Analysts’ Viewpoint

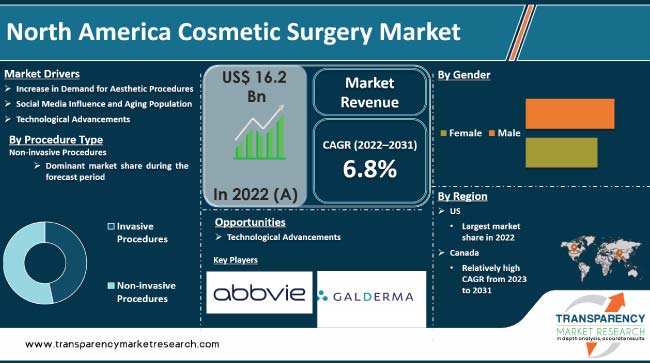

Several key factors are reshaping the industry landscape of the North America cosmetic surgery market. Increase in societal acceptance of cosmetic procedures and emphasis on personal aesthetics are primary factors fueling the North America cosmetic surgery market size.

Changing beauty standards and the influence of social media contribute to the surge in demand for cosmetic enhancements, particularly among younger demographics.

The ongoing trend of minimally invasive procedures and continuous technological innovations, are likely to drive market growth. Furthermore, integration of digital tools for virtual consultations and treatment simulations enhance patient engagement and is a key North America cosmetic surgery market trend.

Increase in focus on personalized treatment plans, catering to the evolving preferences of a diverse patient population is likely to propel market progress.

The North America cosmetic surgery market is experiencing dynamic growth, driven by a convergence of factors reshaping the beauty landscape. Societal acceptance of cosmetic procedures has surged, fueled by evolving beauty standards and the influence of social media. Advancements in medical technologies and surgical techniques, has fueled the demand for aesthetic enhancements.

The region's well-established healthcare infrastructure and a pool of skilled plastic surgeons offer lucrative opportunities for market expansion. Increase in disposable incomes and a heightened emphasis on personal appearance are further market catalysts. Overall, the North America cosmetic surgery market stands as a dynamic and evolving industry at the intersection of healthcare and aesthetics.

People in North America are becoming more receptive to improving their appearance through cosmetic procedures as cultural views and beauty standards change. Opinions of beauty are greatly influenced by the media, especially social media platforms, which in turn influence decisions to seek cosmetic surgery in order to attain the desired aesthetics.

Modern medicine and technological developments have made cosmetic surgery safer, widely available, and more efficient. By being transparent about their cosmetic enhancements on social media, celebrities and influencers help to lessen the stigma attached to these procedures and encourage a wider range of people to think about aesthetic interventions.

The International Society of Aesthetic Plastic Surgery (ISAPS) reports that liposuction maintained its position as the most popular surgical procedure in 2022. The popularity of body contouring procedures is highlighted by the 21.1% increase in liposuction procedures. Liposuction, breast augmentation, eyelid surgery, abdominoplasty, and breast lift were the top five surgical procedures.

In terms of non-surgical procedures, the ISAPS report emphasizes the use of hyaluronic acid and botulinum toxin treatments. The general need for aesthetic interventions is greatly influenced by these non-invasive techniques, which are frequently utilized for wrinkle reduction and facial rejuvenation.

Among the most popular non-surgical procedures were hair removal and chemical peels, with chemical peels surpassing non-surgical skin tightening in the top five. All these factors are expected to boost the North America cosmetic surgery market value.

The North America cosmetic surgery market segmentation in terms of procedure type includes invasive procedures, and non-invasive procedures.

The non-invasive procedures segment held significant market share in 2022. Growth in demand for cosmetic enhancements with minimal downtime and lower associated risks such as injectable options, laser therapies, and non-surgical body contouring procedures, are leading to expansion of this segment.

Patients increasingly favor non-surgical options for facial rejuvenation, wrinkle reduction, and body contouring. The accessibility and convenience offered by non-invasive procedures align with the preferences of a broad demographic, including those seeking subtle enhancements and younger individuals entering the cosmetic market.

Technological advancements, such as advanced dermal fillers, energy-based devices, and laser technologies, continually enhance the efficacy and safety of non-invasive procedures and are boosting the North America cosmetic surgery market share.

The dominance of non-invasive procedures is expected to persist, driven by expanding patient awareness, and a societal shift toward embracing less invasive approaches for cosmetic enhancements in North America.

As per the North America cosmetic surgery market analysis, based on end-user, the hospitals and clinics segment is projected to account for major share during the forecast period. Hospitals, equipped with advanced surgical facilities and multidisciplinary teams, are preferred for complex and extensive cosmetic procedures.

The credibility and comprehensive medical support offered by hospitals attract patients seeking a holistic approach to cosmetic surgery.

On the other hand, cosmetic clinics cater to a growing demand for minimally invasive procedures and outpatient services. Their accessibility, shorter waiting times, and emphasis on convenience appeal to individuals seeking non-surgical interventions such as injectable or laser treatments.

This underscores a dual strategy within the market, where hospitals cater to intricate surgical interventions, and clinics cater to the burgeoning demand for less invasive procedures, collectively contributing to the North America cosmetic surgery market value.

According to the latest North America cosmetic surgery market forecast, the United States is the dominant country in the region. A combination of economic prosperity, and advanced healthcare infrastructure is driving market dynamics in the country.

Further, evolving beauty standards, strong emphasis on personal appearance, and influence of celebrity culture contribute to the high demand for cosmetic procedures.

The U.S. boasts a pool of skilled plastic surgeons, state-of-the-art medical facilities, and a regulatory environment conducive to innovation. Major metropolitan areas such as Los Angeles, New York, and Miami serve as epicenters for cosmetic surgery practices, attracting patients both domestically and internationally.

The North America cosmetic surgery market is consolidated, with the presence of a limited number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies implemented by leading players.

Johnson & Johnson, AbbVie, Inc., Bausch Health Companies Inc., Cutera, Inc., Merz North America, Inc., Galderma Laboratories, L.P, Sientra, Inc., Apyx Medical, and Long Island Plastic Surgical Group are the prominent North America cosmetic surgery market manufacturers.

Each of these players has been profiled in the North America cosmetic surgery market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 16.2 Bn |

| Market Forecast Value in 2031 | More than US$ 29.2 Bn |

| Growth Rate (CAGR) | 6.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 16.2 Bn in 2022

It is projected to reach more than US$ 29.2 Bn by the end of 2031

The CAGR is anticipated to be 6.8% from 2023 to 2031

Advancements in technology, such as minimally invasive procedures, robotic surgery, and use of advanced imaging techniques

Based on procedure type, the non-invasive procedures segment accounted for more than 53% share in 2022

The U.S. is expected to account for the largest share from 2023 to 2031

Johnson & Johnson, AbbVie, Inc., Bausch Health Companies Inc., Cutera, Inc., Merz North America, Inc., Galderma Laboratories, L.P, Sientra, Inc., Apyx Medical, and Long Island Plastic Surgical Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: North America Cosmetic Surgery Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. North America Cosmetic Surgery Market Analysis and Forecasts, 2017 - 2031

5. Key Insights

5.1. Top Overall Cosmetic and Reconstructive Procedures

5.2. Most Performed Surgical Cosmetic Procedures in the United States in 2022

5.3. Surgical & Non-surgical Highlights in United States by Type

5.4. Technological Advances in Cosmetic Surgery

5.5. Covid Impact Analysis

6. North America Cosmetic Surgery Market Analysis and Forecasts, By Procedure Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Procedure Type, 2017 - 2031

6.3.1. Invasive Procedures

6.3.1.1. Breast augmentation

6.3.1.2. Liposuction

6.3.1.3. Nose reshaping

6.3.1.4. Eyelid Surgery

6.3.1.5. Tummy tuck

6.3.1.6. Others

6.3.2. Non-invasive Procedures

6.3.2.1. Botox injections

6.3.2.2. Soft tissue fillers

6.3.2.3. Chemical peel

6.3.2.4. Laser hair removal

6.3.2.5. Microdermabrasion

6.4. Market Attractiveness By Procedure Type

7. North America Cosmetic Surgery Market Analysis and Forecasts, By Gender

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Gender, 2017 - 2031

7.3.1. Female

7.3.2. Male

7.4. Market Attractiveness By Gender

8. North America Cosmetic Surgery Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Ambulatory Surgical Facilities

8.3.2. Hospitals and Clinics

8.3.3. Physician Offices and Cosmetic Centers

8.4. Market Attractiveness By End-user

9. North America Cosmetic Surgery Market Analysis and Forecasts, By Country

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. United States

9.2.2. Canada

9.3. Market Attractiveness By Country/Region

10. United States Cosmetic Surgery Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Procedure Type, 2017 - 2031

10.2.1. Invasive Procedures

10.2.1.1. Breast augmentation

10.2.1.2. Liposuction

10.2.1.3. Nose reshaping

10.2.1.4. Eyelid Surgery

10.2.1.5. Tummy tuck

10.2.1.6. Others

10.2.2. Non-invasive Procedures

10.2.2.1. Botox injections

10.2.2.2. Soft tissue fillers

10.2.2.3. Chemical peel

10.2.2.4. Laser hair removal

10.2.2.5. Microdermabrasion

10.3. Market Value Forecast By Gender, 2017 - 2031

10.3.1. Female

10.3.2. Male

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Ambulatory Surgical Facilities

10.4.2. Hospitals and Clinics

10.4.3. Physician Offices and Cosmetic Centers

10.5. Market Attractiveness Analysis

10.5.1. By Procedure Type

10.5.2. By Gender

10.5.3. By End-user

11. Canada Cosmetic Surgery Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Procedure Type, 2017 - 2031

11.2.1. Invasive Procedures

11.2.1.1. Breast augmentation

11.2.1.2. Liposuction

11.2.1.3. Nose reshaping

11.2.1.4. Eyelid Surgery

11.2.1.5. Tummy tuck

11.2.1.6. Others

11.2.2. Non-invasive Procedures

11.2.2.1. Botox injections

11.2.2.2. Soft tissue fillers

11.2.2.3. Chemical peel

11.2.2.4. Laser hair removal

11.2.2.5. Microdermabrasion

11.3. Market Value Forecast By Gender, 2017 - 2031

11.3.1. Female

11.3.2. Male

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Ambulatory Surgical Facilities

11.4.2. Hospitals and Clinics

11.4.3. Physician Offices and Cosmetic Centers

11.5. Market Attractiveness Analysis

11.5.1. By Procedure Type

11.5.2. By Gender

11.5.3. By End-user

12. Competition Landscape

12.1. Market Player – Competition Matrix (By Tier and Size of companies)

12.2. Market Share Analysis By Company (2022)

12.3. Company Profiles

12.3.1. Johnson & Johnson

12.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.1.2. Material Portfolio

12.3.1.3. Financial Overview

12.3.1.4. SWOT Analysis

12.3.1.5. Strategic Overview

12.3.2. Bausch Health Companies Inc.

12.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.2.2. Material Portfolio

12.3.2.3. Financial Overview

12.3.2.4. SWOT Analysis

12.3.2.5. Strategic Overview

12.3.3. Cutera, Inc.

12.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.3.2. Material Portfolio

12.3.3.3. Financial Overview

12.3.3.4. SWOT Analysis

12.3.3.5. Strategic Overview

12.3.4. Merz North America, Inc.

12.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.4.2. Material Portfolio

12.3.4.3. Financial Overview

12.3.4.4. SWOT Analysis

12.3.4.5. Strategic Overview

12.3.5. Galderma Laboratories, L.P

12.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.5.2. Material Portfolio

12.3.5.3. Financial Overview

12.3.5.4. SWOT Analysis

12.3.5.5. Strategic Overview

12.3.6. Sientra, Inc.

12.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.6.2. Material Portfolio

12.3.6.3. Financial Overview

12.3.6.4. SWOT Analysis

12.3.6.5. Strategic Overview

12.3.7. Apyx Medical

12.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.7.2. Material Portfolio

12.3.7.3. Financial Overview

12.3.7.4. SWOT Analysis

12.3.7.5. Strategic Overview

12.3.8. Long Island Plastic Surgical Group

12.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.8.2. Material Portfolio

12.3.8.3. Financial Overview

12.3.8.4. SWOT Analysis

12.3.8.5. Strategic Overview

12.3.9. AbbVie Inc.

12.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.9.2. Material Portfolio

12.3.9.3. Financial Overview

12.3.9.4. SWOT Analysis

12.3.9.5. Strategic Overview

List of Tables

Table 1: North America Cosmetic Surgery Market Value (US$ Mn) Forecast, 2017-2031

Table 2: North America Cosmetic Surgery Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 3: US Cosmetic Surgery Market Value (US$ Mn) Forecast, by Gender, 2017-2031

Table 4: US Cosmetic Surgery Market Value (US$ Mn) Forecast, by Procedure Type, 2017-2031

Table 5: US Cosmetic Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 6: Canada Cosmetic Surgery Market Value (US$ Mn) Forecast, by Gender, 2017-2031

Table 7: Canada Cosmetic Surgery Market Value (US$ Mn) Forecast, by Procedure Type, 2017-2031

Table 8: Canada Cosmetic Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: North America Cosmetic Surgery Market

Figure 02: North America Cosmetic Surgery Market Size (US$ Mn) Forecast, 2017-2031

Figure 03: Market Value Share, by Procedure Type (2022)

Figure 04: Market Value Share, by Gender (2022)

Figure 05: Market Value Share, by End-user (2022)

Figure 06: Market Value Share, by Region (2022)

Figure 07: North America Cosmetic Surgery Market Value Share, by Gender, 2022 and 2031

Figure 08 North America Cosmetic Surgery Market Attractiveness, by Gender, 2017-2031

Figure 09: North America Cosmetic Surgery Market Value Share, by Procedure Type, 2022 and 2031

Figure 10: North America Cosmetic Surgery Market Attractiveness, by Procedure Type, 2017-2031

Figure 11: North America Cosmetic Surgery Market Value Share, by End-user, 2022 and 2031

Figure 12: North America Cosmetic Surgery Market Attractiveness, by End-user, 2017-2031

Figure 13: North America Cosmetic Surgery Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 14: North America Cosmetic Surgery Market Value Share, by Country, 2017-2031

Figure 15: North America Cosmetic Surgery Market Attractiveness, by Country, 2017-2031

Figure 16: US Cosmetic Surgery Market Value Share, by Gender, 2022 and 2031

Figure 17: US Cosmetic Surgery Market Attractiveness, by Gender, 2017-2031

Figure 18: US Cosmetic Surgery Market Value Share, by Procedure Type, 2022 and 2031

Figure 19: US Cosmetic Surgery Market Attractiveness, by Procedure Type, 2017-2031

Figure 20: US Cosmetic Surgery Market Value Share, by End-user, 2022 and 2031

Figure 21: US Cosmetic Surgery Market Attractiveness, by End-user, 2017-2031

Figure 22: US Cosmetic Surgery Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 23: Canada Cosmetic Surgery Market Value Share, by Gender, 2022 and 2031

Figure 24: Canada Cosmetic Surgery Market Attractiveness, by Gender, 2017-2031

Figure 25: Canada Cosmetic Surgery Market Value Share, by Procedure, 2022 and 2031

Figure 26: Canada Cosmetic Surgery Market Attractiveness, by Procedure, 2017-2031

Figure 27: Canada Cosmetic Surgery Market Value Share, by Gender, 2022 and 2031

Figure 28: Canada Cosmetic Surgery Market Attractiveness, by Gender, 2017-2031

Figure 29: Canada Cosmetic Surgery Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031