Analysts’ Viewpoint

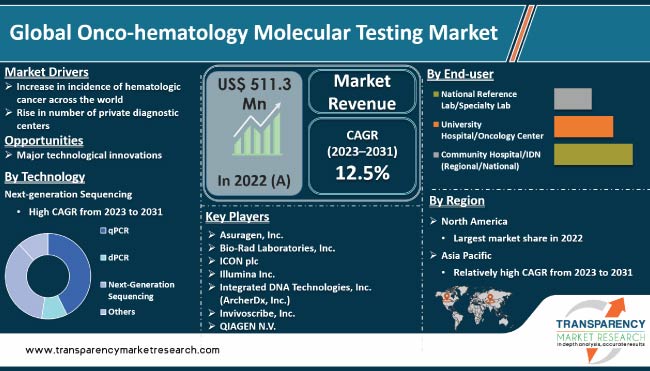

Increase in incidence of blood cancers, rise in awareness about early diagnosis, advancements in testing technologies, and development of targeted therapies are driving the global onco-hematology molecular testing market. Onco-hematology molecular testing refers to diagnostic tests used in the field of hematological oncology that focus on the diagnosis and treatment of blood cancers and related disorders. Rise in awareness among healthcare providers and patients about the importance of early and accurate diagnosis in improving treatment outcomes is expected to propel market expansion in the next few years.

Rise in prevalence of blood cancers and advancements in diagnostic technologies offer lucrative opportunities to market players. Companies are constantly investing in research & development activities to introduce innovative tests and technologies in order to enhance accuracy, speed, and cost-effectiveness of onco-hematology molecular testing.

Hemato oncology tests are diagnostic procedures used in the field of hematological oncology to detect and monitor blood cancers and related disorders. These tests play a crucial role in the early detection, diagnosis, and treatment of hematological malignancies such as leukemia, lymphoma, and myeloma.

Hemato oncology testing involves various techniques, including molecular testing, flow cytometry, cytogenetics, and next-generation sequencing. These tests help identify genetic mutations, chromosomal abnormalities, and other molecular markers associated with different types of blood cancers. By analyzing these markers, healthcare professionals can make accurate diagnoses, determine disease progression, and tailor treatment plans to individual patients.

Importance of onco-hematology molecular testing has grown significantly in the past few years, driven by advancements in testing technologies and development of targeted therapies. These tests provide valuable information for personalized medicine approaches, helping healthcare providers optimize treatment strategies and improve patient outcomes.

Overall, hemato oncology tests are vital tools in the fight against blood cancer, enabling early detection, precise diagnosis, and effective monitoring of these complex diseases. Continued advancements in testing techniques are expected to enhance the accuracy and efficiency of hemato oncology testing in the near future.

Surge in incidence of hematologic cancer across the world is likely to propel the global onco-hematology molecular testing market size during the forecast period. Hematologic cancers, which include leukemia, lymphoma, and myeloma, are a major health concern globally, with increasing numbers of cases being reported each year.

Several factors contribute to the rise in hematologic cancer incidence. These include aging population, environmental factors, exposure to carcinogens, genetic predisposition, and lifestyle changes. Additionally, advancements in medical technology and rise in awareness about early detection and diagnosis have led to improved detection rates of hematologic cancers.

Surge in incidence of hematologic cancers has led to rise in need for accurate and efficient diagnostic tools. Onco-hematology molecular testing plays a crucial role in the diagnosis, prognosis, and monitoring of these diseases. These tests enable healthcare professionals to identify specific genetic mutations, chromosomal abnormalities, and other molecular markers associated with different types of hematologic cancers.

Rise in demand for early and accurate diagnosis is projected to bolster global onco-hematology molecular testing market growth in the near future. Companies are investing in research & development activities to introduce innovative testing technologies, improve the speed & accuracy of tests, and enhance the overall patient experience.

In conclusion, increase in incidence of hematologic cancer across the world is likely to drive the market during the forecast period. Development of advanced testing technologies will play a critical role in early detection, precise diagnosis, and effective management of hematologic cancers, ultimately improving patient outcomes.

Increase in number of private diagnostic centers is expected to drive the global onco-hematology molecular testing industry in the next few years. Private diagnostic centers provide specialized diagnostic services, including onco-hematology molecular testing, to patients in a convenient and efficient manner.

Surge in demand for advanced and specialized healthcare services is ascribed to the rise in private diagnostic centers. Private centers often offer state-of-the-art facilities, advanced testing technologies, and personalized care, attracting patients who seek high-quality diagnostic services. These centers are equipped with sophisticated laboratory infrastructure and have skilled professionals who specialize in onco-hematology molecular testing.

Private diagnostic centers provide several advantages over traditional hospital-based laboratories. These offer shorter waiting times for appointments, quicker turnaround times for test results, and a more patient-centric approach. Patients appreciate the convenience, accessibility, and personalized attention they receive at private diagnostic centers.

Increase in number of private diagnostic centers dedicated to onco-hematology molecular testing is expected to augment the market in the near future. These centers contribute to the expansion of the market by increasing accessibility and availability of onco-hematology molecular testing services to a wider population.

Private centers often invest in advanced technologies and stay updated with the latest advancements in the field, which enhances the accuracy and efficiency of onco-hematology molecular testing.

In conclusion, rise in number of private diagnostic centers is likely to broaden onco-hematology molecular testing market outlook. Increase in access and advanced services offered by private centers contribute to improved patient outcomes and drive the demand for onco-hematology molecular testing.

In terms of blood cancer type, the acute lymphoblastic leukemia (ALL) segment accounted for the largest global onco-hematology molecular testing market share in 2022. The segment is projected to lead the global market during the forecast period.

Acute lymphoblastic leukemia is a type of blood cancer characterized by the rapid production of immature lymphocytes, affecting both children and adults. ALL is the most common type of leukemia in children, comprising a significant portion of pediatric hematologic malignancies. Early detection and accurate diagnosis of ALL are crucial for initiating timely treatment and improving survival rates in pediatric patients.

Advancements in onco-hematology molecular testing technologies have significantly enhanced the detection and monitoring of ALL. Molecular testing techniques, such as fluorescence in situ hybridization (FISH) and polymerase chain reaction (PCR), have enabled the identification of specific genetic abnormalities and chromosomal rearrangements associated with ALL. These tests provide valuable information for risk stratification, treatment selection, and disease monitoring.

The ALL segment has witnessed substantial research & development activities focused on the development of novel diagnostic markers and targeted therapies. Identification of specific genetic mutations, such as Philadelphia chromosome and fusion genes like BCR-ABL1, has led to the development of targeted therapies that have revolutionized the management of ALL.

Based on technology, the next-generation sequencing (NGS) segment is anticipated to grow at a rapid pace during the forecast period. NGS is a high-throughput DNA sequencing technology that enables simultaneous analysis of multiple genes and genomic regions, providing comprehensive insights into the genetic landscape of hematological malignancies.

NGS offers several advantages over traditional sequencing methods, such as Sanger sequencing. It allows for the detection of a range of genetic alterations, including single nucleotide variants, insertions/deletions, copy number variations, and structural rearrangements.

This comprehensive profiling capability of NGS is particularly valuable in onco-hematology molecular testing, as it enables identification of specific genetic mutations and alterations associated with different types of blood cancers.

Rise in adoption of NGS in clinical laboratories & research settings is driving the segment. NGS enables simultaneous analysis of a large number of genes, reducing the time and cost associated with conducting multiple tests individually. This efficiency makes NGS an attractive option for onco-hematology molecular testing, allowing for more streamlined and comprehensive diagnostic workflows.

Ongoing advancements in NGS technologies, such as improved sequencing platforms, enhanced bioinformatics tools, and decreased costs, contribute to the segment's rapid growth. These advancements have made NGS more accessible and affordable, allowing a wider range of laboratories and healthcare providers to incorporate this technology into their diagnostic practices.

In terms of end-user, the national reference lab/specialty lab segment is projected to account for major share of the global onco-hematology molecular testing market during the forecast period.

National reference labs and specialty labs are dedicated facilities equipped with advanced technologies and expertise to perform specialized diagnostic tests, including onco-hematology molecular testing.

National reference labs often serve as centralized facilities that receive samples from various healthcare providers and institutions. These have the capacity to handle a large volume of tests and offer standardized testing protocols, ensuring consistent and accurate results. This makes them an attractive choice for healthcare providers seeking reliable onco-hematology molecular testing services.

Specialty labs focus on specific areas, such as hematology and oncology, and have specialized expertise in conducting complex tests related to blood cancers. These have dedicated teams of pathologists, scientists, and technicians who are well-versed in the intricacies of onco-hematology molecular testing. Their specialized knowledge and experience enable them to provide comprehensive and accurate diagnostic services, contributing to the segment's market share.

National reference labs and specialty labs often have access to advanced testing technologies, including next-generation sequencing (NGS), flow cytometry, and cytogenetics. These labs continuously invest in upgrading their infrastructure and adopting state-of-the-art equipment to stay at the forefront of onco-hematology molecular testing.

According to the latest market forecast, North America is projected to account for major share of the global industry during the forecast period. The U.S. is the largest contributor to market revenue in the region.

North America is witnessing significant onco-hematology molecular testing market demand and is a key revenue contributor globally. The region's dominance can be ascribed to high incidence of hematologic cancer, aging population, rise in awareness about advanced treatment methods, and strong presence of industry players.

Surge in prevalence of leukemia, lymphoma, and multiple myeloma is one of the key drivers of the market value in North America. Statistics from the Canada Cancer Society reveal that nearly 6,700 people in Canada were diagnosed with leukemia in 2021, with 4,000 cases among men and 2,700 cases among women.

According to the American Cancer Society's data for 2023, the U.S. is expected to report 59,610 new cases of leukemia and 20,380 new cases of acute myeloid leukemia (AML) in 2023. High incidence rates of blood cancers are fueling the demand for onco-hematology molecular testing in the region.

Various organizations, such as the Leukemia & Lymphoma Society (LLS), are taking initiatives to improve blood cancer care, further contributing to onco-hematology molecular testing industry growth. In 2021, LLS provided over US$ 241 Mn in grants to support more than 42,000 blood cancer patients in the U.S.

These initiatives play a crucial role in advancing research, raising awareness, and supporting patients, thereby driving the demand for onco-hematology molecular testing.

Overall, North America is experiencing significant growth in the market, driven by high incidence of hematologic cancers, proactive initiatives by organizations, and increase in awareness about advanced treatment options. The trend is expected to continue during the forecast period.

The latest onco-hematology molecular testing market research report provides profiles of leading players operating in the global industry. Asuragen, Inc., Bio-Rad Laboratories, Inc., ICON plc, Illumina, Inc., Integrated DNA Technologies, Inc. (ArcherDx, Inc.), Invivoscribe, Inc., QIAGEN N.V., Thermo Fisher Scientific, Inc., and Cepheid are the prominent players operating in the global market.

These players are focusing on merger & acquisition, strategic collaborations, and new product launches to expand presence. Moreover, these players are following the market trends to gain market share.

Each of these players has been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 511.3 Mn |

|

Forecast (Value) in 2031 |

More than US$ 1.5 Bn |

|

Growth Rate (CAGR) |

12.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 511.3 Mn in 2022

It is projected to reach more than US$ 1.5 Bn by 2031

It is expected to advance at a CAGR of 12.5% from 2023 to 2031

The acute myeloid leukemia segment accounted for the largest market share in 2022

North America is the more lucrative region for vendors

Asuragen, Inc., Bio-Rad Laboratories, Inc., ICON plc, Illumina, Inc., Integrated DNA Technologies, Inc. (ArcherDx, Inc.), Invivoscribe, Inc., QIAGEN N.V., Thermo Fisher Scientific, Inc., and Cepheid are the prominent players operating in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Onco-hematology Molecular Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Onco-hematology Molecular Testing Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Overview of Onco-hematology Molecular Testing Market

5.2. Key Product/ Brand Analysis

5.3. Pipeline Analysis

5.4. COVID-19 Pandemic Impact on Industry

6. Global Onco-hematology Molecular Testing Market Analysis and Forecast, by Blood Cancer Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Blood Cancer Type, 2017-2031

6.3.1. Chronic Myeloid Leukemia

6.3.1.1. Polycythemia Vera

6.3.1.2. Essential Thrombocythaemia

6.3.1.3. Myelofibrosis

6.3.2. Myeloproliferative Neoplasms

6.3.3. Acute Myeloid Leukemia

6.3.4. Acute Lymphoblastic Leukemia

6.4. Market Attractiveness Analysis, by Blood Cancer Type

7. Global Onco-hematology Molecular Testing Market Analysis and Forecast, by Blood Cancer Biomarker

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Blood Cancer Biomarker, 2017-2031

7.3.1. BCR-ABL1 MBCR

7.3.2. JAK2

7.3.3. CALR

7.3.4. MPL

7.3.5. PML-RARA

7.3.6. NPM1

7.3.7. RUNX1-RUNX1T1

7.3.8. CBFB-MYH11

7.3.9. BCR-ABL1 mbcr

7.4. Market Attractiveness Analysis, by Blood Cancer Biomarker

8. Global Onco-hematology Molecular Testing Market Analysis and Forecast, by Technology

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Technology, 2017-2031

8.3.1. qPCR

8.3.2. dPCR

8.3.3. Next-Generation Sequencing

8.3.4. Others

8.4. Market Attractiveness Analysis, by Technology

9. Global Onco-hematology Molecular Testing Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. National Reference Lab/Specialty Lab

9.3.2. University Hospital/Oncology Center

9.3.3. Community Hospital/IDN (Regional/National

9.4. Market Attractiveness Analysis, by End-user

10. Global Onco-hematology Molecular Testing Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Onco-hematology Molecular Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Blood Cancer Type, 2017-2031

11.2.1. Chronic Myeloid Leukemia

11.2.1.1. Polycythemia Vera

11.2.1.2. Essential Thrombocythaemia

11.2.1.3. Myelofibrosis

11.2.2. Myeloproliferative Neoplasms

11.2.3. Acute Myeloid Leukemia

11.2.4. Acute Lymphoblastic Leukemia

11.3. Market Value Forecast, by Blood Cancer Biomarker, 2017-2031

11.3.1. BCR-ABL1 MBCR

11.3.2. JAK2

11.3.3. CALR

11.3.4. MPL

11.3.5. PML-RARA

11.3.6. NPM1

11.3.7. RUNX1-RUNX1T1

11.3.8. CBFB-MYH11

11.3.9. BCR-ABL1 mbcr

11.4. Market Value Forecast, by Technology, 2017-2031

11.4.1. qPCR

11.4.2. dPCR

11.4.3. Next-Generation Sequencing

11.4.4. Others

11.5. Market Value Forecast, by End-user, 2017-2031

11.5.1. National Reference Lab/Specialty Lab

11.5.2. University Hospital/Oncology Center

11.5.3. Community Hospital/IDN (Regional/National

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Blood Cancer Type

11.7.2. By Blood Cancer Biomarker

11.7.3. By Technology

11.7.4. By End-user

11.7.5. By Country

12. Europe Onco-hematology Molecular Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Blood Cancer Type, 2017-2031

12.2.1. Chronic Myeloid Leukemia

12.2.1.1. Polycythemia Vera

12.2.1.2. Essential Thrombocythaemia

12.2.1.3. Myelofibrosis

12.2.2. Myeloproliferative Neoplasms

12.2.3. Acute Myeloid Leukemia

12.2.4. Acute Lymphoblastic Leukemia

12.3. Market Value Forecast, by Blood Cancer Biomarker, 2017-2031

12.3.1. BCR-ABL1 MBCR

12.3.2. JAK2

12.3.3. CALR

12.3.4. MPL

12.3.5. PML-RARA

12.3.6. NPM1

12.3.7. RUNX1-RUNX1T1

12.3.8. CBFB-MYH11

12.3.9. BCR-ABL1 mbcr

12.4. Market Value Forecast, by Technology, 2017-2031

12.4.1. qPCR

12.4.2. dPCR

12.4.3. Next-Generation Sequencing

12.4.4. Others

12.5. Market Value Forecast, by End-user, 2017-2031

12.5.1. National Reference Lab/Specialty Lab

12.5.2. University Hospital/Oncology Center

12.5.3. Community Hospital/IDN (Regional/National

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Blood Cancer Type

12.7.2. By Blood Cancer Biomarker

12.7.3. By Technology

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Onco-hematology Molecular Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Blood Cancer Type, 2017-2031

13.2.1. Chronic Myeloid Leukemia

13.2.1.1. Polycythemia Vera

13.2.1.2. Essential Thrombocythaemia

13.2.1.3. Myelofibrosis

13.2.2. Myeloproliferative Neoplasms

13.2.3. Acute Myeloid Leukemia

13.2.4. Acute Lymphoblastic Leukemia

13.3. Market Value Forecast, by Blood Cancer Biomarker, 2017-2031

13.3.1. BCR-ABL1 MBCR

13.3.2. JAK2

13.3.3. CALR

13.3.4. MPL

13.3.5. PML-RARA

13.3.6. NPM1

13.3.7. RUNX1-RUNX1T1

13.3.8. CBFB-MYH11

13.3.9. BCR-ABL1 mbcr

13.4. Market Value Forecast, by Technology, 2017-2031

13.4.1. qPCR

13.4.2. dPCR

13.4.3. Next-Generation Sequencing

13.4.4. Others

13.5. Market Value Forecast, by End-user, 2017-2031

13.5.1. National Reference Lab/Specialty Lab

13.5.2. University Hospital/Oncology Center

13.5.3. Community Hospital/IDN (Regional/National

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Blood Cancer Type

13.7.2. By Blood Cancer Biomarker

13.7.3. By Technology

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Onco-hematology Molecular Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Blood Cancer Type, 2017-2031

14.2.1. Chronic Myeloid Leukemia

14.2.1.1. Polycythemia Vera

14.2.1.2. Essential Thrombocythaemia

14.2.1.3. Myelofibrosis

14.2.2. Myeloproliferative Neoplasms

14.2.3. Acute Myeloid Leukemia

14.2.4. Acute Lymphoblastic Leukemia

14.3. Market Value Forecast, by Blood Cancer Biomarker, 2017-2031

14.3.1. BCR-ABL1 MBCR

14.3.2. JAK2

14.3.3. CALR

14.3.4. MPL

14.3.5. PML-RARA

14.3.6. NPM1

14.3.7. RUNX1-RUNX1T1

14.3.8. CBFB-MYH11

14.3.9. BCR-ABL1 mbcr

14.4. Market Value Forecast, by Technology, 2017-2031

14.4.1. qPCR

14.4.2. dPCR

14.4.3. Next-Generation Sequencing

14.4.4. Others

14.5. Market Value Forecast, by End-user, 2017-2031

14.5.1. National Reference Lab/Specialty Lab

14.5.2. University Hospital/Oncology Center

14.5.3. Community Hospital/IDN (Regional/National

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Blood Cancer Type

14.7.2. By Blood Cancer Biomarker

14.7.3. By Technology

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Onco-hematology Molecular Testing Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Blood Cancer Type, 2017-2031

15.2.1. Chronic Myeloid Leukemia

15.2.1.1. Polycythemia Vera

15.2.1.2. Essential Thrombocythaemia

15.2.1.3. Myelofibrosis

15.2.2. Myeloproliferative Neoplasms

15.2.3. Acute Myeloid Leukemia

15.2.4. Acute Lymphoblastic Leukemia

15.3. Market Value Forecast, by Blood Cancer Biomarker, 2017-2031

15.3.1. BCR-ABL1 MBCR

15.3.2. JAK2

15.3.3. CALR

15.3.4. MPL

15.3.5. PML-RARA

15.3.6. NPM1

15.3.7. RUNX1-RUNX1T1

15.3.8. CBFB-MYH11

15.3.9. BCR-ABL1 mbcr

15.4. Market Value Forecast, by Technology, 2017-2031

15.4.1. qPCR

15.4.2. dPCR

15.4.3. Next-Generation Sequencing

15.4.4. Others

15.5. Market Value Forecast, by End-user, 2017-2031

15.5.1. National Reference Lab/Specialty Lab

15.5.2. University Hospital/Oncology Center

15.5.3. Community Hospital/IDN (Regional/National

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Blood Cancer Type

15.7.2. By Blood Cancer Biomarker

15.7.3. By Technology

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2022

16.3. Company Profiles

16.3.1. Asuragen, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Bio-Rad Laboratories, Inc.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. ICON plc

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Integrated DNA Technologies, Inc. (ArcherDx, Inc.)

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Invivoscribe, Inc.

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. QIAGEN N.V.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Thermo Fisher Scientific, Inc.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Cepheid

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Illumina, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

List of Tables

Table 01: Global Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Type, 2017-2031

Table 02: Global Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Biomarker, 2017‒2031

Table 03: Global Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 04: Global Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Type, 2017-2031

Table 08: North America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Biomarker, 2017‒2031

Table 09: North America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 10: North America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 11: Europe Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Type, 2017-2031

Table 13: Europe Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Biomarker, 2017‒2031

Table 14: Europe Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 15: Europe Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Type, 2017-2031

Table 18: Asia Pacific Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Biomarker, 2017‒2031

Table 19: Asia Pacific Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 20: Asia Pacific Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Latin America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Type, 2017-2031

Table 23: Latin America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Biomarker, 2017‒2031

Table 24: Latin America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 25: Latin America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 26: Middle East & Africa Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Type, 2017-2031

Table 28: Middle East & Africa Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Blood Cancer Biomarker, 2017‒2031

Table 29: Middle East & Africa Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 30: Middle East & Africa Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Onco-hematology Molecular Testing Market Value Share, by Blood Cancer Type, 2022

Figure 03: Global Onco-hematology Molecular Testing Market Value Share, by Blood Cancer Biomarker, 2022

Figure 04: Global Onco-hematology Molecular Testing Market Value Share, by Technology, 2022

Figure 05: Global Onco-hematology Molecular Testing Market Value Share, by End-user, 2022

Figure 06: Global Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Type, 2022 and 2031

Figure 07: Global Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Type, 2023-2031

Figure 08: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by Chronic Myeloid Leukemia , 2017-2031

Figure 09: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by Myeloproliferative Neoplasms, 2017-2031

Figure 10: Global Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Biomarker, 2022 and 2031

Figure 11: Global Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Biomarker 2023-2031

Figure 12: Global Onco-hematology Molecular Testing Market Value (US$ Mn), by BCR-ABL1 MBCR, 2017‒2031

Figure 13: Global Onco-hematology Molecular Testing Market Value (US$ Mn), by JAK2, 2017‒2031

Figure 14: Global Onco-hematology Molecular Testing Market Value (US$ Mn), by Irreversible CALR, 2017‒2031

Figure 15: Global Onco-hematology Molecular Testing Market Value (US$ Mn), by MPL, 2017‒2031

Figure 16: Global Onco-hematology Molecular Testing Market Value (US$ Mn), by Others, 2017‒2031

Figure 17: Global Onco-hematology Molecular Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 18: Global Onco-hematology Molecular Testing Market Attractiveness Analysis, Technology, 2023-2031

Figure 19: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by QPCR , 2017-2031

Figure 20: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by DPCR, 2017-2031

Figure 21: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by Next-Generation Sequencing, 2017-2031

Figure 22: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by Others, 2017-2031

Figure 23: Global Onco-hematology Molecular Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: Global Onco-hematology Molecular Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 25: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by National Reference Lab/Specialty Lab, 2017-2031

Figure 26: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by University Hospital/Oncology Center, 2017-2031

Figure 27: Global Onco-hematology Molecular Testing Market Revenue (US$ Mn), by Others, 2017-2031

Figure 28: Global Onco-hematology Molecular Testing Market Value Share Analysis, by Region, 2022 and 2031

Figure 29: Global Onco-hematology Molecular Testing Market Attractiveness Analysis, by Region, 2023-2031

Figure 30: North America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 31: North America Onco-hematology Molecular Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 32: North America Onco-hematology Molecular Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 33: North America Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Type, 2022 and 2031

Figure 34: North America Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Type, 2023-2031

Figure 35: North America Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Biomarker, 2022 and 2031

Figure 36: North America Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Biomarker 2023-2031

Figure 37: North America Onco-hematology Molecular Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 38: North America Onco-hematology Molecular Testing Market Attractiveness Analysis, Technology, 2023-2031

Figure 39: North America Onco-hematology Molecular Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: North America Onco-hematology Molecular Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 41: Europe Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 42: Europe Onco-hematology Molecular Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 43: Europe Onco-hematology Molecular Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 44: Europe Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Type, 2022 and 2031

Figure 45: Europe Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Type, 2023-2031

Figure 46: Europe Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Biomarker, 2022 and 2031

Figure 47: Europe Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Biomarker 2023-2031

Figure 48: Europe Onco-hematology Molecular Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 49: Europe Onco-hematology Molecular Testing Market Attractiveness Analysis, Technology, 2023-2031

Figure 50: Europe Onco-hematology Molecular Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Europe Onco-hematology Molecular Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 52: Asia Pacific Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 53: Asia Pacific Onco-hematology Molecular Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Asia Pacific Onco-hematology Molecular Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 55: Asia Pacific Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Type, 2022 and 2031

Figure 56: Asia Pacific Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Type, 2023-2031

Figure 57: Asia Pacific Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Biomarker, 2022 and 2031

Figure 58: Asia Pacific Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Biomarker 2023-2031

Figure 59: Asia Pacific Onco-hematology Molecular Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 60: Asia Pacific Onco-hematology Molecular Testing Market Attractiveness Analysis, Technology, 2023-2031

Figure 61: Asia Pacific Onco-hematology Molecular Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Asia Pacific Onco-hematology Molecular Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 63: Latin America Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 64: Latin America Onco-hematology Molecular Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 65: Latin America Onco-hematology Molecular Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 66: Latin America Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Type, 2022 and 2031

Figure 67: Latin America Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Type, 2023-2031

Figure 68: Latin America Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Biomarker, 2022 and 2031

Figure 69: Latin America Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Biomarker, 2023-2031

Figure 70: Latin America Onco-hematology Molecular Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 71: Latin America Onco-hematology Molecular Testing Market Attractiveness Analysis, Technology, 2023-2031

Figure 72: Latin America Onco-hematology Molecular Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Latin America Onco-hematology Molecular Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 74: Middle East & Africa Onco-hematology Molecular Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 75: Middle East & Africa Onco-hematology Molecular Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 76: Middle East & Africa Onco-hematology Molecular Testing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 77: Middle East & Africa Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Type, 2022 and 2031

Figure 78: Middle East & Africa Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Type, 2023-2031

Figure 79: Middle East & Africa Onco-hematology Molecular Testing Market Value Share Analysis, by Blood Cancer Biomarker, 2022 and 2031

Figure 80: Middle East & Africa Onco-hematology Molecular Testing Market Attractiveness Analysis, by Blood Cancer Biomarker 2023-2031

Figure 81: Middle East & Africa Onco-hematology Molecular Testing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 82: Middle East & Africa Onco-hematology Molecular Testing Market Attractiveness Analysis, by Technology, 2023-2031

Figure 83: Middle East & Africa Onco-hematology Molecular Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 84: Middle East & Africa Onco-hematology Molecular Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 85: Global Onco-hematology Molecular Testing Market Share Analysis, by Company (2022)