Analysts’ Viewpoint on Market Scenario

Rise in demand for faster data transmission with low latency is fueling the global NFC chip market size. NFC chips offer advanced security and battery-free sensing for IoT applications. They also provide dual-mode tamper status detection.

Significant investment in technologies such as 5G, artificial intelligence, cloud computing, big data analytics, IoT, and cyber security is likely to augment market expansion during the forecast period. NFC chips are widely used in POS systems, smartphones, laptops, electronic shelf labels, contactless payments, and parking access management systems. Growth of the retail sector is projected to offer lucrative growth opportunities for vendors in the industry. Market players are launching low-cost RFID inlays to enhance their NFC chip market share.

Near-field Communication (NFC) chip is a silicon component or Integrated Circuit (IC) that enables short-range, wireless communication between two devices when connected to an appropriate NFC chip antenna. It provides an additional layer of security, as only devices within close proximity of each other can communicate via NFC.

Near-field communication chips are used in various industries such as automotive & transportation, consumer electronics, BFSI, retail, healthcare, building & infrastructure, and media & entertainment. User data is stored in a small amount of non-volatile memory within the NFC chip. Data in programmable NFC chips can be written on both sides.

Smartphones and other mobile devices support near-field communication. NFC card chips are secure and easy to use. Contactless payment solutions and e-ticketing employ NFC. RFID and NFC technologies allow retailers in the personal care market to improve customer pre-sales, during-sales, and post-sales experience. These technologies, along with the broader use of analytics, enable a more profound understanding of consumer behavior.

Thus, the public transportation service market and the retail sector are increasingly deploying NFC-enabled systems. Adoption of NFC in e-ticketing reduces the cost of issuing tickets and maintaining the ticketing infrastructure.

According to the UN Conference on Trade and Development, movement restrictions induced by COVID-19 have led to an increase in the share of online retail sales from 16% to 19% of total retail sales in 2020. The report further added that online retail sales grew significantly in several countries, with the Republic of Korea reporting the highest share of 25.9% in 2020, up from 20.8% the year before. Thus, rapid growth in the e-commerce sector is expected to fuel market statistics in the near future.

As per the Retailers Association of India (RAI), the retail industry achieved 96% of pre-COVID-19 sales in September 2021, driven by the increase in purchasing power of consumers and rise in demand for retail products. India’s retail trading sector attracted US$ 3.96 Bn in FDIs between April 2000 and March 2022. Thus, expansion in the retail sector is also likely to contribute to the NFC chip market growth in the next few years.

NFC chips simplify user interfaces. This enhances their applicability in consumer products. Smartphone manufacturers install NFC chips in handsets to enable contactless payments and wireless data transfer. Consumer electronic devices such as speakers, TVs, cameras, refrigerators, and washing machines also rely on NFC chips to boost contactless data transfer.

Automotive and infrastructure industries are likely to grow at a rapid pace in the next few years, thereby augmenting the NFC chip market progress. Rise in integration of various connected technologies and advanced infotainment & security features is contributing to the expansion in automotive and infrastructure industries. Communication through NFC chips is considered the safest among other similar technologies such as Bluetooth and Wi-Fi. Thus, NFC chips are increasingly used in security systems in these industries.

Rise in deployment of wireless charging and NFC-enabled vehicle diagnostic systems is estimated to propel NFC chip industry revenue in the near future. Automobiles rely on NFC chips for fast and intuitive device pairing and robust fleet management. Digital key management systems reduce the cost and complexity of physical key handling. NFC-enabled express cards with power reserve help start a vehicle when the phone’s battery is drained. NFC also allows for ad hoc sharing of private cars with family and friends.

Several governments across the globe provide subsidies to telecom companies and support digitalization in the retail sector. This is anticipated to drive market size during the forecast period.

In Mexico, various banks are collaborating with mobile payment technology firms to facilitate advanced mobile POS systems. NFC chips are also used in the healthcare sector in several monitoring systems, medical implants, and medical data storage devices.

According to the latest NFC chip market forecast, Asia Pacific is expected to dominate the industry during 2022 to 2031. Rise in demand for NFC chips in smartphones, smart wearables, POS systems, and high-performance NFC reader chips is boosting market revenue in the region. The industry is also driven by expansion in the fintech sector. According to IBEF, the fintech market in India is expected to reach US$ 83.48 Bn by 2025.

Growth in the mobile wallet market in India and China is projected to fuel the Asia Pacific market for NFC chips during 2022 to 2031. According to the Asian Development Bank Institute, the People’s Republic of China has been witnessing rapid increase in mobile payments over the last few years. The number of active users of Alipay, a third-party mobile and online payment platform in the country, rose from a little over 100 million in 2013 to 900 million in 2018, while that of WeChat Pay grew from about 350 million to 1.1 billion during the same period. The total transaction value jumped from RMB 14.5 Trn in 2013 to RMB 277.4 Trn in 2018.

The NFC chip business in North America and Europe is expected to grow at a significant pace during the forecast period. Increase in usage of payment gateways, rise in number of reader terminals in retail stores, and surge in adoption of NFC-enabled credit and debit cards are augmenting the market share of these regions.

According to The German Banking Industry Committee, 75 million of the 100 million bank cards in Germany are equipped with NFC chips. Europe has been substantially ahead in terms of application of the NFC chip technology in the healthcare sector, especially in countries such as Germany, France, and Finland. The NFC chip industry in Middle East & Africa and South America is anticipated to grow at a steady pace during the forecast period.

The market is fragmented, with a large number of vendors catering to the global demand. Most of the vendors are adopting various organic and inorganic strategies such as collaborations, partnerships, product launches, and mergers & acquisitions to enhance their NFC chip market share.

Broadcom Inc., HID Global, Intel Corporation, Infineon Technologies AG, Marvell Technology, Inc., MediaTek Inc., Nordic Semiconductor, NXP Semiconductors N.V., Qualcomm Technologies, Inc., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., Sony Corporation, STMicroelectronics N.V., and Texas Instruments Incorporated are key entities operating in the industry.

These vendors have been profiled in the NFC chip market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.5 Bn |

|

Market Forecast Value in 2031 |

US$ 5.8 Bn |

|

Growth Rate (CAGR) |

14.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

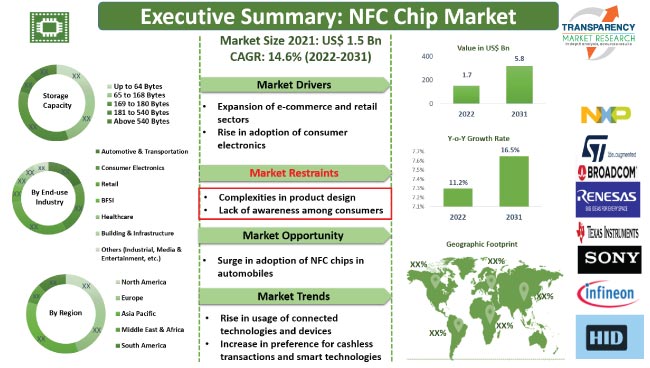

It stood at US$ 1.5 Bn in 2021.

It is expected to advance at a CAGR of 14.6% from 2022 to 2031.

It is likely to reach US$ 5.8 Bn by 2031.

Expansion of e-commerce and retail sectors and rise in demand for consumer electronics.

Asia Pacific is a more lucrative region for vendors.

Broadcom Inc., HID Global, Intel Corporation, Infineon Technologies AG, Marvell Technology, Inc., MediaTek Inc., Nordic Semiconductor, NXP Semiconductors N.V., Qualcomm Technologies, Inc., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., Sony Corporation, STMicroelectronics N.V., and Texas Instruments Incorporated.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumptions and Acronyms

2. Executive Summary

2.1. Global NFC Chip Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global NFC Technology Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global NFC Chip Market Analysis, By Storage Capacity

5.1. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Storage Capacity, 2017–2031

5.1.1. Up to 64 Bytes

5.1.2. 65 to 168 Bytes

5.1.3. 169 to 180 Bytes

5.1.4. 181 to 540 Bytes

5.1.5. Above 540 Bytes

5.2. Market Attractiveness Analysis, By Storage Capacity

6. Global NFC Chip Market Analysis, By Application

6.1. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

6.1.1. Smartphones

6.1.2. Laptops & Notebooks

6.1.3. Smart Cards

6.1.4. Televisions

6.1.5. Point of Sales Systems

6.1.6. Medical Devices

6.1.7. Vehicles

6.1.8. Others (Smart Wearables, Printers, etc.)

6.2. Market Attractiveness Analysis, By Application

7. Global NFC Chip Market Analysis, By End-use Industry

7.1. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

7.1.1. Automotive & Transportation

7.1.2. Consumer Electronics

7.1.3. Retail

7.1.4. BFSI

7.1.5. Healthcare

7.1.6. Building & Infrastructure

7.1.7. Others (Industrial, Media & Entertainment, etc.)

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global NFC Chip Market Analysis and Forecast, By Region

8.1. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America NFC Chip Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Storage Capacity, 2017–2031

9.3.1. Up to 64 Bytes

9.3.2. 65 to 168 Bytes

9.3.3. 169 to 180 Bytes

9.3.4. 181 to 540 Bytes

9.3.5. Above 540 Bytes

9.4. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

9.4.1. Smartphones

9.4.2. Laptops & Notebooks

9.4.3. Smart Cards

9.4.4. Televisions

9.4.5. Point of Sales Systems

9.4.6. Medical Devices

9.4.7. Vehicles

9.4.8. Others (Smart Wearables, Printers, etc.)

9.5. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

9.5.1. Automotive & Transportation

9.5.2. Consumer Electronics

9.5.3. Retail

9.5.4. BFSI

9.5.5. Healthcare

9.5.6. Building & Infrastructure

9.5.7. Others (Industrial, Media & Entertainment, etc.)

9.6. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Storage Capacity

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe NFC Chip Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Storage Capacity, 2017–2031

10.3.1. Up to 64 Bytes

10.3.2. 65 to 168 Bytes

10.3.3. 169 to 180 Bytes

10.3.4. 181 to 540 Bytes

10.3.5. Above 540 Bytes

10.4. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

10.4.1. Smartphones

10.4.2. Laptops & Notebooks

10.4.3. Smart Cards

10.4.4. Televisions

10.4.5. Point of Sales Systems

10.4.6. Medical Devices

10.4.7. Vehicles

10.4.8. Others (Smart Wearables, Printers, etc.)

10.5. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

10.5.1. Automotive & Transportation

10.5.2. Consumer Electronics

10.5.3. Retail

10.5.4. BFSI

10.5.5. Healthcare

10.5.6. Building & Infrastructure

10.5.7. Others (Industrial, Media & Entertainment, etc.)

10.6. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Storage Capacity

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific NFC Chip Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Storage Capacity, 2017–2031

11.3.1. Up to 64 Bytes

11.3.2. 65 to 168 Bytes

11.3.3. 169 to 180 Bytes

11.3.4. 181 to 540 Bytes

11.3.5. Above 540 Bytes

11.4. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

11.4.1. Smartphones

11.4.2. Laptops & Notebooks

11.4.3. Smart Cards

11.4.4. Televisions

11.4.5. Point of Sales Systems

11.4.6. Medical Devices

11.4.7. Vehicles

11.4.8. Others (Smart Wearables, Printers, etc.)

11.5. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.5.1. Automotive & Transportation

11.5.2. Consumer Electronics

11.5.3. Retail

11.5.4. BFSI

11.5.5. Healthcare

11.5.6. Building & Infrastructure

11.5.7. Others (Industrial, Media & Entertainment, etc.)

11.6. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Storage Capacity

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa NFC Chip Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Storage Capacity, 2017–2031

12.3.1. Up to 64 Bytes

12.3.2. 65 to 168 Bytes

12.3.3. 169 to 180 Bytes

12.3.4. 181 to 540 Bytes

12.3.5. Above 540 Bytes

12.4. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

12.4.1. Smartphones

12.4.2. Laptops & Notebooks

12.4.3. Smart Cards

12.4.4. Televisions

12.4.5. Point of Sales Systems

12.4.6. Medical Devices

12.4.7. Vehicles

12.4.8. Others (Smart Wearables, Printers, etc.)

12.5. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.5.1. Automotive & Transportation

12.5.2. Consumer Electronics

12.5.3. Retail

12.5.4. BFSI

12.5.5. Healthcare

12.5.6. Building & Infrastructure

12.5.7. Others (Industrial, Media & Entertainment, etc.)

12.6. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Storage Capacity

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America NFC Chip Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Storage Capacity, 2017–2031

13.3.1. Up to 64 Bytes

13.3.2. 65 to 168 Bytes

13.3.3. 169 to 180 Bytes

13.3.4. 181 to 540 Bytes

13.3.5. Above 540 Bytes

13.4. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

13.4.1. Smartphones

13.4.2. Laptops & Notebooks

13.4.3. Smart Cards

13.4.4. Televisions

13.4.5. Point of Sales Systems

13.4.6. Medical Devices

13.4.7. Vehicles

13.4.8. Others (Smart Wearables, Printers, etc.)

13.5. NFC Chip Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.5.1. Automotive & Transportation

13.5.2. Consumer Electronics

13.5.3. Retail

13.5.4. BFSI

13.5.5. Healthcare

13.5.6. Building & Infrastructure

13.5.7. Others (Industrial, Media & Entertainment, etc.)

13.6. NFC Chip Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Storage Capacity

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global NFC Chip Market Competition Matrix - a Dashboard View

14.1.1. Global NFC Chip Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Broadcom Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. HID Global

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Intel Corporation

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Infineon Technologies AG

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Marvell Technology, Inc.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. MediaTek Inc.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Nordic Semiconductor

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. NXP Semiconductors N.V.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Qualcomm Technologies, Inc.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Renesas Electronics Corporation

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Samsung Electronics Co., Ltd.

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Sony Corporation

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. STMicroelectronics N.V.

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. Texas Instruments Incorporated

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Storage Capacity

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Country/Sub-region

List of Tables

Table 01: Global NFC Chip Market Size & Forecast, By Storage Capacity, Value (US$ Mn), 2017-2031

Table 02: Global NFC Chip Market Size & Forecast, By Storage Capacity, Volume (Million Units), 2017-2031

Table 03: Global NFC Chip Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 04: Global NFC Chip Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 05: Global NFC Chip Market Size & Forecast, By Region, Value (US$ Mn), 2017-2031

Table 06: North America NFC Chip Market Size & Forecast, By Storage Capacity, Value (US$ Mn), 2017-2031

Table 07: North America NFC Chip Market Size & Forecast, By Storage Capacity, Volume (Million Units), 2017-2031

Table 08: North America NFC Chip Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 09: North America NFC Chip Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 10: North America NFC Chip Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 11: Europe NFC Chip Market Size & Forecast, By Storage Capacity, Value (US$ Mn), 2017-2031

Table 12: Europe NFC Chip Market Size & Forecast, By Storage Capacity, Volume (Million Units), 2017-2031

Table 13: Europe NFC Chip Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 14: Europe NFC Chip Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 15: Europe NFC Chip Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 16: Asia Pacific NFC Chip Market Size & Forecast, By Storage Capacity, Value (US$ Mn), 2017-2031

Table 17: Asia Pacific NFC Chip Market Size & Forecast, By Storage Capacity, Volume (Million Units), 2017-2031

Table 18: Asia Pacific NFC Chip Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 19: Asia Pacific NFC Chip Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 20: Asia Pacific NFC Chip Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 21: Middle East & Africa NFC Chip Market Size & Forecast, By Storage Capacity, Value (US$ Mn), 2017-2031

Table 22: Middle East & Africa NFC Chip Market Size & Forecast, By Storage Capacity, Volume (Million Units), 2017-2031

Table 23: Middle East & Africa NFC Chip Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 24: Middle East & Africa NFC Chip Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 25: Middle East & Africa NFC Chip Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 26: South America NFC Chip Market Size & Forecast, By Storage Capacity, Value (US$ Mn), 2017-2031

Table 27: South America NFC Chip Market Size & Forecast, By Storage Capacity, Volume (Million Units), 2017-2031

Table 28: South America NFC Chip Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 29: South America NFC Chip Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 30: South America NFC Chip Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

List of Figures

Figure 01: Global NFC Chip Market, Value (US$ Mn), 2017-2031

Figure 02: Global NFC Chip Market, Volume (Million Units), 2017-2031

Figure 03: Global NFC Chip Market Size & Forecast, By Storage Capacity, Revenue (US$ Mn), 2017-2031

Figure 04: Global NFC Chip Market Attractiveness, By Storage Capacity, Value (US$ Mn), 2022-2031

Figure 05: Global NFC Chip Market Share Analysis, by Storage Capacity, 2022 and 2031

Figure 06: Global NFC Chip Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 07: Global NFC Chip Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 08: Global NFC Chip Market Share Analysis, by Application, 2022 and 2031

Figure 09: Global NFC Chip Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 10: Global NFC Chip Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 11: Global NFC Chip Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 12: Global NFC Chip Market Size & Forecast, By Region, Revenue (US$ Mn), 2017-2031

Figure 13: Global NFC Chip Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 14: Global NFC Chip Market Share Analysis, by Region, 2022 and 2031

Figure 15: North America NFC Chip Market, Value (US$ Mn), 2017-2031

Figure 16: North America NFC Chip Market, Volume (Million Units), 2017-2031

Figure 17: North America NFC Chip Market Size & Forecast, By Storage Capacity, Revenue (US$ Mn), 2017-2031

Figure 18: North America NFC Chip Market Attractiveness, By Storage Capacity, Value (US$ Mn), 2022-2031

Figure 19: North America NFC Chip Market Share Analysis, by Storage Capacity, 2022 and 2031

Figure 20: North America NFC Chip Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 21: North America NFC Chip Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 22: North America NFC Chip Market Share Analysis, by Application, 2022 and 2031

Figure 23: North America NFC Chip Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 24: North America NFC Chip Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 25: North America NFC Chip Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 26: North America NFC Chip Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 27: North America NFC Chip Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 28: North America NFC Chip Market Share Analysis, by Country, 2022 and 2031

Figure 29: Europe NFC Chip Market, Value (US$ Mn), 2017-2031

Figure 30: Europe NFC Chip Market, Volume (Million Units), 2017-2031

Figure 31: Europe NFC Chip Market Size & Forecast, By Storage Capacity, Revenue (US$ Mn), 2017-2031

Figure 32: Europe NFC Chip Market Attractiveness, By Storage Capacity, Value (US$ Mn), 2022-2031

Figure 33: Europe NFC Chip Market Share Analysis, by Storage Capacity, 2022 and 2031

Figure 34: Europe NFC Chip Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 35: Europe NFC Chip Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 36: Europe NFC Chip Market Share Analysis, by Application, 2022 and 2031

Figure 37: Europe NFC Chip Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 38: Europe NFC Chip Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 39: Europe NFC Chip Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 40: Europe NFC Chip Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 41: Europe NFC Chip Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 42: Europe NFC Chip Market Share Analysis, by Country, 2022 and 2031

Figure 43: Asia Pacific NFC Chip Market, Value (US$ Mn), 2017-2031

Figure 44: Asia Pacific NFC Chip Market, Volume (Million Units), 2017-2031

Figure 45: Asia Pacific NFC Chip Market Size & Forecast, By Storage Capacity, Revenue (US$ Mn), 2017-2031

Figure 46: Asia Pacific NFC Chip Market Attractiveness, By Storage Capacity, Value (US$ Mn), 2022-2031

Figure 47: Asia Pacific NFC Chip Market Share Analysis, by Storage Capacity, 2022 and 2031

Figure 48: Asia Pacific NFC Chip Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 49: Asia Pacific NFC Chip Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 50: Asia Pacific NFC Chip Market Share Analysis, by Application, 2022 and 2031

Figure 51: Asia Pacific NFC Chip Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 52: Asia Pacific NFC Chip Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 53: Asia Pacific NFC Chip Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 54: Asia Pacific NFC Chip Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 55: Asia Pacific NFC Chip Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 56: Asia Pacific NFC Chip Market Share Analysis, by Country, 2022 and 2031

Figure 57: Middle East & Africa NFC Chip Market, Value (US$ Mn), 2017-2031

Figure 58: Middle East & Africa NFC Chip Market, Volume (Million Units), 2017-2031

Figure 59: Middle East & Africa NFC Chip Market Size & Forecast, By Storage Capacity, Revenue (US$ Mn), 2017-2031

Figure 60: Middle East & Africa NFC Chip Market Attractiveness, By Storage Capacity, Value (US$ Mn), 2022-2031

Figure 61: Middle East & Africa NFC Chip Market Share Analysis, by Storage Capacity, 2022 and 2031

Figure 62: Middle East & Africa NFC Chip Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 63: Middle East & Africa NFC Chip Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 64: Middle East & Africa NFC Chip Market Share Analysis, by Application, 2022 and 2031

Figure 65: Middle East & Africa NFC Chip Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 66: Middle East & Africa NFC Chip Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 67: Middle East & Africa NFC Chip Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 68: Middle East & Africa NFC Chip Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 69: Middle East & Africa NFC Chip Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 70: Middle East & Africa NFC Chip Market Share Analysis, by Country, 2022 and 2031

Figure 71: South America NFC Chip Market, Value (US$ Mn), 2017-2031

Figure 72: South America NFC Chip Market, Volume (Million Units), 2017-2031

Figure 73: South America NFC Chip Market Size & Forecast, By Storage Capacity, Revenue (US$ Mn), 2017-2031

Figure 74: South America NFC Chip Market Attractiveness, By Storage Capacity, Value (US$ Mn), 2022-2031

Figure 75: South America NFC Chip Market Share Analysis, by Storage Capacity, 2022 and 2031

Figure 76: South America NFC Chip Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 77: South America NFC Chip Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 78: South America NFC Chip Market Share Analysis, by Application, 2022 and 2031

Figure 79: South America NFC Chip Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 80: South America NFC Chip Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 81: South America NFC Chip Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 82: South America NFC Chip Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 83: South America NFC Chip Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 84: South America NFC Chip Market Share Analysis, by Country, 2022 and 2031