Analysts’ Viewpoint on Market Scenario

Significant expansion of data centers is a key factor driving North America wall fan coil market growth. Increase in reliance on internet and social media as well as advancements in technology have led to a surge in number of data centers. Additionally, growth in concerns about global warming is expected to boost the sales of wall fan coil units. This, in turn, is expected to positively impact the North America wall fan coil industry growth.

Expansion of the retail sector has boosted the construction of commercial and warehouse infrastructure where heating and cooling systems are extensively used. Key players such as Carrier Corporation and Daikin Industries Ltd. are investing in technological advancements in wall fan coils. Companies are also developing new designs to meet customer needs and increase their North America wall fan coil market share.

Wall-mounted fan coil unit, also known as a fan coil unit (FCU), consists of a heating or cooling heat exchanger or coil or fan. It is part of the HVAC system in residential, commercial, and industrial buildings. Wall-mounted fan coil is a device that uses a coil and a fan to heat or cool a room without connecting to ductwork.

Wall-mounted fan coil unit is used to control the temperature of the installation space. The temperature is manually controlled by a switch or a thermostat. The thermostat controls the flow of water to the heat exchanger using a control valve and/or fan speed. According to the North America wall fan coil industry research report, growth of the construction industry is leading to a rise in sales of wall fan coils.

Fan coil units (FCU) make HVAC systems ergonomic and quieter in handling air conditioning. Wall-mounted fan coil units improve indoor air quality and thus provide comfort inside buildings. Indoor air moves over a coil, which further heats or cools the air before throwing it back into the room. FCUs are less expensive to install than ducted systems. Thus, the utilization of FCUs in HVAC is rising. Since the wall-mounted fan coil unit is installed on the wall, it occupies minimum space as compared to other fan coil units.

Demand for wall fan coil units is rising in commercial establishments (offices, shopping malls, retail stores, hotels, and restaurants), as high-efficiency wall fan coil units for heating and cooling systems ensure that accommodation in buildings is more comfortable.

Fan coil unit (FCU) comprises a fan that draws air from the space into the unit and blows it over a cooling or heating coil. The air coming out of the fan coil unit (FCU) is hotter or cooler than before. Fan coil units are used in office buildings and shopping centers, as well as in small spaces for relief from congestion.

Offline distribution channels contribute significantly to the sale of wall fan coils in North America. This can be ascribed to instant access to the product and purchasing convenience. Customers can conduct quality checks in offline stores, whereas on-the-spot quality checks are not possible in the online distribution platforms.

The U.S. is anticipated to hold the largest share of the North America wall fan coil market during the forecast period. Rise in demand for wall fan coils in various end-use applications for controlling air temperature and ventilation is driving the market in the U.S.

Latest advancements in wall fan coils are helping to develop energy efficient heating and cooling systems that are more affordable. This helps in penetrating new markets and offers significant opportunities to the North America wall fan coil market.

North America wall fan coil manufacturers & suppliers include Carrier Corporation, Williams International, Haier lnc., Hitachi, Ltd., LG Electronics Inc., Zehnder Group, REFRA, Daikin Industries, Ltd., International Electrotechnical Commission, and Johnson Controls.

|

Attribute |

Detail |

|

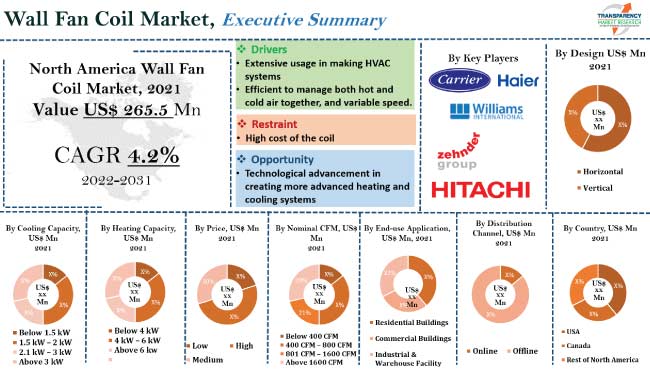

Market Size Value in 2021 (Base Year) |

US$ 265.5 Mn |

|

Market Forecast Value in 2031 |

US$ 400.7 Mn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

North America Wall Fan Coil Industry Analysis |

North America qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, and regulatory analysis. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Country Covered |

|

|

Wall Fan Coil Market Segmentation |

|

|

North America Wall Fan Coil Market Players Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It stood at US$ 265.5 Mn.

It is expected to reach US$ 400.7 Mn.

It is estimated to grow at a CAGR of 4.2%.

Extensive usage in making HVAC systems, efficiency in managing hot and cold air together, and variable speed.

The offline segment contributed the largest share in 2021.

The U.S. is a more attractive country for vendors.

Carrier Corporation, Williams International, Haier lnc., Hitachi, Ltd., LG Electronics Inc., Zehnder Group, REFRA, Daikin Industries, Ltd., International Electrotechnical Commission, and Johnson Controls.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Fan Coil Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Roadmap

5.9. Regulatory Framework

5.10. North America Wall Fan Coil Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. North America Wall Fan Coil Market Analysis and Forecast, By Design

6.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Design, 2017 - 2031

6.1.1. Horizontal

6.1.2. Vertical

6.2. Incremental Opportunity, By Design

7. North America Wall Fan Coil Market Analysis and Forecast, By Cooling Capacity

7.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Cooling Capacity, 2017 - 2031

7.1.1. Below 1.5 kW

7.1.2. 1.5 kW - 2 kW

7.1.3. 2.1 kW - 3 kW

7.1.4. Above 3 kW

7.2. Incremental Opportunity, By Cooling Capacity

8. North America Wall Fan Coil Market Analysis and Forecast, By Heating Capacity

8.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Heating Capacity, 2017 - 2031

8.1.1. Below 4 kW

8.1.2. 4 kW – 6 kW

8.1.3. Above 6 kW

8.2. Incremental Opportunity, By Heating Capacity

9. North America Wall Fan Coil Market Analysis and Forecast, By Price

9.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, By Price

10. North America Wall Fan Coil Market Analysis and Forecast, By Nominal CFM

10.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Nominal CFM, 2017 - 2031

10.1.1. Below 400 CFM

10.1.2. 400 CFM - 800 CFM

10.1.3. 801 CFM - 1600 CFM

10.1.4. Above 1600 CFM

10.2. Incremental Opportunity, By Nominal CFM

11. North America Wall Fan Coil Market Analysis and Forecast, By End-Use Application

11.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By End-use Application, 2017 - 2031

11.1.1. Residential Buildings

11.1.2. Commercial Buildings

11.1.2.1. Office Space

11.1.2.2. Hotels

11.1.2.3. Restaurants

11.1.2.4. Hospitals

11.1.2.5. Retail

11.1.2.6. Others

11.1.3. Industrial & Warehouse Facility

11.2. Incremental Opportunity, By End-use Application

12. North America Wall Fan Coil Market Analysis and Forecast, By Distribution Channel

12.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

12.1.1. Online Sales

12.1.1.1. E-Commerce Website

12.1.1.2. Company Owned Website

12.1.2. Offline Sales

12.1.2.1. Specialized Store

12.1.2.2. Mega-Retail Store

12.1.2.3. Others

12.2. Incremental Opportunity, By Distribution Channel

13. North America Wall Fan Coil Market Analysis and Forecast, Country & Sub-region

13.1. North America Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Country & Sub-region, 2017 - 2031

13.1.1. USA

13.1.2. Canada

13.1.3. Rest of North America

13.2. Incremental Opportunity, By Country

14. USA Wall Fan Coil Market Analysis and Forecast

14.1. Country Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Design, 2017 - 2031

14.5.1. Horizontal

14.5.2. Vertical

14.6. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Cooling Capacity, 2017 - 2031

14.6.1. Below 1.5 kW

14.6.2. 1.5 kW - 2 kW

14.6.3. 2.1 kW - 3 kW

14.6.4. Above 3 kW

14.7. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Heating Capacity, 2017 - 2031

14.7.1. Below 4 kW

14.7.2. 4 kW – 6 kW

14.7.3. Above 6 kW

14.8. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

14.8.1. Low

14.8.2. Medium

14.8.3. High

14.9. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Nominal CFM, 2017 - 2031

14.9.1. Below 400 CFM

14.9.2. 400 CFM - 800 CFM

14.9.3. 801 CFM - 1600 CFM

14.9.4. Above 1600 CFM

14.10. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By End-use Application, 2017 - 2031

14.10.1. Residential Buildings

14.10.2. Commercial Buildings

14.10.2.1. Office Space

14.10.2.2. Hotels

14.10.2.3. Restaurants

14.10.2.4. Hospitals

14.10.2.5. Retail

14.10.2.6. Others

14.10.3. Industrial & Warehouse Facility

14.11. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

14.11.1. Online Sales

14.11.1.1. E-Commerce Website

14.11.1.2. Company Owned Website

14.11.2. Offline Sales

14.11.2.1. Specialized Store

14.11.2.2. Mega-Retail Store

14.11.2.3. Others

14.12. Incremental Opportunity Analysis

15. Canada Wall Fan Coil Market Analysis and Forecast

15.1. Country Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Design, 2017 - 2031

15.5.1. Horizontal

15.5.2. Vertical

15.6. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Cooling Capacity, 2017 - 2031

15.6.1. Below 1.5 kW

15.6.2. 1.5 kW - 2 kW

15.6.3. 2.1 kW - 3 kW

15.6.4. Above 3 kW

15.7. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Heating Capacity, 2017 - 2031

15.7.1. Below 4 kW

15.7.2. 4 kW – 6 kW

15.7.3. Above 6 kW

15.8. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

15.8.1. Low

15.8.2. Medium

15.8.3. High

15.9. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Nominal CFM, 2017 - 2031

15.9.1. Below 400 CFM

15.9.2. 400 CFM - 800 CFM

15.9.3. 801 CFM - 1600 CFM

15.9.4. Above 1600 CFM

15.10. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By End-use Application, 2017 - 2031

15.10.1. Residential Building

15.10.2. Commercial Building

15.10.2.1. Office Space

15.10.2.2. Hotels

15.10.2.3. Restaurants

15.10.2.4. Hospitals

15.10.2.5. Retail

15.10.2.6. Others

15.10.3. Industrial & Warehouse Facility

15.11. Wall Fan Coil Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

15.11.1. Online Sales

15.11.1.1. E-Commerce Website

15.11.1.2. Company Owned Website

15.11.2. Offline Sales

15.11.2.1. Specialized Store

15.11.2.2. Mega-Retail Store

15.11.2.3. Others

15.12. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2021

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. Carrier Corporation

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. Williams International

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Haier lnc.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. Hitachi, Ltd.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. LG Electronics Inc.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. Zehnder Group

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. REFRA

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Daikin Industries, Ltd.

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. International Electrotechnical Commission

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Johnson Controls

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Design

17.1.2. Cooling Capacity

17.1.3. Heating Capacity

17.1.4. Price

17.1.5. Nominal CFM

17.1.6. End-Use Application

17.1.7. Distribution Channels

17.1.8. Geography

17.2. Understanding the Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Wall Fan Coil Market, By Design, Thousand Units, 2017-2031

Table 2: North America Wall Fan Coil Market, By Design, US$ Mn, 2017-2031

Table 3: North America Wall Fan Coil Market, By Cooling Capacity, Thousand Units, 2017-2031

Table 4: North America Wall Fan Coil Market, By Cooling Capacity, US$ Mn, 2017-2031

Table 5: North America Wall Fan Coil Market, By Heating Capacity, Thousand Units, 2017-2031

Table 6: North America Wall Fan Coil Market, By Heating Capacity, US$ Mn, 2017-2031

Table 7: North America Wall Fan Coil Market, By Price, Thousand Units, 2017-2031

Table 8: North America Wall Fan Coil Market, By Price, US$ Mn, 2017-2031

Table 9: North America Wall Fan Coil Market, By Nominal CFM, Thousand Units, 2017-2031

Table 10: North America Wall Fan Coil Market, By Nominal CFM, US$ Mn, 2017-2031

Table 11: North America Wall Fan Coil Market, By End-use Application, Thousand Units, 2017-2031

Table 12: North America Wall Fan Coil Market, By End-use Application, US$ Mn, 2017-2031

Table 13: North America Wall Fan Coil Market, By Distribution Channel, Thousand Units, 2017-2031

Table 14: North America Wall Fan Coil Market, By Distribution Channel, US$ Mn, 2017-2031

Table 15: North America Wall Fan Coil Market, By Country, Thousand Units, 2017-2031

Table 16: North America Wall Fan Coil Market, By Country, US$ Mn, 2017-2031

Table 17: USA Wall Fan Coil Market, By Design, Thousand Units, 2017-2031

Table 18: USA Wall Fan Coil Market, By Design, US$ Mn, 2017-2031

Table 19: USA Wall Fan Coil Market, By Cooling Capacity, Thousand Units, 2017-2031

Table 20: USA Wall Fan Coil Market, By Cooling Capacity, US$ Mn, 2017-2031

Table 21: USA Wall Fan Coil Market, By Heating Capacity, Thousand Units, 2017-2031

Table 22: USA Wall Fan Coil Market, By Heating Capacity, US$ Mn, 2017-2031

Table 23: USA Wall Fan Coil Market, By Price, Thousand Units, 2017-2031

Table 24: USA Wall Fan Coil Market, By Price, US$ Mn, 2017-2031

Table 25: USA Wall Fan Coil Market, By Nominal CFM, Thousand Units, 2017-2031

Table 26: USA Wall Fan Coil Market, By Nominal CFM, US$ Mn, 2017-2031

Table 27: USA Wall Fan Coil Market, By End-Use Application, Thousand Units, 2017-2031

Table 28: USA Wall Fan Coil Market, By End-Use Application, US$ Mn, 2017-2031

Table 29: USA Wall Fan Coil Market, By Distribution Channel, Thousand Units, 2017-2031

Table 30: USA Wall Fan Coil Market, By Distribution Channel, US$ Mn, 2017-2031

Table 31: Canada Wall Fan Coil Market, By Design, Thousand Units, 2017-2031

Table 32: Canada Wall Fan Coil Market, By Design, US$ Mn, 2017-2031

Table 33: Canada Wall Fan Coil Market, By Cooling Capacity, Thousand Units, 2017-2031

Table 34: Canada Wall Fan Coil Market, By Cooling Capacity, US$ Mn, 2017-2031

Table 35: Canada Wall Fan Coil Market, By Heating Capacity, Thousand Units, 2017-2031

Table 36: Canada Wall Fan Coil Market, By Heating Capacity, US$ Mn, 2017-2031

Table 37: Canada Wall Fan Coil Market, By Price, Thousand Units, 2017-2031

Table 38: Canada Wall Fan Coil Market, By Price, US$ Mn, 2017-2031

Table 39: Canada Wall Fan Coil Market, By Nominal CFM, Thousand Units, 2017-2031

Table 40: Canada Wall Fan Coil Market, By Nominal CFM, US$ Mn, 2017-2031

Table 41: Canada Wall Fan Coil Market, By End-use Application, Thousand Units, 2017-2031

Table 42: Canada Wall Fan Coil Market, By End-use Application, US$ Mn, 2017-2031

Table 43: Canada Wall Fan Coil Market, By Distribution Channel, Thousand Units, 2017-2031

Table 44: Canada Wall Fan Coil Market, By Distribution Channel, US$ Mn, 2017-2031

List of Figures

Figure 1: North America Wall Fan Coil Market, By Design, Thousand Units, 2017-2031

Figure 2: North America Wall Fan Coil Market, By Design, US$ Mn, 2017-2031

Figure 3: North America Wall Fan Coil Market Incremental Opportunity, By Design, US$ Mn, 2017-2031

Figure 4: North America Wall Fan Coil Market, By Cooling Capacity, Thousand Units, 2017-2031

Figure 5: North America Wall Fan Coil Market, By Cooling Capacity, US$ Mn, 2017-2031

Figure 6: North America Wall Fan Coil Market Incremental Opportunity, By Cooling Capacity, US$ Mn, 2017-2031

Figure 7: North America Wall Fan Coil Market, By Heating Capacity, Thousand Units, 2017-2031

Figure 8: North America Wall Fan Coil Market, By Heating Capacity, US$ Mn, 2017-2031

Figure 9: North America Wall Fan Coil Market Incremental Opportunity, By Heating Capacity, US$ Mn, 2017-2031

Figure 10: North America Wall Fan Coil Market, By Price, Thousand Units, 2017-2031

Figure 11: North America Wall Fan Coil Market, By Price, US$ Mn, 2017-2031

Figure 12: North America Wall Fan Coil Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 13: North America Wall Fan Coil Market, By Nominal CFM, Thousand Units, 2017-2031

Figure 14: North America Wall Fan Coil Market, By Nominal CFM, US$ Mn, 2017-2031

Figure 15: North America Wall Fan Coil Market Incremental Opportunity, By Nominal CFM, US$ Mn, 2017-2031

Figure 16: North America Wall Fan Coil Market, By End-Use Application, Thousand Units, 2017-2031

Figure 17: North America Wall Fan Coil Market, By End-Use Application, US$ Mn, 2017-2031

Figure 18: North America Wall Fan Coil Market Incremental Opportunity, By End-use Application, US$ Mn, 2017-2031

Figure 19: North America Wall Fan Coil Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 20: North America Wall Fan Coil Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 21: North America Wall Fan Coil Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 22: North America Wall Fan Coil Market, By Country, Thousand Units, 2017-2031

Figure 23: North America Wall Fan Coil Market, By Country, US$ Mn, 2017-2031

Figure 24: North America Wall Fan Coil Market Incremental Opportunity, By Country, US$ Mn, 2017-2031

Figure 25: USA Wall Fan Coil Market, By Design, Thousand Units, 2017-2031

Figure 26: USA Wall Fan Coil Market, By Design, US$ Mn, 2017-2031

Figure 27: USA Wall Fan Coil Market Incremental Opportunity, By Design, US$ Mn, 2017-2031

Figure 28: USA Wall Fan Coil Market, By Cooling Capacity, Thousand Units, 2017-2031

Figure 29: USA Wall Fan Coil Market, By Cooling Capacity, US$ Mn, 2017-2031

Figure 30: USA Wall Fan Coil Market Incremental Opportunity, By Cooling Capacity, US$ Mn, 2017-2031

Figure 31: USA Wall Fan Coil Market, By Heating Capacity, Thousand Units, 2017-2031

Figure 32: USA Wall Fan Coil Market, By Heating Capacity, US$ Mn, 2017-2031

Figure 33: USA Wall Fan Coil Market Incremental Opportunity, By Heating Capacity, US$ Mn, 2017-2031

Figure 34: USA Wall Fan Coil Market, By Price, Thousand Units, 2017-2031

Figure 35: USA Wall Fan Coil Market, By Price, US$ Mn, 2017-2031

Figure 36: USA Wall Fan Coil Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 37: USA Wall Fan Coil Market, By Nominal CFM, Thousand Units, 2017-2031

Figure 38: USA Wall Fan Coil Market, By Nominal CFM, US$ Mn, 2017-2031

Figure 39: USA Wall Fan Coil Market Incremental Opportunity, By Nominal CFM, US$ Mn, 2017-2031

Figure 40: USA Wall Fan Coil Market, By End-Use Application, Thousand Units, 2017-2031

Figure 41: USA Wall Fan Coil Market, By End-Use Application, US$ Mn, 2017-2031

Figure 42: USA Wall Fan Coil Market Incremental Opportunity, By End-use Application, US$ Mn, 2017-2031

Figure 43: USA Wall Fan Coil Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 44: USA Wall Fan Coil Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 45: USA Wall Fan Coil Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 46: Canada Wall Fan Coil Market, By Design, Thousand Units, 2017-2031

Figure 47: Canada Wall Fan Coil Market, By Design, US$ Mn, 2017-2031

Figure 48: Canada Wall Fan Coil Market Incremental Opportunity, By Design, US$ Mn, 2017-2031

Figure 49: Canada Wall Fan Coil Market, By Cooling Capacity, Thousand Units, 2017-2031

Figure 50: Canada Wall Fan Coil Market, By Cooling Capacity, US$ Mn, 2017-2031

Figure 51: Canada Wall Fan Coil Market Incremental Opportunity, By Cooling Capacity, US$ Mn, 2017-2031

Figure 52: Canada Wall Fan Coil Market, By Heating Capacity, Thousand Units, 2017-2031

Figure 53: Canada Wall Fan Coil Market, By Heating Capacity, US$ Mn, 2017-2031

Figure 54: Canada Wall Fan Coil Market Incremental Opportunity, By Heating Capacity, US$ Mn, 2017-2031

Figure 55: Canada Wall Fan Coil Market, By Price, Thousand Units, 2017-2031

Figure 56: Canada Wall Fan Coil Market, By Price, US$ Mn, 2017-2031

Figure 57: Canada Wall Fan Coil Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 58: Canada Wall Fan Coil Market, By Nominal CFM, Thousand Units, 2017-2031

Figure 59: Canada Wall Fan Coil Market, By Nominal CFM, US$ Mn, 2017-2031

Figure 60: Canada Wall Fan Coil Market Incremental Opportunity, By Nominal CFM, US$ Mn, 2017-2031

Figure 61: Canada Wall Fan Coil Market, By End-Use Application, Thousand Units, 2017-2031

Figure 62: Canada Wall Fan Coil Market, By End-Use Application, US$ Mn, 2017-2031

Figure 63: Canada Wall Fan Coil Market Incremental Opportunity, By End-use Application, US$ Mn, 2017-2031

Figure 64: Canada Wall Fan Coil Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 65: Canada Wall Fan Coil Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 66: Canada Wall Fan Coil Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031