Oil & Gas Data Management Market - Snapshot

Digital data is growing exponentially in the current market. IoT proliferation is generating volumes of digital information at an exponential rate. The data universe has seen this tremendous growth in the last few years. In fact, over 80% to 90% of digital data present in the current market was created in the last two years. With data rise, the number of data breaches has gone up. Oil & gas data management software are a category of advanced software utilized by oil & gas companies to manage and protect their data. The projects undertaken by such companies have high level of complexity in operations, resource management, capital management, inventory management etc. Data management software helps companies optimize resources, track progress of the projects, and increase their efficiency.

Data management software allows businesses to manage and access their data effectively on a real time basis. Numerous software development providers and vendors are laying emphasis on enrichment of data management software by integrating value added processing such as regulatory compliance management tools, data analytics, data warehousing, and other features, for instance process design control. Moreover, increasing adoption of IoT and AI is projected to enhance large scale implementation of data management software by small and large enterprises in the oil & gas industry. Cloud platform adoption, next generation data center evolution, and cost effective and flexible data management solutions are creating demand traction for data management as a service in the oil & gas industry. It is anticipated that rising trend of cloud adoption would drive the data management market over the years. Rising data breaches across the globe is necessitating the modernization of existing enterprise infrastructure. Thus, enterprise data management infrastructure modernization across the world is set to boost the global oil & gas data management market in the near future. However, lack of complete data security assurance and misuse of collected data are factors obstructing the growth of the oil & gas data management market in international and domestic markets.

The oil & gas data management market has been segmented in terms of component, and region. In terms of component, the market has been segmented into solution and services. The solution segment has further been classified into corporate/enterprise data management system, project data management system, and national data repository. The national data repository sub segment consists of seismic data management system, well data management system, project data management system, and borehole data management system. The services segment has been bifurcated into consulting & planning, integration & implementation, and operation & maintenance. Geographically, the market has been segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

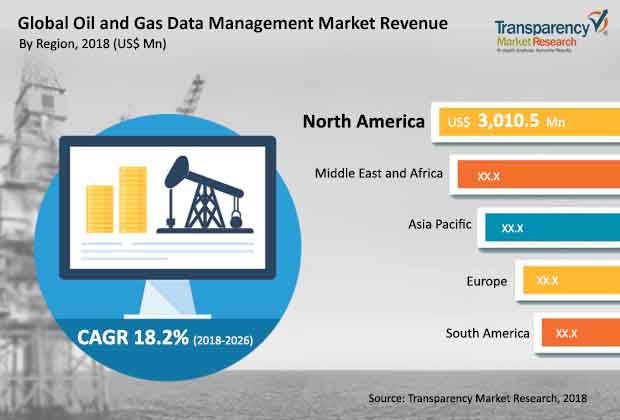

North America remained the dominant region in the oil & gas data management market in 2017.The region accounted for almost one-third of the global market revenue share and is expected to continue its leading position throughout the forecast period. This is due to the fact that a large number of mid-sized and small enterprises are leaning toward data management software. Middle East & Africa captured the second largest market share in 2017. Asia Pacific witnessed significant growth in 2017, buoyed by rising adoption rate of digitalization in data management over the years. It is however seeing hurdles in the growth of the oil & gas data management market. Factors such as different regulatory compliances and limited availability of efficient infrastructure are seen as key reasons for the potential growth slag.

This report on the global oil & gas data management market provides market revenue share analysis of the various key participants. Some of the key players profiled in the oil & gas data management market report include Capgemini S.A., EMC Corporation, IBM Corporation, Newgen Software, Inc., Cisco Systems, Inc., SAP SE, Tata Consultancy Services Ltd., Oracle Corporation, Halliburton, Informatica Corporation, and Schlumberger Limited.

Escalating Influence of Automation across the Oil and Gas Industry to Boost the Growth Opportunities across the Oil & Gas Data Management Market

The oil & gas data management market is anticipated to observe a stable growth period during the assessment period of 2018-2026. The growing penetration of digitalization across a large number of industries and sectors is expected to serve as a vital growth factor for the oil & gas data management market.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary : Global Oil and Gas Data Management Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. PESTEL Analysis - Global Oil and Gas Data Management Market

4.3. Market Dynamics

4.3.1. Drivers

4.3.1.1. Supply Side

4.3.1.2. Demand Side

4.3.2. Restraints

4.3.3. Opportunities

4.3.4. Impact Analysis of Drivers & Restraints

4.4. Regulations and Policies for Oil and Gas Industry

4.5. Porter’s Five Forces Analysis - Global Oil and Gas Data Management Market

4.6. Ecosystem Analysis - Global Oil and Gas Data Management Market

4.7. Oil and Gas Data Management Market: Use Cases/Case Studies by Major National/Regional Repositories

4.7.1. PetroChina Company Limited

4.7.2. Oil & Natural Gas Corporation Limited

4.7.3. DINO

4.7.4. Others

4.8. Global Oil and Gas Data Management Market Analysis and Forecast, 2016 - 2026

4.8.1. Market Revenue Analysis (US$ Mn)

4.8.1.1. Historic growth trends, 2012-2017

4.8.1.2. Forecast trends, 2017-2026

5. Global Oil and Gas Data Management Market Analysis and Forecast, By Component

5.1. Overview & Definition

5.2. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

5.2.1. By Solution

5.2.1.1. Corporate/Enterprise Data Management System

5.2.1.2. Project Data Management System

5.2.1.3. National Data Repository

5.2.1.3.1. Standalone

5.2.1.3.1.1. Seismic Data Management system

5.2.1.3.1.2. Well Data Management System

5.2.1.3.1.3. Borehole Data Management System

5.2.1.3.2. Integrated Solution

5.2.2. By Services

5.2.2.1. Consulting & Planning

5.2.2.2. Integration & Implementation

5.2.2.3. Operation & Maintenance

5.3. Market Attractiveness By Component

6. Global Oil and Gas Data Management Market Analysis and Forecast, by Region

6.1. Key Findings

6.2. Oil and Gas Data Management Market Size (US$ Mn) Forecast, by Region, 2016 - 2026

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Attractiveness by Region

7. North America Oil and Gas Data Management Market Analysis and Forecast

7.1. Key Findings

7.2. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

7.2.1. By Solution

7.2.1.1. Corporate/Enterprise Data Management System

7.2.1.2. Project Data Management System

7.2.1.3. National Data Repository

7.2.1.3.1. Standalone

7.2.1.3.1.1. Seismic Data Management system

7.2.1.3.1.2. Well Data Management System

7.2.1.3.1.3. Borehole Data Management System

7.2.1.3.2. Integrated Solution

7.2.2. By Services

7.2.2.1. Consulting & Planning

7.2.2.2. Integration & Implementation

7.2.2.3. Operation & Maintenance

7.3. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

7.3.1. The U.S.

7.3.2. Canada

7.3.3. Rest of North America

7.4. Market Attractiveness Analysis

7.4.1. By Component

7.4.2. By Country

8. Europe Oil and Gas Data Management Market Analysis and Forecast

8.1. Key Findings

8.2. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

8.2.1. By Solution

8.2.1.1. Corporate/Enterprise Data Management System

8.2.1.2. Project Data Management System

8.2.1.3. National Data Repository

8.2.1.3.1. Standalone

8.2.1.3.1.1. Seismic Data Management system

8.2.1.3.1.2. Well Data Management System

8.2.1.3.1.3. Borehole Data Management System

8.2.1.3.2. Integrated Solution

8.2.2. By Services

8.2.2.1. Consulting & Planning

8.2.2.2. Integration & Implementation

8.2.2.3. Operation & Maintenance

8.3. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

8.3.1. Germany

8.3.2. France

8.3.3. UK

8.3.4. Rest of Europe

8.4. Market Attractiveness Analysis

8.4.1. By Component

8.4.2. By Country

9. Asia Pacific Oil and Gas Data Management Market Analysis and Forecast

9.1. Key Findings

9.2. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

9.2.1. By Solution

9.2.1.1. Corporate/Enterprise Data Management System

9.2.1.2. Project Data Management System

9.2.1.3. National Data Repository

9.2.1.3.1. Standalone

9.2.1.3.1.1. Seismic Data Management system

9.2.1.3.1.2. Well Data Management System

9.2.1.3.1.3. Borehole Data Management System

9.2.1.3.2. Integrated Solution

9.2.2. By Services

9.2.2.1. Consulting & Planning

9.2.2.2. Integration & Implementation

9.2.2.3. Operation & Maintenance

9.3. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

9.3.1. China

9.3.2. Japan

9.3.3. India

9.3.4. Australia

9.3.5. Rest of Asia Pacific

9.4. Market Attractiveness Analysis

9.4.1. By Component

9.4.2. By Country

10. Middle East and Africa (MEA) Oil and Gas Data Management Market Analysis and Forecast

10.1. Key Findings

10.2. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

10.2.1. By Solution

10.2.1.1. Corporate/Enterprise Data Management System

10.2.1.2. Project Data Management System

10.2.1.3. National Data Repository

10.2.1.3.1. Standalone

10.2.1.3.1.1. Seismic Data Management system

10.2.1.3.1.2. Well Data Management System

10.2.1.3.1.3. Borehole Data Management System

10.2.1.3.2. Integrated Solution

10.2.2. By Services

10.2.2.1. Consulting & Planning

10.2.2.2. Integration & Implementation

10.2.2.3. Operation & Maintenance

10.3. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

10.3.1. GCC

10.3.2. South Africa

10.3.3. Rest of MEA

10.4. Market Attractiveness Analysis

10.4.1. By Component

10.4.2. By Country

11. South America Oil and Gas Data Management Market Analysis and Forecast

11.1. Key Findings

11.2. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

11.2.1. By Solution

11.2.1.1. Corporate/Enterprise Data Management System

11.2.1.2. Project Data Management System

11.2.1.3. National Data Repository

11.2.1.3.1. Standalone

11.2.1.3.1.1. Seismic Data Management system

11.2.1.3.1.2. Well Data Management System

11.2.1.3.1.3. Project Data Management System

11.2.1.3.1.4. Borehole Data Management System

11.2.1.3.2. Integrated Solution

11.2.2. By Services

11.2.2.1. Consulting & Planning

11.2.2.2. Integration & Implementation

11.2.2.3. Operation & Maintenance

11.3. Oil and Gas Data Management Market Size (US$ Mn) Forecast, By Country, 2016 - 2026

11.3.1. Brazil

11.3.2. Rest of South America

11.4. Market Attractiveness Analysis

11.4.1. By Component

11.4.2. By Country

12. Competition Landscape

12.1. Market Player – Competition Matrix

12.2. Market Revenue Share Analysis (%), By Company (2017)

13. Company Profiles

13.1. Corporate/Enterprise Data Management Solution Providers

13.1.1. Capgemini S.A.

13.1.1.1. Product Portfolio

13.1.1.2. Geographical Presence

13.1.1.3. SWOT

13.1.1.4. Financial Overview

13.1.1.5. Strategy

13.1.2. EMC Corporation

13.1.2.1. Product Portfolio

13.1.2.2. Geographical Presence

13.1.2.3. SWOT

13.1.2.4. Financial Overview

13.1.2.5. Strategy

13.1.3. IBM Corporation

13.1.3.1. Product Portfolio

13.1.3.2. Geographical Presence

13.1.3.3. SWOT

13.1.3.4. Financial Overview

13.1.3.5. Strategy

13.1.4. Newgen Software, Inc.

13.1.4.1. Product Portfolio

13.1.4.2. Geographical Presence

13.1.4.3. SWOT

13.1.4.4. Financial Overview

13.1.4.5. Strategy

13.1.5. Cisco Systems, Inc.

13.1.5.1. Product Portfolio

13.1.5.2. Geographical Presence

13.1.5.3. SWOT

13.1.5.4. Financial Overview

13.1.5.5. Strategy

13.1.6. SAP SE

13.1.6.1. Product Portfolio

13.1.6.2. Geographical Presence

13.1.6.3. SWOT

13.1.6.4. Financial Overview

13.1.6.5. Strategy

13.1.7. Tata Consultancy Services Ltd.

13.1.7.1. Product Portfolio

13.1.7.2. Geographical Presence

13.1.7.3. SWOT

13.1.7.4. Financial Overview

13.1.7.5. Strategy

13.1.8. Oracle Corporation

13.1.8.1. Product Portfolio

13.1.8.2. Geographical Presence

13.1.8.3. SWOT

13.1.8.4. Financial Overview

13.1.8.5. Strategy

13.2. NDR & Project Data Management Providers

13.2.1. Halliburton

13.2.1.1. Product Portfolio

13.2.1.2. Geographical Presence

13.2.1.3. SWOT

13.2.1.4. Financial Overview

13.2.1.5. Strategy

13.2.2. Informatica Corporation

13.2.2.1. Product Portfolio

13.2.2.2. Geographical Presence

13.2.2.3. SWOT

13.2.2.4. Financial Overview

13.2.2.5. Strategy

13.2.3. Schlumberger Limited

13.2.3.1. Product Portfolio

13.2.3.2. Geographical Presence

13.2.3.3. SWOT

13.2.3.4. Financial Overview

13.2.3.5. Strategy

14. Key Takeaways

List of Tables

Table: 01 Global Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table: 02 Global Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table: 03 Global Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Solution, 2016 - 2026

Table: 04 Oil & Gas Data Management Market CAGR (%), By Solution

Table: 05 Global Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By National Data Repository, 2016 - 2026

Table: 06 Oil & Gas Data Management Market CAGR (%), By National Data Repository

Table: 07 Global Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Standalone, 2016 - 2026

Table: 08 Oil & Gas Data Management Market CAGR (%), By Standalone

Table: 09 Global Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table: 10 Oil & Gas Data Management Market CAGR (%), By Services

Table: 11 Global Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Region, 2016 - 2026

Table: 12 Oil & Gas Data Management Market CAGR (%), By Country

Table: 13 North America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table: 14 Oil & Gas Data Management Market CAGR (%), By Component

Table: 15 North America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Solution, 2016 - 2026

Table: 16 Oil & Gas Data Management Market CAGR (%), By Solution

Table: 17 North America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By National Data Repository, 2016 - 2026

Table: 18 Oil & Gas Data Management Market CAGR (%), By National Data Repository

Table: 19 North America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Standalone, 2016 - 2026

Table: 20 Oil & Gas Data Management Market CAGR (%), By Standalone

Table: 21 North America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table: 22 Oil & Gas Data Management Market CAGR (%), By Services

Table: 23 North America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table: 24 Oil & Gas Data Management Market CAGR (%), By Country

Table: 25 Europe Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table: 26 Oil & Gas Data Management Market CAGR (%), By Component

Table: 27 Europe Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Solution, 2016 - 2026

Table: 28 Oil & Gas Data Management Market CAGR (%), By Solution

Table: 29 Europe Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By National Data Repository, 2016 - 2026

Table: 30 Oil & Gas Data Management Market CAGR (%), By National Data Repository

Table: 31 Europe Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Standalone, 2016 - 2026

Table: 32 Oil & Gas Data Management Market CAGR (%), By Standalone

Table: 33 Europe Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table: 34 Oil & Gas Data Management Market CAGR (%), By Services

Table: 35 Europe Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table: 36 Oil & Gas Data Management Market CAGR (%), By Country

Table: 37 Asia Pacific Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table: 38 Oil & Gas Data Management Market CAGR (%), By Component

Table: 39 Asia Pacific Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Solution, 2016 - 2026

Table: 40 Oil & Gas Data Management Market CAGR (%), By Solution

Table: 41 Asia Pacific Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By National Data Repository, 2016 - 2026

Table: 42 Oil & Gas Data Management Market CAGR (%), By National Data Repository

Table: 43 Asia Pacific Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Standalone, 2016 - 2026

Table: 44 Oil & Gas Data Management Market CAGR (%), By Standalone

Table: 45 Asia Pacific Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table: 46 Oil & Gas Data Management Market CAGR (%), By Services

Table: 47 Asia Pacific Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table: 48 Oil & Gas Data Management Market CAGR (%), By Country

Table: 49 Middle East & Africa Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table: 50 Oil & Gas Data Management Market CAGR (%), By Component

Table: 51 Middle East & Africa Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Solution, 2016 - 2026

Table: 52 Oil & Gas Data Management Market CAGR (%), By Solution

Table: 53 Middle East & Africa Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By National Data Repository, 2016 - 2026

Table: 54 Oil & Gas Data Management Market CAGR (%), By National Data Repository

Table: 55 Middle East & Africa Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Standalone, 2016 - 2026

Table: 56 Oil & Gas Data Management Market CAGR (%), By Standalone

Table: 57 Middle East & Africa Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table: 58 Oil & Gas Data Management Market CAGR (%), By Services

Table: 59 Middle East & Africa Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table: 60 Oil & Gas Data Management Market CAGR (%), By Country

Table: 61 South America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table: 62 Oil & Gas Data Management Market CAGR (%), By Component

Table: 63 South America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Solution, 2016 - 2026

Table: 64 Oil & Gas Data Management Market CAGR (%), By Solution

Table: 65 South America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By National Data Repository, 2016 - 2026

Table: 66 Oil & Gas Data Management Market CAGR (%), By National Data Repository

Table: 67 South America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Standalone, 2016 - 2026

Table: 68 Oil & Gas Data Management Market CAGR (%), By Standalone

Table: 69 South America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table: 70 Oil & Gas Data Management Market CAGR (%), By Services

Table: 71 South America Oil & Gas Data Management Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table: 72 Oil & Gas Data Management Market CAGR (%), By Country

List of Figures

Figure: 01 Historic growth trends, 2012-2017 (US$ Mn)

Figure: 02 Forecast trends, 2018-2026 (US$ Mn)

Figure: 03 Global Oil & Gas Data Management Market Size (US$ Mn) Forecast, 2016 – 2026

Figure: 04 Global Oil & Gas Data Management Market Y-o-Y Growth (Value %) Forecast, 2016 – 2026

Figure: 05 Global Oil & Gas Data Management Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure: 06 Global Oil & Gas Data Management Market Attractiveness Analysis, by Component

Figure: 07 North America Oil & Gas Data Management Market Attractiveness Analysis, by Country

Figure: 08 North America Oil & Gas Data Management Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016– 2026

Figure: 09 North America Oil & Gas Data Management Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure: 10 North America Oil & Gas Data Management Market Attractiveness Analysis, by Component

Figure: 11 North America Oil & Gas Data Management Market Attractiveness Analysis, by Country

Figure: 12 Europe Oil & Gas Data Management Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016– 2026

Figure: 13 Europe Oil & Gas Data Management Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure: 14 Europe Oil & Gas Data Management Market Attractiveness Analysis, by Component

Figure: 15 Europe Oil & Gas Data Management Market Attractiveness Analysis, by Country

Figure: 16 Asia Pacific Oil & Gas Data Management Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016– 2026

Figure: 17 Asia Pacific Oil & Gas Data Management Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure: 18 Asia Pacific Oil & Gas Data Management Market Attractiveness Analysis, by Component

Figure: 19 Asia Pacific Oil & Gas Data Management Market Attractiveness Analysis, by Country

Figure: 20 Middle East & Africa Oil & Gas Data Management Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016– 2026

Figure: 21 Middle East & Africa Oil & Gas Data Management Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure: 22 Middle East & Africa Oil & Gas Data Management Market Attractiveness Analysis, by Component

Figure: 23 Middle East & Africa Oil & Gas Data Management Market Attractiveness Analysis, by Country

Figure: 24 South America Oil & Gas Data Management Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016– 2026

Figure: 25 South America Oil & Gas Data Management Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure: 26 South America Oil & Gas Data Management Market Attractiveness Analysis, by Component

Figure: 27 South America Oil & Gas Data Management Market Attractiveness Analysis, by Country

Figure: 28 Competition Matrix

Figure: 29 Market Share Analysis