Air conditioning and ventilation are gaining importance in residential, commercial, and industrial spaces due to the COVID-19 pandemic. With workplaces and offices slowly returning to site following the ease of lockdown restrictions in several countries, managers are adhering to government guidelines around the safe operation & maintenance of air conditioning systems at workplaces. Such trends are translating into revenue opportunities for companies in the North America fan coils market, since these guidelines are stressing on the importance of local fan coil units that help to maximize the air exchange rate.

Employers are taking recommendations from HVAC (Heating, Ventilation and Air Conditioning) engineers to solve concerns surrounding the safe operation of HVAC systems. Though companies in the North America fan coils market may have experienced a dip in sales during the peak of the pandemic, mass vaccination, and ease in lockdown restrictions are anticipated to revive market growth.

Chilled water fan coil units and air-cooled heat pumps are being preferred in overall system design for high-rise residential development. The revenue of residential end users is predicted to grow at an exponential rate as compared to commercial and industrial end users. However, the complexity of chilled water fan coil units involves multiple pipe systems, pumps, and the chiller, which requires skilled maintenance. The chilled water pipes can pose a condensation issue, if they are not properly insulated throughout the building. As compared to refrigerant-based systems, chilled water fan coil units are found to be a better option, since there are limitations on how much refrigerant a building can contain.

Since F-Gas regulations require frequent inspection of pipework joints, which can be a costly affair, chilled water systems are a better option with the help of inert liquid, which eliminates the need for additional requirements.

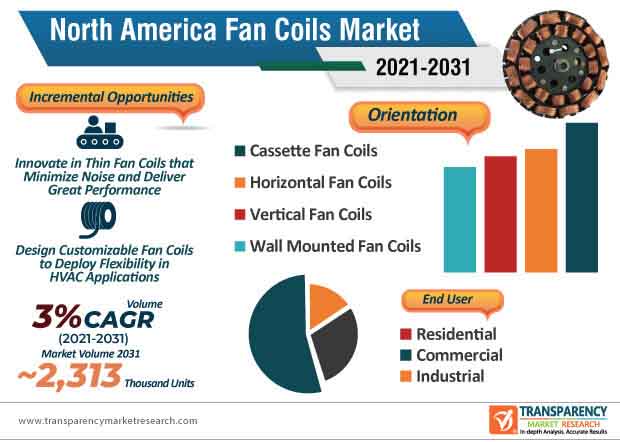

The North America fan coils market is expected to grow at a modest CAGR of ~4% during the forecast period. Manufacturers are building their system portfolio in various installations such as ceiling-mounted, floor-mounted, duct, and cassette fan coils. They are increasing the availability of ceiling mounted fan coils that include high efficiency brushless motors. Manufacturers in the North America fan coils market are using attractively designed casing for fan coils suitable for residential heating and air conditioning applications.

Careful design of main components, refined styling, and versatility in fan coils are being favored by stakeholders in residential, commercial, and industrial sectors.

Compact and concealed fan coil units are being developed by manufacturers in the North America fan coils market. Carrier Global Corporation - a U.S. multinational home appliances corporation is promoting its Idrofan concealed fan coil units that can be used for false ceiling applications. Easy installation and maintenance are key demands of end users. Compact and modular ducted units are being designed for false ceiling applications. This explains why the North America fan coils market is estimated to reach ~2,313 thousand units by 2031.

Manufacturers in the North America fan coils market are offering concealed fan coil units that are reliable and economical in tertiary buildings such as hotel guest rooms, offices, and light commercial applications. Standard and low noise versions are being available in concealed fan coils. On the other hand, hydraulic ducted fan coils are acquiring popularity for their low energy consumption and extremely quiet operation.

Hydronic water terminals are being used to transform fan coils that are not only standard, but are also customized function of the air conditioning requirements of customers. BiniClima - an air conditioning system supplier in Rovereto, Italy, is putting together its design, production, and commerce of hydronic water terminals to develop fan coils that can be customized as per specific air conditioning requirements. Companies in the North America fan coils market are bolstering their production capabilities in underfloor fan coils, ceiling fan coils, and fan coils with floor covering.

Cassette with innovative designs and optimal air distribution in the environment are being preferred. This explains why cassette fan coils are predicted to register the highest revenue among all orientation types in the North America fan coils market.

Smart fan coils are storming the North America fan coils market. Panasonic after having a strategic partnership with Systemair to develop sustainable HVAC&R solutions, is increasing focus in smart fan coils that deliver optimum comfort, low energy consumption, and flexible installation for horizontal or vertical applications. Apart from performance, aesthetic design in smart fan coils is being preferred by customers. Manufacturers in the fan coils market are innovating in stylish floor-standing fan coils with advanced controllers to boost machine uptake.

Since the revenue of residential sector is expected to advance at a rapid rate, manufacturers are increasing the availability of aesthetically-sound fan coils that easily blend into homes. Elegant design and product refinements are becoming important requirements in fan coil production.

Vertical high-rise fan coils are being developed by manufacturers in the North America fan coils market. They have entered the competition to achieve energy efficiency, optimum indoor air quality (IAQ), flexibility, and the likes to gain an edge over other manufacturers. The serviceability of vertical high-rise fan coils is involving touch-safe control boxes, integrated user interface with real language LED display, and built-in tachometer, among others, which is helping stakeholders to stand out from other products and machines currently available in the market.

In order to boost credibility credentials, manufacturers are conducting air and leak tests of coils & piping packages before mounting on the fan coil. On the other hand, greater design flexibility is being achieved with two and four-pipe systems. Manufacturers are increasing efforts to incorporate latest technology electronically commutated motors (ECMs) for achieving energy efficiency and extended motor life.

Analysts’ Viewpoint

Employers now have a legal duty to ensure adequate supply of fresh air in commercial workspaces in the light of the COVID-19 pandemic. HVAC engineers are advising employers and floor managers to avoid recirculation of air between spaces, rooms or zones occupied by different people to prevent the spread of COVID-19. However, chilled water fan coil units are under scrutiny for increased cost and complexity as a result of high maintenance in centralized heating & cooling plants. Companies in the North America fan coils market should tap into high demand areas such as the alternative to refrigerant-based system, since the latter has high global warming potential.

1. Preface

1.1. Market Definition and Scope

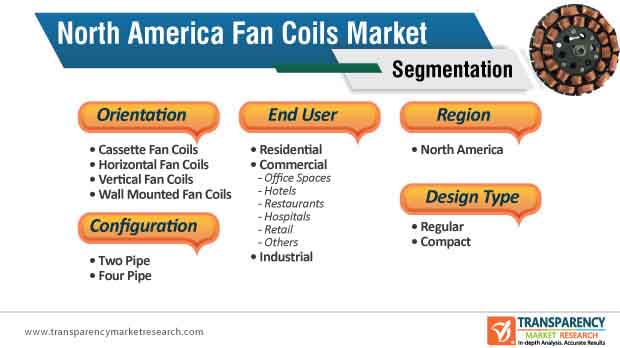

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. HVAC Industry Overview

5.5. Covid-19 Impact Analysis

5.6. Regulatory Framework

5.7. Porter’s Five Forces Analysis

5.8. Value Chain Analysis

5.9. Industry SWOT Analysis

5.10. North America Fan Coils Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Revenue Projections (000’ Units)

6. North America Fan Coils Market Analysis and Forecast, By Design Type

6.1. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Design Type, 2017 - 2031

6.1.1. Regular

6.1.2. Compact

6.2. Incremental Opportunity, By Design Type

7. North America Fan Coils Market Analysis and Forecast, By Configuration

7.1. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Configuration, 2017 - 2031

7.1.1. Two Pipe

7.1.2. Four Pipe

7.2. Incremental Opportunity, By Configuration

8. North America Fan Coils Market Analysis and Forecast, By Orientation

8.1. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Orientation, 2017 - 2031

8.1.1. Cassette Fan Coils

8.1.2. Horizontal Fan Coils

8.1.3. Vertical Fan Coils

8.1.4. Wall Mounted Fan Coils

8.2. Incremental Opportunity, By Orientation

9. North America Fan Coils Market Analysis and Forecast, By End-user

9.1. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By End User, 2017 - 2031

9.1.1. Residential

9.1.2. Commercial

9.1.2.1. Office Spaces

9.1.2.2. Hotels

9.1.2.3. Restaurants

9.1.2.4. Hospitals

9.1.2.5. Retail

9.1.2.6. Others

9.1.3. Industrial

9.2. Incremental Opportunity, By End User

10. North America Fan Coils Market Analysis and Forecast, by Country & Sub-region

10.1. Fan Coils Market Size (US$ Mn, 000’ Units) (000’ Units), by Country & Sub-region, 2017 - 2031

10.1.1. U.S

10.1.2. Canada

10.1.3. Rest of North America

10.2. Incremental Opportunity, by Country

11. U.S. Fan Coils Market Analysis and Forecast

11.1. Country Snapshot

11.2. Key Trends

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price ($)

11.4. COVID-19 Impact Analysis

11.5. Key Supplier Analysis

11.6. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Design Type, 2017 - 2031

11.6.1. Regular

11.6.2. Compact

11.7. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Configuration, 2017 - 2031

11.7.1. Two Pipe

11.7.2. Four Pipe

11.8. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Orientation, 2017 - 2031

11.8.1. Cassette Fan Coils

11.8.2. Horizontal Fan Coils

11.8.3. Vertical Fan Coils

11.8.4. Wall Mounted Fan Coils

11.9. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By End-user, 2017 - 2031

11.9.1. Residential

11.9.2. Commercial

11.9.2.1. Office Spaces

11.9.2.2. Hotels

11.9.2.3. Restaurants

11.9.2.4. Hospitals

11.9.2.5. Retail

11.9.2.6. Others

11.9.3. Industrial

11.10. Incremental Opportunity Analysis

12. Canada Fan Coils Market Analysis and Forecast

12.1. Country Snapshot

12.2. Key Trends

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price ($)

12.4. COVID-19 Impact Analysis

12.5. Key Supplier Analysis

12.6. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Design Type, 2017 - 2031

12.6.1. Regular

12.6.2. Compact

12.7. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Configuration, 2017 - 2031

12.7.1. Two Pipe

12.7.2. Four Pipe

12.8. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By Orientation, 2017 - 2031

12.8.1. Cassette Fan Coils

12.8.2. Horizontal Fan Coils

12.8.3. Vertical Fan Coils

12.8.4. Wall Mounted Fan Coils

12.9. Fan Coils Market Size (US$ Mn, 000’ Units) Forecast, By End-user, 2017 - 2031

12.9.1. Residential

12.9.2. Commercial

12.9.2.1. Office Spaces

12.9.2.2. Hotels

12.9.2.3. Restaurants

12.9.2.4. Hospitals

12.9.2.5. Retail

12.9.2.6. Others

12.9.3. Industrial

12.10. Incremental Opportunity Analysis

13. Competition Landscape

13.1. Market Player – Competition Dashboard

13.2. Market Share Analysis - 2020

13.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

13.3.1. Carrier Corporation

13.3.1.1. Company Overview

13.3.1.2. Sales Area/Geographical Presence

13.3.1.3. Revenue

13.3.1.4. Strategy & Business Overview

13.3.2. Daikin Industries, Ltd.

13.3.2.1. Company Overview

13.3.2.2. Sales Area/Geographical Presence

13.3.2.3. Revenue

13.3.2.4. Strategy & Business Overview

13.3.3. Trane Inc.

13.3.3.1. Company Overview

13.3.3.2. Sales Area/Geographical Presence

13.3.3.3. Revenue

13.3.3.4. Strategy & Business Overview

13.3.4. Williams Corporation

13.3.4.1. Company Overview

13.3.4.2. Sales Area/Geographical Presence

13.3.4.3. Revenue

13.3.4.4. Strategy & Business Overview

13.3.5. Zehnder Group

13.3.5.1. Company Overview

13.3.5.2. Sales Area/Geographical Presence

13.3.5.3. Revenue

13.3.5.4. Strategy & Business Overview

13.3.6. Siemens AG

13.3.6.1. Company Overview

13.3.6.2. Sales Area/Geographical Presence

13.3.6.3. Revenue

13.3.6.4. Strategy & Business Overview

13.3.7. IEC

13.3.7.1. Company Overview

13.3.7.2. Sales Area/Geographical Presence

13.3.7.3. Revenue

13.3.7.4. Strategy & Business Overview

13.3.8. Refra

13.3.8.1. Company Overview

13.3.8.2. Sales Area/Geographical Presence

13.3.8.3. Revenue

13.3.8.4. Strategy & Business Overview

13.3.9. AERMEC

13.3.9.1. Company Overview

13.3.9.2. Sales Area/Geographical Presence

13.3.9.3. Revenue

13.3.9.4. Strategy & Business Overview

13.3.10. Johnson Controls

13.3.10.1. Company Overview

13.3.10.2. Sales Area/Geographical Presence

13.3.10.3. Revenue

13.3.10.4. Strategy & Business Overview

13.3.11. Crane Co.

13.3.11.1. Company Overview

13.3.11.2. Sales Area/Geographical Presence

13.3.11.3. Revenue

13.3.11.4. Strategy & Business Overview

13.3.12. LG electronics

13.3.12.1. Company Overview

13.3.12.2. Sales Area/Geographical Presence

13.3.12.3. Revenue

13.3.12.4. Strategy & Business Overview

14. Key Takeaways

14.1. Identification of Potential Market Spaces

14.2. Prevailing Market Risks

List of Tables

Table 1: North America Fan Coils Market Volume Size and Forecast, By Orientation, Units, 2017 - 2031

Table 2: North America Fan Coils Market Value Size and Forecast, By Orientation, US$ Mn, 2017 - 2031

Table 3: North America Fan Coils Market Volume Size and Forecast, By Configuration, Units, 2017 - 2031

Table 4: North America Fan Coils Market Value Size and Forecast, By Configuration, US$ Mn, 2017 - 2031

Table 5: North America Fan Coils Market Volume Size and Forecast, By Design Type, Units, 2017 - 2031

Table 6: North America Fan Coils Market Value Size and Forecast, By Design Type, US$ Mn, 2017 - 2031

Table 7: North America Fan Coils Market Volume Size and Forecast, By End-User, Units, 2017 - 2031

Table 8: North America Fan Coils Market Value Size and Forecast, By End-User, US$ Mn, 2017 - 2031

Table 9: North America Fan Coils Market Volume Size and Forecast, By Country, Units, 2017 - 2031

Table 10: North America Fan Coils Market Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Table 11: U.S. Fan Coils Market Volume Size and Forecast, By Orientation, Units, 2017 - 2031

Table 12: U.S. Fan Coils Market Value Size and Forecast, By Orientation, US$ Mn, 2017 - 2031

Table 13: U.S. Fan Coils Market Volume Size and Forecast, By Configuration, Units, 2017 - 2031

Table 14: U.S. Fan Coils Market Value Size and Forecast, By Configuration, US$ Mn, 2017 - 2031

Table 15: U.S. Fan Coils Market Volume Size and Forecast, By Design Type, Units, 2017 - 2031

Table 16: U.S. Fan Coils Market Value Size and Forecast, By Design Type, US$ Mn, 2017 - 2031

Table 17: U.S. Fan Coils Market Volume Size and Forecast, By End-User, Units, 2017 - 2031

Table 18: U.S. Fan Coils Market Value Size and Forecast, By End-User, US$ Mn, 2017 - 2031

Table 19: Canada Fan Coils Market Volume Size and Forecast, By Orientation, Units, 2017 - 2031

Table 20: Canada Fan Coils Market Value Size and Forecast, By Orientation, US$ Mn, 2017 - 2031

Table 21: Canada Fan Coils Market Volume Size and Forecast, By Configuration, Units, 2017 - 2031

Table 22: Canada Fan Coils Market Value Size and Forecast, By Configuration, US$ Mn, 2017 - 2031

Table 23: Canada Fan Coils Market Volume Size and Forecast, By Design Type, Units, 2017 - 2031

Table 24: Canada Fan Coils Market Value Size and Forecast, By Design Type, US$ Mn, 2017 - 2031

Table 25: Canada Fan Coils Market Volume Size and Forecast, By End-User, Units, 2017 - 2031

Table 26: Canada Fan Coils Market Value Size and Forecast, By End-User, US$ Mn, 2017 - 2031

List of Figures

Figure 1: North America Fan Coils Market Volume Size and Forecast, By Orientation, Units, 2017 - 2031

Figure 2: North America Fan Coils Market Value Size and Forecast, By Orientation, US$ Mn, 2017 - 2031

Figure 3: North America Fan Coils Market Incremental Opportunity, By Orientation, US$ Mn, 2021 - 2031

Figure 4: North America Fan Coils Market Volume Size and Forecast, By Configuration, Units, 2017 - 2031

Figure 5: North America Fan Coils Market Value Size and Forecast, By Configuration, US$ Mn, 2017 - 2031

Figure 6: North America Fan Coils Market Incremental Opportunity, By Configuration, US$ Mn, 2021 - 2031

Figure 7: North America Fan Coils Market Volume Size and Forecast, By Design Type, Units, 2017 - 2031

Figure 8: North America Fan Coils Market Value Size and Forecast, By Design Type, US$ Mn, 2017 - 2031

Figure 9: North America Fan Coils Market Incremental Opportunity, By Design Type, US$ Mn, 2021 - 2031

Figure 10: North America Fan Coils Market Volume Size and Forecast, By End-User, Units, 2017 - 2031

Figure 11: North America Fan Coils Market Value Size and Forecast, By End-User, US$ Mn, 2017 - 2031

Figure 12: North America Fan Coils Market Incremental Opportunity, By End-User, US$ Mn, 2021 - 2031

Figure 13: North America Fan Coils Market Volume Size and Forecast, By Country, Units, 2017 - 2031

Figure 14: North America Fan Coils Market Value Size and Forecast, By Country, US$ Mn, 2017 - 2031

Figure 15: North America Fan Coils Market Incremental Opportunity, By Country, US$ Mn, 2021 - 2031

Figure 16: U.S. Fan Coils Market Volume Size and Forecast, By Orientation, Units, 2017 - 2031

Figure 17: U.S. Fan Coils Market Value Size and Forecast, By Orientation, US$ Mn, 2017 - 2031

Figure 18: U.S. Fan Coils Market Incremental Opportunity, By Orientation, US$ Mn, 2021 - 2031

Figure 19: U.S. Fan Coils Market Volume Size and Forecast, By Configuration, Units, 2017 - 2031

Figure 20: U.S. Fan Coils Market Value Size and Forecast, By Configuration, US$ Mn, 2017 - 2031

Figure 21: U.S. Fan Coils Market Incremental Opportunity, By Configuration, US$ Mn, 2021 - 2031

Figure 22: U.S. Fan Coils Market Volume Size and Forecast, By Design Type, Units, 2017 - 2031

Figure 23: U.S. Fan Coils Market Value Size and Forecast, By Design Type, US$ Mn, 2017 - 2031

Figure 24: U.S. Fan Coils Market Incremental Opportunity, By Design Type, US$ Mn, 2021 - 2031

Figure 25: U.S. Fan Coils Market Volume Size and Forecast, By End-User, Units, 2017 - 2031

Figure 26: U.S. Fan Coils Market Value Size and Forecast, By End-User, US$ Mn, 2017 - 2031

Figure 27: U.S. Fan Coils Market Incremental Opportunity, By End-User, US$ Mn, 2021 - 2031

Figure 28: Canada Fan Coils Market Volume Size and Forecast, By Orientation, Units, 2017 - 2031

Figure 29: Canada Fan Coils Market Value Size and Forecast, By Orientation, US$ Mn, 2017 - 2031

Figure 30: Canada Fan Coils Market Incremental Opportunity, By Orientation, US$ Mn, 2021 - 2031

Figure 31: Canada Fan Coils Market Volume Size and Forecast, By Configuration, Units, 2017 - 2031

Figure 32: Canada Fan Coils Market Value Size and Forecast, By Configuration, US$ Mn, 2017 - 2031

Figure 33: Canada Fan Coils Market Incremental Opportunity, By Configuration, US$ Mn, 2021 - 2031

Figure 34: Canada Fan Coils Market Volume Size and Forecast, By Design Type, Units, 2017 - 2031

Figure 35: Canada Fan Coils Market Value Size and Forecast, By Design Type, US$ Mn, 2017 - 2031

Figure 36: Canada Fan Coils Market Incremental Opportunity, By Design Type, US$ Mn, 2021 - 2031

Figure 37: Canada Fan Coils Market Volume Size and Forecast, By End-User, Units, 2017 - 2031

Figure 38: Canada Fan Coils Market Value Size and Forecast, By End-User, US$ Mn, 2017 - 2031

Figure 39: Canada Fan Coils Market Incremental Opportunity, By End-User, US$ Mn, 2021 – 2031