Analysts’ Viewpoint on Market Scenario

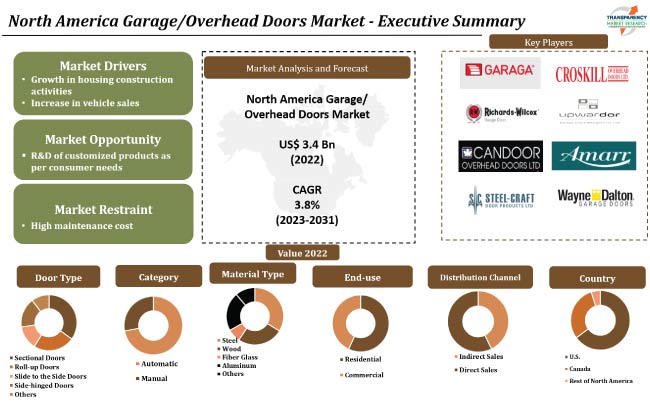

The North America garage/overhead doors market size is expected to grow at a significant pace due to surge in the construction of new residential and commercial buildings. Additionally, growth in the trend of home automation systems and smart homes is driving the demand for technologically advanced garage/overhead doors that can be controlled remotely.

The North America garage/overhead doors industry is witnessing a shift toward eco-friendly and sustainable products, with the use of materials such as wood, aluminum, and steel becoming increasingly popular. Additionally, adoption of energy-efficient garage/overhead doors is also gaining traction, as they can help reduce energy consumption and lower utility bills for consumers.

Garage/overhead doors are typically large, hinged doors that are used to provide access to garages, warehouses, and other similar spaces. They are usually made of durable materials such as steel, wood, or aluminum and are designed to provide security, insulation, and protection from weather elements.

Garage/overhead doors can be either manual or automatic, depending on the user's preference and budget. Manual doors are operated by hand and require physical effort to open and close, while automatic doors are equipped with motors and can be controlled remotely through smartphone apps or home automation systems.

Garage/overhead doors are widely employed in commercial buildings such as retail storefronts, service stations, and fire stations. New home construction, renovation, and remodeling of existing homes are also contributing to the demand for garage/overhead doors. Several homeowners choose to replace their old, worn-out doors with newer, more durable models that provide better security and insulation.

According to the U.S. Department of Commerce, in February 2023, the U.S. reported 1,406,000 housing completion and 1,309,000 housing starts. In 2021, the Government of Canada invested US$ 6.62 Bn in 2,876 infrastructure projects in the Ontario province. Thus, rise in investment in the construction sector is projected to spur the North America garage/overhead doors market growth in the near future.

Garage/overhead doors are essential in providing secure access to garages and carports, enabling homeowners to safely park and store their vehicles. Demand for larger garage/overhead doors that can accommodate multiple vehicles is likely to increase with rise in the number of two-car and three-car households. This, in turn, is estimated to boost the North America garage/overhead doors market progress in the next few years. According to the Federal Reserve Bank of St. Louis, in January 2023, 16.21 million cars were sold in the U.S., witnessing a rise from 13.87 million in December 2022.

According to the latest North America garage/overhead doors market trends, the sectional doors segment is expected to dominate the industry during the forecast period. Sectional garage doors offer the ability to open upright and are suspended underneath the ceiling to provide extra space. These doors are flexible and weather-resistant.

Demand for roll-up garage doors, slide to the side garage doors, and side-hinged garage doors is projected to increase in the near future, as these doors are preferred by a large number of people owing to their attractive design and opening styles.

According to the latest North America garage/overhead doors market analysis, the automatic category segment is anticipated to hold largest share during the forecast period. Automatic garage doors offer several advantages over traditional manual doors, such as convenience, increased security, and improved energy efficiency. They can be controlled through smartphone apps or home automation systems, enabling homeowners to open and close the doors remotely, monitor the status of the door, and receive alerts in case of unauthorized access.

The manual segment is projected to grow at a significant pace in the near future. A sizable number of consumers prefer manual garage doors, as they are available at a reasonable cost and can be operated without a power supply.

The U.S. is anticipated to dominate the industry during the forecast period. High per capita income and rise in the expenditure on household products are driving market dynamics in the country. According to the World Bank, in 2021, the U.S. per capita income was US$ 70,248.6, which was a rise from US$ 63,530.6 in 2020.

The industry in Canada is expected to grow at a significant pace in the near future. Growth in the immigrant population and the resultant surge in investment in housing construction are boosting market statistics in the country.

Garaga Inc., Creative Door, Richards-Wilcox, Steel-Craft Door Products Ltd., Canada West Garage Doors Inc., Equal Door Industries, Wayne-Dalton, Colson Overhead Doors Ltd., Red Deer Overdoor, Croskill Overhead Doors Ltd., and Upwardor Inc. are key entities operating in this industry.

Vendors in the industry are progressively focusing on the production of insulated garage doors, which is likely to mitigate the use of external cooling and heating systems. They are offering energy-efficient garage/overhead doors to increase their North America garage/overhead doors market share.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 3.4 Bn |

|

Market Forecast Value in 2031 |

US$ 4.7 Bn |

|

Growth Rate (CAGR) |

3.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 3.4 Bn in 2022.

It is estimated to be 3.8% from 2023 to 2031.

Growth in housing construction activities and increase in sales of vehicles.

The indirect sales segment is projected to hold largest share during the forecast period.

The U.S. is anticipated to hold prominent share from 2023 to 2031.

Garaga Inc., Creative Door, Richards-Wilcox, Steel-Craft Door Products Ltd., Canada West Garage Doors Inc., Equal Door Industries, Wayne-Dalton, Colson Overhead Doors Ltd., Red Deer Overdoor, Croskill Overhead Doors Ltd., and Upwardor Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. North America Garage/Overhead Doors Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projection (US$ Mn)

5.8.2. Market Volume Projection (Thousand Units)

6. North America Garage/Overhead Doors Market Analysis and Forecast, by Door Type

6.1. North America Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Door Type, 2017- 2031

6.1.1. Sectional Doors

6.1.2. Roll-up Doors

6.1.3. Slide to the Side Doors

6.1.4. Side-hinged Doors

6.1.5. Others (Tilt-up/Up and Over Canopy Doors, Tilt-up/Up and Over Retractable Doors, etc.)

6.2. Incremental Opportunity, by Door Type

7. North America Garage/Overhead Doors Market Analysis and Forecast, by Category

7.1. North America Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

7.1.1. Automatic

7.1.2. Manual

7.2. Incremental Opportunity, by Category

8. North America Garage/Overhead Doors Market Analysis and Forecast, by Material Type

8.1. North America Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), Material Type, 2017- 2031

8.1.1. Steel

8.1.2. Wood

8.1.3. Fiber Glass

8.1.4. Aluminum

8.1.5. Others (Vinyl, etc.)

8.2. Incremental Opportunity, by Price

9. North America Garage/Overhead Doors Market Analysis and Forecast, by End-use

9.1. North America Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

9.1.1. Residential

9.1.2. Commercial

9.2. Incremental Opportunity, by End-use

10. North America Garage/Overhead Doors Market Analysis and Forecast, by Distribution Channel

10.1. North America Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. North America Garage/Overhead Doors Market Analysis and Forecast, by Country

11.1. North America Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

11.1.1. U.S.

11.1.2. Canada

11.1.3. Rest of North America

11.2. Incremental Opportunity, by Country

12. U.S. Garage/Overhead Doors Market Analysis and Forecast

12.1. Country Snapshot

12.2. Key Supplier Analysis

12.3. COVID-19 Impact Analysis

12.4. Key Trends Analysis

12.4.1. Supply side

12.4.2. Demand Side

12.5. Price Trend Analysis

12.5.1. Weighted Average Selling Price (US$)

12.6. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Door Type, 2017- 2031

12.6.1. Sectional Doors

12.6.2. Roll-up Doors

12.6.3. Slide to the Side Doors

12.6.4. Side-hinged Doors

12.6.5. Others (Tilt-up/Up and Over Canopy Doors, Tilt-up/Up and Over Retractable Doors, etc.)

12.7. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

12.7.1. Automatic

12.7.2. Manual

12.8. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Material Type, 2017- 2031

12.8.1. Steel

12.8.2. Wood

12.8.3. Fiber Glass

12.8.4. Aluminum

12.8.5. Others (Vinyl, etc.)

12.9. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

12.9.1. Residential

12.9.2. Commercial

12.10. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.10.1. Direct Sales

12.10.2. Indirect Sales

13. Canada Garage/Overhead Doors Market Analysis and Forecast

13.1. Country Snapshot

13.2. Key Supplier Analysis

13.3. COVID-19 Impact Analysis

13.4. Key Trends Analysis

13.4.1. Supply side

13.4.2. Demand Side

13.5. Price Trend Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Door Type, 2017- 2031

13.6.1. Sectional Doors

13.6.2. Roll-up Doors

13.6.3. Slide to the Side Doors

13.6.4. Side-hinged Doors

13.6.5. Others (Tilt-up/Up and Over Canopy Doors, Tilt-up/Up and Over Retractable Doors, etc.)

13.7. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

13.7.1. Automatic

13.7.2. Manual

13.8. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Material Type, 2017- 2031

13.8.1. Steel

13.8.2. Wood

13.8.3. Fiber Glass

13.8.4. Aluminum

13.8.5. Others (Vinyl, etc.)

13.9. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

13.9.1. Residential

13.9.2. Commercial

13.10. Garage/Overhead Doors Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

13.10.1. Direct Sales

13.10.2. Indirect Sales

14. Competition Landscape

14.1. Competition Dashboard

14.2. Market Share Analysis % (2022)

14.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

14.3.1. Garaga Inc.

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. Financial Information

14.3.1.4. (Subject to Data Availability)

14.3.1.5. Business Strategies / Recent Developments

14.3.2. Creative Door

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. Financial Information

14.3.2.4. (Subject to Data Availability)

14.3.2.5. Business Strategies / Recent Developments

14.3.3. Richards-Wilcox

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. Financial Information

14.3.3.4. (Subject to Data Availability)

14.3.3.5. Business Strategies / Recent Developments

14.3.4. Steel-Craft Door Products Ltd.

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. Financial Information

14.3.4.4. (Subject to Data Availability)

14.3.4.5. Business Strategies / Recent Developments

14.3.5. Canada West Garage Doors Inc.

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. Financial Information

14.3.5.4. (Subject to Data Availability)

14.3.5.5. Business Strategies / Recent Developments

14.3.6. Equal Door Industries

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. Financial Information

14.3.6.4. (Subject to Data Availability)

14.3.6.5. Business Strategies / Recent Developments

14.3.7. Wayne-Dalton

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. Financial Information

14.3.7.4. (Subject to Data Availability)

14.3.7.5. Business Strategies / Recent Developments

14.3.8. Colson Overhead Doors Ltd.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. Financial Information

14.3.8.4. (Subject to Data Availability)

14.3.8.5. Business Strategies / Recent Developments

14.3.9. Red Deer Overdoor

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. Financial Information

14.3.9.4. (Subject to Data Availability)

14.3.9.5. Business Strategies / Recent Developments

14.3.10. Croskill Overhead Doors Ltd.

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. Financial Information

14.3.10.4. (Subject to Data Availability)

14.3.10.5. Business Strategies / Recent Developments

14.3.11. Upwardor Inc.

14.3.11.1. Company Overview

14.3.11.2. Product Portfolio

14.3.11.3. Financial Information

14.3.11.4. (Subject to Data Availability)

14.3.11.5. Business Strategies / Recent Developments

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. Door Type

15.1.2. Category

15.1.3. Material Type

15.1.4. End-use

15.1.5. Distribution Channel

15.1.6. Geography

15.2. Understanding Procurement Process of End-users

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Garage/Overhead Doors Market, by Door Type, Thousand Units, 2017-2031

Table 2: North America Garage/Overhead Doors Market, by Door Type, US$ Mn, 2017-2031

Table 3: North America Garage/Overhead Doors Market, by Category, Thousand Units, 2017-2031

Table 4: North America Garage/Overhead Doors Market, by Category, US$ Mn, 2017-2031

Table 5: North America Garage/Overhead Doors Market, by Material Type, Thousand Units, 2017-2031

Table 6: North America Garage/Overhead Doors Market, by Material Type, US$ Mn, 2017-2031

Table 7: North America Garage/Overhead Doors Market, by End-use, Thousand Units, 2017-2031

Table 8: North America Garage/Overhead Doors Market, by End-use, US$ Mn, 2017-2031

Table 9: North America Garage/Overhead Doors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 10: North America Garage/Overhead Doors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 11: North America Garage/Overhead Doors Market, by Country Thousand Units, 2017-2031

Table 12: North America Garage/Overhead Doors Market, by Country US$ Mn, 2017-2031

Table 13: U.S. Garage/Overhead Doors Market, by Door Type, Thousand Units, 2017-2031

Table 14: U.S. Garage/Overhead Doors Market, by Door Type, US$ Mn, 2017-2031

Table 15: U.S. Garage/Overhead Doors Market, by Category, Thousand Units, 2017-2031

Table 16: U.S. Garage/Overhead Doors Market, by Category, US$ Mn, 2017-2031

Table 17: U.S. Garage/Overhead Doors Market, by Material Type, Thousand Units, 2017-2031

Table 18: U.S. Garage/Overhead Doors Market, by Material Type, US$ Mn, 2017-2031

Table 19: U.S. Garage/Overhead Doors Market, by End-use, Thousand Units, 2017-2031

Table 20: U.S. Garage/Overhead Doors Market, by End-use, US$ Mn, 2017-2031

Table 21: U.S. Garage/Overhead Doors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 22: U.S. Garage/Overhead Doors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 23: Canada Garage/Overhead Doors Market, by Door Type, Thousand Units, 2017-2031

Table 24: Canada Garage/Overhead Doors Market, by Door Type, US$ Mn, 2017-2031

Table 25: Canada Garage/Overhead Doors Market, by Category, Thousand Units, 2017-2031

Table 26: Canada Garage/Overhead Doors Market, by Category, US$ Mn, 2017-2031

Table 27: Canada Garage/Overhead Doors Market, by Material Type, Thousand Units, 2017-2031

Table 28: Canada Garage/Overhead Doors Market, by Material Type, US$ Mn, 2017-2031

Table 29: Canada Garage/Overhead Doors Market, by End-use, Thousand Units, 2017-2031

Table 30: Canada Garage/Overhead Doors Market, by End-use, US$ Mn, 2017-2031

Table 31: Canada Garage/Overhead Doors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 32: Canada Garage/Overhead Doors Market, by Distribution Channel, US$ Mn, 2017-2031

List of Figures

Figure 1: North America Garage/Overhead Doors Market, by Door Type, Thousand Units, 2017-2031

Figure 2: North America Garage/Overhead Doors Market, by Door Type, US$ Mn, 2017-2031

Figure 3: North America Garage/Overhead Doors Market Incremental Opportunity, by Door Type, US$ Mn, 2017-2031

Figure 4: North America Garage/Overhead Doors Market, by Category, Thousand Units, 2017-2031

Figure 5: North America Garage/Overhead Doors Market, by Category, US$ Mn, 2017-2031

Figure 6: North America Garage/Overhead Doors Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 7: North America Garage/Overhead Doors Market, by Material Type, Thousand Units, 2017-2031

Figure 8: North America Garage/Overhead Doors Market, by Material Type, US$ Mn, 2017-2031

Figure 9: North America Garage/Overhead Doors Market Incremental Opportunity, by Material Type, US$ Mn, 2017-2031

Figure 10: North America Garage/Overhead Doors Market, by End-use, Thousand Units, 2017-2031

Figure 11: North America Garage/Overhead Doors Market, by End-use, US$ Mn, 2017-2031

Figure 12: North America Garage/Overhead Doors Market Incremental Opportunity, by End-use, US$ Mn, 2017-2031

Figure 13: North America Garage/Overhead Doors Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 14: North America Garage/Overhead Doors Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 15: North America Garage/Overhead Doors Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 16: North America Garage/Overhead Doors Market, by Country Thousand Units, 2017-2031

Figure 17: North America Garage/Overhead Doors Market, by Country US$ Mn, 2017-2031

Figure 18: North America Garage/Overhead Doors Market Incremental Opportunity, by Country US$ Mn, 2017-2031

Figure 19: U.S. Garage/Overhead Doors Market, by Door Type, Thousand Units, 2017-2031

Figure 20: U.S. Garage/Overhead Doors Market, by Door Type, US$ Mn, 2017-2031

Figure 21: U.S. Garage/Overhead Doors Market Incremental Opportunity, by Door Type, US$ Mn, 2017-2031

Figure 22: U.S. Garage/Overhead Doors Market, by Category, Thousand Units, 2017-2031

Figure 23: U.S. Garage/Overhead Doors Market, by Category, US$ Mn, 2017-2031

Figure 24: U.S. Garage/Overhead Doors Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 25: U.S. Garage/Overhead Doors Market, by Material Type, Thousand Units, 2017-2031

Figure 26: U.S. Garage/Overhead Doors Market, by Material Type, US$ Mn, 2017-2031

Figure 27: U.S. Garage/Overhead Doors Market Incremental Opportunity, by Material Type, US$ Mn, 2017-2031

Figure 28: U.S. Garage/Overhead Doors Market, by End-use, Thousand Units, 2017-2031

Figure 29: U.S. Garage/Overhead Doors Market, by End-use, US$ Mn, 2017-2031

Figure 30: U.S. Garage/Overhead Doors Market Incremental Opportunity, by End-use, US$ Mn, 2017-2031

Figure 31: U.S. Garage/Overhead Doors Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 32: U.S. Garage/Overhead Doors Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 33: U.S. Garage/Overhead Doors Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 34: Canada Garage/Overhead Doors Market, by Door Type, Thousand Units, 2017-2031

Figure 35: Canada Garage/Overhead Doors Market, by Door Type, US$ Mn, 2017-2031

Figure 36: Canada Garage/Overhead Doors Market Incremental Opportunity, by Door Type, US$ Mn, 2017-2031

Figure 37: Canada Garage/Overhead Doors Market, by Category, Thousand Units, 2017-2031

Figure 38: Canada Garage/Overhead Doors Market, by Category, US$ Mn, 2017-2031

Figure 39: Canada Garage/Overhead Doors Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 40: Canada Garage/Overhead Doors Market, by Material Type, Thousand Units, 2017-2031

Figure 41: Canada Garage/Overhead Doors Market, by Material Type, US$ Mn, 2017-2031

Figure 42: Canada Garage/Overhead Doors Market Incremental Opportunity, by Material Type, US$ Mn, 2017-2031

Figure 43: Canada Garage/Overhead Doors Market, by End-use, Thousand Units, 2017-2031

Figure 44: Canada Garage/Overhead Doors Market, by End-use, US$ Mn, 2017-2031

Figure 45: Canada Garage/Overhead Doors Market Incremental Opportunity, by End-use, US$ Mn, 2017-2031

Figure 46: Canada Garage/Overhead Doors Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 47: Canada Garage/Overhead Doors Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 48: Canada Garage/Overhead Doors Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031