The oil & gas sector has witnessed significant transformation in the past few years and is showing no signs of slowing down in that regard. The oil & gas industry has successfully negotiated its way through the slump in crude oil prices post 2014-2015. While the oil & gas sector continued to make strides, oil & gas EPC market has witnessed significant development as well. Stakeholders in the oil & gas EPC market are focusing on improving break-even points, adoption of newer technologies, and fulfilling the growing demand for energy worldwide.

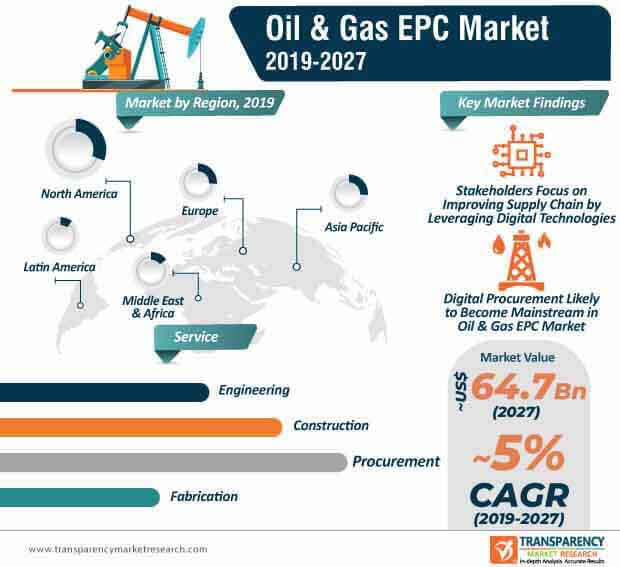

The last couple of years witnessed significant growth in the number of onshore and offshore oil & gas activities. Offshore project sanctioning is expected to gain significant momentum during the forecast period (2019-2027) and is on course to generate record-high revenues. Moreover, engineering and procurement projects are set to present a plethora of opportunities for stakeholders involved in the oil & gas EPC market. Market participants are expected to leverage advanced technologies to improve supply-demand and formulate impactful business models, as the energy sector continues to evolve. Due to these factors, the oil & gas EPC market is expected to reach a value of ~US$ 64.7 Bn by the end of 2027.

The growth of the oil & gas sector is marred by a host of unpredictable and volatile factors, including economic and geopolitical uncertainties, evolving global markets, regulatory limitations, etc. These factors have played a key role in persuading stakeholders in the oil & gas EPC market to adopt a dynamic approach for their processes and operations. In the current scenario, oil & gas EPC companies are seeking solutions to address a range of challenges, including dwindling fuel consumption, growing adoption of electric vehicles, stringent regulatory and environmental policies, snowballing costs of upstream and exploration projects, etc.

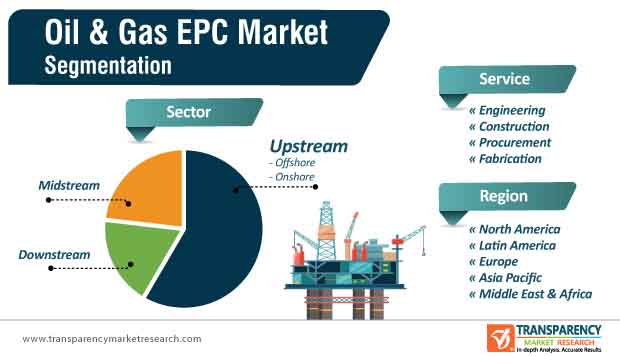

Companies in the current market landscape are focusing on building effective procurement strategies that will assist them in saving costs, improving supplier relationships, enhancing spending efficiency, and simultaneously dealing with risks involved in supply chain. While upstream businesses are no stranger to cost-reduction tactics, at the back of the mounting environmental concerns, market players are leveraging the benefits of digital technologies and finding new sustainable growth avenues. The upstream sector segment is projected to reach a value of ~US$ 26.1 Bn and account for ~ 58% share of the oil & gas EPC market in 2020.

Within the oil & gas EPC market, stakeholders are aiming to expand their market share and values by turning toward organic and inorganic strategies. While some stakeholders are launching new oil & gas networks, others are tapping into opportunities presented by offshore and onshore projects. For instance, in August 2019, Achilles launched a new oil & gas supplier network for the European region in which around 6,000 suppliers were integrated into a single supply chain. The adoption of such digital technologies is expected to play an important role in improving the supply chain of all oil & gas companies in the European region.

In September 2018, Adnoc awarded a ~US$ 860 Mn contract for the expansion of a gas development project. As per the agreement, Adnoc LNG, a subsidiary of the Abu Dhabi National Oil Company, awarded the contract to Target Engineering Construction Company and Tecnicas Reunidas for the provision of construction, procurement, and engineering services for phase two of the Integrated Gas Development Expansion project. As per the agreement, the two companies will manage equipment & material supply, installation, construction, engineering, drying, and an array of other auxiliary services. The rise of digital technologies has paved the way for digital procurement in the oil & gas EPC market in recent years, and the trend is projected to continue particularly in the Middle East & Africa and the Asia Pacific. While stakeholders in the oil & gas sector continue to find alternatives to streamline their supply chain, digital procurement solutions have emerged as an ideal candidate to address these problems.

Analysts’ Viewpoint

The oil & gas EPC market is expected to grow at a CAGR of ~5% during the forecast period. Some of the key factors that are expected to influence growth include rise in the number of offshore and onshore projects, technological advancements, project sanctioning, and growing focus on improving the supply chain. Digital technologies will play a key role in improving supply chain performance and mitigate the risks involved in the supply chain. Digital procurement is likely to gain significant popularity during the forecast period, as more number of companies are leaning toward digital technologies to strengthen their foothold in the oil & gas EPC market.

Oil & Gas EPC Market: Overview

Rise in Deepwater E&P Activities to Drive Oil & Gas EPC Market

Volatility in Prices of Crude Oil to Hamper Oil & Gas EPC Market

Large Number of Proven Oil & Gas Reserves to Offer Lucrative Opportunities to Oil & Gas EPC Market

Recent Developments, Expansions, Acquisitions, and New Contracts

North America to Dominate Oil & Gas EPC Market

Oil & Gas EPC Market Highly Competitive

Oil & Gas EPC Market is projected to reach US$ 64.7 Bn by the end of 2027

Oil & Gas EPC Market is expected to grow at a CAGR of 5% during 2019 – 2027

Rise in Deepwater E&P Activities is anticipated to propel the oil & gas EPC market in the near future

North America is a more attractive region for vendors in the Oil & Gas EPC Market

Key vendors in the Oil & Gas EPC Market are TechnipFMC, Plc., WorleyParsons Limited, Saipem SpA, Petrofac Limited, Bechtel Corporation, Mott MacDonald, Fluor Corporation, L&T Hydrocarbon Engineering, etc

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary: Global Oil & Gas Market

3.1. Market Snapshot

3.2. Top Two Trends

4. Market Overview

4.1. Product Overview

4.2. Key Market Developments

4.3. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of Substitutes

5.2.2. Bargaining Power of Buyers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of New Entrants

5.2.5. Degree of Competition

5.3. Regulatory Scenario

5.4. Value Chain Analysis

5.4.1. List of Oil & Gas EPC Service Providers

6. Global Oil & Gas Market Value (US$ Mn) Analysis, by Sector

6.1. Key Findings and Introduction

6.2. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

6.2.1. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Upstream, 2018–2027

6.2.2. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Midstream, 2018–2027

6.2.3. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Downstream, 2018–2027

6.3. Global Oil & Gas EPC Market Attractiveness Analysis, by Sector

7. Global Oil & Gas EPC Market Value (US$ Mn) Analysis, by Service

7.1. Key Findings and Introduction

7.2. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

7.2.1. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Engineering, 2018–2027

7.2.2. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Procurement, 2018–2027

7.2.3. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Construction, 2018–2027

7.2.4. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Fabrication, 2018–2027

7.3. Global Oil & Gas EPC Market Attractiveness Analysis, by Service

8. Global Oil & Gas EPC Market Analysis, by Region

8.1. Key Findings

8.2. Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global Oil & Gas EPC Market Attractiveness Analysis, by Region

9. North America Oil & Gas EPC Market Overview

9.1. Key Findings

9.2. Key Drivers

9.3. North America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

9.4. North America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

9.5. North America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country

9.5.1. U.S. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

9.5.2. U.S. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

9.5.3. Canada Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

9.5.4. Canada Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

9.6. North America Oil & Gas EPC Market Attractiveness Analysis, by Sector

9.7. North America Oil & Gas EPC Market Attractiveness Analysis, by Service

9.8. North America Oil & Gas EPC Market Attractiveness Analysis, by Country

10. Europe Oil & Gas EPC Market Overview

10.1. Key Findings

10.2. Key Drivers

10.3. Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

10.4. Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

10.5. Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region

10.5.1. Norway Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

10.5.2. Norway Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

10.5.3. U.K. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

10.5.4. U.K. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

10.5.5. Russia & CIS Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

10.5.6. Russia & CIS Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

10.5.7. Rest of Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

10.5.8. Rest of Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

10.6. Europe Oil & Gas EPC Market Attractiveness Analysis, by Sector

10.7. Europe Oil & Gas EPC Market Attractiveness Analysis, by Service

10.8. Europe Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

11. Asia Pacific Oil & Gas EPC Market Overview

11.1. Key Findings

11.2. Key Drivers

11.3. Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

11.4. Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

11.5. Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region

11.5.1. China Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

11.5.2. China Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

11.5.3. India Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

11.5.4. India Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

11.5.5. Japan Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

11.5.6. Japan Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

11.5.7. ASEAN Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

11.5.8. ASEAN Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

11.5.9. Rest of Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

11.5.10. Rest of Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

11.6. Asia Pacific Oil & Gas EPC Market Attractiveness Analysis, by Sector

11.7. Asia Pacific Oil & Gas EPC Market Attractiveness Analysis, by Service

11.8. Asia Pacific Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

12. Middle East & Africa Oil & Gas EPC Market Overview

12.1. Key Findings

12.2. Key Drivers

12.3. Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.4. Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5. Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region

12.5.1. Saudi Arabia Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.2. Saudi Arabia Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5.3. UAE Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.4. UAE Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5.5. Oman Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.6. Oman Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5.7. Qatar Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.8. Qatar Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5.9. Kuwait Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.10. Kuwait Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5.11. Algeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.12. Algeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5.13. Nigeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.14. Nigeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.5.15. Rest of Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

12.5.16. Rest of Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

12.6. Middle East & Africa Oil & Gas EPC Market Attractiveness Analysis, by Sector

12.7. Middle East & Africa Oil & Gas EPC Market Attractiveness Analysis, by Service

12.8. Middle East & Africa Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

13. Latin America Oil & Gas EPC Market Overview

13.1. Key Findings

13.2. Key Drivers

13.3. Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

13.4. Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

13.5. Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region

13.5.1. Brazil Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

13.5.2. Brazil Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

13.5.3. Mexico Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

13.5.4. Mexico Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

13.5.5. Rest of Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

13.5.6. Rest of Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

13.6. Latin America Oil & Gas EPC Market Attractiveness Analysis, by Sector

13.7. Latin America Oil & Gas EPC Market Attractiveness Analysis, by Service

13.8. Latin America Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

14. Competition Landscape

14.1. Global Oil & Gas EPC Market Share Analysis, by Company (2018)

14.2. Competition Matrix

14.2.1. Petrofac Limited

14.2.2. Saipem

14.3. Market Footprint Analysis, 2018

14.4. Company Profiles

14.4.1. TechnipFMC plc.

14.4.1.1. Company Details

14.4.1.2. Company Description

14.4.1.3. Business Overview

14.4.1.4. Strategic Overview/Recent Developments

14.4.2. WorleyParsons Limited

14.4.2.1. Company Details

14.4.2.2. Company Description

14.4.2.3. Business Overview

14.4.2.4. Strategic Overview/Recent Developments

14.4.3. Saipem SpA

14.4.3.1. Company Details

14.4.3.2. Company Description

14.4.3.3. Business Overview

14.4.3.4. Strategic Overview/Recent Developments

14.4.4. Petrofac Limited

14.4.4.1. Company Details

14.4.4.2. Company Description

14.4.4.3. Business Overview

14.4.4.4. Financial Details

14.4.4.5. Strategic Overview/Recent Developments

14.4.4. Bechtel Corporation

14.4.4.1. Company Details

14.4.4.2. Company Description

14.4.4.3. Business Overview

14.4.4.4. Strategic Overview/Recent Developments

14.4.5. Mott MacDonald

14.4.5.1. Company Details

14.4.5.2. Company Description

14.4.5.3. Business Overview

14.4.5.4. Strategic Overview/Recent Developments

14.4.6. Fluor Corporation

14.4.6.1. Company Details

14.4.6.2. Company Description

14.4.6.3. Business Overview

14.4.6.4. Strategic Overview/Recent Developments

14.4.7. L&T Hydrocarbon Engineering

14.4.7.1. Company Details

14.4.7.2. Company Description

14.4.7.3. Business Overview

14.4.8. John Wood Group PLC

14.4.8.1. Company Details

14.4.8.2. Company Description

14.4.8.3. Business Overview

14.4.8.4. Strategic Overview/Recent Developments

14.4.9. National Petroleum Construction Company

14.4.9.1. Company Details

14.4.9.2. Company Description

14.4.9.3. Business Overview

14.4.9.4. Financial Details

14.4.9.5. Strategic Overview/Recent Developments

14.4.10. SNC-Lavalin Group

14.4.10.1. Company Details

14.4.10.2. Company Description

14.4.10.3. Business Overview

14.4.10.4. Financial Details

14.4.10.5. Strategic Overview/Recent Developments

14.4.11. KBR, Inc.

14.4.11.1. Company Details

14.4.11.2. Company Description

14.4.11.3. Business Overview

14.4.11.4. Strategic Overview/Recent Development

14.4.12. JGC Holding Corporation

14.4.12.1. Company Details

14.4.12.2. Company Description

14.4.12.3. Business Overview

14.4.12.4. Strategic Overview/Recent Developments

14.4.13. Galfar Engineering and Contracting SAOG

14.4.13.1. Company Details

14.4.13.2. Company Description

14.4.13.3. Business Overview

14.4.13.4. Strategic Overview/Recent Developments

14.4.14. Lamprell

14.4.14.1. Company Details

14.4.14.2. Company Description

14.4.14.3. Business Overview

14.4.14.4. Strategic Overview/Recent Developments

List of Tables

Table 01: Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 02: Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 03: Global Oil & Gas EPC Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 04: North America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 05: North America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 06: North America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 07: U.S. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 08: U.S. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 09: Canada Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 10: Canada Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 11: Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 12: Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 13: Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 14: Norway Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 15: Norway Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 16: U.K. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 17: U.K. Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 18: Russia & CIS Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 19: Russia & CIS Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 20: Rest of Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 21: Rest of Europe Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 22: Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 23: Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 24: Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 25: China Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 26: China Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 27: Japan Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 28: Japan Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 29: India Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 30: India Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 31: ASEAN Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 32: ASEAN Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 33: Rest of Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 34: Rest of Asia Pacific Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 35: Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 36: Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 37: Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 38: Saudi Arabia Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 39: Saudi Arabia Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 40: UAE Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 41: UAE Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 42: Oman Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 43: Oman Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 44: Qatar Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 45: Qatar Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 46: Kuwait Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 47: Kuwait Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 48: Algeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 49: Algeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 50: Nigeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 51: Nigeria Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 52: Rest of Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 53: Rest of Middle East & Africa Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 54: Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 55: Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 56: Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 57: Brazil Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 58: Brazil Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 59: Mexico Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 60: Mexico Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

Table 61: Rest of Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Sector, 2018–2027

Table 62: Rest of Latin America Oil & Gas EPC Market Value (US$ Mn) Forecast, by Service, 2018–2027

List of Figures

Figure 01: Global Oil & Gas EPC Market Value (US$ Mn), 2018

Figure 02: New Offshore Wells Drilled

Figure 03: Discovery of Oil & Gas Fields/Wells/Blocks, by Region, 2018

Figure 04: Global Crude Oil Prices (US$ per Barrel), 2006–2018

Figure 05: Global Oil & Gas EPC Market Value Share Analysis, by Sector, 2018 and 2027

Figure 06: Global Oil & Gas EPC Market Attractiveness Analysis, by Sector, 2018

Figure 07: Global Oil & Gas EPC Market Value Share Analysis, by Service, 2018 and 2027

Figure 08: Global Oil & Gas EPC Market Attractiveness Analysis, by Service, 2018

Figure 09: Global Oil & Gas EPC Market Value Share Analysis, by Region, 2018 and 2027

Figure 10: Global Oil & Gas EPC Market Attractiveness Analysis, by Region, 2018

Figure 11: North America Oil & Gas EPC Market Value Share Analysis, by Country, 2018 and 2027

Figure 12: North America Oil & Gas EPC Market Attractiveness Analysis, by Sector

Figure 13: North America Oil & Gas EPC Market Attractiveness Analysis, by Service

Figure 14: North America Oil & Gas EPC Market Attractiveness Analysis, by Country

Figure 15: Europe Oil & Gas EPC Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 16: Europe Oil & Gas EPC Market Attractiveness Analysis, by Sector

Figure 17: Europe Oil & Gas EPC Market Attractiveness Analysis, by Service

Figure 18: Europe Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

Figure 19: Asia Pacific Oil & Gas EPC Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 20: Asia Pacific Oil & Gas EPC Market Attractiveness Analysis, by Sector

Figure 21: Asia Pacific Oil & Gas EPC Market Attractiveness Analysis, by Service

Figure 22: Asia Pacific Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

Figure 23: Middle East & Africa Oil & Gas EPC Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 24 Middle East & Africa Oil & Gas EPC Market Attractiveness Analysis, by Sector

Figure 25 Middle East & Africa Oil & Gas EPC Market Attractiveness Analysis, by Service

Figure 26: Middle East & Africa Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

Figure 27: Latin America Oil & Gas EPC Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 28: Latin America Oil & Gas EPC Market Attractiveness Analysis, by Sector

Figure 29: Latin America Oil & Gas EPC Market Attractiveness Analysis, by Service

Figure 30: Latin America Oil & Gas EPC Market Attractiveness Analysis, by Country and Sub-region

Figure 31: Global Oil & Gas EPC Market Share Analysis, by Company (2018)

Figure 32: TechnipFMC plc. Breakdown of Revenue, by Business Segment, 2018

Figure 33: TechnipFMC plc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 34: WorleyParsons Limited Breakdown of Revenue, by Business Segment, 2018

Figure 35: WorleyParsons Limited Breakdown of Revenue, by Geography, 2018

Figure 36: WorleyParsons Limited Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 37: Saipem SpA Breakdown of Revenue, by Business Segment, 2018

Figure 38: Saipem SpA Breakdown of Revenue, by Geography, 2018

Figure 39: Saipem SpA Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 40: Petrofac Limited Breakdown of Revenue, by Business Segment, 2018

Figure 41: Petrofac Limited Breakdown of Revenue, by Geography, 2018

Figure 42: Petrofac Limited Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 43: Bechtel Corporation Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2018

Figure 44: Mott MacDonald Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2018

Figure 45: Mott MacDonald Breakdown of Revenue, by Region, 2018

Figure 46: Fluor Corporation Breakdown of Revenue, by Business Segment, 2018

Figure 47: Fluor Corporation Breakdown of Revenue, by Geography, 2018

Figure 48: Fluor Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 49: L&T Hydrocarbon Engineering Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 50: L&T Hydrocarbon Engineering Breakdown of Revenue, by Geography, 2018

Figure 51: John Wood Group PLC Breakdown of Revenue, by Business Segment, 2018

Figure 52: John Wood Group PLC Breakdown of Revenue, by Geography, 2018

Figure 53: John Wood Group PLC Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 54: SNC-Lavalin Group Breakdown of Revenue, by Business Segment, 2018

Figure 55: SNC-Lavalin Group Breakdown of Revenue, by Key Regions, 2018

Figure 56: SNC-Lavalin Group Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 57: KBR Inc. Breakdown of Revenue, by Business Segment, 2018

Figure 58: KBR Inc. Breakdown of Revenue, by Key Regions, 2018

Figure 59: KBR Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 60: JGC Holding Corporation Breakdown of Revenue, by Business Segment, 2018

Figure 61: JGC Holding Corporation Breakdown of Revenue, by Key Regions, 2018

Figure 62: JGC Holding Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 63: Galfar Engineering and Contracting SAOG Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 64: Lamprell Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 65: Lamprell Breakdown of Revenue, by Business Segment, 2018