Analysts’ Viewpoint

Increase in number of vehicles on road, expansion of the automotive industry in emerging markets, and the need for regular maintenance have been consistently driving the automotive oil filter industry growth for the last few years. The aftermarket segment plays a crucial role in the automotive oil filter market. Vehicle owners turn to the aftermarket for oil filter replacements, as vehicles age or warranties expire, thereby contributing to continuous demand. Advancements in automotive engine filtration, extended service life, and adaptability to different vehicle models have attracted consumers and original equipment manufacturers (OEMs).

Growth in commercial vehicle fleets, including taxis, delivery vehicles, and logistics trucks, also contributes to the increased demand for oil filters in fleet maintenance operations. Rising awareness about the importance of preventive maintenance, including regular oil changes and filter replacements, has led to more consumers prioritizing proper vehicle maintenance. Clean engine oil is essential for optimal fuel-efficiency and engine performance. The use of high-quality oil filters ensures that the engine remains well-lubricated and protected from contaminants.

An automotive oil filter is a vital component of a vehicle's lubrication system, which is designed to remove contaminants and impurities from the engine oil. It is typically made of a metal canister housing with an inlet and outlet. The canister contains a filter media made of various materials, such as cellulose, synthetic fibers, or a combination of both.

The primary function of an automotive oil filter is to trap and remove particles such as dirt, dust, and other debris that accumulate in the engine oil during the combustion process and normal wear and tear. Additionally, the benefits of oil filters in maintaining oil quality and cleanliness of the engine oil ensure the oils retain their efficient lubrication properties and extend the engine's life.

The shift toward synthetic and semi-synthetic engine oils has been gaining momentum due to their enhanced performance and extended service intervals. These high-performance oils require compatible oil filters capable of handling their unique characteristics.

Emission standards are a set of quantitative limits on the permissible amount of air pollutants that may be released from vehicles over a limited time. They are designed to achieve air quality standards and to protect human health. Rising concerns about the environment, due to emission of harmful gases such as CO2, etc., has led to stringent air emission norms around the globe. For instance the average CO2 emissions target for new passenger automobiles is 130 grams per kilometer under EU Regulation No. 443/2009. Starting in 2021, a target of 95 grams per kilometer is anticipated to be applied.

Moreover, adherence to these norms are mandatory for automobile manufacturers; therefore, in order to meet these regulatory norms, the usage of filters in automobiles is likely to increase during the forecast period. This is estimated to offer significant automotive oil filter market opportunities for manufacturers of various types of automotive oil filters.

Emission regulations often target reducing particulate matter (PM) emissions, which include fine particles and soot emitted by internal combustion engines. Automotive oil filters are designed to capture and trap particles, such as soot and other contaminants, to prevent them from entering the engine and being emitted through the exhaust system. Enhanced engine oil filtration systems help reduce particulate emissions and comply with emission standards.

Increase in vehicle production means more vehicles are entering the market and being purchased by consumers. Rise in vehicle ownership propels the need for regular maintenance, including oil changes and filter replacements. This positively impacts the automotive oil filter market dynamics.

Growth of the automotive industry, particularly in emerging economies, has led to increased vehicle production. Expansion of the automotive sector in countries with rising middle-class populations and improving economic conditions results in higher vehicle sales and, subsequently, a greater demand for oil filters.

Rise in urbanization, worldwide, has led to greater demand for personal transportation. Demand for automobiles for commuting and transportation is increasing, as more number of people move to cities and urban areas. This urbanization contributes to the growth of the automotive industry. This, in turn, is estimated to augment the automotive oil filter market outlook in the next few years.

Apart from individual vehicle ownership, the expansion of commercial fleets, such as taxis, delivery vehicles, and logistics trucks, also contributes to the increased demand for automotive oil filters. Fleet operators require regular maintenance of their vehicles, including oil changes and filter replacements, to keep their vehicles running efficiently.

Based on fuel type, the automotive oil filter market segmentation comprises gasoline (petrol) and diesel. Diesel engine oil filters accounted for 52.04% of the total demand. Diesel engines operate at higher compression ratios and produce more heat as compared to gasoline engines. This is because diesel engines exert more stress on the engine oil, leading to increased wear and a higher accumulation of contaminants in the oil. Therefore, regular oil changes and the use of high-quality oil filters are essential in order to maintain the health and longevity of the engine.

Diesel engines are frequently used in heavy-duty applications, such as commercial trucks and construction equipment. These vehicles and machinery operate in challenging environments, where they are exposed to dust, dirt, and debris. Oil filters are essential to protect the engine from these harsh conditions and maintaining its efficiency.

Based on filter type, the fuel filter segment accounted for 37.80% of the automotive oil filter market share in 2022. The quality of fuel varies from region to region, and contaminants can be present in the fuel supply. Fuel filters play a critical role in removing particles, debris, and impurities from the fuel before it reaches the engine. Clean fuel is essential for the proper functioning and longevity of the engine, making fuel filters a crucial component in maintaining engine performance.

Fuel injectors in modern engines operate at high pressures and have small openings, making them susceptible to clogging from even minor contaminants. Innovative car lubricant and fuel filters prevent these contaminants from reaching the fuel injectors and other engine components, ensuring smooth fuel flow and preventing potential damage.

According to the regional analysis of the automotive oil filter market research, Asia Pacific is anticipated to dominate the global automotive oil filter business in terms of volume and revenue. The automotive industry in the region has experienced significant growth in the last few years. Rising incomes, urbanization, and increasing access to credit have led to a surge in vehicle ownership and sales. Increase in number of vehicles on road fuels the demand for regular maintenance, including oil changes and replacements of oil filters.

Moreover, Asia Pacific is home to some of the world's most populous countries, and consequently, the vehicle fleet size is substantially high in the region. The larger the vehicle fleet, the higher the demand for automotive oil filters for routine maintenance and replacements.

Several countries in Asia Pacific are implementing stringent emission regulations to address air pollution and environmental concerns. Clean engine oil, facilitated by high-quality oil filters, is essential to comply with these emission standards and maintain engine health.

The global automotive oil filter industry is highly fragmented among major players who have presence worldwide. Market participants are following the latest automotive oil filter market trends and creating supply chain networks to increase their revenue share. However, key companies are enhancing their market positions through collaborations, mergers, acquisitions, and expansion of product lines. Key players operating in the automotive oil filter business include AL Group LTD, ALCO Filters Ltd., Baldwin Filters, Cummins Inc., DENSO CORPORATION, Donaldson Company, Inc., Fildex Filters Canada, FILTRAK BRANDT GmbH, K&N Engineering Inc., Luman Group, MAHLE GmbH, MANN + HUMMELS, Nevsky Filter, Robert Bosch GmbH, Siam Filter Products LTD, Sogefi SpA, and UFI Filters.

The automotive oil filter market report also contains profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 4.2 Bn |

|

Market Forecast Value in 2031 |

US$ 4.3 Bn |

|

Growth Rate (CAGR) |

0.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

Units for Volume & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

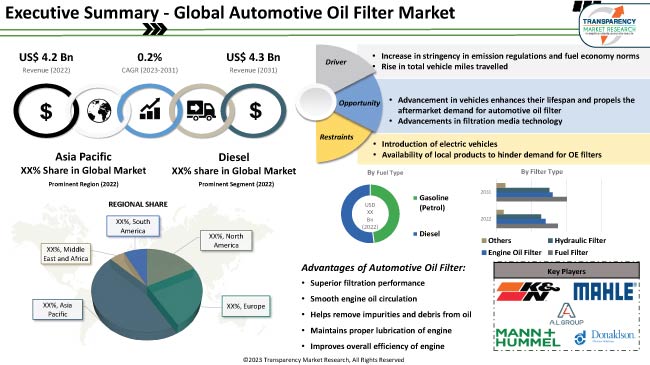

The global market was valued at US$ 4.2 Bn in 2022

It is expected to expand at a CAGR of 0.25% by 2031

The global business is estimated to reach a value of US$ 4.3 Bn in 2031

Stringent regulations on vehicle emission and the global increase in vehicle production

In terms of fuel type, the diesel segment accounted for 52.04% share in 2022

Asia Pacific registered highest demand for automotive oil filter in 2022

AL Group LTD, ALCO Filters Ltd., Baldwin Filters, Cummins Inc., DENSO CORPORATION, Donaldson Company, Inc., Fildex Filters Canada, FILTRAK BRANDT GmbH, K&N Engineering Inc., Luman Group, MAHLE GmbH, MANN + HUMMELS, Nevsky Filter, Robert Bosch GmbH, Siam Filter Products LTD, Sogefi SpA, UFI Filters

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value, Units, US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Value Chain Analysis

2.10. Gross Margin Analysis

3. Global Automotive Oil Filter Market, by Fuel Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Fuel Type

3.2.1. Gasoline (Petrol)

3.2.2. Diesel

4. Global Automotive Oil Filter Market, by Filter Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Type

4.2.1. Fuel Filter

4.2.2. Engine Oil Filter

4.2.3. Hydraulic Oil Filter

4.2.4. Others

5. Global Automotive Oil Filter Market, by Filter Media

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Media

5.2.1. Cellulose

5.2.2. Synthetic

5.2.3. Others

6. Global Automotive Oil Filter Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

6.2.1. Passenger Cars

6.2.1.1. Hatchback

6.2.1.2. Sedan

6.2.1.3. SUVs

6.2.2. Light Commercial Vehicles

6.2.3. Heavy Duty Trucks

6.2.4. Buses and Coaches

6.2.5. Off-road Vehicles

6.2.5.1. Agriculture Tractors & Equipment

6.2.5.2. Construction & Mining Equipment

6.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

7. Global Automotive Oil Filter Market, by Sales Channel

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Sales Channel

7.2.1. OEMs

7.2.2. Aftermarket

8. Global Automotive Oil Filter Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Oil Filter Market

9.1. Market Snapshot

9.2. North America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Fuel Type

9.2.1. Gasoline (Petrol)

9.2.2. Diesel

9.3. North America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Type

9.3.1. Fuel Filter

9.3.2. Engine Oil Filter

9.3.3. Hydraulic Oil Filter

9.3.4. Others

9.4. North America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Media

9.4.1. Cellulose

9.4.2. Synthetic

9.4.3. Others

9.5. North America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

9.5.1. Passenger Cars

9.5.1.1. Hatchback

9.5.1.2. Sedan

9.5.1.3. SUVs

9.5.2. Light Commercial Vehicles

9.5.3. Heavy Duty Trucks

9.5.4. Buses and Coaches

9.5.5. Off-road Vehicles

9.5.5.1. Agriculture Tractors & Equipment

9.5.5.2. Construction & Mining Equipment

9.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

9.6. North America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Sales Channel

9.6.1. OEMs

9.6.2. Aftermarket

9.7. Key Country Analysis - North America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Automotive Oil Filter Market

10.1. Market Snapshot

10.2. Europe Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Fuel Type

10.2.1. Gasoline (Petrol)

10.2.2. Diesel

10.3. Europe Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Type

10.3.1. Fuel Filter

10.3.2. Engine Oil Filter

10.3.3. Hydraulic Oil Filter

10.3.4. Others

10.4. Europe Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Media

10.4.1. Cellulose

10.4.2. Synthetic

10.4.3. Others

10.5. Europe Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

10.5.1. Passenger Cars

10.5.1.1. Hatchback

10.5.1.2. Sedan

10.5.1.3. SUVs

10.5.2. Light Commercial Vehicles

10.5.3. Heavy Duty Trucks

10.5.4. Buses and Coaches

10.5.5. Off-road Vehicles

10.5.5.1. Agriculture Tractors & Equipment

10.5.5.2. Construction & Mining Equipment

10.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

10.6. Europe Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Sales Channel

10.6.1. OEMs

10.6.2. Aftermarket

10.7. Key Country Analysis - Europe Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031

10.7.1. Germany

10.7.2. U. K.

10.7.3. France

10.7.4. Italy

10.7.5. Spain

10.7.6. Nordic Countries

10.7.7. Russia & CIS

10.7.8. Rest of Europe

11. Asia Pacific Automotive Oil Filter Market

11.1. Market Snapshot

11.2. Asia Pacific Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Fuel Type

11.2.1. Gasoline (Petrol)

11.2.2. Diesel

11.3. Asia Pacific Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Type

11.3.1. Fuel Filter

11.3.2. Engine Oil Filter

11.3.3. Hydraulic Oil Filter

11.3.4. Others

11.4. Asia Pacific Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Media

11.4.1. Cellulose

11.4.2. Synthetic

11.4.3. Others

11.5. Asia Pacific Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

11.5.1. Passenger Cars

11.5.1.1. Hatchback

11.5.1.2. Sedan

11.5.1.3. SUVs

11.5.2. Light Commercial Vehicles

11.5.3. Heavy Duty Trucks

11.5.4. Buses and Coaches

11.5.5. Off-road Vehicles

11.5.5.1. Agriculture Tractors & Equipment

11.5.5.2. Construction & Mining Equipment

11.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

11.6. Asia Pacific Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Sales Channel

11.6.1. OEMs

11.6.2. Aftermarket

11.7. Key Country Analysis - Asia Pacific Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. ASEAN Countries

11.7.5. South Korea

11.7.6. ANZ

11.7.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Oil Filter Market

12.1. Market Snapshot

12.2. Middle East & Africa Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Fuel Type

12.2.1. Gasoline (Petrol)

12.2.2. Diesel

12.3. Middle East & Africa Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Type

12.3.1. Fuel Filter

12.3.2. Engine Oil Filter

12.3.3. Hydraulic Oil Filter

12.3.4. Others

12.4. Middle East & Africa Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Media

12.4.1. Cellulose

12.4.2. Synthetic

12.4.3. Others

12.5. Middle East & Africa Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

12.5.1. Passenger Cars

12.5.1.1. Hatchback

12.5.1.2. Sedan

12.5.1.3. SUVs

12.5.2. Light Commercial Vehicles

12.5.3. Heavy Duty Trucks

12.5.4. Buses and Coaches

12.5.5. Off-road Vehicles

12.5.5.1. Agriculture Tractors & Equipment

12.5.5.2. Construction & Mining Equipment

12.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

12.6. Middle East & Africa Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Sales Channel

12.6.1. OEMs

12.6.2. Aftermarket

12.7. Key Country Analysis - Middle East & Africa Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Turkey

12.7.4. Rest of Middle East & Africa

13. South America Automotive Oil Filter Market

13.1. Market Snapshot

13.2. South America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Fuel Type

13.2.1. Gasoline (Petrol)

13.2.2. Diesel

13.3. South America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Type

13.3.1. Fuel Filter

13.3.2. Engine Oil Filter

13.3.3. Hydraulic Oil Filter

13.3.4. Others

13.4. South America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Filter Media

13.4.1. Cellulose

13.4.2. Synthetic

13.4.3. Others

13.5. South America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

13.5.1. Passenger Cars

13.5.1.1. Hatchback

13.5.1.2. Sedan

13.5.1.3. SUVs

13.5.2. Light Commercial Vehicles

13.5.3. Heavy Duty Trucks

13.5.4. Buses and Coaches

13.5.5. Off-road Vehicles

13.5.5.1. Agriculture Tractors & Equipment

13.5.5.2. Construction & Mining Equipment

13.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

13.6. South America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031, by Sales Channel

13.6.1. OEMs

13.6.2. Aftermarket

13.7. Key Country Analysis - South America Automotive Oil Filter Market Size Analysis & Forecast, 2017-2031

13.7.1. Brazil

13.7.2. Argentina

13.7.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Pricing comparison among key players

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. AL Group LTD

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. ALCO Filters Ltd.

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Baldwin Filters

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Cummins Inc.

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. DENSO CORPORATION

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Donaldson Company, Inc.

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Fildex Filters Canada

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. FILTRAK BRANDT GmbH

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. K&N Engineering Inc.

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Luman Group

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. MAHLE GmbH

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. MANN + HUMMELS

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Nevsky Filter

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Robert Bosch GmbH

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. Siam Filter Products LTD

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. Sogefi SpA

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

15.17. UFI Filters

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Production Locations

15.17.4. Product Portfolio

15.17.5. Competitors & Customers

15.17.6. Subsidiaries & Parent Organization

15.17.7. Recent Developments

15.17.8. Financial Analysis

15.17.9. Profitability

15.17.10. Revenue Share

15.18. Other Key Players

15.18.1. Company Overview

15.18.2. Company Footprints

15.18.3. Production Locations

15.18.4. Product Portfolio

15.18.5. Competitors & Customers

15.18.6. Subsidiaries & Parent Organization

15.18.7. Recent Developments

15.18.8. Financial Analysis

15.18.9. Profitability

15.18.10. Revenue Share

List of Tables

Table 1: Global Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Table 2: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 3: Global Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Table 4: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Table 5: Global Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Table 6: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Table 7: Global Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 11: Global Automotive Oil Filter Market Volume (Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Table 14: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 15: North America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Table 16: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Table 17: North America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Table 18: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Table 19: North America Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 20: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 21: North America Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 23: North America Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Table 26: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 27: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Table 28: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Table 29: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Table 30: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Table 31: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 33: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 35: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Table 38: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 39: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Table 40: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Table 41: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Table 42: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Table 43: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 45: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 47: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Table 50: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 51: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Table 52: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Table 53: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Table 54: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Table 55: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Table 62: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 63: South America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Table 64: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Table 65: South America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Table 66: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Table 67: South America Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 68: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 69: South America Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 71: South America Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Figure 2: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 3: Global Automotive Oil Filter Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Figure 5: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Figure 6: Global Automotive Oil Filter Market, Incremental Opportunity, by Filter Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Figure 8: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Figure 9: Global Automotive Oil Filter Market, Incremental Opportunity, by Filter Media, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Oil Filter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Automotive Oil Filter Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 16: Global Automotive Oil Filter Market Volume (Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Oil Filter Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Oil Filter Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Figure 20: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 21: North America Automotive Oil Filter Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Figure 23: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Figure 24: North America Automotive Oil Filter Market, Incremental Opportunity, by Filter Type, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Figure 26: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Figure 27: North America Automotive Oil Filter Market, Incremental Opportunity, by Filter Media, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: North America Automotive Oil Filter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Automotive Oil Filter Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 34: North America Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Oil Filter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Figure 38: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 39: Europe Automotive Oil Filter Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Figure 41: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Figure 42: Europe Automotive Oil Filter Market, Incremental Opportunity, by Filter Type, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Figure 44: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Figure 45: Europe Automotive Oil Filter Market, Incremental Opportunity, by Filter Media, Value (US$ Bn), 2022-2031

Figure 46: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Automotive Oil Filter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 49: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Automotive Oil Filter Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 52: Europe Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Oil Filter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Figure 56: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 57: Asia Pacific Automotive Oil Filter Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Figure 59: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Figure 60: Asia Pacific Automotive Oil Filter Market, Incremental Opportunity, by Filter Type, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Figure 62: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Figure 63: Asia Pacific Automotive Oil Filter Market, Incremental Opportunity, by Filter Media, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Oil Filter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Automotive Oil Filter Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Oil Filter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Figure 74: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 75: Middle East & Africa Automotive Oil Filter Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Figure 77: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Figure 78: Middle East & Africa Automotive Oil Filter Market, Incremental Opportunity, by Filter Type, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Figure 80: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Figure 81: Middle East & Africa Automotive Oil Filter Market, Incremental Opportunity, by Filter Media, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Oil Filter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Oil Filter Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Oil Filter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 91: South America Automotive Oil Filter Market Volume (Units) Forecast, by Fuel Type, 2017-2031

Figure 92: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 93: South America Automotive Oil Filter Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 94: South America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Type, 2017-2031

Figure 95: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Type, 2017-2031

Figure 96: South America Automotive Oil Filter Market, Incremental Opportunity, by Filter Type, Value (US$ Bn), 2022-2031

Figure 97: South America Automotive Oil Filter Market Volume (Units) Forecast, by Filter Media, 2017-2031

Figure 98: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Filter Media, 2017-2031

Figure 99: South America Automotive Oil Filter Market, Incremental Opportunity, by Filter Media, Value (US$ Bn), 2022-2031

Figure 100: South America Automotive Oil Filter Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 101: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Automotive Oil Filter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 103: South America Automotive Oil Filter Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Automotive Oil Filter Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 106: South America Automotive Oil Filter Market Volume (Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Oil Filter Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Oil Filter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031