Analysts’ Viewpoint on North America Robotic Lawn Mower Market Scenario

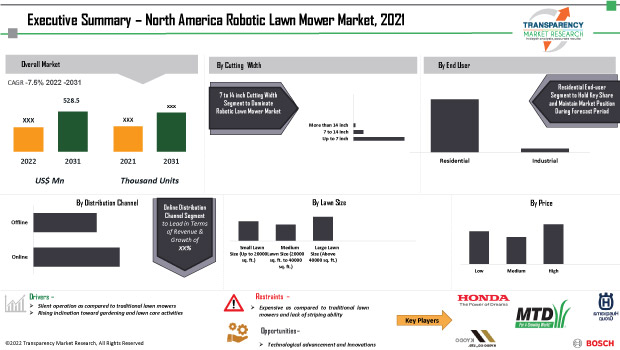

The North America robotic lawn mower market is projected to be driven by rising inclination toward gardening and lawn care activities, and is considered as a safer option as compared to traditional mowers. The growing interest of millennial and young consumers in gardening activities, lawn care maintenance, and landscaping is fueling the demand for robotic lawn mowers in the U.S. market. Moreover, companies in the robotic lawn mower market are focusing on high-growth cutting width segments such as between 7-14 inches cutting width to keep their businesses growing post the COVID-19 pandemic. Majority of customers have changed their shopping habits from physical to online channels, favoring value-based items. For instance, many manufacturers have redesigned their websites, and are active on other digital platforms to increase brand awareness. In addition, participating in trade shows & events provides a good opportunity for manufacturers to showcase their products to the global audience.

A robotic lawn mower is a self-sufficient robot that is used to cut lawn grass. It is a professional cleaning robot that falls under the domestic robot’s category. Generally, a robotic lawn mower requires the user to maintain a border wire around the lawn that defines the area to be mowed. The robotic lawn mower uses this wire to locate the boundary of the area to be trimmed and in some cases, to locate a recharging dock. Mostly, robotic mowers are capable of maintaining up to 320,000 sq. ft. of grass.

Robotic lawn mowers enable end-users to choose from various cutting width categories such as up to 7 inch, 7 to 14 inch, more than 14 inch, and also offers lawn mowers for various lawn sizes such as lawn size below & above 40,000 sq. ft.

The COVID-19 pandemic has been an effective catalyzer in compelling the young population across the U.S. to stay at home and encouraged them to engage in gardening and lawn care activities. Furthermore, inadequate availability of quality labor in the landscaping industry in the U.S. is also driving the growth of the market. Consumers in most nations plan to continue to direct their spending toward necessities while reducing spending in most discretionary areas. Consumers all across the world have reacted to the crisis of COVID-19 and the resulting disruption to typical consumer habits by experimenting with new buying patterns and indicating a strong desire to continue doing so in the future as well.

Robotic lawn mowers are significantly quieter than traditional lawn mowers. Robotic mowers below 60 decibels (dB) can sometimes mow under certain circumstances where ordinary lawn mowers are not allowed to. A robotic mower lives and works quietly any lawn, mowing throughout the day and night, only stopping to charge. The range in noise output from the quietest robot lawn mower to the loudest is from 58 to 74 dB. This is roughly equal to the difference between a quiet conversation and a vacuum cleaner in operation.

Internet retailing has been witnessing robust growth in the robotic lawn mower market over the past few years. The online retail industry offers a wide variety of buying options to its customers. Furthermore, customers have increasingly become confident in terms of using online payment options due to advancements in online payment security options.

Bargain options made available by various online retail websites also attract customers. The widening range of Internet retailing websites has further boosted the sale of robotic lawn mowers and other products. Major players in the e-commerce sector are progressively offering far more lucrative deals to shoppers in order to make their presence felt.

Moreover, rising disposable income has spurred the demand for robotic lawn mowers across the globe. Economic growth in developing economies has led to a rise in disposable income of consumers. This has helped increase consumer confidence in terms of buying and investing in high-quality robotic lawn mowers in the market.

The North America robotic lawn mower market is expected to grow at a rapid pace, owing to an increase in various cutting width categories such as up to 7 inch, between 7 to 14 inch, and more than 14 inch, available across the U.S., Canada, and rest of North America. The market in the U.S is expected to grow at a high growth rate, followed by Canada, over the next few years.

Robotic lawn mowers are safe to operate as compared to traditional lawn mowers. Robotic lawn mowers use different cutting systems and technology, which reduce the risk of injury massively. They have collision, tilt, and lift sensors that cause the mower to stop the blades in a fraction of a second if interrupted. The blades also use much less energy than conventional mowers. Hence, this is a prime factor driving the growth of the market.

In terms of cutting width, the 7 to 14-inch segment is expected to dominate the robotic lawn mower market during the forecast period. Based on growth rate, the small lawn size segment is expected to grow at a faster rate during the forecast period. Robotic lawn mowers are expected to witness acceptance in the commercial industry. Several strategies and approaches have been established to increase the revenue of robotic lawn mowers over the years, with technological alliances considered to be one of the most promising strategies.

Based on country and sub-region, the North America robotic lawn mower market can be categorized into U.S, Canada, and Rest of North America. The U.S. accounted for a dominant share of the North America robotic lawn mower market in 2021, and is expected to maintain its leading position over the forecast period. The U.S. robotic lawn mower market is expected to register the highest CAGR in the future.

Key players operating in the robotic lawn mower market in the region are adopting new technologies to provide quality products to their customers. Increasing promotional activities are also expected to have a positive impact on the market in the region.

The robotic lawn mower market is consolidated with a small number of large-scale vendors controlling majority of the market share. Key firms are heavily spending on comprehensive research and development. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by the market players.

American Honda Motor Co., Inc., ECHO Robotics, Deere & Company, Husqvarna AB, Kyodo Co., Ltd, MTD Products Inc., Positec Tool Corporation, Bosch, Redback, and Zucchetti Centro Sistemi SPA, among others, are the prominent entities operating in this market. Each of these players has been profiled in the robotic lawn mower Market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 258.6 Mn |

|

Market Forecast Value in 2031 |

US$ 528.5 Mn |

|

Growth Rate (CAGR) |

7.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood over US$ 258.6 Mn

The market is estimated to grow at a CAGR of 7.5%

Silent operation as compared to traditional lawn mowers and rising inclination toward gardening and lawn care activities

7 to 14 inch cutting width robotic lawn mower accounted for around 46.9% share of the market in 2021

American Honda Motor Co. Inc., ECHO Robotics, Deere & Company, Husqvarna AB, Kyodo Co., Ltd, MTD Products Inc., Positec Tool Corporation, Bosch, Redback, and Zucchetti Centro Sistemi SPA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Lawn Mowers Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Technology Overview

5.8. COVID-19 Impact Analysis

5.9. North America Robotic Lawn Mowers Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. North America Robotic Lawn Mowers Market Analysis and Forecast, By Cutting Width

6.1. North America Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Cutting Width, 2017 - 2031

6.1.1. Up to 7 inch

6.1.2. 7 inch to 9 inch

6.1.3. More than 9 inch

6.2. Incremental Opportunity, By Cutting Width

7. North America Robotic Lawn Mowers Market Analysis and Forecast, By Lawn Size

7.1. North America Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Lawn Size, 2017 - 2031

7.1.1. Small Lawn Size

7.1.2. Medium Lawn Size

7.1.3. Large Lawn Size

7.2. Incremental Opportunity, By Lawn Size

8. North America Robotic Lawn Mowers Market Analysis and Forecast, By End-users

8.1. North America Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By End-users, 2017 - 2031

8.1.1. Residential

8.1.2. Commercial

8.2. Incremental Opportunity, By End-users

9. North America Robotic Lawn Mowers Market Analysis and Forecast, By Price

9.1. North America Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, By Price

10. North America Robotic Lawn Mowers Market Analysis and Forecast, By Distribution Channel

10.1. North America Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company Owned Websites

10.1.2. Offline

10.1.2.1. Hypermarket and Supermarkets

10.1.2.2. Specialty Stores

10.1.2.3. Other Retail Based Stores

10.2. Incremental Opportunity, By Distribution Channel

11. North America Robotic Lawn Mowers Market Analysis and Forecast, By Country & Sub-region

11.1. North America Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Country & Sub-region, 2017 - 2031

11.1.1 U.S

11.1.2. Canada

11.1.3. Rest of North America

11.1. Incremental Opportunity, By Country

12. U.S Robotic Lawn Mowers Market Analysis and Forecast

12.1. Country Snapshot

12.2. Consumer Buying Behavior

12.3. Brand Analysis

12.4. Covid-19 Impact Analysis

12.5. Price Trend Analysis

12.5.1. Weighted Average Price

12.5.2. Price Impact- Covid 19

12.6. Key Trends Analysis

12.6.1. Demand Side

12.6.2. Supplier Side

12.7. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Cutting Width, 2017 - 2031

12.7.1. Up to 7 inch

12.7.2. 7 inch to 9 inch

12.7.3. More than 9 inch

12.8. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Lawn Size, 2017 - 2031

12.8.1. Small Lawn Size

12.8.2. Medium Lawn Size

12.8.3. Large Lawn Size

12.9. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By End-users, 2017 - 2031

12.9.1. Residential

12.9.2. Commercial

12.10. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

12.10.1. Low

12.10.2. Medium

12.10.3. High

12.11. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

12.11.1. Online

12.11.1.1. E-commerce Websites

12.11.1.2. Company Owned Websites

12.11.2. Offline

12.11.2.1. Hypermarket and Supermarkets

12.11.2.2. Specialty Stores

12.11.2.3. Other Retail Based Stores

12.12. Incremental Opportunity, By Distribution Channel

13. Canada Robotic Lawn Mowers Market Analysis and Forecast

13.1. Country Snapshot

13.2. Consumer Buying Behavior

13.3. Brand Analysis

13.4. Covid-19 Impact Analysis

13.5. Price Trend Analysis

13.5.1. Weighted Average Price

13.5.2. Price Impact- Covid 19

13.6. Key Trends Analysis

13.6.1. Demand Side

13.6.2. Supplier Side

13.7. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Cutting Width, 2017 - 2031

13.7.1. Up to 7 inch

13.7.2. 7 inch to 9 inch

13.7.3. More than 9 inch

13.8. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Lawn Size, 2017 - 2031

13.8.1. Small Lawn Size

13.8.2. Medium Lawn Size

13.8.3. Large Lawn Size

13.9. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By End-users, 2017 - 2031

13.9.1. Residential

13.9.2. Commercial

13.10. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

13.10.1. Low

13.10.2. Medium

13.10.3. High

13.11. Robotic Lawn Mowers Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

13.11.1. Online

13.11.1.1. E-commerce Websites

13.11.1.2. Company Owned Websites

13.11.2. Offline

13.11.2.1. Hypermarket and Supermarkets

13.11.2.2. Specialty Stores

13.11.2.3. Other Retail Based Stores

13.12. Incremental Opportunity, By Distribution Channel

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), 2020

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

14.3.1. American Honda Motor Co., Inc.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Financial/Revenue

14.3.1.4. Strategy & Business Overview

14.3.1.5. Sales Channel Analysis

14.3.1.6. Size Portfolio

14.3.2. Autmow Robotic Mowing Company

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Financial/Revenue

14.3.2.4. Strategy & Business Overview

14.3.2.5. Sales Channel Analysis

14.3.2.6. Size Portfolio

14.3.3. Deere & Company

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Financial/Revenue

14.3.3.4. Strategy & Business Overview

14.3.3.5. Sales Channel Analysis

14.3.3.6. Size Portfolio

14.3.4. Husqvarna AB

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Financial/Revenue

14.3.4.4. Strategy & Business Overview

14.3.4.5. Sales Channel Analysis

14.3.4.6. Size Portfolio

14.3.5. Kyodo Co., Ltd.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Financial/Revenue

14.3.5.4. Strategy & Business Overview

14.3.5.5. Sales Channel Analysis

14.3.5.6. Size Portfolio

14.3.6. MTD Products Inc.

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Financial/Revenue

14.3.6.4. Strategy & Business Overview

14.3.6.5. Sales Channel Analysis

14.3.6.6. Size Portfolio

14.3.7. Positec Tool Corporation

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Financial/Revenue

14.3.7.4. Strategy & Business Overview

14.3.7.5. Sales Channel Analysis

14.3.7.6. Size Portfolio

14.3.8. Stanley Black & Decker Inc.

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Financial/Revenue

14.3.8.4. Strategy & Business Overview

14.3.8.5. Sales Channel Analysis

14.3.8.6. Size Portfolio

14.3.9. Wiper S.R.L.

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Financial/Revenue

14.3.9.4. Strategy & Business Overview

14.3.9.5. Sales Channel Analysis

14.3.9.6. Size Portfolio

14.3.10. Zucchetti Centro Sistemi SPA

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Financial/Revenue

14.3.10.4. Strategy & Business Overview

14.3.10.5. Sales Channel Analysis

14.3.10.6. Size Portfolio

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. Cutting Width

15.1.2. Lawn Size

15.1.3. End-users

15.1.4. Price

15.1.5. Distribution Channel

15.1.6. Country

15.2. Understanding the Buying Process of the Consumers

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Table 2: North America Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 - 2031

Table 3: North America Robotic Lawn Mower, Volume Size and Forecast, By Lawn Size, Thousand Units, 2017 - 2031

Table 4: North America Robotic Lawn Mower, Value Size and Forecast, By Lawn Size, US$ Mn, 2017 - 2031

Table 5: North America Robotic Lawn Mower, Volume Size and Forecast, By End-Users, Thousand Units, 2017 - 2031

Table 6: North America Robotic Lawn Mower, Value Size and Forecast, By End-Users, US$ Mn, 2017 - 2031

Table 7: North America Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Table 8: North America Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Table 9: North America Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Table 10: North America Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Table 11: North America Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Table 12: North America Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 - 2031

Table 13: U.S Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Table 14: U.S Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 - 2031

Table 15: U.S Robotic Lawn Mower, Volume Size and Forecast, By Lawn Size, Thousand Units, 2017 - 2031

Table 16: U.S Robotic Lawn Mower, Value Size and Forecast, By Lawn Size, US$ Mn, 2017 - 2031

Table 17: U.S Robotic Lawn Mower, Volume Size and Forecast, By End-Users, Thousand Units, 2017 - 2031

Table 18: U.S Robotic Lawn Mower, Value Size and Forecast, By End-Users, US$ Mn, 2017 - 2031

Table 19: U.S Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Table 20: U.S Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Table 21: U.S Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Table 22: U.S Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Table 23: U.S Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Table 24: U.S Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 - 2031

Table 25: Canada Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Table 26: Canada Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 - 2031

Table 27: Canada Robotic Lawn Mower, Volume Size and Forecast, By Lawn Size, Thousand Units, 2017 - 2031

Table 28: Canada Robotic Lawn Mower, Value Size and Forecast, By Lawn Size, US$ Mn, 2017 - 2031

Table 29: Canada Robotic Lawn Mower, Volume Size and Forecast, By End-Users, Thousand Units, 2017 - 2031

Table 30: Canada Robotic Lawn Mower, Value Size and Forecast, By End-Users, US$ Mn, 2017 - 2031

Table 31: Canada Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Table 32: Canada Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Table 33: Canada Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Table 34: Canada Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Table 35: Canada Robotic Lawn Mower, Volume Size and Forecast, By Thousand Units, 2017 - 2031

Table 36: Canada Robotic Lawn Mower, Value Size and Forecast, By US$ Mn, 2017 - 2031

List of Figures

Figure 1: North America Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Figure 2: North America Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 - 2031

Figure 3: North America Robotic Lawn Mower, Incremental Opportunity, By Cutting Width, US$ Mn, 2021 - 2031

Figure 4: North America Robotic Lawn Mower, Volume Size and Forecast, By Lawn Size, Thousand Units, 2017 - 2031

Figure 5: North America Robotic Lawn Mower, Value Size and Forecast, By Lawn Size, US$ Mn, 2017 - 2031

Figure 6: North America Robotic Lawn Mower, Incremental Opportunity, By Lawn Size, US$ Mn, 2021 - 2031

Figure 7: North America Robotic Lawn Mower, Volume Size and Forecast, By End-Users, Thousand Units, 2017 - 2031

Figure 8: North America Robotic Lawn Mower, Value Size and Forecast, By End-Users, US$ Mn, 2017 - 2031

Figure 9: North America Robotic Lawn Mower, Incremental Opportunity, By End-Users, US$ Mn, 2017 - 2031

Figure 10: North America Robotic Lawn Mower, Volume Size and Forecast, By Price, Thousand Units, 2017 - 2031

Figure 11: North America Robotic Lawn Mower, Value Size and Forecast, By Price, US$ Mn, 2017 - 2031

Figure 12: North America Robotic Lawn Mower, Incremental Opportunity, By Price, US$ Mn, 2017 - 2031

Figure 13: North America Robotic Lawn Mower, Volume Size and Forecast, By Distribution Channel, Thousand Units, 2017 - 2031

Figure 14: North America Robotic Lawn Mower, Value Size and Forecast, By Distribution Channel, US$ Mn, 2017 - 2031

Figure 15: North America Robotic Lawn Mower, Incremental Opportunity, By Distribution Channel, US$ Mn, 2017 - 2031

Figure 16: North America Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 – 2031

Figure 17: North America Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 – 2031

Figure 18: North America Robotic Lawn Mower, Incremental Opportunity, By Country, US$ Mn, 2017 - 2031

Figure 19: U.S Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Figure 20: U.S Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 – 2031

Figure 21: U.S Robotic Lawn Mower, Incremental Opportunity, By Cutting Width, US$ Mn, 2017 - 2031

Figure 22: U.S Robotic Lawn Mower, Volume Size and Forecast, By Lawn Size, Thousand Units, 2017 - 2031

Figure 23: U.S Robotic Lawn Mower, Value Size and Forecast, By Lawn Size, US$ Mn, 2017 - 2031

Figure 24: U.S Robotic Lawn Mower, Incremental Opportunity, By Lawn Size, US$ Mn, 2017 - 2031

Figure 25: U.S Robotic Lawn Mower, Volume Size and Forecast, By End-Users, Thousand Units, 2017 - 2031

Figure 26: U.S Robotic Lawn Mower, Value Size and Forecast, By End-Users, US$ Mn, 2017 - 2031

Figure 27: U.S Robotic Lawn Mower, Incremental Opportunity, By End-Users, US$ Mn, 2017 - 2031

Figure 28: U.S Robotic Lawn Mower, Volume Size and Forecast, By Price, Thousand Units, 2017 - 2031

Figure 29: U.S Robotic Lawn Mower, Value Size and Forecast, By Price, US$ Mn, 2017 - 2031

Figure 30: U.S Robotic Lawn Mower, Incremental Opportunity, By Price, US$ Mn, 2017 - 2031

Figure 31: U.S Robotic Lawn Mower, Volume Size and Forecast, By Distribution Channel, Thousand Units, 2017 - 2031

Figure 32: U.S Robotic Lawn Mower, Value Size and Forecast, By Distribution Channel, US$ Mn, 2017 - 2031

Figure 33: U.S Robotic Lawn Mower, Incremental Opportunity, By Distribution Channel, US$ Mn, 2024 - 2031

Figure 34: U.S Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Figure 35: U.S Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 – 2031

Figure 36: U.S Robotic Lawn Mower, Incremental Opportunity, By Country, US$ Mn, 2017 - 2031

Figure 37: Canada Robotic Lawn Mower, Volume Size and Forecast, By Cutting Width, Thousand Units, 2017 - 2031

Figure 38: Canada Robotic Lawn Mower, Value Size and Forecast, By Cutting Width, US$ Mn, 2017 - 2031

Figure 39: Canada Robotic Lawn Mower, Incremental Opportunity, By Cutting Width, US$ Mn, 2017 - 2031

Figure 40: Canada Robotic Lawn Mower, Volume Size and Forecast, By Lawn Size, Thousand Units, 2017 - 2031

Figure 41: Canada Robotic Lawn Mower, Value Size and Forecast, By Lawn Size, US$ Mn, 2017 - 2031

Figure 42: Canada Robotic Lawn Mower, Incremental Opportunity, By Lawn Size, US$ Mn, 2017 - 2031

Figure 43: Canada Robotic Lawn Mower, Volume Size and Forecast, By End-Users, Thousand Units, 2017 - 2031

Figure 44: Canada Robotic Lawn Mower, Value Size and Forecast, By End-Users, US$ Mn, 2017 - 2031

Figure 45: Canada Robotic Lawn Mower, Incremental Opportunity, By End-Users, US$ Mn, 2017 - 2031

Figure 46: Canada Robotic Lawn Mower, Volume Size and Forecast, By Price, Thousand Units, 2017 - 2031

Figure 47: Canada Robotic Lawn Mower, Value Size and Forecast, By Price, US$ Mn, 2017 - 2031

Figure 48: Canada Robotic Lawn Mower, Incremental Opportunity, By Price, US$ Mn, 2017 - 2031

Figure 49: Canada Robotic Lawn Mower, Volume Size and Forecast, By Distribution Channel, Thousand Units, 2017 –2031

Figure 50: Canada Robotic Lawn Mower, Value Size and Forecast, By Distribution Channel, US$ Mn, 2017 - 2031

Figure 51: Canada Robotic Lawn Mower, Incremental Opportunity, By Distribution Channel, US$ Mn, 2017 - 2031

Figure 52: Canada Robotic Lawn Mower, Volume Size and Forecast, By Country, Thousand Units, 2017 - 2031

Figure 53: Canada Robotic Lawn Mower, Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Figure 54: Canada Robotic Lawn Mower, Incremental Opportunity, By Country, US$ Mn, 2017 - 2031