Oil and GasData Monetization Market - Snapshot

Oil and gas companies are turning the large volume and variety of data into intelligence for improved asset productivity. Real-time data analysis is essential for deriving value out of unstructured data generated from sensors present in the oil field. Predictive and prescriptive analytics are the approaches that help oil and gas companies to minimize expenses and earn money by turning this data into valuable assets.The creation and consumption of data continues to grow in the oil and gas industry and with it, the investment in data analytics and data management software and services. Data monetization can be used to leverage insights to identify new revenue opportunities, trigger product, process & service innovation and optimization, improve production, and enhance service quality in the oil and gas industry. Large proven oil reserves in Venezuela, Saudi Arabia, Canada, Iran, Iraq, Kuwait, UAE, Russia, the U.S. and China brings an opportunity to drive growth of the oil and gas data monetization market as there is significant growth opportunity for adoption of indirect data monetization i.e. the software and services for driving insights for development of these fields and direct data monetization i.e. mainly the exploration data products. Seismic surveys and geophysical surveys conducted in these regions to find new exploration sites and their potential, and the anticipated use of software solutions will continue to drive the market over the forecast period.

The data monetization in oil and gas market is segmented based on method, component, oil companies, application, E&P lifecycle, and region. The oil and gas data monetization market has two methods of monetization viz., direct and indirect. By component, the market is segmented as data-as-a-service, professional services, and platform/software. Data-as-a-service segment covers data exchange/transaction for direct monetary benefits. Platform/software and professional services represent indirect data monetization. The oil and gas data monetization market is also segmented based on upstream oil companies into National Oil Companies (NOCs), Independent Oil Companies (IOCs), National Data Repository (NDR), and oil and gas service companies. National Oil Companies (NOCs) segment is majorly driven by indirect data monetization and is anticipated to dominate the global oil and gas data monetization market over the forecast period. NOCs are increasingly spending on software/platforms and services, thus accounting for the maximum share in the data monetization market. Further, by application, the market is segmented into upstream (conventional, unconventional), midstream, and downstream. It is anticipated that the upstream application segment will continue to dominate the market over the forecast period. Upstream application segment is also classified by E&P lifecycle into exploration, development, and production segments. Exploration segment is expected to expand over the forecast period driven mainly by increasing adoption of software and solutions in deep-water exploration and shale gas exploration activities.The increasing demand for data products such as seismic survey data, geophysical data, and magnetic survey data is also driving the exploration segment in the data monetization market.

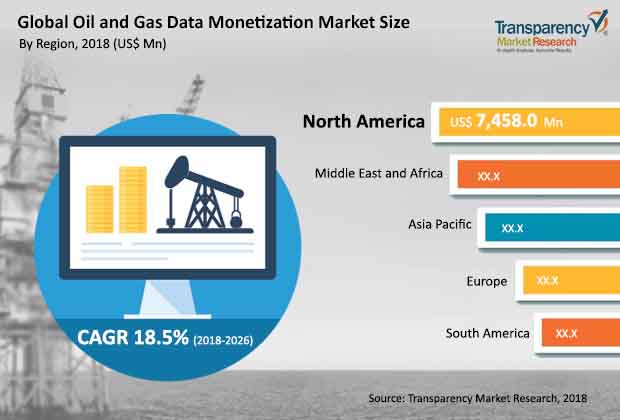

Regional segmentation of the oil and gas data monetization market includes North America, Europe, Asia Pacific, South America, and Middle East & Africa (MEA). North America is projected to dominate the oil and gas data monetization market throughout the forecast period due to availability of necessary infrastructure, increasing oil production, and use of indirect data monetization solutions for shale oil reserves exploration, development & production,and presence of oil and gas service companies involved in direct data monetization. Asia Pacific is expected tobe the fastest growing region during the forecast period due to rising investments in the E&P sector.

Key players in the oil and gas data monetization market are Halliburton, Schlumberger Limited,Informatica Corporation, SAP SE, Oracle Corporation, Accentureplc, IBM Corporation, EMC Corporation, Microsoft Corporation, Tata Consultancy Services Ltd., Datawatch, Drillinginfo, Hitachi VantaraCorporation, Hortonworks, Inc.,Capgemini SE, Newgen Software, Inc., Cloudera, Inc., Cisco Software, Inc.,SAS Institute, Inc.,MapR Technologies, Inc., Palantir Solutions, OSIsoft LLC, Infosys Limited, and NETSCOUT among others. Along with the players mentioned above, the market share analysis of direct data monetization players such as TGS, CGG, PGS, Ion Geophysical Corporation, and Western Geo is also provided separately in the report.

Focus on Asset Productivity to Expand Horizon in Oil and Gas Data Monetization Market

Oil and gas companies have in recent years have witnessed the transformative potential of advanced data analytics to make decisions across the entire value chain. Two recent developments have become the lynchpin of growing investment potential in the software and services used for monetizing data, directly or indirectly. The demand in oil and gas data monetization market has thrived on the back growing promise of data analytics to boost asset productivity on one hand to combat the declining profits. Over the years, the oil and gas companies have suffered some serious challenges arising out of the fact that hydrocarbon production is declining in popularity. Data analytics are viewed as new framework for decisions that will allow them to reinvigorate their growth strategies. Stalwarts in the oil and gas exploration and production have already leveraged the advantage by collaborating with oil and gas service companies. Asset management, notably predictive and preventive management, is become one of the key objectives for data monetization trends. Various areas including portfolio management and operations management are unlocking the unique value propositions of data analytics. This is a key trend shaping the expansion of the oil and gas data monetization market.

The Covid-19 pandemic has brought several unprecedented challenges to economic growth across the world. Several nations have witnessed the disruptive potential of the still-emerging pandemic on the firms’ production, major business models across key sectors, and strategic frameworks for meeting the end users’ demands. The pandemic has hit the bottom-line of many companies and organizations across almost all industries. The oil and gas data monetization market has also seen some notable upheavals, and have begun looking for frameworks to absorb the macroeconomics and microeconomics shocks. Thus, approaches to harness RoI have changed dramatically in numerous industries, including for upstream and downstream players in the oil and gas sector. Further, the data-driven decisions are expected to become more important than ever, given the uncertainties prevalent in the post-pandemic world.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Oil and Gas Data Monetization Market

4. Market Overview

4.1. Introduction

4.2. Key Findings

4.3. Global Market – Macro Economic Factors Overview

4.3.1. World GDP Indicator – For Top 20 Economies

4.3.2. Global IT Spending in Oil and Gas (US$ Mn), 2015, 2016, 2017

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. Value Chain Analysis

4.4.3. Key Market Indicators

4.4.3.1. Multi-client Data Services in Oil and Gas Direct Data Monetization Market

4.4.3.2. Global Oil and Gas Well Data, By Country (2016)

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.4.4.5. Key Trends

4.5. Global Oil and Gas Data Monetization Market Analysis and Forecast, 2016 - 2026

4.5.1. Market Revenue Analysis (US$ Mn)

4.5.1.1. Historic growth trends, 2012-2017

4.5.1.2. Forecast trends, 2017-2026

4.6. Market Outlook

5. Global Oil and Gas Data Monetization Market Analysis and Forecasts, byMethod

5.1. Definitions

5.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

5.2.1. Indirect Data Monetization

5.2.2. Direct Data Monetization

5.3. Market Attractiveness By Method

6. Global Oil and Gas Data Monetization Market Analysis and Forecasts, by Component

6.1. Definitions

6.2. Market Size (US$ Mn) Forecast byComponent, 2016-2026

6.2.1. Data as a Service

6.2.2. Professional Services

6.2.3. Platform/Software

6.3. Market Attractiveness by Component

7. Global Oil and Gas Direct Data Monetization Market Analysis and Forecasts, byApplication

7.1. Definitions

7.2. Market Size (US$ Mn) Forecast byApplication, 2016-2026

7.2.1. Upstream

7.2.1.1. Conventional

7.2.1.2. Unconventional

7.2.2. Midstream

7.2.3. Downstream

7.3. Market Attractiveness by Application

8. Global Oil and Gas Indirect Data Monetization Market Analysis and Forecasts, byApplication

8.1. Definitions

8.2. Market Size (US$ Mn) Forecast byApplication, 2016-2026

8.2.1. Upstream

8.2.1.1. Conventional

8.2.1.2. Unconventional

8.2.2. Midstream

8.2.3. Downstream

8.3. Market Attractiveness by Application

9. Global Upstream Oil and Gas Direct Data Monetization Market Analysis and Forecasts, byE&P Lifecycle

9.1. Definitions

9.2. Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

9.2.1. Exploration

9.2.2. Development

9.2.3. Production

9.3. Market Attractiveness by E&P Lifecycle

10. Global Upstream Oil and Gas Indirect Data Monetization Market Analysis and Forecasts, by E&P Lifecycle

10.1. Definitions

10.2. Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

10.2.1. Exploration

10.2.2. Development

10.2.3. Production

10.3. Market Attractiveness by E&P Lifecycle

11. Global Upstream Oil and Gas Direct Data Monetization Market Analysis and Forecasts, byOil Companies

11.1. Definitions

11.2. Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

11.2.1. National Oil Companies

11.2.2. Independent Oil Companies

11.2.3. National Data Repository

11.2.4. Oil and Gas Service Company

11.3. Market Attractiveness by Oil Companies

12. Global Upstream Oil and Gas Indirect Data Monetization Market Analysis and Forecasts, byOil Companies

12.1. Definitions

12.2. Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

12.2.1. National Oil Companies

12.2.2. Independent Oil Companies

12.2.3. National Data Repository

12.2.4. Oil and Gas Service Company

12.3. Market Attractiveness by Oil Companies

13. Global Oil and Gas Data Monetization Market Analysis and Forecast, by Country

13.1. Overview

13.2. Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Country, 2016 - 2026

13.2.1. The U.S.

13.2.2. Canada

13.2.3. Rest of North America

13.2.4. Germany

13.2.5. France

13.2.6. UK

13.2.7. Rest of Europe

13.2.8. China

13.2.9. Japan

13.2.10. India

13.2.11. Australia

13.2.12. Rest of Asia Pacific

13.2.13. GCC

13.2.14. South Africa

13.2.15. Rest of MEA

13.2.16. Brazil

13.2.17. Rest of South America

13.3. Market Attractiveness by Country

14. The U.S.Oil and Gas Data Monetization Market Analysis and Forecast

14.1. Key Findings

14.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

14.2.1. Indirect Data Monetization

14.2.2. Direct Data Monetization

14.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

14.3.1. Data as a Service

14.3.2. Professional Services

14.3.3. Platform/Software

14.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

14.4.1. Upstream

14.4.1.1. Conventional

14.4.1.2. Unconventional

14.4.2. Midstream

14.4.3. Downstream

14.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

14.5.1. Upstream

14.5.1.1. Conventional

14.5.1.2. Unconventional

14.5.2. Midstream

14.5.3. Downstream

14.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

14.6.1. Exploration

14.6.2. Development

14.6.3. Production

14.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

14.7.1. Exploration

14.7.2. Development

14.7.3. Production

14.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

14.8.1. National Oil Companies

14.8.2. Independent Oil Companies

14.8.3. National Data Repository

14.8.4. Oil and Gas Service Company

14.9. Upstream IndirectData Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

14.9.1. National Oil Companies

14.9.2. Independent Oil Companies

14.9.3. National Data Repository

14.9.4. Oil and Gas Service Company

14.10. Market Attractiveness Analysis

14.10.1. By Component

14.10.2. By Method

14.10.3. By Application

14.10.4. By E&P Lifecycle

14.10.5. By Oil Companies

15. Canada Oil and Gas Data Monetization Market Analysis and Forecast

15.1. Key Findings

15.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

15.2.1. Indirect Data Monetization

15.2.2. Direct Data Monetization

15.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

15.3.1. Data as a Service

15.3.2. Professional Services

15.3.3. Platform/Software

15.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

15.4.1. Upstream

15.4.1.1. Conventional

15.4.1.2. Unconventional

15.4.2. Midstream

15.4.3. Downstream

15.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

15.5.1. Upstream

15.5.1.1. Conventional

15.5.1.2. Unconventional

15.5.2. Midstream

15.5.3. Downstream

15.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

15.6.1. Exploration

15.6.2. Development

15.6.3. Production

15.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

15.7.1. Exploration

15.7.2. Development

15.7.3. Production

15.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

15.8.1. National Oil Companies

15.8.2. Independent Oil Companies

15.8.3. National Data Repository

15.8.4. Oil and Gas Service Company

15.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

15.9.1. National Oil Companies

15.9.2. Independent Oil Companies

15.9.3. National Data Repository

15.9.4. Oil and Gas Service Company

15.10. Market Attractiveness Analysis

15.10.1. By Component

15.10.2. By Method

15.10.3. By Application

15.10.4. By E&P Lifecycle

15.10.5. By Oil Companies

16. GermanyOil and Gas Data Monetization Market Analysis and Forecast

16.1. Key Findings

16.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

16.2.1. Indirect Data Monetization

16.2.2. Direct Data Monetization

16.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

16.3.1. Data as a Service

16.3.2. Professional Services

16.3.3. Platform/Software

16.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

16.4.1. Upstream

16.4.1.1. Conventional

16.4.1.2. Unconventional

16.4.2. Midstream

16.4.3. Downstream

16.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

16.5.1. Upstream

16.5.1.1. Conventional

16.5.1.2. Unconventional

16.5.2. Midstream

16.5.3. Downstream

16.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

16.6.1. Exploration

16.6.2. Development

16.6.3. Production

16.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

16.7.1. Exploration

16.7.2. Development

16.7.3. Production

16.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

16.8.1. National Oil Companies

16.8.2. Independent Oil Companies

16.8.3. National Data Repository

16.8.4. Oil and Gas Service Company

16.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

16.9.1. National Oil Companies

16.9.2. Independent Oil Companies

16.9.3. National Data Repository

16.9.4. Oil and Gas Service Company

16.10. Market Attractiveness Analysis

16.10.1. By Component

16.10.2. By Method

16.10.3. By Application

16.10.4. By E&P Lifecycle

16.10.5. By Oil Companies

17. FranceOil and Gas Data Monetization Market Analysis and Forecast

17.1. Key Findings

17.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

17.2.1. Indirect Data Monetization

17.2.2. Direct Data Monetization

17.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

17.3.1. Data as a Service

17.3.2. Professional Services

17.3.3. Platform/Software

17.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

17.4.1. Upstream

17.4.1.1. Conventional

17.4.1.2. Unconventional

17.4.2. Midstream

17.4.3. Downstream

17.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

17.5.1. Upstream

17.5.1.1. Conventional

17.5.1.2. Unconventional

17.5.2. Midstream

17.5.3. Downstream

17.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

17.6.1. Exploration

17.6.2. Development

17.6.3. Production

17.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

17.7.1. Exploration

17.7.2. Development

17.7.3. Production

17.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

17.8.1. National Oil Companies

17.8.2. Independent Oil Companies

17.8.3. National Data Repository

17.8.4. Oil and Gas Service Company

17.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

17.9.1. National Oil Companies

17.9.2. Independent Oil Companies

17.9.3. National Data Repository

17.9.4. Oil and Gas Service Company

17.10. Market Attractiveness Analysis

17.10.1. By Component

17.10.2. By Method

17.10.3. By Application

17.10.4. By E&P Lifecycle

17.10.5. By Oil Companies

18. UK Oil and Gas Data Monetization Market Analysis and Forecast

18.1. Key Findings

18.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

18.2.1. Indirect Data Monetization

18.2.2. Direct Data Monetization

18.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

18.3.1. Data as a Service

18.3.2. Professional Services

18.3.3. Platform/Software

18.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

18.4.1. Upstream

18.4.1.1. Conventional

18.4.1.2. Unconventional

18.4.2. Midstream

18.4.3. Downstream

18.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

18.5.1. Upstream

18.5.1.1. Conventional

18.5.1.2. Unconventional

18.5.2. Midstream

18.5.3. Downstream

18.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

18.6.1. Exploration

18.6.2. Development

18.6.3. Production

18.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

18.7.1. Exploration

18.7.2. Development

18.7.3. Production

18.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

18.8.1. National Oil Companies

18.8.2. Independent Oil Companies

18.8.3. National Data Repository

18.8.4. Oil and Gas Service Company

18.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

18.9.1. National Oil Companies

18.9.2. Independent Oil Companies

18.9.3. National Data Repository

18.9.4. Oil and Gas Service Company

18.10. Market Attractiveness Analysis

18.10.1. By Component

18.10.2. By Method

18.10.3. By Application

18.10.4. By E&P Lifecycle

18.10.5. By Oil Companies

19. China Oil and Gas Data Monetization Market Analysis and Forecast

19.1. Key Findings

19.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

19.2.1. Indirect Data Monetization

19.2.2. Direct Data Monetization

19.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

19.3.1. Data as a Service

19.3.2. Professional Services

19.3.3. Platform/Software

19.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

19.4.1. Upstream

19.4.1.1. Conventional

19.4.1.2. Unconventional

19.4.2. Midstream

19.4.3. Downstream

19.5. Indirect Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

19.5.1. Upstream

19.5.1.1. Conventional

19.5.1.2. Unconventional

19.5.2. Midstream

19.5.3. Downstream

19.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

19.6.1. Exploration

19.6.2. Development

19.6.3. Production

19.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

19.7.1. Exploration

19.7.2. Development

19.7.3. Production

19.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

19.8.1. National Oil Companies

19.8.2. Independent Oil Companies

19.8.3. National Data Repository

19.8.4. Oil and Gas Service Company

19.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

19.9.1. National Oil Companies

19.9.2. Independent Oil Companies

19.9.3. National Data Repository

19.9.4. Oil and Gas Service Company

19.10. Market Attractiveness Analysis

19.10.1. By Component

19.10.2. By Method

19.10.3. By Application

19.10.4. By E&P Lifecycle

19.10.5. By Oil Companies

20. India Oil and Gas Data Monetization Market Analysis and Forecast

20.1. Key Findings

20.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

20.2.1. Indirect Data Monetization

20.2.2. Direct Data Monetization

20.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

20.3.1. Data as a Service

20.3.2. Professional Services

20.3.3. Platform/Software

20.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

20.4.1. Upstream

20.4.1.1. Conventional

20.4.1.2. Unconventional

20.4.2. Midstream

20.4.3. Downstream

20.5. Indirect Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

20.5.1. Upstream

20.5.1.1. Conventional

20.5.1.2. Unconventional

20.5.2. Midstream

20.5.3. Downstream

20.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

20.6.1. Exploration

20.6.2. Development

20.6.3. Production

20.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

20.7.1. Exploration

20.7.2. Development

20.7.3. Production

20.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

20.8.1. National Oil Companies

20.8.2. Independent Oil Companies

20.8.3. National Data Repository

20.8.4. Oil and Gas Service Company

20.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

20.9.1. National Oil Companies

20.9.2. Independent Oil Companies

20.9.3. National Data Repository

20.9.4. Oil and Gas Service Company

20.10. Market Attractiveness Analysis

20.10.1. By Component

20.10.2. By Method

20.10.3. By Application

20.10.4. By E&P Lifecycle

20.10.5. By Oil Companies

21. Japan Oil and Gas Data Monetization Market Analysis and Forecast

21.1. Key Findings

21.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

21.2.1. Indirect Data Monetization

21.2.2. Direct Data Monetization

21.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

21.3.1. Data as a Service

21.3.2. Professional Services

21.3.3. Platform/Software

21.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

21.4.1. Upstream

21.4.1.1. Conventional

21.4.1.2. Unconventional

21.4.2. Midstream

21.4.3. Downstream

21.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

21.5.1. Upstream

21.5.1.1. Conventional

21.5.1.2. Unconventional

21.5.2. Midstream

21.5.3. Downstream

21.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

21.6.1. Exploration

21.6.2. Development

21.6.3. Production

21.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

21.7.1. Exploration

21.7.2. Development

21.7.3. Production

21.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

21.8.1. National Oil Companies

21.8.2. Independent Oil Companies

21.8.3. National Data Repository

21.8.4. Oil and Gas Service Company

21.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

21.9.1. National Oil Companies

21.9.2. Independent Oil Companies

21.9.3. National Data Repository

21.9.4. Oil and Gas Service Company

21.10. Market Attractiveness Analysis

21.10.1. By Component

21.10.2. By Method

21.10.3. By Application

21.10.4. By E&P Lifecycle

21.10.5. By Oil Companies

22. Australia Oil and Gas Data Monetization Market Analysis and Forecast

22.1. Key Findings

22.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

22.2.1. Indirect Data Monetization

22.2.2. Direct Data Monetization

22.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

22.3.1. Data as a Service

22.3.2. Professional Services

22.3.3. Platform/Software

22.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

22.4.1. Upstream

22.4.1.1. Conventional

22.4.1.2. Unconventional

22.4.2. Midstream

22.4.3. Downstream

22.5. Indirect Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

22.5.1. Upstream

22.5.1.1. Conventional

22.5.1.2. Unconventional

22.5.2. Midstream

22.5.3. Downstream

22.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

22.6.1. Exploration

22.6.2. Development

22.6.3. Production

22.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

22.7.1. Exploration

22.7.2. Development

22.7.3. Production

22.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

22.8.1. National Oil Companies

22.8.2. Independent Oil Companies

22.8.3. National Data Repository

22.8.4. Oil and Gas Service Company

22.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

22.9.1. National Oil Companies

22.9.2. Independent Oil Companies

22.9.3. National Data Repository

22.9.4. Oil and Gas Service Company

22.10. Market Attractiveness Analysis

22.10.1. By Component

22.10.2. By Method

22.10.3. By Application

22.10.4. By E&P Lifecycle

22.10.5. By Oil Companies

23. GCC Oil and Gas Data Monetization Market Analysis and Forecast

23.1. Key Findings

23.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

23.2.1. Indirect Data Monetization

23.2.2. Direct Data Monetization

23.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

23.3.1. Data as a Service

23.3.2. Professional Services

23.3.3. Platform/Software

23.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

23.4.1. Upstream

23.4.1.1. Conventional

23.4.1.2. Unconventional

23.4.2. Midstream

23.4.3. Downstream

23.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

23.5.1. Upstream

23.5.1.1. Conventional

23.5.1.2. Unconventional

23.5.2. Midstream

23.5.3. Downstream

23.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

23.6.1. Exploration

23.6.2. Development

23.6.3. Production

23.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

23.7.1. Exploration

23.7.2. Development

23.7.3. Production

23.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

23.8.1. National Oil Companies

23.8.2. Independent Oil Companies

23.8.3. National Data Repository

23.8.4. Oil and Gas Service Company

23.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

23.9.1. National Oil Companies

23.9.2. Independent Oil Companies

23.9.3. National Data Repository

23.9.4. Oil and Gas Service Company

23.10. Market Attractiveness Analysis

23.10.1. By Component

23.10.2. By Method

23.10.3. By Application

23.10.4. By E&P Lifecycle

23.10.5. By Oil Companies

24. South Africa Oil and Gas Data Monetization Market Analysis and Forecast

24.1. Key Findings

24.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

24.2.1. Indirect Data Monetization

24.2.2. Direct Data Monetization

24.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

24.3.1. Data as a Service

24.3.2. Professional Services

24.3.3. Platform/Software

24.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

24.4.1. Upstream

24.4.1.1. Conventional

24.4.1.2. Unconventional

24.4.2. Midstream

24.4.3. Downstream

24.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

24.5.1. Upstream

24.5.1.1. Conventional

24.5.1.2. Unconventional

24.5.2. Midstream

24.5.3. Downstream

24.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

24.6.1. Exploration

24.6.2. Development

24.6.3. Production

24.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

24.7.1. Exploration

24.7.2. Development

24.7.3. Production

24.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

24.8.1. National Oil Companies

24.8.2. Independent Oil Companies

24.8.3. National Data Repository

24.8.4. Oil and Gas Service Company

24.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

24.9.1. National Oil Companies

24.9.2. Independent Oil Companies

24.9.3. National Data Repository

24.9.4. Oil and Gas Service Company

24.10. Market Attractiveness Analysis

24.10.1. By Component

24.10.2. By Method

24.10.3. By Application

24.10.4. By E&P Lifecycle

24.10.5. By Oil Companies

25. Brazil Oil and Gas Data Monetization Market Analysis and Forecast

25.1. Key Findings

25.2. Market Size (US$ Mn) Forecast by Method, 2016-2026

25.2.1. Indirect Data Monetization

25.2.2. Direct Data Monetization

25.3. Data Monetization Market Size (US$ Mn) Forecast byComponent, 2016-2026

25.3.1. Data as a Service

25.3.2. Professional Services

25.3.3. Platform/Software

25.4. Direct Data Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

25.4.1. Upstream

25.4.1.1. Conventional

25.4.1.2. Unconventional

25.4.2. Midstream

25.4.3. Downstream

25.5. IndirectData Monetization Market Size (US$ Mn) Forecast byApplication, 2016-2026

25.5.1. Upstream

25.5.1.1. Conventional

25.5.1.2. Unconventional

25.5.2. Midstream

25.5.3. Downstream

25.6. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

25.6.1. Exploration

25.6.2. Development

25.6.3. Production

25.7. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by E&P Lifecycle, 2016-2026

25.7.1. Exploration

25.7.2. Development

25.7.3. Production

25.8. Upstream Direct Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

25.8.1. National Oil Companies

25.8.2. Independent Oil Companies

25.8.3. National Data Repository

25.8.4. Oil and Gas Service Company

25.9. Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast by Oil Companies, 2016-2026

25.9.1. National Oil Companies

25.9.2. Independent Oil Companies

25.9.3. National Data Repository

25.9.4. Oil and Gas Service Company

25.10. Market Attractiveness Analysis

25.10.1. By Component

25.10.2. By Method

25.10.3. By Application

25.10.4. By E&P Lifecycle

25.10.5. By Oil Companies

26. Competition Landscape

26.1. Market Player – Competition Matrix

26.2. Market Revenue Share Analysis (%), By Company (2017)

27. Company Profiles

27.1. Indirect Data Monetization Providers in Oil and Gas Industry

27.1.1. Accenture

27.1.1.1. Overview

27.1.1.2. Key Competitors

27.1.1.3. Financial Overview

27.1.1.4. Strategy

27.1.1.5. Recent Developments

27.1.2. Datameer

27.1.2.1. Overview

27.1.2.2. Key Competitors

27.1.2.3. Financial Overview

27.1.2.4. Strategy

27.1.2.5. Recent Developments

27.1.3. Datawatch

27.1.3.1. Overview

27.1.3.2. Key Competitors

27.1.3.3. Financial Overview

27.1.3.4. Strategy

27.1.3.5. Recent Developments

27.1.4. Drillinginfo Inc.

27.1.4.1. Overview

27.1.4.2. Key Competitors

27.1.4.3. Financial Overview

27.1.4.4. Strategy

27.1.4.5. Recent Developments

27.1.5. General Electric

27.1.5.1. Overview

27.1.5.2. Key Competitors

27.1.5.3. Financial Overview

27.1.5.4. Strategy

27.1.5.5. Recent Developments

27.1.6. Hitachi Vantara Corporation

27.1.6.1. Overview

27.1.6.2. Key Competitors

27.1.6.3. Financial Overview

27.1.6.4. Strategy

27.1.6.5. Recent Developments

27.1.7. Hortonworks Inc.

27.1.7.1. Overview

27.1.7.2. Key Competitors

27.1.7.3. Financial Overview

27.1.7.4. Strategy

27.1.7.5. Recent Developments

27.1.8. International Business Machines Corporation

27.1.8.1. Overview

27.1.8.2. Key Competitors

27.1.8.3. Financial Overview

27.1.8.4. Strategy

27.1.8.5. Recent Developments

27.1.9. MapR Technologies, Inc.

27.1.9.1. Overview

27.1.9.2. Key Competitors

27.1.9.3. Financial Overview

27.1.9.4. Strategy

27.1.9.5. Recent Developments

27.1.10. Microsoft Corporation

27.1.10.1. Overview

27.1.10.2. Key Competitors

27.1.10.3. Financial Overview

27.1.10.4. Strategy

27.1.10.5. Recent Developments

27.1.11. Northwest Analytics Inc.

27.1.11.1. Overview

27.1.11.2. Key Competitors

27.1.11.3. Financial Overview

27.1.11.4. Strategy

27.1.11.5. Recent Developments

27.1.12. Oracle Corporation

27.1.12.1. Overview

27.1.12.2. Key Competitors

27.1.12.3. Financial Overview

27.1.12.4. Strategy

27.1.12.5. Recent Developments

27.1.13. OSI Soft

27.1.13.1. Overview

27.1.13.2. Key Competitors

27.1.13.3. Financial Overview

27.1.13.4. Strategy

27.1.13.5. Recent Developments

27.1.14. Palantir Economic Solutions Ltd

27.1.14.1. Overview

27.1.14.2. Key Competitors

27.1.14.3. Financial Overview

27.1.14.4. Strategy

27.1.14.5. Recent Developments

27.1.15. SAP SE

27.1.15.1. Overview

27.1.15.2. Key Competitors

27.1.15.3. Financial Overview

27.1.15.4. Strategy

27.1.15.5. Recent Developments

27.1.16. SAS Institute Inc.

27.1.16.1. Overview

27.1.16.2. Key Competitors

27.1.16.3. Financial Overview

27.1.16.4. Strategy

27.1.16.5. Recent Developments

27.1.17. Capgemini S.A.

27.1.17.1. Overview

27.1.17.2. Key Competitors

27.1.17.3. Financial Overview

27.1.17.4. Strategy

27.1.17.5. Recent Developments

27.1.18. Cloudera, Inc.

27.1.18.1. Overview

27.1.18.2. Key Competitors

27.1.18.3. Financial Overview

27.1.18.4. Strategy

27.1.18.5. Recent Developments

27.1.19. EMC Corporation

27.1.19.1. Overview

27.1.19.2. Key Competitors

27.1.19.3. Financial Overview

27.1.19.4. Strategy

27.1.19.5. SWOT Analysis

27.1.20. Newgen Software, Inc.

27.1.20.1. Overview

27.1.20.2. Key Competitors

27.1.20.3. Financial Overview

27.1.20.4. Strategy

27.1.20.5. SWOT Analysis

27.1.21. Cisco Systems, Inc.

27.1.21.1. Overview

27.1.21.2. Key Competitors

27.1.21.3. Financial Overview

27.1.21.4. Strategy

27.1.21.5. SWOT Analysis

27.1.22. Tata Consultancy Services Ltd.

27.1.22.1. Overview

27.1.22.2. Key Competitors

27.1.22.3. Financial Overview

27.1.22.4. Strategy

27.1.22.5. SWOT Analysis

27.1.23. Halliburton

27.1.23.1. Overview

27.1.23.2. Key Competitors

27.1.23.3. Financial Overview

27.1.23.4. Strategy

27.1.23.5. SWOT Analysis

27.1.24. Informatica Corporation

27.1.24.1. Overview

27.1.24.2. Key Competitors

27.1.24.3. Financial Overview

27.1.24.4. Strategy

27.1.24.5. SWOT Analysis

27.1.25. Schlumberger Limited

27.1.25.1. Overview

27.1.25.2. Key Competitors

27.1.25.3. Financial Overview

27.1.25.4. Strategy

27.1.25.5. SWOT Analysis

27.2. Global Data Monetization Players

27.2.1. Adastra Corporation

27.2.1.1. Overview

27.2.1.2. Description

27.2.1.3. Products

27.2.1.4. Revenue

27.2.1.5. Sales Breakdown by Geography

27.2.1.6. Key Financial Indicator

27.2.1.7. SWOT Analysis

27.2.1.8. Recent Development

27.2.1.9. Strategic Overview

27.2.2. ALC

27.2.2.1. Overview

27.2.2.2. Description

27.2.2.3. Products

27.2.2.4. Revenue

27.2.2.5. Sales Breakdown by Geography

27.2.2.6. Key Financial Indicator

27.2.2.7. SWOT Analysis

27.2.2.8. Recent Development

27.2.2.9. Strategic Overview

27.2.3. Connectiva Analytics and Insights Ltd.

27.2.3.1. Overview

27.2.3.2. Description

27.2.3.3. Products

27.2.3.4. Revenue

27.2.3.5. Sales Breakdown by Geography

27.2.3.6. Key Financial Indicator

27.2.3.7. SWOT Analysis

27.2.3.8. Recent Development

27.2.3.9. Strategic Overview

27.2.4. Dawex

27.2.4.1. Overview

27.2.4.2. Description

27.2.4.3. Products

27.2.4.4. Revenue

27.2.4.5. Sales Breakdown by Geography

27.2.4.6. Key Financial Indicator

27.2.4.7. SWOT Analysis

27.2.4.8. Recent Development

27.2.4.9. Strategic Overview

27.2.5. Intel Corporation

27.2.5.1. Overview

27.2.5.2. Description

27.2.5.3. Products

27.2.5.4. Revenue

27.2.5.5. Sales Breakdown by Geography

27.2.5.6. Key Financial Indicator

27.2.5.7. SWOT Analysis

27.2.5.8. Recent Development

27.2.5.9. Strategic Overview

27.2.6. Mahindra Comviva

27.2.6.1. Overview

27.2.6.2. Description

27.2.6.3. Products

27.2.6.4. Revenue

27.2.6.5. Sales Breakdown by Geography

27.2.6.6. Key Financial Indicator

27.2.6.7. SWOT Analysis

27.2.6.8. Recent Development

27.2.6.9. Strategic Overview

27.2.7. Mnubo

27.2.7.1. Overview

27.2.7.2. Description

27.2.7.3. Products

27.2.7.4. Revenue

27.2.7.5. Sales Breakdown by Geography

27.2.7.6. Key Financial Indicator

27.2.7.7. SWOT Analysis

27.2.7.8. Recent Development

27.2.7.9. Strategic Overview

27.2.8. NETSCOUT

27.2.8.1. Overview

27.2.8.2. Description

27.2.8.3. Products

27.2.8.4. Revenue

27.2.8.5. Sales Breakdown by Geography

27.2.8.6. Key Financial Indicator

27.2.8.7. SWOT Analysis

27.2.8.8. Recent Development

27.2.8.9. Strategic Overview

27.2.9. Paxata, Inc

27.2.9.1. Overview

27.2.9.2. Description

27.2.9.3. Products

27.2.9.4. Revenue

27.2.9.5. Sales Breakdown by Geography

27.2.9.6. Key Financial Indicator

27.2.9.7. SWOT Analysis

27.2.9.8. Recent Development

27.2.9.9. Strategic Overview

27.2.10. Redknee Solutions Inc.

27.2.10.1. Overview

27.2.10.2. Description

27.2.10.3. Products

27.2.10.4. Revenue

27.2.10.5. Sales Breakdown by Geography

27.2.10.6. Key Financial Indicator

27.2.10.7. SWOT Analysis

27.2.10.8. Recent Development

27.2.10.9. Strategic Overview

27.2.11. SQLstream, Inc.

27.2.11.1. Overview

27.2.11.2. Description

27.2.11.3. Products

27.2.11.4. Revenue

27.2.11.5. Sales Breakdown by Geography

27.2.11.6. Key Financial Indicator

27.2.11.7. SWOT Analysis

27.2.11.8. Recent Development

27.2.11.9. Strategic Overview

27.2.12. Virtusa Corporation

27.2.12.1. Overview

27.2.12.2. Description

27.2.12.3. Products

27.2.12.4. Revenue

27.2.12.5. Sales Breakdown by Geography

27.2.12.6. Key Financial Indicator

27.2.12.7. SWOT Analysis

27.2.12.8. Recent Development

27.2.12.9. Strategic Overview

28. Key Takeaways

List of Tables

Table 1 : Global Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 2 : Global Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 3 : Global Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 4 : Global Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 5 : Global Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 6 : Global Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 7 : Global Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 8 : Global Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 9 : North America Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 10 : Europe Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 11 : Asia Pacific Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 12 : MEA Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 13 : South America Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 14 : U.S. Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 15 : U.S. Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 16 : U.S. Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 17 : U.S. Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 18 : U.S. Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 19 : U.S. Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 20 : U.S. Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 21 : U.S. Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 22 : Canada Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 23 : Canada Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 24 : Canada Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 25 : Canada Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 26 : Canada Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 27 : Canada Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 28 : Canada Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 29 : Canada Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 30 : Germany Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 31 : Germany Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 32 : Germany Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 33 : Germany Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 34 : Germany Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 35 : Germany Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 36 : Germany Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 37 : Germany Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 38 : France Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 39 : France Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 40 : France Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 41 : France Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 42 : France Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 43 : France Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 44 : France Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 45 : France Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 46 : UK Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 47 : UK Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 48 : UK Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 49 : UK Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 50 : UK Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 51 : UK Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 52 : UK Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 53 : UK Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 54 : China Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 55 : China Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 56 : China Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 57 : China Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 58 : China Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 59 : China Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 60 : China Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 61 : China Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 62 : Japan Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 63 : Japan Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 64 : Japan Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 65 : Japan Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 66 : Japan Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 67 : Japan Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 68 : Japan Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 69 : Japan Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 70 : India Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 71 : India Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 72 : India Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 73 : India Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 74 : India Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 75 : India Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 76 : India Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 77 : India Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 78 : Australia Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 79 : Australia Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 80 : Australia Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 81 : Australia Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 82 : Australia Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 83 : Australia Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 84 : Australia Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 85 : Australia Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 86 : GCC Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 87 : GCC Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 88 : GCC Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 89 : GCC Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 90 : GCC Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 91 : GCC Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 92 : GCC Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 93 : GCC Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 94 : South Africa Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 95 : South Africa Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 96 : South Africa Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 97 : South Africa Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 98 : South Africa Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 99 : South Africa Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 100 : South Africa Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 101 : South Africa Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 102 : Brazil Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Method, 2016 – 2026

Table 103 : Brazil Oil and Gas Data Monetization Market Size (US$ Mn) Forecast, by Component, 2016 – 2026

Table 104 : Brazil Oil and Gas Direct Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 105 : Brazil Oil and Gas Indirect Data Monetization Market Size (US$ Mn) Forecast, by Application, 2016 – 2026

Table 106 : Brazil Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 107 : Brazil Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by E&P Lifecycle, 2016 – 2026

Table 108 : Brazil Oil and Gas Upstream Direct Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

Table 109 : Brazil Oil and Gas Upstream Indirect Data Monetization Market Size (US$ Mn) Forecast, by Oil Companies, 2016 – 2026

List of Figures

Figure 1: Research Methodology

Figure 2 : Global Oil and Gas Data Monetization Market

Figure 3 : Gross Domestic Product (GDP) per Capita; Analysis (1/2) (US$ Tn), By Major Countries, 2011-2016

Figure 4 : Global Oil and Gas CAPEX (US$ Mn), 2015 – 2017

Figure 5 : Global Oil and Gas IT Spending CAPEX (US$ Mn), 2015 – 2017

Figure 6 : Energy Consumption (Quadrillion British Thermal Units)

Figure 7 : Number of IoT Devices/Year (Bn Units)

Figure 8 : Global Oil and Gas Data Monetization Market Size (US$ Mn) and Forecast, 2012 – 2026

Figure 9 : Global Oil and Gas Data Monetization Market Opportunity Analysis, 2016 – 2026

Figure 10 : Global Oil and Gas Data Monetization Market Value Share (Value %), by Component, 2018

Figure 11 : Global Oil and Gas Indirect Data Monetization Market Value Share (Value %), by Application, 2018

Figure 12 : Global Oil and Gas Data Indirect Monetization Market Value Share (Value %), by E&P Lifecycle, 2018

Figure 13 : Global Oil and Gas Indirect Data Monetization Market Value Share (Value %), by Oil Companies, 2018

Figure 14 : Global Oil and Gas Data Monetization Market Value Share (Value %), by Method, 2018

Figure 15 : Global Oil and Gas Direct Data Monetization Market Value Share (Value %), by Application, 2018

Figure 16 : Global Oil and Gas Data Direct Monetization Market Value Share (Value %), by E&P Lifecycle, 2018

Figure 17 : Global Oil and Gas Direct Data Monetization Market Value Share (Value %), by Oil Companies, 2018

Figure 18 : Global Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 19 : Global Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 20 : Global Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 21 : Global Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 22 : Global Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 23 : Global Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 24 : Global Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 25 : Global Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 26 : U.S. Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 27 : U.S. Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 28 : U.S. Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 29 : U.S. Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 30 : U.S. Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 31 : U.S. Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 32 : U.S. Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 33 : U.S. Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 34 : Canada Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 35 : Canada Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 36 : Canada Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 37 : Canada Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 38 : Canada Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 39 : Canada Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 40 : Canada Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 41 : Canada Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 42 : Canada Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 43 : Canada Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 44 : Germany Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 45 : Germany Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 46 : Germany Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 47 : Germany Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 48 : Germany Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 49 : Germany Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 50 : Germany Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 51 : Germany Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 52 : Germany Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 53 : Germany Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 54 : France Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 55 : France Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 56 : France Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 57 : France Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 58 : France Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 59 : France Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 60 : France Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 61 : France Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 62 : France Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 63 : France Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 64 : UK Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 65 : UK Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 66 : UK Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 67 : UK Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 68 : UK Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 69 : UK Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 70 : UK Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 71 : UK Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 72 : UK Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 73 : UK Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 74 : China Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 75 : China Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 76 : China Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 77 : China Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 78 : China Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 79 : China Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 80 : China Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 81 : China Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 82 : China Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 83 : China Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 84 : Japan Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 85 : Japan Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 86 : Japan Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 87 : Japan Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 88 : Japan Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 89 : Japan Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 90 : Japan Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 91 : Japan Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 92 : Japan Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 93 : Japan Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 94: India Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 95: India Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 96: India Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 97: India Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 98: India Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 99: India Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 100: India Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 101: India Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 102: India Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 103 : India Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 104 : Australia Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 105 : Australia Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 106 : Australia Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 107 : Australia Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 108 : Australia Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 109 : Australia Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 110 : Australia Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 111 : Australia Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 112 : Australia Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 113 : Australia Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 114 : GCC Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 115: GCC Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 116 : GCC Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 117 : GCC Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 118 : GCC Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 119 : GCC Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 120 : GCC Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 121 : GCC Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 122 : GCC Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 123 : GCC Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 124 : South Africa Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 125: South Africa Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 126 : South Africa Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 127 : South Africa Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 128 : South Africa Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 129 : South Africa Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Application (2018)

Figure 130 : South Africa Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 131 : South Africa Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by E&P Lifecycle (2018)

Figure 132 : South Africa Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 133 : South Africa Oil and Gas Indirect Data Monetization Market Attractiveness Analysis, by Oil Companies (2018)

Figure 134 : Brazil Oil and Gas Data Monetization Market (US$ Mn) Forecast, 2016 – 2026

Figure 135: Brazil Oil and Gas Data Monetization Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure 136 : Brazil Oil and Gas Data Monetization Market Attractiveness Analysis, by Method (2018)

Figure 137 : Brazil Oil and Gas Data Monetization Market Attractiveness Analysis, by Component (2018)

Figure 138 : Brazil Oil and Gas Direct Data Monetization Market Attractiveness Analysis, by Application (2018)