The widespread diagnostic and serological testing is emerging as one of the key measures to mitigate the COVID-19 pandemic. The increased load on healthcare systems, social distancing, and convenience needs of individuals is anticipated to boost the growth of the North America direct-to-consumer laboratory testing market.

Even though DTC (direct-to-consumer) tests have many advantages, it is also associated with significant ethical and regulatory concerns. The FDA (Food & Drug Administration) exercised its discretion not to enforce requirements for laboratories and commercial manufacturers operating without EUA (Emergency Use Authorization), as long as they provided a disclaimer that the tests are not reviewed by the FDA. This has led to concerns about the quality of many tests in the North America direct-to-consumer laboratory testing market. Eventually, the FDA has changed its approach for aligning its policy for serological tests with that for diagnostic tests. It has recommended companies to obtain EUA before marketing its at-home serological tests.

Risks and benefits of DTC tests are influencing the growth of the North America direct-to-consumer laboratory testing market. Convenience, low cost, and confidentiality advantages are bolstering market growth, whereas difficult to interpret results and risk of incorrect self-diagnosis are creating concerns amongst individuals. Nevertheless, advantages such as non-health tests and increase in number of people becoming health conscious tend to offset the disadvantages of DTC tests. The popularity of at-home DNA test kits is contributing to the growth of the North America direct-to-consumer laboratory testing market.

With the advent of point of care testing, along with self-empowerment of patients, companies in the North America direct-to-consumer laboratory testing market are capitalizing on revenue opportunities. The trend of quantitative self-movement has led to increased data collection and subsequent analysis, which may fundamentally improve the ability of individual patients to understand and predict the state of their health.

Some DTC test data can be analyzed by swarm intelligence or by Big Data analysis, which allows new observations that is not possible with previous methods of healthcare. Such findings are bolstering the growth of the North America direct-to-consumer laboratory testing market. DTC tests are helping individuals to take charge of their health.

The North America direct-to-consumer laboratory testing market is slated to clock a CAGR of 22.6% during the forecast period. Market stakeholders and telecommunication companies are anticipated to enter into collaborations to help individuals stay informed about their health status by sending lab results directly to their mobile devices.

Smartphone-based healthcare services are growing prominent in the North America direct-to-consumer laboratory testing market. The combination of artificial intelligence (AI) and cloud computing is being deployed for genetic decoding to provide services such as tailored health management. Cloud computing is helping to store and manage personal genome analysis information.

Since lab tests provide critical information about a person’s health, DTC testing is meant to help patients be more directly involved in decisions about their own health. The North America direct-to-consumer laboratory testing market is expected to reach the valuation of US$ 8.86 Bn by 2031. Although DTC tests are generally not covered by insurance, the cost of a DTC test is less than the copay for a primary care visit and required laboratory charges.

On the other hand, consumers can choose which DTC testing company they want to use rather than being forced by a choice given by the insurance company. This option for best price and convenience is translating into revenue opportunities for companies in the North America direct-to-consumer laboratory testing market. Since tests for STI (Sexually Transmitted Infections) and drug screenings are highly sensitive, DTC tests are a great solution for maintaining confidentiality.

Analysts’ Viewpoint

Labs are focusing on essential medical services such as diabetes testing and disease risk assessment testing to keep the economies running during the COVID-19 pandemic. DTC tests help to avoid time-consuming processes involved with insurance companies and primary care providers. However, in many cases, DTC testing provides individuals with raw results that are difficult to interpret. Hence, companies in the North America direct-to-consumer laboratory testing market should not only make information dissemination easy but also unlock growth opportunities with AI and cloud computing. Obtaining test results in-hand can empower consumers to create a healthy lifestyle and encourage them to seek adequate medical help.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 929.4 Mn |

|

Market Forecast Value in 2031 |

US$ 8.86 Bn |

|

Growth Rate |

22.6% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Format |

Electronic (PDF) + Excel |

|

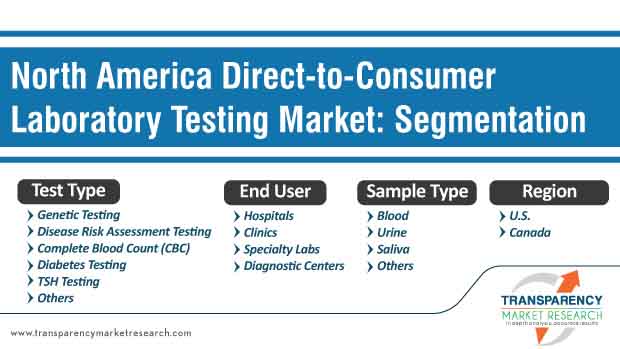

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Direct-to-consumer laboratory testing market in north america is expected to reach the valuation of US$ 8.86 Bn by 2031

Direct-to-consumer laboratory testing market in north america is slated to clock a CAGR of 22.6% during 2021-2031

Direct-to-consumer laboratory testing market in north america is driven by rise in prevalence of various lifestyle-associated and infectious diseases

The saliva segment dominated the north america direct-to-consumer laboratory testing market and the trend is projected to continue during the forecast period

Key players in the direct-to-consumer laboratory testing market in North America are Laboratory Corporation of America, Quest Diagnostics Incorporated, 23andMe Biotechnology, Any Lab Test Now, Everlywell Health

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: North America Direct-to-Consumer Laboratory Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. North America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Key Industrial Events (Licensing Partnership/Merger & Acquisition)

5.2. Disease Prevalence & Incidence Rate

5.3. Regulatory Scenario

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. North America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Sample Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Sample Type, 2017–2031

6.3.1. Blood

6.3.2. Urine

6.3.3. Saliva

6.3.4. Others

6.4. Market Attractiveness Analysis, by Sample Type

7. North America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Test Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Test Type, 2017–2031

7.3.1. Genetic Testing

7.3.2. Disease Risk Assessment Testing

7.3.2.1. Cancer

7.3.2.2. STDs

7.3.2.3. Others

7.3.3. CBC

7.3.4. Diabetes testing

7.3.5. TSH testing

7.3.6. Others

7.4. Market Attractiveness Analysis, by Test Type

8. North America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Specialty Labs

8.3.4. Diagnostic Centers

8.4. Market Attractiveness Analysis, by End-user

9. North America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Country

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. U.S.

9.2.2. Canada

9.3. Market Attractiveness Analysis, by Country

10. Competition Landscape

10.1. Market Player - Competition Matrix (by tier and size of companies)

10.2. Market Share Analysis, by Company, 2020

10.3. Company Profiles

10.3.1. Quest Diagnostics Incorporated

10.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.1.2. Product Portfolio

10.3.1.3. Strategic Overview

10.3.1.4. SWOT Analysis

10.3.2. Laboratory Corporation of America Holdings

10.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.2.2. Product Portfolio

10.3.2.3. Strategic Overview

10.3.2.4. SWOT Analysis

10.3.3. 23andMe, Inc.

10.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.3.2. Product Portfolio

10.3.3.3. Strategic Overview

10.3.3.4. SWOT Analysis

10.3.4. ANY LAB TEST NOW

10.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.4.2. Product Portfolio

10.3.4.3. Strategic Overview

10.3.4.4. SWOT Analysis

10.3.5. Direct Labs LLC

10.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.5.2. Product Portfolio

10.3.5.3. Strategic Overview

10.3.5.4. SWOT Analysis

10.3.6. Everlywell

10.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.6.2. Product Portfolio

10.3.6.3. Strategic Overview

10.3.6.4. SWOT Analysis

10.3.7. MyMedLab

10.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.7.2. Product Portfolio

10.3.7.3. Strategic Overview

10.3.7.4. SWOT Analysis

10.3.8. ColorGenomics

10.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.8.2. Product Portfolio

10.3.8.3. Strategic Overview

10.3.8.4. SWOT Analysis

10.3.9. Ancestry

10.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.9.2. Product Portfolio

10.3.9.3. Strategic Overview

10.3.9.4. SWOT Analysis

10.3.10. WellnessFX

10.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.10.2. Product Portfolio

10.3.10.3. Strategic Overview

10.3.10.4. SWOT Analysis

10.3.11. LetsGetChecked

10.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.11.2. Product Portfolio

10.3.11.3. Strategic Overview

10.3.11.4. SWOT Analysis

10.3.12. Other Prominent Players

10.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.12.2. Product Portfolio

10.3.12.3. Strategic Overview

10.3.12.4. SWOT Analysis

List of Tables

Table 01: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 02: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 03: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 04: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 05: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 1: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 2: North America Direct-to-Consumer Laboratory Testing Market Value Share, by Country, 2020 and 2031

Figure 3: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Country, 2021–2031

Figure 4: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 5: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 6: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 7: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 8: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by End-user, 2020 and 2031

Figure 9: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by End-user, 2021–2031