Oil spill management mainly entails the utilization of technologies to prevent oil spills, devising appropriate clean-up strategies post spilling, and implementing techniques to minimize waste and devastating ecological effect of the spilt oil. The oil spill management market is mainly driven by the need for managing operational oil spills from sectors such as exploration and production, refining and marketing, and chemical. World over, these sectors have been involved in a variety of pipeline transportation and seaborne of crude oil and chemicals. This has mandated the need for oil spill management technologies and methods.

In recent years, hefty penalty borne by prominent oil companies for the devastating effect they caused to the ecology and economy due to operational oil spills has boosted the demand for proper oil spill management mechanism. Constant advancement in technologies for pre-oil spill and post-oil management teams is expected to boost the market.

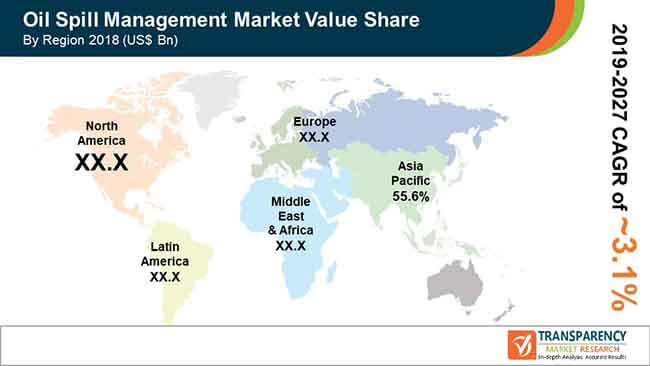

The global oil spill management market is projected to rise at a CAGR of 3.1% from 2019 to 2027. Growing at this pace, the opportunities in the market is expected to reach US$ 139.4 Bn by the end of the forecast period.

On the basis of product type, the market is segmented into offshore and onshore. Based on technology, the market is segmented into post-oil and pre-oil spill management scenarios. The pre-oil spill management is further segmented into double hulling, pipeline leak detection, and blowout preventers (BOPs). The post-oil spill management segment is further divided into physical, mechanical, and chemical and biological methods.

The continued rise in oil drilling activities, especially onshore, has bolstered the uptake of pressure control equipment such as blowout preventers and technologies such as pipeline leak detection. Stringent regulations imposed by governments of several nations to prevent accidental and operational oil spills have stimulated oil companies to strictly follow preventive measures.

The International Maritime Organization (IMO), primarily involved with regulating shipping, imposes stringent regulations, such as the mandatory use of double-hulled ships for newly built oil tankers, in order to minimize marine pollution. This has accentuated the market in recent years. Furthermore, several governmental regulation in advanced nations such as the U.S. has made double-hulled ships compulsory for all new ships with oil tankers. In addition, mounting concerns arising due to the leaks in oil and gas pipelines has propelled the demand for pipeline leak detection systems among operators.

Based on geography, the oil spill management market is segmented into Asia Pacific, North America, Europe, and Rest of the World. Of these, Asia Pacific is projected to lead the market over the forecast period. The growth of the regional market is fueled by the prominent presence of big shipping companies in several Asian nations such as Japan, South Korea, and China. A number of ship building companies have witnessed substantial demand for double-hulled ships in recent years. In addition, the rapidly rising number of domestic shipbuilding and repairing activities in countries such as Thailand, Vietnam, Malaysia, the Philippines, and Indonesia is expected to boost the regional market.

Meanwhile, North America is a prominent region for oil spill management market. The extensive implementation of mechanical containment in managing oil spills is anticipated to accentuate the regional market.

Key Players in the Oil Spill Management Market

are the prime players operating in the oil spill management market.

1. Executive Summary: Global Oil Spill Management Market

2. Market Overview

2.1. Market Segmentation

2.2. Market Definitions

2.3. Market Trends

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.7. Regulatory Landscape

3. Case Study 1 – The Exxon Valdez Oil Spill-1989

4. Case Study 2 – The Deepwater Horizon Oil Spill 2010

5. Global Oil Spill Management Market Analysis and Forecast, by Technology

5.1. Key Findings

5.2. Market Definitions

5.3. Global Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

5.3.1. Pre-Oil Spill Management

5.3.1.1. Blowout Preventers

5.3.1.2. Double Hulling

5.3.1.3. Pipeline Leak Detection

5.3.2. Post-Oil Spill Management

5.3.2.1. Mechanical Containment Methods

5.3.2.2. Chemical and Biological Management Methods

5.3.2.3. Physical Management Methods

5.4. Global Oil Spill Management Market Attractiveness Analysis, by Technology

6. Global Oil Spill Management Market Analysis and Forecast, by Product Type

6.1. Key Findings

6.2. Market Definitions

6.3. Global Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

6.3.1. Onshore

6.3.2. Offshore

6.4. Global Oil Spill Management Market Attractiveness Analysis, by Product Type

7. Global Oil Spill Management Market Analysis and Forecast, by Region

7.1. Global Oil Spill Management Market Value (US$ Mn), by Region, 2018–2027

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East and Africa

7.1.5. South and Central America

7.2. Global Oil Spill Management Market Attractiveness Analysis, by Region

8. North America Oil Spill Management Market Analysis and Forecast

8.1. Key Findings

8.2. North America Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

8.3. North America Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

8.4. North America Oil Spill Management Market Value (US$ Mn), by Country/Sub-region, 2018–2027

8.4.1. U.S.

8.4.2. Canada

8.5. U.S. Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

8.6. U.S. Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

8.7. Canada Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

8.8. Canada Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

8.9. North America Oil Spill Management Market Share and Attractiveness Analysis, by Technology

8.10. North America Oil Spill Management Market Share and Attractiveness Analysis, by Product Type

8.11. North America Oil Spill Management Market Share and Attractiveness Analysis, by Country/Sub-region

9. Europe Oil Spill Management Market Analysis and Forecast

9.1. Key Findings

9.2. Europe Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

9.3. Europe Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

9.4. Europe Oil Spill Management Market Value (US$ Mn), by Country/Sub-region, 2018–2027

9.4.1. U.K.

9.4.2. Norway

9.4.3. Russia & CIS

9.4.4. Rest of Europe

9.5. U.K. Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

9.6. U.K.Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

9.7. Norway Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

9.8. Norway Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

9.9. Russia & CIS Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

9.10. Russia & CIS Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

9.11. Rest of Europe Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

9.12. Rest of Europe Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

9.13. Europe Oil Spill Management Market Share and Attractiveness Analysis, by Technology

9.14. Europe Oil Spill Management Market Share and Attractiveness Analysis, by Product Type

9.15. Europe Oil Spill Management Market Share and Attractiveness Analysis, by Country/Sub-region

10. Asia Pacific Oil Spill Management Market Analysis and Forecast

10.1. Key Findings

10.2. Asia Pacific Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

10.3. Asia Pacific Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

10.4. Asia Pacific Oil Spill Management Market Value (US$ Mn), by Country/Sub-region, 2018–2027

10.4.1. China

10.4.2. India

10.4.3. ASEAN

10.4.4. Rest of Asia Pacific

10.5. China Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

10.6. China Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

10.7. India Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

10.8. India Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

10.9. ASEAN Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

10.10. ASEAN Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

10.11. Rest of Asia Pacific Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

10.12. Rest of Asia Pacific Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

10.13. Asia Pacific Oil Spill Management Market Share and Attractiveness Analysis, by Technology

10.14. Asia Pacific Oil Spill Management Market Share and Attractiveness Analysis, by Product Type

10.15. Asia Pacific Oil Spill Management Market Share and Attractiveness Analysis, by Country/Sub-region

11. Rest of the World Oil Spill Management Market Analysis and Forecast

11.1. Key Findings

11.2. Rest of the World Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

11.3. Rest of the World Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

11.4. Rest of the World Oil Spill Management Market Value (US$ Mn), by Country/Sub-region, 2018–2027

11.4.1. GCC

11.4.2. Venezuela

11.4.3. Nigeria

11.4.4. Others

11.5. GCC Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

11.6. GCC Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

11.7. Venezuela Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

11.8. Venezuela Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

11.9. Nigeria Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

11.10. Nigeria Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

11.11. Others Oil Spill Management Market Value (US$ Mn), by Technology, 2018–2027

11.12. Others Oil Spill Management Market Value (US$ Mn), by Product Type, 2018–2027

11.13. Rest of the World Oil Spill Management Market Share and Attractiveness Analysis, by Technology

11.14. Rest of the World Oil Spill Management Market Share and Attractiveness Analysis, by Product Type

11.15. Rest of the World Oil Spill Management Market Share and Attractiveness Analysis, by Country/Sub-region

12. Competition Landscape

12.1. Competition Matrix, by Key Players

12.2. Global Oil Spill Management Market Share Analysis, by Company, 2018

12.3. Product Mapping

12.4. Company Profiles

12.4.1. Cameron International Corporation

12.4.1.1. Company overview

12.4.1.2. Product portfolio

12.4.1.3. Financial overview

12.4.1.4. Business strategy

12.4.1.5. Recent developments

12.4.2. National Oilwell Varco

12.4.2.1. Company overview

12.4.2.2. Product portfolio

12.4.2.3. Financial overview

12.4.2.4. Business strategy

12.4.2.5. Recent developments

12.4.3. Control Flow Inc.

12.4.3.1. Company overview

12.4.3.2. Product portfolio

12.4.3.3. Financial overview

12.4.3.4. Business strategy

12.4.3.5. Recent developments

12.4.4. Fender & Spill Response Services L.L.C.

12.4.4.1. Company overview

12.4.4.2. Product portfolio

12.4.4.3. Financial overview

12.4.4.4. Business strategy

12.4.4.5. Recent developments

12.4.5. Northern Tanker Company Oy

12.4.5.1. Company overview

12.4.5.2. Product portfolio

12.4.5.3. Financial overview

12.4.5.4. Business strategy

12.4.5.5. Recent developments

12.4.6. SkimOil, Inc.

12.4.6.1. Company overview

12.4.6.2. Product portfolio

12.4.6.3. Financial overview

12.4.6.4. Business strategy

12.4.6.5. Recent developments

12.4.7. Hyundai Heavy Industries Co., Ltd.

12.4.7.1. Company overview

12.4.7.2. Product portfolio

12.4.7.3. Financial overview

12.4.7.4. Business strategy

12.4.7.5. Recent developments

12.4.8. GE Oil & Gas

12.4.8.1. Company overview

12.4.8.2. Product portfolio

12.4.8.3. Financial overview

12.4.8.4. Business strategy

12.4.8.5. Recent developments

12.4.9. Cosco Shipyard Group Co., Ltd.

12.4.9.1. Company overview

12.4.9.2. Product portfolio

12.4.9.3. Financial overview

12.4.9.4. Business strategy

12.4.9.5. Recent developments

12.4.10. CURA Emergency Services

12.4.10.1. Company overview

12.4.10.2. Product portfolio

12.4.10.3. Financial overview

12.4.10.4. Business strategy

12.4.10.5. Recent developments

12.4.11. Ecolab Inc.

12.4.11.1. Company overview

12.4.11.2. Product portfolio

12.4.11.3. Financial overview

12.4.11.4. Business strategy

12.4.11.5. Recent developments

13. Primary Research - Key Insights

14. Appendix

14.1. Research Methodology and Assumptions

List of Tables

TABLE 1 Global Pre-Oil Spill Management Market Snapshot

TABLE 2 Global Pre-Oil Spill Management Market Snapshot

TABLE 3 Overall Snapshot of Stakeholder Impact, Exxon Valdez Oil Spill

TABLE 4 Overall Snapshot of Stakeholder Impact, BP Oil Spill

TABLE 5 Blowout Preventers Ratings

TABLE 6 Drivers of the Oil Spill Management Market: Impact Analysis

TABLE 7 Trade of Crude Oil Through Major Trade Choke Points, 2015 – 2018 (Million Barrels/Day)

TABLE 8 Restraints of the Oil Spill Management Market: Impact Analysis

TABLE 9 Opportunities of the Oil Spill Management Market: Impact Analysis

TABLE 10 Global Physical Management Methods Market revenue estimate, by regional segment, 2009-2018 (USD Million)

TABLE 11 Global Chemical and Biological Management Method Market revenue estimate, by regional segment, 2009-2018 (USD Million)

TABLE 12 Global Mechanical Containment Method Market revenue estimate, by regional segment, 2009-2018 (USD Million)

TABLE 13 Methods Employed For Onshore Oil Spill Management

TABLE 14 Major Onshore Oil Spills Since 2000

TABLE 15 Global Onshore Post-Oil Spill Management Market revenue estimate, by regional segment, 2009-2018 (USD Million)

TABLE 16 Major Offshore Oil Spills Since 2000

TABLE 17 Global Offshore Post-Oil Spill Management Market revenue estimate, by regional segment, 2009-2018 (USD Million)

TABLE 18 North America Post-Oil Spill Management Market revenue estimate, by technology segment, 2009-2018 (USD Million)

TABLE 19 North America Post-Oil Spill Management Market revenue estimate, by type, 2009-2018 (USD Million)

TABLE 20 Major Skimmer Types Used To Manage Prestige Oil Spill

TABLE 21 Europe Post-Oil Spill Management Market revenue estimate, by technology segment, 2009-2018 (USD Million)

TABLE 22 Europe Post-Oil Spill Management Market revenue estimate, by type, 2009-2018 (USD Million)

TABLE 23 Asia Pacific Post-Oil Spill Management Market revenue estimate, by technology segment, 2009-2018 (USD Million)

TABLE 24 Asia Pacific Post-Oil Spill Management Market revenue estimate, by type, 2009-2018 (USD Million)

TABLE 25 Rest of the World (RoW) Post-Oil Spill Management Market revenue estimate, by technology, 2009-2018 (USD Million)

TABLE 26 Rest of the World (RoW) Post-Oil Spill Management Market revenue estimate, by type, 2009-2018 (USD Million)

TABLE 27 Global Blowout Preventers market revenue and forecast, by regional segment, 2018 - 2027 (USD Million)

TABLE 28 Global Double Hulling Market revenue and forecast, by regional segment, 2018 - 2027 (USD Million)

TABLE 29 Global Leak Detection Systems Market revenue and forecast, by regional segment, 2018 - 2027 (USD Million)

TABLE 30 Global Onshore Pre-Oil Spill Management Market revenue and forecast, by regional segment, 2018 - 2027 (USD Million)

TABLE 31 Global Offshore Pre-Oil Spill Management Market revenue and forecast, by regional segment, 2018 - 2027 (USD Million)

TABLE 32 North America Pre-Oil Spill Management Market revenue and forecast, by technology segment, 2018 - 2027 (USD Million)

TABLE 33 North America Pre-Oil Spill Management Market revenue and forecast, by type, 2018 - 2027 (USD Million)

TABLE 34 Europe Pre-Oil Spill Management Market revenue and forecast, by technology segment, 2018 - 2027 (USD Million)

TABLE 35 Europe Pre-Oil Spill Management Market revenue and forecast, by type, 2018 - 2027 (USD Million)

TABLE 36 Asia Pacific Pre-Oil Spill Management Market revenue and forecast, by technology segment, 2018 - 2027 (USD Million)

TABLE 37 Asia Pacific Pre-Oil Spill Management Market revenue and forecast, by type, 2018 - 2027 (USD Million)

TABLE 38 Rest of the World (RoW) Pre-Oil Spill Management Market revenue and forecast, by technology segment, 2018 - 2027 (USD Million)

TABLE 39 Rest of the World (RoW) Pre-Oil Spill Management Market revenue and forecast, by type, 2018 - 2027 (USD Million)

List of Figures

FIG. 1 Oil Spill Management (GHP): Market segmentation

FIG. 2 Global Pre-Oil Spill Management Market Revenue Estimates and Forecast, 2018 – 2027 (USD Million)

FIG. 3 Global Post-Oil Spill Management Market Revenue Estimates, 2009 – 2018 (USD Million)

FIG. 4 Booms Deployed by Exxon, By Day (Thousands of Feet)

FIG. 5 Vessels Present On-Scene, By Day (Units)

FIG. 6 Exxon Personnel Present On-Scene, By Day (Units)

FIG. 7 Skimmers Deployed On-Scene, By Contributor and Day (Units)

FIG. 8 Stakeholders Directly and Indirectly Impacted by Oil Spill

FIG. 9 Stakeholders in Macondo Well Project, by Company Share

FIG. 10 Stakeholders Directly and Indirectly Impacted by Oil Spill

FIG. 11 Criminal Penalties Levied on Project Stakeholders (USD Million)

FIG. 12 Split of Chemical Penalty Spending, By Spend Type

FIG. 13 BP plc 5 Year Historical Stock Prices, USD/Share, 2015 – 2018

FIG. 14 BP plc Profit After Interest and Tax, USD Million, 2015 – 2018

FIG. 15 Value chain analysis of Oil Spill Management (Blowout Preventer) Market

FIG. 16 Value chain analysis of Oil Spill Management (Double Hulling) Market

FIG. 17 Positioning of Strategic Trade Choke Points with Major Ports alongside

FIG. 18 Regional Distribution of Natural Gas Pipeline Projects Planned in 2018 (Miles)

FIG. 19 Regional Distribution of Crude Oil Pipeline Projects Planned in 2018 (Miles)

FIG. 20 Regional Distribution of Product Pipeline Projects Planned in 2018 (Miles)

FIG. 21 Regional Distribution of Pipeline Projects Planned in 2018 (Miles)

FIG. 22 Crude Oil Prices, By Month, 2018 (USD / Barrel)

FIG. 23 Porter’s five forces analysis: Pre-oil Spill Management (Blowout Preventers)

FIG. 24 Porter’s five forces analysis: Pre-oil Spill Management (Double Hulling)

FIG. 25 Market Attractiveness Analysis of Global Pre-Oil Spill Management Market, by Region, 2018

FIG. 26 Global Physical Management Methods market revenue, 2009 – 2018 (USD Million)

FIG. 27 Global Chemical and Biological Management Methods Market revenue estimate, 2009 – 2018 (USD Million)

FIG. 28 Global Mechanical Containment Method Market revenue estimate, 2009 – 2018 (USD Million)

FIG. 29 Global Onshore Post-Oil Spill Management Market revenue estimate 2009 – 2018 (USD Million)

FIG. 30 Average Oil Spills From Tankers, By Number of Incidents (2009 – 2018)

FIG. 31 Volume of Oil Spilled From Tankers per Decade as Percentage of Total Oil Spilled Globally, 2009 – 2018

FIG. 32 Number of Tanker Oil Spill Incidents, By Causes, 2009 – 2018

FIG. 33 Large Tanker Oil Spill Incidents, 2009 – 2018

FIG. 34 Global Offshore Post-Oil Spill Management Market revenue estimate, 2009 – 2018 (USD Million)

FIG. 35 North America Post-Oil Spill Management Market revenue estimate, 2009 – 2018 (USD Million)

FIG. 36 Europe Post-Oil Spill Management Market revenue estimate, 2009 – 2018 (USD Million)

FIG. 37 Asia Pacific Post-Oil Spill Management Market revenue estimate, 2009 – 2018 (USD Million)

FIG. 38 Rest of the World (RoW) Post-Oil Spill Management Market revenue estimate, 2009 – 2018 (USD Million)

FIG. 39 Global Pre-Oil Spill Management Market Estimates and Forecast, by Technology, 2018 and 2027 (USD Million)

FIG. 40 Global Blowout Preventers (BOPs) market revenue, 2018 – 2027 (USD Million)

FIG. 41 Global Double Hulling market revenue, 2018 – 2027 (USD Million)

FIG. 42 Global Leak Detection Systems market revenue, 2018 – 2027 (USD Million)

FIG. 43 Global Pre-Oil Spill Management Market, revenue share by type, 2018 and 2027

FIG. 44 Global Onshore Pre-Oil Spill Management Market revenue, 2018 - 2027 (USD Million)

FIG. 45 Global Offshore Pre-Oil Spill Management Market volume and revenue, 2018 - 2027 (USD Million)

FIG. 46 Global Pre-Oil Spill Management Market Estimates and Forecast, by Region, 2018 and 2027 (USD Million)

FIG. 47 North America Pre-Oil Spill Management market revenue, 2018 – 2027 (USD Million)

FIG. 48 Europe Pre-Oil Spill Management market revenue, 2018 – 2027 (USD Million)

FIG. 49 Asia Pacific Pre-Oil Spill Management market revenue, 2018 – 2027 (USD Million)

FIG. 50 Rest of the World (RoW) Pre-Oil Spill Management market revenue, 2018 – 2027 (USD Million)

FIG. 142. Argentina, Middle Distillates Storage Market, Million Cubic Meter, 2018–2027

FIG. 143. Argentina, Open Top Tanks Storage Market, Million Cubic Meter, 2018–2027

FIG. 144. Argentina, Fixed Roof Tanks Storage Market, Million Cubic Meter, 2018–2027

FIG. 145. Argentina, Floating Roof Tanks Storage Market, Million Cubic Meter, 2018–2027

FIG. 146. Argentina, Other Storage Facilities Market, Million Cubic Meter, 2018–2027