Technological Breakthroughs in Touchscreen Display to Bolster Growth of the Global Kiosk Market

The demand for kiosks is driven by various factors such as reduced investment costs than conventional channels, improved consumer shopping experiences, expanded uses other than traditional ones, and breakthroughs in touch screen display as well as glass technology. These factors are expected to bolster growth of the global kiosk market in the years to come.

The rise in vehicle manufacturing in developing markets, governments' increasing focus on imposing tight regulatory requirements on the automotive sector, and a growing preference for outsourcing TIC services to expand market share. In addition to growing customer knowledge about product quality and safety, rising use of automotive electronics to ensure passenger and vehicle safety is likely to drive demand in the global kiosk market.

Growing Popularity of Interactive Kiosks is Expected to Foster Growth of the Market

The COVID-19 epidemic is going to wreak havoc on the kiosk industry, as the crisis has wreaked havoc on the tourism as well as retail industries. As per the United Nations World Tourism Organization (UNWTO), foreign tourist numbers decreased by 98% in May 2020, is likely to cost the global tourism industry an estimated US$ 320 Bn. Consumers are being forced to stay at home as a result of lockdowns and social distancing tactics, resulting in a significant drop in foot traffic at retail shops. The Trust for Retailers & Retail Associates of India (TRRAI), for example, predicts that the Indian retail sector is estimated to experience a 25-30% drop in activity. These technologies are widely used in the tourism industry to book tickets, cabs, fill out immigration paperwork, and obtain flight information, among other things. Kiosks are required in retail to make shopping easier for customers. Due to the contraction of both sectors' activity, demand for such devices will surely fall during the pandemic. Such multiple uses are expected to boost growth of the global kiosk market in the years to come.

Interactive kiosks provide consumers with a variety of useful services, including emergency warnings, advertising, live transit feeds, and free limitless Wi-Fi access, all of which help to improve urban life. Consumers benefit from the Internet of Things (IoT) and other intelligent linked gadgets.

North America Kiosk Market: Snapshot

The North America kiosk market has been witnessing significant advancements over the past few years. Pop-up kiosks and the incorporation of digital signage offer high scope for growth over the forecast period. Emerging as an important marketing tool for businesses to reach their target audience, kiosks enable the assessment of new products as well as new geographic locations. Online retailers have been given a chance to experiment in traditional retail settings without investing in any physical presence.

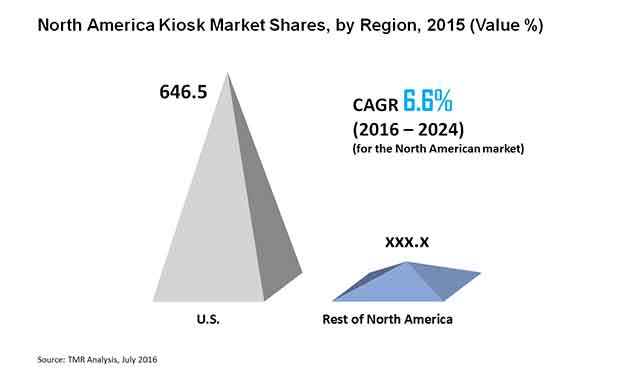

The revenue of the kiosk market in North America stood at US$2.5 bn in 2015 and is expected to reach US$4.4 bn by 2024 at a 6.2% CAGR therein. On the basis of volume, the market is projected to expand at a CAGR of 6.6% from 2016 to 2024.

Adoption Rate of Kiosks in Retail Surpasses that of Healthcare

Retail and healthcare are the most prominent applications of kiosks in North America, with the highest return on investment (ROI). Apart from these, kiosks also find application in other end-use sectors such as government, banking, financial services, and insurance (BFSI), travel and tourism, advertisement, and entertainment.

In the retail sector, kiosks are used for gift registry, inventory extension, loyalty, bill payment, and automated retail vending. Technological advancements in the retail sector are likely to fuel the use of kiosks in this application segment, enabling it to emerge as the dominant one by 2024. The adoption rate of healthcare-based kiosks is relatively slower, but is likely to pick up pace over the coming years. In the healthcare sector, kiosks are used for applications such as patient check-in and check-out, wayfinding and directory, human resource, hospital information, patient and physician communication portals, and virtual receptionist.

U.S. Kiosk Market Benefits from Strong Presence of Leading Players

The North America kiosk market is bifurcated into the U.S. and rest of North America by geography. In 2015, the U.S. emerged as the dominant segment by revenue as well as volume and the country is estimated to continue its lead through 2024. The U.S. kiosk market was valued at US$2.3 bn in 2015 and is projected to expand at a CAGR of 6.4% during the forecast period to cross US$4 bn by 2024. Both the retail and healthcare application segments in the U.S. contributed to the dominance of this region in the North America kiosk market. The U.S. kiosk market is projected to expand at a pace much greater than that of the rest of North America, TMR predicts.

One of the major factors responsible for the dominance of the U.S. in the North America kiosk market is the established presence of leading players and their continuous promotional efforts across the country. A case in point would be CVS Caremark Corp. The U.S.-based retailer and healthcare company has thousands of drug and pharmacy stores across the country with integrated kiosk bases. Food Lion, the U.S. division of Brussels-based Delhaize Group, has retail kiosks set up all over the U.S. in collaboration with American computer hardware, software and electronics company NCR Corporation. Retail giants such as The Kroger Company, Wal-Mart Stores, Inc., ALDI US, and Albertsons Companies Inc. have been progressing with their self-checkout rollouts. All of these activities continue to drive the kiosk market in the U.S.

Some of the prominent players in the North America kiosk market are NCR Corporation, Kontron AG, Meridian Kiosks, Slabb Kiosk, ZIVELO, Optical Phusion, Inc. (OPI), Wincor Nixdorf AG, RedyRef, Olea Kiosk Inc., Phoenix Kiosk, Kiosk Information Systems, Fujitsu Ltd., and Diebold, Inc.

Kiosk market in North America stood at US$2.5 bn in 2015.

Kiosk market to expand at a CAGR of 6.6% during the forecast period 2016 to 2024.

Pop-up kiosks and the incorporation of digital signage offer high scope for growth over the forecast period.

North America accounted for a major share of the kiosk market.

Key players operating in the kiosk market are NCR Corporation, Kontron AG, Meridian Kiosks, Slabb Kiosk, ZIVELO, Optical Phusion, Inc. (OPI), Wincor Nixdorf AG, RedyRef, Olea Kiosk Inc., Phoenix Kiosk, Kiosk Information Systems, Fujitsu Ltd., and Diebold, Inc.

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. North America Kiosk Market Snapshot

2.2. North America Kiosk Market Revenue, 2014 – 2024 (US$ Mn) and Year-on-Year Growth (%)

3. North America Kiosk Market Analysis, 2014 – 2024 (US$ Mn)

3.1. Key Trends Analysis

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. North America Kiosk Market Analysis, By Application, 2014 – 2024 (US$ Mn)

3.3.1. Retail

3.3.1.1. Inventory Extension Kiosk

3.3.1.2. Gift Registry Kiosk

3.3.1.3. Bill Payment Kiosk

3.3.1.4. Loyalty Kiosk

3.3.1.5. Automated Retail Vending Kiosk

3.3.2. Healthcare

3.3.2.1. Wayfinding/Directory Kiosks

3.3.2.2. Patient Check-in/Check-out Kiosk

3.3.2.3. Hospital Information Kiosk

3.3.2.4. Human Resource Kiosk

3.3.2.5. Virtual Receptionist Kiosk

3.3.2.6. Patient/Physician Communication Portal

3.3.3. North America Kiosk Market Analysis, By Country (US$ Mn)

3.3.3.1. U.S.

3.3.3.2. Rest of North America

3.4. North America Kiosk Market Analysis, By Application, 2014 – 2024 (Thousand Units)

3.4.1. Retail

3.4.1.1. Inventory Extension Kiosk

3.4.1.2. Gift Registry Kiosk

3.4.1.3. Bill Payment Kiosk

3.4.1.4. Loyalty Kiosk

3.4.1.5. Automated Retail Vending Kiosk

3.4.2. Healthcare

3.4.2.1. Wayfinding/Directory Kiosks

3.4.2.2. Patient Check-in/Check-out Kiosk

3.4.2.3. Hospital Information Kiosk

3.4.2.4. Human Resource Kiosk

3.4.2.5. Virtual Receptionist Kiosk

3.4.2.6. Patient/Physician Communication Portal

3.4.3. North America Kiosk Market Analysis, By Country (Thousand Units)

3.4.3.1. U.S.

3.4.3.2. Rest of North America

3.5. Competitive Landscape

3.5.1. Market Positioning of Key Players, 2015

3.5.2. Recommendations

4. Company Profiles

4.1. NCR Corporation

4.1.1. Company Details (HQ, Foundation Year, Employee Strength)

4.1.2. Market Presence, By Segment and Geography

4.1.3. Key Developments

4.1.4. Strategy and Historical Roadmap

4.1.5. Revenue and Operating Profits

4.2. Kiosk Information Systems

4.2.1. Company Details (HQ, Foundation Year, Employee Strength)

4.2.2. Market Presence, By Segment and Geography

4.2.3. Key Developments

4.2.4. Strategy and Historical Roadmap

4.2.5. Revenue and Operating Profits

4.3. Diebold, Inc.

4.3.1. Company Details (HQ, Foundation Year, Employee Strength)

4.3.2. Market Presence, By Segment and Geography

4.3.3. Key Developments

4.3.4. Strategy and Historical Roadmap

4.3.5. Revenue and Operating Profits

4.4. Slabb Kiosks.

4.4.1. Company Details (HQ, Foundation Year, Employee Strength)

4.4.2. Market Presence, By Segment and Geography

4.4.3. Key Developments

4.4.4. Strategy and Historical Roadmap

4.4.5. Revenue and Operating Profits

4.5. Olea Kiosks Inc.

4.5.1. Company Details (HQ, Foundation Year, Employee Strength)

4.5.2. Market Presence, By Segment and Geography

4.5.3. Key Developments

4.5.4. Strategy and Historical Roadmap

4.5.5. Revenue and Operating Profits

4.6. Phoenix Kiosk

4.6.1. Company Details (HQ, Foundation Year, Employee Strength)

4.6.2. Market Presence, By Segment and Geography

4.6.3. Key Developments

4.6.4. Strategy and Historical Roadmap

4.6.5. Revenue and Operating Profits

4.7. Kontron AG

4.7.1. Company Details (HQ, Foundation Year, Employee Strength)

4.7.2. Market Presence, By Segment and Geography

4.7.3. Key Developments

4.7.4. Strategy and Historical Roadmap

4.7.5. Revenue and Operating Profits

4.8. Wincor Nixdorf AG

4.8.1. Company Details (HQ, Foundation Year, Employee Strength)

4.8.2. Market Presence, By Segment and Geography

4.8.3. Key Developments

4.8.4. Strategy and Historical Roadmap

4.8.5. Revenue and Operating Profits

4.9. Meridian Kiosks

4.9.1. Company Details (HQ, Foundation Year, Employee Strength)

4.9.2. Market Presence, By Segment and Geography

4.9.3. Key Developments

4.9.4. Strategy and Historical Roadmap

4.9.5. Revenue and Operating Profits

4.10. Fujitsu Ltd

4.10.1. Company Details (HQ, Foundation Year, Employee Strength)

4.10.2. Market Presence, By Segment and Geography

4.10.3. Key Developments

4.10.4. Strategy and Historical Roadmap

4.10.5. Revenue and Operating Profits

4.11. Optical Phusion, Inc. (OPI)

4.11.1. Company Details (HQ, Foundation Year, Employee Strength)

4.11.2. Market Presence, By Segment and Geography

4.11.3. Key Developments

4.11.4. Strategy and Historical Roadmap

4.11.5. Revenue and Operating Profits

4.12. Phoenix Kiosks

4.12.1. Company Details (HQ, Foundation Year, Employee Strength)

4.12.2. Market Presence, By Segment and Geography

4.12.3. Key Developments

4.12.4. Strategy and Historical Roadmap

4.12.5. Revenue and Operating Profits

4.13. RedyRef

4.13.1. Company Details (HQ, Foundation Year, Employee Strength)

4.13.2. Market Presence, By Segment and Geography

4.13.3. Key Developments

4.13.4. Strategy and Historical Roadmap

4.13.5. Revenue and Operating Profits

4.14. ZIVELO

4.14.1. Company Details (HQ, Foundation Year, Employee Strength)

4.14.2. Market Presence, By Segment and Geography

4.14.3. Key Developments

4.14.4. Strategy and Historical Roadmap

4.14.5. Revenue and Operating Profits

List of Tables

Table-1. Market Snapshot

Table 2. North America Kiosk Market Analysis, By Application, 2014 – 2024 (US$ Mn)

Table-3. North America Retail Kiosk Market Analysis, By Type, 2014 – 2024 (US$ Mn)

Table-4. North America Healthcare Kiosk Market Analysis, By Type, 2014 – 2024 (US$ Mn)

Table-5. North America Kiosk Market Analysis, By Country, 2014 – 2024 (US$ Mn)

Table-6. North America Kiosk Market Analysis, By Application, 2014 – 2024 (Thousand Units)

Table-7. North America Retail Kiosk Market Analysis, By Type, 2014 – 2024 (Thousand Units)

Table-8. North America Healthcare Kiosk Market Analysis, By Type, 2014 – 2024 (Thousand Units)

Table-9. North America Kiosk Market Analysis, By Country, 2014 – 2024 (US$ Mn)

List of Figures

Figure-1. North America Kiosk Market Revenue, 2014 – 2024 (US$ Mn) and Y-o-Y Growth (%)

Figure-2. North America Kiosk Market Snapshot, By Application (%)

Figure-3. North America Retail Kiosk Market Snapshot, By Type (%)

Figure-4. North America Healthcare Kiosk Market Snapshot, By Type (%)

Figure-5. North America Kiosk Market Revenue Share, By Country (%)

Figure-6. North America Kiosk Market Revenue, 2014 – 2024 (Thousand Units) and Y-o-Y Growth (%)

Figure-7. North America Kiosk Market Snapshot, By Application (%)

Figure-8. North America Retail Kiosk Market Snapshot, By Type (%)

Figure-9. North America Healthcare Kiosk Market Snapshot, By Type (%)

Figure-10. North America Kiosk Market Volume Share, By Country (%)

Figure-11. North America Kiosk Market: Market Positioning of Key Players, 2015