The market for ventricular assist devices (VAD) in North America has exhibited a great pace of development and the pace of adoption of these devices keeps on staying solid. A few variables are responsible for the rising interest for ventricular assist devices in the region, with the central ones being the increasing pace of incidence of cardiovascular diseases and the immense pool of patients anticipating donor hearts for transplant.

It is evaluated that advance cardiovascular breakdown influences about 2.3% of the all out population of North America and is a significant socioeconomic burden. The ascent in the region's geriatric population, which is a segment progressively vulnerable to cardiovascular breakdowns, the rising population of smokers, solid spotlight on R&D exercises focused on the advancement of increasingly compelling devices, and ideal government activities are additionally driving the market for ventricular assist devices in the region.

From a topographical point of view, the ventricular assist devices advertise has been analyzed for the U.S. what's more, Canada. Of these, the U.S. represented over an extensive portion of the general market in 2015 and is relied upon to keep on bookkeeping a similarly huge offer throughout the following not many years also. The U.S. advertise is relied upon to hold its strength inferable from the nearness of a portion of the North America and worldwide market's driving organizations, a noteworthy ascent in new innovative work exercises, and expanded patient mindfulness about the assortment of items accessible in the market to successfully oversee number of heart diseases.

The Canada advertise directly represents a generally small offer in the North America ventricular assist devices showcase however is relied upon to observe development at a consistent pace in the following hardly any years. The increasing pace of incidence of cardiovascular diseases and a great repayment picture are required to fuel the market for ventricular assist devices in the nation in the following not many years. In addition, the market in Canada is likewise expected to profit by the low force of rivalry in the seller scene, which makes the nation a promising speculation ground for organizations seeking to go into the field of ventricular assist devices.

North America Ventricular Assist Device Market: Snapshot

The market for ventricular assist devices (VAD) in North America has exhibited an excellent rate of growth and the rate of adoption of these devices continues to remain strong. Several factors are responsible for the rising demand for ventricular assist devices in the region, with the chief ones being the rising rate of incidence of cardiovascular diseases and the vast pool of patients awaiting donor hearts for transplant.

It is estimated that advance heart failure affects nearly 2.3% of the total population of North America and is a major socioeconomic burden. The rise in the region’s geriatric population, which is a demographic more susceptible to heart failures, the rising population of smokers, strong focus on R&D activities aimed at the development of more effective devices, and favorable government initiatives are also driving the market for ventricular assist devices in the region.

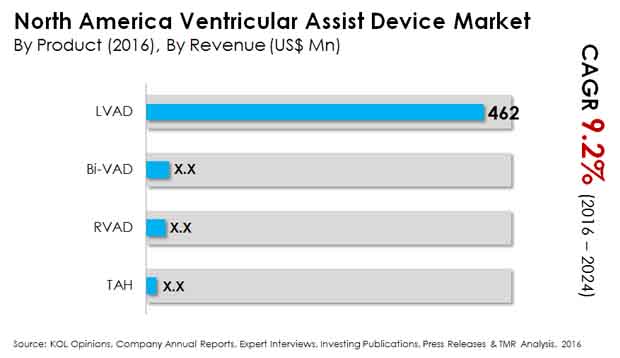

Transparency Market Research states that the market will exhibit a promising 9.20% CAGR over the period between 2016 and 2024, rising from a valuation of US$0.49 bn in 2015 to US$1.07 bn by 2024.

LVADs to Continue Amass Maximum Share in North America VAD Market

The key ventricular assist devices in the North America market include bi-ventricular assist devices (Bi-VADs), left ventricular assist devices (LAVDs), right ventricular assist devices (RVADs), and total artificial hearts (TAHs).

Of these, the segment of left ventricular assist devices has been witnessing a relatively higher demand for ventricular assistance in the North America market. The trend is expected to remain strong over the next few years, with the segment expected to exhibit a promising 9.6% CAGR over the period between 2016 and 2024. The segment of total artificial hearts is also expected to exhibit growth at a promising pace over the said period as technological advances allow the development of products with excellent operational capability. The increasing availability of such products is leading to their increased use as a bridge to transplant and in destination therapy.

Increased R&D Activities and Awareness to Help U.S. Retain Dominance

From a geographical perspective, the ventricular assist devices market has been examined for the U.S. and Canada. Of these, the U.S. accounted for over 80% of the overall market in 2015 and is expected to continue to account an equally significant share over the next few years as well. The U.S. market is expected to retain its dominance owing to the presence of some of the North America and global market’s leading companies, a significant rise in new research and development activities, and increased patient awareness about the variety of products available in the market to effectively manage a number of heart disease.

The Canada market presently accounts for a relatively meagre share in the North America ventricular assist devices market but is expected to witness growth at a steady pace in the next few years. The rising rate of incidence of cardiovascular diseases and a favorable reimbursement picture are expected to fuel the market for ventricular assist devices in the country in the next few years. Moreover, the market in Canada is also expected to benefit from the low intensity of competition in the vendor landscape, which makes the country a promising investment ground for companies aspiring to enter into the field of ventricular assist devices.

The highly competitive market for ventricular assist devices in North America features vendors such as Abiomed, Berlin Heart GmbH, Sunshine Heart Inc., St. Jude Medical, SynCardia Systems LLC, and Heart Ware International Inc. To gain a larger share in the market, companies have relied upon strategies such as product innovation and strategic alliances with new vendors and companies with technological prowess.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: North America Ventricular Assist Device Market

Chapter 4. Market Overview

4.1. Introduction

4.2. Key Industry Developments

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Forces Analysis

Chapter 5. North America Ventricular Assist Device Market Analysis and Forecast, By Product Type

5.1. Key Findings

5.2. Introduction

5.3. Market Size (US$ Mn) Forecast, by Product Type

5.3.1. Left Ventricular Assist Device (LVAD)

5.3.2. Right Ventricular Assist Device (RVAD)

5.3.3. Biventricular Assist Device (Bi-VAD)

5.3.4. Total Artificial Heart (TAH)

5.4. Market Attractiveness Analysis, by Product Type, 2015

5.5. Key Trends

Chapter 6. North America Ventricular Assist Device Market Analysis and Forecast, By Indication

6.1. Key Findings

6.2. Introduction

6.3. Market Size (US$ Mn) Forecast, by Indication

6.3.1. Bridge to Transplant (BTT)

6.3.2. Destination therapy (DT)

6.3.3. Bridge to Recovery (BTR)

6.4. Market Attractiveness Analysis, by Indication, 2014

6.5. Key Trends

Chapter 7. North America Ventricular Assist Device Market Analysis and Forecast, By Region

7.1. Market Scenario

7.2. Introduction

7.3. Market Size (US$ Mn) Forecast, by Region

7.3.1. U.S.

7.3.2. Canada

7.4. Market Attractiveness Analysis, by Region, 2015

Chapter 8. U.S. Ventricular Assist Device Market Analysis and Forecast

8.1. Key Findings

8.2. Introduction

8.3. Market Size (US$ Mn) Forecast, by Product Type

8.3.1. LVAD

8.3.2. RVAD

8.3.3. Bi-VAD

8.3.4. TAH

8.4. Market Size (US$ Mn) Forecast, by Indication

8.4.1. BTT

8.4.2. DT

8.4.3. BTR

8.5. Market Attractiveness Analysis, by Product Type, 2015

8.6. Market Attractiveness Analysis, by Indication, 2015

8.7. Key Trends

Chapter 9. Canada Ventricular Assist Device Market Analysis and Forecast

9.1. Key Findings

9.2. Introduction

9.3. Market Size (US$ Mn) Forecast, by Product Type

9.3.1. LVAD

9.3.2. RVAD

9.3.3. Bi-VAD

9.3.4. TAH

9.4. Market Size (US$ Mn) Forecast, by Indication

9.4.1. BTT

9.4.2. DT

9.4.3. BTR

9.5. Market Attractiveness Analysis, by Product Type, 2015

9.6. Market Attractiveness Analysis, by Indication, 2015

9.7. Key Trends

Chapter 10. Competition Landscape

10.1. North America Ventricular Assist Device Market Share Analysis, Key Players, 2015

10.2. Competition Matrix

10.3. Company Profiles

10.3.1. ABIOMED

10.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.1.2. Financial Overview

10.3.1.3. Product Portfolio

10.3.1.4. SWOT Analysis

10.3.1.5. Strategic Overview

10.3.2. Heart Ware International Inc.

10.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.2.2. Financial Overview

10.3.2.3. Product Portfolio

10.3.2.4. SWOT Analysis

10.3.2.5. Strategic Overview

10.3.3. St. Jude Medical

10.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.3.2. Financial Overview

10.3.3.3. Product Portfolio

10.3.3.4. SWOT Analysis

10.3.4. SUNSHINE HEART, Inc.

10.3.4.1. Company Overview (HQ, business segments, employee strength)

10.3.4.2. Financial Overview

10.3.4.3. Product Portfolio

10.3.4.4. SWOT Analysis

10.3.4.5. Strategic Overview

10.3.5. SynCardia Systems, LLC.

10.3.5.1. Company Overview (HQ, business segments, employee strength)

10.3.5.2. Product Portfolio

10.3.5.3. SWOT Analysis

10.3.5.4. Recent Developments

10.3.5.5. Strategic Overview

10.3.6. Berlin Heart GmbH

10.3.6.1. Company Overview (HQ, business segments, employee strength)

10.3.6.2. Financial Overview

10.3.6.3. Product Portfolio

10.3.6.4. SWOT Analysis

10.3.6.5. Strategic Overview

List of Tables

Table 1: North America Ventricular Assist Device Market Size Analysis and Forecast (US$ Mn), by Product Type, 2014–2024

Table 2: North America Ventricular Assist Device Market Size Analysis and Forecast (US$ Mn), by Indication, 2014–2024

Table 3: North America Ventricular Assist Device Market Size Analysis and Forecast (US$ Mn), by Region, 2014–2024

Table 4: U.S. Ventricular Assist Device Market Size Analysis and Forecast (US$ Mn), by Product Type, 2014–2024

Table 5: U.S. Ventricular Assist Device Market Size Analysis and Forecast (US$ Mn), by Indication Type, 2014–2024

Table 6: Canada Ventricular Assist Device Market Size Analysis and Forecast (US$ Mn), by Product Type, 2014–2024

Table 7: Canada Ventricular Assist Device Market Size Analysis and Forecast (US$ Mn), by Indication, 2014–2024

List of Figures

Figure 1: North America Ventricular Assist Device Market Size (US$ Mn), 2014–2024

Figure 2: North America Ventricular Assist Device Market Value Share Analysis, by Product Type, 2014 and 2024

Figure 3: North America LVAD Market Revenue (US$ Mn), 2014–2024

Figure 4: North America RVAD Market Revenue (US$ Mn), 2014–2024

Figure 5: North America Bi-VAD Market Revenue (US$ Mn), 2014–2024

Figure 6: North America TAH Market Revenue (US$ Mn), 2014–2024

Figure 7: North America Ventricular Assist Device Attractiveness Analysis, by Product Type, 2015

Figure 8: North America Ventricular Assist Device Value Share Analysis, by Indication, 2014 and 2024

Figure 9: North America BTT Market Revenue (US$ Mn), 2014–2024

Figure 10: North America DT Market Revenue (US$ Mn), 2014–2024

Figure 11: North America BTR Market Revenue (US$ Mn), 2014–2024

Figure 12: North America Ventricular Assist Device Attractiveness Analysis, by Indication, 2015

Figure 13: North America Ventricular Assist Device Value Share Analysis, by Region, 2014 and 2024

Figure 14: North America Ventricular Assist Device Attractiveness Analysis, by Region, 2015

Figure 15: U.S. Ventricular Assist Device Market Size (US$ Mn), 2014–2024

Figure 16: U.S. Ventricular Assist Device Market Y-o-Y Growth Projections, 2015–2024

Figure 17: U.S. Market Value Share Analysis, by Product Type, 2014 and 2024

Figure 18: U.S. Market Value Share Analysis, by Indication, 2014 and 2024

Figure 19: U.S. Ventricular Assist Device Market Analysis and Forecast, US$ Mn, by Product Type, 2014– 2024

Figure 20: U.S. Ventricular Assist Device Market Analysis and Forecast, US$ Mn, by Indication, 2014–2024

Figure 21: U.S. Ventricular Assist Device Market Attractiveness Analysis, by Product Type, 2015

Figure 22: U.S. Ventricular Assist Device Market Attractiveness Analysis, by Indication, 2015

Figure 23: Canada Ventricular Assist Device Market Size (US$ Mn), 2014–2024

Figure 24: Canada Ventricular Assist Device Market Y-o-Y Growth Projections, 2015–2024

Figure 25: Canada Market Value Share Analysis, by Product Type, 2014 and 2024

Figure 26: Canada Market Value Share Analysis, by Indication, 2014 and 2024

Figure 27: Canada Ventricular Assist Device Market Analysis and Forecast, US$ Mn, by Product Type, 2014–2024

Figure 28: Canada Ventricular Assist Device Market Analysis and Forecast, US$ Mn, by Indication, 2014–2024

Figure 29: Canada Ventricular Assist Device Market Attractiveness Analysis, by Product Type, 2015

Figure 30: Canada Ventricular Assist Device Market Attractiveness Analysis, by Indication, 2015

Figure 31: North America Ventricular Assist Device Market Share Analysis, by Company (2015)