Analysts’ Viewpoint

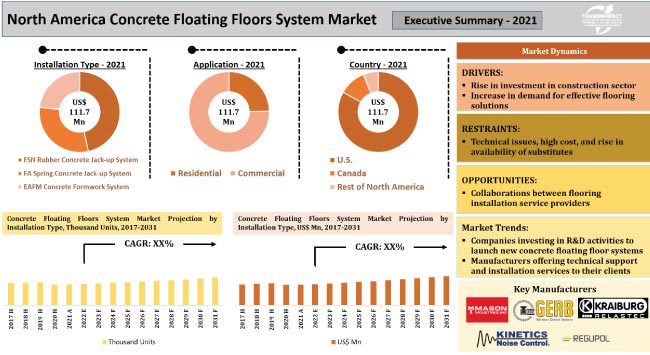

Rise in investment in the construction sector and increase in demand for effective flooring solutions are driving the demand for concrete floating floor systems. These systems are used to reduce the noise caused by external factors. Rapid growth in commercial construction such as hotels, corporate offices, mega retail stores, auditoriums, theatres, and studios is augmenting the demand for different types of vibration-free, seismic controllable, and acoustic architecture design in construction units. This is anticipated to offer lucrative opportunities for companies operating in the concrete floating floors system market in North America.

Manufacturers are focusing on introducing efficient concrete floating floor solutions, such as concrete flooring machines, to increase their market share. Furthermore, key players are expanding their manufacturing capacities to broaden revenue streams.

The concrete floating floors system market growth is driven by expansion in the renovation and construction industry as well as rise in usage of coatings in industrial, commercial, and residential applications. Availability of a wide range of systems for concrete floating floors, such as rubber concrete jack-up systems, spring concrete jack-up systems, and concrete formwork systems, is fueling market expansion. These systems offer excellent heat and chemical resistance, strong adhesion, and effective electrical insulation. Low cost of epoxy concrete floor coatings compared to their competitors is also expected to fuel the North America concrete floating floors system market statistics in the near future.

Powder coatings are becoming increasingly popular, as they outperform other coatings in terms of environmental laws due to the lack of solvents and VOCs in them. Epoxy, polyurethane, and polyaspartic are the commonly used concrete floor coatings in North America. Solid-based, solvent-borne, and water-based epoxy coatings are options for concrete floor coatings.

The North America concrete floating floors system market size is estimated to grow at a CAGR of 3.6% during the forecast period, due to the rise in construction and renovation activities in the region. Increase in construction and renovation of hotels, corporate offices, mega retail stores, auditoriums, theaters, and studios is driving the demand for concrete floating floors systems. Rise in government investment to support commercial buildings with advanced architectural solutions in order to prevent risks associated with seismic activity, shock, and vibrations is also likely to boost the market in the near future.

Rapid growth in migration is encouraging real estate developers to invest in construction sites across North America. For instance, Canada is considered to be one of the most attractive places to migrate. Rise in government initiatives to provide decent residential spaces with suitable living environments for citizens is also contributing to the market progress.

Manufacturers are increasing their R&D activities to develop effective flooring solutions. Concrete flooring machines are extensively used in the construction sector in North America owing to their benefits such as easy installation and flexible design. These machines are suitable for passive and active isolation; hence, their demand is rising at a steady pace in the region.

Construction of concrete floating floors offers safety and a good base for rooms or other commercial spaces such as offices. Furthermore, floating concrete floor systems act as a barrier for the entry of moisture arising from the ground. Hence, these systems are widely used in cold or high rainfall areas of Canada and the U.S.

Demand for natural rubber, elastomer, neoprene-based floating floor isolators, and floor isolation pads is rising in high-end construction projects, as these help prevent noise and multidirectional vibration issues in architecture structures. Concrete floating floor systems are preferred over concrete slabs owing to their better quality. These systems offer acoustic isolation, which protects sensitive areas from noise sources.

Based on installation type, the FSN rubber concrete jack-up system segment is expected to dominate the North America concrete floating floors system market during the forecast period. The FSN rubber concrete jack-up system is cost-effective, highly flexible, and assures excellent performance.

Manufacturers have launched various research initiatives to provide solutions related to sustainable practices by recycling rubber or metallic waste. This is likely to help meet sustainable construction practices and strengthen competitiveness in the construction industry.

Based on application, the market segmentation entails residential and commercial domains. The commercial segment is likely to dominate the industry during the forecast period. Rise in construction and renovation of offices, theaters, and gyms in North America is projected to fuel the segment in the near future. Increase in investment in infrastructure development by governments of several countries in North America is anticipated to augment the commercial segment during the forecast period.

Construction and development of theme parks, auditoriums, and playgrounds is estimated to create lucrative market opportunities for players in North America.

Canada is expected to dominate the North America concrete floating floors system market during the forecast period, due to rapid industrialization and urbanization, rise in population, and increase in number of infrastructure development projects in the country. Additionally, growth in investments in the infrastructure sector by the government is expected to boost the market in the country. Advancements in technology are also likely to fuel market development in the near future.

The U.S. is likely to follow Canada, led by the presence of key players such as Mason Industries Inc., KRAIBURG Relastec GmbH & Co. KG, and Kinetic Noise Control, Inc. These players are promoting a broad range of innovative flooring solutions for residential as well commercial spaces to remain competitive in the market.

The market is consolidated, with a few large-scale companies controlling substantial share. Most of the companies are making substantial investments in research and development activities, primarily to introduce innovative concrete floating floor systems. Major strategies adopted by key players include expansion of product portfolios and mergers and acquisitions.

TVS Sports Surfaces, INS Acoustics Ltd., Farrat Ltd, Paroc Group Oy, Vibro-Acoustics Swegon North America, Kinetics Noise Control, Inc., GERB Group, InstaCoustic Limited, PAULSTRA SNC, Getzner, Regupol, Kraiburg Relastec, Mason Industries Inc., Catalyst Acoustics Group, AMC Mecanocaucho, and Pliteq are the prominent market participants.

The North America concrete floating floors system industry research report profiles key players based on parameters such as company overview, business strategies, product portfolio, financial overview, recent developments and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 111.7 Mn |

|

Market Forecast Value in 2031 |

US$ 157.8 Mn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the North America as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry stood at US$ 111.7 Mn in 2021.

The CAGR is estimated to be 3.6% during 2022 to 2031.

Rise in investment in construction sector and increase in demand for effective flooring solutions.

The commercial segment held the largest share in 2021.

Canada is a more attractive country for vendors.

TVS Sports Surfaces, INS Acoustics Ltd., Farrat ltd, Paroc Group Oy, Vibro-Acoustics Swegon North America, Kinetics Noise Control Inc., Gerb Group, Instacoustic limited, Paulstra SNC, Getzner, Regupol, Kraiburg relastec, mason industries Inc., Catalyst Acoustics Group, AMC Mecanocaucho, and Pliteq.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Building Construction Market Overview

5.3. Porter’s Five Forces Analysis

5.4. Value Chain Analysis

5.5. Industry SWOT Analysis

5.6. Standards and Regulations

5.7. North America Concrete Floating Floors System Market Analysis and Forecast, 2017 - 2031

5.7.1. Market Revenue Projections (US$ Mn)

5.7.2. Market Revenue Projections (Thousand Units)

6. North America Concrete Floating Floors System Market Analysis and Forecast

6.1. Regional Snapshot

6.2. Concrete Floating Floors System Market (US$ Mn and Thousand Units) Forecast, By Installation Type, 2017 - 2031

6.2.1. FSN Rubber Concrete Jack-up System

6.2.2. FS Spring Concrete Jack-up System

6.2.3. EAFM Concrete Formwork System

6.3. Concrete Floating Floors System Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

6.3.1. Residential

6.3.2. Commercial

6.3.2.1. Cinemas

6.3.2.2. Theaters

6.3.2.3. Audio Studios

6.3.2.4. Others

6.4. Concrete Floating Floors System Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

6.4.1. U.S.

6.4.2. Canada

6.4.3. Rest of North America

7. U.S. Concrete Floating Floors System Market Analysis and Forecast

7.1. Country Snapshot

7.2. Price Trend Analysis

7.2.1. Weighted Average Selling Price (US$)

7.3. Key Supplier Analysis

7.4. Concrete Floating Floors System Market (US$ Mn and Thousand Units) Forecast, By Installation Type, 2017 - 2031

7.4.1. FSN Rubber Concrete Jack-up System

7.4.2. FS Spring Concrete Jack-up System

7.4.3. EAFM Concrete Formwork System

7.5. Concrete Floating Floors System Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

7.5.1. Residential

7.5.2. Commercial

7.5.2.1. Cinemas

7.5.2.2. Theaters

7.5.2.3. Audio Studios

7.5.2.4. Others

8. Canada Concrete Floating Floors System Market Analysis and Forecast

8.1. Country Snapshot

8.2. Price Trend Analysis

8.2.1. Weighted Average Selling Price (US$)

8.3. Key Supplier Analysis

8.4. Concrete Floating Floors System Market (US$ Mn and Thousand Units) Forecast, By Installation Type, 2017 - 2031

8.4.1. FSN Rubber Concrete Jack-up System

8.4.2. FS Spring Concrete Jack-up System

8.4.3. EAFM Concrete Formwork System

8.5. Concrete Floating Floors System Market (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

8.5.1. Residential

8.5.2. Commercial

8.5.2.1. Cinemas

8.5.2.2. Theaters

8.5.2.3. Audio Studios

8.5.2.4. Others

9. Competition Landscape

9.1. Market Player – Competition Dashboard

9.2. Market Revenue Share Analysis (%), By Company, (2021)

9.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

9.3.1. TVS Sports Surfaces

9.3.1.1. Company Overview

9.3.1.2. Sales Area/Geographical Presence

9.3.1.3. Revenue

9.3.1.4. Strategy & Business Overview

9.3.2. INS Acoustics Ltd.

9.3.2.1. Company Overview

9.3.2.2. Sales Area/Geographical Presence

9.3.2.3. Revenue

9.3.2.4. Strategy & Business Overview

9.3.3. Farrat Ltd

9.3.3.1. Company Overview

9.3.3.2. Sales Area/Geographical Presence

9.3.3.3. Revenue

9.3.3.4. Strategy & Business Overview

9.3.4. Paroc Group Oy

9.3.4.1. Company Overview

9.3.4.2. Sales Area/Geographical Presence

9.3.4.3. Revenue

9.3.4.4. Strategy & Business Overview

9.3.5. Vibro-Acoustics Swegon North America

9.3.5.1. Company Overview

9.3.5.2. Sales Area/Geographical Presence

9.3.5.3. Revenue

9.3.5.4. Strategy & Business Overview

9.3.6. Kinetics Noise Control, Inc.

9.3.6.1. Company Overview

9.3.6.2. Sales Area/Geographical Presence

9.3.6.3. Revenue

9.3.6.4. Strategy & Business Overview

9.3.7. GERB Group

9.3.7.1. Company Overview

9.3.7.2. Sales Area/Geographical Presence

9.3.7.3. Revenue

9.3.7.4. Strategy & Business Overview

9.3.8. InstaCoustic Limited

9.3.8.1. Company Overview

9.3.8.2. Sales Area/Geographical Presence

9.3.8.3. Revenue

9.3.8.4. Strategy & Business Overview

9.3.9. PAULSTRA SNC

9.3.9.1. Company Overview

9.3.9.2. Sales Area/Geographical Presence

9.3.9.3. Revenue

9.3.9.4. Strategy & Business Overview

9.3.10. Getzner

9.3.10.1. Company Overview

9.3.10.2. Sales Area/Geographical Presence

9.3.10.3. Revenue

9.3.10.4. Strategy & Business Overview

9.3.11. Regupol

9.3.11.1. Company Overview

9.3.11.2. Sales Area/Geographical Presence

9.3.11.3. Revenue

9.3.11.4. Strategy & Business Overview

9.3.12. Kraiburg Relastec

9.3.12.1. Company Overview

9.3.12.2. Sales Area/Geographical Presence

9.3.12.3. Revenue

9.3.12.4. Strategy & Business Overview

9.3.13. Mason Industries Inc.

9.3.13.1. Company Overview

9.3.13.2. Sales Area/Geographical Presence

9.3.13.3. Revenue

9.3.13.4. Strategy & Business Overview

9.3.14. Catalyst Acoustics Group

9.3.14.1. Company Overview

9.3.14.2. Sales Area/Geographical Presence

9.3.14.3. Revenue

9.3.14.4. Strategy & Business Overview

9.3.15. AMC Mecanocaucho

9.3.15.1. Company Overview

9.3.15.2. Sales Area/Geographical Presence

9.3.15.3. Revenue

9.3.15.4. Strategy & Business Overview

9.3.16. Pliteq

9.3.16.1. Company Overview

9.3.16.2. Sales Area/Geographical Presence

9.3.16.3. Revenue

9.3.16.4. Strategy & Business Overview

10. Key Takeaway

10.1. Identification of Potential Market Spaces

10.1.1. Installation Type

10.1.2. Application

10.1.3. Region

10.2. Understanding the Procurement Process of the Customers

10.3. Prevailing Market Risks

List of Tables

Table 1: North America Concrete Floating Floors System Market Value (US$ Mn) Projection By Installation Type 2017-2031

Table 2: North America Concrete Floating Floors System Market Volume (Thousand Units) Projection By Installation Type 2017-2031

Table 3: North America Concrete Floating Floors System Market Value (US$ Mn) Projection By Application 2017-2031

Table 4: North America Concrete Floating Floors System Market Volume (Thousand Units) Projection By Application 2017-2031

Table 5: North America Concrete Floating Floors System Market Value (US$ Mn) Projection By Country 2017-2031

Table 6: North America Concrete Floating Floors System Market Volume (Thousand Units) Projection By Country 2017-2031

Table 7: U.S. Concrete Floating Floors System Market Value (US$ Mn) Projection By Installation Type 2017-2031

Table 8: U.S. Concrete Floating Floors System Market Volume (Thousand Units) Projection By Installation Type 2017-2031

Table 9: U.S. Concrete Floating Floors System Market Value (US$ Mn) Projection By Application 2017-2031

Table 10: U.S. Concrete Floating Floors System Market Volume (Thousand Units) Projection By Application 2017-2031

Table 11: U.S. Concrete Floating Floors System Market Value (US$ Mn) Projection By Country 2017-2031

Table 12: U.S. Concrete Floating Floors System Market Volume (Thousand Units) Projection By Country 2017-2031

Table 13: Canada Concrete Floating Floors System Market Value (US$ Mn) Projection By Installation Type 2017-2031

Table 14: Canada Concrete Floating Floors System Market Volume (Thousand Units) Projection By Installation Type 2017-2031

Table 15: Canada Concrete Floating Floors System Market Value (US$ Mn) Projection By Application 2017-2031

Table 16: Canada Concrete Floating Floors System Market Volume (Thousand Units) Projection By Application 2017-2031

Table 17: Canada Concrete Floating Floors System Market Value (US$ Mn) Projection By Country 2017-2031

Table 18: Canada Concrete Floating Floors System Market Volume (Thousand Units) Projection By Country 2017-2031

List of Figures

Figure 1: North America Concrete Floating Floors System Market Value (US$ Mn) Projection, By Installation Type 2017-2031

Figure 2: North America Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Installation Type 2017-2031

Figure 3: North America Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Installation Type 2022-2031

Figure 4: North America Concrete Floating Floors System Market Value (US$ Mn) Projection, By Application 2017-2031

Figure 5: North America Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Application 2017-2031

Figure 6: North America Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2022-2031

Figure 7: North America Concrete Floating Floors System Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 8: North America Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 9: North America Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2022-2031

Figure 10: U.S. Concrete Floating Floors System Market Value (US$ Mn) Projection, By Installation Type 2017-2031

Figure 11: U.S. Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Installation Type 2017-2031

Figure 12: U.S. Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Installation Type 2022-2031

Figure 13: U.S. Concrete Floating Floors System Market Value (US$ Mn) Projection, By Application 2017-2031

Figure 14: U.S. Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Application 2017-2031

Figure 15: U.S. Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2022-2031

Figure 16: U.S. Concrete Floating Floors System Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 17: U.S. Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 18: U.S. Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2022-2031

Figure 19: Canada Concrete Floating Floors System Market Value (US$ Mn) Projection, By Installation Type 2017-2031

Figure 20: Canada Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Installation Type 2017-2031

Figure 21: Canada Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Installation Type 2022-2031

Figure 22: Canada Concrete Floating Floors System Market Value (US$ Mn) Projection, By Application 2017-2031

Figure 23: Canada Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Application 2017-2031

Figure 24: Canada Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2022-2031

Figure 25: Canada Concrete Floating Floors System Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 26: Canada Concrete Floating Floors System Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 27: Canada Concrete Floating Floors System Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2022-2031