Global Night Vision Surveillance Cameras Market: Snapshot

The recurrent incidents of terror strikes have raised an alarm globally, compelling governments to explore technologies offering improved safety to their citizens. The rising cross border infiltration and growing fear of terrorism have created a market for products facilitating perpetual surveillance. As the situation surrounding global security worsens, the demand for night vision surveillance cameras is expected to rise, says TMR.

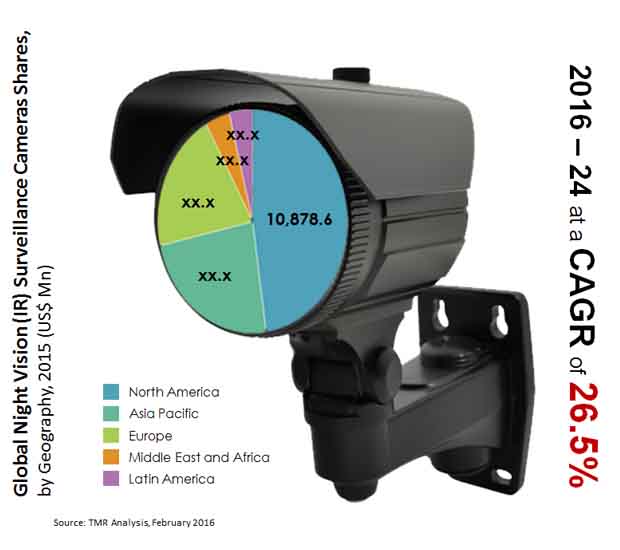

The increasing demand for secured borders, secured living premises, and secured access surges, will in response bolster opportunities for the global night vision surveillance cameras market. As per TMR, the global market is likely to pace at an exponential CAGR of 26.5% between 2015 and 2024. Benefitting from the growing security concerns and demand for uninterrupted surveillance, the global night vision (IR) surveillance cameras market, which stood at US$22.8 mn in 2015, is expected to reach US$175.8 mn by 2024.

Subsequent to the advent of latest technologies in the market, the price of night vision (IR) cameras is likely to fall at a significant rate. The market is also likely to gain from the increasing competition, as it encourages product innovation.

The demand for night vision cameras is expected to increase in response to the rising construction of smart homes. These homes are in general integrated with technologies that enable to control and detect any criminal activities. Gaining impetus from demand for advanced protection of offices, homes, and properties, the global night vision (IR) surveillance cameras market is poised to surge exponentially.

However, as online shopping makes inroads into lives of consumers, sellers are likely to emphasize more on aggressive pricing strategies. This could have an adverse impact on the market’s trajectory during the forecast period.

Defense and Public Sector Exhibits Highest Deployment of Night Vision Surveillance (IR) Cameras

Demand for night vision surveillance cameras is highest in the defense segment and the public sector. The recent instances of terror attacks on critical infrastructure, have brought their safety concerns at the fore. Banking, power, health, water supply, and communication systems have continued to remain at the target of sophisticated terror attacks. Any attack on critical infrastructure could make an economy highly vulnerable to further adversities. Ensuring their safety is therefore considered the foremost objective of any government. Proliferation of night vision (IR) surveillance cameras is therefore rapid across the public sector.

Beside terror attacks, rising concerns related to natural disasters, accidents, criminal activities, and accidents have also resulted in the high market share of this segment in the market.

Highest Demand for Night Vision Surveillance Cameras Witnessed in North America

Regionally, North America has been exhibiting the most attractive opportunities for the global night vision surveillance (IR) cameras market. TMR projects the regional market to expand at a CAGR of 27% during the forecast period. The higher spending of developed economies in North America on public sector and defense provides ripe opportunities for the sale of advanced security devices.

Other regional segments of the global night vision (IR) cameras include Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regions, the sale of night vision cameras in Europe has been increasing at a robust pace. It is further expected to increase owing to the high demand for intelligent video in the region. Besides this, the increasing manufacturing of surveillance products in Asia Pacific creates substantial opportunities for sale of surveillance cameras in the region.

Some of the most prominent companies operating in the global night vision (IR) surveillance cameras market include Axis Communications AB, Robert Bosch, GmBH, L-3 Communications Holdings, Pelco Corporation, BAE System Plc., and others. These companies mainly focus on product innovation and research and development to increase their profit margins in the market.

Table of Contents

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global Night Vision (IR) Surveillance Cameras Market Snapshot

2.2. Global Night Vision (IR) Surveillance Cameras Market Revenue and Volume, 2014 – 2024 (US$ Mn and Mn Units) and Year-on-Year Growth (%)

3. Global Night Vision (IR) Surveillance Cameras Market Analysis, 2014 – 2024 (US$ Mn and Mn Units)

3.1. Key Trends Analysis

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. Global Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

3.3.1. Box Cameras

3.3.2. Dome Cameras

3.3.3. Bullet Cameras

3.4. Global Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

3.4.1. PTZ (Pan, Tilt and Zoom)

3.4.2. Fixed

3.5. Global Night Vision (IR) Surveillance Cameras Market Analysis, By End-use Application, 2014 – 2024 (US$ Mn and Mn Units)

3.5.1. Retail

3.5.2. Business Organizations

3.5.3. Transportation

3.5.4. Public Sector and Defense

3.5.5. Industrial

3.5.6. Stadiums

3.5.7. Others (Hospitality, Education, and Residential)

3.6. Competitive Landscape

3.6.1. Market Positioning of Key Players, 2015

3.6.2. Competitive Strategies Adopted by Leading Players

3.6.3. Recommendations

4. North America Night Vision (IR) Surveillance Cameras Market Analysis, 2014 – 2024 (US$ Mn and Mn Units)

4.1. Key Trends Analysis

4.2. Global Night Vision (IR) Surveillance Cameras Market Analysis, By Shape, 2014 – 2024 (US$ Mn and Mn Units)

4.2.1. Box Cameras

4.2.2. Dome Cameras

4.2.3. Bullet Cameras

4.3. North America Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

4.3.1. PTZ (Pan, Tilt and Zoom)

4.3.2. Fixed

4.4. North America Night Vision (IR) Surveillance Cameras Market Analysis, By End-use Application, 2014 – 2024 (US$ Mn and Mn Units)

4.4.1. Retail

4.4.2. Business Organizations

4.4.3. Transportation

4.4.4. Public Sector and Defense

4.4.5. Industrial

4.4.6. Stadiums

4.4.7. Others (Hospitality, Education, and Residential)

4.5. North America Night Vision (IR) Surveillance Cameras Market Analysis, By Country, 2014 – 2024 (US$ Mn and Mn Units)

4.5.1. Overview

4.5.2. U.S.

4.5.3. Rest of North America

5. Europe Night Vision (IR) Surveillance Cameras Market Analysis, 2014 – 2024 (US$ Mn and Mn Units)

5.1. Key Trends Analysis

5.2. Europe Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

5.2.1. Box Cameras

5.2.2. Dome Cameras

5.2.3. Bullet Cameras

5.3. Europe Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

5.3.1. PTZ (Pan, Tilt and Zoom)

5.3.2. Fixed

5.4. Europe Night Vision (IR) Surveillance Cameras Market Analysis, By End-use Application, 2014 – 2024 (US$ Mn and Mn Units)

5.4.1. Retail

5.4.2. Business Organizations

5.4.3. Transportation

5.4.4. Public Sector and Defense

5.4.5. Industrial

5.4.6. Stadiums

5.4.7. Others (Hospitality, Education, and Residential)

5.5. Europe Night Vision (IR) Surveillance Cameras Market Analysis, By Region, 2014 – 2024 (US$ Mn and Mn Units)

5.5.1. Overview

5.5.2. EU7 (UK, Italy, Spain, France, Germany, Belgium, and Netherlands)

5.5.3. CIS

5.5.4. Rest of Europe

6. Asia Pacific Night Vision (IR) Surveillance Cameras Market Analysis, 2014 – 2024 (US$ Mn and Mn Units)

6.1. Key Trends Analysis

6.2. Asia Pacific Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

6.2.1. Box Cameras

6.2.2. Dome Cameras

6.2.3. Bullet Cameras

6.3. Asia Pacific Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

6.3.1. PTZ (Pan, Tilt and Zoom)

6.3.2. Fixed

6.4. Asia Pacific Night Vision (IR) Surveillance Cameras Market Analysis, By End-use Application, 2014 – 2024 (US$ Mn and Mn Units)

6.4.1. Retail

6.4.2. Business Organizations

6.4.3. Transportation

6.4.4. Public Sector and Defense

6.4.5. Industrial

6.4.6. Stadiums

6.4.7. Others (Hospitality, Education, and Residential)

6.5. Asia Pacific Night Vision (IR) Surveillance Cameras Market Analysis, By Region, 2014 – 2024 (US$ Mn and Mn Units)

6.5.1. Overview

6.5.2. Japan

6.5.3. China

6.5.4. South Asia (India, Pakistan, Bangladesh, & Sri Lanka)

6.5.5. Australasia (Australia, NZ & Guinea)

6.5.6. Rest of APAC

7. Middle East and Africa (MEA) Night Vision (IR) Surveillance Cameras Market Analysis, 2014 – 2024 (US$ Mn and Mn Units)

7.1. Key Trends Analysis

7.2. MEA Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

7.2.1. Box Cameras

7.2.2. Dome Cameras

7.2.3. Bullet Cameras

7.3. MEA Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

7.3.1. PTZ (Pan, Tilt and Zoom)

7.3.2. Fixed

7.4. MEA Night Vision (IR) Surveillance Cameras Market Analysis, By End-use Application, 2014 – 2024 (US$ Mn and Mn Units)

7.4.1. Retail

7.4.2. Business Organizations

7.4.3. Transportation

7.4.4. Public Sector and Defense

7.4.5. Industrial

7.4.6. Stadiums

7.4.7. Others (Hospitality, Education, and Residential)

7.5. Middle East and Africa (MEA) Night Vision (IR) Surveillance Cameras Market Analysis, By Region, 2014 – 2024 (US$ Mn and Mn Units)

7.5.1. Overview

7.5.2. GCC Countries

7.5.3. South Africa

7.5.4. Rest of MEA

8. Latin America Night Vision (IR) Surveillance Cameras Market Analysis, 2014 – 2024 (US$ Mn and Mn Units)

8.1. Key Trends Analysis

8.2. Latin America Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

8.2.1. Box Cameras

8.2.2. Dome Cameras

8.2.3. Bullet Cameras

8.3. Latin America Night Vision (IR) Surveillance Cameras Market Analysis, By Type, 2014 – 2024 (US$ Mn and Mn Units)

8.3.1. PTZ (Pan, Tilt and Zoom)

8.3.2. Fixed

8.4. Latin America Night Vision (IR) Surveillance Cameras Market Analysis, By End-use Application, 2014 – 2024 (US$ Mn and Mn Units)

8.4.1. Retail

8.4.2. Business Organizations

8.4.3. Transportation

8.4.4. Public Sector and Defense

8.4.5. Industrial

8.4.6. Stadiums

8.4.7. Others (Hospitality, Education, and Residential)

8.5. Latin America Night Vision (IR) Surveillance Cameras Market Analysis, By Region, 2014 – 2024 (US$ Mn and Mn Units)

8.5.1. Overview

8.5.2. Brazil

8.5.3. Rest of Latin America

9. Company Profiles

9.1. Axis Communications AB

9.1.1. Company Details (HQ, Foundation Year, Employee Strength)

9.1.2. Market Presence, By Segment and Geography

9.1.3. Key Developments

9.1.4. Strategy and Historical Roadmap

9.1.5. Revenue and Operating Profits

* Similar details would be provided for all the players mentioned below

9.2. BAE Systems plc.

9.3. FLIR Systems

9.4. Hikvision Digital Technology Co., Ltd.

9.5. L-3 Communications Holdings

9.6. Pelco Corporation

9.7. Raytheon Company

9.8. Robert Bosch GmbH

9.9. Samsung Electronics Co., Ltd.