Sequencing-based surveillance is emerging as an effective way to identify new coronavirus strains and other unknown pathogens. As such, the introduction of COVID-19 vaccines by India has lowered the pressure on companies in the global NGS sample preparation market to detect mutations in the strain. Moreover, companies such as the U.S. biotechnology company Illumina continue to provide public health officials and researchers with valuable insight on tracking the transmission routes of the virus globally.

Companies in the NGS sample preparation market are increasing efforts to identify viral mutations that may affect vaccine potency. They are boosting R&D to create screen targets that hold promising potentials in COVID-19 therapeutics. Companies are identifying and characterizing antimicrobial resistance alleles and respiratory co-infections.

Next generation sequencing (NGS) is undergoing a significant change by evolving from a technology used for research purposes to the one that is applied in clinical diagnostics. However, companies are faced with drawbacks in library preparation and different automation strategies. It has been found that pipetting workstations facilitate high throughput processing, but offer limited flexibility during procedures. This has led to the emergence of microfluidic solutions that offer great potential due to miniaturization and decreased investment costs.

Microfluidic systems are being used for automation. However, microfluidic systems are relatively new and only a handful of them are being commercialized. Hence, companies in the NGS sample preparation market are partnering with academic groups to advance in the field of microfluidic systems and pipetting workstations to assess its implementation in library preparation protocols.

Automation in the NGS sample preparation market has led to stakeholders making use of robotic instruments to decrease cost and increase output in lab settings. Biocompare - a provider of life sciences products and new technologies, is keen on adding robotic instruments in their sequencing procedures to enable cost efficient automation of processes.

The NGS sample preparation market is expected to cross the revenue of US$ 4.1 Bn by 2030, as automation is gauging strong business grounds in reagent handling, right from isolation to library prep.

Apart from medical services, companies in the NGS sample preparation market are tapping into incremental opportunities in the fields of agriculture and animal research to broaden their revenue streams. This is evident since the market is predicted to expand at an astonishing CAGR of 16.2% during the assessment period.

NGS is revolutionizing agricultural productivity, and helping to evaluate its role in human health, gut, air, water, and soil microbiomes. Companies in the NGS sample preparation market are increasing their research in the discovery of new disease genes in animals pertaining to multigenic disorders. NGS is also helping to track the source of plant diseases and is suggesting ways to eliminate them.

The NGS-based metagenomic screening has sparked advancements in the field of veterinary medicines. However, there is a lack of protocols tailored to veterinary requirements, which is affecting the growth of the NGS sample preparation market. Hence, companies are developing NGS-based protocols that can be used in veterinary virology. Thus, companies are gaining a strong research ground in porcine samples that are spiked with different DNA and RNA viruses.

On the other hand, foodborne viral infections are emerging as a leading cause for increased morbidity and mortality worldwide. Hence, companies in the NGS sample preparation market are increasing their focus in viral partial genomic sequencing in order to track foodborne outbreaks. NGS is being used for the detection and characterization of the viral density in food.

Analysts’ Viewpoint

Apart from human health, companies in the NGS sample preparation market are gaining a strong research base in identifying how coronavirus strains have the potential to affect animal health. NGS is helping to track the source of plant diseases to avoid food wastage on the global level. However, viral partial genomic sequencing also provides a comprehensive description of the RNA and DNA virome, which causes foodborne viral infections. However, research in this field is found to be limited to electron microscopy, which lacks the sensitivity required for meaningful food testing. Hence, companies should combine the use of microfluidic devices with multiplexed polymerase chain reaction (PCR) to allow detection of different RNA foodborne viruses.

NGS sample preparation market is expected to cross the revenue of US$ 4.1 Bn by 2030

NGS sample preparation market is projected to expand at a CAGR of ~16% from 2020 to 2030

NGS sample preparation market is driven by rapid expansion of the life sciences industry and rise in inclination toward personalized medicines

The drug and biomarker discovery segment accounted for a major share of the global NGS sample preparation market

Key players in the global NGS sample preparation market include QIAGEN, Thermo Fisher Scientific, Inc., Merck KGaA (Merck Millipore), Hoffmann-La Roche Ltd., Agilent Technologies

1. Preface

1.1. Market Definition and Scope

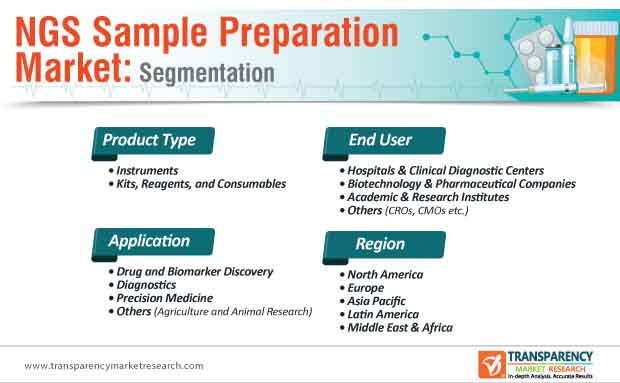

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global NGS Sample Preparation Market

4. Market Overview

4.1. Introduction

4.1.1. Market Introduction

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.3. Opportunities

4.4. Global NGS Sample Preparation Market Analysis and Forecast, 2018–2030

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events (Mergers, Acquisitions, Product Launches, Strategic Partnerships, etc.)

5.2. Technological Advancement

5.3. Regulatory Scenario

5.4. COVID-19 Impact Analysis

6. Global NGS Sample Preparation Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2018–2030

6.3.1. Instruments

6.3.2. Kits, Reagents, and Consumables

6.4. Market Attractiveness Analysis, by Product

7. Global NGS Sample Preparation Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2018–2030

7.3.1. Drug and Biomarker Discovery

7.3.2. Diagnostics

7.3.3. Precision Medicine

7.3.4. Others (agriculture and animal research)

7.4. Market Attractiveness Analysis, by Application

8. Global NGS Sample Preparation Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2018–2030

8.3.1. Hospitals & Clinical Diagnostic Centers

8.3.2. Biotechnology & Pharmaceutical Companies

8.3.3. Academic & Research Institutes

8.3.4. Others (CROs, CMOs etc.)

8.4. Market Attractiveness Analysis, by End-user

9. Global NGS Sample Preparation Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America NGS Sample Preparation Market Analysis and Forecast

10.1. Introduction

10.2. Market Value Forecast, by Product, 2018–2030

10.2.1. Instruments

10.2.2. Kits, Reagents & Consumables

10.3. Market Value Forecast, by Application, 2018–2030

10.3.1. Drug and Biomarker Discovery

10.3.2. Diagnostics

10.3.3. Precision Medicine

10.3.4. Others (agriculture and animal research)

10.4. Market Value Forecast, by End-user, 2018–2030

10.4.1. Hospitals & Clinical Diagnostic Centers

10.4.2. Biotechnology & Pharmaceutical Companies

10.4.3. Academic & Research Institutes

10.4.4. Others (CROs, CMOs etc.)

10.5. Market Value Forecast, by Country, 2018–2030

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe NGS Sample Preparation Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2018–2030

11.2.1. Instruments

11.2.2. Kits, Reagents, and Consumables

11.3. Market Value Forecast by Application, 2018–2030

11.3.1. Drug and Biomarker Discovery

11.3.2. Diagnostics

11.3.3. Precision Medicine

11.3.4. Others (agriculture and animal research)

11.4. Market Value Forecast, by End-user, 2018–2030

11.4.1. Hospitals & Clinical Diagnostic Centers

11.4.2. Biotechnology & Pharmaceutical Companies

11.4.3. Academic & Research Institutes

11.4.4. Others (CROs, CMOs etc.)

11.5. Market Value Forecast, by Country/Sub-region, 2018–2030

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe NGS Sample Preparation Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific NGS Sample Preparation Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2018–2030

12.2.1. Instruments

12.2.2. Kits, Reagents, and Consumables

12.3. Market Value Forecast, by Application, 2018–2030

12.3.1. Drug and Biomarker Discovery

12.3.2. Diagnostics

12.3.3. Precision Medicine

12.3.4. Others (agriculture and animal research)

12.4. Market Value Forecast, by End-user, 2018–2030

12.4.1. Hospitals & Clinical Diagnostic Centers

12.4.2. Biotechnology & Pharmaceutical Companies

12.4.3. Academic & Research Institutes

12.4.4. Others (CROs, CMOs etc.)

12.5. Market Value Forecast, by Country/Sub-region, 2018–2030

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America NGS Sample Preparation Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2018–2030

13.2.1. Instruments

13.2.2. Kits, Reagents, and Consumables

13.3. Market Value Forecast, by Application, 2018–2030

13.3.1. Drug and Biomarker Discovery

13.3.2. Diagnostics

13.3.3. Precision Medicine

13.3.4. Others (agriculture and animal research)

13.4. Market Value Forecast, by End-user, 2018–2030

13.4.1. Hospitals & Clinical Diagnostic Centers

13.4.2. Biotechnology & Pharmaceutical Companies

13.4.3. Academic & Research Institutes

13.4.4. Others (CROs, CMOs etc.)

13.5. Market Value Forecast, by Country/Sub-region, 2018-2030

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa NGS Sample Preparation Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2018–2030

14.2.1. Instruments

14.2.2. Kits, Reagents, and Consumables

14.3. Market Value Forecast, by Application, 2018–2030

14.3.1. Drug and Biomarker Discovery

14.3.2. Diagnostics

14.3.3. Precision Medicine

14.3.4. Others (agriculture and animal research)

14.4. Market Value Forecast, by End-user, 2018–2030

14.4.1. Hospitals & Clinical Diagnostic Centers

14.4.2. Biotechnology & Pharmaceutical Companies

14.4.3. Academic & Research Institutes

14.4.4. Others (CROs, CMOs etc.)

14.5. Market Value Forecast, by Country/Sub-region, 2018–2030

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Share Analysis, by Company, 2019

15.2. Company Profiles

15.2.1. QIAGEN

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.1.5. SWOT Analysis

15.2.2. Thermo Fisher Scientific, Inc.

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.2.5. SWOT Analysis

15.2.3. Merck KGaA (Merck Millipore)

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.3.5. SWOT Analysis

15.2.4. F. Hoffmann-La Roche Ltd.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.4.5. SWOT Analysis

15.2.5. Agilent Technologies

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.5.5. SWOT Analysis

15.2.6. Promega Corporation

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.6.5. SWOT Analysis

15.2.7. Illumina, Inc.

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.7.5. SWOT Analysis

15.2.8. Integrated DNA Technologies, Inc. (Danaher Corporation)

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.8.5. SWOT Analysis

15.2.9. New England Biolabs

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.9.5. SWOT Analysis

15.2.10. Tecan Trading AG

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

15.2.10.5. SWOT Analysis

List of Tables

Table 01: Global NGS Sample Preparation Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 02: Global NGS Sample Preparation Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 03: Global NGS Sample Preparation Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 04: Global NGS Sample Preparation Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 05: North America NGS Sample Preparation Market Value (US$ Mn) Forecast, by Country, 2018–2030

Table 06: North America NGS Sample Preparation Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 07: North America NGS Sample Preparation Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 08: North America NGS Sample Preparation Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 09: Europe NGS Sample Preparation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 10: Europe NGS Sample Preparation Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 11: Europe NGS Sample Preparation Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 12: Europe NGS Sample Preparation Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 13: Asia Pacific NGS Sample Preparation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018-2030

Table 14: Asia Pacific NGS Sample Preparation Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 15: Asia Pacific NGS Sample Preparation Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 16: Asia Pacific NGS Sample Preparation Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 17: Latin America NGS Sample Preparation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 18: Latin America NGS Sample Preparation Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 19: Latin America NGS Sample Preparation Market Value (US$ Mn) Forecast, by Application, 2018-2030

Table 20: Latin America NGS Sample Preparation Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 21: Middle East & Africa NGS Sample Preparation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 22: Middle East & Africa NGS Sample Preparation Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 23: Middle East & Africa NGS Sample Preparation Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 24: Middle East & Africa NGS Sample Preparation Market Value (US$ Mn) Forecast, by End-user, 2018–2030

List of Figures

Figure 01: Global NGS Sample Preparation Market Value (US$ Mn) Forecast, 2018–2030

Figure 02: Global NGS Sample Preparation Market Value Share, by Product, 2020

Figure 03: Global NGS Sample Preparation Market Value Share, by Application, 2020

Figure 04: Global NGS Sample Preparation Market Value Share, by End-user, 2020

Figure 05: Global NGS Sample Preparation Market Value Share, by Extraction Type, 2020

Figure 06: Global NGS Sample Preparation Market Value Share Analysis, by Product, 2020 and 2030

Figure 07: Global NGS Sample Preparation Market Attractiveness Analysis, by Product, 2021–2030

Figure 08: Global NGS Sample Preparation Market Value (US$ Mn), by Instruments, 2018–2030

Figure 09: Global NGS Sample Preparation Market Value (US$ Mn), by Extraction kits, Reagents, and Consumables, 2018–2030

Figure 10: Global NGS Sample Preparation Market Value Share Analysis, by Application, 2020 and 2030

Figure 11: Global NGS Sample Preparation Market Attractiveness Analysis, by Application, 2021–2030

Figure 12: Global NGS Sample Preparation Market Value (US$ Mn), by Drug and Biomarker Discovery, 2018–2030

Figure 13: Global NGS Sample Preparation Market Value (US$ Mn), by Diagnostics, 2018–2030

Figure 14: Global NGS Sample Preparation Market Value (US$ Mn), by Precision Medicine, 2018–2030

Figure 15: Global NGS Sample Preparation Market Value (US$ Mn), by Others, 2018–2030

Figure 16: Global NGS Sample Preparation Market Value Share Analysis, by End-user, 2020 and 2030

Figure 17: Global NGS Sample Preparation Market Attractiveness Analysis, by End-user, 2021–2030

Figure 18: Global NGS Sample Preparation Market Value (US$ Mn), by Hospitals & Clinical Diagnostic Centers, 2018-2030

Figure 19: Global NGS Sample Preparation Market Value (US$ Mn), by Biotechnology & Pharmaceutical Companies, 2018–2030

Figure 20: Global NGS Sample Preparation Market Value (US$ Mn), by Academic & Research Institutes, 2018–2030

Figure 21: Global NGS Sample Preparation Market Value (US$ Mn), by Others, 2018–2030

Figure 22: Global NGS Sample Preparation Market Value Share Analysis, by Region, 2020 and 2030

Figure 23: Global NGS Sample Preparation Market Attractiveness Analysis, by Region, 2021–2030

Figure 24: North America NGS Sample Preparation Market Value (US$ Mn) Forecast, 2018–2030

Figure 25: North America NGS Sample Preparation Market Value Share Analysis, by Country, 2020 and 2030

Figure 26: North America NGS Sample Preparation Market Attractiveness Analysis, by Country, 2021–2030

Figure 27: North America NGS Sample Preparation Market Value Share Analysis, by Product, 2020 and 2030

Figure 28: North America NGS Sample Preparation Market Attractiveness Analysis, by Product, 2021–2030

Figure 29: North America NGS Sample Preparation Market Value Share Analysis, by Application, 2020 and 2030

Figure 30: North America NGS Sample Preparation Market Attractiveness Analysis, by Application, 2021–2030

Figure 31: North America NGS Sample Preparation Market Value Share Analysis, by End-user, 2020 and 2030

Figure 32: North America NGS Sample Preparation Market Attractiveness Analysis, by End-user, 2021–2030

Figure 33: Europe NGS Sample Preparation Market Value (US$ Mn) Forecast, 2018–2030

Figure 34: Europe NGS Sample Preparation Market Value Share Analysis, by Country/Sub-region, 2020 and 2030

Figure 35: Europe NGS Sample Preparation Market Attractiveness Analysis, by Country/Sub-region, 2021–2030

Figure 36: Europe NGS Sample Preparation Market Value Share Analysis, by Product, 2020 and 2030

Figure 37: Europe NGS Sample Preparation Market Attractiveness Analysis, by Product, 2021–2030

Figure 38: Europe NGS Sample Preparation Market Value Share Analysis, by Application, 2020 and 2030

Figure 39: Europe NGS Sample Preparation Market Attractiveness Analysis, by Application, 2021–2030

Figure 40: Europe NGS Sample Preparation Market Value Share Analysis, by End-user, 2020 and 2030

Figure 41: Europe NGS Sample Preparation Market Attractiveness Analysis, by End-user, 2021–2030

Figure 42: Asia Pacific NGS Sample Preparation Market Value (US$ Mn) Forecast, 2018–2030

Figure 43: Asia Pacific NGS Sample Preparation Market Value Share Analysis, by Country/Sub-region, 2020 and 2030

Figure 44: Asia Pacific NGS Sample Preparation Market Attractiveness Analysis, by Country/Sub-region, 2021–2030

Figure 45: Asia Pacific NGS Sample Preparation Market Value Share Analysis, by Product, 2020 and 2030

Figure 46: Asia Pacific NGS Sample Preparation Market Attractiveness Analysis, by Product, 2021–2030

Figure 47: Asia Pacific NGS Sample Preparation Market Value Share Analysis, by Application, 2020 and 2030

Figure 48: Asia Pacific NGS Sample Preparation Market Attractiveness Analysis, by Application, 2021–2030

Figure 49: Asia Pacific NGS Sample Preparation Market Value Share Analysis, by End-user, 2020 and 2030

Figure 50: Asia Pacific NGS Sample Preparation Market Attractiveness Analysis, by End-user, 2021–2030

Figure 51: Latin America NGS Sample Preparation Market Value (US$ Mn) Forecast, 2018–2030

Figure 52: Latin America NGS Sample Preparation Market Value Share Analysis, by Country/Sub-region, 2020 and 2030

Figure 53: Latin America NGS Sample Preparation Market Attractiveness Analysis, by Country/Sub-region, 2021–2030

Figure 54: Latin America NGS Sample Preparation Market Value Share Analysis, by Product, 2020 and 2030

Figure 55: Latin America NGS Sample Preparation Market Attractiveness Analysis, by Product, 2021–2030

Figure 56: Latin America NGS Sample Preparation Market Value Share Analysis, by Application, 2020 and 2030

Figure 57: Latin America NGS Sample Preparation Market Attractiveness Analysis, by Application, 2021–2030

Figure 58: Latin America NGS Sample Preparation Market Value Share Analysis, by End-user, 2020 and 2030

Figure 59: Latin America NGS Sample Preparation Market Attractiveness Analysis, by End-user, 2021–2030

Figure 60: Middle East & Africa NGS Sample Preparation Market Value (US$ Mn) Forecast, 2018–2030

Figure 61: Middle East & Africa NGS Sample Preparation Market Value Share Analysis, by Country/Sub-region, 2020 and 2030

Figure 62: Middle East & Africa NGS Sample Preparation Market Attractiveness Analysis, by Country/Sub-region, 2021–2030

Figure 63: Middle East & Africa NGS Sample Preparation Market Value Share Analysis, by Product, 2020 and 2030

Figure 64: Middle East & Africa NGS Sample Preparation Market Attractiveness Analysis, by Product, 2021–2030

Figure 65: Middle East & Africa NGS Sample Preparation Market Value Share Analysis, by Application, 2020 and 2030

Figure 66: Middle East & Africa NGS Sample Preparation Market Attractiveness Analysis, by Application, 2021–2030

Figure 67: Middle East & Africa NGS Sample Preparation Market Value Share Analysis, by End-user, 2020 and 2030

Figure 68: Middle East & Africa NGS Sample Preparation Market Attractiveness Analysis, by End-user, 2021–2030