Global Ophthalmic Lasers Market: Overview

One of the key factors responsible for driving the growth of the global ophthalmic lasers market is the increasing number of patients suffering from numerous eye diseases across the world. There are study reports that show the rate of occurring partial or full blindness has considerably increased over the period and could still double to its current volume by 2020. This growth is mainly down to the diseases such as cataract, glaucoma, and diabetes. The increasing awareness about the benefits of timely diagnosis and productive medical care such as laser operation could avoid occurrence of these conditions is also helping to drive the growth of the global ophthalmic lasers market. Moreover, increasing awareness among people about the effectiveness of the treatment methods that are available is also projected to fuel the market growth in coming years.

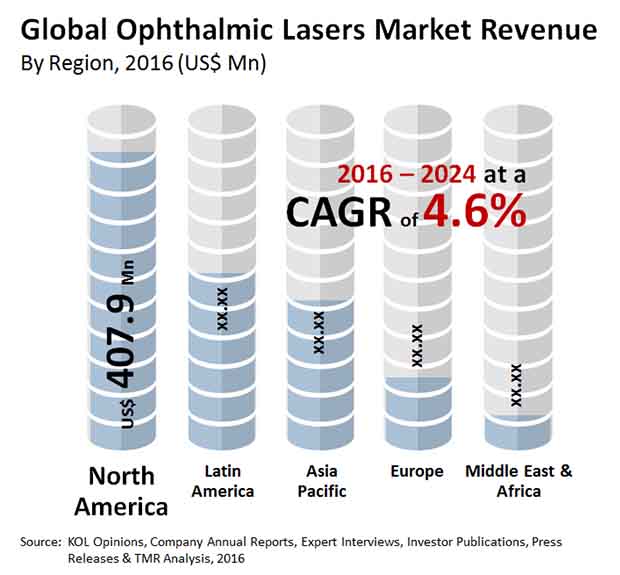

The global ophthalmic lasers market stood at overall valuation of US$0.97 bn in the year 2015. This valuation is estimated to reach to a figure of US$1.44 bn by the end of the given forecast period of 2016 to 2024. This growth over the course of the mentioned forecast period is expected to be achieved at a healthy CAGR of 4.60%.

Ophthalmic Clinics to Lead End User Segment due to Increasing Preference to Visit Specialists for Treatment

Ambulatory surgical centers, hospitals, and ophthalmic clinics have emerged as the important end users of the ophthalmic laser surgeries. With an outstanding rate of expansion, the ophthalmic clinics have been stated as the leading contributing segment to the overall revenue generation of the global ophthalmic lasers market.

The demand for ophthalmic lasers from this sector is expected to remain on the rise at a great pace compare to the other segments thanks to the growing preference for visiting the specialists for laser treatment procedures. Hospitals and other ambulatory surgical centers are also projected to experience a steady growth in requirement of ophthalmic lasers in the coming years.

North America to Remain Dominant Market Owing to Strong Healthcare and Regulatory Structure

Depending on geographical regions, the global market for ophthalmic lasers can be classified into North America, Europe, Latin America, Asia Pacific, and the Middle East and Africa. Owing to the widespread presence of prominent market players, North America has been the leading regional segment for the global ophthalmic lasers market accounting for over 40% of market share in the year 2016.

Over the coming years of the aforementioned forecast period, the key focus of the prominent players in the market is expected to be on the research and development activities and ensuring the availability of world class healthcare infrastructure and regulatory systems for avoiding the delay of product approval to support the North American market continue its dominance.

The ophthalmic lasers market in Asia Pacific is expected to witness a substantial growth rate which will be more the growth rate of the other geographical regions. This high growth rate of the ophthalmic lasers market in Asia Pacific is due to a large population base. Emerging economies such as China is projected to be the most promising domestic market for ophthalmic laser in the region of Asia Pacific.

Some of the key players in the market include names such as Ellex Medical Lasers Ltd., Lumenis Ltd., Novartis AG, IRIDEX Corp, Abbott Laboratories Inc., Ziemer Ophthalmic Systems AG, Carl Zeiss Meditec AG, and NIDEK Co. Ltd. among others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Ophthalmic Lasers Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Global Ophthalmic Lasers Market Analysis and Forecasts, 2014–2024

4.3.1. Market Revenue Projections (US$ Mn)

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.6. Market Outlook

5. Global Ophthalmic Lasers Market Analysis and Forecasts, By Product

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value (US$ Mn) Forecast By Product , 2014–2024

5.4.1. Diode Lasers

5.4.2. Femtosecond Lasers

5.4.3. Excimer Lasers

5.4.4. Nd:YAG lasers

5.4.5. Argon Lasers

5.4.6. SLT Lasers

5.5. Market Attractiveness By Product

6. Global Ophthalmic Lasers Market Analysis and Forecasts, By Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Value (US$ Mn) Forecast By Application , 2014–2024

6.4.1. Glaucoma

6.4.2. Cataract

6.4.3. Refractive Error Corrections

6.4.4. Diabetic Retinopathy

6.4.5. AMD

6.5. Market Attractiveness By Application

7. Global Ophthalmic Lasers Market Analysis and Forecasts, By End User

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Value (US$ Mn) Forecast By End User , 2014–2024

7.4.1. Hospitals

7.4.2. Ambulatory Surgical Centers

7.4.3. Ophthalmic Clinics

7.5. Market Attractiveness By End User

8. Global Ophthalmic Lasers Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Value (US$ Mn) Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Latin America

8.2.4. Asia Pacific

8.2.5. Middle East & Africa

8.4. Market Attractiveness By Country/Region

9. North America Ophthalmic Lasers Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Key Trends

9.2. Market Value (US$ Mn) Forecast By Product , 2014–2024

9.2.1. Diode Lasers

9.2.2. Femtosecond Lasers

9.2.3. Excimer Lasers

9.2.4. Nd:YAG lasers

9.2.5. Argon Lasers

9.2.6. SLT Lasers

9.3. Market Value (US$ Mn) Forecast By Application , 2014–2024

9.3.1. Glaucoma

9.3.2. Cataract

9.3.3. Refractive Error Corrections

9.3.4. Diabetic Retinopathy

9.3.5. AMD

9.4. Market Value (US$ Mn) Forecast By End User , 2014–2024

9.4.1. Hospitals

9.4.2. Ambulatory Surgical Centers

9.4.3. Ophthalmic Clinics

9.5. Market Value (US$ Mn) Forecast By Country , 2014–2024

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Product

9.6.2. By Application

9.6.3. By End User

9.6.4. By Country

10. Europe Ophthalmic Lasers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.1.2. Key Trends

10.2. Market Value (US$ Mn) Forecast By Product , 2014–2024

10.2.1. Diode Lasers

10.2.2. Femtosecond Lasers

10.2.3. Excimer Lasers

10.2.4. Nd:YAG lasers

10.2.5. Argon Lasers

10.2.6. SLT Lasers

10.3. Market Value (US$ Mn) Forecast By Application , 2014–2024

10.3.1. Glaucoma

10.3.2. Cataract

10.3.3. Refractive Error Corrections

10.3.4. Diabetic Retinopathy

10.3.5. AMD

10.4. Market Value (US$ Mn) Forecast By End User , 2014–2024

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Ophthalmic Clinics

10.5. Market Value (US$ Mn) Forecast By Country , 2014–2024

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End User

10.6.4. By Country

11. Latin America Ophthalmic Lasers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Key Trends

11.2. Market Value (US$ Mn) Forecast By Product , 2014–2024

11.2.1. Diode Lasers

11.2.2. Femtosecond Lasers

11.2.3. Excimer Lasers

11.2.4. Nd:YAG lasers

11.2.5. Argon Lasers

11.2.6. SLT Lasers

11.3. Market Value (US$ Mn) Forecast By Application , 2014–2024

11.3.1. Glaucoma

11.3.2. Cataract

11.3.3. Refractive Error Corrections

11.3.4. Diabetic Retinopathy

11.3.5. AMD

11.4. Market Value (US$ Mn) Forecast By End User , 2014–2024

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Ophthalmic Clinics

11.5. Market Value (US$ Mn) Forecast By Country , 2014–2024

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Rest of Latin America

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End User

11.6.4. By Country

12. Asia Pacific Ophthalmic Lasers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.1.2. Key Trends

12.2. Market Value (US$ Mn) Forecast By Product , 2014–2024

12.2.1. Diode Lasers

12.2.2. Femtosecond Lasers

12.2.3. Excimer Lasers

12.2.4. Nd:YAG lasers

12.2.5. Argon Lasers

12.2.6. SLT Lasers

12.3. Market Value (US$ Mn) Forecast By Application , 2014–2024

12.3.1. Glaucoma

12.3.2. Cataract

12.3.3. Refractive Error Corrections

12.3.4. Diabetic Retinopathy

12.3.5. AMD

12.4. Market Value (US$ Mn) Forecast By End User , 2014–2024

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Ophthalmic Clinics

12.5. Market Value (US$ Mn) Forecast By Country , 2014–2024

12.5.1. India

12.5.2. China

12.5.3. Japan

12.5.4. Australia

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End User

12.6.4. By Country

13. Middle East & Africa Ophthalmic Lasers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.1.2. Key Trends

13.2. Market Value (US$ Mn) Forecast By Product , 2014–2024

13.2.1. Diode Lasers

13.2.2. Femtosecond Lasers

13.2.3. Excimer Lasers

13.2.4. Nd:YAG lasers

13.2.5. Argon Lasers

13.2.6. SLT Lasers

13.3. Market Value (US$ Mn) Forecast By Application , 2014–2024

3.3.1. Glaucoma

13.3.2. Cataract

13.3.3. Refractive Error Corrections

13.3.4. Diabetic Retinopathy

13.3.5. AMD

13.4. Market Value (US$ Mn) Forecast By End User , 2014–2024

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Ophthalmic Clinics

13.5. Market Value (US$ Mn) Forecast By Country , 2014–2024

13.5.1. U.A.E.

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End User

13.6.4. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2015)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. Abbott Laboratories, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Business Overview

14.3.1.3. Product Portfolio

14.3.1.4. Financial Overview

14.3.1.5. SWOT Analysis

14.3.1.6. Strategic overview

14.3.2. Carl Zeiss Meditec AG

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Business Overview

14.3.2.3. Product Portfolio

14.3.2.4. Financial Overview

14.3.2.5. SWOT Analysis

14.3.2.6. Strategic overview

14.3.3. Ellex Medical Lasers Limited

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Business Overview

14.3.3.3. Product Portfolio

14.3.3.4. Financial Overview

14.3.3.5. SWOT Analysis

14.3.3.6. Strategic overview

14.3.4. IRIDEX Corporation

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Business Overview

14.3.4.3. Product Portfolio

14.3.4.4. Financial Overview

14.3.4.5. SWOT Analysis

14.3.4.6. Strategic overview

14.3.5. Lumenis Ltd.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Business Overview

14.3.5.3. Product Portfolio

14.3.5.4. Financial Overview

14.3.5.5. SWOT Analysis

14.3.5.6. Strategic overview

14.3.6. NIDEK CO., LTD

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Business Overview

14.3.6.3. Product Portfolio

14.3.6.4. Financial Overview

14.3.6.5. SWOT Analysis

14.3.6.6. Strategic overview

14.3.7. Novartis AG

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Business Overview

14.3.7.3. Product Portfolio

14.3.7.4. Financial Overview

14.3.7.5. SWOT Analysis

14.3.7.6. Strategic overview

14.3.8. Quantel Group

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Business Overview

14.3.8.3. Product Portfolio

14.3.8.4. Financial Overview

14.3.8.5. SWOT Analysis

14.3.8.6. Strategic overview

14.3.9. SCHWIND eye-tech-solutions GmbH & Co. KG

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Business Overview

14.3.9.3. Product Portfolio

14.3.9.4. Financial Overview

14.3.9.5. SWOT Analysis

14.3.9.6. Strategic overview

14.3.10. Topcon Corporation

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Business Overview

14.3.10.3. Product Portfolio

14.3.10.4. Financial Overview

14.3.10.5. SWOT Analysis

14.3.10.6. Strategic overview

14.3.11. Valeant Pharmaceuticals International, Inc.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Business Overview

14.3.11.3. Product Portfolio

14.3.11.4. Financial Overview

14.3.11.5. SWOT Analysis

14.3.11.6. Strategic overview

14.3.12. Ziemer Ophthalmic Systems AG

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Business Overview

14.3.12.3. Product Portfolio

14.3.12.4. Financial Overview

14.3.12.5. SWOT Analysis

14.3.12.6. Strategic overview

List of Tables

Table 01: Global Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 02: Global Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 03: Global Ophthalmic Lasers Market Size (US$ Mn) Forecast, by End-user, 2014–2024

Table 04: Global Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Region, 2014–2024

Table 05: North America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 06: North America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 07: North America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by End-user, 2014–2024

Table 08: North America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 09: Europe Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 10: Europe Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 11: Europe Ophthalmic Lasers Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 12: Europe Ophthalmic lasers Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 13: Latin America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 14: Latin America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 15: Latin America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by End-user, 2014–2024

Table 16: Latin America Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 17: Asia Pacific Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 18: Asia Pacific Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 19: Asia Pacific Ophthalmic Lasers Market Size (US$ Mn) Forecast, by End User, 2014–2024

Table 20: Asia Pacific Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 21: MEA Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 22: MEA Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 23: MEA Ophthalmic Lasers Market Size (US$ Mn) Forecast, by End-user, 2014–2024

Table 24: MEA Ophthalmic Lasers Market Size (US$ Mn) Forecast, by Country, 2014–2024

List of Figures

Figure 01: Global Ophthalmic Lasers Market Size (US$ Mn) Forecast, 2014–2024

Figure 02: Market Value Share by Product (2016)

Figure 03: Market Value Share by Application (2016)

Figure 04: Market Value Share by Region (2016)

Figure 05: Market Value Share by End User (2016)

Figure 06: Global Ophthalmic Lasers Market Value Share Analysis, by Product, 2015 and 2024

Figure 07: Global Diode Lasers Market Revenue (US$ Mn) and

Figure 08: Global Femotsecond Lasers Market Revenue (US$ Mn) and Y-o-Y Growth, 2014–2024

Figure 09: Global Excimer Lasers Market Revenue (US$ Mn) and Y-o-Y, 2014–2024

Figure 10: Global Nd:YAG Lasers Market Revenue (US$ Mn) and Y-o-Y, 2014–2024

Figure 11: Global Argon Lasers Market Revenue (US$ Mn) and Y-o-Y, 2014–2024

Figure 12: Global SLT Lasers Market Revenue (US$ Mn) and Y-o-Y, 2014–2024

Figure 13: Ophthalmic Lasers Market Attractiveness Analysis, by Product, 2015

Figure 14: Global Ophthalmic Lasers Market Value Share Analysis, by Application, 2015 and 2024

Figure 15: Global Glaucoma Market Revenue (US$ Mn) and Y-o-Y Growth, 2014–2024

Figure 16: Global Cataract Market Revenue (US$ Mn) and Y-o-Y, 2014–2024

Figure 17: Global Refractive Error Corrections Market Revenue (US$ Mn) and Y-o-Y, 2014–2024

Figure 18: Global Diabetic Retinopathy Market Revenue (US$ Mn) and Y-o-Y, 2014–2024

Figure 19: Global AMD Market Revenue (US$ Mn) and Y-o-Y Growth, 2014–2024

Figure 20: Global Ophthalmic Lasers Market Attractiveness Analysis, by Application, 2015

Figure 21: Global Ophthalmic Lasers Market Value Share Analysis, by End-user, 2015 and 2024

Figure 22: Global Hospitals Market Revenue (US$ Mn) and Y-o-Y Growth, 2014–2024

Figure 23: Global Ambulatory Surgical Centers Market Revenue (US$ Mn) and Y-o-Y Growth, 2014–2024

Figure 24: Global Ophthalmic Clinics Market Revenue (US$ Mn) and Y-o-Y Growth, 2014–2024

Figure 25: Global Ophthalmic Lasers Market Attractiveness Analysis, by End-user, 2015

Figure 26: Global Ophthalmic Lasers Market Value Share Analysis, by Region, 2015 and 2024

Figure 27: Global Ophthalmic Lasers Market Attractiveness Analysis, by Region, 2015

Figure 28: North America Ophthalmic Lasers Market Size (US$ Mn) Forecast, 2014–2024

Figure 29: North America Ophthalmic Lasers Market Attractiveness, by Country, 2015

Figure 30: North America Ophthalmic Lasers Market Value Share Analysis, by Product, 2015 and 2024

Figure 31: North America Ophthalmic Lasers Market Value Share Analysis, by Application, 2015 and 2024

Figure 32: North America Ophthalmic Lasers Market Value Share Analysis, by End-user, 2015 and 2024

Figure 33: North America Ophthalmic Lasers Market Value Share Analysis, by Country, 2015 and 2024

Figure 34: North America Ophthalmic Lasers Market Attractiveness Analysis, by Product, 2015

Figure 35: North America Ophthalmic Lasers Market Attractiveness Analysis, by Application, 2015

Figure 36: North America Ophthalmic Lasers Market Attractiveness Analysis, by End-user, 2015

Figure 37: Europe Ophthalmic Lasers Market Size (US$ Mn) Forecast, 2014–2024

Figure 38: Europe Ophthalmic Lasers Market Attractiveness, by Country, 2015

Figure 39: Europe Ophthalmic Lasers Market Value Share Analysis, by Product, 2015 and 2024

Figure 40: Europe Ophthalmic Lasers Market Value Share Analysis, by Application, 2015 and 2024

Figure 41: Europe Ophthalmic Lasers Market Value Share Analysis, by End User, 2015 and 2024

Figure 42: Europe Ophthalmic Lasers Market Value Share Analysis, by Country, 2015 and 2024

Figure 43: Europe Ophthalmic Lasers Market Attractiveness Analysis, by Product, 2015

Figure 44: Europe Ophthalmic Lasers Market Attractiveness Analysis, by Application, 2015

Figure 45: Europe Ophthalmic Lasers Market Attractiveness Analysis, by End User, 2015

Figure 46: Latin America Ophthalmic Lasers Market Size (US$ Mn) Forecast, 2014–2024

Figure 47: Latin America Ophthalmic Lasers Market Attractiveness Analysis, by Country, 2015

Figure 48: Latin America Ophthalmic Lasers Market Value Share Analysis, by Product, 2015 and 2024

Figure 49: Latin America Ophthalmic Lasers Market Value Share Analysis, by Application, 2015 and 2024

Figure 50: Latin America Ophthalmic Lasers Market Value Share Analysis, by End-user, 2015 and 2024

Figure 51: Latin America Ophthalmic Lasers Market Value Share Analysis, by Country, 2015 and 2024

Figure 52: Latin America Ophthalmic Lasers Market Attractiveness Analysis, by Product, 2015

Figure 53: Latin America Ophthalmic Lasers Market Attractiveness Analysis, by Application, 2015

Figure 54: Latin America Ophthalmic Lasers Market Attractiveness Analysis, by End-user, 2015

Figure 55: Asia Pacific Ophthalmic Lasers Market Size (US$ Mn) Forecast, 2014–2024

Figure 56: Asia Pacific Ophthalmic Lasers Market Attractiveness, by Country, 2015

Figure 57: Asia Pacific Ophthalmic Lasers Market Value Share Analysis, by Product, 2015 and 2024

Figure 58: Asia Pacific Ophthalmic Lasers Market Value Share Analysis, by Application, 2015 and 2024

Figure 59: Asia Pacific Ophthalmic Lasers Market Value Share Analysis, by End-user, 2015 and 2024

Figure 60: Asia Pacific Ophthalmic Lasers Market Value Share Analysis, by Country, 2015 and 2024

Figure 61: Asia Pacific Ophthalmic Lasers Market Attractiveness Analysis, by Product, 2015

Figure 62: Asia Pacific Ophthalmic Lasers Market Attractiveness Analysis, by Application, 2015

Figure 63: Asia Pacific Ophthalmic Lasers Market Attractiveness Analysis, by End-user, 2015

Figure 64: MEA Ophthalmic Lasers Market Size (US$ Mn) Forecast, 2014–2024

Figure 65: MEA Ophthalmic Lasers Market Attractiveness, by Country, 2015

Figure 66: MEA Ophthalmic Lasers Market Value Share Analysis, by Product, 2015 and 2024

Figure 67: MEA Ophthalmic Lasers Market Value Share Analysis, by Application, 2015 and 2024

Figure 68: MEA Ophthalmic Lasers Market Value Share Analysis, by End-user, 2015 and 2024

Figure 69: MEA Ophthalmic Lasers Market Value Share Analysis, by Country, 2015 and 2024

Figure 70: MEA Ophthalmic Lasers Market Attractiveness Analysis, by Product, 2015

Figure 71: MEA Ophthalmic Lasers Market Attractiveness Analysis, by Application, 2015

Figure 72: MEA Ophthalmic Lasers Market Attractiveness Analysis, by

Figure 73: Global Ophthalmic Lasers Market Share Analysis, by Company (2015)