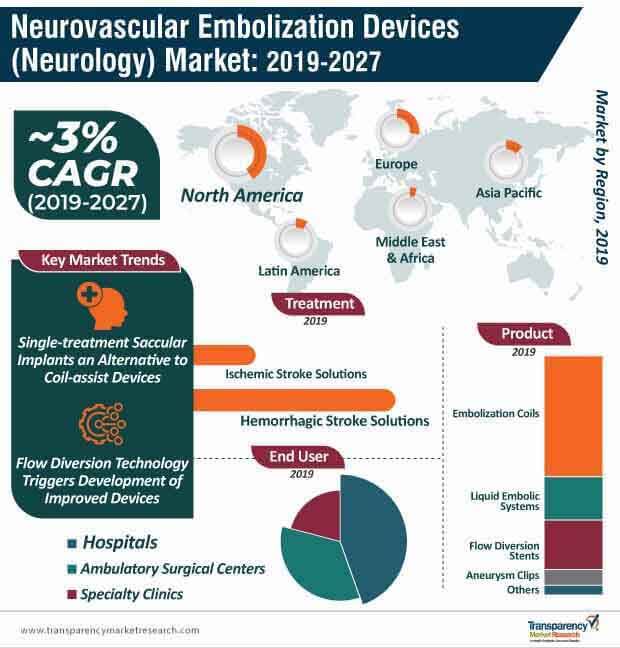

Healthcare companies in the neurovascular embolization devices (neurology) market have successfully established a strong foundation for treatment options with the help of embolization coils and liquid embolic systems. However, these treatment options present unique challenges in certain health conditions such as wide-neck bifurcated aneurysms. To overcome this challenge, manufacturers are introducing single-treatment saccular implants. Based on the same principle, healthcare companies in the neurovascular embolization devices (neurology) market are developing Woven EndoBridge (WEB) aneurysm embolization systems that overcome the complications associated with coil-assist devices and surgical clippings.

WEB devices are gaining prominence as a less-invasive treatment alternative for wide-neck intracranial aneurysms in the neurovascular embolization devices (neurology) market space. This is why, many healthcare companies are investing in WEB devices and seeking the approval of health commissions. For instance, in January 2019, MicroVention — a neuroendovascular medical device company, announced the launch of an FDA-approved WEB aneurysm embolization system for the treatment of wide-neck bifurcated aneurysms.

Recent advances in device technology are more focused on the control and precision of device placement during deployment procedures. To achieve this, healthcare companies in the neurovascular embolization devices (neurology) market are innovating in flow diversion technology. This is evident, as among the products in the neurovascular embolization devices (neurology) market, flow diversion stents are estimated to have the second-highest revenue of ~US$ 215 million by 2027.

Flow diversion technology has triggered the need for improved devices in the neurovascular embolization devices (neurology) landscape. As such, manufacturers are increasing the availability of flow-diverting devices for use in hospitals and ambulatory surgical centers. However, flow-diverting devices lead to challenging complications such as vertebrobasilar aneurysms in patients. Thus, healthcare companies are overcoming this limitation by seeking licensed approval from health commissions, so that their devices are credible. They are increasing research & development to validate clinically-approved data on the long-term benefits of using flow-diverting devices.

Although flow diversion stents result in fewer complications in patients, lack of clinical evidence about their long-term outcome remains a matter of debate. This is why, healthcare companies in the neurovascular embolization devices (neurology) market are supporting the treatment infrastructure with pipeline embolization devices (PEDs). Since these devices are outperforming other endoluminal devices, manufacturers are promoting their application for bifurcation aneurysms.

Posterior circulation aneurysm is another driver that is demanding the need for PEDs in the neurovascular embolization devices (neurology) market. As such, manufacturers are introducing variations in braided stents, local porosity, and filament position modeled with cone beam computed tomography to provide critical information to healthcare providers, prior to surgical treatments. PED technology is being rapidly transformed into pipeline flex technology. Although limited studies prove its long-term outcomes, pipeline flex is found to be a safe treatment option, and it serves as a short-term efficacy alternative.

Analysts’ Viewpoint

The adoption of WEB devices for neurovascular embolization treatment is relatively slow in European countries. Thus, manufacturers in the neurovascular embolization devices (neurology) market should increase production capabilities for WEB devices in North America, since this region is projected to account for the largest market share in the neurovascular embolization devices (neurology) market over the forecast period.

Although embolization coils and flow diversion stents account for a significant amount of the revenue in the market, health complications associated with these products act as a hurdle for manufacturers. Taking a cue from the North America market, manufacturers in Europe and Asia Pacific should develop and promote WEB devices that will help create more incremental opportunities in these high-growth regions.

To gain credibility in the market, healthcare companies should seek approvals, such as the FDA Premarket Approval (PMA), to strategically market their product offerings in the highly consolidated global neurovascular embolization devices (neurology) market.

Neurovascular Embolization Devices (Neurology) Market: Overview

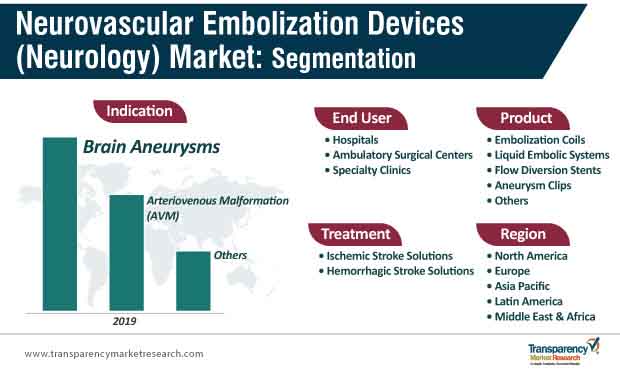

Neurovascular Embolization Devices (Neurology) Market: Segment Analysis

Neurovascular Embolization Devices (Neurology) Market: Key Insights

Neurovascular Embolization Devices (Neurology) Market: Prominent Players

Neurovascular embolization devices (neurology) market is anticipated to reach ~US$ 1.6 Bn by 2027

Neurovascular embolization devices (neurology) market to expand at a CAGR of ~3% from 2019 to 2027

Neurovascular embolization devices (neurology) market is driven by increase in incidence of neurovascular diseases across the globe

The embolization coils product segment dominated the global neurovascular embolization devices (neurology) market

Key players in the global neurovascular embolization devices (neurology) market include Stryker Corporation, Terumo Medical Corporation, DePuy Synthes (Johnson & Johnson Services, Inc.), Boston Scientific Corporation, Acandis GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Neurovascular Embolization Devices (Neurology) Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Neurovascular Embolization Devices (Neurology) Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Key Industry Developments

5.2. Regulatory Scenario

5.3. Reimbursement Scenario

5.4. Key Mergers & Acquisitions

5.5. Technological Advancements

6. Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Product

6.1. Introduction & Definition

6.2. Global Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Product, 2017–2027

6.2.1. Embolization Coils

6.2.2. Liquid Embolic Systems

6.2.3. Flow Diversion Stents

6.2.4. Aneurysm Clips

6.2.5. Others

6.3. Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Product

7. Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Treatment

7.1. Introduction & Definition

7.2. Global Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Treatment, 2017–2027

7.2.1. Ischemic Stroke Solution

7.2.2. Hemorrhagic Stroke Solution

7.3. Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Treatment

8. Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Indication

8.1. Introduction

8.2. Global Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Indication, 2017–2027

8.2.1. Brain Aneurysms

8.2.2. Arteriovenous Malformation (AVM)

8.2.3. Others

8.3. Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Indication

9. Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by End User

9.1. Introduction

9.2. Global Neurovascular Embolization Devices (Neurology) Market Value Forecast, by End User, 2017–2027

9.2.1. Hospitals

9.2.2. Ambulatory Surgery Centers

9.2.3. Specialty Clinics

9.3. Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by End User

10. Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Region

10.1. Introduction

10.2. Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Region, 2017–2027

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Region

11. North America Neurovascular Embolization Devices (Neurology) Market Analysis and Forecast

11.1. Introduction

11.2. North America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Product, 2017–2027

11.2.1. Embolization Coils

11.2.2. Liquid Embolic Systems

11.2.3. Flow Diversion Stents

11.2.4. Aneurysm Clips

11.2.5. Others

11.3. North America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Treatment, 2017–2027

11.3.1. Ischemic Stroke Solution

11.3.2. Hemorrhagic Stroke Solution

11.4. North America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Indication, 2017–2027

11.4.1. Brain Aneurysms

11.4.2. Arteriovenous Malformation (AVM)

11.4.3. Others

11.5. North America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by End User, 2017–2027

11.5.1. Hospitals

11.5.2. Ambulatory Surgery Centers

11.5.3. Specialty Clinics

11.6. North America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Country/Sub-region, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.7. North America Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Treatment

11.7.3. By Indication

11.7.4. By End User

11.7.5. By Country/Sub-region

12. Europe Neurovascular Embolization Devices (Neurology) Market Analysis and Forecast

12.1. Introduction

12.2. Europe Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Product, 2017–2027

12.2.1. Embolization Coils

12.2.2. Liquid Embolic Systems

12.2.3. Flow Diversion Stents

12.2.4. Aneurysm Clips

12.2.5. Others

12.3. Europe Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Treatment, 2017–2027

12.3.1. Ischemic Stroke Solution

12.3.2. Hemorrhagic Stroke Solution

12.4. Europe Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Indication, 2017–2027

12.4.1. Brain Aneurysms

12.4.2. Arteriovenous Malformation (AVM)

12.4.3. Others

12.5. Europe Neurovascular Embolization Devices (Neurology) Market Value Forecast, by End User, 2017–2027

12.5.1. Hospitals

12.5.2. Ambulatory Surgery Centers

12.5.3. Specialty Clinics

12.6. Europe Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Country/Sub-region, 2017–2027

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Europe Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Treatment

12.7.3. By Indication

12.7.4. By End User

12.7.5. By Country/Sub-region

13. Asia Pacific Neurovascular Embolization Devices (Neurology) Market Analysis and Forecast

13.1. Introduction

13.2. Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Product, 2017–2027

13.2.1. Embolization Coils

13.2.2. Liquid Embolic Systems

13.2.3. Flow Diversion Stents

13.2.4. Aneurysm Clips

13.2.5. Others

13.3. Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Treatment, 2017–2027

13.3.1. Ischemic Stroke Solution

13.3.2. Hemorrhagic Stroke Solution

13.4. Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Indication, 2017–2027

13.4.1. Brain Aneurysms

13.4.2. Arteriovenous Malformation (AVM)

13.4.3. Others

13.5. Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Forecast, by End User, 2017–2027

13.5.1. Hospitals

13.5.2. Ambulatory Surgery Centers

13.5.3. Specialty Clinics

13.6. Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Country/Sub-region, 2017–2027

13.6.1. Japan

13.6.2. China

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Asia Pacific Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Treatment

13.7.3. By Indication

13.7.4. By End User

13.7.5. By Country/Sub-region

14. Latin America Neurovascular Embolization Devices (Neurology) Market Analysis and Forecast

14.1. Introduction

14.2. Latin America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Product, 2017–2027

14.2.1. Embolization Coils

14.2.2. Liquid Embolic Systems

14.2.3. Flow Diversion Stents

14.2.4. Aneurysm Clips

14.2.5. Others

14.3. Latin America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Treatment, 2017–2027

14.3.1. Ischemic Stroke Solution

14.3.2. Hemorrhagic Stroke Solution

14.4. Latin America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Indication, 2017–2027

14.4.1. Brain Aneurysms

14.4.2. Arteriovenous Malformation (AVM)

14.4.3. Others

14.5. Latin America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by End User, 2017–2027

14.5.1. Hospitals

14.5.2. Ambulatory Surgery Centers

14.5.3. Specialty Clinics

14.6. Latin America Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Country/Sub-region, 2017–2027

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Latin America Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Treatment

14.7.3. By Indication

14.7.4. By End User

14.7.5. By Country/Sub-region

15. Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Analysis and Forecast

15.1. Introduction

15.2. Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Product, 2017–2027

15.2.1. Embolization Coils

15.2.2. Liquid Embolic Systems

15.2.3. Flow Diversion Stents

15.2.4. Aneurysm Clips

15.2.5. Others

15.3. Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Treatment, 2017–2027

15.3.1. Ischemic Stroke Solution

15.3.2. Hemorrhagic Stroke Solution

15.4. Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Indication, 2017–2027

15.4.1. Brain Aneurysms

15.4.2. Arteriovenous Malformation (AVM)

15.4.3. Others

15.5. Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Forecast, by End User, 2017–2027

15.5.1. Hospitals

15.5.2. Ambulatory Surgery Centers

15.5.3. Specialty Clinics

15.6. Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Forecast, by Country/Sub-region, 2017–2027

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Treatment

15.7.3. By Indication

15.7.4. By End User

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Global Neurovascular Embolization Devices (Neurology) Market Share Analysis, by Company (2018)

16.2. Company Profiles

16.2.1. Medtronic plc

16.2.1.1. Company Description

16.2.1.2. Business Overview

16.2.1.3. Financial Overview

16.2.1.4. Strategic Overview

16.2.1.5. SWOT Analysis

16.2.2. Stryker Corporation

16.2.2.1. Company Description

16.2.2.2. Business Overview

16.2.2.3. Financial Overview

16.2.2.4. Strategic Overview

16.2.2.5. SWOT Analysis

16.2.3. DePuy Synthes (Johnson & Johnson Services, Inc.)

16.2.3.1. Company Description

16.2.3.2. Business Overview

16.2.3.3. Financial Overview

16.2.3.4. Strategic Overview

16.2.3.5. SWOT Analysis

16.2.4. B.Braun Melsungen AG

16.2.4.1. Company Description

16.2.4.2. Business Overview

16.2.4.3. Financial Overview

16.2.4.4. Strategic Overview

16.2.4.5. SWOT Analysis

16.2.5. Penumbra, Inc.

16.2.5.1. Company Description

16.2.5.2. Business Overview

16.2.5.3. Financial Overview

16.2.5.4. Strategic Overview

16.2.5.5. SWOT Analysis

16.2.6. Acandis GmbH

16.2.6.1. Company Description

16.2.6.2. Business Overview

16.2.6.3. Financial Overview

16.2.6.4. Strategic Overview

16.2.6.5. SWOT Analysis

16.2.7. BALT EXTRUSION

16.2.7.1. Company Description

16.2.7.2. Business Overview

16.2.7.3. Financial Overview

16.2.7.4. Strategic Overview

16.2.7.5. SWOT Analysis

16.2.8. Terumo Medical Corporation

16.2.8.1. Company Description

16.2.8.2. Business Overview

16.2.8.3. Financial Overview

16.2.8.4. Strategic Overview

16.2.8.5. SWOT Analysis

16.2.9. Boston Scientific Corporation

16.2.9.1. Company Description

16.2.9.2. Business Overview

16.2.9.3. Financial Overview

16.2.9.4. Strategic Overview

16.2.9.5. SWOT Analysis

16.2.10. Spartan Micro, Inc.

16.2.10.1. Company Description

16.2.10.2. Business Overview

16.2.10.3. Financial Overview

16.2.10.4. Strategic Overview

16.2.10.5. SWOT Analysis

List of Tables

Table 01: Hospital Inpatient Billing and Payment Reimbursement Scenario

Table 02: Physician Billing and Payment for Reimbursement

Table 03: Key Mergers and Acquisitions

Table 04: Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 05: Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Treatment, 2017–2027

Table 06: Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 07: Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 08: Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 09: North America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 10: North America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 11: North America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Treatment, 2017?2027

Table 12: North America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Indication, 2017?2027

Table 13: North America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 14: Europe Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 15: Europe Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 16: Europe Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Indication, 2017?2027

Table 17: Europe Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Treatment, 2017?2027

Table 18: Europe Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 19: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 20: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 21: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Treatment, 2017?2027

Table 22: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Indication, 2017?2027

Table 23: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 24: Latin America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 25: Latin America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 26: Latin America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Treatment, 2017?2027

Table 27: Latin America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Indication, 2017?2027

Table 28: Latin America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 29: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 30: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 31: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Treatment, 2017?2027

Table 32: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by Indication, 2017?2027

Table 33: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, by End User, 2017?2027

List of Figures

Figure 01: Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast and Distribution (%), by Region, 2019 and 2027

Figure 02: Neurovascular Embolization Devices (Neurology) Market – Key Industry Developments

Figure 03: Market Drivers

Figure 04: Market Restraints

Figure 05: Key Opportunities

Figure 06: Global Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast, 2017–2027

Figure 07: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Product (2018)

Figure 08: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Treatment (2018)

Figure 09: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Indication (2018)

Figure 10: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by End User (2018)

Figure 11: Europe Regulatory Approval Process

Figure 12: Technological Advancements

Figure 13: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Product, 2018 and 2027

Figure 14: Global Neurovascular Embolization Devices Neurology) Market Attractiveness, by Product, 2019–2027

Figure 15: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Embolization Coils, 2017–2027

Figure 16: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Liquid Embolic Systems, 2017–2027

Figure 17: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Flow Diversion Stents, 2017–2027

Figure 18: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Aneurysm Clips, 2017–2027

Figure 19: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 20: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Treatment, 2018 and 2027

Figure 21: Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Treatment, 2019–2027

Figure 22: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hemorrhagic Stroke Solution, 2017–2027

Figure 23: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ischemic Stroke Solution, 2017–2027

Figure 24: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Indication, 2018 and 2027

Figure 25: Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Indication, 2019–2027

Figure 26: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Brain Aneurysms, 2017–2027

Figure 27: Global Ne Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Arteriovenous Malformations (AVMs), 2017–2027

Figure 28: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 29: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by End User, 2018 and 2027

Figure 30: Global Neurovascular Embolization Devices (Neurology) Market Attractiveness, by End User, 2019–2027

Figure 31: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 32: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgical Centers, 2017–2027

Figure 33: Global Neurovascular Embolization Devices (Neurology) Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Specialty Clinics, 2017–2027

Figure 34: Global Neurovascular Embolization Devices (Neurology) Market: Regional Outlook

Figure 35: Global Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Region, 2018 and 2027

Figure 36: Global Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis, by Region, 2019–2027

Figure 37: North America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 38: North America Neurovascular Embolization Devices (Neurology) Market Value Share Analysis, by Country, 2018 and 2027

Figure 39: North America Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis, by Country, 2019–2027

Figure 40: North America Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Product, 2018 and 2027

Figure 41: North America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Product, 2019–2027

Figure 42: North America Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Treatment, 2018 and 2027

Figure 43: North America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Treatment, 2019–2027

Figure 44: North America Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Indication, 2018 and 2027

Figure 45: North America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Indication, 2019–2027

Figure 46: North America Neurovascular Embolization Devices (Neurology) Market Value Share (%), by End User, 2018 and 2027

Figure 47: North America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by End User, 2019–2027

Figure 48: Europe Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 49: Europe Neurovascular Embolization Devices (Neurology) Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 50: Europe Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 51: Europe Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Product, 2018 and 2027

Figure 52: Europe Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Product, 2019–2027

Figure 53: Europe Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Indication, 2018 and 2027

Figure 54: Europe Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Indication, 2019–2027

Figure 55: Europe Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Treatment, 2018 and 2027

Figure 56: Europe N Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Treatment, 2019–2027

Figure 57: Europe Neurovascular Embolization Devices (Neurology) Market Value Share (%), by End User, 2018 and 2027

Figure 58: Europe Neurovascular Embolization Devices (Neurology) Market Attractiveness, by End User, 2019–2027

Figure 59: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 60: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 61: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 62: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Product, 2018 and 2027

Figure 63: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Product, 2019–2027

Figure 64: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Treatment, 2018 and 2027

Figure 65: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Treatment, 2019–2027

Figure 66: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Indication, 2018 and 2027

Figure 67: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Indication, 2019–2027

Figure 68: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Value Share (%), by End User, 2018 and 2027

Figure 69: Asia Pacific Neurovascular Embolization Devices (Neurology) Market Attractiveness, by End User, 2019–2027

Figure 70: Latin America Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 71: Latin America Neurovascular Embolization Devices (Neurology) Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 72: Latin America Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 73: Latin Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Product, 2018 and 2027

Figure 74: Latin America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Product, 2019–2027

Figure 75: Latin America Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Treatment, 2018 and 2027

Figure 76: Latin America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Treatment, 2019–2027

Figure 77: Latin America Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Indication, 2018 and 2027

Figure 78: Latin America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Indication, 2019–2027

Figure 79: Latin America Neurovascular Embolization Devices (Neurology) Market Value Share (%), by End User, 2018 and 2027

Figure 80: Latin America Neurovascular Embolization Devices (Neurology) Market Attractiveness, by End User, 2019–2027

Figure 81: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 82: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 83: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 84: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Product, 2018 and 2027

Figure 85: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Product, 2019–2027

Figure 86: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Treatment, 2018 and 2027

Figure 87: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Treatment, 2019–2027

Figure 88: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Share (%), by Indication, 2018 and 2027

Figure 89: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Attractiveness, by Indication, 2019–2027

Figure 90: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Value Share (%), by End User, 2018 and 2027

Figure 91: Middle East & Africa Neurovascular Embolization Devices (Neurology) Market Attractiveness, by End User, 2019–2027

Figure 92: Global Neurovascular Embolization Devices (Neurology) Market Share Analysis, by Company (2018)