Over the years, the nisin market has been showing consistent development. The market is picking up force from the expanding interest in natural food preservatives over the globe. The rising concept of organic farming far and wide has in this manner has opened doors for the nisin market. Other than this, expanding global populace, fast industrialization, and the interest in spotless and new water are the main market drivers. Thus, the nisin market is projected to show substantial growth during the forecast period of 2019-2028.

The report on nisin market by Transparency Market Research has many aspects that can help the stakeholders design the future strategy of their business. Transparency Market Research presents the various aspects of the nisin market such as competitive landscape, regional segmentation, latest trends, and others in a systematic manner to the stakeholders. Furthermore, the predictions are based on real-time data and extensive research. According to the analysis conducted by Transparency Market Research, the nisin market is anticipated to expand at a CAGR of ~5% during the forecast period of 2019-2028. The nisin market is estimated to reach ~US$ 297 Mn by 2028.

Food adulteration is the key concern around the world. The rising incidences of food adulteration have compelled the regulatory bodies to put forth norms to control food contamination. This has been invigorating a significant wave of optimism in the nisin market. The consumer shift towards synthesized food preservatives over the past few years has stirred optimism among nisin manufacturers. In addition, such efforts have paved the way for natural food preservatives. The need for exploring the rancidity-control property of nisin has been subjected to scientific discussions on its role in curbing serious public health issues among the global populace. For instance, the extensive use of synthetic food preservatives may lead to several health issues related to the stomach and intestines. The use of natural preservatives in food items is recommended by clinicians. The prevalence of organic farming in developing countries of the world is also a key factor bolstering the nisin market growth. Increased focus on the application of nisin in various processes involved in the food and beverages industry has also boosted the demand.

The adoption of nisin in food preservatives has caught steam among the global populace. This aspect has spurred new avenues for nisin makers to tap into the growth prospects of the vitamin deficiency treatment market. This has considerably fueled the prospects of various products using nisin as the main constituent. For instance, the growing demand for anti-bacterial formulation in treating human ulcers and mastitis among cattle has augmented the growth of the nisin market.

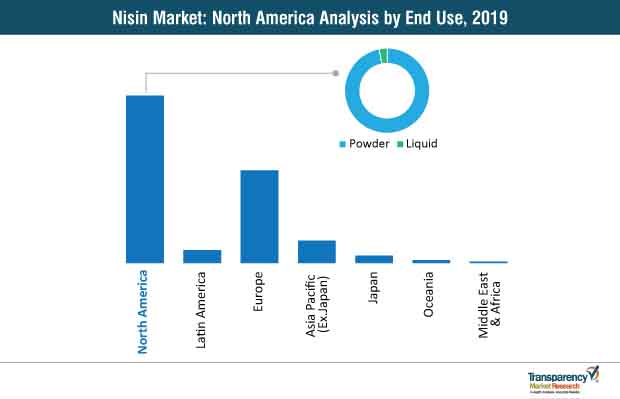

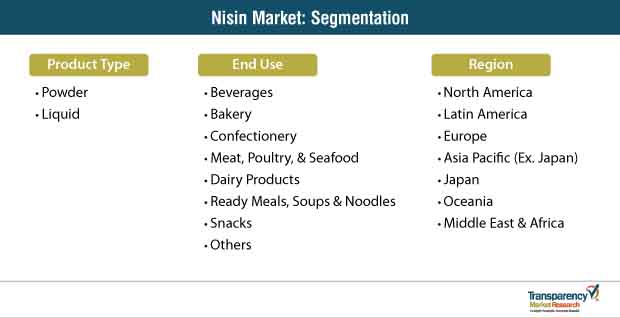

Market players are focused on improving the efficacy of preservatives to meet the needs of the consumers. Players are benefitting from the increasing trend of clean label products. Among the various end-users food and beverage industry has witnessed substantial opportunities. The increasing number of consumers opting for natural and clean labeled products is also boosting the market. Over the past few years, nisin is found in liquid and powdered form. However liquid nisin segment has been projected to show exponential growth in the nisin market.

Countries are constantly updating the research activities related to the use of natural preservatives in food products. This has given scope to innovations in the area of preservatives. The growing efforts of government bodies in developed and developing countries to promote natural and safe eating habits will open new avenues in the nisin market over the not-so-distant future. This has been made possible with the approval of nisin as a safe food preservative in commercial use. North America leads the nisin market by holding the major chunk of the market share that accounts for ~54% whereas, Europe holds ~23%of the market share.

Strategic collaborations are also crucial for the growth of the nisin market. The players indulge in mergers, acquisitions, joint ventures, and partnerships. These activities assist in increasing the influence of the players in the nisin market.

Nisin Market is estimated to rise at a CAGR of 5% during forecast period

Growing application in the pharmaceutical to spell growth for nisin market

Asia Pacific is more attractive region for vendors in the Nisin Market

Some of the leading players dominating the global nisin market are Shandong Freda Biotechnology Co., Ltd., Royal DSM N.V., Chihon Biotechnology Co., Ltd., Danisco A/S, Zhejiang Silver-Elephant Bio-engineering Co. Ltd, and MAYASAN Food Industries A.S.

Beverages, Bakery, Confectionery, Meat, Poultry and Seafood, Dairy Products, Ready Meals, Soups and Noodles, Snacks are the end-use segments in the Nisin Market

1. Global Nisin in Food & Beverage Market - Executive Summary

1.1. Global Nisin in Food & Beverage Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Food Items across Globe

3.1.2. Global and Regional Per Capita Food Consumption

3.1.3. Population of Key Countries

3.1.4. Food and Beverage Industry Overview

3.2. Trend for Preservation

3.2.1. Natural Preservation

3.2.2. Artificial Preservation

3.3. Drivers

3.3.1. Economic Drivers

3.3.2. Supply Side Drivers

3.3.3. Demand Side Drivers

3.4. Market Restraints

3.4.1. Regulatory concerns

3.4.2. Supply chain issues

3.4.3. Others

3.5. Market Trends

3.6. Trend Analysis- Impact on Time Line (2018-2027)

3.7. Forecast Factors – Relevance and Impact

3.8. Key Regulations By Regions

4. Associated Industry and Key Indicator Assessment

4.1. Food Additives Industry Overview

4.1.1. Market Size and Forecast

4.1.2. Market Size and Y-o-Y Growth

4.1.3. Absolute $ Opportunity

5. Global Nisin in Food & Beverage Market Pricing Analysis

5.1. Price Point Assessment by Form

5.2. Regional Average Pricing Analysis

5.2.1. North America

5.2.2. Latin America

5.2.3. Europe

5.2.4. Asia Pacific Ex. Japan (APEJ)

5.2.5. Japan

5.2.6. Oceania

5.2.7. Middle East and Africa

5.3. Price Forecast till 2027

5.4. Factors Influencing Pricing

6. Global Nisin in Food & Beverage Market Analysis and Forecast

6.1. Market Size Analysis (2013-2016) and Forecast (2018-2026)

6.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

6.1.2. Absolute $ Opportunity

6.2. Global Nisin in Food & Beverage Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

6.2.1. Forecast Factors and Relevance of Impact

6.2.2. Regional Nisin in Food & Beverage Market Business Performance Summary

7. Global Nisin in Food & Beverage Market Analysis By Form

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison By Form

7.1.2. Basis Point Share (BPS) Analysis By Form

7.2. Nisin in Food & Beverage Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2017-2026) By Form

7.2.1. Powder

7.2.1.1. Beverages

7.2.1.2. Bakery

7.2.1.3. Confectionery

7.2.1.4. Meat, Poultry & Seafood

7.2.1.5. Dairy Products

7.2.1.6. Ready Meals, Soups & Noodles

7.2.1.7. Snacks

7.2.1.8. Others

7.2.2. Liquid

7.2.2.1. Beverages

7.2.2.2. Bakery

7.2.2.3. Confectionery

7.2.2.4. Meat, Poultry & Seafood

7.2.2.5. Dairy Products

7.2.2.6. Ready Meals, Soups & Noodles

7.2.2.7. Snacks

7.2.2.8. Others

7.3. Market Attractiveness Analysis By Form

8. Global Nisin in Food & Beverage Market Analysis By End Use

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By End Use

8.1.2. Basis Point Share (BPS) Analysis By End Use

8.2. Nisin in Food & Beverage Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2026) By End Use

8.2.1. Beverages

8.2.2. Bakery

8.2.3. Confectionery

8.2.4. Meat, Poultry & Seafood

8.2.5. Dairy Products

8.2.6. Ready Meals, Soups & Noodles

8.2.7. Snacks

8.2.8. Others

8.3. Market Attractiveness Analysis By End Use

9. Global Nisin in Food & Beverage Market Analysis and Forecast, By Region

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Region

9.1.2. Y-o-Y Growth Projections By Region

9.2. Nisin in Food & Beverage Market Size (US$ Mn) and Volume (MT) & Forecast (2018-2026) Analysis By Region

9.2.1. North America

9.2.2. Europe

9.2.3. APEJ

9.2.4. Japan

9.2.5. Oceania

9.2.6. Latin America

9.2.7. Middle East and Africa

9.3. Market Attractiveness Analysis By Region

10. North America Nisin in Food & Beverage Market Analysis and Forecast

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Country

10.1.2. Y-o-Y Growth Projections By Country

10.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

10.2.1. Market Attractiveness By Country

10.2.1.1. U.S.

10.2.1.2. Canada

10.2.2. By Form

10.2.3. By End Use

10.3. Market Attractiveness Analysis

10.3.1. By Country

10.3.2. By Form

10.3.3. By End Use

10.4. Drivers and Restraints: Impact Analysis

11. Latin America Nisin in Food & Beverage Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.1.3. Key Regulations

11.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

11.2.1. By Country

11.2.1.1. Brazil

11.2.1.2. Mexico

11.2.1.3. Chile

11.2.1.4. Peru

11.2.1.5. Argentina

11.2.1.6. Rest of Latin America

11.2.2. By Form

11.2.3. By End Use

11.3. Market Attractiveness Analysis

11.3.1. By Country

11.3.2. By Form

11.3.3. By End Use

11.4. Drivers and Restraints: Impact Analysis

12. Europe Nisin in Food & Beverage Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.1.3. Key Regulations

12.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2012-2018) and Forecast (2018-2026)

12.2.1. By Country

12.2.1.1. EU-4 (Germany, France, Italy, Spain)

12.2.1.2. U.K.

12.2.1.3. BENELUX

12.2.1.4. Nordic

12.2.1.5. Russia

12.2.1.6. Poland

12.2.1.7. Rest of Europe

12.2.2. By Form

12.2.3. By End Use

12.3. Market Attractiveness Analysis

12.3.1. By Country

12.3.2. By Form

12.3.3. By End Use

12.4. Drivers and Restraints: Impact Analysis

13. APEJ Nisin in Food & Beverage Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.1.3. Key Regulations

13.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

13.2.1. By Country

13.2.1.1. India

13.2.1.2. China

13.2.1.3. South Korea

13.2.1.4. South East Asia (ASEAN)

13.2.1.4.1. Thailand

13.2.1.4.2. Indonesia

13.2.1.4.3. Malaysia

13.2.1.4.4. Philippines

13.2.1.4.5. Other ASEAN Countries

13.2.1.5. Others

13.2.2. By Form

13.2.3. By End Use

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By Form

13.3.3. By End Use

13.4. Drivers and Restraints: Impact Analysis

14. Japan Nisin in Food & Beverage Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

14.2.1. By Form

14.2.2. By End Use

14.3. Market Attractiveness Analysis

14.3.1. By Form

14.3.2. By End Use

14.4. Drivers and Restraints: Impact Analysis

15. Oceania Nisin in Food & Beverage Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

15.2.1. By Form

15.2.2. By End Use

15.3. Market Attractiveness Analysis

15.3.1. By Form

15.3.2. By End Use

15.4. Drivers and Restraints: Impact Analysis

16. Middle East and Africa (MEA) Nisin in Food & Beverage Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

16.2.1. By Country

16.2.1.1. GCC Countries

16.2.1.2. South Africa

16.2.1.3. North Africa

16.2.1.4. Rest of MEA

16.2.2. By Form

16.2.3. By End Use

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By Form

16.3.3. By End Use

16.4. Drivers and Restraints: Impact Analysis

17. Thailand Nisin in Food & Beverage Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis

17.1.2. Y-o-Y Growth Projections

17.1.3. Key Regulations

17.2. Nisin in Food & Beverage Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2017-2026)

17.2.1. By Form

17.2.2. By End Use

17.3. Market Attractiveness Analysis

17.3.1. By Form

17.3.2. By End Use

18. Recommendation – Critical Success Factors

List of Tables

Table 01: Global Nisin Market Value (US$ Mn) by Region, 2019 & 2028

Table 02: Global Nisin Market Volume (MT) by Region, 2019 & 2028

Table 03: Global Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 04: Global Nisin Market Volume (MT) by Form, 2019 & 2028

Table 05: Global Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 06: Global Nisin Market Volume (MT) by Form, 2019 & 2028

Table 07: Global Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 08: Global Nisin Market Volume (MT) by Form, 2019 & 2028

Table 09: Global Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 10: Global Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 11: North America Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Table 12: North America Nisin Market Volume (MT) by Country, 2019 & 2028

Table 13: North America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 14: North America Nisin Market Volume (MT) by Form, 2019 & 2028

Table 15: North America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 16: North America Nisin Market Volume (MT) by Form, 2019 & 2028

Table 17: North America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 18: North America Nisin Market Volume (MT) by Form, 2019 & 2028

Table 19: North America Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 20: North America Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 21: Latin America Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Table 22: Latin America Nisin Market Volume (MT) by Country, 2019 & 2028

Table 23: Latin America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 24: Latin America Nisin Market Volume (MT) by Form, 2019 & 2028

Table 25: Latin America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 26: Latin America Nisin Market Volume (MT) by Form, 2019 & 2028

Table 27: Latin America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 28: Latin America Nisin Market Volume (MT) by Form, 2019 & 2028

Table 29: Latin America Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 30: Latin America Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 31: Europe Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Table 32: Europe Nisin Market Volume (MT) by Country, 2019 & 2028

Table 33: Europe Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 34: Europe Nisin Market Volume (MT) by Form, 2019 & 2028

Table 35: Europe Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 36: Europe Nisin Market Volume (MT) by Form, 2019 & 2028

Table 37: Europe Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 38: Europe Nisin Market Volume (MT) by Form, 2019 & 2028

Table 39: Europe Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 40: Europe Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 41: APEJ Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Table 42: APEJ Nisin Market Volume (MT) by Country, 2019 & 2028

Table 43: APEJ Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 44: APEJ Nisin Market Volume (MT) by Form, 2019 & 2028

Table 45: APEJ Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 46: APEJ Nisin Market Volume (MT) by Form, 2019 & 2028

Table 47: APEJ Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 48: APEJ Nisin Market Volume (MT) by Form, 2019 & 2028

Table 49: APEJ Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 50: APEJ Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 51: Japan Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 52: Japan Nisin Market Volume (MT) by Form, 2019 & 2028

Table 53: Japan Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 54: Japan Nisin Market Volume (MT) by Form, 2019 & 2028

Table 55: Japan Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 56: Japan Nisin Market Volume (MT) by Form, 2019 & 2028

Table 57: Japan Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 58: Japan Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 59: Oceania Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Table 60: Oceania Nisin Market Volume (MT) by Country, 2019 & 2028

Table 61: Oceania Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 62: Oceania Nisin Market Volume (MT) by Form, 2019 & 2028

Table 63: Oceania Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 64: Oceania Nisin Market Volume (MT) by Form, 2019 & 2028

Table 65: Oceania Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 66: Oceania Nisin Market Volume (MT) by Form, 2019 & 2028

Table 67: Oceania Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 68: Oceania Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 69: MEA Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Table 70: MEA Nisin Market Volume (MT) by Country, 2019 & 2028

Table 71: MEA Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 72: MEA Nisin Market Volume (MT) by Form, 2019 & 2028

Table 73: MEA Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 74: MEA Nisin Market Volume (MT) by Form, 2019 & 2028

Table 75: MEA Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 76: MEA Nisin Market Volume (MT) by Form, 2019 & 2028

Table 77: MEA Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 78: MEA Nisin Market Volume (MT) by End Use, 2019 & 2028

Table 79: Thailand Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 80: Thailand Nisin Market Volume (MT) by Form, 2019 & 2028

Table 81: Thailand Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 82: Thailand Nisin Market Volume (MT) by Form, 2019 & 2028

Table 83: Thailand Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Table 84: Thailand Nisin Market Volume (MT) by Form, 2019 & 2028

Table 85: Thailand Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Table 86: Thailand Nisin Market Volume (MT) by End Use, 2019 & 2028

List of Figures

Figure 01: Global Nisin Market Value (US$ Mn) and Volume (MT) Forecast, 2018–2028

Figure 02: Global Nisin Market Absolute $ Opportunity (US$ Mn), 2018–2028

Figure 03: Global Nisin Market Value (US$ Mn) by Region, 2019 & 2028

Figure 04: Global Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 05: Global Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 06: Global Nisin Market Share (%) & BPS Analysis by Region, 2019 & 2028

Figure 07: Global Nisin Market Share (%) & BPS Analysis by Region, 2019 & 2028

Figure 08: Global Nisin Market Share (%) & BPS Analysis by Form, 2019 & 2028

Figure 09: Global Nisin Market Share (%) & BPS Analysis by Form, 2019 & 2028

Figure 10: Global Nisin Market Share (%) & BPS Analysis by End Use, 2019 & 2028

Figure 11: Global Nisin Market Share (%) & BPS Analysis by End Use, 2019 & 2028

Figure 12: Global Nisin Market Value (US$ Mn) by Region, 2019 & 2028

Figure 13: Global Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 14: Global Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 15: North America Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 16: North America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 17: North America Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 18: North America Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 19: North America Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 20: North America Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 21: North America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 22: North America Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 23: Latin America Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 24: Latin America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 25: Latin America Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 26: Latin America Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 27: Latin America Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 28: Latin America Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 29: Latin America Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 30: Latin America Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 31: Europe Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 32: Europe Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 33: Europe Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 34: Europe Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 35: Europe Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 36: Europe Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 37: Europe Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 38: Europe Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 39: APEJ Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 40: APEJ Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 41: APEJ Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 42: APEJ Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 43: APEJ Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 44: APEJ Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 45: APEJ Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 46: APEJ Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 47: Japan Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 48: Japan Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 49: Japan Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 50: Japan Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 51: Oceania Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 52: Oceania Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 53: Oceania Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 54: Oceania Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 55: Oceania Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 56: Oceania Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 57: Oceania Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 58: Oceania Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 59: MEA Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 60: MEA Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 61: MEA Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 62: MEA Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 63: MEA Nisin Market Share (%) & BPS Analysis by Country, 2019 & 2028

Figure 64: MEA Nisin Market Value (US$ Mn) by Country, 2019 & 2028

Figure 65: MEA Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 66: MEA Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 67: Thailand Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 68: Thailand Nisin Market Value (US$ Mn) by End Use, 2019 & 2028

Figure 69: Thailand Nisin Market Value (US$ Mn) by Form, 2019 & 2028

Figure 70: Thailand Nisin Market Value (US$ Mn) by End Use, 2019 & 2028