North America Facial Injectables Market: Snapshot

Owing to the rising disposable incomes and changing lifestyles, there has been a continued rise of facial injectables demand across North America. The market for facial injectables is estimated to be growing a faster pace due to emerging physical appearance obsession globally. The focus on aesthetics and the desire to become young is also anticipated to increase the demand for facial surgeries in the years to come. Not only that, the rise in longevity of these injectables effects has also gained momentum in North America market.

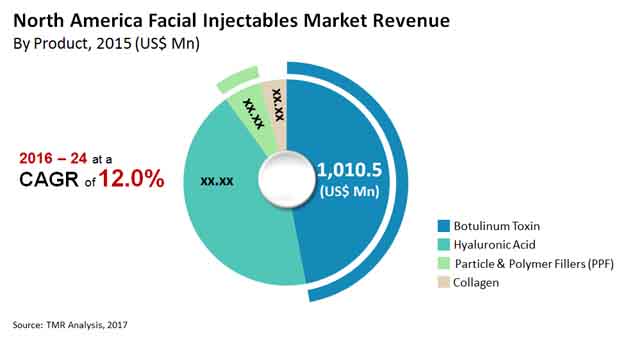

The North America market for injectables is anticipated to rise to US$5.8 bn by 2024 from that of US$2.1 bn of 2015. The market is expected to rise at a promising 12.0% CAGR during the forecast years of 2016 and 2024.

The North America market for injectables is anticipated to rise to US$5.8 bn by 2024 from that of US$2.1 bn of 2015. The market is expected to rise at a promising 12.0% CAGR during the forecast years of 2016 and 2024.

Botox Making Extensive Demand in Market for Skin Rejuvenation

Based on product segmentation of facial injectables in the market it can be categorized into Collagen, botulinum toxin, particle and polymer fillers, and hyaluronic acid. With a major share accounting in the market as per 2015, botulinum toxin has been leading. The sub segments of collagen being human based and porcine or bovine-based and the sub segments of particle and polymer fillers being calcium hydroxyapatite, Poly-L-Lactic acid and Polymethylmethacrylate Beads or PMMA microspheres). However, botox has been attributing to effectiveness mainly in reducing wrinkles and face lines and skin rejuvenation, making an extensive demand in the market. The segment is estimated to rise with a CAGR of 12.7% within the forecast period of 2016 to 2024.

Treatment wise, the regional market for facial injectables is segmented into lip augmentation, facial pain, and wrinkle treatment. Owing to these less recovery time and minimally invasive strategies, the facial injectables are being widely used in the cosmetics industry.

Based on end user segmentation, the North America market for facial injectables market is segmented into physician clinics, dermatology clinics, cosmetic centers, hospitals and ambulatory surgical centers. The expanding awareness of beauty and aesthetics in skin rejuvenation is anticipated to fuel the injectable filler demand in the market.

U.S. Growing at Rapid Pace due to Rising Demand for Anti-aging Treatment

The market for facial injectables in North America is segmented into Canada, and U.S. in terms of geography. A large portion of the share of facial injectables in North America came from the U.S. according to the 2015 reports. Owing to the rise in demand for dermal fillers in anti-aging treatment, the market for facial injectables in North America is experiencing a rapid growth.

According to The American Society for Aesthetic Plastic Surgery prediction, the popularity of people with skin problems will continue to rise and treatment for which will encourage the uptake of both surgical and non- surgical aesthetic procedures across the region followed by Canada and the Rest of North America.

The key players in the market for facial injectables in North America are Bloomage BioTechnology Corporation Limited, Ipsen Group, Allergan Plc, Prollenium Medical Technologies Inc., Galderma S.A. (Nestle), and Merz Pharma & Co. KGaA. Among these, Allergan Plc holds a dominant share in the market making the market fairly monopolistic in nature.

North America Facial Injectables Market Garner Revenue Growth from Growing Awareness About Safety and Efficacy of Procedures

North America has seen rapidly growing popularity of dermal fillers, evident in the millions of women as well as men undergoing the procedures. Facial injectables are popularly used in facial contouring, wrinkle treatment, lip augmentation, and effect the symmetry features around the face. The drive for North America facial injectables market has stemmed from the growing success outcomes of such procedures in removing the visible signs of aging. The regional market has also grown in potential on the back of growing number of cosmetic surgeons creating awareness about the safety and efficacy of facial injectables. On the other side of the spectrum, materials manufacturers have been relentlessly focused on unveiling new materials that are biocompatible and also meet the desired objective in patients. Further, fast expanding array of FDA approved filler products in recent years has enriched the landscape of the North America facial injectables market. The region, especially the U.S., has witnessed rapidly growing number of cosmetic centers and dermatology clinics where certified cosmetic surgeons who also offer a comprehensive pre-treatment consultation. Over the years, the regional market has benefitted from the growing awareness about the existing protocols for evaluating the effectiveness of facial injectables in meeting the expectations of target individuals.

The COVID-19 has emerged as a huge humanitarian crisis, with unprecedented repercussions on the health systems of countries worldwide. The subsequent waves have been of higher concern to governments around the world, with new mutant viruses showing the capacity to spread rapidly and infect more people. Policy makers are working collaboratively to upgrade the healthcare infrastructure, augment hospital beds, and ensuring the availability of essential medications to seriously ill patients. Several such measures are working in direction to reducing the mortality and morbidity of the novel coronavirus. On other side of the spectrum, incessant efforts to vaccinate a large proportion of population, especially older adults, to reduce the viral load. All these developments are also shaping the demand and production dynamics of manufacturers and other players in the facial injectables market.

Chapter 1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

Chapter 2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

Chapter 3. Executive Summary

3.1. North America facial injectables market: Market Snapshot

3.2. Market Share Analysis by country, 2015

Chapter 4. Market Overview

4.1. Product Overview

4.2. North America facial injectables market : Key Industry Events

4.3. North America Facial Injectables Market Size (US$ Mn) Forecast, 2014–2024

4.4. North America Facial Injectables Market Outlook

4.5. Porter’s Five Forces Analysis

Chapter 5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.2.1. Enhanced longevity of the effects to augment demand for facial injectables

5.2.2. Improving lifestyles and rising inclination toward minimally invasive surgeries

5.2.3. Growing global obsession with physical appearance and the desire to look young

5.2.4. Escalating number of patients with various cosmetic skin problems such as scars, deep lines, and wrinkles

5.2.5. Increased rate of spending on esthetic procedures

5.3. Restraints

5.3.1. Side-effects of available products limiting adoption

5.3.2. Lack of appropriate reimbursement policies supporting cosmetic procedures

5.3.3. High cost of treatment

5.4. Opportunities

5.4.1. Product innovation and process development to overcome disadvantages of commercially available products

5.4.2. New tools and smartphone applications that aid the purchasing process are likely to be created and used by consumers

5.5. Key Trends

Chapter 6. North America Facial Injectables Market Analysis, by Product Type

6.1. Key Findings

6.2. Introduction

6.3. North America Facial Injectables Market Value Share Analysis, by Product Type

6.4. North America Facial Injectables Market Analysis, by Product Type

6.4.1. Botulinum Toxin

6.4.2. Hyaluronic Acid

6.4.3. Collagen

6.4.3.1. Porcine/ Bovine-Based

6.4.3.2. Human Based

6.4.4. Particle & Polymer Fillers (PPF)

6.4.4.1. Polymethylmethacrylate Beads (PMMA microspheres)

6.4.4.2. Poly-L-Lactic Acid

6.4.4.3. Calcium Hydroxyapatite

6.5. North America Facial Injectables Market Attractiveness Analysis, by Product

6.6. Key Trends

Chapter 7. North America Facial Injectables Market Analysis, by Treatment Type

7.1. Key Findings

7.2. Introduction

7.3. North America Facial Injectables Market Value Share Analysis, by Treatment

7.4. North America Facial Injectables Market Analysis, by Treatment

7.4.1. Facial Pain

7.4.2. Wrinkle Treatment

7.4.3. Lip Augmentation

7.4.4. Others

7.5. North America Facial Injectables Market Attractiveness Analysis, by Treatment

7.6. Key Trends

Chapter 8. North America Facial Injectables Market Analysis, by End user

8.1. Key Findings

8.2. Introduction

8.3. North America Facial Injectables Market Value Share Analysis, by End User

8.4. North America Facial Injectables Market Analysis, by End User

8.4.1. Hospitals

8.4.2. Ambulatory Surgical Centers

8.4.3. Cosmetic Centers

8.4.4. Dermatology Clinics

8.4.5. Physician Clinics

8.5. North America Facial Injectables Market Attractiveness Analysis, by End User

8.6. Key Trends

Chapter 9. North America Facial Injectables Market Analysis, by Country

9.1. North America Facial Injectables Market Value Share Analysis, by Country

9.2. North America Facial Injectables Market Forecast, by Country

9.3. North America Facial Injectables Market Attractiveness Analysis, by Country

9.4. Market Trends

Chapter 10. Company Profiles

10.1. North America Facial Injectables Market Share Analysis, by Company (2015)

10.2. Competition Matrix

10.3. Company Profiles

10.3.1. Allergan plc.

10.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.1.2. Financial Overview

10.3.1.3. Product Portfolio

10.3.1.4. SWOT Analysis

10.3.1.5. Strategic Overview

10.3.2. Galderma S.A. (Nestle)

10.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.2.2. Financial Overview

10.3.2.3. Product Portfolio

10.3.2.4. SWOT Analysis

10.3.2.5. Strategic Overview

10.3.3. Merz Pharma & Co. KGaA

10.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.3.2. Financial Overview

10.3.3.3. Product Portfolio

10.3.3.4. SWOT Analysis

10.3.3.5. Strategic Overview

10.3.4. Prollenium Medical Technologies Inc.

10.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.4.2. Financial Overview

10.3.4.3. Product Portfolio

10.3.4.4. SWOT Analysis

10.3.4.5. Strategic Overview

10.3.5. Ipsen Group

10.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.5.2. Financial Overview

10.3.5.3. Product Portfolio

10.3.5.4. SWOT Analysis

10.3.5.5. Strategic Overview

10.3.6. Bloomage BioTechnology Corporation Limited

10.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.6.2. Financial Overview

10.3.6.3. Product Portfolio

10.3.6.4. SWOT Analysis

10.3.6.5. Strategic Overview

List of Tables

Table 1: North America Facial Injectables Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

Table 2: North America Collagen Market Size (US$ Mn) Forecast, 2014–2024

Table 3: North America Particle & Polymer Fillers (PPF) Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

Table 4: North America Facial Injectables Market Size (US$ Mn) Forecast, by Treatment Type, 2014–2024

Table 5: North America Facial Injectables Market Size (US$ Mn) Forecast, by End-user, 2014–2024

Table 6: North America Facial Injectables Market Size (US$ Mn) Forecast, by Country, 2014–2024

List of Figures

Figure 1: North America Facial Injectables Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2014–2024

Figure 2: North America Facial Injectables Market Value Share, by Product Type, 2016 and 2024

Figure 3: North America Botulinum Toxin Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 4: North America Hyaluronic Acid Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 5: North America Collagen Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 6: North America Particles and Polymer Fillers (PPF) Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 7: Facial Injectables Market Attractiveness Analysis, by Product Type, 2016–2024

Figure 8: North America Facial Injectables Market Value Share, by Treatment Type, 2016 and 2024

Figure 9: North America Facial Pain Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 10: North America Wrinkle Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 11: North America Lip Augmentation Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 12: North America Others Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 13: Facial Injectables Market Attractiveness Analysis, by Treatment Type, 2016–2024

Figure 14: North America Facial Injectables Market Value Share, by End-user, 2016 and 2024

Figure 15: North America Facial Injectables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2014–2024

Figure 16: North America Facial Injectables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgical Centers, 2014–2024

Figure 17: North America Facial Injectables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cosmetic Centers, 2014–2024

Figure 18: North America Facial Injectables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Dermatology Clinics, 2014–2024

Figure 19: North America Facial Injectables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Physician Clinics, 2014–2024

Figure 20: North America Facial Injectables Market Attractiveness Analysis, by End-user, 2016–2024

Figure 21: North America Facial Injectables Market Value Share Analysis, by Country, 2016 and 2024

Figure 22: North America Facial Injectables Market Attractiveness Analysis, by Country, 2016–2024

Figure 23: North America Facial Injectables Market Share Analysis, by Company, 2016 (Estimated)