Analysts’ Viewpoint

China is rapidly gaining recognition for developing one of the largest global public charging infrastructures. In particular, for connectivity between airports and urban centers, NEV fleets seem more plausible. Comparatively, switching from conventional private vehicles to electric vehicles (EVs) has a lower potential to improve urban air quality than switching to NEV fleets or electric fleets (e-fleets).

However, range anxiety and the high cost of batteries are two issues preventing NEV fleets from being widely adopted. Key players in the NEV fleet industry should therefore increase their R&D expenditures for lithium-ion battery technology based on graphene and sulfur. Battery manufacturers are emphasizing on getting rid of cobalt from their products since these new technologies have the potential to significantly reduce the cost of production and the price of current batteries.

Emerging trend of electric vehicles and rising need to commercialize public passenger fleets are augmenting the NEV fleet market growth. Newer battery electric vehicle and hybrid electric vehicle versions are reportedly being introduced by global automakers. Current technological developments are driving the emergence of new energy or electric automobiles.

Growing concerns about tailpipe emission and its negative impacts on the environment are anticipated to boost the growth prospects of the NEV fleet market. Demand for new energy vehicles is increasing, as people become more aware about how quickly fossil fuels are running out, how expensive they are getting, and the ill-effects they are generating due to pollution.

However, consumers must take into account additional issues before ‘going electric’. For instance, fleet managers must comprehend the effects of charging several vehicles while maintaining fleet operations, as well as the additional considerations bigger medium/heavy-duty (MD/HD) vehicles require.

Electric vehicles (EVs) are effective options for public fleets since they can handle diverse daily driving requirements. They are useful in light-duty, medium/heavy-duty (MD/HD), and even off-road applications and offer numerous advantages. Studies and surveys on the topic indicate that the cities with the fastest adoption of NEVs have lower emission levels than other places. Additionally, because NEVs have fewer moveable or rotating parts than conventional engine fleets, they are a far better option for E-fleet owners than ICE vehicles. This is a key factor that is estimated to fuel the NEV fleet market revenue during the projection period.

Fleet operators can boost revenue by lowering costs associated with fleet maintenance and operations by using NEV fleets. These features encourage and persuade fleet owner-drivers and passengers to choose NEV fleets or cabs, which in turn is propelling the NEV fleet market demand.

Stringent pollution control standards set by numerous governments worldwide, together with tax incentives and subsidies for NEV sales, are boosting the adoption of electric vehicle fleet globally. A rise in awareness about the adoption of green mobility is also expected to drive NEV fleet market opportunities during the forecast period, which is seen as the future or tomorrow's mobility. The limited availability of fossil fuels and the auto industry's declining reliance on these fuels are further encouraging the adoption of NEV fleets.

EVs can refuel at public stations or fleet facilities. When they are not in use, EVs may charge overnight with the aid of facility charging. Public direct-current fast-charging (DCFC) facilities are becoming more prevalent along important transit corridors to increase EV range for longer trips. Moreover, EVs are helping businesses accomplish environmental goals, due to their high efficiency and low emissions benefits. EV fleets are being extensively employed in public transit such as transit/school buses, police cars, and taxis which is creating a favorable impression. Thus, EVs are assisting public fleets in adhering to state or local alternative transportation policies.

Based on NEV type, the battery electric vehicle (BEV) segment accounted for prominent market share in 2022. Increased demand for low-emission vehicles and government tax credit exemptions on their purchase are prominent factors boosting the NEV market statistics. Furthermore, the battery electric vehicle segment is estimated to expand significantly during the projected period due to the car's zero emissions and reduced noise.

In terms of application, the passenger commercial fleet segment is projected to grow considerably in the next few years, primarily due to flourishing e-hailing services as well as growing demand from intercity and intra-city public transit applications.

Asia Pacific accounted for a significant portion of the worldwide NEV fleet market share. Expansion of NEV fleet industry is primarily due to the rise in demand for electric vehicles in China, India, South Korea and Japan, along with the rise in development of accessibility of electric charging stations.

Moreover, the Government of China is implementing a huge charging station installation program and offering extra tax breaks and incentives to encourage the use of NEV fleets and lower the nation's emissions. Consequently, China is projected to account for a notable market share during the forecast period.

Additionally, the Government of India is anticipated to support the adoption of electric cabs n the nation's major cities, which is estimated to positively impact the NEV fleet market forecast in the next few years.

South Korea is displaying a much stronger intensity in green transformation than several other countries in the region, thanks to strong support and electrification strategy offered by its government. In 2020, South Korea opened a new page in its eco-friendly transformation by announcing the ‘New Green Deal’, which is estimated to foresee 1.13 million EVs and 200,000 hydrogen vehicles on the roads by 2025.

Some of the key players identified in the NEV fleet market across the globe are AB Volvo, BAIC Motor Corporation Ltd., Beiqi Foton Motor Co., Ltd., BMW AG, BYD Auto Co., Ltd., Changan Automobile Company Limited., Daimler AG, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Hyundai Motor Company, JAC Motors, London Electric Vehicle Company, Mahindra and Mahindra Limited, Nissan Motor Corporation, Renault, TATA Motors, Tesla, Inc., Toyota Motor Corporation, Volkswagen.

Key players in the NEV fleet market research report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Volume in 2022 |

2579 |

|

Market Forecast Volume in 2031 |

17361 |

|

Growth Rate (CAGR) |

23.60% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

Number of New Fleets for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, Volume chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

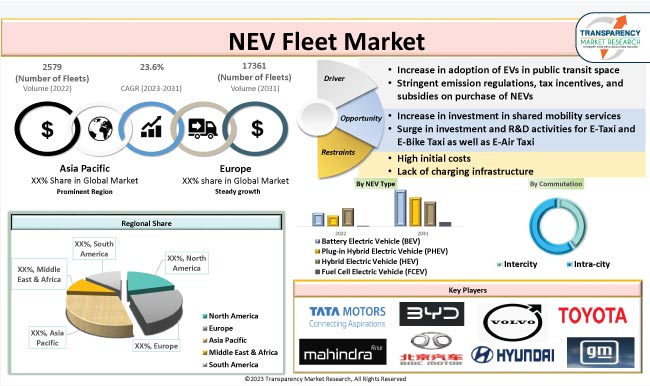

The global market stood at 2,579 new fleets in 2022

It is expected to rise at a CAGR of 23.6% by 2031

The business is anticipated to reach 17,361 new fleets in 2031

Increase in adoption of electric vehicles in public transit and in commercial transport solutions and surge in demand for noiseless, eco-friendly, and efficient vehicles

Based on NEV Type, the battery electric vehicle (BEV) segment held largest share in 2022

Asia Pacific was highly lucrative for NEV fleets

Leading players identified in the global NEV Fleet Market are: AB Volvo, BAIC Motor Corporation Ltd., Beiqi Foton Motor Co., Ltd., BMW AG, BYD Auto Co., Ltd., Changan Automobile Company Limited., Daimler AG, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Hyundai Motor Company, JAC Motors, London Electric Vehicle Company, Mahindra and Mahindra Limited, Nissan Motor Corporation, Renault, TATA Motors, Tesla, Inc., Toyota Motor Corporation, Volkswagen, and others.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Volume (Number of New Fleets), 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Macro-Economic Factors

3.3.1. Per Capita Consumption (PCC)

3.3.2. Government Regulations

3.3.3. Industrial Developments

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunity

3.5. Market Factor Analysis

3.5.1. Porter’s Five Force Analysis

3.5.2. SWOT Analysis

3.6. Regulatory Scenario

3.7. Key Trend Analysis

3.8. Value Chain Analysis

3.8.1. Component Manufacturer

3.8.2. System Suppliers

3.8.3. Tier 1 Players

3.8.4. 0.5 Tier Players/ Technology Providers

3.9. Regulatory Scenario

3.9.1. NEV Fleet Market - Various Government Announcement on EVs

4. NEV Fleet Market - Emission Impact Analysis

4.1. Government Emission Regulations

4.2. Auto Manufacturers Announcement

4.3. Announcement and Implementation on banning ICE

5. Global NEV Fleet Market, by NEV Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global NEV Fleet Market Size & Forecast, 2017-2031, by NEV Type

5.2.1. Battery Electric Vehicle (BEV)

5.2.2. Plug-in Hybrid Electric Vehicle (PHEV)

5.2.3. Hybrid Electric Vehicle (HEV)

5.2.4. Fuel Cell Electric Vehicle (FCEV)

6. Global NEV Fleet Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global NEV Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

6.2.1. Two Wheelers

6.2.2. Three Wheelers

6.2.3. Passenger Cars

6.2.3.1. Hatchback

6.2.3.2. Sedan

6.2.3.3. Utility Vehicles (SUVs & MPVs)

6.2.4. Light Commercial Vehicles

6.2.5. Heavy Duty Trucks

6.2.6. Buses and Coaches

6.2.7. Off-Highway Vehicles

6.2.7.1. Agriculture Tractors & Equipment

6.2.7.2. Construction & Mining Equipment

6.2.7.3. Industrial Vehicles (Forklift, AGV, Etc.)

7. Global NEV Fleet Market, by Commutation

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global NEV Fleet Market Size & Forecast, 2017-2031, by Commutation

7.2.1. Intercity

7.2.2. Intra-city

8. Global NEV Fleet Market, by Fleet Size

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global NEV Fleet Market Size & Forecast, 2017-2031, by Fleet Size

8.2.1. 2 to 50

8.2.2. 51-100

8.2.3. 101-200

8.2.4. 201-500

8.2.5. 501-1000

8.2.6. 1001- 2000

8.2.7. More than 2000

9. Global NEV Fleet Market, by Source of Electrification

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global NEV Fleet Market Size & Forecast, 2017-2031, by Source of Electrification

9.2.1. Traditional Battery

9.2.1.1. Lithium- Ion

9.2.1.2. Lead Acid

9.2.1.3. Nickel-Metal Hydride (Ni-MH)

9.2.2. Hydrogen Fuel Cell

9.2.3. Solar Battery

10. Global NEV Fleet Market, by Application

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global NEV Fleet Market Size & Forecast, 2017-2031, by Application

10.2.1. Personal Fleet

10.2.2. Passenger Commercial Fleet

10.2.2.1. Taxi

10.2.2.2. City Buses

10.2.2.3. Intercity Buses

10.2.2.4. Ride Sharing

10.2.2.5. Delivery fleets

10.2.3. Cargo fleets

10.2.4. Others

11. Global NEV Fleet Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global NEV Fleet Market Size & Forecast, 2017-2031, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America NEV Fleet Market

12.1. Market Snapshot

12.2. NEV Fleet Market Size & Forecast, 2017-2031, by NEV Type

12.2.1. Battery Electric Vehicle (BEV)

12.2.2. Plug-in Hybrid Electric Vehicle (PHEV)

12.2.3. Hybrid Electric Vehicle (HEV)

12.2.4. Fuel Cell Electric Vehicle (FCEV)

12.3. NEV Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

12.3.1. Two Wheelers

12.3.2. Three Wheelers

12.3.3. Passenger Cars

12.3.3.1. Hatchback

12.3.3.2. Sedan

12.3.3.3. Utility Vehicles (SUVs & MPVs)

12.3.4. Light Commercial Vehicles

12.3.5. Heavy Duty Trucks

12.3.6. Buses and Coaches

12.3.7. Off-Highway Vehicles

12.3.7.1. Agriculture Tractors & Equipment

12.3.7.2. Construction & Mining Equipment

12.3.7.3. Industrial Vehicles (Forklift, AGV, Etc.)

12.4. NEV Fleet Market Size & Forecast, 2017-2031, by Commutation

12.4.1. Intercity

12.4.2. Intra-city

12.5. NEV Fleet Market Size & Forecast, 2017-2031, by Fleet Size

12.5.1. 2 to 50

12.5.2. 51-100

12.5.3. 101-200

12.5.4. 201-500

12.5.5. 501-1000

12.5.6. 1001- 2000

12.5.7. More than 2000

12.6. NEV Fleet Market Size & Forecast, 2017-2031, by Source of Electrification

12.6.1. Traditional Battery

12.6.1.1. Lithium- Ion

12.6.1.2. Lead Acid

12.6.1.3. Nickel-Metal Hydride (Ni-MH)

12.6.2. Hydrogen Fuel Cell

12.6.3. Solar Battery

12.7. NEV Fleet Market Size & Forecast, 2017-2031, by Application

12.7.1. Personal Fleet

12.7.2. Passenger Commercial Fleet

12.7.2.1. Taxi

12.7.2.2. City Buses

12.7.2.3. Intercity Buses

12.7.2.4. Ride Sharing

12.7.2.5. Delivery fleets

12.7.3. Cargo fleets

12.7.4. Others

12.8. Key Country Analysis - North America NEV Fleet Market Size & Forecast, 2017-2031

12.8.1. U. S.

12.8.2. Canada

12.8.3. Mexico

13. Europe NEV Fleet Market

13.1. Market Snapshot

13.2. NEV Fleet Market Size & Forecast, 2017-2031, by NEV Type

13.2.1. Battery Electric Vehicle (BEV)

13.2.2. Plug-in Hybrid Electric Vehicle (PHEV)

13.2.3. Hybrid Electric Vehicle (HEV)

13.2.4. Fuel Cell Electric Vehicle (FCEV)

13.3. NEV Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

13.3.1. Two Wheelers

13.3.2. Three Wheelers

13.3.3. Passenger Cars

13.3.3.1. Hatchback

13.3.3.2. Sedan

13.3.3.3. Utility Vehicles (SUVs & MPVs)

13.3.4. Light Commercial Vehicles

13.3.5. Heavy Duty Trucks

13.3.6. Buses and Coaches

13.3.7. Off-Highway Vehicles

13.3.7.1. Agriculture Tractors & Equipment

13.3.7.2. Construction & Mining Equipment

13.3.7.3. Industrial Vehicles (Forklift, AGV, Etc.)

13.4. NEV Fleet Market Size & Forecast, 2017-2031, by Commutation

13.4.1. Intercity

13.4.2. Intra-city

13.5. NEV Fleet Market Size & Forecast, 2017-2031, by Fleet Size

13.5.1. 2 to 50

13.5.2. 51-100

13.5.3. 101-200

13.5.4. 201-500

13.5.5. 501-1000

13.5.6. 1001- 2000

13.5.7. More than 2000

13.6. NEV Fleet Market Size & Forecast, 2017-2031, by Source of Electrification

13.6.1. Traditional Battery

13.6.1.1. Lithium- Ion

13.6.1.2. Lead Acid

13.6.1.3. Nickel-Metal Hydride (Ni-MH)

13.6.2. Hydrogen Fuel Cell

13.6.3. Solar Battery

13.7. NEV Fleet Market Size & Forecast, 2017-2031, by Application

13.7.1. Personal Fleet

13.7.2. Passenger Commercial Fleet

13.7.2.1. Taxi

13.7.2.2. City Buses

13.7.2.3. Intercity Buses

13.7.2.4. Ride Sharing

13.7.2.5. Delivery fleets

13.7.3. Cargo fleets

13.7.4. Others

13.8. Key Country Analysis - Europe NEV Fleet Market Size & Forecast, 2017-2031

13.8.1. Germany

13.8.2. U. K.

13.8.3. France

13.8.4. Italy

13.8.5. Spain

13.8.6. Nordic Countries

13.8.7. Russia & CIS

13.8.8. Rest of Europe

14. Asia Pacific NEV Fleet Market

14.1. Market Snapshot

14.2. NEV Fleet Market Size & Forecast, 2017-2031, by NEV Type

14.2.1. Battery Electric Vehicle (BEV)

14.2.2. Plug-in Hybrid Electric Vehicle (PHEV)

14.2.3. Hybrid Electric Vehicle (HEV)

14.2.4. Fuel Cell Electric Vehicle (FCEV)

14.3. NEV Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

14.3.1. Two Wheelers

14.3.2. Three Wheelers

14.3.3. Passenger Cars

14.3.3.1. Hatchback

14.3.3.2. Sedan

14.3.3.3. Utility Vehicles (SUVs & MPVs)

14.3.4. Light Commercial Vehicles

14.3.5. Heavy Duty Trucks

14.3.6. Buses and Coaches

14.3.7. Off-Highway Vehicles

14.3.7.1. Agriculture Tractors & Equipment

14.3.7.2. Construction & Mining Equipment

14.3.7.3. Industrial Vehicles (Forklift, AGV, Etc.)

14.4. NEV Fleet Market Size & Forecast, 2017-2031, by Commutation

14.4.1. Intercity

14.4.2. Intra-city

14.5. NEV Fleet Market Size & Forecast, 2017-2031, by Fleet Size

14.5.1. 2 to 50

14.5.2. 51-100

14.5.3. 101-200

14.5.4. 201-500

14.5.5. 501-1000

14.5.6. 1001- 2000

14.5.7. More than 2000

14.6. NEV Fleet Market Size & Forecast, 2017-2031, by Source of Electrification

14.6.1. Traditional Battery

14.6.1.1. Lithium- Ion

14.6.1.2. Lead Acid

14.6.1.3. Nickel-Metal Hydride (Ni-MH)

14.6.2. Hydrogen Fuel Cell

14.6.3. Solar Battery

14.7. NEV Fleet Market Size & Forecast, 2017-2031, by Application

14.7.1. Personal Fleet

14.7.2. Passenger Commercial Fleet

14.7.2.1. Taxi

14.7.2.2. City Buses

14.7.2.3. Intercity Buses

14.7.2.4. Ride Sharing

14.7.2.5. Delivery fleets

14.7.3. Cargo fleets

14.7.4. Others

14.8. Key Country Analysis - Asia Pacific NEV Fleet Market Size & Forecast, 2017-2031, by Country

14.8.1. China

14.8.2. India

14.8.3. Japan

14.8.4. ASEAN Countries

14.8.5. South Korea

14.8.6. ANZ

14.8.7. Rest of Asia Pacific

15. Middle East & Africa NEV Fleet Market

15.1. Market Snapshot

15.2. NEV Fleet Market Size & Forecast, 2017-2031, by NEV Type

15.2.1. Battery Electric Vehicle (BEV)

15.2.2. Plug-in Hybrid Electric Vehicle (PHEV)

15.2.3. Hybrid Electric Vehicle (HEV)

15.2.4. Fuel Cell Electric Vehicle (FCEV)

15.3. NEV Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

15.3.1. Two Wheelers

15.3.2. Three Wheelers

15.3.3. Passenger Cars

15.3.3.1. Hatchback

15.3.3.2. Sedan

15.3.3.3. Utility Vehicles (SUVs & MPVs)

15.3.4. Light Commercial Vehicles

15.3.5. Heavy Duty Trucks

15.3.6. Buses and Coaches

15.3.7. Off-Highway Vehicles

15.3.7.1. Agriculture Tractors & Equipment

15.3.7.2. Construction & Mining Equipment

15.3.7.3. Industrial Vehicles (Forklift, AGV, Etc.)

15.4. NEV Fleet Market Size & Forecast, 2017-2031, by Commutation

15.4.1. Intercity

15.4.2. Intra-city

15.5. NEV Fleet Market Size & Forecast, 2017-2031, by Fleet Size

15.5.1. 2 to 50

15.5.2. 51-100

15.5.3. 101-200

15.5.4. 201-500

15.5.5. 501-1000

15.5.6. 1001- 2000

15.5.7. More than 2000

15.6. NEV Fleet Market Size & Forecast, 2017-2031, by Source of Electrification

15.6.1. Traditional Battery

15.6.1.1. Lithium- Ion

15.6.1.2. Lead Acid

15.6.1.3. Nickel-Metal Hydride (Ni-MH)

15.6.2. Hydrogen Fuel Cell

15.6.3. Solar Battery

15.7. NEV Fleet Market Size & Forecast, 2017-2031, by Application

15.7.1. Personal Fleet

15.7.2. Passenger Commercial Fleet

15.7.2.1. Taxi

15.7.2.2. City Buses

15.7.2.3. Intercity Buses

15.7.2.4. Ride Sharing

15.7.2.5. Delivery fleets

15.7.3. Cargo fleets

15.7.4. Others

15.8. Key Country Analysis - Middle East & Africa NEV Fleet Market Size & Forecast, 2017-2031, by Country

15.8.1. GCC

15.8.2. South Africa

15.8.3. Turkey

15.8.4. Rest of Middle East & Africa

16. South America NEV Fleet Market

16.1. Market Snapshot

16.2. NEV Fleet Market Size & Forecast, 2017-2031, by NEV Type

16.2.1. Battery Electric Vehicle (BEV)

16.2.2. Plug-in Hybrid Electric Vehicle (PHEV)

16.2.3. Hybrid Electric Vehicle (HEV)

16.2.4. Fuel Cell Electric Vehicle (FCEV)

16.3. NEV Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

16.3.1. Two Wheelers

16.3.2. Three Wheelers

16.3.3. Passenger Cars

16.3.3.1. Hatchback

16.3.3.2. Sedan

16.3.3.3. Utility Vehicles (SUVs & MPVs)

16.3.4. Light Commercial Vehicles

16.3.5. Heavy Duty Trucks

16.3.6. Buses and Coaches

16.3.7. Off-Highway Vehicles

16.3.7.1. Agriculture Tractors & Equipment

16.3.7.2. Construction & Mining Equipment

16.3.7.3. Industrial Vehicles (Forklift, AGV, Etc.)

16.4. NEV Fleet Market Size & Forecast, 2017-2031, by Commutation

16.4.1. Intercity

16.4.2. Intra-city

16.5. NEV Fleet Market Size & Forecast, 2017-2031, by Fleet Size

16.5.1. 2 to 50

16.5.2. 51-100

16.5.3. 101-200

16.5.4. 201-500

16.5.5. 501-1000

16.5.6. 1001- 2000

16.5.7. More than 2000

16.6. NEV Fleet Market Size & Forecast, 2017-2031, by Source of Electrification

16.6.1. Traditional Battery

16.6.1.1. Lithium- Ion

16.6.1.2. Lead Acid

16.6.1.3. Nickel-Metal Hydride (Ni-MH)

16.6.2. Hydrogen Fuel Cell

16.6.3. Solar Battery

16.7. NEV Fleet Market Size & Forecast, 2017-2031, by Application

16.7.1. Personal Fleet

16.7.2. Passenger Commercial Fleet

16.7.2.1. Taxi

16.7.2.2. City Buses

16.7.2.3. Intercity Buses

16.7.2.4. Ride Sharing

16.7.2.5. Delivery fleets

16.7.3. Cargo fleets

16.7.4. Others

16.8. Key Country Analysis - South America NEV Fleet Market Size & Forecast, 2017-2031

16.8.1. Brazil

16.8.2. Argentina

16.8.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2022

17.2. Key Strategy Analysis

17.2.1. Strategic Overview - Expansion, M&A, Partnership

17.2.2. Product & Marketing Strategy

17.3. Consumer Trend Analysis for Key Players

17.3.1. Battery Electric Vehicle

17.3.2. Plug-in Hybrid Electric Vehicle

17.3.3. Hybrid Electric Vehicle

17.3.4. Fuel Cell Eletric Vehicle

17.4. Pricing comparison among key players

17.5. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1. AB Volvo

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. BAIC Motor Corporation., Ltd

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. Beiqi Foton Motor Co., Ltd.

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. BMW AG

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. BYD Auto Co., Ltd.

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. Changan Automobile Company Limited.

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Daimler AG

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. Ford Motor Company

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. General Motors Company

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. Honda Motor Co., Ltd.

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Hyundai Motor Company

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. JAC Motors

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. London Electric Vehicle Company

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. Mahindra and Mahindra Limited

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. Nissan Motor Corporation

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. Renault

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

18.17. TATA Motors

18.17.1. Company Overview

18.17.2. Company Footprints

18.17.3. Production Locations

18.17.4. Product Portfolio

18.17.5. Competitors & Customers

18.17.6. Subsidiaries & Parent Organization

18.17.7. Recent Developments

18.17.8. Financial Analysis

18.17.9. Profitability

18.17.10. Revenue Share

18.18. Tesla, Inc.

18.18.1. Company Overview

18.18.2. Company Footprints

18.18.3. Production Locations

18.18.4. Product Portfolio

18.18.5. Competitors & Customers

18.18.6. Subsidiaries & Parent Organization

18.18.7. Recent Developments

18.18.8. Financial Analysis

18.18.9. Profitability

18.18.10. Revenue Share

18.19. Toyota Motor Corporation

18.19.1. Company Overview

18.19.2. Company Footprints

18.19.3. Production Locations

18.19.4. Product Portfolio

18.19.5. Competitors & Customers

18.19.6. Subsidiaries & Parent Organization

18.19.7. Recent Developments

18.19.8. Financial Analysis

18.19.9. Profitability

18.19.10. Revenue Share

18.20. Volkswagen

18.20.1. Company Overview

18.20.2. Company Footprints

18.20.3. Production Locations

18.20.4. Product Portfolio

18.20.5. Competitors & Customers

18.20.6. Subsidiaries & Parent Organization

18.20.7. Recent Developments

18.20.8. Financial Analysis

18.20.9. Profitability

18.20.10. Revenue Share

18.21. Others

18.21.1. Company Overview

18.21.2. Company Footprints

18.21.3. Production Locations

18.21.4. Product Portfolio

18.21.5. Competitors & Customers

18.21.6. Subsidiaries & Parent Organization

18.21.7. Recent Developments

18.21.8. Financial Analysis

18.21.9. Profitability

18.21.10. Revenue Share

List of Tables

Table 1: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Table 2: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Table 3: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Table 4: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Table 5: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Table 6: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Table 7: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Region, 2017-2031

Table 8: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Table 9: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Table 10: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Table 11: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Table 12: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Table 13: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Table 14: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Table 15: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Table 16: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Table 17: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Table 18: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Table 19: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Table 20: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Table 21: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Table 22: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Table 23: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Table 24: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Table 25: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Table 26: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Table 27: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Table 28: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Table 29: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Table 30: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Table 31: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Table 32: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Table 33: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Table 34: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Table 35: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Table 36: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Table 37: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Table 38: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Table 39: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Table 40: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Table 41: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Table 42: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Figure 2: Global NEV Fleet Market, Incremental Opportunity, by NEV Type, Volume (Number of New Fleets), 2023-2031

Figure 3: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Figure 4: Global NEV Fleet Market, Incremental Opportunity, by Vehicle Type, Volume (Number of New Fleets), 2023-2031

Figure 5: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Figure 6: Global NEV Fleet Market, Incremental Opportunity, by Commutation, Volume (Number of New Fleets), 2023-2031

Figure 7: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Figure 8: Global NEV Fleet Market, Incremental Opportunity, by Fleet Size, Volume (Number of New Fleets), 2023-2031

Figure 9: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Figure 10: Global NEV Fleet Market, Incremental Opportunity, by Source of Electrification, Volume (Number of New Fleets), 2023-2031

Figure 11: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Figure 12: Global NEV Fleet Market, Incremental Opportunity, by Application, Volume (Number of New Fleets), 2023-2031

Figure 13: Global NEV Fleet Market Volume (Number of New Fleets) Forecast, by Region, 2017-2031

Figure 14: Global NEV Fleet Market, Incremental Opportunity, by Region, Volume (Number of New Fleets), 2023-2031

Figure 15: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Figure 16: North America NEV Fleet Market, Incremental Opportunity, by NEV Type, Volume (Number of New Fleets), 2023-2031

Figure 17: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Figure 18: North America NEV Fleet Market, Incremental Opportunity, by Vehicle Type, Volume (Number of New Fleets), 2023-2031

Figure 19: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Figure 20: North America NEV Fleet Market, Incremental Opportunity, by Commutation, Volume (Number of New Fleets), 2023-2031

Figure 21: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Figure 22: North America NEV Fleet Market, Incremental Opportunity, by Fleet Size, Volume (Number of New Fleets), 2023-2031

Figure 23: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Figure 24: North America NEV Fleet Market, Incremental Opportunity, by Source of Electrification, Volume (Number of New Fleets), 2023-2031

Figure 25: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Figure 26: North America NEV Fleet Market, Incremental Opportunity, by Application, Volume (Number of New Fleets), 2023-2031

Figure 27: North America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Figure 28: North America NEV Fleet Market, Incremental Opportunity, by Country, Volume (Number of New Fleets), 2023-2031

Figure 29: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Figure 30: Europe NEV Fleet Market, Incremental Opportunity, by NEV Type, Volume (Number of New Fleets), 2023-2031

Figure 31: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Figure 32: Europe NEV Fleet Market, Incremental Opportunity, by Vehicle Type, Volume (Number of New Fleets), 2023-2031

Figure 33: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Figure 34: Europe NEV Fleet Market, Incremental Opportunity, by Commutation, Volume (Number of New Fleets), 2023-2031

Figure 35: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Figure 36: Europe NEV Fleet Market, Incremental Opportunity, by Fleet Size, Volume (Number of New Fleets), 2023-2031

Figure 37: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Figure 38: Europe NEV Fleet Market, Incremental Opportunity, by Source of Electrification, Volume (Number of New Fleets), 2023-2031

Figure 39: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Figure 40: Europe NEV Fleet Market, Incremental Opportunity, by Application, Volume (Number of New Fleets), 2023-2031

Figure 41: Europe NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Figure 42: Europe NEV Fleet Market, Incremental Opportunity, by Country, Volume (Number of New Fleets), 2023-2031

Figure 43: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Figure 44: Asia Pacific NEV Fleet Market, Incremental Opportunity, by NEV Type, Volume (Number of New Fleets), 2023-2031

Figure 45: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Figure 46: Asia Pacific NEV Fleet Market, Incremental Opportunity, by Vehicle Type, Volume (Number of New Fleets), 2023-2031

Figure 47: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Figure 48: Asia Pacific NEV Fleet Market, Incremental Opportunity, by Commutation, Volume (Number of New Fleets), 2023-2031

Figure 49: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Figure 50: Asia Pacific NEV Fleet Market, Incremental Opportunity, by Fleet Size, Volume (Number of New Fleets), 2023-2031

Figure 51: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Figure 52: Asia Pacific NEV Fleet Market, Incremental Opportunity, by Source of Electrification, Volume (Number of New Fleets), 2023-2031

Figure 53: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Figure 54: Asia Pacific NEV Fleet Market, Incremental Opportunity, by Application, Volume (Number of New Fleets), 2023-2031

Figure 55: Asia Pacific NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Figure 56: Asia Pacific NEV Fleet Market, Incremental Opportunity, by Country, Volume (Number of New Fleets), 2023-2031

Figure 57: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Figure 58: Middle East & Africa NEV Fleet Market, Incremental Opportunity, by NEV Type, Volume (Number of New Fleets), 2023-2031

Figure 59: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Figure 60: Middle East & Africa NEV Fleet Market, Incremental Opportunity, by Vehicle Type, Volume (Number of New Fleets), 2023-2031

Figure 61: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Figure 62: Middle East & Africa NEV Fleet Market, Incremental Opportunity, by Commutation, Volume (Number of New Fleets), 2023-2031

Figure 63: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Figure 64: Middle East & Africa NEV Fleet Market, Incremental Opportunity, by Fleet Size, Volume (Number of New Fleets), 2023-2031

Figure 65: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Figure 66: Middle East & Africa NEV Fleet Market, Incremental Opportunity, by Source of Electrification, Volume (Number of New Fleets), 2023-2031

Figure 67: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Figure 68: Middle East & Africa NEV Fleet Market, Incremental Opportunity, by Application, Volume (Number of New Fleets), 2023-2031

Figure 69: Middle East & Africa NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Figure 70: Middle East & Africa NEV Fleet Market, Incremental Opportunity, by Country, Volume (Number of New Fleets), 2023-2031

Figure 71: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by NEV Type, 2017-2031

Figure 72: South America NEV Fleet Market, Incremental Opportunity, by NEV Type, Volume (Number of New Fleets), 2023-2031

Figure 73: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Vehicle Type, 2017-2031

Figure 74: South America NEV Fleet Market, Incremental Opportunity, by Vehicle Type, Volume (Number of New Fleets), 2023-2031

Figure 75: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Commutation, 2017-2031

Figure 76: South America NEV Fleet Market, Incremental Opportunity, by Commutation, Volume (Number of New Fleets), 2023-2031

Figure 77: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Fleet Size, 2017-2031

Figure 78: South America NEV Fleet Market, Incremental Opportunity, by Fleet Size, Volume (Number of New Fleets), 2023-2031

Figure 79: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Source of Electrification, 2017-2031

Figure 80: South America NEV Fleet Market, Incremental Opportunity, by Source of Electrification, Volume (Number of New Fleets), 2023-2031

Figure 81: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Application, 2017-2031

Figure 82: South America NEV Fleet Market, Incremental Opportunity, by Application, Volume (Number of New Fleets), 2023-2031

Figure 83: South America NEV Fleet Market Volume (Number of New Fleets) Forecast, by Country, 2017-2031

Figure 84: South America NEV Fleet Market, Incremental Opportunity, by Country, Volume (Number of New Fleets), 2023-2031