High Demand for Non-invasive NASH Treatment to Augment Market

Over the past couple of decades, the number of obesity, diabetes, and non-alcoholic fatty liver diseases (NAFLD) cases have increased at a rapid pace. The range of NAFLD extends from steatosis to non-alcoholic steatohepatitis (NASH). The rise in the prevalence of NAFLD has caused a great amount of economic burden on nations worldwide and as per trends, patients suffering from NAFLD-related diseases have emerged as one of the major subset of people requiring liver transplant. One of the major factors that is likely to propel the adoption of NASH biomarker is the high prevalence of NAFLD and the undesirable outcomes. The adoption of conventional techniques to address NAFLD such as biopsy is steadily declining due to limitations, including sampling bias, complications such as pain, bleeding, mortality, and poor acceptability.

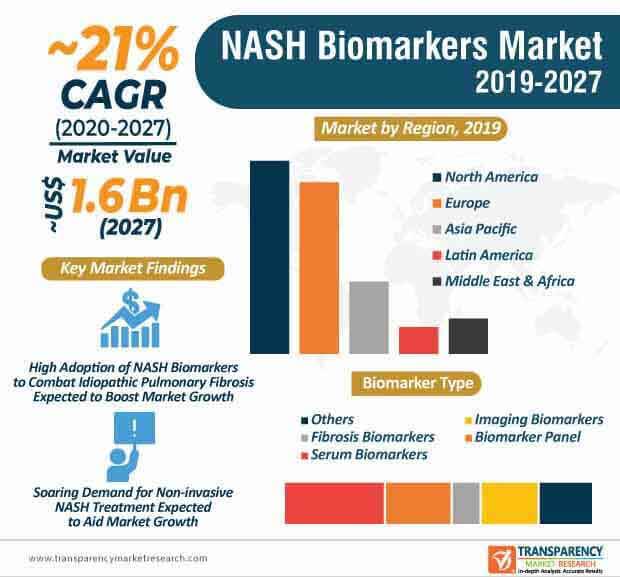

The demand for non-invasive techniques to treat NAFLD has witnessed a consistent growth over the past decade. Non-invasive techniques that have gained significant popularity to combat NAFLD include NASH, NAFLD-based fibrosis, and steatosis, among others. The surge in demand for these non-invasive techniques is expected to boost the demand for NASH biomarkers during the forecast period. In recent times, players operating in the global NASH biomarkers are increasingly investigating the algorithms that consist non-imaging and imaging biomarkers to diagnose fibrosis and minimize biopsies in clinical settings. Technological advancements, research and development activities coupled with high prevalence of NAFLD are some of major factors that are likely to drive the expansion of the non-alcoholic steatohepatitis (NASH) biomarkers market during the assessment period. At the back of these factors, the global non-alcoholic steatohepatitis (NASH) biomarkers market is expected to attain a market value of ~US$ 2 Bn by the end of 2027.

Adoption of NASH Biomarkers to Address Idiopathic Pulmonary Fibrosis

Advancements in the healthcare sector, along with research activities are likely to play a key role in the growth of the global non-alcoholic steatohepatitis (NASH) biomarkers market. In recent times, a considerable amount of research has been undertaken in discovering the potential treatments for idiopathic pulmonary fibrosis (IPF). In the past decade, the progression from NAFLD to NASH has increased at a rapid pace and has emerged as one of the most prevalent chronic liver conditions particularly in the Western regions, including North America and Europe– a factor due to which the production of NASH biomarkers is set to witness a considerable growth.

At present, while researchers are increasingly focusing on improving the efficacy of NASH biomarkers, healthcare providers, medical professionals, and healthcare workers are projected to increase awareness regarding NASH. Medical experts are of the opinion that the prevalence of NASH is set to grow at a rapid pace in the coming decade due to which, robust measures are required to combat the same. Public health groups, along with government organizations particularly in developed regions are focusing on formulating new guidelines that govern the management of NASH. Innovations within the non-alcoholic steatohepatitis (NASH) biomarkers market are primarily targeting improvements in non-invasive screening and diagnostic testing. In addition, companies operating in the current market landscape are increasingly focusing on different molecules for the treatment of NASH. Moreover, at present, while a large number of drugs are in phase three trials, multiple drugs are in the pipeline across world. Companies operating in the current market landscape are primarily focusing on replacing painful and invasive biopsies with non-invasive NASH biomarkers. The launch of the new project by the Foundation for the National Institutes of Health (FNIH) Biomarkers Consortium aimed toward standardizing biological markers to improve the diagnosis of NASH. The Non-Invasive Biomarkers of Metabolic Liver Disease project is expected to make a direct comparison between conventional and non-conventional techniques to address NASH and suggest the best tools to diagnose NASH. Such projects are expected to promote the sales of NASH biomarkers during the forecast period and thus, will augment the growth of the non-alcoholic steatohepatitis (NASH) biomarkers market.

Companies Adapt, Adjust, and Assess Pipeline Products, Seek FDA Approval

The advent of the novel coronavirus pandemic is expected to create major roadblocks for companies operating in the current non-alcoholic steatohepatitis (NASH) biomarkers market. Mobilization of researchers, front-line clinicians, manufacturers, and other participants in the value chain has emerged as a major area of concern amidst the chaos. On the heels of the health and economic crisis worldwide, The Global Liver Institute, recently revealed its plans to address the global pandemic by adapting and provide creative solutions. While supply chains within the non-alcoholic steatohepatitis (NASH) biomarkers market are likely to be disrupted, companies should focus on formulating effective business continuity strategies and focus on product diversification to address the business challenges put forward by the global pandemic.

Analysts’ Viewpoint

The global non-alcoholic steatohepatitis (NASH) biomarkers market is expected to grow at a staggering CAGR of ~21% during the forecast period. The market growth can be attributed to a host of factors, including high demand for non-invasive techniques to address NASH, research and development activities, government support for the development of NASH biomarkers, and high focus on curbing the prevalence of diabetes and NAFLD. Market players are anticipated to focus on the development of new NASH biomarkers and attain the approval from the FDA. Moreover, North America and Europe are likely to be the hotbeds of development within the global non-alcoholic steatohepatitis (NASH) biomarkers market.

Non-alcoholic Steatohepatitis (NASH) Biomarkers Market: Overview

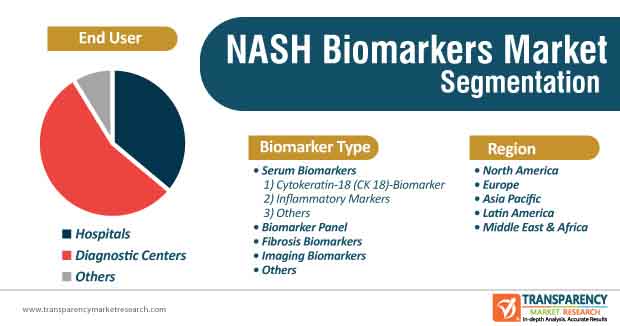

Non-alcoholic Steatohepatitis (NASH) Biomarkers Market: Segmentation

Non-alcoholic Steatohepatitis (NASH) Biomarkers Market: Regional Segmentation

Non-alcoholic Steatohepatitis (NASH) Biomarkers Market: Major Players

Non-alcoholic steatohepatitis biomarkers market to reach valuation of value of ~US$ 2 Bn by the end of 2027

Non-alcoholic steatohepatitis biomarkers market is expected to grow at a staggering CAGR of ~21% during 2019 - 2027

Non-alcoholic steatohepatitis biomarkers market is driven by the increase in prevalence of NAFLD & NASH disease

North America accounted for a major share of the global non-alcoholic steatohepatitis biomarkers market

Key players in the global non-alcoholic steatohepatitis biomarkers market include Biopredictive, Quest Diagnostics, Exalenz Bioscience Ltd, GENFIT, Siemens Healthineers

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Non-alcoholic Steatohepatitis Biomarkers Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with Key countries

5.2. Regulatory Scenario by Region/globally

5.3. Pipeline Analysis

6. Global Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast, by Biomarker Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Biomarker Type, 2017–2027

6.3.1. Serum Biomarkers

6.3.1.1. Cytokeratin-18 (CK 18) Marker

6.3.1.2. Inflammatory markers

6.3.1.3. Others

6.3.2. Biomarker Panel

6.3.3. Fibrosis Biomarkers

6.3.4. Imaging Biomarkers

6.3.5. Others

6.4. Market Attractiveness Analysis, by Biomarker Type

7. Global Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by End-user, 2017–2027

7.3.1. Hospitals

7.3.2. Diagnostic Centers

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Biomarker Type, 2017–2027

9.2.1. Serum Biomarkers

9.2.1.1. Cytokeratin-18 (CK 18) Marker

9.2.1.2. Inflammatory Markers

9.2.1.3. Others

9.2.2. Biomarker Panel

9.2.3. Fibrosis Biomarkers

9.2.4. Imaging Biomarkers

9.2.5. Others

9.3. North America Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by End-user, 2017–2027

9.3.1. Hospitals

9.3.2. Diagnostic Centers

9.3.3. Others

9.4. North America Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Country, 2017–2027

9.4.1. U.S.

9.4.2. Canada

9.5. North America Non-alcoholic Steatohepatitis Biomarkers Market Attractiveness Analysis

9.5.1. By Biomarker Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Biomarker Type, 2017–2027

10.2.1. Serum Biomarkers

10.2.1.1. Cytokeratin-18 (CK 18) Marker

10.2.1.2. Inflammatory Markers

10.2.1.3. Others

10.2.2. Biomarker Panel

10.2.3. Fibrosis Biomarkers

10.2.4. Imaging Biomarkers

10.2.5. Others

10.3. Europe Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by End-user, 2017–2027

10.3.1. Hospitals

10.3.2. Diagnostic Centers

10.3.3. Others

10.4. Europe Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Country/Sub-region, 2017–2027

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Europe Non-alcoholic Steatohepatitis Biomarkers Market Attractiveness Analysis

10.5.1. By Biomarker Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Biomarker Type, 2017–2027

11.2.1. Serum Biomarkers

11.2.1.1. Cytokeratin-18 (CK 18) Marker

11.2.1.2. Inflammatory Markers

11.2.1.3. Others

11.2.2. Biomarker Panel

11.2.3. Fibrosis Biomarkers

11.2.4. Imaging Biomarkers

11.2.5. Others

11.3. Asia Pacific Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by End-user, 2017–2027

11.3.1. Hospitals

11.3.2. Diagnostic Centers

11.3.3. Others

11.4. Asia Pacific Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Country/Sub-region, 2017–2027

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Non-alcoholic Steatohepatitis Biomarkers Market Attractiveness Analysis

11.5.1. By Biomarker Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Biomarker Type, 2017–2027

12.2.1. Serum Biomarkers

12.2.1.1. Cytokeratin-18 (CK 18) Marker

12.2.1.2. Inflammatory Markers

12.2.1.3. Others

12.2.2. Biomarker Panel

12.2.3. Fibrosis Biomarkers

12.2.4. Imaging Biomarkers

12.2.5. Others

12.3. Latin America Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by End-user, 2017–2027

12.3.1. Hospitals

12.3.2. Diagnostic Centers

12.3.3. Others

12.4. Latin America Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Country/Sub-region, 2017–2027

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Non-alcoholic Steatohepatitis Biomarkers Market Attractiveness Analysis

12.5.1. By Biomarker Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Non-alcoholic Steatohepatitis Biomarkers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Biomarker Type, 2017–2027

13.2.1. Serum Biomarkers

13.2.1.1. Cytokeratin-18 (CK 18) Marker

13.2.1.2. Inflammatory Markers

13.2.1.3. Others

13.2.2. Biomarker Panel

13.2.3. Fibrosis Biomarkers

13.2.4. Imaging Biomarkers

13.2.5. Others

13.3. Middle East & Africa Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by End-user, 2017–2027

13.3.1. Hospitals

13.3.2. Diagnostics Centers

13.3.3. Others

13.4. Middle East & Africa Non-alcoholic Steatohepatitis Biomarkers Market Value Forecast, by Country/Sub-region, 2017–2027

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Middle East & Africa Non-alcoholic Steatohepatitis Biomarkers Market Attractiveness Analysis

13.5.1. By Biomarker Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competitive Landscape

14.1. Market Share Analysis, by Company, 2018

14.2. Company Profiles

14.2.1. Biopredictive

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Product Portfolio

14.2.1.3. Strategic Overview

14.2.1.4. SWOT Analysis

14.2.2. Quest Diagnostics

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Financial Overview

14.2.2.3. Product Portfolio

14.2.2.4. Strategic Overview

14.2.2.5. SWOT Analysis

14.2.3. Exalenz Bioscience Ltd

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Financial Overview

14.2.3.3. Product Portfolio

14.2.3.4. Strategic Overview

14.2.3.5. SWOT Analysis

14.2.4. GENFIT

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Financial Overview

14.2.4.3. Product Portfolio

14.2.4.4. Strategic Overview

14.2.4.5. SWOT Analysis

14.2.5. Siemens Healthineers

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Financial Overview

14.2.5.3. Product Portfolio

14.2.5.4. Strategic Overview

14.2.5.5. SWOT Analysis

14.2.6. ONE WAY LIVER, S.L

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Product Portfolio

14.2.6.3. Strategic Overview

14.2.6.4. SWOT Analysis

14.2.7. Prometheus Laboratories Inc.

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Product Portfolio

14.2.7.3. Strategic Overview

14.2.7.4. SWOT Analysis

14.2.8. Gilead Sciences Ltd.

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Financial Overview

14.2.8.3. Product Portfolio

14.2.8.4. Strategic Overview

14.2.8.5. SWOT Analysis

List of Tables

Table 01: Opportunity Map, by Biomarker Type, 2018

Table 03: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast, by Biomarker Type, 2017–2027

Table 04: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast, by Serum Biomarker Type, 2017–2027

Table 05: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 06: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast, by Region, 2017–2027

Table 07: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Biomarker Type, 2017–2027

Table 08: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Serum Biomarker Type, 2017–2027

Table 09: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 10: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 11: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Biomarker Type, 2017–2027

Table 12: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Serum Biomarker Type, 2017–2027

Table 13: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 14: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 15: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Biomarker Type, 2017–2027

Table 16: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Serum Biomarker Type, 2017–2027

Table 17: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 18: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 19: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Biomarker Type, 2017–2027

Table 20: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Serum Biomarker Type, 2017–2027

Table 21: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 22: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 23: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Biomarker Type, 2017–2027

Table 24: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Serum Biomarker Type, 2017–2027

Table 25: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 26: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Non-alcoholic Steatohepatitis Market Size (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Market Share Analysis, by Region, 2018

Figure 03: Global Non-alcoholic Steatohepatitis Biomarker Market Revenue Projection (US$ Mn), 2017–2027

Figure 04 : Market Value Share, by Biomarker Type, 2018

Figure 05: Market Value Share, by End-user, 2018

Figure 06: Market Value Share, by Region, 2018

Figure 07: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Biomarker Type, 2018 and 2027

Figure 08: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Biomarker Type, 2019–2027

Figure 09: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Serum Biomarkers, 2017–2027

Figure 10: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Biomarker Panel, 2017–2027

Figure 11: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Fibrosis Biomarkers, 2017–2027

Figure 12: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Imaging Biomarkers , 2017–2027

Figure 13: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2027

Figure 14: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by End-user, 2018 and 2027

Figure 15: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by End-user, 2019–2027

Figure 16: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2019–2027

Figure 17: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diagnostic Centers, 2019–2027

Figure 18: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2019–2027

Figure 19: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Region, 2018 and 2027

Figure 20: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Region, 2019–2027

Figure 21: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2019–2027

Figure 22: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Biomarker Type, 2018 and 2027

Figure 23: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Biomarker Type, 2019–2027

Figure 24: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by End-user, 2018 and 2027

Figure 25: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by End-user, 2019–2027

Figure 26: North America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Country, 2018 and 2027

Figure 27: North America Non-alcoholic Steatohepatitis ( NASH) Biomarkers Market Attractiveness, by Country, 2019–2027

Figure 28: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2019–2027

Figure 29: Europe Non-alcoholic Steatohepatitis ( NASH) Biomarkers Market Value Share, by Biomarker Type, 2018 and 2027

Figure 30: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Biomarker Type, 2019–2027

Figure 31: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by End-user, 2018 and 2027

Figure 32: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by End-user, 2019–2027

Figure 33: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 34: Europe Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 35: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2019–2027

Figure 36: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Biomarker Type, 2018 and 2027

Figure 37: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Biomarker Type, 2019–2027

Figure 38: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by End-user, 2018 and 2027

Figure 39: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by End-user, 2019–2027

Figure 40: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 41: Asia Pacific Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 42: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2019–2027

Figure 43: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Biomarker Type, 2018 and 2027

Figure 44: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Biomarker Type, 2019–2027

Figure 45: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by End-user, 2018 and 2027

Figure 46: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by End-user, 2019–2027

Figure 47: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 48: Latin America Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 49: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2019–2027

Figure 50: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Biomarker Type, 2018 and 2027

Figure 51: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Biomarker Type, 2019–2027

Figure 52: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by End-user, 2018 and 2027

Figure 53: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by End-user, 2019–2027

Figure 54: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 55: Middle East & Africa Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 56: Global Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Position Analysis, by Company (2018)

Figure 57: Quest Diagnostics, Research & Development (US$ Mn), 2016–2018

Figure 58: Quest Diagnostics, Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 59: Quest Diagnostics, Breakdown of Net Sales, by Business Segment, 2018

Figure 60: Exalenz Bioscience Ltd , Breakdown of Net Sales, by Region, 2018

Figure 61: Exalenz Bioscience Ltd , Research & Development (US$ Mn), 2016–2018

Figure 62: Exalenz Bioscience Ltd , Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 63: Exalenz Bioscience Ltd , Breakdown of Net Sales, by Business Segment, 2018

Figure 64: GENFIT, Breakdown of Net Sales, by Region, 2018

Figure 65: GENFIT, Research & Development (US$ Mn), 2016–2018

Figure 66: GENFIT, Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 67: GENFIT, Breakdown of Net Sales, by Business Segment, 2018

Figure 68: Siemens Healthineers, Breakdown of Net Sales, by Region, 2018

Figure 69: Siemens Healthineers, Research & Development (US$ Mn), 2016–2018

Figure 70: Siemens Healthineers, Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 71: Siemens Healthineers, Breakdown of Net Sales, by Business Segment, 2018

Figure 72: Gilead Sciences, Inc., Breakdown of Net Sales, by Region, 2018

Figure 73: Gilead Sciences, Inc., Research & Development (US$ Mn), 2016–2018

Figure 74: Gilead Sciences, Inc., Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 75: Gilead Sciences, Inc., Breakdown of Net Sales, by Business Segment, 2018