Analysts’ Viewpoint

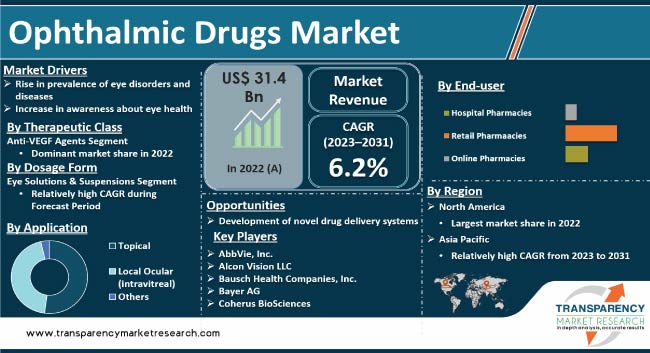

Increase in prevalence of eye disorders and diseases is driving the global ophthalmic drugs market. Surge in incidence of eye conditions, such as glaucoma, cataracts, macular degeneration, and diabetic retinopathy, due to aging population and changing lifestyles has led to higher demand for effective ophthalmic drugs to manage and treat these conditions. Furthermore, rise in healthcare expenditure and increase in awareness about eye health are likely to bolster global ophthalmic drugs market growth.

Advancements in technology and introduction of gene & stem cell therapies in ophthalmology offer lucrative opportunities to market players. Pharmaceutical companies are investing significantly in R&D to develop innovative drugs with enhanced therapeutic efficacy and improved delivery systems.

However, stringent regulatory requirements, high cost associated with drug development & clinical trials, availability of low-cost generic drugs, and high risk of adverse effects of drugs are likely to hamper the ophthalmic drugs industry growth during the forecast period.

Ophthalmic drugs are a category of pharmaceuticals specifically designed for the treatment, management, and prevention of eye disorders and diseases. These drugs are formulated to be administered directly to the eyes or their surrounding structures, typically in the form of eye drops, ointments, gels, or injections.

The field of ophthalmology encompasses a range of conditions, including but not limited to glaucoma, macular degeneration, diabetic retinopathy, dry eye, conjunctivitis, and ocular infections. Ophthalmic drugs are developed to address the specific needs of these conditions and provide therapeutic relief, improve vision, or slow down disease progression.

There are several categories of ophthalmic drugs, each targeting different aspects of eye health and functioning. Anti-inflammatory drugs are used to reduce inflammation in the eyes and provide relief from symptoms such as redness, swelling, and pain.

Anti-infective drugs, such as antibiotics and antivirals, are utilized to treat bacterial, viral, and fungal infections affecting the eyes. Anti-glaucoma drugs are designed to lower intraocular pressure, a major risk factor for glaucoma, to prevent further damage to the optic nerve. Anti-allergy drugs help manage allergic reactions that affect the eyes, such as itching, watering, and redness.

Development of ophthalmic drugs involves extensive research and clinical trials to ensure safety, efficacy, and proper delivery to the targeted ocular tissues. Formulation techniques are used to optimize drug delivery, such as creating sustained-release formulations that prolong drug release and reduce the frequency of administration. Combination therapies, which involve multiple active ingredients in a single formulation, are also being explored to enhance treatment outcomes and convenience for patients.

The global is driven by aging population, rise in prevalence of eye diseases, technological advancements, and surge in healthcare expenditure. Incidence of age-related eye disorders, such as cataracts and macular degeneration, is likely to increase due to rise in global geriatric population, which, in turn, is driving the demand for ophthalmic drugs.

Technological advancements in drug delivery systems, such as nanoparticles and implants, offer new avenues for targeted and sustained drug delivery to the eyes. Furthermore, increase in healthcare spending and rise in awareness about eye health are propelling global ophthalmic drugs market demand.

Rise in prevalence of ophthalmic disorders and diseases is one of the key drivers of the ophthalmic drugs market size. Eye disorders, such as cataract, glaucoma, age-related macular degeneration (AMD), diabetic retinopathy, and dry eye syndrome, are becoming more common.

This is ascribed to several factors such as aging population, unhealthy lifestyle choices, and increase in incidence of chronic diseases such as diabetes. If untreated, these eye conditions could cause vision impairment or even blindness, leading to rise in prevalence of the conditions.

According to the World Health Organization (WHO), over 2.2 billion people globally have some form of visual impairment or blindness. Of these, 1 billion people have a condition that could have been prevented or is yet to be treated. WHO estimates the number of people with vision impairment to triple by 2050, with the greatest increase in low- and middle-income countries.

According to the American Academy of Ophthalmology, the prevalence of age-related macular degeneration (AMD) is expected to increase from 196 million people in 2020 to 288 million people in 2040, an increase of 47% in just 20 years.

According to The International Myopia Institute, currently, around 30% of the world’s population has myopia and is expected to reach 50%, which is a staggering 5 billion people. The Glaucoma Research Foundation states that about 3 million individuals in the U.S. are affected by glaucoma, and the number is anticipated to rise to 4.2 million by 2030.

Surge in awareness about eye health and the importance of early diagnosis and treatment is another key factor driving the global ophthalmic drugs market share. Awareness about eye health is increasing through education and outreach programs. For instance, the World Sight Day is an annual event held on the second Thursday of October to raise awareness about the importance of eye health.

Organizations such as the American Academy of Ophthalmology and the International Agency for the Prevention of Blindness run public education campaigns to spread awareness about eye health and encourage people to have regular eye check-ups.

Non-Governmental Organizations (NGOs) such as Orbis International, Sight Savers, and the International Agency for the Prevention of Blindness (IAPB) are working to increase awareness about eye health and provide eye care services to underserved populations.

In the U.S., the National Eye Institute runs the Healthy Vision Month campaign every May to encourage people to take care of their eyes and have regular eye exams.

The Fred Hollows Foundation, an international development organization, works to prevent and treat blindness and other vision problems in developing countries. The foundation provides training to local eye care workers and advocates for better eye health policies.

Governments and healthcare organizations across the world are investing in campaigns and initiatives to educate the public about the significance of regular eye checkups and timely intervention. This has led to increase in the number of patients seeking ophthalmic drugs for treatment.

In terms of therapeutic class, the anti-VEGF segment accounted for major share of the global market in 2022. This is ascribed to increase in prevalence of ophthalmic diseases, including diabetic retinopathy, macular edema, age-related macular degeneration (AMD), and retinal vein occlusion, combined with surge in global geriatric population that is exposed to the risk of developing the condition.

Novel product launches across the globe are expected to fuel the segment. For example, in December 2022, Valitor announced a presentation on Multivalent Polymer Technology and Novel Anti-VEGF Antibody Conjugate Platform at the Ophthalmology Innovation Source Summit.

Based on indication, retinal disorders is projected to be a lucrative segment of the global ophthalmic drugs market during the forecast period.

Retinal disorders, such as diabetic retinopathy, age-related macular degeneration (AMD), and retinal vein occlusion (RVO), are becoming more common across the world. This has led to increase in demand for effective treatments for these conditions.

Availability of promising pipeline products is anticipated to propel the retinal disorders segment during the analysis period. Moreover, nearly 11 million people in the U.S. have some form of AMD, while 1.1 million people, or 10%, have wet AMD. Nearly 200,000 new cases of wet AMD are diagnosed every year across the U.S. Diabetic retinopathy impacts nearly 7.7 million people in the country. The number is expected to increase to 11.3 million by 2030.

In terms of dosage form, the eye drops segment is projected to dominate the global ophthalmic drugs market during the forecast period.

Increase in global geriatric population, which is more susceptible to eye illnesses, and surge in number of bacterial infection cases in youngsters are anticipated to propel the eye drops segment in the next few years.

Several novel innovations in eye drops, such as nanoparticle-based eye drops, preservative-free eye drops, and smart eye drops, are driving the segment. For instance, in August 2022, Alcon announced new addition to its advanced portfolio of dry-eye medications. The new ‘SYSTANE COMPLETE’ Preservative-Free eye drops is an all-in-one solution available in multi-dose and easy-to-use bottle.

In October 2021, Novaliq, a biopharmaceutical company specializing in innovative ocular therapeutics using their proprietary EyeSol technology, declared the adoption and implementation of a quality management system aligned with Annex IX, Chapter I of the EU Medical Device Regulation (MDR). This system was applied for assessing the compliance of their medical devices, namely NovaTears, NovaTears+Omega-3, and EvoTears OMEGA.

According to ophthalmic drugs market trends, North America is a significant market for ophthalmic drugs, with the U.S. being the largest contributor to market revenue. Increase in prevalence of common eye disorders and eye diseases across the region is one of the major factors driving the market during the forecast period.

According to the CDC, in the U.S. alone, around 12 million people aged 40 and older suffer from vision impairment, with about a million suffering from blindness.

In Canada, 5.5 million Canadians (1 in 7) have vision threatening eye conditions. Additionally, introduction of new and innovative ophthalmic drugs & therapies, increase in healthcare expenditure, and rise in awareness about eye health are propelling the market in the country.

Strong presence of prominent players, including Regeneron Pharmaceuticals Inc., Allergan/AbbVie, and Alcon Vision LLC, and their effective strategies are expected to drive the market in the region. Moreover, startup companies operating in the U.S. are entering into partnerships. For instance, in February 2023, Eyenovia and Formosa partnered for new ophthalmic therapeutics.

The market in Asia Pacific is projected to expand at the fastest CAGR during the forecast period. Expansion of the market in the region can be attributed to high disease prevalence, emergence of local companies, and presence of a large patient pool.

Asia Pacific has the largest patient base. Multiple strategic initiatives implemented by key drug manufacturers are projected to bolster market expansion in the region.

In July 2018, Novotech, Asia Pacific-centered global biotech CRO, announced partnership with the Asian Eye Institute, Inc. (AEI), the Philippines-based prominent eye center, in order to facilitate rapid and high-quality feasibility, recruitment processes, and start-up for its ophthalmology clients.

This report provides profiles of leading players operating in the global ophthalmic drugs market. These include AbbVie, Inc., Alcon Vision LLC, Bausch Health Companies, Inc., Bayer AG, Coherus BioSciences, F. Hoffmann-La Roche Ltd., Novartis Pharmaceuticals Corporation, Pfizer, Inc., Regeneron Pharmaceuticals, Inc., Santen, Inc., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd.

These players engage in mergers & acquisitions, strategic collaborations, and new product launches to expand presence and gain market share.

The ophthalmic drugs industry research report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

|

Attribute |

Detail |

|---|---|

|

Size in 2022 |

US$ 31.4 Bn |

|

Forecast (Value) in 2031 |

More than US$ 52.8 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 31.4 Bn in 2022

It is projected to reach more than US$ 52.8 Bn by 2031

It is anticipated to expand at a CAGR of 6.2% from 2023 to 2031

The anti-VEGF agents segment accounted for the largest market share in 2022

North America is expected to account for the leading market share during the forecast period.

AbbVie, Inc., Alcon Vision LLC, Bausch Health Companies, Inc., Bayer AG, Coherus BioSciences, F. Hoffmann-La Roche Ltd., Novartis Pharmaceuticals Corporation, Pfizer, Inc., Regeneron Pharmaceuticals, Inc., Santen, Inc., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd. are the leading players in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ophthalmic Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ophthalmic Drugs Market Volume Forecast, by Dosage Form, 2017-2031

5. Key Insights

5.1. Disease Prevalence & Incidence rate globally with key countries

5.2. Pipeline Analysis

5.3. Key Industry Events

5.4. Covid-19 Pandemic Impact on the Industry

6. Global Ophthalmic Drugs Market Analysis and Forecast, by Therapeutic Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Therapeutic Class, 2017-2031

6.3.1. Anti-VEGF Agents

6.3.2. Anti-glaucoma Drugs

6.3.2.1. Alpha Agonist

6.3.2.2. Beta Blockers

6.3.2.3. Prostaglandin Analogs

6.3.2.4. Combined Medication

6.3.2.5. Others

6.3.3. Anti-inflammatory Drugs

6.3.3.1. Steroids

6.3.3.2. NSAIDs

6.3.4. Anti-infective Drugs

6.3.4.1. Anti-bacterial Drugs

6.3.4.2. Anti-fungal Drugs

6.3.4.3. Others

6.3.5. Anti-allergy Drugs

6.3.6. Others

6.4. Market Attractiveness Analysis, by Therapeutic Class

7. Global Ophthalmic Drugs Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Indication, 2017-2031

7.3.1. Dry Eye

7.3.2. Glaucoma

7.3.3. Infection/Inflammation

7.3.4. Retinal Disorders

7.3.4.1. Wet AMD

7.3.4.2. Dry AMD

7.3.4.3. Diabetic Retinopathy

7.3.4.4. Others

7.3.5. Allergy

7.3.6. Uveitis

7.3.7. Others

7.4. Market Attractiveness Analysis, by Indication

8. Global Ophthalmic Drugs Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2017-2031

8.3.1. Topical

8.3.2. Local Ocular (intravitreal)

8.3.3. Others

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Ophthalmic Drugs Market Analysis and Forecast, by Product Type

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Product Type, 2017-2031

9.3.1. Prescription

9.3.2. OTC

9.4. Market Attractiveness Analysis, by Product Type

10. Global Ophthalmic Drugs Market Analysis and Forecast, by Dosage Form

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by Dosage Form, 2017-2031

10.3.1. Eye Drops

10.3.2. Eye Solutions & Suspensions

10.3.3. Capsules & Tablets

10.3.4. Gels

10.3.5. Ointments

10.3.6. Others

10.4. Market Attractiveness Analysis, by Dosage Form

11. Global Ophthalmic Drugs Market Analysis and Forecast, by Distribution Channel

11.1. Introduction & Definition

11.2. Key Findings / Developments

11.3. Market Value Forecast, by Distribution Channel, 2017-2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.4. Market Attractiveness Analysis, by Distribution Channel

12. Global Ophthalmic Drugs Market Analysis and Forecast, by Region

12.1. Key Findings

12.2. Market Value Forecast, by Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Market Attractiveness Analysis, by Region

13. North America Ophthalmic Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Therapeutic Class, 2017-2031

13.2.1. Anti-VEGF Agents

13.2.2. Anti-glaucoma Drugs

13.2.2.1. Alpha Agonist

13.2.2.2. Beta Blockers

13.2.2.3. Prostaglandin Analogs

13.2.2.4. Combined Medication

13.2.2.5. Others

13.2.3. Anti-inflammatory Drugs

13.2.3.1. Steroids

13.2.3.2. NSAIDs

13.2.4. Anti-infective Drugs

13.2.4.1. Anti-bacterial Drugs

13.2.4.2. Anti-fungal Drugs

13.2.4.3. Others

13.2.5. Anti-allergy Drugs

13.2.6. Others

13.3. Market Value Forecast, by Indication, 2017-2031

13.3.1. Dry Eye

13.3.2. Glaucoma

13.3.3. Infection/Inflammation

13.3.4. Retinal Disorders

13.3.4.1. Wet AMD

13.3.4.2. Dry AMD

13.3.4.3. Diabetic Retinopathy

13.3.4.4. Others

13.3.5. Allergy

13.3.6. Uveitis

13.3.7. Others

13.4. Market Value Forecast, by Route of Administration, 2017-2031

13.4.1. Topical

13.4.2. Local Ocular (intravitreal)

13.4.3. Others

13.5. Market Value Forecast, by Product Type, 2017-2031

13.5.1. Prescription

13.5.2. OTC

13.6. Market Value Forecast, by Dosage Form, 2017-2031

13.6.1. Eye Drops

13.6.2. Eye Solutions & Suspensions

13.6.3. Capsules & Tablets

13.6.4. Gels

13.6.5. Ointments

13.6.6. Others

13.7. Market Value Forecast, by Distribution Channel, 2017-2031

13.7.1. Hospital Pharmacies

13.7.2. Retail Pharmacies

13.7.3. Online Pharmacies

13.8. Market Value Forecast, by Country, 2017-2031

13.8.1. U.S.

13.8.2. Canada

13.9. Market Attractiveness Analysis

13.9.1. By Therapeutic Class

13.9.2. By Indication

13.9.3. By Route of Administration

13.9.4. By Product Type

13.9.5. By Dosage Form

13.9.6. By Distribution Channel

13.9.7. By Country

14. Europe Ophthalmic Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Therapeutic Class, 2017-2031

14.2.1. Anti-VEGF Agents

14.2.2. Anti-glaucoma Drugs

14.2.2.1. Alpha Agonist

14.2.2.2. Beta Blockers

14.2.2.3. Prostaglandin Analogs

14.2.2.4. Combined Medication

14.2.2.5. Others

14.2.3. Anti-inflammatory Drugs

14.2.3.1. Steroids

14.2.3.2. NSAIDs

14.2.4. Anti-infective Drugs

14.2.4.1. Anti-bacterial Drugs

14.2.4.2. Anti-fungal Drugs

14.2.4.3. Others

14.2.5. Anti-allergy Drugs

14.2.6. Others

14.3. Market Value Forecast, by Indication, 2017-2031

14.3.1. Dry Eye

14.3.2. Glaucoma

14.3.3. Infection/Inflammation

14.3.4. Retinal Disorders

14.3.4.1. Wet AMD

14.3.4.2. Dry AMD

14.3.4.3. Diabetic Retinopathy

14.3.4.4. Others

14.3.5. Allergy

14.3.6. Uveitis

14.3.7. Others

14.4. Market Value Forecast, by Route of Administration, 2017-2031

14.4.1. Topical

14.4.2. Local Ocular (intravitreal)

14.4.3. Others

14.5. Market Value Forecast, by Product Type, 2017-2031

14.5.1. Prescription

14.5.2. OTC

14.6. Market Value Forecast, by Dosage Form, 2017-2031

14.6.1. Eye Drops

14.6.2. Eye Solutions & Suspensions

14.6.3. Capsules & Tablets

14.6.4. Gels

14.6.5. Ointments

14.6.6. Others

14.7. Market Value Forecast, by Distribution Channel, 2017-2031

14.7.1. Hospital Pharmacies

14.7.2. Retail Pharmacies

14.7.3. Online Pharmacies

14.8. Market Value Forecast, by Country/Sub-region, 2017-2031

14.8.1. Germany

14.8.2. U.K.

14.8.3. France

14.8.4. Spain

14.8.5. Italy

14.8.6. Rest of Europe

14.9. Market Attractiveness Analysis

14.9.1. By Therapeutic Class

14.9.2. By Indication

14.9.3. By Route of Administration

14.9.4. By Product Type

14.9.5. By Dosage Form

14.9.6. By Distribution Channel

14.9.7. By Country/Sub-region

15. Asia Pacific Ophthalmic Drugs Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Therapeutic Class, 2017-2031

15.2.1. Anti-VEGF Agents

15.2.2. Anti-glaucoma Drugs

15.2.2.1. Alpha Agonist

15.2.2.2. Beta Blockers

15.2.2.3. Prostaglandin Analogs

15.2.2.4. Combined Medication

15.2.2.5. Others

15.2.3. Anti-inflammatory Drugs

15.2.3.1. Steroids

15.2.3.2. NSAIDs

15.2.4. Anti-infective Drugs

15.2.4.1. Anti-bacterial Drugs

15.2.4.2. Anti-fungal Drugs

15.2.4.3. Others

15.2.5. Anti-allergy Drugs

15.2.6. Others

15.3. Market Value Forecast, by Indication, 2017-2031

15.3.1. Dry Eye

15.3.2. Glaucoma

15.3.3. Infection/Inflammation

15.3.4. Retinal Disorders

15.3.4.1. Wet AMD

15.3.4.2. Dry AMD

15.3.4.3. Diabetic Retinopathy

15.3.4.4. Others

15.3.5. Allergy

15.3.6. Uveitis

15.3.7. Others

15.4. Market Value Forecast, by Route of Administration, 2017-2031

15.4.1. Topical

15.4.2. Local Ocular (intravitreal)

15.4.3. Others

15.5. Market Value Forecast, by Product Type, 2017-2031

15.5.1. Prescription

15.5.2. OTC

15.6. Market Value Forecast, by Dosage Form, 2017-2031

15.6.1. Eye Drops

15.6.2. Eye Solutions & Suspensions

15.6.3. Capsules & Tablets

15.6.4. Gels

15.6.5. Ointments

15.6.6. Others

15.7. Market Value Forecast, by Distribution Channel, 2017-2031

15.7.1. Hospital Pharmacies

15.7.2. Retail Pharmacies

15.7.3. Online Pharmacies

15.8. Market Value Forecast, by Country/Sub-region, 2017-2031

15.8.1. China

15.8.2. Japan

15.8.3. India

15.8.4. Australia & New Zealand

15.8.5. Rest of Asia Pacific

15.9. Market Attractiveness Analysis

15.9.1. By Therapeutic Class

15.9.2. By Indication

15.9.3. By Route of Administration

15.9.4. By Product Type

15.9.5. By Dosage Form

15.9.6. By Distribution Channel

15.9.7. By Country/Sub-region

16. Latin America Ophthalmic Drugs Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Therapeutic Class, 2017-2031

16.2.1. Anti-VEGF Agents

16.2.2. Anti-glaucoma Drugs

16.2.2.1. Alpha Agonist

16.2.2.2. Beta Blockers

16.2.2.3. Prostaglandin Analogs

16.2.2.4. Combined Medication

16.2.2.5. Others

16.2.3. Anti-inflammatory Drugs

16.2.3.1. Steroids

16.2.3.2. NSAIDs

16.2.4. Anti-infective Drugs

16.2.4.1. Anti-bacterial Drugs

16.2.4.2. Anti-fungal Drugs

16.2.4.3. Others

16.2.5. Anti-allergy Drugs

16.2.6. Others

16.3. Market Value Forecast, by Indication, 2017-2031

16.3.1. Dry Eye

16.3.2. Glaucoma

16.3.3. Infection/Inflammation

16.3.4. Retinal Disorders

16.3.4.1. Wet AMD

16.3.4.2. Dry AMD

16.3.4.3. Diabetic Retinopathy

16.3.4.4. Others

16.3.5. Allergy

16.3.6. Uveitis

16.3.7. Others

16.4. Market Value Forecast, by Route of Administration, 2017-2031

16.4.1. Topical

16.4.2. Local Ocular (intravitreal)

16.4.3. Others

16.5. Market Value Forecast, by Product Type, 2017-2031

16.5.1. Prescription

16.5.2. OTC

16.6. Market Value Forecast, by Dosage Form, 2017-2031

16.6.1. Eye Drops

16.6.2. Eye Solutions & Suspensions

16.6.3. Capsules & Tablets

16.6.4. Gels

16.6.5. Ointments

16.6.6. Others

16.7. Market Value Forecast, by Distribution Channel, 2017-2031

16.7.1. Hospital Pharmacies

16.7.2. Retail Pharmacies

16.7.3. Online Pharmacies

16.8. Market Value Forecast, by Country/Sub-region,2017-2031

16.8.1. Brazil

16.8.2. Mexico

16.8.3. Rest of Latin America

16.9. Market Attractiveness Analysis

16.9.1. By Therapeutic Class

16.9.2. By Indication

16.9.3. By Route of Administration

16.9.4. By Product Type

16.9.5. By Dosage Form

16.9.6. By Distribution Channel

16.9.7. By Country/Sub-region

17. Middle East & Africa Ophthalmic Drugs Market Analysis and Forecast

17.1. Introduction

17.1.1. Key Findings

17.2. Market Value Forecast, by Therapeutic Class, 2017-2031

17.2.1. Anti-VEGF Agents

17.2.2. Anti-glaucoma Drugs

17.2.2.1. Alpha Agonist

17.2.2.2. Beta Blockers

17.2.2.3. Prostaglandin Analogs

17.2.2.4. Combined Medication

17.2.2.5. Others

17.2.3. Anti-inflammatory Drugs

17.2.3.1. Steroids

17.2.3.2. NSAIDs

17.2.4. Anti-infective Drugs

17.2.4.1. Anti-bacterial Drugs

17.2.4.2. Anti-fungal Drugs

17.2.4.3. Others

17.2.5. Anti-allergy Drugs

17.2.6. Others

17.3. Market Value Forecast, by Indication, 2017-2031

17.3.1. Dry Eye

17.3.2. Glaucoma

17.3.3. Infection/Inflammation

17.3.4. Retinal Disorders

17.3.4.1. Wet AMD

17.3.4.2. Dry AMD

17.3.4.3. Diabetic Retinopathy

17.3.4.4. Others

17.3.5. Allergy

17.3.6. Uveitis

17.3.7. Others

17.4. Market Value Forecast, by Route of Administration, 2017-2031

17.4.1. Topical

17.4.2. Local Ocular (intravitreal)

17.4.3. Others

17.5. Market Value Forecast, by Product Type, 2017-2031

17.5.1. Prescription

17.5.2. OTC

17.6. Market Value Forecast, by Dosage Form, 2017-2031

17.6.1. Eye Drops

17.6.2. Eye Solutions & Suspensions

17.6.3. Capsules & Tablets

17.6.4. Gels

17.6.5. Ointments

17.6.6. Others

17.7. Market Value Forecast, by Distribution Channel, 2017-2031

17.7.1. Hospital Pharmacies

17.7.2. Retail Pharmacies

17.7.3. Online Pharmacies

17.8. Market Value Forecast, by Country/Sub-region, 2017-2031

17.8.1. GCC Countries

17.8.2. South Africa

17.8.3. Rest of Middle East & Africa

17.9. Market Attractiveness Analysis

17.9.1. By Therapeutic Class

17.9.2. By Indication

17.9.3. By Route of Administration

17.9.4. By Product Type

17.9.5. By Dosage Form

17.9.6. By Distribution Channel

17.9.7. By Country/Sub-region

18. Competition Landscape

18.1. Market Player - Competition Matrix (by tier and size of companies)

18.2. Market Share Analysis, by Company, 2022

18.3. Company Profiles

18.3.1. AbbVie, Inc.

18.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.1.2. Product Portfolio

18.3.1.3. Financial Overview

18.3.1.4. SWOT Analysis

18.3.1.5. Strategic Overview

18.3.2. Alcon Vision LLC

18.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.2.2. Product Portfolio

18.3.2.3. Financial Overview

18.3.2.4. SWOT Analysis

18.3.2.5. Strategic Overview

18.3.3. Bausch Health Companies, Inc.

18.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.3.2. Product Portfolio

18.3.3.3. Financial Overview

18.3.3.4. SWOT Analysis

18.3.3.5. Strategic Overview

18.3.4. Bayer AG

18.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.4.2. Product Portfolio

18.3.4.3. Financial Overview

18.3.4.4. SWOT Analysis

18.3.4.5. Strategic Overview

18.3.5. Coherus BioSciences

18.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.5.2. Product Portfolio

18.3.5.3. Financial Overview

18.3.5.4. SWOT Analysis

18.3.5.5. Strategic Overview

18.3.6. F. Hoffmann-La Roche Ltd.

18.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.6.2. Product Portfolio

18.3.6.3. Financial Overview

18.3.6.4. SWOT Analysis

18.3.6.5. Strategic Overview

18.3.7. Novartis Pharmaceuticals Corporation

18.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.7.2. Product Portfolio

18.3.7.3. Financial Overview

18.3.7.4. SWOT Analysis

18.3.7.5. Strategic Overview

18.3.8. Pfizer, Inc.

18.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.8.2. Product Portfolio

18.3.8.3. Financial Overview

18.3.8.4. SWOT Analysis

18.3.8.5. Strategic Overview

18.3.9. Regeneron Pharmaceuticals, Inc.

18.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.9.2. Product Portfolio

18.3.9.3. Financial Overview

18.3.9.4. SWOT Analysis

18.3.9.5. Strategic Overview

18.3.10. Santen, Inc.

18.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.10.2. Product Portfolio

18.3.10.3. Financial Overview

18.3.10.4. SWOT Analysis

18.3.10.5. Strategic Overview

18.3.11. Sun Pharmaceutical Industries Ltd.

18.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.11.2. Product Portfolio

18.3.11.3. Financial Overview

18.3.11.4. SWOT Analysis

18.3.11.5. Strategic Overview

18.3.12. Teva Pharmaceutical Industries Ltd.

18.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.12.2. Product Portfolio

18.3.12.3. Financial Overview

18.3.12.4. SWOT Analysis

18.3.12.5. Strategic Overview

List of Tables

Table 01: Global Ophthalmic Drugs Market Volume (Prescriptions in Mn) Forecast, by Dosage Form, 2017-2031

Table 02: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017-2031

Table 03: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-glaucoma Drugs, 2017-2031

Table 04: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-inflammatory Drugs, 2017-2031

Table 05: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-infective Drugs, 2017-2031

Table 06: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 07: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Retinal Disorders, 2017-2031

Table 08: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 09: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 10: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Dosage Form, 2017-2031

Table 11: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 12: Global Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 13: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 14: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017-2031

Table 15: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-glaucoma Drugs, 2017-2031

Table 16: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-inflammatory Drugs, 2017-2031

Table 17: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-infective Drugs, 2017-2031

Table 18: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 19: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Retinal Disorders, 2017-2031

Table 20: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 21: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 22: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Dosage Form, 2017-2031

Table 23: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 24: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 25: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017-2031

Table 26: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-glaucoma Drugs, 2017-2031

Table 27: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-inflammatory Drugs, 2017-2031

Table 28: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-infective Drugs, 2017-2031

Table 29: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 30: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Retinal Disorders, 2017-2031

Table 31: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 32: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 33: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Dosage Form, 2017-2031

Table 34: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 35: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 36: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017-2031

Table 37: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-glaucoma Drugs, 2017-2031

Table 38: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-inflammatory Drugs, 2017-2031

Table 39: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-infective Drugs, 2017-2031

Table 40: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 41: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Retinal Disorders, 2017-2031

Table 42: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 43: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 44: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Dosage Form, 2017-2031

Table 45: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 46: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 47: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017-2031

Table 48: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-glaucoma Drugs, 2017-2031

Table 49: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-inflammatory Drugs, 2017-2031

Table 50: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-infective Drugs, 2017-2031

Table 51: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 52: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Retinal Disorders, 2017-2031

Table 53: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 54: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 55: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Dosage Form, 2017-2031

Table 56: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 57: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 58: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017-2031

Table 59: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-glaucoma Drugs, 2017-2031

Table 60: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-inflammatory Drugs, 2017-2031

Table 61: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Anti-infective Drugs, 2017-2031

Table 62: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 63: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Retinal Disorders, 2017-2031

Table 64: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 65: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 66: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Dosage Form, 2017-2031

Table 67: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: Global Ophthalmic Drugs Market Value Share Analysis, by Therapeutic Class 2022 and 2031

Figure 02: Global Ophthalmic Drugs Market Attractiveness Analysis, Therapeutic Class, 2023-2031

Figure 03: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Anti-VEGF Agents, 2017-2031

Figure 04: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Anti-glaucoma Drugs, 2017-2031

Figure 05: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Anti-inflammatory Drugs, 2017-2031

Figure 06: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Anti-infective Drugs, 2017-2031

Figure 07: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Anti-allergy Drugs, 2017-2031

Figure 08: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 09: Global Ophthalmic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 10: Global Ophthalmic Drugs Market Attractiveness Analysis, Indication, 2023-2031

Figure 11: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Dry Eye, 2017-2031

Figure 12: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Glaucoma, 2017-2031

Figure 13: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Infection/Inflammation, 2017-2031

Figure 14: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Retinal Disorders, 2017-2031

Figure 15: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Allergy, 2017-2031

Figure 16: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Uveitis 2017-2031

Figure 17: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 18: Global Ophthalmic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 19: Global Ophthalmic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 20: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Topical, 2017-2031

Figure 21: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Local Ocular (intravitreal), 2017-2031

Figure 22: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 23: Global Ophthalmic Drugs Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 24: Global Ophthalmic Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 25: Global Ophthalmic Drugs Market Value (US$ Mn), by Prescription, 2017‒2031

Figure 26: Global Ophthalmic Drugs Market Value (US$ Mn), by OTC, 2017‒2031

Figure 27: Global Ophthalmic Drugs Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 28: Global Ophthalmic Drugs Market Attractiveness Analysis, Dosage Form, 2023-2031

Figure 29: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Eye Drops, 2017-2031

Figure 30: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Eye Solutions & Suspensions, 2017-2031

Figure 31: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Capsules & Tablets, 2017-2031

Figure 32: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Gels, 2017-2031

Figure 33: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Ointments, 2017-2031

Figure 34: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 35: Global Ophthalmic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 36: Global Ophthalmic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 37: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 38: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 39: Global Ophthalmic Drugs Market Revenue (US$ Mn), by Online Pharmacies, 2017-2031

Figure 40: Global Ophthalmic Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 41: Global Ophthalmic Drugs Market Attractiveness Analysis, by Region, 2023-2031

Figure 42: North America Ophthalmic Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 43: North America Ophthalmic Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 44: North America Ophthalmic Drugs Market Attractiveness Analysis, by Country, 2023-2031

Figure 45: North America Ophthalmic Drugs Market Value Share Analysis, by Therapeutic Class 2022 and 2031

Figure 46: North America Ophthalmic Drugs Market Attractiveness Analysis, Therapeutic Class, 2023-2031

Figure 47: North America Ophthalmic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 48: North America Ophthalmic Drugs Market Attractiveness Analysis, Indication, 2023-2031

Figure 49: North America Ophthalmic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 50: North America Ophthalmic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 51: North America Ophthalmic Drugs Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 52: North America Ophthalmic Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 53: North America Ophthalmic Drugs Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 54: North America Ophthalmic Drugs Market Attractiveness Analysis, Dosage Form, 2023-2031

Figure 55: North America Ophthalmic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 56: North America Ophthalmic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 57: Europe Ophthalmic Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 58: Europe Ophthalmic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 59: Europe Ophthalmic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 60: Europe Ophthalmic Drugs Market Value Share Analysis, by Therapeutic Class, 2022 and 2031

Figure 61: Europe Ophthalmic Drugs Market Attractiveness Analysis, Therapeutic Class, 2023-2031

Figure 62: Europe Ophthalmic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 63: Europe Ophthalmic Drugs Market Attractiveness Analysis, Indication, 2023-2031

Figure 64: Europe Ophthalmic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 65: Europe Ophthalmic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 66: Europe Ophthalmic Drugs Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 67: Europe Ophthalmic Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 68: Europe Ophthalmic Drugs Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 69: Europe Ophthalmic Drugs Market Attractiveness Analysis, Dosage Form, 2023-2031

Figure 70: Europe Ophthalmic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 71: Europe Ophthalmic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 72: Asia Pacific Ophthalmic Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 73: Asia Pacific Ophthalmic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 74: Asia Pacific Ophthalmic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 75: Asia Pacific Ophthalmic Drugs Market Value Share Analysis, by Therapeutic Class, 2022 and 2031

Figure 76: Asia Pacific Ophthalmic Drugs Market Attractiveness Analysis, Therapeutic Class, 2023-2031

Figure 77: Asia Pacific Ophthalmic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 78: Asia Pacific Ophthalmic Drugs Market Attractiveness Analysis, Indication, 2023-2031

Figure 79: Asia Pacific Ophthalmic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 80: Asia Pacific Ophthalmic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 81: Asia Pacific Ophthalmic Drugs Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 82: Asia Pacific Ophthalmic Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 83: Asia Pacific Ophthalmic Drugs Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 84: Asia Pacific Ophthalmic Drugs Market Attractiveness Analysis, Dosage Form, 2023-2031

Figure 85: Asia Pacific Ophthalmic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 86: Asia Pacific Ophthalmic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 87: Latin America Ophthalmic Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 88: Latin America Ophthalmic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 89: Latin America Ophthalmic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 90: Latin America Ophthalmic Drugs Market Value Share Analysis, by Therapeutic Class, 2022 and 2031

Figure 91: Latin America Ophthalmic Drugs Market Attractiveness Analysis, Therapeutic Class, 2023-2031

Figure 92: Latin America Ophthalmic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 93: Latin America Ophthalmic Drugs Market Attractiveness Analysis, Indication, 2023-2031

Figure 94: Latin America Ophthalmic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 95: Latin America Ophthalmic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 96: Latin America Ophthalmic Drugs Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 97: Latin America Ophthalmic Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 98: Latin America Ophthalmic Drugs Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 99: Latin America Ophthalmic Drugs Market Attractiveness Analysis, Dosage Form, 2023-2031

Figure 100: Latin America Ophthalmic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 101: Latin America Ophthalmic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 102: Middle East & Africa Ophthalmic Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 103: Middle East & Africa Ophthalmic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 104: Middle East & Africa Ophthalmic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 105: Middle East & Africa Ophthalmic Drugs Market Value Share Analysis, by Therapeutic Class 2022 and 2031

Figure 106: Middle East & Africa Ophthalmic Drugs Market Attractiveness Analysis, Therapeutic Class, 2023-2031

Figure 107: Middle East & Africa Ophthalmic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 108: Middle East & Africa Ophthalmic Drugs Market Attractiveness Analysis, Indication, 2023-2031

Figure 109: Middle East & Africa Ophthalmic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 110: Middle East & Africa Ophthalmic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 111: Middle East & Africa Ophthalmic Drugs Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 112: Middle East & Africa Ophthalmic Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 113: Middle East & Africa Ophthalmic Drugs Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 114: Middle East & Africa Ophthalmic Drugs Market Attractiveness Analysis, Dosage Form, 2023-2031

Figure 115: Middle East & Africa Ophthalmic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 116: Middle East & Africa Ophthalmic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031