Analysts’ Viewpoint on North America Bedsore Mattress and Topper Market Scenario

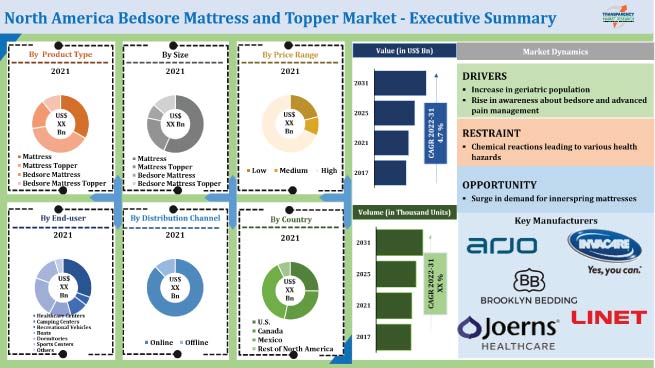

Increase in geriatric population and rise in awareness about bedsore and advanced pain management are driving the North America bedsore mattress and topper market. Various types of pressure-relieving mattresses are used in healthcare facilities to increase comfort for an individual suffering from pressure ulcers. Rise in cases of bedsores in bedbound patients is expected to boost the demand for medical mattresses in the near future. Patients suffering from chronic diseases are at risk of bedsores. Manufacturers are investing significantly in R&D of new products to increase their market share. They are also expanding their presence in untapped regions to broaden their revenue streams.

Bedsore mattresses and toppers are used for the management of pressure ulcers, which are injuries to the skin and underlying tissues. Bedridden patients with chronic diseases may suffer from pressure sores. Various support mechanisms are used for the treatment of these ulcers. The use of bedsore mattresses and toppers can help reduce the risk of bedsores. Foam is a key material used in the manufacture of mattresses. It evenly distributes weight at low pressure. This enables the mattress to maintain its static position, which consequently aids in relieving pressure.

Static mattresses (foam), alternating or dynamic mattresses (air), crossover mattresses (combination of air and foam), solid-filled mattresses, and low air loss mattresses are some of the various types of pressure-relieving mattresses. Patients with high risk of skin damage prefer hybrid mattresses, which include static and alternating cells. Low-tech beds filled with water are budget friendly. Water in fluid-filled mattresses conforms to the shape of the body and evenly distributes pressure. Nectar, Saatva, DreamCloud, and Helix Sunset Luxe are some of the best pressure relief mattresses available in the market.

Increase in cases of bedsores is expected to boost the demand for medical pressure mattresses in North America in the next few years. Medical air mattresses for bedsores are anti-fungal, anti-mite, and waterproof. They are employed for the treatment of bedsores in bedridden patients. Medical air mattresses are slim and facilitate even distribution of body pressure. This helps in proper blood circulation throughout the body. Bedsore mattresses with alternating pressure are crucial to keeping patients comfortable.

Based on product type, the North America bedsore mattress and topper market has been segmented into mattress, mattress topper, bedsore mattress, and bedsore mattress topper. The mattress segment has been further divided into memory foam, innerspring, latex, hybrid, and others. The innerspring sub-segment is expected to grow significantly during the forecast period. Demand for innerspring mattresses is high in North America compared to other mattresses. Innerspring mattresses have a quilted and smoother-to-the-touch top compared to hybrid and pressure-relief memory foam mattresses.

The memory foam sub-segment is also likely to grow at a notable pace in the next few years. Memory foam mattresses are widely used in North America, as they are economical and can evenly distribute pressure throughout the body.

The bedsore mattress topper segment has been further classified into air, foam, and others. The air sub-segment dominated the market in 2021. Foam and air sub-segments are likely to record notable market share in the next few years. Bedsore air mattresses are gaining popularity among the people in the region. Firmness of these mattresses can be adjusted to help reduce body or joint pain. Healthcare facilities in North America prefer foam and air-filled mattresses.

The U.S. is expected to dominate the North America bedsore mattress and topper market during the forecast period. Presence of prominent bedsores & RV mattress manufacturers, expansion in the medical mattress market, and high prevalence of chronic diseases are driving the market in the country. Rise in healthcare expenditure is likely to contribute to the growth of the pressure relief mattress market in the U.S. Healthcare expenditure in the U.S. rose by 9.7% in 2020, reaching US$ 4.1 Trn or US$ 12,530 per person, according to the National Health Expenditure Accounts.

The North America bedsore mattress and topper market is consolidated, with a few large-scale vendors controlling majority of the share. Manufacturers are investing significantly in comprehensive research and development activities, primarily to introduce customized products with advanced technologies. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by players. Arjo AB, Brooklyn Bedding LLC, Invacare Corporation, Joerns Healthcare LLC., Linet Group SE, Medline Industries, Inc., Lippert, Delarkin, Stryker Corporation, and GF Health Products, Inc. are leading players operating in the market.

Key players have been profiled in the North America bedsore mattress and topper market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.6 Bn |

|

Market Forecast Value in 2031 |

US$ 7.3 Bn |

|

CAGR |

4.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at North America as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The North America bedsore mattress and topper market stood at US$ US$ 4.6 Bn in 2021.

The North America bedsore mattress and topper market is estimated to grow at a CAGR of 4.7% during the forecast period.

The North America bedsore mattress and topper market is estimated to reach US$ 7.3 Bn by 2031.

Surge in demand for specialty mattresses and increase in cases of bedsores.

The U.S. is a more attractive country for vendors in the North America bedsore mattress and topper market.

Arjo AB, Brooklyn Bedding LLC, Invacare Corporation, Joerns Healthcare LLC., Linet Group SE, Medline Industries, Inc., Lippert, Delarkin, Stryker Corporation, and GF Health Products, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Mattress Industry Market Overview

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. North America Bedsore Mattress and Topper Market Analysis and Forecast, 2017- 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. North America Bedsore Mattress and Topper Market Analysis and Forecast, by Product Type

6.1. North America Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

6.1.1. Mattress

6.1.1.1. Memory Foam

6.1.1.2. Innerspring

6.1.1.3. Latex

6.1.1.4. Hybrid

6.1.1.5. Others

6.1.2. Mattress Topper

6.1.2.1. Memory Foam

6.1.2.2. Latex

6.1.2.3. Feather

6.1.2.4. Wool

6.1.2.5. Others

6.1.3. Bedsore Mattress

6.1.3.1. Foam

6.1.3.2. Hybrid

6.1.3.3. Air

6.1.3.4. Others

6.1.4. Bedsore Mattress Topper

6.1.4.1. Air

6.1.4.2. Foam

6.1.4.3. Others

6.2. Incremental Opportunity, by Product Type

7. North America Bedsore Mattress and Topper Market Analysis and Forecast, by Size

7.1. North America Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Size, 2017- 2031

7.2. Mattress

7.2.1. Twin/Single

7.2.2. Twin XL

7.2.3. Full/Double

7.2.4. Queen

7.2.5. King

7.2.6. Others

7.3. Mattress Topper

7.3.1. Twin/Single

7.3.2. Twin XL

7.3.3. Full/Double

7.3.4. Queen

7.3.5. King

7.3.6. Others

7.4. Bedsore Mattress

7.4.1. Single

7.4.2. Twin Single

7.4.3. Queen

7.4.4. Others

7.5. Bedsore Mattress Topper

7.5.1. Single

7.5.2. Twin Single

7.5.3. Queen

7.5.4. Others

7.6. Incremental Opportunity, by Size

8. North America Bedsore Mattress and Topper Market Analysis and Forecast, by Price Range

8.1. North America Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Price Range, 2017- 2031

8.1.1. Low

8.1.2. Medium

8.1.3. High

8.2. Incremental Opportunity, by Price Range

9. North America Bedsore Mattress and Topper Market Analysis and Forecast, by End-user

9.1. North America Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

9.1.1. Healthcare Centers

9.1.2. Camping Centers

9.1.3. Recreational Vehicles

9.1.4. Boats

9.1.5. Dormitories

9.1.6. Sports Centers

9.1.7. Others

9.2. Incremental Opportunity, End-user

10. North America Bedsore Mattress and Topper Market Analysis and Forecast, by Distribution Channel

10.1. North America Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

10.1.1. Online

10.1.1.1. Company Websites

10.1.1.2. E-commerce Websites

10.1.2. Offline

10.1.2.1. Direct Sales

10.1.2.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. North America Bedsore Mattress and Topper Market Analysis and Forecast, by Country

11.1. North America Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

11.1.1. U.S.

11.1.2. Canada

11.1.3. Mexico

11.1.4. Rest of North America

11.2. Incremental Opportunity, by Country

12. U.S. Bedsore Mattress and Topper Market Analysis and Forecast

12.1. Country Snapshot

12.2. Key Trends Analysis

12.2.1. Supply side

12.2.2. Demand Side

12.3. Key Supplier Analysis

12.4. Consumer Buying Behavior Analysis

12.5. Price Trend Analysis

12.5.1. Weighted Average Selling Price (US$)

12.6. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

12.6.1. Mattress

12.6.1.1. Memory Foam

12.6.1.2. Innerspring

12.6.1.3. Latex

12.6.1.4. Hybrid

12.6.1.5. Others

12.6.2. Mattress Topper

12.6.2.1. Memory Foam

12.6.2.2. Latex

12.6.2.3. Feather

12.6.2.4. Wool

12.6.2.5. Others

12.6.3. Bedsore Mattress

12.6.3.1. Foam

12.6.3.2. Hybrid

12.6.3.3. Air

12.6.3.4. Others

12.6.4. Bedsore Mattress Topper

12.6.4.1. Air

12.6.4.2. Foam

12.6.4.3. Others

12.7. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Size, 2017- 2031

12.8. Mattress

12.8.1. Twin/Single

12.8.2. Twin XL

12.8.3. Full/Double

12.8.4. Queen

12.8.5. King

12.8.6. Others

12.9. Mattress Topper

12.9.1. Twin/Single

12.9.2. Twin XL

12.9.3. Full/Double

12.9.4. Queen

12.9.5. King

12.9.6. Others

12.10. Bedsore Mattress

12.10.1. Single

12.10.2. Twin Single

12.10.3. Queen

12.10.4. Others

12.11. Bedsore Mattress Topper

12.11.1. Single

12.11.2. Twin Single

12.11.3. Queen

12.11.4. Others

12.12. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Price Range, 2017- 2031

12.12.1. Low

12.12.2. Medium

12.12.3. High

12.13. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

12.13.1. Healthcare Centers

12.13.2. Camping Centers

12.13.3. Recreational Vehicles

12.13.4. Boats

12.13.5. Dormitories

12.13.6. Sports Centers

12.13.7. Others

12.14. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.14.1. Online

12.14.1.1. Company Websites

12.14.1.2. E-commerce Websites

12.14.2. Offline

12.14.2.1. Direct Sales

12.14.2.2. Indirect Sales

12.15. Incremental Opportunity Analysis

13. Canada Bedsore Mattress and Topper Market Analysis and Forecast

13.1. Country Snapshot

13.2. Key Trends Analysis

13.2.1. Supply side

13.2.2. Demand Side

13.3. Key Supplier Analysis

13.4. Consumer Buying Behavior Analysis

13.5. Price Trend Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

13.6.1. Mattress

13.6.1.1. Memory Foam

13.6.1.2. Innerspring

13.6.1.3. Latex

13.6.1.4. Hybrid

13.6.1.5. Others

13.6.2. Mattress Topper

13.6.2.1. Memory Foam

13.6.2.2. Latex

13.6.2.3. Feather

13.6.2.4. Wool

13.6.2.5. Others

13.6.3. Bedsore Mattress

13.6.3.1. Foam

13.6.3.2. Hybrid

13.6.3.3. Air

13.6.3.4. Others

13.6.4. Bedsore Mattress Topper

13.6.4.1. Air

13.6.4.2. Foam

13.6.4.3. Others

13.7. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Size, 2017- 2031

13.8. Mattress

13.8.1. Twin/Single

13.8.2. Twin XL

13.8.3. Full/Double

13.8.4. Queen

13.8.5. King

13.8.6. Others

13.9. Mattress Topper

13.9.1. Twin/Single

13.9.2. Twin XL

13.9.3. Full/Double

13.9.4. Queen

13.9.5. King

13.9.6. Others

13.10. Bedsore Mattress

13.10.1. Single

13.10.2. Twin Single

13.10.3. Queen

13.10.4. Others

13.11. Bedsore Mattress Topper

13.11.1. Single

13.11.2. Twin Single

13.11.3. Queen

13.11.4. Others

13.12. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Price Range, 2017- 2031

13.12.1. Low

13.12.2. Medium

13.12.3. High

13.13. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

13.13.1. Healthcare Centers

13.13.2. Camping Centers

13.13.3. Recreational Vehicles

13.13.4. Boats

13.13.5. Dormitories

13.13.6. Sports Centers

13.13.7. Others

13.14. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

13.14.1. Online

13.14.1.1. Company Websites

13.14.1.2. E-commerce Websites

13.14.2. Offline

13.14.2.1. Direct Sales

13.14.2.2. Indirect Sales

13.15. Incremental Opportunity Analysis

14. Mexico Bedsore Mattress and Topper Market Analysis and Forecast

14.1. Country Snapshot

14.2. Key Trends Analysis

14.2.1. Supply side

14.2.2. Demand Side

14.3. Key Supplier Analysis

14.4. Consumer Buying Behavior Analysis

14.5. Price Trend Analysis

14.5.1. Weighted Average Selling Price (US$)

14.6. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

14.6.1. Mattress

14.6.1.1. Memory Foam

14.6.1.2. Innerspring

14.6.1.3. Latex

14.6.1.4. Hybrid

14.6.1.5. Others

14.6.2. Mattress Topper

14.6.2.1. Memory Foam

14.6.2.2. Latex

14.6.2.3. Feather

14.6.2.4. Wool

14.6.2.5. Others

14.6.3. Bedsore Mattress

14.6.3.1. Foam

14.6.3.2. Hybrid

14.6.3.3. Air

14.6.3.4. Others

14.6.4. Bedsore Mattress Topper

14.6.4.1. Air

14.6.4.2. Foam

14.6.4.3. Others

14.7. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Size, 2017- 2031

14.8. Mattress

14.8.1. Twin/Single

14.8.2. Twin XL

14.8.3. Full/Double

14.8.4. Queen

14.8.5. King

14.8.6. Others

14.9. Mattress Topper

14.9.1. Twin/Single

14.9.2. Twin XL

14.9.3. Full/Double

14.9.4. Queen

14.9.5. King

14.9.6. Others

14.10. Bedsore Mattress

14.10.1. Single

14.10.2. Twin Single

14.10.3. Queen

14.10.4. Others

14.11. Bedsore Mattress Topper

14.11.1. Single

14.11.2. Twin Single

14.11.3. Queen

14.11.4. Others

14.12. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Price Range, 2017- 2031

14.12.1. Low

14.12.2. Medium

14.12.3. High

14.13. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

14.13.1. Healthcare Centers

14.13.2. Camping Centers

14.13.3. Recreational Vehicles

14.13.4. Boats

14.13.5. Dormitories

14.13.6. Sports Centers

14.13.7. Others

14.14. Bedsore Mattress and Topper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.14.1. Online

14.14.1.1. Company Websites

14.14.1.2. E-commerce Websites

14.14.2. Offline

14.14.2.1. Direct Sales

14.14.2.2. Indirect Sales

14.15. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2021)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies/Recent Developments)

15.3.1. Arjo AB

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information

15.3.1.4. (Subject to Data Availability)

15.3.1.5. Business Strategies/Recent Developments

15.3.2. Brooklyn Bedding LLC

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information

15.3.2.4. (Subject to Data Availability)

15.3.2.5. Business Strategies/Recent Developments

15.3.3. Invacare Corporation

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information

15.3.3.4. (Subject to Data Availability)

15.3.3.5. Business Strategies/Recent Developments

15.3.4. Joerns Healthcare LLC

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information

15.3.4.4. (Subject to Data Availability)

15.3.4.5. Business Strategies/Recent Developments

15.3.5. Linet Group SE

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information

15.3.5.4. (Subject to Data Availability)

15.3.5.5. Business Strategies/Recent Developments

15.3.6. Medline Industries, Inc.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information

15.3.6.4. (Subject to Data Availability)

15.3.6.5. Business Strategies/Recent Developments

15.3.7. Lippert

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information

15.3.7.4. (Subject to Data Availability)

15.3.7.5. Business Strategies/Recent Developments

15.3.8. Delarkin

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information

15.3.8.4. (Subject to Data Availability)

15.3.8.5. Business Strategies/Recent Developments

15.3.9. Stryker Corporation

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information

15.3.9.4. (Subject to Data Availability)

15.3.9.5. Business Strategies/Recent Developments

15.3.10. GF Health Products, Inc.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information

15.3.10.4. (Subject to Data Availability)

15.3.10.5. Business Strategies/Recent Developments

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. Product Type

16.1.2. Size

16.1.3. Price Range

16.1.4. End-user

16.1.5. Distribution Channel

16.1.6. Country

16.2. Understanding the Buying Behavior of Consumers

16.3. Prevailing Market Risks

16.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Table 2: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Table 3: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Table 4: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Table 5: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Table 6: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Table 7: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Table 8: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Table 9: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Table 10: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Country

Table 11: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Country

Table 12: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Table 13: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Table 14: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Table 15: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Table 16: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Table 17: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Table 18: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Table 19: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Table 20: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Table 21: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Table 22: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Table 23: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Table 24: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Table 25: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Table 26: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Table 27: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Table 28: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Table 29: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Table 30: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Table 31: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Table 32: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Table 33: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Table 34: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Table 35: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Table 36: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Table 37: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Table 38: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Table 39: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Table 40: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Table 41: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Table 42: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Table 43: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Table 44: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Table 45: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Table 46: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Table 47: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Table 48: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Table 49: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Table 50: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Table 51: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

List of Figures

Figure 1: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Figure 2: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Figure 3: North America Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031, by Product Type

Figure 4: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Figure 5: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Figure 6: North America Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Size

Figure 7: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Figure 8: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Figure 9: North America Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Price Range

Figure 10: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Figure 11: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Figure 12: North America Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By End-user

Figure 13: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Figure 14: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Figure 15: North America Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Distribution Channel

Figure 16: North America Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Country

Figure 17: North America Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Country

Figure 18: North America Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Country

Figure 19: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Figure 20: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Figure 21: U.S. Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Product Type

Figure 22: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Figure 23: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Figure 24: U.S. Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Size

Figure 25: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Figure 26: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Figure 27: U.S. Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Price Range

Figure 28: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Figure 29: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Figure 30: U.S. Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By End-user

Figure 31: U.S. Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Figure 32: U.S. Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Figure 33: U.S. Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Distribution Channel

Figure 34: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Figure 35: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Figure 36: Canada Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Product Type

Figure 37: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Figure 38: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Figure 39: Canada Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Size

Figure 40: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Figure 41: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Figure 42: Canada Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Price Range

Figure 43: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Figure 44: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Figure 45: Canada Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By End-user

Figure 46: Canada Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Figure 47: Canada Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Figure 48: Canada Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Distribution Channel

Figure 49: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Product Type

Figure 50: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Product Type

Figure 51: Mexico Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Product Type

Figure 52: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Size

Figure 53: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Size

Figure 54: Mexico Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Size

Figure 55: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Price Range

Figure 56: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Price Range

Figure 57: Mexico Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Price Range

Figure 58: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by End-user

Figure 59: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by End-user

Figure 60: Mexico Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By End-user

Figure 61: Mexico Bedsore Mattress and Topper Market Value (US$ Mn) Projection, 2017-2031, by Distribution Channel

Figure 62: Mexico Bedsore Mattress and Topper Market Volume (Thousand Units) Projection, 2017-2031, by Distribution Channel

Figure 63: Mexico Bedsore Mattress and Topper Market Incremental Opportunities, (US$ Mn) Forecast, 2017-2031 By Distribution Channel