Analysts’ Viewpoint on Market Scenario

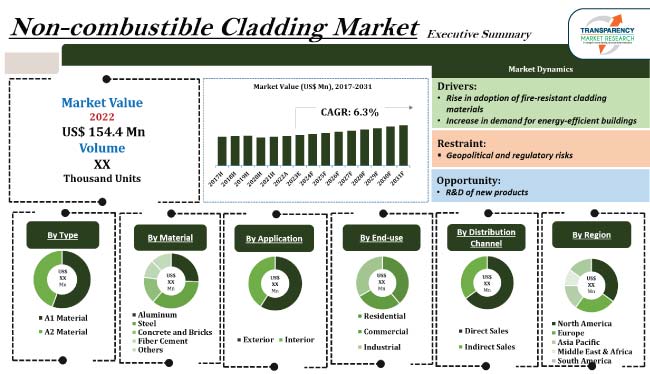

The non-combustible cladding market size is anticipated to grow at a steady pace during the forecast period due to rise in adoption of fire-resistant cladding materials and surge in demand for energy-efficient buildings. Non-combustible cladding and facade technologies are gaining popularity in a variety of industries due to their fire-resistance property.

Revival of stalled infrastructure projects and surge in investment in the R&D of new cladding materials are likely to offer lucrative opportunities to players in the global non-combustible cladding industry. Non-combustible cladding manufacturers are allocating a major portion of their revenue to R&D to differentiate them from the competition.

Non-combustible cladding is a type of cladding that does not burn or ignite. It is usually made from non-combustible materials such as metal, concrete, and stone. Non-combustible cladding is commonly used in commercial and residential buildings to reduce the risk of fire.

Non-combustible cladding materials are designed to withstand high temperatures and resist the spread of flames. These materials are often employed in hospitals, schools, and other public buildings. They are also utilized to provide insulation and sound absorption. Fire-resistant materials can be used to reduce the impact of earthquakes. They are designed to absorb shock, thereby preventing extensive damage.

When exposed to direct flame, fireproof cladding materials such as fiber cement do not ignite or contribute to fires. The capacity of fiber cement to provide fire protection, as well as increase in the use of fire-resistant materials, are driving the non-combustible cladding market growth.

Non-combustible cladding materials are gaining popularity due to their fire-resistant properties. Fire-resistant cladding materials are essential for preventing the spread of fire in buildings. Thus, surge in construction of buildings is expected to drive the non-combustible cladding market development in the near future.

Non-combustible materials are used for fire-resistant cladding. Fiber cement cladding is more fire resistant than PVC cladding, which melts and warps when exposed to fire. Non-combustible cladding materials are cheap and easy to install. Steel pre-formed panels and reinforced cement-based tiles do not cause or contribute to flames. They are utilized as exterior wall cladding materials in residential, commercial, and industrial structures and support non-combustible construction.

Non-combustible cladding is gaining traction in various industries as it helps to reduce construction costs and air pollution. It is also esthetically pleasing and can contribute to the overall esthetics of a property. Non-combustible cladding materials, such as fiber cement, stone, and stucco, are being employed to reduce the risk of fire in buildings. Additionally, these materials are more durable than combustible cladding materials, thereby requiring less maintenance and repair.

Various industries are investing in non-combustible cladding materials to ensure fire safety. Non-combustible siding materials meet the strictest standards for fire and weather protection. Hence, implementation of stringent regulations regarding fire safety and a ban on the usage of combustible cladding materials are fueling the non-combustible cladding market progress.

Non-combustible cladding materials provide an effective barrier against fire and smoke and are compliant with building codes and regulations. They are also energy-efficient, reducing the need for heating and cooling systems. Thus, growth in demand for energy-efficient buildings is boosting the non-combustible cladding market expansion.

Non-combustible cladding shields structures from inclement weather. Rain and storms may wreak havoc on a house's internal and external walls. This can be avoided by applying an extra layer of material to the walls. Using fire-resistant materials and applying one material over another to produce a skin or layer offers additional protection to walls.

According to the latest non-combustible cladding market forecast, North America is expected to hold largest share from 2023 to 2031. Rise in investment in construction projects and implementation of stringent regulations related to fire safety are fueling the market dynamics of the region.

Increase in awareness about fire safety and surge in cost of combustible cladding are also projected to offer non-combustible cladding market opportunities to vendors in North America. The region is witnessing a rise in the installation of non-combustible cladding materials, such as stones, bricks, and concrete, to reduce the risk of fire. The future of the non-combustible cladding market in North America is lucrative due to growth in demand for energy-efficient building solutions.

The global industry is highly competitive, with the presence of several global and regional players. Non-combustible cladding market top players are emphasizing product development as a major marketing strategy. They are also adopting partnership, collaboration, and M&A strategies to increase their non-combustible cladding market share.

3A Composites GmbH, Rockwool International A/S, Knauf Gips KG, Saint-Gobain Construction Products UK Limited, Ash & Lacy Holdings Ltd., Guttercrest Ltd., Interplast Company Limited, James Hardie Europe GmbH, OLAM, and Qora Cladding are key players in the non-combustible cladding market.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 154.4 Mn |

| Market Forecast Value in 2031 | US$ 264.8 Mn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Mn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope |

Available upon request |

| Pricing |

Available upon request |

It was valued at US$ 154.4 Mn in 2022

It is estimated to grow at a CAGR of 6.3% from 2023 to 2031

It is projected to reach US$ 264.8 Mn by the end of 2031

Rise in adoption of fire-resistant cladding materials and increase in demand for energy-efficient buildings

The A1 material type segment dominated the business in 2022

North America is estimated to record the highest demand during the forecast period

3A Composites GmbH, Rockwool International A/S, Knauf Gips KG, Saint-Gobain Construction Products UK Limited, Ash & Lacy Holdings Ltd., Guttercrest Ltd., Interplast Company Limited, James Hardie Europe GmbH, OLAM, and Qora Cladding

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Fire Safety Process Market Overview

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Technology Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. Trade Analysis

5.9. Regulatory Framework

5.10. Non-combustible Cladding Market Analysis and Forecast, 2017- 2031

5.10.1. Market Value Projection (US$ Mn)

5.10.2. Market Volume Projection (Thousand Units)

6. Global Non-combustible Cladding Market Analysis and Forecast, by Type

6.1. Global Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

6.1.1. A1 Material

6.1.2. A2 Material

6.2. Incremental Opportunity, by Type

7. Global Non-combustible Cladding Market Analysis and Forecast, by Material

7.1. Global Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

7.1.1. Aluminum

7.1.2. Steel

7.1.3. Concrete and Bricks

7.1.4. Fiber Cement

7.1.5. Others

7.2. Incremental Opportunity, by Material

8. Global Non-combustible Cladding Market Analysis and Forecast, by Application

8.1. Global Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

8.1.1. Exterior

8.1.2. Interior

8.2. Incremental Opportunity, by Application

9. Global Non-combustible Cladding Market Analysis and Forecast, by End-use

9.1. Global Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

9.1.1. Residential

9.1.2. Commercial

9.1.3. Industrial

9.2. Incremental Opportunity, by End-use

10. Global Non-combustible Cladding Market Analysis and Forecast, by Distribution Channel

10.1. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. Global Non-combustible Cladding Market Analysis and Forecast, by Region

11.1. Global Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Non-combustible Cladding Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trend Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

12.5.1. A1 Material

12.5.2. A2 Material

12.6. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

12.6.1. Aluminum

12.6.2. Steel

12.6.3. Concrete and Bricks

12.6.4. Fiber Cement

12.6.5. Others

12.7. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

12.7.1. Exterior

12.7.2. Interior

12.8. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

12.8.1. Residential

12.8.2. Commercial

12.8.3. Industrial

12.9. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Non-combustible Cladding Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trend Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

13.5.1. A1 Material

13.5.2. A2 Material

13.6. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

13.6.1. Aluminum

13.6.2. Steel

13.6.3. Concrete and Bricks

13.6.4. Fiber Cement

13.6.5. Others

13.7. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

13.7.1. Exterior

13.7.2. Interior

13.8. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

13.8.1. Residential

13.8.2. Commercial

13.8.3. Industrial

13.9. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Non-combustible Cladding Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trend Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

14.5.1. A1 Material

14.5.2. A2 Material

14.6. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

14.6.1. Aluminum

14.6.2. Steel

14.6.3. Concrete and Bricks

14.6.4. Fiber Cement

14.6.5. Others

14.7. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

14.7.1. Exterior

14.7.2. Interior

14.8. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

14.8.1. Residential

14.8.2. Commercial

14.8.3. Industrial

14.9. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Non-combustible Cladding Market Homes Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Non-combustible Cladding Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trend Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

15.5.1. A1 Material

15.5.2. A2 Material

15.6. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

15.6.1. Aluminum

15.6.2. Steel

15.6.3. Concrete and Bricks

15.6.4. Fiber Cement

15.6.5. Others

15.7. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

15.7.1. Exterior

15.7.2. Interior

15.8. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

15.8.1. Residential

15.8.2. Commercial

15.8.3. Industrial

15.9. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Non-combustible Cladding Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trend Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

16.5.1. A1 Material

16.5.2. A2 Material

16.6. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

16.6.1. Aluminum

16.6.2. Steel

16.6.3. Concrete and Bricks

16.6.4. Fiber Cement

16.6.5. Others

16.7. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

16.7.1. Exterior

16.7.2. Interior

16.8. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

16.8.1. Residential

16.8.2. Commercial

16.8.3. Industrial

16.9. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

16.9.1. Direct Sales

16.9.2. Indirect Sales

16.10. Non-combustible Cladding Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2022)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. 3A Composites GmbH

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information

17.3.1.4. (Subject to Data Availability)

17.3.1.5. Business Strategies / Recent Developments

17.3.2. Rockwool International A/S

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information

17.3.2.4. (Subject to Data Availability)

17.3.2.5. Business Strategies / Recent Developments

17.3.3. Knauf Gips KG

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information

17.3.3.4. (Subject to Data Availability)

17.3.3.5. Business Strategies / Recent Developments

17.3.4. Saint-Gobain Construction Products UK Limited

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information

17.3.4.4. (Subject to Data Availability)

17.3.4.5. Business Strategies / Recent Developments

17.3.5. Ash & Lacy Holdings Ltd.

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information

17.3.5.4. (Subject to Data Availability)

17.3.5.5. Business Strategies / Recent Developments

17.3.6. Guttercrest Ltd.

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information

17.3.6.4. (Subject to Data Availability)

17.3.6.5. Business Strategies / Recent Developments

17.3.7. Interplast Company Limited

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information

17.3.7.4. (Subject to Data Availability)

17.3.7.5. Business Strategies / Recent Developments

17.3.8. James Hardie Europe GmbH

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information

17.3.8.4. (Subject to Data Availability)

17.3.8.5. Business Strategies / Recent Developments

17.3.9. OLAM

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information

17.3.9.4. (Subject to Data Availability)

17.3.9.5. Business Strategies / Recent Developments

17.3.10. Qora Cladding

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information

17.3.10.4. (Subject to Data Availability)

17.3.10.5. Business Strategies / Recent Developments

17.3.11. Other Key Players

17.3.11.1. Company Overview

17.3.11.2. Product Portfolio

17.3.11.3. Financial Information

17.3.11.4. (Subject to Data Availability)

17.3.11.5. Business Strategies / Recent Developments

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. By Type

18.1.2. By Material

18.1.3. By Application

18.1.4. By End-use

18.1.5. By Distribution Channel

18.1.6. By Region

18.2. Understanding Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Table 2: Global Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Table 3: Global Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Table 4: Global Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Table 5: Global Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Table 6: Global Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Table 7: Global Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Table 8: Global Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Table 9: Global Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 10: Global Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 11: Global Non-combustible Cladding Market Value, by Region, US$ Mn, 2017-2031

Table 12: Global Non-combustible Cladding Market Volume, by Region, Thousand Units, 2017-2031

Table 13: North America Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Table 14: North America Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Table 15: North America Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Table 16: North America Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Table 17: North America Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Table 18: North America Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Table 19: North America Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Table 20: North America Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Table 21: North America Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 22: North America Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 23: North America Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Table 24: North America Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Table 25: Europe Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Table 26: Europe Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Table 27: Europe Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Table 28: Europe Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Table 29: Europe Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Table 30: Europe Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Table 31: Europe Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Table 32: Europe Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Table 33: Europe Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 34: Europe Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 35: Europe Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Table 36: Europe Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Table 37: Asia Pacific Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Table 38: Asia Pacific Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Table 39: Asia Pacific Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Table 40: Asia Pacific Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Table 41: Asia Pacific Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Table 42: Asia Pacific Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Table 43: Asia Pacific Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 44: Asia Pacific Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 45: Asia Pacific Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Table 46: Asia Pacific Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Table 47: Middle East & Africa Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Table 48: Middle East & Africa Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Table 49: Middle East & Africa Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Table 50: Middle East & Africa Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Table 51: Middle East & Africa Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Table 52: Middle East & Africa Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Table 53: Middle East & Africa Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Table 54: Middle East & Africa Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Table 55: Middle East & Africa Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 56: Middle East & Africa Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 57: Middle East & Africa Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Table 58: Middle East & Africa Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Table 59: South America Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Table 60: South America Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Table 61: South America Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Table 62: South America Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Table 63: South America Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Table 64: South America Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Table 65: South America Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Table 66: South America Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Table 67: South America Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 68: South America Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 69: South America Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Table 70: South America Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

List of Figures

Figure 1: Global Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Figure 2: Global Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Figure 3: Global Non-combustible Cladding Market Incremental Opportunity, by Type, 2021-2031

Figure 4: Global Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Figure 5: Global Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Figure 6: Global Non-combustible Cladding Market Incremental Opportunity, by Material,2021-2031

Figure 7: Global Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Figure 8: Global Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Figure 9: Global Non-combustible Cladding Market Incremental Opportunity, by Application, 2021-2031

Figure 10: Global Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Figure 11: Global Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Figure 12: Global Non-combustible Cladding Market Incremental Opportunity, by End-use, 2021-2031

Figure 13: Global Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 14: Global Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 15: Global Non-combustible Cladding Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 16: Global Non-combustible Cladding Market Value, by Region, US$ Mn, 2017-2031

Figure 17: Global Non-combustible Cladding Market Volume, by Region, Thousand Units, 2017-2031

Figure 18: Global Non-combustible Cladding Market Incremental Opportunity, by Region, 2021-2031

Figure 19: North America Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Figure 20: North America Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Figure 21: North America Non-combustible Cladding Market Incremental Opportunity, by Type, 2021-2031

Figure 22: North America Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Figure 23: North America Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Figure 24: North America Non-combustible Cladding Market Incremental Opportunity, by Material, 2021-2031

Figure 25: North America Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Figure 26: North America Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Figure 27: North America Non-combustible Cladding Market Incremental Opportunity, by Application, 2021-2031

Figure 28: North America Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Figure 29: North America Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Figure 30: North America Non-combustible Cladding Market Incremental Opportunity, by End-use, 2021-2031

Figure 31: North America Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 32: North America Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 33: North America Non-combustible Cladding Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 34: North America Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Figure 35: North America Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Figure 36: North America Non-combustible Cladding Market Incremental Opportunity, by Country, 2021-2031

Figure 37: Europe Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Figure 38: Europe Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Figure 39: Europe Non-combustible Cladding Market Incremental Opportunity, by Type, 2021-2031

Figure 40: Europe Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Figure 41: Europe Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Figure 42: Europe Non-combustible Cladding Market Incremental Opportunity, by Material, 2021-2031

Figure 43: Europe Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Figure 44: Europe Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Figure 45: Europe Non-combustible Cladding Market Incremental Opportunity, by Application, 2021-2031

Figure 46: Europe Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Figure 47: Europe Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Figure 48: Europe Non-combustible Cladding Market Incremental Opportunity, by End-use, 2021-2031

Figure 49: Europe Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 50: Europe Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 51: Europe Non-combustible Cladding Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 52: Europe Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Figure 53: Europe Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Figure 54: Europe Non-combustible Cladding Market Incremental Opportunity, by Country, 2021-2031

Figure 55: Asia Pacific Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Figure 56: Asia Pacific Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Figure 57: Asia Pacific Non-combustible Cladding Market Incremental Opportunity, by Type, 2021-2031

Figure 58: Asia Pacific Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Figure 59: Asia Pacific Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Figure 60: Asia Pacific Non-combustible Cladding Market Incremental Opportunity, by Material, 2021-2031

Figure 61: Asia Pacific Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Figure 62: Asia Pacific Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Figure 63: Asia Pacific Non-combustible Cladding Market Incremental Opportunity, by Application, 2021-2031

Figure 64: Asia Pacific Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Figure 65: Asia Pacific Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Figure 66: Asia Pacific Non-combustible Cladding Market Incremental Opportunity, by End-use, 2021-2031

Figure 67: Asia Pacific Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 68: Asia Pacific Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 69: Asia Pacific Non-combustible Cladding Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 70: Asia Pacific Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Figure 71: Asia Pacific Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Figure 72: Asia Pacific Non-combustible Cladding Market Incremental Opportunity, by Country, 2021-2031

Figure 73: Middle East & Africa Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Figure 74: Middle East & Africa Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Figure 75: Middle East & Africa Non-combustible Cladding Market Incremental Opportunity, by Type, 2021-2031

Figure 76: Middle East & Africa Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Figure 77: Middle East & Africa Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Figure 78: Middle East & Africa Non-combustible Cladding Market Incremental Opportunity, by Material, 2021-2031

Figure 79: Middle East & Africa Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Figure 80: Middle East & Africa Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Figure 81: Middle East & Africa Non-combustible Cladding Market Incremental Opportunity, by Application, 2021-2031

Figure 82: Middle East & Africa Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Figure 83: Middle East & Africa Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Figure 84: Middle East & Africa Non-combustible Cladding Market Incremental Opportunity, by End-use, 2021-2031

Figure 85: Middle East & Africa Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 86: Middle East & Africa Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 87: Middle East & Africa Non-combustible Cladding Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 88: Middle East & Africa Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Figure 89: Middle East & Africa Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Figure 90: Middle East & Africa Non-combustible Cladding Market Incremental Opportunity, by Country, 2021-2031

Figure 91: South America Non-combustible Cladding Market Value, by Type, US$ Mn, 2017-2031

Figure 92: South America Non-combustible Cladding Market Volume, by Type, Thousand Units, 2017-2031

Figure 93: South America Non-combustible Cladding Market Incremental Opportunity, by Type, 2021-2031

Figure 94: South America Non-combustible Cladding Market Value, by Material, US$ Mn, 2017-2031

Figure 95: South America Non-combustible Cladding Market Volume, by Material, Thousand Units, 2017-2031

Figure 96: South America Non-combustible Cladding Market Incremental Opportunity, by Material, 2021-2031

Figure 97: South America Non-combustible Cladding Market Value, by Application, US$ Mn, 2017-2031

Figure 98: South America Non-combustible Cladding Market Volume, by Application, Thousand Units, 2017-2031

Figure 99: South America Non-combustible Cladding Market Incremental Opportunity, by Application, 2021-2031

Figure 100: South America Non-combustible Cladding Market Value, by End-use, US$ Mn, 2017-2031

Figure 101: South America Non-combustible Cladding Market Volume, by End-use, Thousand Units, 2017-2031

Figure 102: South America Non-combustible Cladding Market Incremental Opportunity, by End-use, 2021-2031

Figure 103: South America Non-combustible Cladding Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 104: South America Non-combustible Cladding Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 105: South America Non-combustible Cladding Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 106: South America Non-combustible Cladding Market Value, by Country, US$ Mn, 2017-2031

Figure 107: South America Non-combustible Cladding Market Volume, by Country, Thousand Units, 2017-2031

Figure 108: South America Non-combustible Cladding Market Incremental Opportunity, by Country, 2021-2031