Stakeholders in the North America refurbished dental equipment & maintenance market are supporting healthcare professionals in the practice of dental equipment asepsis during the ongoing coronavirus pandemic. A-dec - a dental office furniture and equipment manufacturer based in Newberg, U.S., is increasing efforts to support dental practitioners for dental equipment infection control.

Dental practitioners and companies in the North America refurbished dental equipment & maintenance market are gaining awareness about guidelines issued by the World Health Organization (WHO) and the United States Centers for Disease Control and Prevention (CDC). This guidance is necessary for re-opening of practice during the pandemic and pertaining to small business administration loans. Digital events and webinars are growing prominent to support dental practitioners.

Request a sample to get extensive insights into the Refurbished Dental Equipment & Maintenance Market

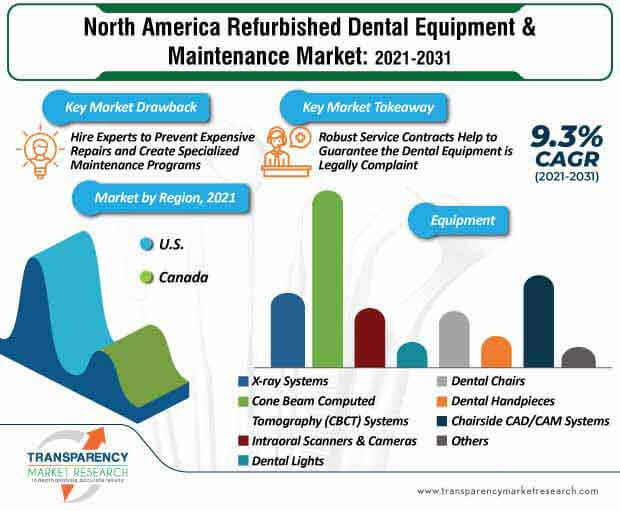

When equipment malfunctions or breaks down, the downtime results in loss of productivity and repair costs. However, high repair costs are creating concerns for cash-strapped healthcare systems. Hence, service providers are competing to offer cost efficient maintenance, repair, and safety services. Companies in the North America refurbished dental equipment & maintenance market are hiring experts that help to prevent expensive repairs, promote the safe use of equipment, and create specialized maintenance programs.

Specialized maintenance programs are helping to track who is responsible for handling the equipment, along with documentation whilst ensuring appropriate resale value for the equipment. Service providers are increasing efforts to address a variety of simulated equipment problems to assess and repair during chairside. There is a need for hands-on experiences designed to heighten the understanding of common equipment malfunctions.

To understand how our report can bring difference to your business strategy, Ask for a brochure

The North America refurbished dental equipment & maintenance market is expected to expand at a CAGR of 9.3% during the forecast period. Dental equipment engineers are playing a key role in ensuring refurbished machines run at peak performance. Companies in the North America refurbished dental equipment & maintenance market are offering rapid and meticulous repair work to dental practitioners. Thus, to boost credibility, service providers are adhering to stringent compliance standards to ensure patient quality of life and better medical outcomes.

The North America refurbished dental equipment & maintenance market is expected to reach the revenue of US$ 611.3 Mn by 2031. Service providers are offering annual equipment servicing and three tier of service contract to enhance client experience. Companies are increasing focus on breakdown repair and ongoing maintenance for critical dental equipment. They are ensuring legal compliance checks to meet international standards.

Robust service contracts help to guarantee that the dental equipment is legally complaint and regularly inspected to ensure the equipment performs in peak condition. Since quality dental practice training is hard to find in the U.S., service providers are developing courses that will provide continued professional development opportunities.

Comprehensive compliance services are being provided by companies in the North America refurbished dental equipment & maintenance market. These services help to remove stress from meeting compliance standards. Hence, companies are hiring experts to ensure compliance with necessary standards to run required checks for optimum maintenance of refurbished dental equipment.

Peak performance of refurbished dental equipment is critical while providing dental services, since dentistry is technology dependent. Companies in the North America refurbished dental equipment & maintenance market are gaining awareness about these requirements and helping dental practitioners to care less about concerns with the functionality of the equipment.

An increasing number of new dental practices are contributing to market growth. New dental surgeries and private dental ventures are creating revenue opportunities for service providers. Cash-rich service providers have an edge over emerging market players, since dental practitioners are looking for experienced service providers.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Refurbished Dental Equipment & Maintenance Market

Analysts’ Viewpoint

Adhering to standards and importance of transmission-based precautions are growing prominent among dental practitioners amid the ongoing coronavirus pandemic. It has been found that high competition is emerging as a challenge for service providers since dental practitioners are looking for cost efficient repair & maintenance services. Although cash-rich companies are advantageous about their experience, emerging companies are increasing their R&D efforts to provide latest repair & maintenance services to gain a competitive edge over established service providers. Apart from services, companies in the North America refurbished dental equipment & maintenance market are offering educational courses to dental staff to ensure efficient handling of machines.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 243.5 Mn |

|

Market Forecast Value in 2031 |

US$ 611.3 Mn |

|

Growth Rate (CAGR) |

9.3% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

North America Refurbished Dental Equipment & Maintenance Market – Segmentation

The refurbished dental equipment & maintenance market in North America has been segmented based on equipment and maintenance. The report presents extensive market dynamics and progressive trends associated with different segments and how they are influencing the refurbished dental equipment & maintenance market in North America.

| Equipment |

|

| Maintenance |

|

| Country |

|

Refurbished dental equipment & maintenance market in North America to reach valuation of US$ 611.3 Mn by 2031

Refurbished dental equipment & maintenance market in North America is expected to expand at a CAGR of 9.3% during 2021-2031

Refurbished dental equipment & maintenance market in North America is driven by rise in dental diseases, and presence of companies offering dental refurbished products and technological advancements

U.S. held a major share of the refurbished dental equipment & maintenance market in North America

Key players operating in the refurbished dental equipment & maintenance market in North America include Capital Dental Equipment, North America Imaging Resources, Renew Digital, LLC, Dental Equipment Liquidators, Inc., Dental Planet, LLC

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: North America Refurbished Dental Equipment & Maintenance Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. North America Refurbished Dental Equipment & Maintenance Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. North America Refurbished Dental Equipment & Maintenance Market Analysis and Forecast, by Equipment

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Value Forecast, by Equipment, 2017–2031

5.3.1. X-ray Systems

5.3.2. Cone Beam Computed Tomography (CBCT) Systems

5.3.3. Intraoral Scanners & Cameras

5.3.4. Dental Lights

5.3.5. Dental Chairs

5.3.6. Dental Handpieces

5.3.7. Chairside CAD/CAM Systems

5.3.8. Others

5.4. Market Attractiveness Analysis, by Equipment

6. North America Refurbished Dental Equipment Market Analysis and Forecast, by Equipment, by Country

6.1. Key Findings

6.2. Market Value Forecast, by Country

6.2.1. U.S.

6.2.2. Canada

6.3. Market Attractiveness Analysis, by Country

7. North America Refurbished Dental Equipment & Maintenance Market Analysis and Forecast, by Maintenance

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Maintenance, 2017–2031

7.3.1. X-ray Systems

7.3.2. Cone Beam Computed Tomography (CBCT) Systems

7.3.3. Intraoral Scanners & Cameras

7.3.4. Dental Lights

7.3.5. Dental Chairs

7.3.6. Dental Handpieces

7.3.7. Chairside CAD/CAM Systems

7.3.8. Others

7.4. Market Attractiveness Analysis, by Maintenance

8. North America Refurbished Dental Maintenance Market Analysis and Forecast, by Maintenance, by Country

8.1. Key Findings

8.2. Market Value Forecast, by Country

8.2.1. North America

8.2.2. Canada

8.3. Market Attractiveness Analysis, by Country

9. Competition Landscape

9.1. Market Player – Competition Matrix (By Tier and Size of companies)

9.2. Company Profiles

9.2.1. American Dental Refurbishment

9.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.1.2. Company Financials

9.2.1.3. Growth Strategies

9.2.1.4. SWOT Analysis

9.2.2. Atlas Resell Management

9.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.2.2. Company Financials

9.2.2.3. Growth Strategies

9.2.2.4. SWOT Analysis

9.2.3. A & K Dental Equipment

9.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.3.2. Company Financials

9.2.3.3. Growth Strategies

9.2.3.4. SWOT Analysis

9.2.4. Capital Dental Equipment

9.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.4.2. Company Financials

9.2.4.3. Growth Strategies

9.2.4.4. SWOT Analysis

9.2.5. Collins Dental Equipment, Inc.

9.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.5.2. Company Financials

9.2.5.3. Growth Strategies

9.2.5.4. SWOT Analysis

9.2.6. DENTAL Equipment Liquidators, Inc.

9.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.6.2. Company Financials

9.2.6.3. Growth Strategies

9.2.6.4. SWOT Analysis

9.2.7. Dental Planet, LLC

9.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.7.2. Company Financials

9.2.7.3. Growth Strategies

9.2.7.4. SWOT Analysis

9.2.8. Henry Schein, Inc.

9.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.8.2. Company Financials

9.2.8.3. Growth Strategies

9.2.8.4. SWOT Analysis

9.2.9. Independent Dental, Inc.

9.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.9.2. Company Financials

9.2.9.3. Growth Strategies

9.2.9.4. SWOT Analysis

9.2.10. North America Imaging Resources

9.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.10.2. Company Financials

9.2.10.3. Growth Strategies

9.2.10.4. SWOT Analysis

9.2.11. Pre-Owned Dental, Inc.

9.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.11.2. Company Financials

9.2.11.3. Growth Strategies

9.2.11.4. SWOT Analysis

9.2.12. Renew Digital, LLC

9.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.12.2. Company Financials

9.2.12.3. Growth Strategies

9.2.12.4. SWOT Analysis

List of Tables

Table 01: North America Refurbished Dental Equipment & Maintenance Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 02: North America Refurbished Dental Equipment & Maintenance Market Value (US$ Mn) Forecast, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2031

Table 03: North America Refurbished Dental Equipment & Maintenance Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 04: North America Refurbished Dental Equipment & Maintenance Market Value (US$ Mn) Forecast, by Maintenance, 2017–2031

Table 05: North America Refurbished Dental Equipment & Maintenance Market Value (US$ Mn) Forecast, by Maintenance, by Country, 2017–2031

List of Figures

Figure 01: North America Refurbished Dental Equipment & Maintenance Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: North America Refurbished Dental Equipment & Maintenance Market Value Share, by Equipment, 2020

Figure 03: North America Refurbished Dental Equipment & Maintenance Market Value Share, by Maintenance, 2020

Figure 04: North America Refurbished Dental Equipment Market Value Share, by Country, 2020

Figure 05: North America Refurbished Dental Maintenance Market Value Share, by Country, 2020

Figure 06: North America Refurbished Dental Equipment & Maintenance Market Value Share Analysis, by Equipment, 2020 and 2031

Figure 07: North America Refurbished Dental Equipment & Maintenance Market Attractiveness Analysis, by Equipment, 2021–2031

Figure 08: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by X-ray Systems, 2017–2031

Figure 09: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Cone Beam Computed Tomography (CBCT) Systems, 2017–2031

Figure 10: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Intraoral Scanners & Cameras, 2017–2031

Figure 11: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Dental Lights, 2017–2031

Figure 12: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Dental Chairs, 2017–2031

Figure 13: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Dental Handpieces, 2017–2031

Figure 14: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Chairside CAD/CAM Systems, 2017–2031

Figure 15: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Others, 2017–2031

Figure 16: North America Refurbished Dental Equipment Market Value Share Analysis, by Country, 2020 and 2031

Figure 17: North America Refurbished Dental Equipment Market Attractiveness Analysis, by Country, 2021–2031

Figure 18: North America Refurbished Dental Equipment & Maintenance Market Value Share Analysis, by Maintenance , 2020 and 2031

Figure 19: North America Refurbished Dental Equipment & Maintenance Market Attractiveness Analysis, by Maintenance , 2021–2031

Figure 20: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by X-ray Systems, 2017–2031

Figure 21: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Cone Beam Computed Tomography (CBCT) Systems, 2017–2031

Figure 22: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Intraoral Scanners & Cameras, 2017–2031

Figure 23: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Dental Lights, 2017–2031

Figure 24: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Dental Chairs, 2017–2031

Figure 25: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Dental Handpieces, 2017–2031

Figure 26: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Chairside CAD/CAM Systems, 2017–2031

Figure 27: North America Refurbished Dental Equipment & Maintenance Market Revenue (US$ Mn), by Others, 2017–2031

Figure 28: North America Refurbished Dental Equipment & Maintenance Market Analysis, by Maintenance, by Country, 2020 and 2031

Figure 29: North America Refurbished Dental Equipment & Maintenance Market Analysis, by Maintenance, by Country, 2021–2031