Analysts’ Viewpoint

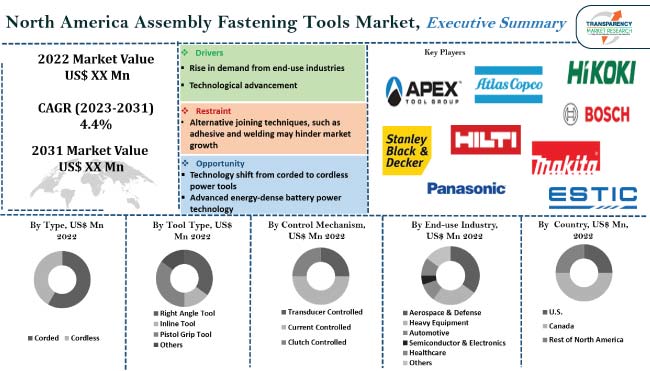

Rise in demand from end-use industries and technological advancements are anticipated to have a profound impact on the North America assembly fastening tools market growth in the near future.

The use of assembly fastening tools in North America has seen significant growth over the years, ascribed to surge in demand for faster and more efficient assembly processes. Many manufacturers are now using automated assembly fastening tools to increase productivity and reduce labor costs. These devices are designed to provide quick and precise assembly of components while also increasing the quality of the finished product.

The trend of using assembly fastening tools in North America is expected to continue to grow as manufacturers develop new and improved tools to meet the needs of modern manufacturing.

Assembly fastening tools are essential for any manufacturing, assembly, maintenance, or repair operation. These tools are used to join two or more parts together in a secure and reliable manner, and are typically more efficient than manual methods.

The tools are used for the assembly of parts and components with the help of fasteners such as bolts, nuts, screws, and rivets, as well as to cut, shape, and form materials. Assembly fastening tools come in a variety of shapes, designs, and sizes, including manual, semi-automatic, and fully automated systems and can be used to complete a wide variety of tasks.

Assembly fastening tools are designed to reduce the amount of time and effort required to complete a task, and often come with safety features and ergonomic designs to ensure the safety of the user. These tools are essential for ensuring the quality and reliability of the products manufactured. The quality and performance of assembly fastening tools is expected to increase as technology advances.

The North America Assembly Fastening Tools Industry is expected to witness an upsurge in its growth rate in the near future, owing to the rise in demand from end-use industries.

The automotive industry in Canada is growing rapidly, with the total number of road motor vehicles registered in Canada increasing to 26.2 million in 2021, up 1.9% from 2020. Canada was the 12th largest producer of vehicles in the world in 2019 and the country is responsible for 13% of vehicle production in North America.

The manufacturing of automobiles and auto parts represents 16.8% of all manufacturing sales in Canada. Demand for assembly fastening tools is projected to increase with the growth in the automotive sector, positively impacting the North America assembly fastening tools market size.

Growth of the market is further attributed to the surge in demand for automated and user-friendly assembly fastening tools, which are capable of providing better performance. The growth in demand for light and strong fastening tools to reduce the overall weight of automotive components is expected to drive the North America assembly fastening tools market demand.

The North America fastening solutions market has witnessed significant growth due to the adoption of advance technology for assembly fastening tools.

Introduction of fastening technology in North America such as cordless tools and robotics has had a positive impact on the market. The growth in focus on safety and the environment is encouraging manufacturers to develop eco-friendly assembly fastening tools. The increase in investments in research and development activities by major market players is also a market catalyst.

Furthermore, the trend of digitization and automation has enabled the market to offer more efficient and durable assembly fastening tools. Advancements in technology have enabled the market to offer more cost-effective and efficient assembly fastening tools.

The rise in demand for lightweight and durable assembly fastening tools has further driven market progress. One of the key North America assembly fastening tools market trends is the popularity of green and sustainable products that enable the market to offer more environment-friendly assembly fastening tools.

According to the latest North America assembly fastening tools market forecast, the U.S. is expected to hold the largest share during the forecast period. Expansion strategies employed by various companies in the country is fueling the market dynamics of the region. Rise in demand for assembly fasting tools from the metal industry, which includes the production of aluminum and stainless steel, is contributing to the North America fastener tools market share.

As per the North America assembly fastening tools market analysis, demand for customized tools is driving the growth of the market in Canada, which is anticipated to expand at the fastest rate. Innovations in fastening tools for North American manufacturers are mainly focused on the development of customized tools to meet the needs of specific industries. Additionally, the emergence of new technologies such as 3D printing and digital twinning are also likely to offer lucrative opportunities for market expansion.

The business model of prominent North America manufacturers includes investments in R&D, product expansions, and mergers and acquisitions. Product development is a major marketing strategy of top players. The market is highly competitive, with the presence of various global and regional players.

Apex Tool Group, LLC, Atlas Copco, C. & E. Fein GmbH, Desoutter Industrial Tools, Estic Corporation, Hitachi Koki Co., Ltd, HS-Technik GmbH, Ingersoll-Rand, Makita Corporation, Panasonic Corporation, and Stanley Black & Decker are the prominent entities profiled in the North America assembly fastening tools market report.

Key players have been profiled in the North America assembly fastening tools market research based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 847.1 Mn |

| Market Forecast Value in 2031 | US$ 1.2 Bn |

| Growth Rate (CAGR) | 4.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn/Bn for Value & Thousand Units for Volume |

| Market Analysis | Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 847.1 Mn in 2022

The CAGR is projected to be 4.4% from 2023 to 2031

Rise in demand from end-use industries, and technological advancement

In terms of control mechanism, the clutch controlled segment accounted for significant share in 2022

The U.S. is likely to be the most lucrative region during the forecast period

Apex Tool Group, LLC, Atlas Copco, C. & E. Fein GmbH, Desoutter Industrial Tools, Estic Corporation, Hitachi Koki Co., Ltd, HS-Technik GmbH, Ingersoll-Rand, Makita Corporation, Panasonic Corporation, and Stanley Black & Decker

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Technology Analysis

5.9. Standard and Regulation Analysis

5.10. North America Assembly Fastening Tools Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. North America Assembly Fastening Tools Market Analysis and Forecast, By Type

6.1. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Type, 2017 - 2031

6.1.1. Corded

6.1.1.1. DC Electric Tools

6.1.1.1.1. Screwdriver

6.1.1.1.2. Impact Driver/ Wrench

6.1.1.1.3. Nut runners

6.1.1.1.4. Others

6.1.1.2. Pneumatic

6.1.1.2.1. Screwdriver

6.1.1.2.2. Impact Driver/ Wrench

6.1.1.2.3. Nut runners

6.1.1.2.4. Others

6.1.2. Cordless

6.1.2.1. Screwdriver

6.1.2.2. Impact Driver/ Wrench

6.1.2.3. Nut runners

6.1.2.4. Others

6.2. Incremental Opportunity, By Type

7. North America Assembly Fastening Tools Market Analysis and Forecast, By Tool Type

7.1. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Tool Type, 2017 - 2031

7.1.1. Right Angle Tool

7.1.2. Inline Tool

7.1.3. Pistol Grip Tool

7.1.4. Others

7.2. Incremental Opportunity, By Tool Type

8. North America Assembly Fastening Tools Market Analysis and Forecast, By Control Mechanism

8.1. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Control Mechanism, 2017 - 2031

8.1.1. Transducer Controlled

8.1.2. Current Controlled

8.1.3. Clutch Controlled

8.2. Incremental Opportunity, By Control Mechanism

9. North America Assembly Fastening Tools Market Analysis and Forecast, By End-use Industry

9.1. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

9.1.1. Aerospace & Defense

9.1.2. Heavy Equipment

9.1.3. Automotive

9.1.4. Semiconductor & Electronics

9.1.5. Healthcare

9.1.6. Others

9.2. Incremental Opportunity, By End-use Industry

10. North America Assembly Fastening Tools Market Analysis and Forecast, By Country

10.1. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017 - 2031

10.1.1. U.S

10.1.2. Canada

10.1.3. Rest of North America

10.2. Incremental Opportunity, By Country

11. U.S. North America Assembly Fastening Tools Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Macroeconomic Scenario

11.3. Key Supplier Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Price

11.5. Key Trends Analysis

11.5.1. Demand Side

11.5.2. Supplier Side

11.6. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Type, 2017 - 2031

11.6.1. Corded

11.6.1.1. DC Electric Tools

11.6.1.1.1. Screwdriver

11.6.1.1.2. Impact Driver/ Wrench

11.6.1.1.3. Nut runners

11.6.1.1.4. Others

11.6.1.2. Pneumatic

11.6.1.2.1. Screwdriver

11.6.1.2.2. Impact Driver/ Wrench

11.6.1.2.3. Nut runners

11.6.1.2.4. Others

11.6.2. Cordless

11.6.2.1. Screwdriver

11.6.2.2. Impact Driver/ Wrench

11.6.2.3. Nut runners

11.6.2.4. Others

11.7. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Tool Type, 2017 - 2031

11.7.1. Right Angle Tool

11.7.2. Inline Tool

11.7.3. Pistol Grip Tool

11.7.4. Others

11.8. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Control Mechanism, 2017 - 2031

11.8.1. Transducer Controlled

11.8.2. Current Controlled

11.8.3. Clutch Controlled

11.9. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

11.9.1. Aerospace & Defense

11.9.2. Heavy Equipment

11.9.3. Automotive

11.9.4. Semiconductor & Electronics

11.9.5. Healthcare

11.9.6. Others

12. Canada North America Assembly Fastening Tools Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Macroeconomic Scenario

12.3. Key Supplier Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Key Trends Analysis

12.5.1. Demand Side

12.5.2. Supplier Side

12.6. Market Size (US$ Mn and Thousand Units) Forecast, Type, 2017 - 2031

12.6.1. Corded

12.6.1.1. DC Electric Tools

12.6.1.1.1. Screwdriver

12.6.1.1.2. Impact Driver/ Wrench

12.6.1.1.3. Nut runners

12.6.1.1.4. Others

12.6.1.2. Pneumatic

12.6.1.2.1. Screwdriver

12.6.1.2.2. Impact Driver/ Wrench

12.6.1.2.3. Nut runners

12.6.1.2.4. Others

12.6.2. Cordless

12.6.2.1. Screwdriver

12.6.2.2. Impact Driver/ Wrench

12.6.2.3. Nut runners

12.6.2.4. Others

12.7. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Tool Type, 2017 - 2031

12.7.1. Right Angle Tool

12.7.2. Inline Tool

12.7.3. Pistol Grip Tool

12.7.4. Others

12.8. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, Control Mechanism, 2017 - 2031

12.8.1. Transducer Controlled

12.8.2. Current Controlled

12.8.3. Clutch Controlled

12.9. North America Assembly Fastening Tools Market Size (US$ Mn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

12.9.1. Aerospace & Defense

12.9.2. Heavy Equipment

12.9.3. Automotive

12.9.4. Semiconductor & Electronics

12.9.5. Healthcare

12.9.6. Others

13. Competition Landscape

13.1. Market Player – Competition Dashboard

13.2. Market Share Analysis (%), by Company, (2022)

13.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

13.3.1. Apex Tool Group, LLC

13.3.1.1. Company Overview

13.3.1.2. Sales Area/Geographical Presence

13.3.1.3. Revenue

13.3.1.4. Strategy & Business Overview

13.3.2. Atlas Copco

13.3.2.1. Company Overview

13.3.2.2. Sales Area/Geographical Presence

13.3.2.3. Revenue

13.3.2.4. Strategy & Business Overview

13.3.3. C. & E. Fein GmbH

13.3.3.1. Company Overview

13.3.3.2. Sales Area/Geographical Presence

13.3.3.3. Revenue

13.3.3.4. Strategy & Business Overview

13.3.4. Desoutter Industrial Tools

13.3.4.1. Company Overview

13.3.4.2. Sales Area/Geographical Presence

13.3.4.3. Revenue

13.3.4.4. Strategy & Business Overview

13.3.5. Estic Corporation

13.3.5.1. Company Overview

13.3.5.2. Sales Area/Geographical Presence

13.3.5.3. Revenue

13.3.5.4. Strategy & Business Overview

13.3.6. Hitachi Koki Co., Ltd

13.3.6.1. Company Overview

13.3.6.2. Sales Area/Geographical Presence

13.3.6.3. Revenue

13.3.6.4. Strategy & Business Overview

13.3.7. HS-Technik GmbH

13.3.7.1. Company Overview

13.3.7.2. Sales Area/Geographical Presence

13.3.7.3. Revenue

13.3.7.4. Strategy & Business Overview

13.3.8. Ingersoll-Rand

13.3.8.1. Company Overview

13.3.8.2. Sales Area/Geographical Presence

13.3.8.3. Revenue

13.3.8.4. Strategy & Business Overview

13.3.9. Makita Corporation

13.3.9.1. Company Overview

13.3.9.2. Sales Area/Geographical Presence

13.3.9.3. Revenue

13.3.9.4. Strategy & Business Overview

13.3.10. Panasonic Corporation

13.3.10.1. Company Overview

13.3.10.2. Sales Area/Geographical Presence

13.3.10.3. Revenue

13.3.10.4. Strategy & Business Overview

13.3.11. Stanley Black & Decker

13.3.11.1. Company Overview

13.3.11.2. Sales Area/Geographical Presence

13.3.11.3. Revenue

13.3.11.4. Strategy & Business Overview

13.3.12. Other Key Players

13.3.12.1. Company Overview

13.3.12.2. Sales Area/Geographical Presence

13.3.12.3. Revenue

13.3.12.4. Strategy & Business Overview

14. Go to Market Strategy

14.1. Identification of Potential Market Spaces

14.1.1. By Type

14.1.2. By Tool Type

14.1.3. By Control Mechanism

14.1.4. By End-use Industry

14.1.5. By Region

14.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Assembly Fastening Tools Market Value (US$ Mn), by Type, 2017-2031

Table 2: North America Assembly Fastening Tools Market Volume (Thousand Units), by Type 2017-2031

Table 3: North America Assembly Fastening Tools Market Value (US$ Mn), by Tool Type, 2017-2031

Table 4: North America Assembly Fastening Tools Market Volume (Thousand Units), by Tool Type 2017-2031

Table 5: North America Assembly Fastening Tools Market Value (US$ Mn), by Control Mechanism, 2017-2031

Table 6: North America Assembly Fastening Tools Market Volume (Thousand Units), by Control Mechanism 2017-2031

Table 7: North America Assembly Fastening Tools Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 8: North America Assembly Fastening Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 9: North America Assembly Fastening Tools Market Value (US$ Mn), by Region, 2017-2031

Table 10: North America Assembly Fastening Tools Market Volume (Thousand Units), by Region 2017-2031

Table 11: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Type, 2017-2031

Table 12: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Type 2017-2031

Table 13: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Tool Type, 2017-2031

Table 14: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Tool Type 2017-2031

Table 15: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Control Mechanism, 2017-2031

Table 16: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Control Mechanism 2017-2031

Table 17: U.S. Assembly Fastening Tools Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 18: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 19: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Region, 2017-2031

Table 20: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Region 2017-2031

Table 21: Canada Assembly Fastening Tools Market Value (US$ Mn), by Type, 2017-2031

Table 22: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Type 2017-2031

Table 23: Canada Assembly Fastening Tools Market Value (US$ Mn), by Tool Type, 2017-2031

Table 24: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Tool Type 2017-2031

Table 25: Canada Assembly Fastening Tools Market Value (US$ Mn), by Control Mechanism, 2017-2031

Table 26: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Control Mechanism 2017-2031

Table 27: Canada Assembly Fastening Tools Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 28: Canada Assembly Fastening Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 29: Canada Assembly Fastening Tools Market Value (US$ Mn), by Region, 2017-2031

Table 30: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: North America Assembly Fastening Tools Market Value (US$ Mn), by Type, 2017-2031

Figure 2: North America Assembly Fastening Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 3: North America Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 4: North America Assembly Fastening Tools Market Value (US$ Mn), by Tool Type, 2017-2031

Figure 5: North America Assembly Fastening Tools Market Volume (Thousand Units), by Tool Type 2017-2031

Figure 6: North America Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Tool Type, 2023-2031

Figure 7: North America Assembly Fastening Tools Market Value (US$ Mn), by Control Mechanism, 2017-2031

Figure 8: North America Assembly Fastening Tools Market Volume (Thousand Units), by Control Mechanism 2017-2031

Figure 9: North America Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Control Mechanism, 2023-2031

Figure 10: North America Assembly Fastening Tools Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 11: North America Assembly Fastening Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 12: North America Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 13: North America Assembly Fastening Tools Market Value (US$ Mn), by Region, 2017-2031

Figure 14: North America Assembly Fastening Tools Market Volume (Thousand Units), by Region 2017-2031

Figure 15: North America Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 16: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Type, 2017-2031

Figure 17: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 18: U.S. Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 19: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Tool Type, 2017-2031

Figure 20: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Tool Type 2017-2031

Figure 21: U.S. Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Tool Type, 2023-2031

Figure 22: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Control Mechanism, 2017-2031

Figure 23: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Control Mechanism 2017-2031

Figure 24: U.S. Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Control Mechanism, 2023-2031

Figure 25: U.S. Assembly Fastening Tools Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 26: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 27: U.S. Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 28: U.S. Assembly Fastening Tools Market Value (US$ Mn), by Region, 2017-2031

Figure 29: U.S. Assembly Fastening Tools Market Volume (Thousand Units), by Region 2017-2031

Figure 30: U.S. Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 31: Canada Assembly Fastening Tools Market Value (US$ Mn), by Type, 2017-2031

Figure 32: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 33: Canada Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 34: Canada Assembly Fastening Tools Market Value (US$ Mn), by Tool Type, 2017-2031

Figure 35: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Tool Type 2017-2031

Figure 36: Canada Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Tool Type, 2023-2031

Figure 37: Canada Assembly Fastening Tools Market Value (US$ Mn), by Control Mechanism, 2017-2031

Figure 38: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Control Mechanism 2017-2031

Figure 39: Canada Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Control Mechanism, 2023-2031

Figure 40: Canada Assembly Fastening Tools Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 41: Canada Assembly Fastening Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 42: Canada Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 43: Canada Assembly Fastening Tools Market Value (US$ Mn), by Region, 2017-2031

Figure 44: Canada Assembly Fastening Tools Market Volume (Thousand Units), by Region 2017-2031

Figure 45: Canada Assembly Fastening Tools Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031