Analyst Viewpoint

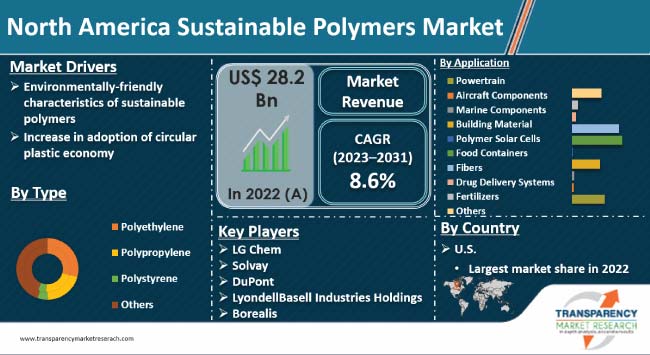

Environmentally-friendly characteristics of sustainable polymers is driving North America sustainable polymers market. Rapid industrialization and economic expansion are fueling demand for sustainable polymers in the region. Surge in applications of these polymers from packaging materials to automotive components, reflecting versatility and adaptability, is propelling market expansion. Furthermore, increase in adoption of circular plastic economy is expected to bolster the sustainable polymers industry in North America during the forecast period.

Development of environmentally-friendly polymers offers lucrative opportunities to market players. Manufacturers are committed to innovation and are investing significantly in research & development in order to expand product portfolio and market presence.

The market in North America has witnessed significant growth since the introduction of sustainable polymers, marking a pivotal shift toward environmentally conscious practices. Sustainability has become a key driver in the polymer industry, leading to the emergence and widespread adoption of eco-friendly alternatives. These sustainable polymers, derived from renewable resources or recycled materials, address concerns about environmental impact of traditional polymer.

The market's evolution reflects a collective effort by industries to reduce carbon footprint and embrace circular economy principles. Companies operating in North America are investing in research & development to innovate and offer sustainable polymer solutions that maintain or even surpass the performance of conventional counterparts. The region has witnessed a surge in consumer awareness and governmental initiatives promoting sustainable practices, further propelling the demand for eco-friendly polymers.

This transformative shift not only underscores the commitment to environmental responsibility, but also presents economic opportunities for businesses embracing sustainable practices. As the North America sustainable polymers market demand continues to expand, it would play a crucial role in shaping a more environmentally conscious and responsible future for the polymer industry.

Polymers have transformed almost every aspect of our daily life. Polymers have brought enormous benefits and convenience to the society. However, these inadvertently have some undesirable consequences on environment and climate change.

Presently, about 8% of total fossil oils are used to manufacture polymers. The number is projected to increase to 20% by 2050. Rise in concerns about undesirable environmental and socioeconomic consequences of petrochemicals and limited fossil resources have shifted focus toward usage of natural biomass for chemical, polymer, and material development.

Importance of sustainable polymers lies in the variety of renewable feedstock and the environmentally-friendly perspectives of materials. Current achievements in polymer chemistry and the involvement of biotechnology have accelerated the progress of multifunctional bio-based polymers.

Utilization of sustainable polymers could avoid dependence on petroleum resources and reduce carbon emission. Based on degradability and various properties & functionalities, sustainable polymers can be developed into materials tailored for certain applications.

The smart design of sustainable polymer composites through materials chemistry and engineering can endow such materials with appealing functionality, making them have significant potential for important applications such as packaging, health, and environmental areas. Thus, environmental characteristics of sustainable polymers are fueling North America sustainable polymers market growth.

Surge in concerns about the environmental impact of plastic waste and plastic-related emission of greenhouse gases (GHGs) have prompted the transition toward a ‘circular plastic economy’. In a circular economy, usage of non-renewable resources and waste production is minimized, while reuse and recycling dominate the life cycles of materials.

In a circular plastic economy, plastic waste becomes raw material for a recycling process at its end of life, and all production and recycling processes are supplied with renewable energy. Renewable resources are the starting materials for polymer products, which have a defined circular end-of-life scenario.

Bioplastics that are 100% bio-based are currently produced at a scale of ~2 million tons per year. These are considered a part of future circular economies to help achieve some of the United Nations’ (UN) Sustainable Development Goals, such as by diverting from fossil resources, introducing new recycling or degradation pathways, and using less toxic reagents and solvents in production processes.

Depending on type, bioplastics can offer improved circularity by using renewable (non-fossil) resources, a lower carbon footprint, biodegradation as an alternative end-of-life (EOL) option and improved material properties.

Carbon dioxide generated through bioplastic incineration, aerobic composting or incineration of methane (CH4) from anaerobic composting is a net-zero addition to the carbon cycle, as it is captured by photosynthesis into new biomass.

Advanced recycling routes enable upcycling of plastic waste. Polymers with functional backbones (such as polyesters or polyamides) can be depolymerized biologically or chemically, and the subsequent monomers are polymerized into tailored high-quality or virgin-quality products.

Polymers with non-functional backbones such as polyolefins (including polyethylene (PE), bio-based PE, polypropylene (PP) and polystyrene) are better suited for cracking into hydrocarbon oil and gas by thermolysis and can then follow a similar upcycling path. Hence, adoption of circular plastic economy is expected to propel the sustainable polymers market value.

In terms of type, the circular economy polymers segment accounted for the largest North America sustainable polymers market share in 2022. This can be ascribed to rise in emphasis on eco-friendly practices and the circular economy model in polymer production. The circular economy polymers sector champions the principles of recycling, reuse, and sustainability, aligning with the region's increasing environmental consciousness.

As North America strives for greater environmental stewardship, the circular economy polymers segment stands at the forefront, contributing significantly to the region's sustainable development goals.

This robust market position not only reflects the industry's commitment to reducing environmental impact, but also signals a broader trend toward prioritizing sustainable solutions in polymer production across the continent.

As per sustainable polymers market research, the U.S dominated the industry in North America in 2022. The country plays a pivotal role in shaping the region's industrial landscape, with its manufacturing sector driving demand for eco-friendly and sustainable solutions, particularly in polymer production. The U.S. not only sets industry standards, but also influences market trends and consumer preferences, fostering a growing awareness and adoption about sustainable polymers.

The country’s commitment to innovation and environmental responsibility further amplifies its impact, as manufacturers increasingly seek alternatives that align with sustainable practices. In this dynamic environment, the U.S. stands as a major catalyst in steering the trajectory of the sustainable polymers market, emphasizing the crucial role it plays in advancing environmentally-conscious manufacturing practices across North America.

The sustainable polymers market in North America consists of several small- to medium-sized manufacturers that compete with each other and with large enterprises. Several businesses have made significant investments in research & development activities, leading to early adoption of next-generation technologies and the development of new products. Leading players are adopting strategies such as product portfolio expansion and merger & acquisition to increase market presence.

LG Chem, Solvay, DuPont, LyondellBasell Industries Holdings, Borealis, Exxon Mobil Corporation, TotalEnergies, Dow, Neste, Stahl Holdings, DSM, and PolyVisions are the prominent players in the market.

Each of these players has been profiled in the sustainable polymers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 28.2 Bn |

| Forecast (Value) in 2031 | US$ 59.0 Bn |

| Growth Rate (CAGR) | 8.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 28.2 Bn in 2022.

It is expected to grow at a CAGR of 8.6% from 2023 to 2031.

Environmentally-friendly characteristics of sustainable polymers and increase in adoption of circular plastic economy.

Circular economy polymers was the largest type segment, with 88.6% share in 2022.

The U.S. was the most lucrative country, with 70.2% share in 2022

LG Chem, Solvay, DuPont, LyondellBasell Industries Holdings, Borealis, Exxon Mobil Corporation, TotalEnergies, Dow, Neste, Stahl Holdings, DSM, and PolyVisions

1. Executive Summary

1.1. North America Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. North America Sustainable Polymers Market Analysis and Forecast, 2023–2031

2.6.1. North America Sustainable Polymers Market Volume (Kilo Tons)

2.6.2. North America Sustainable Polymers Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealer and Distributor

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Process Overview

2.12. Cost Structure Analysis

3. Economic Recovery from COVID-19 Impact

3.1. Impact on Supply Chain of Sustainable Polymers

3.2. Recovery in the Demand for Sustainable Polymers –Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Kilo Tons)

5.1. North America

6. Price Trend Analysis and Forecast (US$/Ton), 2020–2031

6.1. Price Comparison Analysis by Category

7. North America Sustainable Polymers Market Analysis and Forecast, by Category, 2020–2031

7.1. Introduction and Definitions

7.2. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Category, 2020–2031

7.2.1. Bio-based Polymers

7.2.2. Circular Economy Polymers

7.3. North America Sustainable Polymers Market Attractiveness, by Category

8. North America Sustainable Polymers Market Analysis and Forecast, by Feedstock, 2020–2031

8.1. Introduction and Definitions

8.2. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

8.2.1. Plant Oils

8.2.2. Fatty Acids

8.2.3. Cellulose

8.2.4. Lignin

8.2.5. Others

8.3. North America Sustainable Polymers Market Attractiveness, by Feedstock

9. North America Sustainable Polymers Market Analysis and Forecast, by Type, 2020–2031

9.1. Introduction and Definitions

9.2. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.2.1. Polyethylene

9.2.2. Polypropylene

9.2.3. Polystyrene

9.2.4. Others

9.3. North America Sustainable Polymers Market Attractiveness, by Type

10. North America Sustainable Polymers Market Analysis and Forecast, by Application, 2020–2031

10.1. Introduction and Definitions

10.2. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.2.1. Powertrain

10.2.2. Aircraft Components

10.2.3. Marine Components

10.2.4. Building Material

10.2.5. Polymer Solar Cells

10.2.6. Food Containers

10.2.7. Fibers

10.2.8. Drug Delivery Systems

10.2.9. Fertilizers

10.2.10. Others

10.3. North America Sustainable Polymers Market Attractiveness, by Application

11. North America Sustainable Polymers Market Analysis and Forecast, by End-use, 2020–2031

11.1. Introduction and Definitions

11.2. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

11.2.1. Automotive & Transportation

11.2.2. Aerospace

11.2.3. Marine

11.2.4. Building & Construction

11.2.5. Energy

11.2.6. Packaging

11.2.7. Textiles

11.2.8. Pharmaceutical

11.2.9. Agriculture

11.2.10. Others

11.3. North America Sustainable Polymers Market Attractiveness, by End-use

12. North America Sustainable Polymers Market Analysis and Forecast, by Country, 2020–2031

12.1. Key Findings

12.2. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

12.2.1. U.S.

12.2.2. Canada

12.3. North America Sustainable Polymers Market Attractiveness, by Country

13. North America Sustainable Polymers Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Category, 2020–2031

13.3. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

13.4. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.6. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

13.7. North America Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

13.7.1. U.S. Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Category, 2020–2031

13.7.2. U.S. Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

13.7.3. U.S. Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.7.4. U.S. Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.7.5. U.S. Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2020–2031

13.7.6. Canada Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Category, 2020–2031

13.7.7. Canada Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

13.7.8. Canada Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.7.9. Canada Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.7.10. Canada Sustainable Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2020–2031

13.8. North America Sustainable Polymers Market Attractiveness Analysis

14. Competition Landscape

14.1. Market Players - Competition Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, 2022

14.3. Market Footprint Analysis

14.3.1. By Type

14.3.2. By Method

14.4. Company Profiles

14.4.1. LG Chem

14.4.1.1. Company Revenue

14.4.1.2. Business Overview

14.4.1.3. Product Segments

14.4.1.4. Geographic Footprint

14.4.1.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.2. Solvay

14.4.2.1. Company Revenue

14.4.2.2. Business Overview

14.4.2.3. Product Segments

14.4.2.4. Geographic Footprint

14.4.2.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.3. DuPont

14.4.3.1. Company Revenue

14.4.3.2. Business Overview

14.4.3.3. Product Segments

14.4.3.4. Geographic Footprint

14.4.3.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.4. LyondellBasell Industries Holdings

14.4.4.1. Company Revenue

14.4.4.2. Business Overview

14.4.4.3. Product Segments

14.4.4.4. Geographic Footprint

14.4.4.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.5. Borealis

14.4.5.1. Company Revenue

14.4.5.2. Business Overview

14.4.5.3. Product Segments

14.4.5.4. Geographic Footprint

14.4.5.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.6. Exxon Mobil Corporation

14.4.6.1. Company Revenue

14.4.6.2. Business Overview

14.4.6.3. Product Segments

14.4.6.4. Geographic Footprint

14.4.6.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.7. TotalEnergies

14.4.7.1. Company Revenue

14.4.7.2. Business Overview

14.4.7.3. Product Segments

14.4.7.4. Geographic Footprint

14.4.7.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.8. Dow

14.4.8.1. Company Revenue

14.4.8.2. Business Overview

14.4.8.3. Product Segments

14.4.8.4. Geographic Footprint

14.4.8.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.9. Neste

14.4.9.1. Company Revenue

14.4.9.2. Business Overview

14.4.9.3. Product Segments

14.4.9.4. Geographic Footprint

14.4.9.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.10. Stahl Holdings

14.4.10.1. Company Revenue

14.4.10.2. Business Overview

14.4.10.3. Product Segments

14.4.10.4. Geographic Footprint

14.4.10.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.11. DSM

14.4.11.1. Company Revenue

14.4.11.2. Business Overview

14.4.11.3. Product Segments

14.4.11.4. Geographic Footprint

14.4.11.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.12. PolyVisions

14.4.12.1. Company Revenue

14.4.12.2. Business Overview

14.4.12.3. Product Segments

14.4.12.4. Geographic Footprint

14.4.12.5. Production Capacity /Plant Details, etc. (*As Applicable)

14.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 01: North America Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Category, 2020–2031

Table 02: North America Sustainable Polymers Market Value (US$ Mn) Forecast, by Category, 2020–2031

Table 03: North America Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Feedstock, 2020–2031

Table 04: North America Sustainable Polymers Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 05: North America Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 06: North America Sustainable Polymers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 07: North America Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 08: North America Sustainable Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 09: North America Sustainable Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 10: North America Sustainable Polymers Market Value (US$ Mn) Forecast, by End-use 2020–2031

Table 11: U.S. Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Category, 2020–2031

Table 12: U.S. Sustainable Polymers Market Value (US$ Mn) Forecast, by Category, 2020–2031

Table 13: U.S. Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Feedstock, 2020–2031

Table 14: U.S. Sustainable Polymers Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 15: U.S. Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 16: U.S. Sustainable Polymers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 17: U.S. Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 18: U.S. Sustainable Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: U.S. Sustainable Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 20: U.S. Sustainable Polymers Market Value (US$ Mn) Forecast, by End-use 2020–2031

Table 21: Canada Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Category, 2020–2031

Table 22: Canada Sustainable Polymers Market Value (US$ Mn) Forecast, by Category, 2020–2031

Table 23: Canada Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Feedstock, 2020–2031

Table 24: Canada Sustainable Polymers Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 25: Canada Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 26: Canada Sustainable Polymers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 27: Canada Sustainable Polymers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 28: Canada Sustainable Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 29: Canada Sustainable Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 30: Canada Sustainable Polymers Market Value (US$ Mn) Forecast, by End-use 2020–2031

List of Figures

Figure 01: North America Sustainable Polymers Market Share Analysis, by Category, 2022, 2027, and 2031

Figure 02: North America Sustainable Polymers Market Attractiveness, by Category

Figure 03: North America Sustainable Polymers Market Share Analysis, by Feedstock, 2022, 2027, and 2031

Figure 04: North America Sustainable Polymers Market Attractiveness, by Feedstock

Figure 05: North America Sustainable Polymers Market Share Analysis, by Type, 2022, 2027, and 2031

Figure 06: North America Sustainable Polymers Market Attractiveness, by Type

Figure 07: North America Sustainable Polymers Market Share Analysis, by Application, 2022, 2027, and 2031

Figure 08: North America Sustainable Polymers Market Attractiveness, by Application

Figure 09: North America Sustainable Polymers Market Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: North America Sustainable Polymers Market Attractiveness, by End-use

Figure 11: North America Sustainable Polymers Market Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: North America Sustainable Polymers Market Attractiveness, by Country