Analysts’ Viewpoint

Rise in urbanization and growth in awareness about cleanliness are expected to drive the North America toilet paper market. Increase in population and rise in disposable income are fueling the demand for toilet paper. Surge in demand for toilet paper among end-use sectors such as hospitality, corporates, hospital, public facility, education institution, and retail & tourism is augmenting market progress.

Availability of toilet paper on various e-commerce platforms is anticipated to strengthen the North America toilet paper market demand. Key companies are focusing on research and development activities in order to accelerate the roll out of new products, such as bamboo toilet paper, to boost their market share.

Increase in awareness about cleanliness and sanitation is expected to propel the usage of toilet paper across the globe. Toilet paper also serves as a layer of protection for the hands. The cleaning products business has been experiencing significant growth in demand for its products and services, especially after the emergence of the COVID-19 pandemic.

Available in different layers, toilet paper is categorized into single ply toilet paper, double ply toilet paper, triple ply toilet paper, and more than 3 ply toilet paper. Materials used to make toilet paper include bamboo paper, wood pulp, and cotton.

Unsafe sanitation and hygiene is a global health concern, mostly for the poor. After the emergence of the COVID-19 disease, consumers are becoming more hygiene conscious and buying toilet paper and tissues to ensure safe hygiene practices. The outbreak of the pandemic led to a surge in demand for toilet paper. The work from home trend during the pandemic, businesses closing down due to lockdowns, and shelter-in-place orders resulted in considerable demand for consumer toilet paper. Furthermore, rise in awareness about the usage of environment-friendly, recycled, and plastic-free products is likely to boost market statistics in the next few years.

Expansion in tourism and hospitality industries is driving the toilet paper market. The tourism industry is likely to witness considerable growth in the next few years owing to the rise in number of people travelling across the world. This is expected to positively impact the hotel industry, where the demand for toilet paper is high.

Increase in number of commercial spaces such as spas, corporate offices, and educational institutes is also projected to boost market expansion. Usage of tissue paper in households and restaurants has increased significantly in recent times.

In terms of end-user, the residential segment is anticipated to dominate the North America toilet paper market during the forecast period. Rise in population and growth in residential as well as commercial units in emerging economies in North America are projected to boost the demand for toilet paper in the next few years. The market is expanding in the region owing to the increase in awareness about hygiene practices among the population.

Rise in demand for various types of toilet paper for personal care and hygiene maintenance is further augmenting market growth. Approximately 38.75 million Americans used 16 or more toilet paper rolls in 2020. This number is expected to increase significantly in the next few years.

The commercial segment is expected to expand at a rapid pace during the forecast period owing to the increase in demand for toilet paper in various end-use sectors such as hospitality, corporates, hospital, public facility, education, and retail in North America.

In terms of distribution channel, the North America toilet paper market has been bifurcated into online and offline. The offline segment is expected to dominate the market in terms of value and volume during the forecast period. It is anticipated to hold the highest CAGR during the forecast period.

Consumers have options to choose different types of toilet paper on e-commerce or company-owned websites. Growth in popularity of online blogs and articles, which raise awareness about hygiene and sanitization, is strengthening the demand for toilet paper in North America.

The U.S. accounted for the largest overall North America toilet paper market share in 2021. According to industry experts, most of the market changes brought about by COVID-19 are likely to last for many years. Growth in various end-use sectors is boosting the demand for toilet roll paper in the U.S.

Demand for toilet paper in Canada is expected to rise at a significant pace during the forecast period. According to the Forest Products Association of Canada, demand for toilet paper in Canada increased by 241% during the peak of the COVID-19 pandemic.

The business in the region is consolidated, with a few large-scale vendors controlling majority of the share. Most of the firms are spending significantly on research and development activities, primarily to introduce environment-friendly products.

Expansion of product portfolios and mergers and acquisitions are the strategies adopted by key players. Cascades Inc., Johnson & Johnson, Kimberly-Clark Corporation, Procter & Gamble, Reckitt Benckiser, Sephora USA, Inc., The Clorox Company, Essity AB, Georgia-Pacific LLC, and The Sofidel Group are the prominent entities operating in this market.

Key vendors in the industry are continuously striving to launch new products in the market. Additionally, they are focusing on the development of biodegradable products. This is likely to help enterprises increase their sales, leading to industry growth.

Each of these players has been profiled in the North America toilet paper market report based on parameters such as business strategies, company overview, financial overview, recent developments, product portfolio, and business segments.

|

Attribute |

Detail |

|

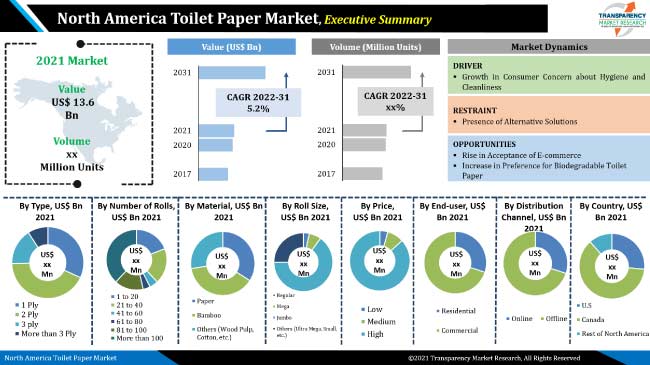

North America Toilet Paper Market Value in 2021 |

US$ 13.6 Bn |

|

Market Forecast Value in 2031 |

US$ 22.5 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the region as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 13.6 Bn in 2021

It is estimated to grow at a CAGR of 5.2% during 2022-2031

It is projected to reach US$ 22.5 Bn by 2031.

The residential segment is likely to dominate during the forecast period

The U.S. is expected to hold the highest CAGR during the forecast period

Growth in consumer concern for hygiene and cleanliness and expansion in tourism and hospitality industries

Cascades Inc., Johnson & Johnson, Kimberly-Clark Corporation, Procter & Gamble, Reckitt Benckiser, Sephora USA, Inc., The Clorox Company, Essity AB, Georgia-Pacific LLC, and The Sofidel Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Hygiene Products Market Overview

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Porter’s Five Forces Analysis

5.9. Regulatory Framework

5.10. Raw Material Analysis

5.11. Trade Analysis (Import-Export Data)

5.12. Toilet Paper Market Analysis and Forecast, 2017 - 2031

5.12.1. Market Revenue Projections (US$ Mn)

5.12.2. Market Volume Projections (Million Units)

6. North America Toilet Paper Market Analysis and Forecast, By Type

6.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Type, 2017 - 2031

6.1.1. 1 Ply

6.1.2. 2 Ply

6.1.3. 3 ply

6.1.4. More than 3 Ply

6.2. Incremental Opportunity, By Type

7. North America Toilet Paper Market Analysis and Forecast, By Number of Rolls

7.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Number of Rolls, 2017 - 2031

7.1.1. 1 to 20

7.1.2. 21 to 40

7.1.3. 41 to 60

7.1.4. 61 to 80

7.1.5. 81 to 100

7.1.6. More than 100

7.2. Incremental Opportunity, By No. of Rolls

8. North America Toilet Paper Market Analysis and Forecast, By Material

8.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Material, 2017 - 2031

8.1.1. Paper

8.1.2. Bamboo

8.1.3. Others (Wood Pulp, Cotton, etc.)

8.2. Incremental Opportunity, By Material

9. North America Toilet Paper Market Analysis and Forecast, By Roll Size

9.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Roll Size, 2017 - 2031

9.1.1. Regular

9.1.2. Mega

9.1.3. Jumbo

9.1.4. Others (Ultra Mega, Small, etc.)

9.2. Incremental Opportunity, By Roll Size

10. North America Toilet Paper Market Analysis and Forecast, By Price

10.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Price, 2017 - 2031

10.1.1. Low

10.1.2. Medium

10.1.3. High

10.2. Incremental Opportunity, By Price

11. North America Toilet Paper Market Analysis and Forecast, By End-user

11.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Material, 2017 - 2031

11.1.1. Residential

11.1.2. Commercial

11.1.2.1. Hospitality

11.1.2.2. Corporates

11.1.2.3. Hospitals

11.1.2.4. Public Facilities

11.1.2.5. Others (Education, Institutions, Retail, etc.)

11.2. Incremental Opportunity, By End-user

12. North America Toilet Paper Market Analysis and Forecast, By Distribution Channel

12.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Distribution Channel, 2017 - 2031

12.1.1. Online

12.1.1.1. Company Owned Website

12.1.1.2. E-Commerce Website

12.1.2. Offline

12.1.2.1. Hypermarket/Supermarkets

12.1.2.2. Departmental Stores

12.1.2.3. Independent Retailers

12.2. Incremental Opportunity, By Distribution Channel

13. North America Toilet Paper Market Analysis and Forecast, By Country

13.1. North America Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Country, 2017 - 2031

13.1.1. U.S.

13.1.2. Canada

13.1.3. Rest of North America

13.2. Incremental Opportunity, By Country

14. U.S. Toilet Paper Market Analysis and Forecast

14.1. Country Snapshot

14.2. Price Trend Analysis

14.3. Key Trend Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Type, 2017 - 2031

14.6.1. 1 Ply

14.6.2. 2 Ply

14.6.3. 3 ply

14.6.4. More than 3 Ply

14.7. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Number of Rolls, 2017 - 2031

14.7.1. 1 to 20

14.7.2. 21 to 40

14.7.3. 41 to 60

14.7.4. 61 to 80

14.7.5. 81 to 100

14.7.6. More than 100

14.8. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Material, 2017 - 2031

14.8.1. Paper

14.8.2. Bamboo

14.8.3. Others (Wood Pulp, Cotton, etc.)

14.9. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Roll Size, 2017 - 2031

14.9.1. Regular

14.9.2. Mega

14.9.3. Jumbo

14.9.4. Others (Ultra Mega, Small, etc.)

14.10. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Price, 2017 - 2031

14.10.1. Low

14.10.2. Medium

14.10.3. High

14.11. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By End-user, 2017 - 2031

14.11.1. Residential

14.11.2. Commercial

14.11.2.1. Hospitality

14.11.2.2. Corporates

14.11.2.3. Hospitals

14.11.2.4. Public Facilities

14.11.2.5. Others (Education, Institutions, Retail, etc.)

14.12. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.1.1. Company Owned Website

14.12.1.2. E-Commerce Website

14.12.2. Offline

14.12.2.1. Hypermarket/Supermarkets

14.12.2.2. Departmental Stores

14.12.2.3. Independent Retailers

14.12.2.4. Others

15. Canada Toilet Paper Market Analysis and Forecast

15.1. Country Snapshot

15.2. Price Trend Analysis

15.3. Key Trend Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Type, 2017 - 2031

15.6.1. 1 Ply

15.6.2. 2 Ply

15.6.3. 3 Ply

15.6.4. More than 3 Ply

15.7. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Number of Rolls, 2017 - 2031

15.7.1. 1 to 20

15.7.2. 21 to 40

15.7.3. 41 to 60

15.7.4. 61 to 80

15.7.5. 81 to 100

15.7.6. More than 100

15.8. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Material, 2017 - 2031

15.8.1. Paper

15.8.2. Bamboo

15.8.3. Others (Wood Pulp, Cotton, etc.)

15.9. Toilet Paper Market Size (US$ Mn) & (Million Units) Forecast, By Distribution Channel, 2017 - 2031

15.9.1. Online

15.9.1.1. Company Owned Website

15.9.1.2. E-Commerce Website

15.9.2. Offline

15.9.2.1. Hypermarket/Supermarkets

15.9.2.2. Departmental Stores

15.9.2.3. Independent Retailers

15.9.2.4. Others

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2021

16.3. Company Profiles (Details – Company Overview, Sales Material Type/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Cascades Inc.

16.3.1.1. Company Overview

16.3.1.2. Sales Material Type/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Johnson & Johnson

16.3.2.1. Company Overview

16.3.2.2. Sales Material Type/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Kimberly-Clark Corporation

16.3.3.1. Company Overview

16.3.3.2. Sales Material Type/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Procter & Gamble

16.3.4.1. Company Overview

16.3.4.2. Sales Material Type/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Reckitt Benckiser

16.3.5.1. Company Overview

16.3.5.2. Sales Material Type/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Sephora USA, Inc.

16.3.6.1. Company Overview

16.3.6.2. Sales Material Type/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. The Clorox Company

16.3.7.1. Company Overview

16.3.7.2. Sales Material Type/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Essity AB

16.3.8.1. Company Overview

16.3.8.2. Sales Material Type/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Georgia-Pacific LLC

16.3.9.1. Company Overview

16.3.9.2. Sales Material Type/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. The Sofidel Group

16.3.10.1. Company Overview

16.3.10.2. Sales Material Type/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. No. of Rolls

17.1.3. Material

17.1.4. Roll Size

17.1.5. Price

17.1.6. End User

17.1.7. Distribution Channel

17.1.8. Country

17.2. Understanding the Buying Process of Customers

17.2.1. Preferred Type

17.2.2. Preferred Pricing

17.2.3. Target Audience

17.3. Prevailing Market Risks

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Toilet Paper Market Value, by Type, US$ Mn, 2017-2031

Table 2: North America Toilet Paper Market Volume, by Type, Million Units, 2017-2031

Table 3: North America Toilet Paper Market Value, by Number of Rolls, US$ Mn, 2017-2031

Table 4: North America Toilet Paper Market Volume, by Number of Rolls, Million Units, 2017-2031

Table 5: North America Toilet Paper Market Value, by Material, US$ Mn, 2017-2031

Table 6: North America Toilet Paper Market Volume, by Material, Million Units, 2017-2031

Table 7: North America Toilet Paper Market Value, by Roll Size, US$ Mn, 2017-2031

Table 8: North America Toilet Paper Market Volume, by Roll Size, Million Units, 2017-2031

Table 9: North America Toilet Paper Market Value, by Price, US$ Mn, 2017-2031

Table 10: North America Toilet Paper Market Volume, by Price, Million Units, 2017-2031

Table 11: North America Toilet Paper Market Value, by End-user, US$ Mn, 2017-2031

Table 12: North America Toilet Paper Market Volume, by End-user, Million Units, 2017-2031

Table 13: North America Toilet Paper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 14: North America Toilet Paper Market Volume, by Distribution Channel, Million Units, 2017-2031

Table 15: North America Toilet Paper Market Value, by Country, US$ Mn, 2017-2031

Table 16: North America Toilet Paper Market Volume, by Country, Thousand Units, 2017-2031

Table 17: U.S. Toilet Paper Market Value, by Type, US$ Mn, 2017-2031

Table 18: U.S. Toilet Paper Market Volume, by Type, Million Units, 2017-2031

Table 19: U.S. Toilet Paper Market Value, by Number of Rolls, US$ Mn, 2017-2031

Table 20: U.S. Toilet Paper Market Volume, by Number of Rolls, Million Units, 2017-2031

Table 21: U.S. Toilet Paper Market Value, by Material, US$ Mn, 2017-2031

Table 22: U.S. Toilet Paper Market Volume, by Material, Million Units, 2017-2031

Table 23: U.S. Toilet Paper Market Value, by Roll Size, US$ Mn, 2017-2031

Table 24: U.S. Toilet Paper Market Volume, by Roll Size, Million Units, 2017-2031

Table 25: U.S. Toilet Paper Market Value, by Price, US$ Mn, 2017-2031

Table 26: U.S. Toilet Paper Market Volume, by Price, Million Units, 2017-2031

Table 27: U.S. Toilet Paper Market Value, by End-user, US$ Mn, 2017-2031

Table 28: U.S. Toilet Paper Market Volume, by End-user, Million Units, 2017-2031

Table 29: U.S. Toilet Paper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 30: U.S. Toilet Paper Market Volume, by Distribution Channel, Million Units, 2017-2031

Table 31: Canada Toilet Paper Market Value, by Type, US$ Mn, 2017-2031

Table 32: Canada Toilet Paper Market Volume, by Type, Million Units, 2017-2031

Table 33: Canada Toilet Paper Market Value, by Number of Rolls, US$ Mn, 2017-2031

Table 34: Canada Toilet Paper Market Volume, by Number of Rolls, Million Units, 2017-2031

Table 35: Canada Toilet Paper Market Value, by Material, US$ Mn, 2017-2031

Table 36: Canada Toilet Paper Market Volume, by Material, Million Units, 2017-2031

Table 37: Canada Toilet Paper Market Value, by Roll Size, US$ Mn, 2017-2031

Table 40: Canada Toilet Paper Market Volume, by Price, Million Units, 2017-2031

Table 41: Canada Toilet Paper Market Value, by End-user, US$ Mn, 2017-2031

Table 42: Canada Toilet Paper Market Volume, by End-user, Million Units, 2017-2031

Table 43: Canada Toilet Paper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 44: Canada Toilet Paper Market Volume, by Distribution Channel, Million Units, 2017-2031

List of Figures

Figure 1: North America Toilet Paper Market Value, by Type, US$ Mn, 2017-2031

Figure 2: North America Toilet Paper Market Volume, by Type, Million Units, 2017-2031

Figure 3: North America Toilet Paper Market Incremental Opportunity, by Type, 2021-2031

Figure 4: North America Toilet Paper Market Value, by Number of Rolls, US$ Mn, 2017-2031

Figure 5: North America Toilet Paper Market Volume, by Number of Rolls, Million Units, 2017-2031

Figure 6: North America Toilet Paper Market Incremental Opportunity, by Number of Rolls, 2021-2031

Figure 7: North America Toilet Paper Market Value, by Material, US$ Mn, 2017-2031

Figure 8: North America Toilet Paper Market Volume, by Material, Million Units, 2017-2031

Figure 9: North America Toilet Paper Market Incremental Opportunity, by Material, 2021-2031

Figure 10: North America Toilet Paper Market Value, by Roll Size, US$ Mn, 2017-2031

Figure 11: North America Toilet Paper Market Volume, by Roll Size, Million Units, 2017-2031

Figure 12: North America Toilet Paper Market Incremental Opportunity, by Roll Size, 2021-2031

Figure 13: North America Toilet Paper Market Value, by Price, US$ Mn, 2017-2031

Figure 14: North America Toilet Paper Market Volume, by Price, Million Units, 2017-2031

Figure 15: North America Toilet Paper Market Incremental Opportunity, by Price, 2021-2031

Figure 16: North America Toilet Paper Market Value, by End User, US$ Mn, 2017-2031

Figure 17: North America Toilet Paper Market Volume, by End User, Thousand Units, 2017-2031

Figure 18: North America Toilet Paper Market Incremental Opportunity, by End User, 2021-2031

Figure 19: North America Toilet Paper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 20: North America Toilet Paper Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 21: North America Toilet Paper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 22: North America Toilet Paper Market Value, by Country, US$ Mn, 2017-2031

Figure 23: North America Toilet Paper Market Volume, by Country, Thousand Units, 2017-2031

Figure 24: North America Toilet Paper Market Incremental Opportunity, by Country, 2021-2031

Figure 25: U.S. Toilet Paper Market Value, by Type, US$ Mn, 2017-2031

Figure 26: U.S. Toilet Paper Market Volume, by Type, Million Units, 2017-2031

Figure 27: U.S. Toilet Paper Market Incremental Opportunity, by Type, 2021-2031

Figure 28: U.S. Toilet Paper Market Value, by Number of Rolls, US$ Mn, 2017-2031

Figure 29: U.S. Toilet Paper Market Volume, by Number of Rolls, Million Units, 2017-2031

Figure 30: U.S. Toilet Paper Market Incremental Opportunity, by Number of Rolls, 2021-2031

Figure 31: U.S. Toilet Paper Market Value, by Material, US$ Mn, 2017-2031

Figure 32: U.S. Toilet Paper Market Volume, by Material, Million Units, 2017-2031

Figure 33: U.S. Toilet Paper Market Incremental Opportunity, by Material, 2021-2031

Figure 34: U.S. Toilet Paper Market Value, by Roll Size, US$ Mn, 2017-2031

Figure 35: U.S. Toilet Paper Market Volume, by Roll Size, Million Units, 2017-2031

Figure 36: U.S. Toilet Paper Market Incremental Opportunity, by Roll Size, 2021-2031

Figure 37: U.S. Toilet Paper Market Value, by Price, US$ Mn, 2017-2031

Figure 38: U.S. Toilet Paper Market Volume, by Price, Million Units, 2017-2031

Figure 39: U.S. Toilet Paper Market Incremental Opportunity, by Price, 2021-2031

Figure 40: U.S. Toilet Paper Market Value, by End User, US$ Mn, 2017-2031

Figure 41: U.S. Toilet Paper Market Volume, by End User, Thousand Units, 2017-2031

Figure 42: U.S. Toilet Paper Market Incremental Opportunity, by End User, 2021-2031

Figure 43: U.S. Toilet Paper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 44: U.S. Toilet Paper Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 45: U.S. Toilet Paper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 46: Canada Toilet Paper Market Value, by Type, US$ Mn, 2017-2031

Figure 47: Canada Toilet Paper Market Volume, by Type, Million Units, 2017-2031

Figure 48: Canada Toilet Paper Market Incremental Opportunity, by Type, 2021-2031

Figure 49: Canada Toilet Paper Market Value, by Number of Rolls, US$ Mn, 2017-2031

Figure 50: Canada Toilet Paper Market Volume, by Number of Rolls, Million Units, 2017-2031

Figure 51: Canada Toilet Paper Market Incremental Opportunity, by Number of Rolls, 2021-2031

Figure 52: Canada Toilet Paper Market Value, by Material, US$ Mn, 2017-2031

Figure 53: Canada Toilet Paper Market Volume, by Material, Million Units, 2017-2031

Figure 54: Canada Toilet Paper Market Incremental Opportunity, by Material, 2021-2031

Figure 55: Canada Toilet Paper Market Value, by Roll Size, US$ Mn, 2017-2031

Figure 56: Canada Toilet Paper Market Volume, by Roll Size, Million Units, 2017-2031

Figure 57: Canada Toilet Paper Market Incremental Opportunity, by Roll Size, 2021-2031

Figure 58: Canada Toilet Paper Market Value, by Price, US$ Mn, 2017-2031

Figure 59: Canada Toilet Paper Market Volume, by Price, Million Units, 2017-2031

Figure 60: Canada Toilet Paper Market Incremental Opportunity, by Price, 2021-2031

Figure 61: Canada Toilet Paper Market Value, by End User, US$ Mn, 2017-2031

Figure 62: Canada Toilet Paper Market Volume, by End User, Thousand Units, 2017-2031

Figure 63: Canada Toilet Paper Market Incremental Opportunity, by End-user, 2021-2031

Figure 64: Canada Toilet Paper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 65: Canada Toilet Paper Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 66: Canada Toilet Paper Market Incremental Opportunity, by Distribution Channel, 2021-2031