attractiveness Analysis, by End-use Industry

Figure 54: Europe Optical Metrology Market Attractiveness Analysis, by Country/Sub-region

Figure 55: Asia Pacific Optical Metrology Market Revenue Projection and Y–O–Y Growth, 2017-2031 (US$ Mn and %)

Figure 56: Asia Pacific Optical Metrology Market Value Share Analysis, by Offering (2021)

Figure 57: Asia Pacific Optical Metrology Market Value Share Analysis, by Offering (2031)

Figure 58: Asia Pacific Optical Metrology Market Value Share Analysis, by Equipment (2021)

Figure 59: Asia Pacific Optical Metrology Market Value Share Analysis, by Equipment (2031)

Figure 60: Asia Pacific Optical Metrology Market Value Share Analysis, by End-use Industry (2021)

Figure 61: Asia Pacific Optical Metrology Market Value Share Analysis, by End-use Industry (2031)

Figure 62: Asia Pacific Optical Metrology Market Value Share Analysis, by Country/Sub-region (2021)

Figure 63: Asia Pacific Optical Metrology Market Value Share Analysis, by Country/Sub-region (2031)

Figure 64: Asia Pacific Optical Metrology Market Attractiveness Analysis, by Offering

Figure 65: Asia Pacific Optical Metrology Market Attractiveness Analysis, by Equipment

Figure 66: Asia Pacific Optical Metrology Market Attractiveness Analysis, by End-use Industry

Figure 67: Asia Pacific Optical Metrology Market Attractiveness Analysis, by Country/Sub-region

Figure 68: Middle East & Africa (MEA) Optical Metrology Market Revenue Projection and Y–O–Y Growth, 2017-2031 (US$ Mn and %)

Figure 69: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by Offering (2021)

Figure 70: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by Offering (2031)

Figure 71: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by Equipment (2021)

Figure 72: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by Equipment (2031)

Figure 73: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by End-use Industry (2021)

Figure 74: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by End-use Industry (2031)

Figure 75: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by Country/Sub-region (2021)

Figure 76: Middle East & Africa (MEA) Optical Metrology Market Value Share Analysis, by Country/Sub-region (2031)

Figure 77: Middle East & Africa (MEA) Optical Metrology Market Attractiveness Analysis, by Offering

Figure 78: Middle East & Africa (MEA) Optical Metrology Market Attractiveness Analysis, by Equipment

Figure 79: Middle East & Africa (MEA) Optical Metrology Market Attractiveness Analysis, by End-use Industry

Figure 80: Middle East & Africa (MEA) Optical Metrology Market Attractiveness Analysis, by Country/Sub-region

Figure 81: South America Optical Metrology Market Revenue Projection and Y–O–Y Growth, 2017-2031 (US$ Mn and %)

Figure 82: South America Optical Metrology Market Value Share Analysis, by Offering (2021)

Figure 83: South America Optical Metrology Market Value Share Analysis, by Offering (2031)

Figure 84: South America Optical Metrology Market Value Share Analysis, by Equipment (2021)

Figure 85: South America Optical Metrology Market Value Share Analysis, by Equipment (2031)

Figure 86: South America Optical Metrology Market Value Share Analysis, by End-use Industry (2021)

Figure 87: South America Optical Metrology Market Value Share Analysis, by End-use Industry (2031)

Figure 88: South America Optical Metrology Market Value Share Analysis, by Country/Sub-region (2021)

Figure 89: South America Optical Metrology Market Value Share Analysis, by Country/Sub-region (2031)

Figure 90: South America Optical Metrology Market Attractiveness Analysis, by Offering

Figure 91: South America Optical Metrology Market Attractiveness Analysis, by Equipment

Figure 92: South America Optical Metrology Market Attractiveness Analysis, by End-use Industry

Figure 93: South America Optical Metrology Market Attractiveness Analysis, by Country/Sub-region