Analysts’ Viewpoint

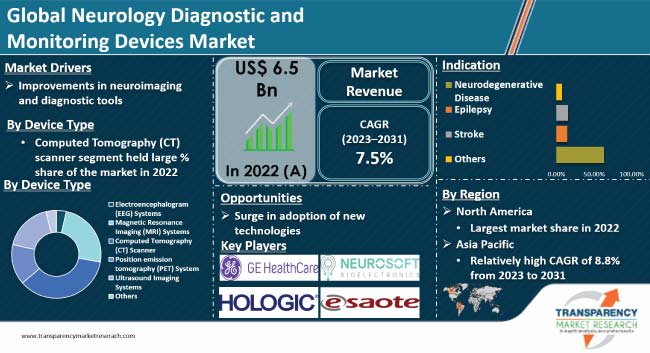

Increase in prevalence of neurological disorders, advancements in technology, and surge in healthcare awareness are the key factors driving the neurology diagnostic and monitoring devices market size.

EEG systems, MRI systems, and CT scanners are expected to witness high demand due to the aging population and better awareness about neurological disorders.

The market is currently dominated by North America and Europe, but Asia Pacific is expected to witness significant growth in the coming years due to rise in awareness and healthcare expenditure.

Development of advanced diagnostic and monitoring equipment, such as MRI & fMRI, digital sensors, and wearable technology, has further fueled market growth.

The global neurology diagnostic and monitoring devices market is poised for significant growth in the next few years, driven by continuous technological advancements.

Neurodegenerative diseases, epilepsy, and stroke affect millions of people worldwide and require accurate and timely diagnosis for effective management and treatment.

Key devices used in diagnosis and monitoring include electroencephalogram (EEG) systems, magnetic resonance imaging (MRI) systems, computed tomography (CT) scanners, position emission tomography (PET) systems, and ultrasound imaging systems.

The rise in prevalence of neurodegenerative diseases, along with the aging population, contribute to the demand for these devices. Technological advancements, such as portable and wireless devices, make neurology diagnostics and monitoring more accessible and convenient.

Advancements in neuroimaging and diagnostic tools are offering lucrative opportunities for neurology diagnostic and monitoring devices market expansion. Devices such as EEG systems, MRI systems, CT scanners, PET systems, and ultrasound imaging systems enable healthcare professionals to accurately diagnose and monitor various neurological conditions.

Real-time diagnostic data collection through wearable technology and digital sensors has improved the accuracy and speed of diagnosis for neurodegenerative diseases. Whole-exome sequencing in clinical diagnostics has enabled more personalized treatment plans for complex neurologic diagnoses.

MRI technology advancements, particularly fMRI and high-resolution imaging, have improved understanding of central nervous system pathologies, facilitating targeted treatments for conditions including epilepsy and stroke.

Furthermore, the demand for non-invasive, accurate diagnostic tools contributes to neurology diagnostic and monitoring devices market growth. Integration of new technologies is expected to continue, improving patient outcomes and driving neurology advancements.

Governments around the world have taken up initiatives to improve neurological care, leading to an increase in funding for research and development in this field. As neurological disorders continue to rise globally, there has been a growing demand for accurate and efficient diagnostic and monitoring devices.

This demand is further fueled by the increase in awareness about the importance of early detection and management of neurological disorders.

This has resulted in the development of advanced and innovative devices, such as brain imaging technologies, electroencephalography (EEG) machines, and neuromodulation devices. The combination of increasing healthcare expenditure and government initiatives, along with the development of advanced and innovative devices, has been a major driving force boosting the neurology diagnostic and monitoring devices market value.

Constant advancements in technology have resulted in the development and availability of advanced diagnostic and monitoring equipment for neurological disorders.

Magnetic Resonance Imaging (MRI), Functional MRI (fMRI), digital sensors and wearable technology, whole-exome sequencing, AI-driven platforms, and neurovative diagnostics are just some of the innovative tools that are being used in the diagnosis and monitoring of neurological disorders.

These technologies offer improved accuracy, sensitivity, and real-time data collection, aiding in the early detection and intervention of neurological diseases. Moreover, the development of smart clothing and artificial intelligence-based tools has further expanded the capabilities of neurology diagnostic and monitoring devices, making them more accessible and convenient for patients.

The involvement of private organizations, public entities, and institutions in the development of these technologies has also contributed to their widespread adoption. As a result, the demand for these advanced devices is expected to continue to rise, augmenting the neurology diagnostic and monitoring devices market revenue.

Based on device type, the computed tomography (CT) scanner segment dominated the neurology diagnostic and monitoring devices industry in 2022. Technological advancements, increasing patient focus on early disease diagnosis, and a rising incidence of targeted diseases are responsible for the dominance of this segment.

The growing preference for minimally invasive diagnostic procedures and the procedural benefits offered by CT scanners further propels the segment.

The neurology diagnostic and monitoring devices market segmentation based on indication includes neurodegenerative disease, epilepsy, stroke, and others. Growth of the market is closely tied to the increasing prevalence of neurodegenerative diseases.

According to research, the neurodegenerative disease segment dominated the global market in 2022.

This is largely due to the millions of people worldwide being affected by these diseases, including Alzheimer's disease, Parkinson's disease, and amyotrophic lateral sclerosis. With such a significant concern, there is a growing need for effective diagnostic and monitoring devices to aid in early detection and management of these diseases.

Non-communicable neurological disorders, such as migraines, multiple sclerosis, Alzheimer's, Parkinson's, and epilepsy, are becoming a global public health challenge. The burden of these disorders is set to rise due to aging populations.

Based on end-user, the hospitals and surgery centers segment is dominant as these facilities conduct thorough evaluations and consider factors such as clinical efficacy, cost-effectiveness, and long-term benefits to ensure the selection of devices that meet their specific needs and offer the best value for money.

They are often affiliated with healthcare organizations that prioritize quality and patient outcomes, emphasizing the importance of selecting the right devices.

The presence of HTA governance models in these centers adds another layer of scrutiny to the purchasing process, assessing the overall impact of a medical device on patient outcomes, healthcare costs, and resource utilization.

As per the latest neurology diagnostic and monitoring devices market forecast, North America dominated the global industry in 2022. Technological advancements, increasing awareness of neurological disorders, high purchasing power, and presence of key players are driving market dynamics in the region.

The rising incidence of neurological disorders in North America has also increased demand for neurology monitoring devices.

Technological advancements in the field attributed to companies such as GE Healthcare, Neurosoft, and Canon Medical Systems Corporation (Canon, Inc.) have contributed to the growth of the neurology diagnostic and monitoring devices market in North America.

Leading players in the global neurology diagnostic and monitoring devices market have adopted strategies such as product portfolio expansion, and securing funding for product development in order to increase market share.

As per the neurology diagnostic and monitoring devices market analysis, the landscape is highly competitive with the strong presence of key players.

GE Healthcare, Neurosoft, Canon Medical Systems Corporation (Canon, Inc.), Fujifilm Holding Corporation, Koninklijke Philips N.V., Siemens Healthineers AG, Shimadzu Corporation, United Imaging Healthcare Co., Ltd. Hologic, Inc., and Esaote SpA are the prominent neurology diagnostic and monitoring devices manufacturers.

Key players have been profiled in the global neurology diagnostic and monitoring devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 6.5 Bn |

| Forecast (Value) in 2031 | US$ 12.4 Bn |

| Growth Rate (CAGR) | 7.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It provides segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.5 Bn in 2022

It is projected to reach more than US$ 12.4 Bn by the end of 2031

The CAGR is projected to be 7.5% from 2023 to 2031

Improvements in neuroimaging and diagnostic tools, and surge in adoption of new technologies

North America is projected to account for major share during the forecast period

GE Healthcare, Neurosoft, Canon Medical Systems Corporation (Canon, Inc.), Fujifilm Holding Corporation, Koninklijke Philips N.V., Siemens Healthineers AG, Shimadzu Corporation, United Imaging Healthcare Co., Ltd. Hologic, Inc., and Esaote SpA.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Neurology Diagnostic and Monitoring Devices Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Neurology Diagnostic and Monitoring Devices Market Analysis and Forecasts, 2017 - 2031

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

5.2. Key Vendor and Distributor Analysis

5.3. Evolving Trends in Medical Imaging Services

5.4. Winning Imperatives, by Key Players

5.5. Growing Adoption of Remote Monitoring Technology, by Medical Imaging Service Providers

5.6. Technological Advancements

6. Global Neurology Diagnostic and Monitoring Devices Market Analysis and Forecasts, By Device Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Device Type, 2017 - 2031

6.3.1. Electroencephalogram (EEG) Systems

6.3.2. Magnetic Resonance Imaging (MRI) Systems

6.3.3. Computed Tomography (CT) Scanner

6.3.4. Position emission tomography (PET) System

6.3.5. Ultrasound Imaging Systems

6.3.6. Others

6.4. Market Attractiveness By Device Type

7. Global Neurology Diagnostic and Monitoring Devices Market Analysis and Forecasts, By Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Indication, 2017 - 2031

7.3.1. Neurodegenerative Disease

7.3.2. Epilepsy

7.3.3. Stroke

7.3.4. Others

7.4. Market Attractiveness By Indication

8. Global Neurology Diagnostic and Monitoring Devices Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals and Surgery Centers

8.3.2. Neurology Centers

8.3.3. Ambulatory Care Centers

8.3.4. Diagnostic Laboratories & Imaging Centers

8.3.5. Research Laboratories & Academic Institutes

8.4. Market Attractiveness By End-user

9. Global Neurology Diagnostic and Monitoring Devices Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Neurology Diagnostic and Monitoring Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Device Type, 2017 - 2031

10.2.1. Electroencephalogram (EEG) Systems

10.2.2. Magnetic Resonance Imaging (MRI) Systems

10.2.3. Computed Tomography (CT) Scanner

10.2.4. Position emission tomography (PET) System

10.2.5. Ultrasound Imaging Systems

10.2.6. Others

10.3. Market Value Forecast By Indication, 2017 - 2031

10.3.1. Neurodegenerative Disease

10.3.2. Epilepsy

10.3.3. Stroke

10.3.4. Others

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Hospitals and Surgery Centers

10.4.2. Neurology Centers

10.4.3. Ambulatory Care Centers

10.4.4. Diagnostic Laboratories & Imaging Centers

10.4.5. Research Laboratories & Academic Institutes

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Device Type

10.6.2. By Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Neurology Diagnostic and Monitoring Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Device Type, 2017 - 2031

11.2.1. Electroencephalogram (EEG) Systems

11.2.2. Magnetic Resonance Imaging (MRI) Systems

11.2.3. Computed Tomography (CT) Scanner

11.2.4. Position emission tomography (PET) System

11.2.5. Ultrasound Imaging Systems

11.2.6. Others

11.3. Market Value Forecast By Indication, 2017 - 2031

11.3.1. Neurodegenerative Disease

11.3.2. Epilepsy

11.3.3. Stroke

11.3.4. Others

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Hospitals and Surgery Centers

11.4.2. Neurology Centers

11.4.3. Ambulatory Care Centers

11.4.4. Diagnostic Laboratories & Imaging Centers

11.4.5. Research Laboratories & Academic Institutes

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Device Type

11.6.2. By Indication

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Neurology Diagnostic and Monitoring Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Device Type, 2017 - 2031

12.2.1. Electroencephalogram (EEG) Systems

12.2.2. Magnetic Resonance Imaging (MRI) Systems

12.2.3. Computed Tomography (CT) Scanner

12.2.4. Position emission tomography (PET) System

12.2.5. Ultrasound Imaging Systems

12.2.6. Others

12.3. Market Value Forecast By Indication, 2017 - 2031

12.3.1. Neurodegenerative Disease

12.3.2. Epilepsy

12.3.3. Stroke

12.3.4. Others

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Hospitals and Surgery Centers

12.4.2. Neurology Centers

12.4.3. Ambulatory Care Centers

12.4.4. Diagnostic Laboratories & Imaging Centers

12.4.5. Research Laboratories & Academic Institutes

12.5. Market Value Forecast By Country, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Device Type

12.6.2. By Indication

12.6.3. By End-user

12.6.4. By Country

13. Latin America Neurology Diagnostic and Monitoring Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Device Type, 2017 - 2031

13.2.1. Electroencephalogram (EEG) Systems

13.2.2. Magnetic Resonance Imaging (MRI) Systems

13.2.3. Computed Tomography (CT) Scanner

13.2.4. Position emission tomography (PET) System

13.2.5. Ultrasound Imaging Systems

13.2.6. Others

13.3. Market Value Forecast By Indication, 2017 - 2031

13.3.1. Neurodegenerative Disease

13.3.2. Epilepsy

13.3.3. Stroke

13.3.4. Others

13.4. Market Value Forecast By End-user, 2017 - 2031

13.4.1. Hospitals and Surgery Centers

13.4.2. Neurology Centers

13.4.3. Ambulatory Care Centers

13.4.4. Diagnostic Laboratories & Imaging Centers

13.4.5. Research Laboratories & Academic Institutes

13.5. Market Value Forecast By Country, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Device Type

13.6.2. By Indication

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Device Type, 2017 - 2031

14.2.1. Electroencephalogram (EEG) Systems

14.2.2. Magnetic Resonance Imaging (MRI) Systems

14.2.3. Computed Tomography (CT) Scanner

14.2.4. Position emission tomography (PET) System

14.2.5. Ultrasound Imaging Systems

14.2.6. Others

14.3. Market Value Forecast By Indication, 2017 - 2031

14.3.1. Neurodegenerative Disease

14.3.2. Epilepsy

14.3.3. Stroke

14.3.4. Others

14.4. Market Value Forecast By End-user, 2017 - 2031

14.4.1. Hospitals and Surgery Centers

14.4.2. Neurology Centers

14.4.3. Ambulatory Care Centers

14.4.4. Diagnostic Laboratories & Imaging Centers

14.4.5. Research Laboratories & Academic Institutes

14.5. Market Value Forecast By Country, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Device Type

14.6.2. By Indication

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2022)

15.3. Company Profiles

15.3.1. GE Healthcare

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Neurosoft

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Canon Medical Systems Corporation (Canon, Inc.)

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Fujifilm Holding Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Koninklijke Philips N.V.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Siemens Healthineers AG

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Shimadzu Corporation

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. United Imaging Healthcare Co., Ltd.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Hologic, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Esaote SpA

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Device Type, 2017 - 2031

Table 02: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Indication, 2017 - 2031

Table 03: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 04: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Region, 2017 - 2031

Table 05: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Country, 2017 - 2031

Table 06: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Devices Type, 2017 - 2031

Table 07: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Indication, 2017 - 2031

Table 08: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 09: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2031

Table 10: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Devices Type, 2017 - 2031

Table 11: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Indication, 2017 - 2031

Table 12: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 13: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2031

Table 14: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Devices Type, 2017 - 2031

Table 15: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Indication, 2017 - 2031

Table 16: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 17: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2031

Table 18: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Devices Type, 2017 - 2031

Table 19: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Indication, 2017 - 2031

Table 20: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 21: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2031

Table 22: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Devices Type, 2017 - 2031

Table 23: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by Indication, 2017 - 2031

Table 24: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

List of Figures

Figure 01: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast, 2017 - 2031

Figure 02: Global Neurology Diagnostic and Monitoring Devices Market Value Share, by Region, 2022

Figure 03: Global Neurology Diagnostic and Monitoring Devices Market Value Share, by Indication, 2022

Figure 04: Global Neurology Diagnostic and Monitoring Devices Market Value Share, by Device Type, 2022

Figure 05: Global Neurology Diagnostic and Monitoring Devices Market Value Share, by End-user, 2022

Figure 06: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Device Type, 2022 - 2031

Figure 07: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by Device Type, 2022

Figure 08: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by Device Type, 2031

Figure 09: Global Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Device Type, 2023 - 2031

Figure 10: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Electroencephalogram (EEG) Systems, 2017 - 2031

Figure 11: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Electroencephalogram (EEG) Systems, 2022 - 2031

Figure 12: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Magnetic Resonance Imaging (MRI) Systems, 2017 - 2031

Figure 13: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Magnetic Resonance Imaging (MRI) Systems, 2022 - 2031

Figure 14: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Computed Tomography (CT) Scanner, 2017 - 2031

Figure 15: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Computed Tomography (CT) Scanner, 2022 - 2031

Figure 16: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Ultrasound Imaging Systems, 2017 - 2031

Figure 17: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Ultrasound Imaging Systems, 2022 - 2031

Figure 18: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Position emission tomography (PET) System, 2017 - 2031

Figure 19: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Position emission tomography (PET) System, 2022 - 2031

Figure 20: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Others, 2017 - 2031

Figure 21: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Others, 2022 - 2031

Figure 22: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Indication, 2022 - 2031

Figure 23: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by Indication, 2022

Figure 24: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by Indication, 2031

Figure 25: Global Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Indication, 2023 - 2031

Figure 26: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Neurodegenerative Disease, 2017 - 2031

Figure 27: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Neurodegenerative Disease, 2022 - 2031

Figure 28: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Epilepsy, 2017 - 2031

Figure 29: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Epilepsy, 2022 - 2031

Figure 30: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Stroke, 2017 - 2031

Figure 31: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Stroke, 2022 - 2031

Figure 32: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Others, 2017 - 2031

Figure 33: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Others, 2022 - 2031

Figure 34: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by End-user, 2022 - 2031

Figure 35: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by End-user, 2022

Figure 36: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by End-user, 2031

Figure 37: Global Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 38: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Hospitals and Surgery Centers, 2017 - 2031

Figure 39: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Hospitals and Surgery Centers, 2022 - 2031

Figure 40: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Neurology Centers, 2017 - 2031

Figure 41: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Neurology Centers, 2022 - 2031

Figure 42: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Ambulatory Care Centers, 2017 - 2031

Figure 43: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Ambulatory Care Centers, 2022 - 2031

Figure 44: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Diagnostic Laboratories & Imaging Centers, 2017 - 2031

Figure 45: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Diagnostic Laboratories & Imaging Centers, 2022 - 2031

Figure 46: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn), by Research Laboratories & Academic Institutes, 2017 - 2031

Figure 47: Global Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Research Laboratories & Academic Institutes, 2022 - 2031

Figure 48: Global Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Region, 2022 - 2031

Figure 49: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by Region, 2022

Figure 50: Global Neurology Diagnostic and Monitoring Devices Market Share Analysis, by Region, 2031

Figure 51: Global Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Region, 2023 - 2031

Figure 52: North America Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Country, 2022 - 2031

Figure 53: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017 - 2031

Figure 54: North America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Country, 2023 - 2031

Figure 55: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Devices Type, 2022 - 2031

Figure 56: North America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Devices Type, 2023 - 2031

Figure 57: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Indication, 2022 - 2031

Figure 58: North America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Indication, 2023 - 2031

Figure 59: North America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by End-user, 2022 - 2031

Figure 60: North America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 61: Europe Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Country, 2022 - 2031

Figure 62: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017 - 2031

Figure 63: Europe Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Country, 2023 - 2031

Figure 64: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Devices Type, 2022 - 2031

Figure 65: Europe Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Devices Type, 2023 - 2031

Figure 66: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Indication, 2022 - 2031

Figure 67: Europe Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Indication, 2023 - 2031

Figure 68: Europe Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by End-user, 2022 - 2031

Figure 69: Europe Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 70: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Country, 2022 - 2031

Figure 71: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017 - 2031

Figure 72: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Country, 2023 - 2031

Figure 73: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Devices Type, 2022 - 2031

Figure 74: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Devices Type, 2023 - 2031

Figure 75: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Indication, 2022 - 2031

Figure 76: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Indication, 2023 - 2031

Figure 77: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by End-user, 2022 - 2031

Figure 78: Asia Pacific Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 79: Latin America Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Country, 2022 - 2031

Figure 80: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017 - 2031

Figure 81: Latin America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Country, 2023 - 2031

Figure 82: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Devices Type, 2022 - 2031

Figure 83: Latin America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Devices Type, 2023 - 2031

Figure 84: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Indication, 2022 - 2031

Figure 85: Latin America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Indication, 2023 - 2031

Figure 86: Latin America Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by End-user, 2022 - 2031

Figure 87: Latin America Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 88: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value Share Analysis, by Country, 2022 - 2031

Figure 89: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017 - 2031

Figure 90: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Country, 2023 - 2031

Figure 91: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Devices Type, 2022 - 2031

Figure 92: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Devices Type, 2023 - 2031

Figure 93: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by Indication, 2022 - 2031

Figure 94: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by Indication, 2023 - 2031

Figure 95: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Value (US$ Mn) Share Analysis, by End-user, 2022 - 2031

Figure 96: Middle East & Africa Neurology Diagnostic and Monitoring Devices Market Attractiveness Analysis, by End-user, 2023 - 2031