Analyst Viewpoint

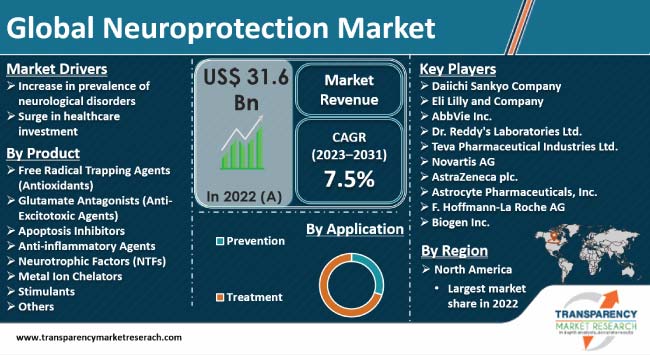

Increase in prevalence of neurological disorders is boosting the global neuroprotection market size. Rise in geriatric population, prevalence of stressful work environment, and growth in adoption of sedentary lifestyle are contributing to high cases of dementia, stroke, and Parkinson’s. Neuroprotection agents offer mechanisms to mitigate symptoms of neurodegenerative issues in an attempt to enhance patients’ quality of life and health.

Surge in healthcare investment is also augmenting the neuroprotection industry value. Growth in need for advanced critical care solutions has resulted in substantial investments in neuroprotection research. Prominent players operating in the global neuroprotection market are engaged in development of novel therapeutics and advancements in neural protection agents to expand their product portfolio and meet the rising demand worldwide.

Neuroprotection refers to a spectrum of strategies and interventions aimed to safeguard the structure and function of the nervous system, especially the brain, and preventing or slowing down the progression of neurodegenerative diseases. These interventions are vital in combating illnesses such as Alzheimer’s, Parkinson's, and stroke.

Neuroprotective agents can encompass pharmaceutical drugs and lifestyle modifications, all with the primary goal of mitigating neuronal damage. Symptoms of neurodegeneration include cognitive impairment such as memory loss, impaired judgment, and motor dysfunction such as muscle stiffness or slowed movement.

Benefits of using neuroprotective agents include improved patient outcomes, enhanced quality of life, and reduced burden to the national healthcare system associated with long-term critical care.

Recent neuroprotection market trends involve advancements in precision medicine, targeted drug delivery, and development of novel therapeutics.

Significant growth in prevalence of neurodegenerative illnesses such as Alzheimer’s and Parkinson’s can be ascribed to several factors such as rise in geriatric population, increase in pollution, and adoption of sedentary lifestyle.

As per a United Nations study, around 1 billion individuals, approximately one-sixth of the global population, are afflicted with neurological disorders. These conditions range from Alzheimer's and Parkinson's diseases to strokes, multiple sclerosis, epilepsy, and migraines.

The study further mentions that an estimated 6.8 million people succumb to these conditions per year. About 50 million individuals worldwide suffer from epilepsy, while more than 24 million live with symptoms of Alzheimer’s and other dementias. Around 2.5 million individuals globally suffer from multiple sclerosis, while Parkinson’s affects over 10 million people annually.

The neuroprotection industry consists of systems or agents that offer interventions via several mechanisms such as reduction of oxidative stress, inflammation, improvement of neuroplasticity, and rapid healing of damaged tissue.

Overall, these agents assist in mitigating ailments, slowing disease progression, and enhancing the quality of life of the patient, while reducing critical care costs. This is boosting neuroprotection market demand.

Increase in awareness about several chronic illnesses and the imperative need for advanced critical care solutions have led to an expansion in healthcare infrastructure and growth in investments in research.

Rise in the elderly population and life expectancy in general is leading to significant growth in patients suffering from Alzheimer’s, Parkinson’s, and strokes. This, in turn, is augmenting the funding required to address these healthcare challenges.

According to the Alzheimer’s Association, the institution invested US$ 100 Mn in dementia research in 2023. As per Alzheimer Disease International, the annual global cost of dementia stands at more than US$ 1.3 Trn and is expected to rise to US$ 2.8 Trn by 2030.

Investments in neuroprotection are pivotal to maintaining the nervous system’s health and mitigating degrading symptoms. Funds are directed toward innovative therapies, precision medicine methods, and drug discovery approaches or clinical trials, thereby fostering neuroprotection market opportunities for companies operating in the landscape.

North America accounted for the dominant neuroprotection market share in 2022. Surge in neurodegenerative disorders and increase in healthcare spending are augmenting the market dynamics of the region.

As per a report from the Alzheimer's Disease Association in 2022, nearly 6.2 million people in the U.S. suffer from Alzheimer’s disease. Similarly, according to the Parkinson’s Foundation, an estimated one million adults in the U.S. live with Parkinson’s disease. This number is likely to reach 1.2 million by 2030.

According to the latest neuroprotection market regional insights, the landscape in Asia Pacific appears promising owing to the region’s high-stress work culture and surge in geriatric population, which is prone to neurological issues.

Governments of several countries in Asia Pacific are working on improving their national healthcare infrastructure and accessibility to raise awareness about neurodegenerative illnesses such as dementia and Parkinson’s.

As per the latest neuroprotection market analysis, prominent manufacturers are investing substantially in the development of neuroprotective therapeutics and neuroprotective drugs to combat the prevalence of neurological issues.

Increase in focus on geographical expansion and improvement in product portfolio via close collaborations are key strategies followed by the leading players in the global landscape.

Daiichi Sankyo Company, Eli Lilly and Company, AbbVie Inc., Dr. Reddy's Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Novartis AG, AstraZeneca plc., Astrocyte Pharmaceuticals, Inc., F. Hoffmann-La Roche AG, and Biogen Inc. are key firms operating in neuroprotection sector.

These companies have been profiled in the neuroprotection market research report based on parameters such as company overview, product portfolio, business strategies, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 31.6 Bn |

| Market Forecast Value in 2031 | US$ 60.1 Bn |

| Growth Rate (CAGR) | 7.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 31.6 Bn in 2022

It is projected to grow at a CAGR of 7.5% from 2023 to 2031

Increase in prevalence of neurological disorders and surge in healthcare investment

The treatment segment accounted for the largest share in 2022

North America was the leading region in 2022

Daiichi Sankyo Company, Eli Lilly and Company, AbbVie Inc., Dr. Reddy's Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Novartis AG, AstraZeneca plc., Astrocyte Pharmaceuticals, Inc., F. Hoffmann-La Roche AG, and Biogen Inc.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Neuroprotection Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Neuroprotection Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Prevalence & Incidence Rate Globally with Key Countries

5.3. COVID-19 Pandemic Impact on Industry

6. Neuroprotection Market Analysis and Forecast, By Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, By Product, 2017–2031

6.3.1. Free Radical Trapping Agents (Antioxidants)

6.3.2. Glutamate Antagonists (Anti-excitotoxic Agents)

6.3.3. Apoptosis Inhibitors

6.3.4. Anti-inflammatory Agents

6.3.5. Neurotrophic Factors (NTFs)

6.3.6. Metal Ion Chelators

6.3.7. Stimulants

6.3.8. Others

6.4. Market Attractiveness, By Product

7. Global Neuroprotection Market Analysis and Forecast, by Application

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Prevention

7.3.2. Treatment

7.4. Market Attractiveness, by Application

8. Global Neuroprotection Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Neuroprotection Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, By Product, 2017–2031

9.2.1. Free Radical Trapping Agents (Antioxidants)

9.2.2. Glutamate Antagonists (Anti-excitotoxic Agents)

9.2.3. Apoptosis Inhibitors

9.2.4. Anti-inflammatory Agents

9.2.5. Neurotrophic Factors (NTFs)

9.2.6. Metal Ion Chelators

9.2.7. Stimulants

9.2.8. Others

9.3. Market Value Forecast, by Application, 2017–2031

9.3.1. Prevention

9.3.2. Treatment

9.4. Market Value Forecast, by Country, 2023–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Application

9.5.3. By Country

10. Europe Neuroprotection Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, By Product, 2017–2031

10.2.1. Free Radical Trapping Agents (Antioxidants)

10.2.2. Glutamate Antagonists (Anti-excitotoxic Agents)

10.2.3. Apoptosis Inhibitors

10.2.4. Anti-inflammatory Agents

10.2.5. Neurotrophic Factors (NTFs)

10.2.6. Metal Ion Chelators

10.2.7. Stimulants

10.2.8. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Prevention

10.3.2. Treatment

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Application

10.5.3. By Country/Sub-region

11. Asia Pacific Neuroprotection Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, By Product, 2017–2031

11.2.1. Free Radical Trapping Agents (Antioxidants)

11.2.2. Glutamate Antagonists (Anti-excitotoxic Agents)

11.2.3. Apoptosis Inhibitors

11.2.4. Anti-inflammatory Agents

11.2.5. Neurotrophic Factors (NTFs)

11.2.6. Metal Ion Chelators

11.2.7. Stimulants

11.2.8. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Prevention

11.3.2. Treatment

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By Application

11.5.3. By Country/Sub-region

12. Latin America Neuroprotection Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, By Product, 2017–2031

12.2.1. Free Radical Trapping Agents (Antioxidants)

12.2.2. Glutamate Antagonists (Anti-excitotoxic Agents)

12.2.3. Apoptosis Inhibitors

12.2.4. Anti-inflammatory Agents

12.2.5. Neurotrophic Factors (NTFs)

12.2.6. Metal Ion Chelators

12.2.7. Stimulants

12.2.8. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Prevention

12.3.2. Treatment

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By Application

12.5.3. By Country/Sub-region

13. Middle East & Africa Neuroprotection Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, By Product, 2017–2031

13.2.1. Free Radical Trapping Agents (Antioxidants)

13.2.2. Glutamate Antagonists (Anti-excitotoxic Agents)

13.2.3. Apoptosis Inhibitors

13.2.4. Anti-inflammatory Agents

13.2.5. Neurotrophic Factors (NTFs)

13.2.6. Metal Ion Chelators

13.2.7. Stimulants

13.2.8. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Prevention

13.3.2. Treatment

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By Application

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Daiichi Sankyo Company

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Treatment Type Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Eli Lilly and Company

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Treatment Type Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. AbbVie Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Treatment Type Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Dr. Reddy's Laboratories Ltd.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Treatment Type Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Teva Pharmaceutical Industries Ltd.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Treatment Type Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Novartis AG

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Treatment Type Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. AstraZeneca plc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Treatment Type Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Astrocyte Pharmaceuticals, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Treatment Type Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. F. Hoffmann-La Roche AG

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Treatment Type Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Biogen Inc.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Treatment Type Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Neuroprotection Market Value (US$ Mn) Forecast, By Product, 2017–2031

Table 02: Global Neuroprotection Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Neuroprotection Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Neuroprotection Market Value (US$ Mn) Forecast, By Product, 2017–2031

Table 05: North America Neuroprotection Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 06: North America Neuroprotection Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 07: Europe Neuroprotection Market Value (US$ Mn) Forecast, By Product, 2017–2031

Table 08: Europe Neuroprotection Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 09: Europe Neuroprotection Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Neuroprotection Market Value (US$ Mn) Forecast, By Product, 2017–2031

Table 11: Asia Pacific Neuroprotection Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Asia Pacific Neuroprotection Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Neuroprotection Market Value (US$ Mn) Forecast, By Product, 2017–2031

Table 14: Latin America Neuroprotection Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Latin America Neuroprotection Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Neuroprotection Market Value (US$ Mn) Forecast, By Product, 2017–2031

Table 17: Middle East & Africa Neuroprotection Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Middle East & Africa Neuroprotection Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Neuroprotection Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Neuroprotection Market Value Share Analysis, By Product 2022 and 2031

Figure 03: Global Neuroprotection Market Attractiveness Analysis, By Product, 2023–2031

Figure 04: Global Neuroprotection Market Value Share Analysis, by Application, 2022 and 2031

Figure 05: Global Neuroprotection Market Attractiveness Analysis, by Application, 2023–2031

Figure 06: Global Neuroprotection Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Neuroprotection Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Neuroprotection Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Neuroprotection Market Value Share Analysis, By Product, 2022 and 2031

Figure 10: North America Neuroprotection Market Attractiveness Analysis, By Product, 2023–2031

Figure 11: North America Neuroprotection Market Value Share Analysis, by Application, 2022 and 2031

Figure 12: North America Neuroprotection Market Attractiveness Analysis, by Application, 2023–2031

Figure 13: North America Neuroprotection Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Neuroprotection Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Neuroprotection Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Neuroprotection Market Value Share Analysis, By Product, 2022 and 2031

Figure 17: Europe Neuroprotection Market Attractiveness Analysis, By Product, 2023–2031

Figure 18: Europe Neuroprotection Market Value Share Analysis, by Application, 2022 and 2031

Figure 19: Europe Neuroprotection Market Attractiveness Analysis, by Application, 2023–2031

Figure 20: Europe Neuroprotection Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Neuroprotection Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Neuroprotection Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Neuroprotection Market Value Share Analysis, By Product 2022 and 2031

Figure 24: Asia Pacific Neuroprotection Market Attractiveness Analysis, By Product, 2023–2031

Figure 25: Asia Pacific Neuroprotection Market Value Share Analysis, by Application, 2022 and 2031

Figure 26: Asia Pacific Neuroprotection Market Attractiveness Analysis, by Application, 2023–2031

Figure 27: Asia Pacific Neuroprotection Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Neuroprotection Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Neuroprotection Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Neuroprotection Market Value Share Analysis, By Product, 2022 and 2031

Figure 31: Latin America Neuroprotection Market Attractiveness Analysis, By Product, 2023–2031

Figure 32: Latin America Neuroprotection Market Value Share Analysis, by Application, 2022 and 2031

Figure 33: Latin America Neuroprotection Market Attractiveness Analysis, by Application, 2023–2031

Figure 34: Latin America Neuroprotection Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Neuroprotection Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Neuroprotection Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Neuroprotection Market Value Share Analysis, By Product, 2022 and 2031

Figure 38: Middle East & Africa Neuroprotection Market Attractiveness Analysis, By Product, 2023–2031

Figure 39: Middle East & Africa Neuroprotection Market Value Share Analysis, by Application, 2022 and 2031

Figure 40: Middle East & Africa Neuroprotection Market Attractiveness Analysis, by Application, 2023–2031

Figure 41: Middle East & Africa Neuroprotection Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Neuroprotection Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Neuroprotection Market Share Analysis, by Company, 2022