Analysts’ Viewpoint on Market Scenario

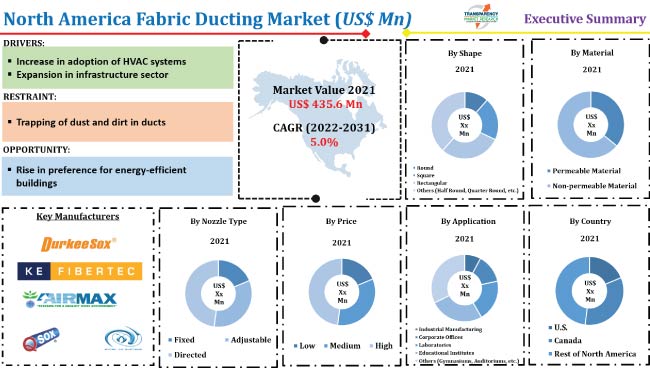

Fabric ducts heat, cool, and ventilate more efficiently than traditional HVAC solutions. Fabric ducting is an effective alternative to conventional ducting, as it offers greater flexibility. Rise in investment in infrastructure development and expansion in the construction sector are driving the North America fabric ducting industry.

Governments of the U.S. and Canada are supporting adoption of green buildings in order to achieve their sustainability goals. Increase in usage of HVAC systems is expected to augment the market development during the forecast period. North American fabric ducting companies are investing significantly in the R&D of new products to increase their revenue share.

Fabric ducting is a ventilation ducting solution that is made of polyester and various other materials. Fabric air ducts allow designers to use various colors and shapes. They improve airflow, and are hygienic and suitable for clean environments. Fabric ducts are lightweight and low-cost solutions. They are also easy to install and clean. These ducts provide more even air distribution than traditional steel ducts. Laser-cut precision air holes in fabric ducts facilitate uniform air distribution along the entire length of the duct.

Fabric ducts operate at significantly reduced static pressure requirements, thereby aiding in energy conservation. Round ducts utilize less material than rectangular ducts. They are also the most efficient ducting system compared to others. Less ownership cost and customizable designs are major benefits of fabric ducting solutions.

Expansion in the construction sector is boosting the demand for robust HVAC systems in North America. Fabric duct systems play a critical role in maintaining the flow of cool and warm air in an enclosed space. These systems deliver an equal amount of air back to the HVAC system to avoid suffocation. Air ducts remove dust particles and unwanted microorganisms to help create a clean environment.

Rise in focus on health and fitness has prompted the populace to invest in clean air solutions. This is expected to drive the North America fabric ducting market statistics during the forecast period. Fabric air distribution systems improve air quality in enclosed spaces by circulating clean air. Air ducts are commonly used in the residential sector to remove unwanted odors. The residential sector has been witnessing rapid growth in the recent past due to the increase in population and migration of the populace to urban areas. This, in turn, is likely to offer lucrative growth opportunities for fabric ducting manufacturers in North America.

Large indoor sports facilities, fitness centers, and swimming pools employ fabric ducts to efficiently heat, cool, and ventilate spaces. Rise in participation in sports and outdoor activities is expected to fuel the North America fabric ducting market progress during the forecast period.

Fabric air conditioning ducts are increasingly becoming the air distribution systems of choice for various commercial institutions such as sports facilities, resorts, stadiums, aquatic centers, and medical facilities. Thus, fabric duct manufacturers are expanding their production capabilities to cater to the specific requirements of target consumers. In December 2020, DuctSox Corporation completed the production of its fabric ductwork for medical tents at one of the largest nonprofit integrated healthcare systems in the U.S.

According to the latest North America fabric ducting market forecast, the permeable material segment is expected to dominate the industry in terms of revenue during the forecast period. Permeable materials are ideal for effective air distribution. They rely on the principle of thermodynamics to provide effective ventilation. Permeable materials offer various benefits such as no condensation and no drafts. These benefits boost the adoption of permeable materials, thereby driving the segment.

In terms of application, the industrial manufacturing segment is anticipated to hold major North America fabric ducting market share during the forecast period. Fabric ducting is widely used in industrial manufacturing to achieve effective cooling compared to compression-based cooling or heating. Additionally, fabric ducting allows the development of movable/adjustable, lightweight, noise-free, vibration-less, and compact designs for effective distribution of cold or hot air. These features augment the demand for fabric ducts in industrial manufacturing.

According to the latest fabric ducting industry forecast, the U.S. is expected to dominate the market during 2022 to 2031. Rise in usage of fabrics for ducting instead of galvanized aluminum or steel is driving the market expansion in the country.

Fabric ducting materials are more affordable than their aluminum counterparts. They reduce installation time and lower maintenance costs. Growth in the industrial sector across the U.S. is likely to further propel the market share during the forecast period.

Detailed profiles of vendors have been provided in the North America fabric ducting market report to evaluate their financials, key product offerings, recent developments, and strategies. Most of the companies actively focus on investment in the R&D of industry-specific solutions. Technology advancements, geographical and capacity expansion, and strategic partnerships and collaborations are major focus areas of these companies.

Durkeesox Air Dispersion System Co., Ltd, KE Fibertec NA, Inc., AIRMAX International, Excel Air Systems, Fabric Duct Systems Inc., Fabricair, Inc., Firemac Ltd., Patterson Fan Company, Inc., PRIHODA s.r.o., and DuctSox Corporation are key entities operating in the market.

|

Attribute |

Detail |

|

Market Value of Fabric Ducting in 2021 |

US$ 435.6 Mn |

|

Market Forecast Value in 2031 |

US$ 704.1 Mn |

|

Growth Rate (CAGR) |

5.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis as well as country level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 435.6 Mn in 2021

It is expected to reach US$ 704.1 Mn by 2031

Increase in adoption of HVAC systems and expansion in infrastructure sector

The permeable segment held the largest share in 2021

The U.S. is a lucrative country for vendors in the business

Durkeesox Air Dispersion System Co., Ltd, KE Fibertec NA, Inc., AIRMAX International, Excel Air Systems, Fabric Duct Systems Inc., Fabricair, Inc., Firemac Ltd., Patterson Fan Company, Inc., PRIHODA s.r.o., and DuctSox Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Ducting Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Roadmap

5.9. North America Fabric Ducting Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. North America Fabric Ducting Market Analysis and Forecast, By Shape

6.1. North America Fabric Ducting Market Size (US$ Mn and Thousand Units), By Shape, 2017 - 2031

6.1.1. Round

6.1.2. Square

6.1.3. Rectangular

6.1.4. Others (Half Round, Quarter Round, etc.)

6.2. Incremental Opportunity, By Shape

7. North America Fabric Ducting Market Analysis and Forecast, By Material

7.1. North America Fabric Ducting Market Size (US$ Mn and Thousand Units), By Material, 2017 - 2031

7.1.1. Permeable Material

7.1.2. Non-permeable Material

7.2. Incremental Opportunity, By Material

8. North America Fabric Ducting Market Analysis and Forecast, By Nozzle Type

8.1. North America Fabric Ducting Market Size (US$ Mn and Thousand Units), By Nozzle Type, 2017 - 2031

8.1.1. Fixed

8.1.2. Adjustable

8.1.3. Directed

8.2. Incremental Opportunity, By Nozzle Type

9. North America Fabric Ducting Market Analysis and Forecast, By Price

9.1. North America Fabric Ducting Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, By Price

10. North America Fabric Ducting Market Analysis and Forecast, By Application

10.1. North America Fabric Ducting Market Size (US$ Mn and Thousand Units), By Application, 2017 - 2031

10.1.1. Industrial Manufacturing

10.1.2. Corporate Offices

10.1.3. Laboratories

10.1.4. Educational Institutes

10.1.5. Others (Gymnasiums, Auditoriums, etc.)

10.2. Incremental Opportunity, By Application

11. North America Fabric Ducting Market Analysis and Forecast, By Country

11.1. North America Fabric Ducting Market Size (US$ Mn and Thousand Units), By Country, 2017 - 2031

11.1.1. U.S.

11.1.2. Canada

11.1.3. Rest of North America

11.2. Incremental Opportunity, By Country

12. U.S. Fabric Ducting Market Analysis and Forecast

12.1. Country Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Shape, 2017 - 2031

12.4.1. Round

12.4.2. Square

12.4.3. Rectangular

12.4.4. Others (Half Round, Quarter Round, etc.)

12.5. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Material, 2017 - 2031

12.5.1. Permeable Material

12.5.2. Non-permeable Material

12.6. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Nozzle Type, 2017 - 2031

12.6.1. Fixed

12.6.2. Adjustable

12.6.3. Directed

12.7. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

12.7.1. Low

12.7.2. Medium

12.7.3. High

12.8. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Application, 2017 - 2031

12.8.1. Industrial Manufacturing

12.8.2. Corporate Offices

12.8.3. Laboratories

12.8.4. Educational Institutes

12.8.5. Others (Gymnasiums, Auditoriums, etc.)

12.9. Incremental Opportunity Analysis

13. Canada Fabric Ducting Market Analysis and Forecast

13.1. Country Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Shape, 2017 - 2031

13.4.1. Round

13.4.2. Square

13.4.3. Rectangular

13.4.4. Others (Half Round, Quarter Round, etc.)

13.5. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Material, 2017 - 2031

13.5.1. Permeable Material

13.5.2. Non-permeable Material

13.6. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Nozzle Type, 2017 - 2031

13.6.1. Fixed

13.6.2. Adjustable

13.6.3. Directed

13.7. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Price, 2017 - 2031

13.7.1. Low

13.7.2. Medium

13.7.3. High

13.8. Fabric Ducting Market Size (US$ Mn and Thousand Units), By Application, 2017 - 2031

13.8.1. Industrial Manufacturing

13.8.2. Corporate Offices

13.8.3. Laboratories

13.8.4. Educational Institutes

13.8.5. Others (Gymnasiums, Auditoriums, etc.)

13.9. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), 2021

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

14.3.1. Durkeesox Air Dispersion System Co., Ltd.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Financial/Revenue

14.3.1.4. Strategy & Business Overview

14.3.1.5. Sales Channel Analysis

14.3.1.6. Size Portfolio

14.3.2. KE Fibertec NA, Inc.

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Financial/Revenue

14.3.2.4. Strategy & Business Overview

14.3.2.5. Sales Channel Analysis

14.3.2.6. Size Portfolio

14.3.3. AIRMAX International

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Financial/Revenue

14.3.3.4. Strategy & Business Overview

14.3.3.5. Sales Channel Analysis

14.3.3.6. Size Portfolio

14.3.4. Excel Air Systems

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Financial/Revenue

14.3.4.4. Strategy & Business Overview

14.3.4.5. Sales Channel Analysis

14.3.4.6. Size Portfolio

14.3.5. Fabric Duct Systems Inc.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Financial/Revenue

14.3.5.4. Strategy & Business Overview

14.3.5.5. Sales Channel Analysis

14.3.5.6. Size Portfolio

14.3.6. Fabricair, Inc.

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Financial/Revenue

14.3.6.4. Strategy & Business Overview

14.3.6.5. Sales Channel Analysis

14.3.6.6. Size Portfolio

14.3.7. Firemac Ltd.

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Financial/Revenue

14.3.7.4. Strategy & Business Overview

14.3.7.5. Sales Channel Analysis

14.3.7.6. Size Portfolio

14.3.8. Patterson Fan Company, Inc.

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Financial/Revenue

14.3.8.4. Strategy & Business Overview

14.3.8.5. Sales Channel Analysis

14.3.8.6. Size Portfolio

14.3.9. PRIHODA s.r.o.

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Financial/Revenue

14.3.9.4. Strategy & Business Overview

14.3.9.5. Sales Channel Analysis

14.3.9.6. Size Portfolio

14.3.10. DuctSox Corporation

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Financial/Revenue

14.3.10.4. Strategy & Business Overview

14.3.10.5. Sales Channel Analysis

14.3.10.6. Size Portfolio

15. Key Takeaway

15.1. Identification of Potential Market Spaces

15.1.1. Shape

15.1.2. Material

15.1.3. Nozzle Type

15.1.4. Price

15.1.5. Application

15.1.6. Geography

15.2. Understanding the Buying Process of the Customers

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Fabric Ducting Market, By Shape, Thousand Units, 2017-2031

Table 2: North America Fabric Ducting Market, By Shape, US$ Mn, 2017-2031

Table 3: North America Fabric Ducting Market, By Material, Thousand Units, 2017-2031

Table 4: North America Fabric Ducting Market, By Material, US$ Mn, 2017-2031

Table 5: North America Fabric Ducting Market, By Nozzle Type, Thousand Units, 2017-2031

Table 6: North America Fabric Ducting Market, By Nozzle Type, US$ Mn, 2017-2031

Table 7: North America Fabric Ducting Market, By Price, Thousand Units, 2017-2031

Table 8: North America Fabric Ducting Market, By Price, US$ Mn, 2017-2031

Table 9: North America Fabric Ducting Market, By Application, Thousand Units, 2017-2031

Table 10: North America Fabric Ducting Market, By Application, US$ Mn, 2017-2031

Table 11: North America Fabric Ducting Market, By Country, Thousand Units, 2017-2031

Table 12: North America Fabric Ducting Market, By Country, US$ Mn, 2017-2031

Table 13: U.S. Fabric Ducting Market, By Shape, Thousand Units, 2017-2031

Table 14: U.S. Fabric Ducting Market, By Shape, US$ Mn, 2017-2031

Table 15: U.S. Fabric Ducting Market, By Material, Thousand Units, 2017-2031

Table 16: U.S. Fabric Ducting Market, By Material, US$ Mn, 2017-2031

Table 17: U.S. Fabric Ducting Market, By Nozzle Type, Thousand Units, 2017-2031

Table 18: U.S. Fabric Ducting Market, By Nozzle Type, US$ Mn, 2017-2031

Table 19: U.S. Fabric Ducting Market, By Price, Thousand Units, 2017-2031

Table 20: U.S. Fabric Ducting Market, By Price, US$ Mn, 2017-2031

Table 21: U.S. Fabric Ducting Market, By Application, Thousand Units, 2017-2031

Table 22: U.S. Fabric Ducting Market, By Application, US$ Mn, 2017-2031

Table 23: Canada Fabric Ducting Market, By Shape, Thousand Units, 2017-2031

Table 24: Canada Fabric Ducting Market, By Shape, US$ Mn, 2017-2031

Table 25: Canada Fabric Ducting Market, By Material, Thousand Units, 2017-2031

Table 26: Canada Fabric Ducting Market, By Material, US$ Mn, 2017-2031

Table 27: Canada Fabric Ducting Market, By Nozzle Type, Thousand Units, 2017-2031

Table 28: Canada Fabric Ducting Market, By Nozzle Type, US$ Mn, 2017-2031

Table 29: Canada Fabric Ducting Market, By Price, Thousand Units, 2017-2031

Table 30: Canada Fabric Ducting Market, By Price, US$ Mn, 2017-2031

Table 31: Canada Fabric Ducting Market, By Application, Thousand Units, 2017-2031

Table 32: Canada Fabric Ducting Market, By Application, US$ Mn, 2017-2031

List of Figures

Figure 1: North America Fabric Ducting Market, By Shape, Thousand Units, 2017-2031

Figure 2: North America Fabric Ducting Market, By Shape, US$ Mn, 2017-2031

Figure 3: North America Fabric Ducting Market Incremental Opportunity, By Shape, US$ Mn, 2017-2031

Figure 4: North America Fabric Ducting Market, By Material, Thousand Units, 2017-2031

Figure 5: North America Fabric Ducting Market, By Material, US$ Mn, 2017-2031

Figure 6: North America Fabric Ducting Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 7: North America Fabric Ducting Market, By Nozzle Type, Thousand Units, 2017-2031

Figure 8: North America Fabric Ducting Market, By Nozzle Type, US$ Mn, 2017-2031

Figure 9: North America Fabric Ducting Market Incremental Opportunity, By Nozzle Type, US$ Mn, 2017-2031

Figure 10: North America Fabric Ducting Market, By Price, Thousand Units, 2017-2031

Figure 11: North America Fabric Ducting Market, By Price, US$ Mn, 2017-2031

Figure 12: North America Fabric Ducting Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 13: North America Fabric Ducting Market, By Application, Thousand Units, 2017-2031

Figure 14: North America Fabric Ducting Market, By Application, US$ Mn, 2017-2031

Figure 15: North America Fabric Ducting Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 16: North America Fabric Ducting Market, By Country, Thousand Units, 2017-2031

Figure 17: North America Fabric Ducting Market, By Country, US$ Mn, 2017-2031

Figure 18: North America Fabric Ducting Market Incremental Opportunity, By Country, US$ Mn, 2017-2031

Figure 19: U.S. Fabric Ducting Market, By Shape, Thousand Units, 2017-2031

Figure 20: U.S. Fabric Ducting Market, By Shape, US$ Mn, 2017-2031

Figure 21: U.S. Fabric Ducting Market Incremental Opportunity, By Shape, US$ Mn, 2017-2031

Figure 22: U.S. Fabric Ducting Market, By Material, Thousand Units, 2017-2031

Figure 23: U.S. Fabric Ducting Market, By Material, US$ Mn, 2017-2031

Figure 24: U.S. Fabric Ducting Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 25: U.S. Fabric Ducting Market, By Nozzle Type, Thousand Units, 2017-2031

Figure 26: U.S. Fabric Ducting Market, By Nozzle Type, US$ Mn, 2017-2031

Figure 27: U.S. Fabric Ducting Market Incremental Opportunity, By Nozzle Type, US$ Mn, 2017-2031

Figure 28: U.S. Fabric Ducting Market, By Price, Thousand Units, 2017-2031

Figure 29: U.S. Fabric Ducting Market, By Price, US$ Mn, 2017-2031

Figure 30: U.S. Fabric Ducting Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 31: U.S. Fabric Ducting Market, By Application, Thousand Units, 2017-2031

Figure 32: U.S. Fabric Ducting Market, By Application, US$ Mn, 2017-2031

Figure 33: U.S. Fabric Ducting Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 34: Canada Fabric Ducting Market, By Shape, Thousand Units, 2017-2031

Figure 35: Canada Fabric Ducting Market, By Shape, US$ Mn, 2017-2031

Figure 36: Canada Fabric Ducting Market Incremental Opportunity, By Shape, US$ Mn, 2017-2031

Figure 37: Canada Fabric Ducting Market, By Material, Thousand Units, 2017-2031

Figure 38: Canada Fabric Ducting Market, By Material, US$ Mn, 2017-2031

Figure 39: Canada Fabric Ducting Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 40: Canada Fabric Ducting Market, By Nozzle Type, Thousand Units, 2017-2031

Figure 41: Canada Fabric Ducting Market, By Nozzle Type, US$ Mn, 2017-2031

Figure 42: Canada Fabric Ducting Market Incremental Opportunity, By Nozzle Type, US$ Mn, 2017-2031

Figure 43: Canada Fabric Ducting Market, By Price, Thousand Units, 2017-2031

Figure 44: Canada Fabric Ducting Market, By Price, US$ Mn, 2017-2031

Figure 45: Canada Fabric Ducting Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 46: Canada Fabric Ducting Market, By Application, Thousand Units, 2017-2031

Figure 47: Canada Fabric Ducting Market, By Application, US$ Mn, 2017-2031

Figure 48: Canada Fabric Ducting Market Incremental Opportunity, By Application, US$ Mn, 2017-2031