Analysts’ Viewpoint on North America Loading Platforms Market Scenario

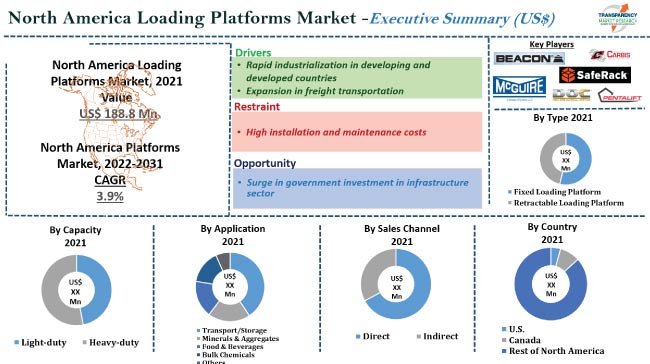

Rapid industrialization in developing and developed countries is driving the North America loading platforms market size. Loading platforms are increasingly used in chemical and freight transportation industries to assemble, install, and relocate equipment, materials, and structures. Several countries in North America are investing significantly in infrastructure development due to rapid urbanization, industrialization, and population growth. Increase in construction and manufacturing activities is anticipated to boost the demand for loading platforms during the forecast period. Prominent companies in the market are investing significantly in R&D activities to expand their product portfolio. They are also signing strategic partnership and M&A deals to increase their loading platforms market share in North America.

Loading platforms are constructed to load or unload goods and materials. They help protect workers against falls while unloading and loading heavy goods. Loading platforms are designed to transfer materials and vehicles from the service area to the internally raised floor of the warehouse. Loading platforms in the construction sector are fixed on single foundation columns to provide straightforward and safe access to the top of tankers and rail cars. They are manufactured to meet operational requirements and environmental conditions. Truck loading platforms, loading dock platforms, mobile loading platforms, forklift loading platforms, telescopic loading platforms, and various loading dock equipment are available in the market.

The U.S. is one of the leading manufacturers of industrial goods and products. Expansion in the manufacturing sector in the country is likely to boost the demand for loading platforms during the forecast period. Additionally, the U.S. continues to attract significant foreign investment, particularly from manufacturing companies. These companies increasingly rely on power-driven machines and material handling equipment for various operations. As of 2022, there are approximately 718,796 manufacturing enterprises in the U.S., a 3.8% increase from that in 2021. The number of enterprises in the manufacturing industry in the country increased by 3.8% annually on average from 2017 to 2022. Rise in demand for bow loading systems in the oil & gas market is also anticipated to drive the market in the next few years. Bow loading systems are used to transfer petroleum products from a floating production, storage, and offloading (FPSO) vessel to a marine shuttle tanker.

Rapid industrialization and urbanization have prompted governments in North America to bolster their investments in the infrastructure sector in the region. In October 2022, the U.S. Department of Transportation, through the Maritime Administration’s Port Infrastructure Development Program (PIDP), announced a US$ 703 Mn plan to fund 41 projects in 22 states and one territory in order to improve port facilities across the country. According to the U.S. Census Bureau, construction investment amounted to around US$ 1.18 Trn during the first eight months of 2022. This expenditure was 10.9% above the US$ 1.06 Trn investment for the same period in 2021.

In terms of type, the North America loading platforms market has been bifurcated into fixed loading platform and retractable loading platform. The retractable loading platform segment is expected to grow at the fastest rate during the forecast period. Expansion in freight transportation is a key factor fueling the segment. Retractable loading platforms are flexible and easy to install and operate. They also require less maintenance.

Based on application, the North America loading platforms market has been segmented into transport/storage, minerals & aggregates, food & beverages, bulk chemicals, and others. The bulk chemicals segment is expected to account for the largest share of the market in North America during the forecast period. Rapid industrialization and surge in construction activities are driving the segment in the region.

The U.S. held the largest value share of the North America loading platforms market in 2021. This trend is expected to continue during the forecast period. Rapid growth in the construction sector is propelling the demand for construction site loading platforms in the U.S.

The market in Canada is expected to grow at a significant pace during the forecast period due to the increase in adoption of material handling equipment across end-use industries in the country. Loading platforms help reduce turnaround time and enhance workplace safety in various loading and unloading activities in construction, transportation, and others industries.

The North America loading platforms market is consolidated, with a few large-scale vendors controlling majority of the share. Loading platform manufacturers, traders, and suppliers are focused on offering novel products that meet customer needs. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by market players. Beacon Industries, Inc., Safe Harbor Access Systems, SafeRack, DOC Manufacturing, Inc., Medlin Ramps, McGuire, Pentalift Equipment Corporation, Carbis Solutions, Superior Handling Equipment, and Dockzilla Co. are prominent entities operating in this market.

Each of these players has been profiled in the North America loading platforms market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 188.8 Mn |

|

Market Forecast Value in 2031 |

US$ 275.2 Mn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the region as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Country Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The North America loading platforms market was valued at US$ 188.8 Mn in 2021.

The North America loading platforms market is estimated to grow at a CAGR of 3.9% during 2022-2031.

The North America loading platforms market is likely to reach US$ 275.2 Mn by 2031.

The retractable loading platform segment is expected to grow at the highest CAGR during the forecast period.

The U.S. is expected to hold the highest CAGR during the forecast period.

Rapid industrialization and surge in government investment in infrastructure sector.

Beacon Industries, Inc., Safe Harbor Access Systems, SafeRack, DOC Manufacturing, Inc., Medlin Ramps, McGuire, Pentalift Equipment Corporation, Carbis Solutions, Superior Handling Equipment, and Dockzilla Co.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Loading System Market Overview

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Technology Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Regulatory Framework

5.10. North America Loading Platforms Analysis and Forecast, 2017- 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. North America Loading Platforms Market Analysis and Forecast, by Type

6.1. North America Loading Platforms Market Size (US$ Mn) (Units), by Type, 2017- 2031

6.1.1. Fixed Loading Platform

6.1.2. Retractable Loading Platform

6.2. Incremental Opportunity, by Type

7. North America Loading Platforms Market Analysis and Forecast, by Capacity

7.1. North America Loading Platforms Market Size (US$ Mn) (Units), by Capacity, 2017- 2031

7.1.1. Light-duty

7.1.2. Heavy-duty

7.2. Incremental Opportunity, by Capacity

8. North America Loading Platforms Market Analysis and Forecast, by Application

8.1. North America Loading Platforms Market Size (US$ Mn) (Units), by Application, 2017- 2031

8.1.1. Transport/Storage

8.1.2. Minerals & Aggregates

8.1.3. Food & Beverages

8.1.4. Bulk Chemicals

8.1.5. Others

8.2. Incremental Opportunity, by Application

9. North America Loading Platforms Market Analysis and Forecast, by Sales Channel

9.1. North America Loading Platforms Market Size (US$ Mn) (Units), by Sales Channel, 2017- 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, by Sales Channel

10. North America Loading Platforms Market Analysis and Forecast, by Country

10.1. North America Loading Platforms Market Size (US$ Mn) (Units), by Country, 2017- 2031

10.1.1. U.S.

10.1.2. Canada

10.1.3. Rest of North America

10.2. Incremental Opportunity, by Country

11. U.S. Loading Platforms Market Analysis and Forecast

11.1. Regional Snapshot

11.2. COVID-19 Impact Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supply Side

11.5. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

11.5.1. Fixed Loading Platform

11.5.2. Retractable Loading Platform

11.6. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 - 2031

11.6.1. Light-duty

11.6.2. Heavy-duty

11.7. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

11.7.1. Transport/Storage

11.7.2. Minerals & Aggregates

11.7.3. Food & Beverages

11.7.4. Bulk Chemicals

11.7.5. Others

11.8. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Sales Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

12. Canada Loading Platforms Market Analysis and Forecast

12.1. Regional Snapshot

12.2. COVID-19 Impact Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supply Side

12.5. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

12.5.1. Fixed Loading Platform

12.5.2. Retractable Loading Platform

12.6. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 - 2031

12.6.1. Light-duty

12.6.2. Heavy-duty

12.7. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

12.7.1. Transport/Storage

12.7.2. Minerals & Aggregates

12.7.3. Food & Beverages

12.7.4. Bulk Chemicals

12.7.5. Others

12.8. Loading Platforms Market (US$ Mn and Thousand Units) Forecast, By Sales Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

13. Competition Landscape

13.1. Competition Dashboard

13.2. Market Share Analysis % (2021)

13.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies/Recent Developments]

13.3.1. Beacon Industries, Inc.

13.3.1.1. Company Overview

13.3.1.2. Product Portfolio

13.3.1.3. Financial Information

13.3.1.4. (Subject to Data Availability)

13.3.1.5. Business Strategies/Recent Developments

13.3.2. Safe Harbor Access Systems

13.3.2.1. Company Overview

13.3.2.2. Product Portfolio

13.3.2.3. Financial Information

13.3.2.4. (Subject to Data Availability)

13.3.2.5. Business Strategies/Recent Developments

13.3.3. SafeRack

13.3.3.1. Company Overview

13.3.3.2. Product Portfolio

13.3.3.3. Financial Information

13.3.3.4. (Subject to Data Availability)

13.3.3.5. Business Strategies/Recent Developments

13.3.4. DOC Manufacturing, Inc.

13.3.4.1. Company Overview

13.3.4.2. Product Portfolio

13.3.4.3. Financial Information

13.3.4.4. (Subject to Data Availability)

13.3.4.5. Business Strategies/Recent Developments

13.3.5. Medlin Ramps

13.3.5.1. Company Overview

13.3.5.2. Product Portfolio

13.3.5.3. Financial Information

13.3.5.4. (Subject to Data Availability)

13.3.5.5. Business Strategies/Recent Developments

13.3.6. McGuire

13.3.6.1. Company Overview

13.3.6.2. Product Portfolio

13.3.6.3. Financial Information

13.3.6.4. (Subject to Data Availability)

13.3.6.5. Business Strategies/Recent Developments

13.3.7. Pentalift Equipment Corporation

13.3.7.1. Company Overview

13.3.7.2. Product Portfolio

13.3.7.3. Financial Information

13.3.7.4. (Subject to Data Availability)

13.3.7.5. Business Strategies/Recent Developments

13.3.8. Carbis Solutions

13.3.8.1. Company Overview

13.3.8.2. Product Portfolio

13.3.8.3. Financial Information

13.3.8.4. (Subject to Data Availability)

13.3.8.5. Business Strategies/Recent Developments

13.3.9. Superior Handling Equipment

13.3.9.1. Company Overview

13.3.9.2. Product Portfolio

13.3.9.3. Financial Information

13.3.9.4. (Subject to Data Availability)

13.3.9.5. Business Strategies/Recent Developments

13.3.10. Dockzilla Co.

13.3.10.1. Company Overview

13.3.10.2. Product Portfolio

13.3.10.3. Financial Information

13.3.10.4. (Subject to Data Availability)

13.3.10.5. Business Strategies/Recent Developments

14. Key Takeaways

14.1. Identification of Potential Market Spaces

14.1.1. By Type

14.1.2. By Capacity

14.1.3. By Application

14.1.4. By Sales Channel

14.1.5. By Country

14.2. Understanding the Procurement Process of End Users

14.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Loading Platforms Market Value, by Type, US$ Mn, 2017-2031

Table 2: North America Loading Platforms Market Volume, by Type, Thousand Units,2017-2031

Table 3: North America Loading Platforms Market Value, by Capacity, US$ Mn, 2017-2031

Table 4: North America Loading Platforms Market Volume, by Capacity, Thousand Units,2017-2031

Table 5: North America Loading Platforms Market Value, by Application, US$ Mn, 2017-2031

Table 6: North America Loading Platforms Market Volume, by Application, Thousand Units,2017-2031

Table 7: North America Loading Platforms Market Value, by Sales Channel, US$ Mn, 2017-2031

Table 8: North America Loading Platforms Market Volume, by Sales Channel, Thousand Units,2017-2031

Table 9: North America Loading Platforms Market Value, by Country, US$ Mn, 2017-2031

Table 10: North America Loading Platforms Market Volume, by Country, Thousand Units,2017-2031

Table 11: U.S. Loading Platforms Market Value, by Type, US$ Mn, 2017-2031

Table 12: U.S. Loading Platforms Market Volume, by Type, Thousand Units,2017-2031

Table 13: U.S. Loading Platforms Market Value, by Capacity, US$ Mn, 2017-2031

Table 14: U.S. Loading Platforms Market Volume, by Capacity, Thousand Units,2017-2031

Table 15: U.S. Loading Platforms Market Value, by Application, US$ Mn, 2017-2031

Table 16: U.S. Loading Platforms Market Volume, by Application, Thousand Units,2017-2031

Table 17: U.S. Loading Platforms Market Value, by Sales Channel, US$ Mn, 2017-2031

Table 18: U.S. Loading Platforms Market Volume, by Sales Channel, Thousand Units,2017-2031

Table 19: Canada Loading Platforms Market Value, by Type, US$ Mn, 2017-2031

Table 20: Canada Loading Platforms Market Volume, by Type, Thousand Units,2017-2031

Table 21: Canada Loading Platforms Market Value, by Capacity, US$ Mn, 2017-2031

Table 22: Canada Loading Platforms Market Volume, by Capacity, Thousand Units,2017-2031

Table 23: Canada Loading Platforms Market Value, by Application, US$ Mn, 2017-2031

Table 24: Canada Loading Platforms Market Volume, by Application, Thousand Units,2017-2031

Table 25: Canada Loading Platforms Market Value, by Sales Channel, US$ Mn, 2017-2031

Table 26: Canada Loading Platforms Market Volume, by Sales Channel, Thousand Units,2017-2031

List of Figures

Figure 1: North America Loading Platforms Market Value, by Type, US$ Mn, 2017-2031

Figure 2: North America Loading Platforms Market Volume, by Type, Thousand Units,2017-2031

Figure 3: North America Loading Platforms Market Incremental Opportunity, by Type, 2021-2031

Figure 4: North America Loading Platforms Market Value, by Capacity, US$ Mn, 2017-2031

Figure 5: North America Loading Platforms Market Volume, by Capacity, Thousand Units,2017-2031

Figure 6: North America Loading Platforms Market Incremental Opportunity, by Capacity, 2021-2031

Figure 7: North America Loading Platforms Market Value, by Application, US$ Mn, 2017-2031

Figure 8: North America Loading Platforms Market Volume, by Application, Thousand Units,2017-2031

Figure 9: North America Loading Platforms Market Incremental Opportunity, by Application, 2021-2031

Figure 10: North America Loading Platforms Market Value, by Sales Channel, US$ Mn, 2017-2031

Figure 11: North America Loading Platforms Market Volume, by Sales Channel, Thousand Units,2017-2031

Figure 12: North America Loading Platforms Market Incremental Opportunity, by Sales Channel, 2021-2031

Figure 13: North America Loading Platforms Market Value, by Country, US$ Mn, 2017-2031

Figure 14: North America Loading Platforms Market Volume, by Country, Thousand Units,2017-2031

Figure 15: North America Loading Platforms Market Incremental Opportunity, by Country,2021-2031

Figure 16: U.S. Loading Platforms Market Value, by Type, US$ Mn, 2017-2031

Figure 17: U.S. Loading Platforms Market Volume, by Type, Thousand Units,2017-2031

Figure 18: U.S. Loading Platforms Market Incremental Opportunity, by Type, 2021-2031

Figure 19: U.S. Loading Platforms Market Value, by Capacity, US$ Mn, 2017-2031

Figure 20: U.S. Loading Platforms Market Volume, by Capacity, Thousand Units,2017-2031

Figure 21: U.S. Loading Platforms Market Incremental Opportunity, by Capacity, 2021-2031

Figure 22: U.S. Loading Platforms Market Value, by Application, US$ Mn, 2017-2031

Figure 23: U.S. Loading Platforms Market Volume, by Application, Thousand Units,2017-2031

Figure 24: U.S. Loading Platforms Market Incremental Opportunity, by Application, 2021-2031

Figure 25: U.S. Loading Platforms Market Value, by Sales Channel, US$ Mn, 2017-2031

Figure 26: U.S. Loading Platforms Market Volume, by Sales Channel, Thousand Units,2017-2031

Figure 27: U.S. Loading Platforms Market Incremental Opportunity, by Sales Channel, 2021-2031

Figure 28: Canada Loading Platforms Market Value, by Type, US$ Mn, 2017-2031

Figure 29: Canada Loading Platforms Market Volume, by Type, Thousand Units,2017-2031

Figure 30: Canada Loading Platforms Market Incremental Opportunity, by Type, 2021-2031

Figure 31: Canada Loading Platforms Market Value, by Capacity, US$ Mn, 2017-2031

Figure 32: Canada Loading Platforms Market Volume, by Capacity, Thousand Units,2017-2031

Figure 33: Canada Loading Platforms Market Incremental Opportunity, by Capacity, 2021-2031

Figure 34: Canada Loading Platforms Market Value, by Application, US$ Mn, 2017-2031

Figure 35: Canada Loading Platforms Market Volume, by Application, Thousand Units,2017-2031

Figure 36: Canada Loading Platforms Market Incremental Opportunity, by Application, 2021-2031

Figure 37: Canada Loading Platforms Market Value, by Sales Channel, US$ Mn, 2017-2031

Figure 38: Canada Loading Platforms Market Volume, by Sales Channel, Thousand Units,2017-2031

Figure 39: Canada Loading Platforms Market Incremental Opportunity, by Sales Channel, 2021-2031