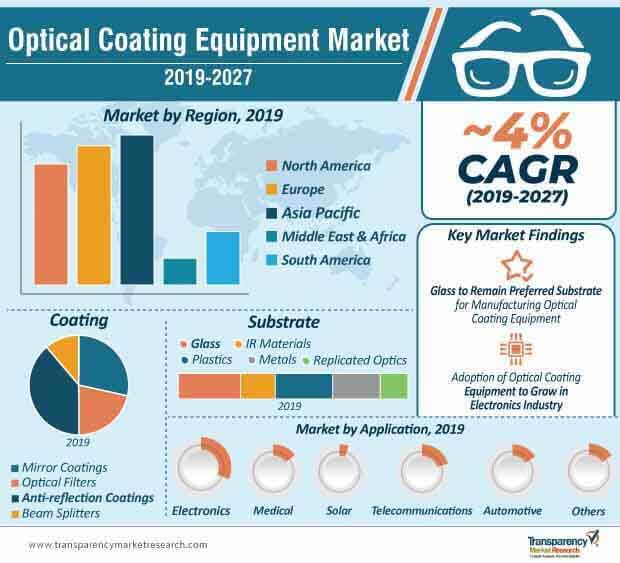

The optical coating equipment landscape has reached a juncture with a multitude of changing dynamics, and a majority of them portend promising growth. According to a new report published by Transparency Market Research (TMR), the optical coating equipment market was valued at ~US$ 4.4 Bn in 2018, and will arrive at a value tantamount to ~US$ 6.4 Bn in 2027, representing a modest CAGR of ~4% during the period of 2019-2027. Continuous headways in fabrication technology, fostering the development of sophisticated optical coatings, irrespective of the curvature surface, are projected to have a profound influence on the landscape.

Since the demand for anti-reflection coatings is witnessing an upsurge, market players tend to leverage the prowess of R&D activities to offer better coating solutions, and gain a competitive edge in the optical coating equipment landscape. However, cost-prohibitive maintenance of optical coating equipment in end-use applications could impede the otherwise average growth strides of the market during the forecast period.

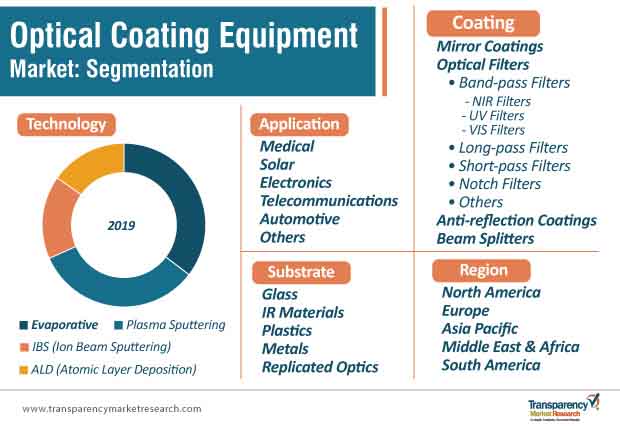

Currently, the dual quest of manufacturers for 'cost-efficiency' and 'technological prowess' is highly reliant on evaporative technology, which leads the batch with a market share of ~35%. However, the challenges apropos of coating will require accurate, faster, and more flexible approaches to incorporate optical coatings in high-end applications, including medical, military and defense, and aerospace, thereby representing lucrative prospects for plasma sputtering technologies in the future.

Another key finding of the report narrows down to the steady adoption rate of optical coating equipment for electronics, automotive, and medical applications. There has been a spurt in the adoption of optical coating equipment for enhancing properties such as sturdiness, reflectivity, transmission, and damage threshold in consumer electronics. On top of that, a massive uptake in the development and sales/purchase of vehicles has created a remunerative scope for optical coating equipment.

With thriving automotive and electronics industries in the region, Asia Pacific will remain a crucial region for manufacturers to achieve long-term profitability. Beside the proliferated adoption of optical coating equipment in the region, major players concentrated in the region will further complement the lead of Asia Pacific, and the regional market will account for ~one-third of the global market share by 2027.

The optical coating equipment market is a highly technology-intensive market, entailing market players to invest in thin-film coating technological skills. Fluctuations in the prices of raw materials used for the development of optical coating equipment, in turn, have an imminent impact on the cost of finished products. Moreover, merely setting up a business in the industry requires a high working capital, which creates an entry barrier for new players. This implies that the threat from new entrants is low, and market players need to consolidate for business success.

Since the entire production cycle relies on the availability of raw materials, market players can reap the benefits of consistent supply of raw materials by collaborating with suppliers. Furthermore, market players need to have an appetite for constant technological reforms, when it comes to the outcome of their products, as high-end medical, automotive, and military applications demand utmost precision.

Analysts’ Viewpoint

Authors of TMR’s study evince optimism regarding the growth of the optical coating equipment market, and portend an underway shift from evaporative technology to plasma sputtering technology, as the focus from cost-efficiency moves towards the precision of an outcome. Developing countries of Asia Pacific are projected to illustrate high RoI potential, given the large reserves of raw materials and affordable labor that bring down per-unit production cost. An intensified focus on the integration of technology can help market players distinguish their position in the optical coating equipment market. Manufacturers may, however, bear the brunt of high maintenance cost, which will have a substantial impact on the adoption of optical coating equipment.

Key manufacturers in the optical coating equipment market such as Buhler Holding AG are strengthening their overseas sales structure by increasing their production capacities. Other key developments in the optical coating equipment market are as follows:

In the global optical coating equipment market report, we have discussed individual strategies, followed by company profiles of manufacturers of optical coating equipment. The ‘Competitive Landscape’ section is included in the optical coating equipment market report to provide readers with a dashboard view and a company market share analysis of the key players operating in the global optical coating equipment market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Value Chain Analysis

4.4. Key Trends Analysis

4.5. Key Market Indicators

4.6. Porter’s Five Forces Analysis

4.7. Industry SWOT Analysis

4.8. Global Optical Coating Equipment Market Analysis and Forecast, 2017 - 2027

4.8.1. Market Value Projections (US$ Mn)

4.8.2. Market Volume Projections (Thousand Units)

5. Global Optical Coating Equipment Market Analysis and Forecast, By Technology

5.1. Segment Snapshot

5.2. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Technology, 2017 - 2027

5.2.1. Evaporative

5.2.2. Plasma Sputtering

5.2.3. IBS ( Ion Beam Sputtering)

5.2.4. ALD (Atomic Layer Deposition)

5.3. Incremental Opportunity Analysis, By Technology

6. Global Optical Coating Equipment Market Analysis and Forecast, By Coating

6.1. Definition and Overview

6.2. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Coating, 2017 - 2027

6.2.1. Mirror Coatings

6.2.2. Optical Filters

6.2.2.1. Bandpass Filters

6.2.2.1.1. NIR Filters

6.2.2.1.2. UV Filters

6.2.2.1.3. VIS Filters

6.2.2.2. Longpass Filters

6.2.2.3. Shortpass Filters

6.2.2.4. Notch Filters

6.2.2.5. Others

6.2.3. Anti-reflection Coatings

6.2.4. Beam Splitters

6.3. Incremental Opportunity Analysis, By Coating

7. Global Optical Coating Equipment Market Analysis and Forecast, By Substrate

7.1. Definition and Overview

7.2. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Substrate, 2017 - 2027

7.2.1. Glass

7.2.2. IR Materials

7.2.3. Plastics

7.2.4. Metals

7.2.5. Replicated Optics

7.3. Incremental Opportunity Analysis, By Substrate

8. Global Optical Coating Equipment Market Analysis and Forecast, By Application

8.1. Definition and Overview

8.2. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Application, 2018 - 2028

8.2.1. Medical

8.2.2. Solar

8.2.3. Electronics

8.2.4. Telecommunications

8.2.5. Automotive

8.2.6. Others

8.3. Incremental Opportunity Analysis, By Application

9. Global Optical Coating Equipment Market Analysis and Forecast, by Region

9.1. Definition and Overview

9.2. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, by Region, 2017 - 2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

9.3. Incremental Opportunity Analysis, by Region

10. North America Optical Coating Equipment Market Analysis and Forecast

10.1. Regional Snapshot

10.1.1. By Technology

10.1.2. By Coating

10.1.3. By Substrate

10.1.4. By Application

10.1.5. By Country

10.2. Price Trend Analysis

10.3. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Technology, 2017 - 2027

10.3.1. Evaporative

10.3.2. Plasma Sputtering

10.3.3. IBS ( Ion Beam Sputtering)

10.3.4. ALD (Atomic Layer Deposition)

10.4. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Coating, 2017 - 2027

10.4.1. Mirror Coatings

10.4.2. Optical Filters

10.4.2.1. Bandpass Filters

10.4.2.1.1. NIR Filters

10.4.2.1.2. UV Filters

10.4.2.1.3. VIS Filters

10.4.2.2. Longpass Filters

10.4.2.3. Shortpass Filters

10.4.2.4. Notch Filters

10.4.2.5. Others

10.4.3. Anti-reflection Coatings

10.4.4. Beam Splitters

10.5. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Substrate, 2017 - 2027

10.5.1. Glass

10.5.2. IR Materials

10.5.3. Plastics

10.5.4. Metals

10.5.5. Replicated Optics

10.6. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Application, 2017 - 2027

10.6.1. Medical

10.6.2. Solar

10.6.3. Electronics

10.6.4. Telecommunications

10.6.5. Automotive

10.6.6. Others

10.7. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Country, 2017 - 2027

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Incremental Opportunity Analysis

10.8.1. By Technology

10.8.2. By Coating

10.8.3. By Substrate

10.8.4. By Application

10.8.5. By Country

11. Europe Optical Coating Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.1.1. By Technology

11.1.2. By Coating

11.1.3. By Substrate

11.1.4. By Application

11.1.5. By Country

11.2. Price Trend Analysis

11.3. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Technology, 2017 - 2027

11.3.1. Evaporative

11.3.2. Plasma Sputtering

11.3.3. IBS ( Ion Beam Sputtering)

11.3.4. ALD (Atomic Layer Deposition)

11.4. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Coating, 2017 - 2027

11.4.1. Mirror Coatings

11.4.2. Optical Filters

11.4.2.1. Bandpass Filters

11.4.2.1.1. NIR Filters

11.4.2.1.2. UV Filters

11.4.2.1.3. VIS Filters

11.4.2.2. Longpass Filters

11.4.2.3. Shortpass Filters

11.4.2.4. Notch Filters

11.4.2.5. Others

11.4.3. Anti-reflection Coatings

11.4.4. Beam Splitters

11.5. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Substrate, 2017 - 2027

11.5.1. Glass

11.5.2. IR Materials

11.5.3. Plastics

11.5.4. Metals

11.5.5. Replicated Optics

11.6. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Application, 2017 - 2027

11.6.1. Medical

11.6.2. Solar

11.6.3. Electronics

11.6.4. Telecommunications

11.6.5. Automotive

11.6.6. Others

11.7. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Country, 2017 - 2027

11.7.1. Germany

11.7.2. U.K.

11.7.3. France

11.7.4. Italy

11.7.5. Rest of Europe

11.8. Incremental Opportunity Analysis

11.8.1. By Technology

11.8.2. By Coating

11.8.3. By Substrate

11.8.4. By Application

11.8.5. By Country

12. Asia Pacific Optical Coating Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.1.1. By Technology

12.1.2. By Coating

12.1.3. By Substrate

12.1.4. By Application

12.1.5. By Country

12.2. Price Trend Analysis

12.3. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Technology, 2017 - 2027

12.3.1. Evaporative

12.3.2. Plasma Sputtering

12.3.3. IBS ( Ion Beam Sputtering)

12.3.4. ALD (Atomic Layer Deposition)

12.4. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Coating, 2017 - 2027

12.4.1. Mirror Coatings

12.4.2. Optical Filters

12.4.2.1. Bandpass Filters

12.4.2.1.1. NIR Filters

12.4.2.1.2. UV Filters

12.4.2.1.3. VIS Filters

12.4.2.2. Longpass Filters

12.4.2.3. Shortpass Filters

12.4.2.4. Notch Filters

12.4.2.5. Others

12.4.3. Anti-reflection Coatings

12.4.4. Beam Splitters

12.5. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Substrate, 2017 - 2027

12.5.1. Glass

12.5.2. IR Materials

12.5.3. Plastics

12.5.4. Metals

12.5.5. Replicated Optics

12.6. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Application, 2017 - 2027

12.6.1. Medical

12.6.2. Solar

12.6.3. Electronics

12.6.4. Telecommunications

12.6.5. Automotive

12.6.6. Others

12.7. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Country,, 2017 - 2027

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. Rest of Asia Pacific

12.8. Incremental Opportunity Analysis

12.8.1. By Technology

12.8.2. By Coating

12.8.3. By Substrate

12.8.4. By Application

12.8.5. By Country

13. Middle East & Africa Optical Coating Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Technology

13.1.2. By Coating

13.1.3. By Substrate

13.1.4. By Application

13.1.5. By Country

13.2. Price Trend Analysis

13.3. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Technology, 2017 - 2027

13.3.1. Evaporative

13.3.2. Plasma Sputtering

13.3.3. IBS ( Ion Beam Sputtering)

13.3.4. ALD (Atomic Layer Deposition)

13.4. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Coating, 2017 - 2027

13.4.1. Mirror Coatings

13.4.2. Optical Filters

13.4.2.1. Bandpass Filters

13.4.2.1.1. NIR Filters

13.4.2.1.2. UV Filters

13.4.2.1.3. VIS Filters

13.4.2.2. Longpass Filters

13.4.2.3. Shortpass Filters

13.4.2.4. Notch Filters

13.4.2.5. Others

13.4.3. Anti-reflection Coatings

13.4.4. Beam Splitters

13.5. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Substrate, 2017 - 2027

13.5.1. Glass

13.5.2. IR Materials

13.5.3. Plastics

13.5.4. Metals

13.5.5. Replicated Optics

13.6. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Application, 2017 - 2027

13.6.1. Medical

13.6.2. Solar

13.6.3. Electronics

13.6.4. Telecommunications

13.6.5. Automotive

13.6.6. Others

13.7. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Country, 2017 - 2027

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of MEA

13.8. Incremental Opportunity Analysis

13.8.1. By Technology

13.8.2. By Coating

13.8.3. By Application

13.8.4. By Country

14. South America Coating Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.1.1. By Technology

14.1.2. By Coating

14.1.3. By Substrate

14.1.4. By Application

14.1.5. By Country

14.2. Price Trend Analysis

14.3. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Technology, 2017 - 2027

14.3.1. Evaporative

14.3.2. Plasma Sputtering

14.3.3. IBS ( Ion Beam Sputtering)

14.3.4. ALD (Atomic Layer Deposition)

14.4. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Coating, 2017 - 2027

14.4.1. Mirror Coatings

14.4.2. Optical Filters

14.4.2.1. Bandpass Filters

14.4.2.1.1. NIR Filters

14.4.2.1.2. UV Filters

14.4.2.1.3. VIS Filters

14.4.2.2. Longpass Filters

14.4.2.3. Shortpass Filters

14.4.2.4. Notch Filters

14.4.2.5. Others

14.4.3. Anti-reflection Coatings

14.4.4. Beam Splitters

14.5. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Substrate, 2017 - 2027

14.5.1. Glass

14.5.2. IR Materials

14.5.3. Plastics

14.5.4. Metals

14.5.5. Replicated Optics

14.6. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Application, 2017 - 2027

14.6.1. Medical

14.6.2. Solar

14.6.3. Electronics

14.6.4. Telecommunications

14.6.5. Automotive

14.6.6. Others

14.7. Optical Coating Equipment Market Size (US$ Mn& Thousand Units) Forecast, By Country, 2017 - 2027

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Incremental Opportunity Analysis

14.8.1. By Technology

14.8.2. By Coating

14.8.3. By Application

14.8.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix

16. Company Profiles[Company Overview, By Technology Portfolio, Financial Information (Subject to Data Availability), Business Strategies / Recent Developments]

16.1. Buhler Holding AG

16.1.1. Company Overview

16.1.2. By Technology Portfolio

16.1.3. Financial Information (Subject to Data Availability)

16.1.4. Business Strategies / Recent Developments

16.2. Cutting Edge Coatings GmbH

16.2.1. Company Overview

16.2.2. By Technology Portfolio

16.2.3. Financial Information (Subject to Data Availability)

16.2.4. Business Strategies / Recent Developments

16.3. Dongguan Huicheng Vacuum Technology Co. Ltd.

16.3.1. Company Overview

16.3.2. By Technology Portfolio

16.3.3. Financial Information (Subject to Data Availability)

16.3.4. Business Strategies / Recent Developments

16.4. Dynavac, Evatec AG

16.4.1. Company Overview

16.4.2. By Technology Portfolio

16.4.3. Financial Information (Subject to Data Availability)

16.4.4. Business Strategies / Recent Developments

16.5. Optorun Co. Ltd.

16.5.1. Company Overview

16.5.2. By Technology Portfolio

16.5.3. Financial Information (Subject to Data Availability)

16.5.4. Business Strategies / Recent Developments

16.6. OptoTechOptikmaschinen GmbH

16.6.1. Company Overview

16.6.2. By Technology Portfolio

16.6.3. Financial Information (Subject to Data Availability)

16.6.4. Business Strategies / Recent Developments

16.7. Satisloh

16.7.1. Company Overview

16.7.2. By Technology Portfolio

16.7.3. Financial Information (Subject to Data Availability)

16.7.4. Business Strategies / Recent Developments

16.8. Scia Systems GmbH

16.8.1. Company Overview

16.8.2. By Technology Portfolio

16.8.3. Financial Information (Subject to Data Availability)

16.8.4. Business Strategies / Recent Developments

16.9. Shincron Co. Ltd.

16.9.1. Company Overview

16.9.2. By Technology Portfolio

16.9.3. Financial Information (Subject to Data Availability)

16.9.4. Business Strategies / Recent Developments

16.10. Solayer GmbH

16.10.1. Company Overview

16.10.2. By Technology Portfolio

16.10.3. Financial Information (Subject to Data Availability)

16.10.4. Business Strategies / Recent Developments

16.11. VON ARDENNE GmbH

16.11.1. Company Overview

16.11.2. By Technology Portfolio

16.11.3. Financial Information (Subject to Data Availability)

16.11.4. Business Strategies / Recent Developments

17. Key Takeaways

List of Tables

Table 1: Global Optical Coating Equipment Market, by Technology, Thousand Units, 2017 - 2027

Table 2: Global Optical Coating Equipment Market, by Technology, US$ Mn, 2017 - 2027

Table 3: Global Optical Coating Equipment Market, by Coating, Thousand Units, 2017 - 2027

Table 4: Global Optical Coating Equipment Market, by Coating, US$ Mn, 2017 - 2027

Table 5: Global Optical Coating Equipment Market, by Substrate, Thousand Units, 2017 - 2027

Table 6: Global Optical Coating Equipment Market, by Substrate, US$ Mn, 2017 - 2027

Table 7: Global Optical Coating Equipment Market, by Application, Thousand Units, 2017 - 2027

Table 8: Global Optical Coating Equipment Market, by Application, US$ Mn, 2017 - 2027

Table 9: Global Optical Coating Equipment Market, by Region, Thousand Units, 2017 - 2027

Table 10: Global Optical Coating Equipment Market, by Region, US$ Mn, 2017 - 2027

Table 11: North America Optical Coating Equipment Market, by Technology, Thousand Units, 2017 - 2027

Table 12: North America Optical Coating Equipment Market, by Technology, US$ Mn, 2017 - 2027

Table 13: North America Optical Coating Equipment Market, by Coating, Thousand Units, 2017 - 2027

Table 14: North America Optical Coating Equipment Market, by Coating, US$ Mn, 2017 - 2027

Table 15: North America Optical Coating Equipment Market, by Substrate, Thousand Units, 2017 - 2027

Table 16: North America Optical Coating Equipment Market, by Substrate, US$ Mn, 2017 - 2027

Table 17: North America Optical Coating Equipment Market, by Application, Thousand Units, 2017 - 2027

Table 18: North America Optical Coating Equipment Market, by Application, US$ Mn, 2017 - 2027

Table 19: North America Optical Coating Equipment Market, by Country, Thousand Units, 2017 - 2027

Table 20: North America Optical Coating Equipment Market, by Country, US$ Mn, 2017 - 2027

Table 21: Europe Optical Coating Equipment Market, by Technology, Thousand Units, 2017 - 2027

Table 22: Europe Optical Coating Equipment Market, by Technology, US$ Mn, 2017 - 2027

Table 23: Europe Optical Coating Equipment Market, by Coating, Thousand Units, 2017 - 2027

Table 24: Europe Optical Coating Equipment Market, by Coating, US$ Mn, 2017 - 2027

Table 25: Europe Optical Coating Equipment Market, by Substrate, Thousand Units, 2017 - 2027

Table 26: Europe Optical Coating Equipment Market, by Substrate, US$ Mn, 2017 - 2027

Table 27: Europe Optical Coating Equipment Market, by Application, Thousand Units, 2017 - 2027

Table 28: Europe Optical Coating Equipment Market, by Application, US$ Mn, 2017 - 2027

Table 29: Europe Optical Coating Equipment Market, by Country, Thousand Units, 2017 - 2027

Table 30: Europe Optical Coating Equipment Market, by Country, US$ Mn, 2017 - 2027

Table 31: Asia Pacific Optical Coating Equipment Market, by Technology, Thousand Units, 2017 - 2027

Table 32: Asia Pacific Optical Coating Equipment Market, by Technology, US$ Mn, 2017 - 2027

Table 33: Asia Pacific Optical Coating Equipment Market, by Coating, Thousand Units, 2017 - 2027

Table 34: Asia Pacific Optical Coating Equipment Market, by Coating, US$ Mn, 2017 - 2027

Table 35: Asia Pacific Optical Coating Equipment Market, by Substrate, Thousand Units, 2017 - 2027

Table 36: Asia Pacific Optical Coating Equipment Market, by Substrate, US$ Mn, 2017 - 2027

Table 37: Asia Pacific Optical Coating Equipment Market, by Application, Thousand Units, 2017 - 2027

Table 38: Asia Pacific Optical Coating Equipment Market, by Application, US$ Mn, 2017 - 2027

Table 39: Asia Pacific Optical Coating Equipment Market, by Country, Thousand Units, 2017 - 2027

Table 40: Asia Pacific Optical Coating Equipment Market, by Country, US$ Mn, 2017 - 2027

Table 41: Middle East & Africa Optical Coating Equipment Market, by Technology, Thousand Units, 2017 - 2027

Table 42: Middle East & Africa Optical Coating Equipment Market, by Technology, US$ Mn, 2017 - 2027

Table 43: Middle East & Africa Optical Coating Equipment Market, by Coating, Thousand Units, 2017 - 2027

Table 44: Middle East & Africa Optical Coating Equipment Market, by Coating, US$ Mn, 2017 - 2027

Table 45: Middle East & Africa Optical Coating Equipment Market, by Substrate, Thousand Units, 2017 - 2027

Table 46: Middle East & Africa Optical Coating Equipment Market, by Substrate, US$ Mn, 2017 - 2027

Table 47: Middle East & Africa Optical Coating Equipment Market, by Application, Thousand Units, 2017 - 2027

Table 48: Middle East & Africa Optical Coating Equipment Market, by Application, US$ Mn, 2017 - 2027

Table 49: Middle East & Africa Optical Coating Equipment Market, by Country, Thousand Units, 2017 - 2027

Table 50: Middle East & Africa Optical Coating Equipment Market, by Country, US$ Mn, 2017 - 2027

Table 51: South America Optical Coating Equipment Market, by Technology, Thousand Units, 2017 - 2027

Table 52: South America Optical Coating Equipment Market, by Technology, US$ Mn, 2017 - 2027

Table 53: South America Optical Coating Equipment Market, by Coating, Thousand Units, 2017 - 2027

Table 54: South America Optical Coating Equipment Market, by Coating, US$ Mn, 2017 - 2027

Table 55: South America Optical Coating Equipment Market, by Substrate, Thousand Units, 2017 - 2027

Table 56: South America Optical Coating Equipment Market, by Substrate, US$ Mn, 2017 - 2027

Table 57: South America Optical Coating Equipment Market, by Application, Thousand Units, 2017 - 2027

Table 58: South America Optical Coating Equipment Market, by Application, US$ Mn, 2017 - 2027

Table 59: South America Optical Coating Equipment Market, by Country, Thousand Units, 2017 - 2027

Table 60: South America Optical Coating Equipment Market, by Country, US$ Mn, 2017 - 2027

List of Figures

Figure 1: Global Optical Coating Equipment Market Projection by Technology, Thousand Units, 2017 - 2027

Figure 2: Global Optical Coating Equipment Market Projection by Technology, US$ Mn, 2017 - 2027

Figure 3: Global Optical Coating Equipment Market, Incremental Opportunity, Technology, US$ Mn, 2019 - 2027

Figure 4: Global Optical Coating Equipment Market Projection by Coating, Thousand Units, 2017 - 2027

Figure 5: Global Optical Coating Equipment Market Projection by Coating, US$ Mn, 2017 - 2027

Figure 6: Global Optical Coating Equipment Market, Incremental Opportunity, Coating, US$ Mn, 2019 - 2027

Figure 7: Global Optical Coating Equipment Market Projection by Substrate, Thousand Units, 2017 - 2027

Figure 8: Global Optical Coating Equipment Market Projection by Substrate, US$ Mn, 2017 - 2027

Figure 9: Global Optical Coating Equipment Market, Incremental Opportunity, Substrate, US$ Mn, 2019 - 2027

Figure 10: Global Optical Coating Equipment Market Projection by Application, Thousand Units, 2017 - 2027

Figure 11: Global Optical Coating Equipment Market Projection by Application, US$ Mn, 2017 - 2027

Figure 12: Global Optical Coating Equipment Market, Incremental Opportunity, Application, US$ Mn, 2019 - 2027

Figure 13: Global Optical Coating Equipment Market Projection by Region, Thousand Units, 2017 - 2027

Figure 14: Global Optical Coating Equipment Market Projection by Region, US$ Mn, 2017 - 2027

Figure 15: Global Optical Coating Equipment Market, Incremental Opportunity, Region, US$ Mn, 2019 - 2027

Figure 16: North America Optical Coating Equipment Market Projection by Technology, Thousand Units, 2017 - 2027

Figure 17: North America Optical Coating Equipment Market Projection by Technology, US$ Mn, 2017 - 2027

Figure 18: North America Optical Coating Equipment Market, Incremental Opportunity, Technology, US$ Mn, 2019 - 2027

Figure 19: North America Optical Coating Equipment Market Projection by Coating, Thousand Units, 2017 - 2027

Figure 20: North America Optical Coating Equipment Market Projection by Coating, US$ Mn, 2017 - 2027

Figure 21: North America Optical Coating Equipment Market, Incremental Opportunity, Coating, US$ Mn, 2019 - 2027

Figure 22: North America Optical Coating Equipment Market Projection by Substrate, Thousand Units, 2017 - 2027

Figure 23: North America Optical Coating Equipment Market Projection by Substrate, US$ Mn, 2017 - 2027

Figure 24: North America Optical Coating Equipment Market, Incremental Opportunity, Substrate, US$ Mn, 2019 - 2027

Figure 25: North America Optical Coating Equipment Market Projection by Application, Thousand Units, 2017 - 2027

Figure 26: North America Optical Coating Equipment Market Projection by Application, US$ Mn, 2017 - 2027

Figure 27: North America Optical Coating Equipment Market, Incremental Opportunity, Application, US$ Mn, 2019 - 2027

Figure 28: North America Optical Coating Equipment Market Projection by Country, Thousand Units, 2017 - 2027

Figure 29: North America Optical Coating Equipment Market Projection by Country, US$ Mn, 2017 - 2027

Figure 30: North America Optical Coating Equipment Market, Incremental Opportunity, Country, US$ Mn, 2019 - 2027

Figure 31: Asia Pacific Optical Coating Equipment Market Projection by Technology, Thousand Units, 2017 - 2027

Figure 32: Asia Pacific Optical Coating Equipment Market Projection by Technology, US$ Mn, 2017 - 2027

Figure 33: Asia Pacific Optical Coating Equipment Market, Incremental Opportunity, Technology, US$ Mn, 2019 - 2027

Figure 34: Asia Pacific Optical Coating Equipment Market Projection by Coating, Thousand Units, 2017 - 2027

Figure 35: Asia Pacific Optical Coating Equipment Market Projection by Coating, US$ Mn, 2017 - 2027

Figure 36: Asia Pacific Optical Coating Equipment Market, Incremental Opportunity, Coating, US$ Mn, 2019 - 2027

Figure 37: Asia Pacific Optical Coating Equipment Market Projection by Substrate, Thousand Units, 2017 - 2027

Figure 38: Asia Pacific Optical Coating Equipment Market Projection by Substrate, US$ Mn, 2017 - 2027

Figure 39: Asia Pacific Optical Coating Equipment Market, Incremental Opportunity, Substrate, US$ Mn, 2019 - 2027

Figure 40: Asia Pacific Optical Coating Equipment Market Projection by Application, Thousand Units, 2017 - 2027

Figure 41: Asia Pacific Optical Coating Equipment Market Projection by Application, US$ Mn, 2017 - 2027

Figure 42: Asia Pacific Optical Coating Equipment Market, Incremental Opportunity, Application, US$ Mn, 2019 - 2027

Figure 43: Asia Pacific Optical Coating Equipment Market Projection by Country, Thousand Units, 2017 - 2027

Figure 44: Asia Pacific Optical Coating Equipment Market Projection by Country, US$ Mn, 2017 - 2027

Figure 45: Asia Pacific Optical Coating Equipment Market, Incremental Opportunity, Country, US$ Mn, 2019 - 2027

Figure 46: Europe Optical Coating Equipment Market Projection by Technology, Thousand Units, 2017 - 2027

Figure 47: Europe Optical Coating Equipment Market Projection by Technology, US$ Mn, 2017 - 2027

Figure 48: Europe Optical Coating Equipment Market, Incremental Opportunity, Technology, US$ Mn, 2019 - 2027

Figure 49: Europe Optical Coating Equipment Market Projection by Coating, Thousand Units, 2017 - 2027

Figure 50: Europe Optical Coating Equipment Market Projection by Coating, US$ Mn, 2017 - 2027

Figure 51: Europe Optical Coating Equipment Market, Incremental Opportunity, Coating, US$ Mn, 2019 - 2027

Figure 52: Europe Optical Coating Equipment Market Projection by Substrate, Thousand Units, 2017 - 2027

Figure 53: Europe Optical Coating Equipment Market Projection by Substrate, US$ Mn, 2017 - 2027

Figure 54: Europe Optical Coating Equipment Market, Incremental Opportunity, Substrate, US$ Mn, 2019 - 2027

Figure 55: Europe Optical Coating Equipment Market Projection by Application, Thousand Units, 2017 - 2027

Figure 56: Europe Optical Coating Equipment Market Projection by Application, US$ Mn, 2017 - 2027

Figure 57: Europe Optical Coating Equipment Market, Incremental Opportunity, Application, US$ Mn, 2019 - 2027

Figure 58: Europe Optical Coating Equipment Market Projection by Country, Thousand Units, 2017 - 2027

Figure 59: Europe Optical Coating Equipment Market Projection by Country, US$ Mn, 2017 - 2027

Figure 60: Europe Optical Coating Equipment Market, Incremental Opportunity, Country, US$ Mn, 2019 - 2027

Figure 61: Middle East & Africa Optical Coating Equipment Market Projection by Technology, Thousand Units, 2017 - 2027

Figure 62: Middle East & Africa Optical Coating Equipment Market Projection by Technology, US$ Mn, 2017 - 2027

Figure 63: Middle East & Africa Optical Coating Equipment Market, Incremental Opportunity, Technology, US$ Mn, 2019 - 2027

Figure 64: Middle East & Africa Optical Coating Equipment Market Projection by Coating, Thousand Units, 2017 - 2027

Figure 65: Middle East & Africa Optical Coating Equipment Market Projection by Coating, US$ Mn, 2017 - 2027

Figure 66: Middle East & Africa Optical Coating Equipment Market, Incremental Opportunity, Coating, US$ Mn, 2019 - 2027

Figure 67: Middle East & Africa Optical Coating Equipment Market Projection by Substrate, Thousand Units, 2017 - 2027

Figure 68: Middle East & Africa Optical Coating Equipment Market Projection by Substrate, US$ Mn, 2017 - 2027

Figure 69: Middle East & Africa Optical Coating Equipment Market, Incremental Opportunity, Substrate, US$ Mn, 2019 - 2027

Figure 70: Middle East & Africa Optical Coating Equipment Market Projection by Application, Thousand Units, 2017 - 2027

Figure 71: Middle East & Africa Optical Coating Equipment Market Projection by Application, US$ Mn, 2017 - 2027

Figure 72: Middle East & Africa Optical Coating Equipment Market, Incremental Opportunity, Application, US$ Mn, 2019 - 2027

Figure 73: Middle East & Africa Optical Coating Equipment Market Projection by Country, Thousand Units, 2017 - 2027

Figure 74: Middle East & Africa Optical Coating Equipment Market Projection by Country, US$ Mn, 2017 - 2027

Figure 75: Middle East & Africa Optical Coating Equipment Market, Incremental Opportunity, Country, US$ Mn, 2019 - 2027

Figure 76: South America Optical Coating Equipment Market Projection by Technology, Thousand Units, 2017 - 2027

Figure 77: South America Optical Coating Equipment Market Projection by Technology, US$ Mn, 2017 - 2027

Figure 78: South America Optical Coating Equipment Market, Incremental Opportunity, Technology, US$ Mn, 2019 - 2027

Figure 79: South America Optical Coating Equipment Market Projection by Coating, Thousand Units, 2017 - 2027

Figure 80: South America Optical Coating Equipment Market Projection by Coating, US$ Mn, 2017 - 2027

Figure 81: South America Optical Coating Equipment Market, Incremental Opportunity, Coating, US$ Mn, 2019 - 2027

Figure 82: South America Optical Coating Equipment Market Projection by Substrate, Thousand Units, 2017 - 2027

Figure 83: South America Optical Coating Equipment Market Projection by Substrate, US$ Mn, 2017 - 2027

Figure 84: South America Optical Coating Equipment Market, Incremental Opportunity, Substrate, US$ Mn, 2019 - 2027

Figure 85: South America Optical Coating Equipment Market Projection by Application, Thousand Units, 2017 - 2027

Figure 86: South America Optical Coating Equipment Market Projection by Application, US$ Mn, 2017 - 2027

Figure 87: South America Optical Coating Equipment Market, Incremental Opportunity, Application, US$ Mn, 2019 - 2027

Figure 88: South America Optical Coating Equipment Market Projection by Country, Thousand Units, 2017 - 2027

Figure 89: South America Optical Coating Equipment Market Projection by Country, US$ Mn, 2017 - 2027

Figure 90: South America Optical Coating Equipment Market, Incremental Opportunity, Country, US$ Mn, 2019 - 2027