Analysts’ Viewpoint on Insect Repellent Apparel Market Scenario

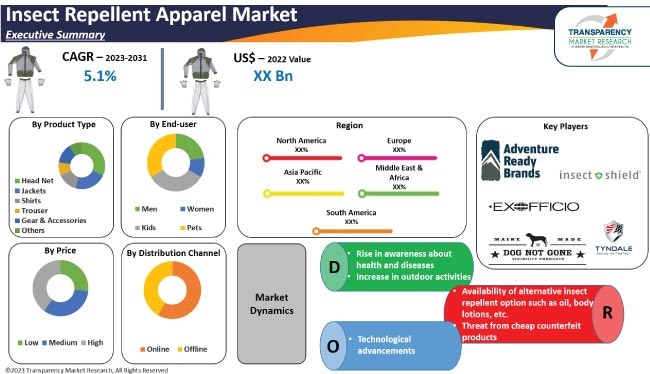

Companies in the insect repellent apparel market are focusing on different types of insect repellent apparel such as trousers, head nets, and jackets to keep their business growing. The market is estimated to witness a decent growth rate (CAGR) of 5.4% during the forecast period. Increase in awareness about the availability of insect repellent apparel and rise in cases of diseases caused by insect bites are boosting the demand for insect repellent apparel. However, availability of various substitute products such as oils, body lotions, and coils is hampering the market. Nevertheless, manufacturers should tap into broad and niche requirements of end-users, such as sustainable and skin-friendly products with new designs, to excel in the market. Burgeoning growth in eCommerce and company-owned websites is expected to create new opportunities for manufacturers of insect repellent apparel post the peak of the COVID-19 pandemic.

Insect repellent apparel is a form of clothing that possesses mosquito repellent characteristics. The apparel is available in different types such as shirts, trousers, jackets, head nets, and gear & accessories. It can be used as indoor wear, as well as while traveling, during camping, hiking, etc. Insect repellent apparel is designed for people of all age groups. The men and women segment dominates the market. The insect repellent apparel market in North America is expected to advance at a decent growth rate during the forecast period, owing to the rise in demand for and awareness about insect repellent apparel in the region.

The need for insect repellent clothing is projected to rise due to the growing popularity of outdoor and leisure activities such as camping, fishing, and hiking. Clothing treated with insecticide-based materials is effective in repelling mosquitoes, bugs, ticks, and other biting insects & mites. This is boosting the demand for insect repellent apparel. The 2021 Outdoor Participation Trends Report, commissioned by the Outdoor Foundation, revealed that 7.1 million Americans participated in outdoor recreation activities in 2020 than in the year prior.

The North America insect repellent apparel market is estimated to grow significantly by the end of 2031, owing to the expansion of industries producing insect repellent apparel. Rise in cases of malaria, dengue fever, and yellow fever in North America have made people more aware about the use of insect repellent apparel.

According to the Centers for Disease Control and Prevention (CDC), as of January 11, 2022, about 2,695 human infections of then West Nile virus occurred in the U.S. in 2020; of these, 191 resulted in deaths. Rise in preference for natural and safer products; and the focus of key players on using natural alternatives for chemicals are anticipated to boost the demand for insect repellent apparel in North America.

Growth in awareness about the availability of a wide range of insect repellent apparel products and their benefits of protection from vector-borne diseases is boosting the demand for the apparel in the region. Furthermore, people in the region are becoming more conscious and aware of insect repellent apparel owing to the rise in cases of various insect-borne diseases such as malaria, Chikungunya, yellow fever, and dengue fever. This is driving the demand for the insect repellent apparel in the region.

Increase in research and development (R&D) activities by key players in North America is resulting in the introduction of insect repellent clothes with improved comfort and durability. Manufacturers are expanding output capacities for insect repellent apparel made of lightweight, breathable textiles, and with UV protective properties. This is expected to drive the sales of insect repellent apparel in the next few years.

Key players are engaged in development of innovative insect repellent apparel clothing, designer hats, and other apparel made from natural materials owing to their increasing adoption among users. This is creating lucrative opportunities for the insect repellent apparel market in North America. Key players in the market are introducing new designs and patterns in apparel. This is driving the demand for insect repellent apparel among the younger generation.

Rise in usage of insect repellent apparel in industrial and agriculture sectors to protect workers from various diseases caused by insects is further augmenting the demand for insect repellent apparel.

In terms of type, the North America insect repellent apparel market has been divided into head nets, jackets, shirts, trousers, gear & accessories, and others. The shirts segment held significant share in 2021, while the trouser segment is expected to grow at the highest CAGR during the forecast period. Trousers are more popular compared to the other types such as jackets, head nets, and shirts, as people prefer trousers during any type of outdoor activity. Head nets and jackets segments are also projected to grow during the forecast period, as key players in the insect repellent apparel market are coming up with innovative designs and skin-friendly materials.

Insect repellent apparel is classified into low, medium, and high in terms of price. The medium-priced segment dominated the insect repellent apparel market in North America in 2021. It is likely to constitute the largest share of the market during the forecast period. The segment is also expected to register the highest CAGR during the forecast period. Medium-range products are easily available in all types of distribution channels. They are also available in different sizes, types, fabrics, colors, etc. The high-priced segment usually has limited stock in terms of innovative designs and ongoing trends.

The U.S. is expected to hold the largest share of the North America insect repellent apparel market during the forecast period. This can be primarily ascribed to the high demand for shirts and trousers, which contributed 29% & 24% share, respectively, of the overall North America market in 2021.

In terms of volume, the U.S. and Canada are likely to account for major share of the insect repellent apparel market in North America during the forecast period. The men and women end-user segment holds the largest share of the insect repellent apparel market in the region.

The insect repellent apparel market in Canada is expected to grow at the fastest CAGR during the forecast period, as the trend of outdoor activities has been rising since the last few years in the country. Moreover, people in Canada spend more on branded fashion apparel.

The North America insect repellent apparel market is consolidated with a small number of large-scale vendors controlling majority of the share. Most of the firms are spending significantly on comprehensive research and development activities, primarily to develop environment-friendly products. Diversification of product portfolios and mergers & acquisitions are the important strategies adopted by key players. Insect Shield, ExOfficio LLC, Royal Robbins, LLC, The Orvis Company, Inc., Tyndale USA, Dog Not Gone, The Original Bug Shirt Company, NoBu.gs Insect Repellent Clothing, Adventure-Ready Brand, and Pang Wangle are the prominent entities operating in this market.

Each of these players has been profiled in the insect repellent apparel market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 70.5 Mn |

|

Market Forecast Value in 2031 |

US$ 116.4 Mn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn for Value Thousand Units for Volume |

|

Market Analysis |

North America qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key market indicators, regulatory framework, COVID-19 impact analysis, and SWOT analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

North America |

|

Countries Covered |

U.S, Canada, Rest of North America |

|

Companies Profiled |

Insect Shield, ExOfficio LLC, Royal Robbins, LLC, The Orvis Company, Inc., Tyndale USA, Dog Not Gone, The Original Bug Shirt Company, NoBu.gs Insect Repellent Clothing, Adventure Ready Brand, and Pang Wangle company |

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The market stood at US$ 70.5 Mn in 2021

The market is estimated to expand at a CAGR of 5.4% during 2022-2031

Rise in awareness insect repellent apparel. Growth in outdoor recreational activities across North America

The U.S. is likely to be the most lucrative market in the next few years

The men’s segment accounted for 44% share of the insect repellent apparel market in 2021

Insect Shield, ExOfficio LLC, Royal Robbins, LLC, The Orvis Company, Inc., Tyndale USA, Dog Not Gone, The Original Bug Shirt Company, NoBu.gs Insect Repellent Clothing Company, Adventure Ready Brand, and Pang Wangle

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Insect Repellent Apparel Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Rules and Regulations

5.9. North America Insect Repellent Apparel Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. North America Insect Repellent Apparel Market Analysis and Forecast, By Type

6.1. North America Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

6.1.1. Head Net

6.1.2. Jackets

6.1.3. Shirts

6.1.4. Trouser

6.1.5. Gear & Accessories

6.1.6. Others

6.2. Incremental Opportunity, By Type

7. North America Insect Repellent Apparel Market Analysis and Forecast, By Price

7.1. North America Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

7.1.1. Low

7.1.2. Medium

7.1.3. High

7.2. Incremental Opportunity, By Price

8. North America Insect Repellent Apparel Market Analysis and Forecast, By End-user

8.1. North America Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

8.1.1. Men

8.1.2. Women

8.1.3. Kids

8.1.4. Pet

8.2. Incremental Opportunity, By End User

9. North America Insect Repellent Apparel Market Analysis and Forecast, By Distribution Channel

9.1. North America Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.1.1. Company owned websites

9.1.1.2. E-commerce websites

9.1.2. Offline

9.1.2.1. Supermarket/Hypermarket

9.1.2.2. Specialty Stores

9.1.2.3. Others

9.2. Incremental Opportunity, By Distribution Channel

10. North America Insect Repellent Apparel Market Analysis and Forecast, Country & Sub-region

10.1. North America Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Country & Sub-region, 2017 - 2031

10.1.1. U.S.

10.1.2. Canada

10.1.3. Rest of North America

10.2. Incremental Opportunity, By Country

11. U.S. Insect Repellent Apparel Market Analysis and Forecast

11.1. Country Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Brand Analysis

11.4. Consumer Buying Behavior Analysis

11.4.1. Brand Awareness

11.4.2. Average Spend

11.4.3. Purchasing Factors

11.5. Key Trends Analysis

11.5.1. Demand Side Analysis

11.5.2. Supply Side Analysis

11.6. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

11.6.1. Head Net

11.6.2. Jackets

11.6.3. Shirts

11.6.4. Trouser

11.6.5. Gear & Accessories

11.6.6. Others

11.7. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

11.7.1. Low

11.7.2. Medium

11.7.3. High

11.8. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By End User, 2017 - 2031

11.8.1. Men

11.8.2. Women

11.8.3. Kids

11.8.4. Pet

11.9. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

11.9.1. Online

11.9.1.1. Company owned websites

11.9.1.2. E-commerce websites

11.9.2. Offline

11.9.2.1. Supermarket/Hypermarket

11.9.2.2. Specialty Stores

11.9.2.3. Others

11.10. Incremental Opportunity Analysis

12. Canada Insect Repellent Apparel Market Analysis and Forecast

12.1. Country Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Brand Analysis

12.4. Consumer Buying Behavior Analysis

12.4.1. Brand Awareness

12.4.2. Average Spend

12.4.3. Purchasing Factors

12.5. Key Trends Analysis

12.5.1. Demand Side Analysis

12.5.2. Supply Side Analysis

12.6. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

12.6.1. Head Net

12.6.2. Jacket

12.6.3. Shirt

12.6.4. Trouser

12.6.5. Gear & Accessories

12.6.6. Others

12.7. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

12.7.1. Low

12.7.2. Medium

12.7.3. High

12.8. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

12.8.1. Men

12.8.2. Women

12.8.3. Kids

12.8.4. Pet

12.9. Insect Repellent Apparel Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. Company owned websites

12.9.1.2. E-commerce websites

12.9.2. Offline

12.9.2.1. Supermarket/Hypermarket

12.9.2.2. Specialty Stores

12.9.2.3. Others

12.10. Incremental Opportunity Analysis

13. Competition Landscape

13.1. Market Player – Competition Dashboard

13.2. Market Share Analysis (%), 2020

13.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

13.3.1. Insect Shield ®

13.3.1.1. Company Overview

13.3.1.2. Sales Area/Geographical Presence

13.3.1.3. Financial/Revenue

13.3.1.4. Strategy & Business Overview

13.3.1.5. Sales Channel Analysis

13.3.1.6. Size Portfolio

13.3.2. ExOfficio LLC.

13.3.2.1. Company Overview

13.3.2.2. Sales Area/Geographical Presence

13.3.2.3. Financial/Revenue

13.3.2.4. Strategy & Business Overview

13.3.2.5. Sales Channel Analysis

13.3.2.6. Size Portfolio

13.3.3. Royal Robbins, LLC

13.3.3.1. Company Overview

13.3.3.2. Sales Area/Geographical Presence

13.3.3.3. Financial/Revenue

13.3.3.4. Strategy & Business Overview

13.3.3.5. Sales Channel Analysis

13.3.3.6. Size Portfolio

13.3.4. The Orvis Company, Inc.

13.3.4.1. Company Overview

13.3.4.2. Sales Area/Geographical Presence

13.3.4.3. Financial/Revenue

13.3.4.4. Strategy & Business Overview

13.3.4.5. Sales Channel Analysis

13.3.4.6. Size Portfolio

13.3.5. Tyndale USA

13.3.5.1. Company Overview

13.3.5.2. Sales Area/Geographical Presence

13.3.5.3. Financial/Revenue

13.3.5.4. Strategy & Business Overview

13.3.5.5. Sales Channel Analysis

13.3.5.6. Size Portfolio

13.3.6. Dog Not Gone

13.3.6.1. Company Overview

13.3.6.2. Sales Area/Geographical Presence

13.3.6.3. Financial/Revenue

13.3.6.4. Strategy & Business Overview

13.3.6.5. Sales Channel Analysis

13.3.6.6. Size Portfolio

13.3.7. The Original Bug Shirt Company

13.3.7.1. Company Overview

13.3.7.2. Sales Area/Geographical Presence

13.3.7.3. Financial/Revenue

13.3.7.4. Strategy & Business Overview

13.3.7.5. Sales Channel Analysis

13.3.7.6. Size Portfolio

13.3.8. NoBu.gs® Insect Repellent Clothing company

13.3.8.1. Company Overview

13.3.8.2. Sales Area/Geographical Presence

13.3.8.3. Financial/Revenue

13.3.8.4. Strategy & Business Overview

13.3.8.5. Sales Channel Analysis

13.3.8.6. Size Portfolio

13.3.9. Adventure Ready Brand

13.3.9.1. Company Overview

13.3.9.2. Sales Area/Geographical Presence

13.3.9.3. Financial/Revenue

13.3.9.4. Strategy & Business Overview

13.3.9.5. Sales Channel Analysis

13.3.9.6. Size Portfolio

13.3.10. Pang Wangle

13.3.10.1. Company Overview

13.3.10.2. Sales Area/Geographical Presence

13.3.10.3. Financial/Revenue

13.3.10.4. Strategy & Business Overview

13.3.10.5. Sales Channel Analysis

13.3.10.6. Size Portfolio

14. Key Takeaway

14.1. Identification of Potential Market Spaces

14.1.1. Type

14.1.2. Price

14.1.3. End User

14.1.4. Distribution Channel

14.1.5. Country

14.2. Understanding the Buying Process of Customers

14.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Insect Repellent Apparel Market, by Type, Thousand Units, 2017-2031

Table 2: North America Insect Repellent Apparel Market, by Type, US$ Mn 2017-2031

Table 3: North America Insect Repellent Apparel Market, by Price, Thousand Units, 2017-2031

Table 4: North America Insect Repellent Apparel Market, by Price, US$ Mn 2017-2031

Table 5: North America Insect Repellent Apparel Market, by End-user, Thousand Units, 2017-2031

Table 6: North America Insect Repellent Apparel Market, by End-user, US$ Mn 2017-2031

Table 7: North America Insect Repellent Apparel Market, by Distribution Channel, Thousand Units, 2017-2031

Table 8: North America Insect Repellent Apparel Market, by Country, US$ Mn 2017-2031

Table 9: North America Insect Repellent Apparel Market, by Country, Thousand Units, 2017-2031

Table 10: North America Insect Repellent Apparel Market, by Distribution Channel, US$ Mn 2017-2031

Table 11: U.S Insect Repellent Apparel Market, by Type, Thousand Units, 2017-2031

Table 12: U.S Insect Repellent Apparel Market, by Type, US$ Mn 2017-2031

Table 13: U.S Insect Repellent Apparel Market, by Price, Thousand Units, 2017-2031

Table 14: U.S Insect Repellent Apparel Market, by Price, US$ Mn 2017-2031

Table 15: U.S Insect Repellent Apparel Market, by End-user, Thousand Units, 2017-2031

Table 16: U.S Insect Repellent Apparel Market, by End-user, US$ Mn 2017-2031

Table 17: U.S Insect Repellent Apparel Market, by Distribution Channel, Thousand Units, 2017-2031

Table 18: U.S Insect Repellent Apparel Market, by Distribution Channel, US$ Mn 2017-2031

Table 19: Canada Insect Repellent Apparel Market, by Type, Thousand Units, 2017-2031

Table 20: Canada Insect Repellent Apparel Market, by Type, US$ Mn 2017-2031

Table 21: Canada Insect Repellent Apparel Market, by Price, Thousand Units, 2017-2031

Table 22: Canada Insect Repellent Apparel Market, by Price, US$ Mn 2017-2031

Table 23: Canada Insect Repellent Apparel Market, by End-user, Thousand Units, 2017-2031

Table 24: Canada Insect Repellent Apparel Market, by End-user, US$ Mn 2017-2031

Table 25: Canada Insect Repellent Apparel Market, by Distribution Channel, Thousand Units, 2017-2031

Table 26: Canada Insect Repellent Apparel Market, by Distribution Channel, US$ Mn 2017-2031

List of Figures

Figure 1: North America Insect Repellent Apparel Market, by Type, Thousand Units, 2017-2031

Figure 2: North America Insect Repellent Apparel Market, by Type, US$ Mn 2017-2031

Figure 3: North America Insect Repellent Apparel Market, Incremental Opportunity, by Type 2017-2031

Figure 4: North America Insect Repellent Apparel Market, by Price, Thousand Units, 2017-2031

Figure 5: North America Insect Repellent Apparel Market, by Price, US$ Mn 2017-2031

Figure 6: North America Insect Repellent Apparel Market, Incremental Opportunity, by Price 2017-2031

Figure 7: North America Insect Repellent Apparel Market, by End-user, Thousand Units, 2017-2031

Figure 8: North America Insect Repellent Apparel Market, by End-user, US$ Mn 2017-2031

Figure 9: North America Insect Repellent Apparel Market, Incremental Opportunity, by End-user 2017-2031

Figure 10: North America Insect Repellent Apparel Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 11: North America Insect Repellent Apparel Market, by Distribution Channel, US$ Mn 2017-2031

Figure 12: North America Insect Repellent Apparel Market, Incremental Opportunity, by Distribution Channel 2017-2031

Figure 13: North America Insect Repellent Apparel Market, by Country, Thousand Units, 2017-2031

Figure 14: North America Insect Repellent Apparel Market, by Country, US$ Mn 2017-2031

Figure 15: North America Insect Repellent Apparel Market, Incremental Opportunity, by Country, 2017-2031

Figure 16: U.S Insect Repellent Apparel Market, by Type, Thousand Units, 2017-2031

Figure 17: U.S Insect Repellent Apparel Market, by Type US$ Mn 2017-2031

Figure 18: U.S Insect Repellent Apparel Market, Incremental Opportunity, by Type 2017-2031

Figure 19: U.S Insect Repellent Apparel Market, by Price, Thousand Units, 2017-2031

Figure 20: U.S Insect Repellent Apparel Market, by Price, US$ Mn 2017-2031

Figure 21: U.S Insect Repellent Apparel Market, Incremental Opportunity, by Price 2017-2031

Figure 22: U.S Insect Repellent Apparel Market, by End-user, Thousand Units, 2017-2031

Figure 23: U.S Insect Repellent Apparel Market, by End-user, US$ Mn 2017-2031

Figure 24: U.S Insect Repellent Apparel Market, Incremental Opportunity, by End-user 2017-2031

Figure 25: U.S Insect Repellent Apparel Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 26: U.S Insect Repellent Apparel Market, by Distribution Channel, US$ Mn 2017-2031

Figure 27: U.S Insect Repellent Apparel Market, Incremental Opportunity, by Distribution Channel 2017-2031

Figure 28: Canada Insect Repellent Apparel Market, by Type, Thousand Units, 2017-2031

Figure 29: Canada Insect Repellent Apparel Market, by Type, US$ Mn 2017-2031

Figure 30: Canada Insect Repellent Apparel Market, Incremental Opportunity, by Type 2017-2031

Figure 31: Canada Insect Repellent Apparel Market, by Price, Thousand Units, 2017-2031

Figure 32: Canada Insect Repellent Apparel Market, by Price, US$ Mn 2017-2031

Figure 33: Canada Insect Repellent Apparel Market, Incremental Opportunity, by Price 2017-2031

Figure 34: Canada Insect Repellent Apparel Market, by End-user, Thousand Units, 2017-2031

Figure 35: Canada Insect Repellent Apparel Market, by End-user, US$ Mn 2017-2031

Figure 36: Canada Insect Repellent Apparel Market, Incremental Opportunity, by End-user 2017-2031

Figure 37: Canada Insect Repellent Apparel Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 38: Canada Insect Repellent Apparel Market, by Distribution Channel, US$ Mn 2017-2031

Figure 39: Canada Insect Repellent Apparel Market, Incremental Opportunity, by Distribution Channel 2017-2031