Analysts’ Viewpoint on Neurostimulation Devices Market Scenario

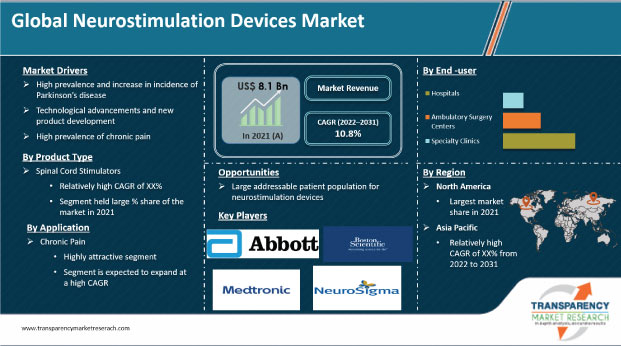

The global neurostimulation devices market is anticipated to record double-digit growth during the forecast period due to the rise in prevalence of neurological disorders, increase in geriatric population, favorable reimbursement rates, and introduction of innovative technologies. Neurostimulation devices are increasingly used to treat various health conditions, such as the effects of stroke and even depression, among patients. Healthcare companies are investing in the development of tiny external controllers that can monitor any abnormal activity in the brain. Companies should plan to invest in the healthcare landscape of Asia Pacific, since the market in the region is projected to witness strong growth in the next few years.

Neurostimulation devices are generally used to diagnose and treat disorders of autonomic nervous system (ANS), central nervous system (CNS), and peripheral nervous system (PNS). Demand for neurostimulators is rising, as these devices help in nociceptive pain management and neuropathic pain management. They also help in the management of epilepsy, depression, and Parkinson’s disease. Demand for neurostimulation devices declined during the COVID-19 pandemic, which has hampered market revenue. The market in Asia Pacific is likely to expand at the fastest growth rate during the forecast period, primarily due to the increase in incidence of neurological disorders such as arthritis and osteoporosis in countries such as Japan and China.

Parkinson’s disease is an age-related neurodegenerative disorder that affects large number of people across the world. It is characterized by muscle contraction, which leads to weakening of physical movement, tremors, muscle rigidity, and gait. It can affect multiple systems of the body.

According to the Parkinson’s Foundation, more than 10 million people live with Parkinson’s disease across the globe. Around one million people in the U.S. suffer from Parkinson's disease. Nearly 60,000 people in the U.S. are estimated to be diagnosed with Parkinson’s disease each year. The exact number of patients is not known primarily due to the incompleteness and inconsistencies of prevalence studies and underdiagnosed cases.

According to the Global Burden of Disease Study, about 13 million people across the globe are likely to be affected by Parkinson’s disease by 2040. China accounts for the largest number of patients with Parkinson’s disease in the world. Currently, around 2.5 million people in the country are afflicted with Parkinson’s disease. This number is expected to double by the end of 2030. Currently, 1.7% of population of China above the age of 65 is affected by Parkinson’s disease.

According to VIARTIS, Albania has the highest prevalence rate of Parkinson’s disease of 800 per 100,000 persons in the world. The highest incidence rate of Parkinson’s disease is observed in France, with around 36 to 49 cases per 100,000. According to the European Parkinson’s Disease Association, currently, around 1.2 million people in the European Union are afflicted with Parkinson’s disease. About 260,000 people in Germany, 150,000 in Italy, and 120,000 people in the U.K. suffer from Parkinson’s disease.

Increase in demand for improved product outcomes & efficiency have led to development of innovative products and technologies to address the unmet needs of patients as well as surgeons. In order to provide improved and alternative solutions to unmet medical needs in neurological disorders, companies have developed novel technologies and devices, such as neurostimulation equipment, to improve the overall quality of life of the affected patient population. In January 2019, Boston Scientific Corporation launched the Vercise Primary Cell and Vercise Gevia Deep Brain Stimulation system for the treatment of symptoms of Parkinson’s disease. In December 2018, Axonics Modulation Technological, Inc. filed the Premarket Approval Application (PMA) with the U.S. FDA for the rechargeable implantable sacral neurostimulation system. In January 2017, Abbott Laboratories launched the new Proclaim DRG neurostimulation system in Europe. The Proclaim DRG neurostimulation system is designed to deliver dorsal root ganglion (DRG) stimulation for patients suffering from chronic neuropathic pain. Abbott is the first and only company that offers DRG therapy and targeted relief for certain types of chronic pain. Thus, the key trend of development and commercialization of novel electrical stimulation devices is driving the global neurostimulation devices market.

The spinal cord stimulators segment accounted for dominant share of the global market in 2021. The segment is projected to grow at a high CAGR from 2022 to 2031.

High prevalence of chronic pain caused due to various reasons such as failed back surgery syndrome, cancer, traumatic pain, and nerve injuries; launch of new products with updated technologies in spinal cord stimulation; and favorable medical reimbursement policies in developed countries are projected to drive the segment during the forecast period.

In terms of application, the global market has been divided into chronic pain, movement disorders, hearing impairments, epilepsy, urinary incontinence, and others. The chronic pain segment held significant market share in 2021 due to the rise in prevalence of chronic pain owing to various medical conditions such as cancer, trauma injuries, surgical trauma, and nerve injuries.

According to the Centers for Disease Control and Prevention (CDC), more than 50 million people were suffering from chronic pain in the U.S. in 2020. Chronic pain is the major cause of long term disability in the U.S. According to the European Pain Federation, around 80 million adults in Europe are living with chronic pain.

Hospitals is projected to be a highly lucrative segment of the global neurostimulation market during the forecast period. Well-established health care infrastructure, favorable medical reimbursement facilities for neurostimulation devices in developed countries, and high cost of implantable devices contributed to the prominent share of the hospitals segment in 2021.

Rise in the number of hospitals in developing countries and increase in implantable neurostimulation surgeries are likely to drive the segment during the forecast period.

North America accounted for the largest market share of around 60% in terms of revenue in 2021. The region is projected to dominate the global market during the forecast period. The market in North America is anticipated to expand at a CAGR of 10.5% from 2022 to 2031.

Early adoption of technologically advanced products, new product launches, and increase in installation of transcranial magnetic stimulation systems in specialty clinics in the U.S. and Canada contributed to the region's dominant share in 2021.

In May 2019, Nevro Corp. launched the Senza Omnia Spinal Cord Stimulation (SCS) System in the U.S. Omnia is the first and the only spinal cord stimulation system designed to deliver its proprietary HF10 therapy along with all other available spinal cord stimulator frequencies.

Increase in geriatric population in the U.S., high prevalence of neurological disorders & chronic pain, and high per capita healthcare expenditure in North America are likely to drive the market in the region during the forecast period.

Europe is projected to be the second most lucrative market for neurostimulation devices. The region held 20.8% share of the global market in 2021. Europe’s market share is likely to rise marginally to reach 21.7% by the end of 2031. The market in the region is expected to grow at a CAGR of 11.3% during the forecast period.

Asia Pacific is projected to be the fastest growing market from 2022 to 2031. This can be ascribed to the shift in production bases of several global manufacturers to the region due to high unmet medical needs and untapped growth opportunities. Additionally, rapid economic development in emerging countries such as India and China; and increase in healthcare expenditure are projected to augment the market in Asia Pacific.

The global neurostimulation devices market is consolidated. A small number of players account for major share of the global market. Key players operating in the global neurostimulation devices market include Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Nevro Corp., LivaNova plc, Axonics Modulation Technologies, Inc., Neuropace, Inc., EndoStim, Inc., NDI Medical, Cochlear Limited, and Neuronetics, Inc. These players have adopted various strategies such as product portfolio expansion, investment in research & development, development of novel neurostimulation devices, and mergers & acquisitions to establish a strong distribution network.

Each of these players has been profiled in the neurostimulation devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 8.1 Bn |

|

Market Forecast Value in 2031 |

US$ 22.3 Bn |

|

Growth Rate (CAGR) |

10.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global neurostimulation devices market was valued at US$ 8.1 Bn in 2021.

The global neurostimulation devices market is projected to reach more than US$ 22.3 Bn by 2031.

The global neurostimulation devices market expanded at a CAGR of 10.0% from 2017 to 2021.

The global neurostimulation devices market is anticipated to expand at a CAGR of 10.8% from 2022 to 2031.

Rise in prevalence of Parkinson’s disease drives the global neurostimulation devices market.

North America is expected to account for major share of the global neurostimulation devices market during the forecast period.

Prominent players in the global neurostimulation devices market include Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Nevro Corp., LivaNova plc, Axonics Modulation Technologies, Inc., Neuropace, Inc., EndoStim, Inc., NDI Medical, Cochlear Limited, and Neuronetics, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Neurostimulation Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Neurostimulation Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence rate globally with key countries

5.3. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.4. COVID-19 Impact on Industry

6. Global Neurostimulation Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Spinal Cord Stimulators

6.3.2. Deep Brain Stimulators

6.3.3. Cochlear Implants

6.3.4. Vagus Nerve Stimulators

6.3.5. Sacral Nerve Stimulators

6.3.6. Percutaneous Tibial Nerve Stimulators

6.3.7. Transcranial Magnetic Stimulators

6.4. Market Attractiveness Analysis, by Product Type

7. Global Neurostimulation Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Ambulatory Surgery Centers

7.3.3. Specialty Clinics

7.4. Market Attractiveness Analysis, by End-user

8. Global Neurostimulation Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Chronic Pain

8.3.2. Movement Disorders

8.3.3. Hearing Impairment

8.3.4. Epilepsy

8.3.5. Urinary Incontinence

8.3.6. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Neurostimulation Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Neurostimulation Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Spinal Cord Stimulators

10.2.2. Deep Brain Stimulators

10.2.3. Cochlear Implants

10.2.4. Vagus Nerve Stimulators

10.2.5. Sacral Nerve Stimulators

10.2.6. Percutaneous Tibial Nerve Stimulators

10.2.7. Transcranial Magnetic Stimulators

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgery Centers

10.3.3. Specialty Clinics

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Chronic Pain

10.4.2. Movement Disorders

10.4.3. Hearing Impairment

10.4.4. Epilepsy

10.4.5. Urinary Incontinence

10.4.6. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By End-user

10.6.3. By Application

10.6.4. By Country

11. Europe Neurostimulation Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Spinal Cord Stimulators

11.2.2. Deep Brain Stimulators

11.2.3. Cochlear Implants

11.2.4. Vagus Nerve Stimulators

11.2.5. Sacral Nerve Stimulators

11.2.6. Percutaneous Tibial Nerve Stimulators

11.2.7. Transcranial Magnetic Stimulators

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Ambulatory Surgery Centers

11.3.3. Specialty Clinics

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Chronic Pain

11.4.2. Movement Disorders

11.4.3. Hearing Impairment

11.4.4. Epilepsy

11.4.5. Urinary Incontinence

11.4.6. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By End-user

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Neurostimulation Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Spinal Cord Stimulators

12.2.2. Deep Brain Stimulators

12.2.3. Cochlear Implants

12.2.4. Vagus Nerve Stimulators

12.2.5. Sacral Nerve Stimulators

12.2.6. Percutaneous Tibial Nerve Stimulators

12.2.7. Transcranial Magnetic Stimulators

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Ambulatory Surgery Centers

12.3.3. Specialty Clinics

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Chronic Pain

12.4.2. Movement Disorders

12.4.3. Hearing Impairment

12.4.4. Epilepsy

12.4.5. Urinary Incontinence

12.4.6. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By End-user

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Neurostimulation Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Spinal Cord Stimulators

13.2.2. Deep Brain Stimulators

13.2.3. Cochlear Implants

13.2.4. Vagus Nerve Stimulators

13.2.5. Sacral Nerve Stimulators

13.2.6. Percutaneous Tibial Nerve Stimulators

13.2.7. Transcranial Magnetic Stimulators

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Ambulatory Surgery Centers

13.3.3. Specialty Clinics

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Chronic Pain

13.4.2. Movement Disorders

13.4.3. Hearing Impairment

13.4.4. Epilepsy

13.4.5. Urinary Incontinence

13.4.6. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By End-user

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Neurostimulation Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Spinal Cord Stimulators

14.2.2. Deep Brain Stimulators

14.2.3. Cochlear Implants

14.2.4. Vagus Nerve Stimulators

14.2.5. Sacral Nerve Stimulators

14.2.6. Percutaneous Tibial Nerve Stimulators

14.2.7. Transcranial Magnetic Stimulators

14.3. Market Value Forecast, by End-user, 2017–2031

14.3.1. Hospitals

14.3.2. Ambulatory Surgery Centers

14.3.3. Specialty Clinics

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Chronic Pain

14.4.2. Movement Disorders

14.4.3. Hearing Impairment

14.4.4. Epilepsy

14.4.5. Urinary Incontinence

14.4.6. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By End-user

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Abbott Laboratories

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Boston Scientific Corporation

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Bioinduction

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Integer Holdings Corporation

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Medtronic

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Nevro Corporation

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Neurosigma, Inc.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Neuropace, Inc.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Neuronetics

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Synapse Biomedical

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Soterix Medical

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overvie

15.3.12. Other Players

List of Tables

Table 01: Global Neurostimulation Devices Market Size (US$ Bn) Forecast, by Product, 2017–2031

Table 02: Global Neurostimulation Devices Market Volume (Units) Forecast, by Product, 2017–2031

Table 03: Global Neurostimulation Devices Market Size (US$ Bn) Forecast, by Application, 2017–2031

Table 04: Global Neurostimulation Devices Market Size (US$ Bn) Forecast, by End-user, 2017–2031

Table 05: Global Neurostimulation Devices Market Size (US$ Bn) Forecast, by Region, 2017–2031

Table 06: North America Neurostimulation Devices Market Size (US$ Bn) Forecast, by Country, 2017–2031

Table 07: North America Neurostimulation Devices Market Size (US$ Bn) Forecast, by Product, 2017–2031

Table 08: North America Neurostimulation Devices Market Volume (Units) Forecast, by Product, 2017–2031

Table 09: North America Neurostimulation Devices Market Size (US$ Bn) Forecast, by Application, 2017–2031

Table 10: North America Neurostimulation Devices Market Size (US$ Bn) Forecast, by End-user, 2017–2031

Table 11: Europe Neurostimulation Devices Market Revenue (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Neurostimulation Devices Market Size (US$ Bn) Forecast, by Product, 2017–2031

Table 13: Europe Neurostimulation Devices Market Volume (Units) Forecast, by Product, 2017–2031

Table 14: Europe Neurostimulation Devices Market Size (US$ Bn) Forecast, by Application, 2017–2031

Table 15: Europe Neurostimulation Devices Market Size (US$ Bn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Neurostimulation Devices Market Size (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Neurostimulation Devices Market Size (US$ Bn) Forecast, by Product, 2017–2031

Table 18: Asia Pacific Neurostimulation Devices Market Volume (Units) Forecast, by Product, 2017–2031

Table 19: Asia Pacific Neurostimulation Devices Market Size (US$ Bn) Forecast, by Application, 2017–2031

Table 20: Asia Pacific Neurostimulation Devices Market Size (US$ Bn) Forecast, by End-user, 2017–2031

Table 21: Latin America Neurostimulation Devices Market Size (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Neurostimulation Devices Market Size (US$ Bn) Forecast, by Product, 2017–2031

Table 23: Latin America Neurostimulation Devices Market Volume (Units) Forecast, by Product, 2017–2031

Table 24: Latin America Neurostimulation Devices Market Size (US$ Bn) Forecast, by Application, 2017–2031

Table 25: Latin America Neurostimulation Devices Market Size (US$ Bn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Neurostimulation Devices Market Size (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Neurostimulation Devices Market Size (US$ Bn) Forecast, by Product, 2017–2031

Table 28: Middle East & Africa Neurostimulation Devices Market Volume (Units) Forecast, by Product, 2017–2031

Table 29: Middle East & Africa Neurostimulation Devices Market Size (US$ Bn) Forecast, by Application, 2017–2031

Table 30: Middle East & Africa Neurostimulation Devices Market Size (US$ Bn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Neurostimulation Devices Market Size (US$ Bn) Forecast, 2017–2031

Figure 02: Global Neurostimulation Devices Market Volume (Units) Forecast, 2017–2031

Figure 03: Market Value Share, by Product, 2021

Figure 04: Market Value Share, by Application, 2021

Figure 05: Market Value Share, by End-user, 2021

Figure 06: Market Value Share, by Region, 2021

Figure 07: Global Neurostimulation Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 08: Global Neurostimulation Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 09: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Spinal Cord Stimulators, 2017–2031

Figure 10: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Deep Brain Stimulators, 2017–2031

Figure 11: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Cochlear Implants, 2017–2031

Figure 12: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Vagus Nerve Stimulators, 2017–2031

Figure 13: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Sacral Nerve Stimulators, 2017–2031

Figure 14: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Percutaneous Tibial Nerve Stimulators, 2017–2031

Figure 15: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Transcranial Magnetic Stimulation, 2017–2031

Figure 16: Global Neurostimulation Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 17: Global Neurostimulation Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 18: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Chronic Pain, 2017–2031

Figure 19: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Movement Disorders, 2017–2031

Figure 20: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Hearing Impairment, 2017–2031

Figure 21: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Epilepsy, 2017–2031

Figure 22: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Urinary Incontinence, 2017–2031

Figure 23: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Major Depressive Disorders, 2017–2031

Figure 24: Global Neurostimulation Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 25: Global Neurostimulation Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 26: Global Neurostimulation Devices Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Hospitals, 2017–2031

Figure 27: Global Neurostimulation Devices Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Ambulatory Surgery Centers, 2017–2031

Figure 28: Global Neurostimulation Devices Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Specialty Clinics, 2017–2031

Figure 29: Global Neurostimulation Devices Market Value Share, by Region, 2021 and 2031

Figure 30: Global Neurostimulation Devices Market Attractiveness Analysis, by Region, 2022–2031

Figure 31: North America Neurostimulation Devices Market Size (US$ Bn) and Volume (Units) Forecast, 2017–2031

Figure 32: North America Neurostimulation Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 33: North America Neurostimulation Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 34: North America Neurostimulation Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 35: North America Neurostimulation Devices Market Attractiveness Analysis, by Product, 2019 -2031

Figure 36: North America Neurostimulation Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 37: North America Neurostimulation Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 38: North America Neurostimulation Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 39: North America Neurostimulation Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 40: Europe Neurostimulation Devices Market Size (US$ Bn) and Volume (Units) Forecast, 2017–2031

Figure 41: Europe Neurostimulation Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Europe Neurostimulation Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Europe Neurostimulation Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 44: Europe Neurostimulation Devices Market Attractiveness Analysis, by Product, 2019 -2031

Figure 45: Europe Neurostimulation Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 46: Europe Neurostimulation Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 47: Europe Neurostimulation Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: Europe Neurostimulation Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Asia Pacific Neurostimulation Devices Market Size (US$ Bn) and Volume (Units) Forecast, 2017–2031

Figure 50: Asia Pacific Neurostimulation Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Asia Pacific Neurostimulation Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Asia Pacific Neurostimulation Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 53: Asia Pacific Neurostimulation Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 54: Asia Pacific Neurostimulation Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 55: Asia Pacific Neurostimulation Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 56: Asia Pacific Neurostimulation Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 57: Asia Pacific Neurostimulation Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 58: Latin America Neurostimulation Devices Market Size (US$ Bn) and Volume (Units) Forecast, 2017–2031

Figure 59: Latin America Neurostimulation Devices Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 60: Latin America Neurostimulation Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Latin America Neurostimulation Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 62: Latin America Neurostimulation Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 63: Latin America Neurostimulation Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 64: Latin America Neurostimulation Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 65: Latin America Neurostimulation Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 66: Latin America Neurostimulation Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 67: Middle East & Africa Neurostimulation Devices Market Size (US$ Bn) and Volume (Units) Forecast, 2017–2031

Figure 68: Middle East & Africa Neurostimulation Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 69: Middle East & Africa Neurostimulation Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 70: Latin America Neurostimulation Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 71: Latin America Neurostimulation Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 72: Middle East & Africa Neurostimulation Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 73: Middle East & Africa Neurostimulation Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 74: Middle East & Africa Neurostimulation Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 75: Middle East & Africa Neurostimulation Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 76: Global Neurostimulation Devices Market Share Analysis, by Company, 2021