Analysts’ Viewpoint

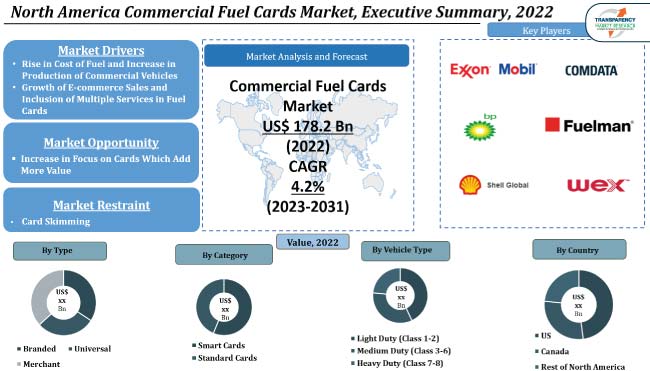

Rise in cost of fuel, surge in production of commercial vehicles, growth in e-commerce sales, and the inclusion of multiple services in fuel cards are projected to boost the North America commercial fuel cards market size.

Increase in partnerships among businesses for the introduction of fuel cards, specifically targeting and focusing on meeting the requirements of certain businesses, is anticipated to offer lucrative opportunities for market expansion.

Furthermore, market players are progressively directing their attention toward the inclusion of an alert system which helps to track down suspicious transactions. Such safety features are anticipated to significantly boost the demand for commercial fuel cards in the next few years. Most companies are also striving to develop customizable commercial fuel cards that cater to precise customer requirements.

Fuel cards are a type of payment card commonly used in gas stations to purchase fuel such as diesel, and gasoline. Fuel cards offer numerous advantages, including the opportunity to help reduce corporate expenses by providing interest-free credit. The product's capacity to increase cash flow for a firm and make budget planning and management easier is expected to contribute positively to the card's use.

Branded, universal, and merchant are the different types of commercial fuel cards. Shell, WEX, and BP are some of the well-known commercial fuel card companies. The benefits of commercial fuel cards for businesses are that they save money, are more efficient, and have a lower carbon footprint. Furthermore, fuel cards are becoming increasingly popular for making payments such as tolls, repairs & maintenance, and parking fees, which is expected to drive market progress.

The cost of fuel in countries around the world is increasingly witnessing a surge over the years. This surge in cost of fuel is anticipated to draw more commercial vehicle owners toward the use of fuel cards as these cards lower the expenses on fuel products.

As per statistical data published by the Federal Reserve Bank of St. Louis, in January 2023, personal consumption expenditure on durable goods stood at US$ 2207.4, which was a rise from US$ 1934.2 in January 2021. The popular use of commercial vehicles for the transportation of industrial and consumer goods to and from neighboring countries such as Canada and Mexico, is likely to propel the North America commercial fuel cards market value. Moreover, the increase in production of commercial vehicles to meet the growing need of different industries is a major market catalyst.

The thriving growth of the e-commerce industry is expected to have a positive impact on the demand for North America commercial fuel cards market as it leads to a rise in usage of commercial vehicles for delivery purposes. E-commerce sales often involve the delivery of goods, which requires transportation. Fuel cards that are integrated with e-commerce platforms can streamline fuel expense management for businesses, making it more efficient and cost-effective. By using these cards for e-commerce-related deliveries, businesses can save on fuel costs, which can be a significant expense for commercial operations.

Furthermore, market players are shifting their focus toward the enhancement of their fuel card offerings through the inclusion of multiple services, such as repair & maintenance, toll charges, and parking charges. Fuel cards also offer discounts and rewards for fuel purchases. All these factors are expected to drive the North America commercial fuel cards market share in the next few years.

The North America commercial fuel cards market segmentation based on type includes branded, universal, and merchant. The branded segment is expected to dominate the market. A large number of consumers still choose to own a fuel card provided by a well-known fuel company as they are considered to be more reliable and trustworthy in comparison with fuel cards from small service providers.

Branded fuel cards represent logos and names of a specific brand which has an effective impact in the generation of brand recognition and loyalty among fuel card consumers. Also, the excellent customer support for branded cards results in further increased product consumption.

Universal and merchant type North America commercial fuel cards market are projected to grow steadily in the forthcoming years. Universal cards can make price comparisons among different filling stations owing to their broad acceptance in multiple filling stations. Furthermore, customizable offerings, and control, which restricts unauthorized purchase, is resulting in popularity of merchant cards.

As per the latest North America commercial fuel cards market forecast, the U.S. is anticipated to account for major share during the forecast period. Flourishing growth of multiple industries which is leading to an increase in the number of commercial vehicles is anticipated to positively contribute to the country’s dominance. Moreover, the surge in number of businesses increasingly desiring to maintain accurate data on expenses drives the usage of fuel cards in the U.S.

The market in Canada is projected to expand considerably during the forecast period. This is anticipated to be propelled by Canadian commercial vehicle owners increasingly being attracted by the fuel card capability to efficiently manage cost and track carbon footprint to help improve their shift toward sustainability.

Detailed profiles of companies are provided in the North America commercial fuel cards industry research report to evaluate their financials, key product offerings, recent developments, and strategies. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by manufacturers in the industry. Leading players are also following the latest North America commercial fuel cards market trends to avail lucrative revenue opportunities.

Arco, BP p.l.c., Chevron Corporation, Exxon Mobil Corporation, Fleet Cards USA, FLEETCOR Technologies, Inc., Pilot Travel Centers LLC, Shell PLC (Shell), Speedway LLC, and U.S. Bank are the prominent North America commercial fuel cards manufacturers.

Each of these players has been profiled in the North America commercial fuel cards market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 178.2 Bn |

| Market Forecast Value in 2031 | US$ 230.9 Bn |

| Growth Rate (CAGR) | 4.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Billion Gallons for Volume |

| Market Analysis | It includes cross-segment analysis at the regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 178.2 Bn in 2022

The CAGR is projected to be 4.2% during the forecast period

Rise in cost of fuel, increase in production of commercial vehicles, growth of e-commerce sales, and inclusion of multiple services in fuel cards

Based on type, the branded segment is expected to hold the leading share during the forecast period

The U.S. is anticipated to hold a prominent share during the forecast period

Arco, BP p.l.c., Chevron Corporation, Exxon Mobil Corporation, Fleet Cards USA, FLEETCOR Technologies, Inc., Pilot Travel Centers LLC, Shell PLC (Shell), Speedway LLC, and U.S. Bank

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. North America Commercial Fuel Cards Market Analysis and Forecast, 2023 - 2031

5.7.1. Market Value Projections (US$ Mn)

5.7.2. Market Volume Projections (Billion Gallons)

6. North America Commercial Fuel Cards Market Analysis and Forecast, By Product Type

6.1. North America Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Type, 2023 - 2031

6.1.1. Branded

6.1.2. Universal

6.1.3. Merchant

6.2. Incremental Opportunity Analysis, By Type

7. North America Commercial Fuel Cards Market Analysis and Forecast, By Category

7.1. North America Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Category, 2023 - 2031

7.1.1. Smart Cards

7.1.2. Standard Cards

7.2. Incremental Opportunity Analysis, By Category

8. North America Commercial Fuel Cards Market Analysis and Forecast, By Vehicle Type

8.1. North America Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Vehicle Type, 2023 - 2031

8.1.1. Light Duty (Class 1-2)

8.1.2. Medium Duty (Class 3-6)

8.1.3. Heavy Duty (Class 7-8)

9. North America Commercial Fuel Cards Market Analysis and Forecast, by Country & Sub-region

9.1. North America Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Country & Sub-region, 2023 - 2031

9.1.1. U.S.

9.1.2. Canada

9.1.3. Rest of North America

9.2. Incremental Opportunity Analysis, by Region

10. U.S. Commercial Fuel Cards Market Analysis and Forecast

10.1. Country Snapshot

10.2. Demographic Overview

10.3. Key Trend Analysis

10.4. Market Share Analysis

10.4.1. Local Manufactures vs Import

10.5. Consumer Buying Behavior Analysis

10.6. Pricing Analysis

10.6.1. Weighted Average Selling Price (US$)

10.7. U.S. Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Type, 2023 - 2031

10.7.1. Branded

10.7.2. Universal

10.7.3. Merchant

10.8. U.S. Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Category, 2023 - 2031

10.8.1. Smart Cards

10.8.2. Standards

10.9. U.S. Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Vehicle Type, 2023 - 2031

10.9.1. Light Duty (Class 1-2)

10.9.2. Medium Duty (Class 3-6)

10.9.3. Heavy Duty (Class 7-8)

10.10. Incremental Opportunity Analysis

11. Canada Commercial Fuel Cards Market Analysis and Forecast

11.1. Country Snapshot

11.2. Demographic Overview

11.3. Key Trend Analysis

11.4. Market Share Analysis

11.4.1. Local Manufactures vs Import

11.5. Consumer Buying Behavior Analysis

11.6. Pricing Analysis

11.6.1. Weighted Average Selling Price (US$)

11.7. Canada Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Type, 2023 - 2031

11.7.1. Branded

11.7.2. Universal

11.7.3. Merchant

11.8. Canada Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Category, 2023 - 2031

11.8.1. Smart Cards

11.8.2. Standards

11.9. Canada Commercial Fuel Cards Market Size (US$ Mn and Billion Gallons), By Vehicle Type, 2023 - 2031

11.9.1. Light Duty (Class 1-2)

11.9.2. Medium Duty (Class 3-6)

11.9.3. Heavy Duty (Class 7-8)

11.10. Incremental Opportunity Analysis

12. Competition Landscape

12.1. Market Player – Competition Dashboard

12.2. Market Share Analysis (%), 2022

12.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

12.3.1. Arco

12.3.1.1. Company Overview

12.3.1.2. Sales Area/Geographical Presence

12.3.1.3. Revenue

12.3.1.4. Strategy & Business Overview

12.3.2. BP p.l.c.

12.3.2.1. Company Overview

12.3.2.2. Sales Area/Geographical Presence

12.3.2.3. Revenue

12.3.2.4. Strategy & Business Overview

12.3.3. Chevron Corporation

12.3.3.1. Company Overview

12.3.3.2. Sales Area/Geographical Presence

12.3.3.3. Revenue

12.3.3.4. Strategy & Business Overview

12.3.4. Exxon Mobil Corporation

12.3.4.1. Company Overview

12.3.4.2. Sales Area/Geographical Presence

12.3.4.3. Revenue

12.3.4.4. Strategy & Business Overview

12.3.5. Fleet Cards USA

12.3.5.1. Company Overview

12.3.5.2. Sales Area/Geographical Presence

12.3.5.3. Revenue

12.3.5.4. Strategy & Business Overview

12.3.6. FLEETCOR Technologies, Inc.

12.3.6.1. Company Overview

12.3.6.2. Sales Area/Geographical Presence

12.3.6.3. Revenue

12.3.6.4. Strategy & Business Overview

12.3.7. Pilot Travel Centers LLC

12.3.7.1. Company Overview

12.3.7.2. Sales Area/Geographical Presence

12.3.7.3. Revenue

12.3.7.4. Strategy & Business Overview

12.3.8. Shell PLC (Shell)

12.3.8.1. Company Overview

12.3.8.2. Sales Area/Geographical Presence

12.3.8.3. Revenue

12.3.8.4. Strategy & Business Overview

12.3.9. Speedway LLC

12.3.9.1. Company Overview

12.3.9.2. Sales Area/Geographical Presence

12.3.9.3. Revenue

12.3.9.4. Strategy & Business Overview

12.3.10. U.S. Bank

12.3.10.1. Company Overview

12.3.10.2. Sales Area/Geographical Presence

12.3.10.3. Revenue

12.3.10.4. Strategy & Business Overview

12.3.11. Other Key Players

12.3.11.1. Company Overview

12.3.11.2. Sales Area/Geographical Presence

12.3.11.3. Revenue

12.3.11.4. Strategy & Business Overview

13. Go To Market Strategy

13.1. Identification of Potential Market Spaces

13.2. Understanding the Buying Process of Customers

13.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Commercial Fuel Cards Market, By Type, Billion Gallons, 2023-2031

Table 2: North America Commercial Fuel Cards Market, By Type, US$ Mn, 2023-2031

Table 3: North America Commercial Fuel Cards Market, By Category, Billion Gallons, 2023-2031

Table 4: North America Commercial Fuel Cards Market, By Category, US$ Mn, 2023-2031

Table 5: North America Commercial Fuel Cards Market, By Vehicle Type, Billion Gallons, 2023-2031

Table 6: North America Commercial Fuel Cards Market, By Vehicle Type, US$ Mn, 2023-2031

Table 7: North America Commercial Fuel Cards Market, By Country Billion Gallons, 2023-2031

Table 8: North America Commercial Fuel Cards Market, By Country US$ Mn, 2023-2031

Table 9: U.S. Commercial Fuel Cards Market, By Type, Billion Gallons, 2023-2031

Table 10: U.S. Commercial Fuel Cards Market, By Type, US$ Mn, 2023-2031

Table 11: U.S. Commercial Fuel Cards Market, By Category, Billion Gallons, 2023-2031

Table 12: U.S. Commercial Fuel Cards Market, By Category, US$ Mn, 2023-2031

Table 13: U.S. Commercial Fuel Cards Market, By Vehicle Type, Billion Gallons, 2023-2031

Table 14: U.S. Commercial Fuel Cards Market, By Vehicle Type, US$ Mn, 2023-2031

Table 15: Canada Commercial Fuel Cards Market, By Type, Billion Gallons, 2023-2031

Table 16: Canada Commercial Fuel Cards Market, By Type, US$ Mn, 2023-2031

Table 17: Canada Commercial Fuel Cards Market, By Category, Billion Gallons, 2023-2031

Table 18: Canada Commercial Fuel Cards Market, By Category, US$ Mn, 2023-2031

Table 19: Canada Commercial Fuel Cards Market, By Vehicle Type, Billion Gallons, 2023-2031

Table 20: Canada Commercial Fuel Cards Market, By Vehicle Type, US$ Mn, 2023-2031

List of Figures

Figure 1: North America Commercial Fuel Cards Market, By Type, Billion Gallons, 2023-2031

Figure 2: North America Commercial Fuel Cards Market, By Type, US$ Mn, 2023-2031

Figure 3: North America Commercial Fuel Cards Market Incremental Opportunity, By Type, US$ Mn, 2023-2031

Figure 4: North America Commercial Fuel Cards Market, By Category, Billion Gallons, 2023-2031

Figure 5: North America Commercial Fuel Cards Market, By Category, US$ Mn, 2023-2031

Figure 6: North America Commercial Fuel Cards Market Incremental Opportunity, By Category, US$ Mn, 2023-2031

Figure 7: North America Commercial Fuel Cards Market, By Vehicle Type, Billion Gallons, 2023-2031

Figure 8: North America Commercial Fuel Cards Market, By Vehicle Type, US$ Mn, 2023-2031

Figure 9: North America Commercial Fuel Cards Market Incremental Opportunity, By Vehicle Type, US$ Mn, 2023-2031

Figure 10: North America Commercial Fuel Cards Market, By Country Billion Gallons, 2023-2031

Figure 11: North America Commercial Fuel Cards Market, By Country US$ Mn, 2023-2031

Figure 12: North America Commercial Fuel Cards Market Incremental Opportunity, By Country US$ Mn, 2023-2031

Figure 13: U.S. Commercial Fuel Cards Market, By Type, Billion Gallons, 2023-2031

Figure 14: U.S. Commercial Fuel Cards Market, By Type, US$ Mn, 2023-2031

Figure 15: U.S. Commercial Fuel Cards Market Incremental Opportunity, By Type, US$ Mn, 2023-2031

Figure 16: U.S. Commercial Fuel Cards Market, By Category, Billion Gallons, 2023-2031

Figure 17: U.S. Commercial Fuel Cards Market, By Category, US$ Mn, 2023-2031

Figure 18: U.S. Commercial Fuel Cards Market Incremental Opportunity, By Category, US$ Mn, 2023-2031

Figure 19: U.S. Commercial Fuel Cards Market, By Vehicle Type, Billion Gallons, 2023-2031

Figure 20: U.S. Commercial Fuel Cards Market, By Vehicle Type, US$ Mn, 2023-2031

Figure 21: U.S. Commercial Fuel Cards Market Incremental Opportunity, By Vehicle Type, US$ Mn, 2023-2031

Figure 22: Canada Commercial Fuel Cards Market, By Type, Billion Gallons, 2023-2031

Figure 23: Canada Commercial Fuel Cards Market, By Type, US$ Mn, 2023-2031

Figure 24: Canada Commercial Fuel Cards Market Incremental Opportunity, By Type, US$ Mn, 2023-2031

Figure 25: Canada Commercial Fuel Cards Market, By Category, Billion Gallons, 2023-2031

Figure 26: Canada Commercial Fuel Cards Market, By Category, US$ Mn, 2023-2031

Figure 27: Canada Commercial Fuel Cards Market Incremental Opportunity, By Category, US$ Mn, 2023-2031

Figure 28: Canada Commercial Fuel Cards Market, By Vehicle Type, Billion Gallons, 2023-2031

Figure 29: Canada Commercial Fuel Cards Market, By Vehicle Type, US$ Mn, 2023-2031

Figure 30: Canada Commercial Fuel Cards Market Incremental Opportunity, By Vehicle Type, US$ Mn, 2023-2031