Neonatal Intensive Care Respiratory Devices Market: Snapshot

The global neonatal intensive care respiratory devices market is all set to gather handsome amount in the form of revenues during the forecast period of 2018 to 2026. One of the key reasons for this growth is increased number of respiratory diseases in newborn babies. In neonatal respiratory care, newborn babies are given best possible treatment for breathing disorders. For this purpose, babies are admitted in to the NICU, where respiratory devices play a key role in the treatment of respiratory disorders.

In recent years, there is considerable growth in the number of preterm births. As a result, subsequent efforts to improve the survival rates of these premature babies have increased. This factor is working as a driver for the global neonatal intensive care respiratory devices market. Apart from this, the government bodies of major worldwide countries have increased investments in advancing their health care infrastructure. This aside, many key enterprises are entering into partnership agreements. The main motive of these partnerships is penetrating the emerging market. All these factors are expected to stimulate the demand avenues for players in the global neonatal intensive care respiratory devices market.

Numerous enterprises working in the global neonatal intensive care respiratory devices market are using various tactics to withstand in aggressive competition. They are heavily investing in research and development activities. This effort is helping them to offer technology driven products to end-users such as specialty clinics, NICU hospitals, and nursing homes. Apart from this, they are focused on making the products more cost-effective. All these factors are projected to boost the growth of the global neonatal intensive care respiratory devices market.

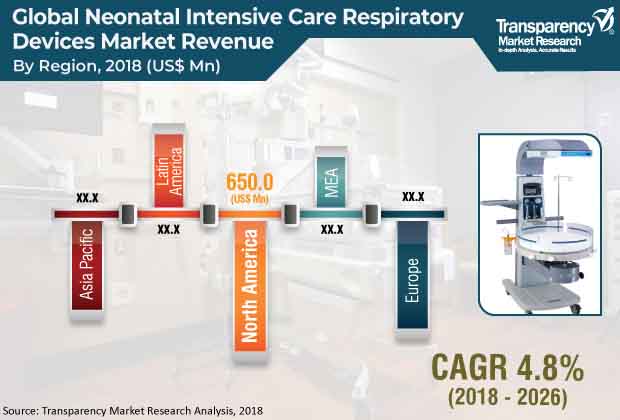

On regional front, North America is one of the key regions in the global neonatal intensive care respiratory devices market. This prominence is on the back of growing efforts by government bodies to grow awareness about neonatal diseases and increased research and development activities in the region.

Neonatal respiratory care involves monitoring and treating newborn babies for breathing disorders. Newborn babies who need intensive care are often admitted to the NICU. The NICU has a range of equipment to take care of the babies, and respiratory devices play a vital role in treating respiratory disorders. However, demand for neonatal intensive care respiratory devices is anticipated to decline during the forecast period owing to high cost and technical errors in NICU devices.

The global neonatal intensive care respiratory devices market was valued at US$ 1,500 Mn in 2017 and is projected to expand at a CAGR of 5% from 2018 to 2026 to reach US$ 2,500 Mn by 2026. High incidence rate of respiratory diseases in newborn babies and increase in incidence of preterm births and corresponding efforts to improve survival rates are likely to fuel the growth of the global market from 2018 to 2026. Surge in government investment in health care infrastructure and strategic alliances among players to penetrate the emerging markets are expected to propel the global market during the forecast period.

There have been significant technological advancements in NICU devices for the treatment of various infectious diseases in the past few years. These devices offer affordable medical technologies and integration of various techniques in a single system. These factors fuel demand for advanced equipment in the NICU health care industry. In September 2018, Koninklijke Philips N.V., in collaboration with the Consortium for Affordable Medical Technologies (CAMTech), developed an innovative resuscitation device called Augmented Infant Resuscitator (AIR). It is an add-on device for conventional neonatal bag-valve-mask (BVM) resuscitators that effectively resuscitates asphyxiated newborns and helps reduce neonatal mortality. These advancements in NICU equipment are projected to boost to the market.

In terms of device type, the global neonatal intensive care respiratory devices market has been segmented into nebulizers, inhalers, ventilators, continuous positive airway pressure devices, apnea monitors, and others. The inhalers segment held the smallest market share in 2017. However, the segment is anticipated to expand at a high CAGR during the forecast period. Based on end-user, the global market has been classified into NICU hospitals, specialty clinics, nursing homes, and others. The NICU hospitals segment accounted for the largest market share in 2017. The segment is expected to expand at a significant CAGR during the forecast period.

North America is projected to account for major share of the global neonatal intensive care respiratory devices market from 2018 to 2026, supported by high cost of technologically advanced respiratory devices and rise in prevalence of premature births. Factors such as government initiatives to spread awareness about neonatal diseases and increase in R&D activities augment the market in the region. Moreover, high prices of products, rapid adoption of new devices, and increase in incidence of premature births in the U.S. boost the growth of the neonatal intensive care respiratory devices market in North America. A report published by the WHO in 2016 stated that the U.S. ranked sixth in the world in premature births. According to data released by the FDA (2016), nearly 6% of 4 million births in the U.S. each year requires NICU admission and majority of them is due to preterm birth.

The neonatal intensive care respiratory devices market in Asia Pacific is projected to expand at a high CAGR during the forecast period due to increase in focus on development of health care infrastructure by both public and private hospitals, high preterm rate, and surge in the number of NICU beds in countries such as South Korea and China. An article published in the Journal of Medical Systems in 2017 indicated that more than 3.5 million preterm births are recoded in India annually.

Key companies operating in the global neonatal intensive care respiratory devices market and profiled in the report include Getinge AB, Vyaire Medical, Inc. (BD), GE Healthcare, Teleflex Incorporated, Drägerwerk AG & Co. KGaA, Medtronic plc, Mercury Medical, Inspiration Healthcare Group plc, and Trudell Medical International.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

1.3. Assumptions and Acronyms Used

2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Key Industry Evolution/Developments

4.3. Market Dynamics

4.3.1. Drivers

4.3.1.1. High incidence rate of respiratory diseases in newborn babies

4.3.1.2. Rising incidences of preterm births and corresponding efforts to increase their survival rate

4.3.2. Restraints

4.3.2.1. High cost of respiratory devices

4.3.2.2. Technical errors in NICU devices

4.3.3. Opportunities

4.3.3.1. Surge in government investment in health care infrastructure

4.3.3.2. Strategic alliance among players to penetrate the emerging market

4.3.4. Technological Assessment

4.3.5. Key Mergers & Acquisitions

4.3.6. Number of Neonatal Intensive Care Beds, by Key Country, 2016

4.3.7. Neonatal Disease Overview

5. Global Neonatal Intensive Care Respiratory Devices Market, by Device Type

5.1. Introduction and Definitions

5.2. Key Findings

5.3. Global Neonatal Intensive Care Respiratory Devices Market Analysis, by Device Type

5.4. Global Neonatal Intensive Care Respiratory Devices Market Forecast, by Device Type

5.4.1. Nebulizers

5.4.2. Inhalers

5.4.3. Ventilators

5.4.4. Continuous Positive Airway Pressure Devices

5.4.5. Apnea Monitors

5.4.6. Others

5.5. Global Neonatal Intensive Care Respiratory Devices Market Attractiveness Analysis, by Device Type

6. Global Neonatal Intensive Care Respiratory Devices Market Analysis and Forecasts, by End-user

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by End-user, 2016–2026

6.3.1. NICU Hospitals

6.3.2. Specialty Clinics

6.3.3. Nursing Homes

6.3.4. Others

6.4. Global Neonatal Intensive Care Respiratory Devices Market Attractiveness Analysis, by End-user

7. Global Neonatal Intensive Care Respiratory Devices Market Analysis and Forecasts, by Region

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Region, 2016–2026

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Latin America

7.3.5. Middle East & Africa

7.4. Global Neonatal Intensive Care Respiratory Devices Attractiveness Analysis, by Region

8. North America Neonatal Intensive Care Respiratory Devices Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. North America Neonatal Intensive Care Respiratory Devices Market Overview

8.3. North America Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Country

8.4. North America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Country

8.4.1. U.S.

8.4.2. Canada

8.5. North America Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type

8.6. North America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Device Type

8.6.1. Nebulizers

8.6.2. Inhalers

8.6.3. Ventilators

8.6.4. Continuous Positive Airway Pressure Devices

8.6.5. Apnea Monitors

8.6.6. Others

8.7. North America Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by End-user

8.8. North America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by End-user

8.8.1. NICU Hospitals

8.8.2. Specialty Clinics

8.8.3. Nursing Homes

8.8.4. Others

8.9. North America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Market Attractiveness

8.9.1. Device Type

8.9.2. End-user

8.9.3. Country

9. Europe Neonatal Intensive Care Respiratory Devices Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Europe Neonatal Intensive Care Respiratory Devices Market Overview

9.3. Europe Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Country/Sub-region

9.4. Europe Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Country/Sub-region

9.4.1. Germany

9.4.2. France

9.4.3. U.K.

9.4.4. Spain

9.4.5. Italy

9.4.6. Rest of Europe

9.5. Europe Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type

9.6. Europe Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Device Type

9.6.1. Nebulizers

9.6.2. Inhalers

9.6.3. Ventilators

9.6.4. Continuous Positive Airway Pressure Devices

9.6.5. Apnea Monitors

9.6.6. Others

9.7. Europe Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by End-user

9.8. Europe Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by End-user

9.8.1. NICU Hospitals

9.8.2. Specialty Clinics

9.8.3. Nursing Homes

9.8.4. Others

9.9. Europe Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Market Attractiveness

9.9.1. Device Type

9.9.2. End-user

9.9.3. Country/Sub-region

10. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Analysis and Forecasts, by Region

10.1. Key Findings

10.2. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Overview

10.3. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Country/Sub-region

10.4. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Country/Sub-region

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Australia & New Zealand

10.4.5. Rest of Asia Pacific

10.5. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type

10.6. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Device Type

10.6.1. Nebulizers

10.6.2. Inhalers

10.6.3. Ventilators

10.6.4. Continuous Positive Airway Pressure Devices

10.6.5. Apnea Monitors

10.6.6. Others

10.7. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by End-user

10.8. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by End-user

10.8.1. NICU Hospitals

10.8.2. Specialty Clinics

10.8.3. Nursing Homes

10.8.4. Others

10.9. Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Market Attractiveness

10.9.1. Device Type

10.9.2. End-user

10.9.3. Country/Sub-region

11. Latin America Neonatal Intensive Care Respiratory Devices Market Analysis and Forecasts, by Region

11.1. Key Findings

11.2. Latin America Neonatal Intensive Care Respiratory Devices Market Overview

11.3. Latin America Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Country/Sub-region

11.4. Latin America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Country/Sub-region

11.4.1. Brazil

11.4.2. Mexico

11.4.3. Rest of Latin America

11.5. Latin America Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type

11.6. Latin America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Device Type

11.6.1. Nebulizers

11.6.2. Inhalers

11.6.3. Ventilators

11.6.4. Continuous Positive Airway Pressure Devices

11.6.5. Apnea Monitors

11.6.6. Others

11.7. Latin America Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by End-user

11.8. Latin America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by End-user

11.8.1. NICU Hospitals

11.8.2. Specialty Clinics

11.8.3. Nursing Homes

11.8.4. Others

11.9. Latin America Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Market Attractiveness

11.9.1. Device Type

11.9.2. End-user

11.9.3. Country/Sub-region

12. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Analysis and Forecasts, by Region

12.1. Key Findings

12.2. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Overview

12.3. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Country/Sub-region

12.4. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Country/Sub-region

12.4.1. South Africa

12.4.2. GCC

12.4.3. Rest of Middle East & Africa

12.5. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type

12.6. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Device Type

12.6.1. Nebulizers

12.6.2. Inhalers

12.6.3. Ventilators

12.6.4. Continuous Positive Airway Pressure Devices

12.6.5. Apnea Monitors

12.6.6. Others

12.7. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by End-user

12.8. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by End-user

12.8.1. NICU Hospitals

12.8.2. Specialty Clinics

12.8.3. Nursing Homes

12.8.4. Others

12.9. Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size and Forecast, by Market Attractiveness

12.9.1. Device Type

12.9.2. End-user

12.9.3. Country/Sub-region

13. Competitive Landscape

13.1. Company Analysis

13.2. Competition Matrix

13.3. Company Profiles

13.3.1. Getinge AB

13.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.1.2. Financial Overview

13.3.1.3. Product Portfolio

13.3.1.4. SWOT Analysis

13.3.1.5. Strategic Overview

13.3.2. Vyaire Medical, Inc.

13.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.2.2. Financial Overview

13.3.2.3. Product Portfolio

13.3.2.4. SWOT Analysis

13.3.2.5. Strategic Overview

13.3.3. GE Healthcare

13.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.3.2. Financial Overview

13.3.3.3. Product Portfolio

13.3.3.4. SWOT Analysis

13.3.3.5. Strategic Overview

13.3.4. Teleflex Incorporated

13.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.4.2. Financial Overview

13.3.4.3. Product Portfolio

13.3.4.4. SWOT Analysis

13.3.4.5. Strategic Overview

13.3.5. Drägerwerk AG & Co. KGaA

13.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.5.2. Financial Overview

13.3.5.3. Product Portfolio

13.3.5.4. SWOT Analysis

13.3.5.5. Strategic Overview

13.3.6. Medtronic plc

13.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.6.2. Financial Overview

13.3.6.3. Product Portfolio

13.3.6.4. SWOT Analysis

13.3.6.5. Strategic Overview

13.3.7. Mercury Medical

13.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.7.2. Financial Overview

13.3.7.3. Product Portfolio

13.3.7.4. SWOT Analysis

13.3.7.5. Strategic Overview

13.3.8. Inspiration Healthcare Group plc

13.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.8.2. Financial Overview

13.3.8.3. Product Portfolio

13.3.8.4. SWOT Analysis

13.3.8.5. Strategic Overview

13.3.9. Trudell Medical International

13.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.9.2. Financial Overview

13.3.9.3. Product Portfolio

13.3.9.4. SWOT Analysis

13.3.9.5. Strategic Overview

Table 01: Key Mergers & Acquisition in the NICU Medical Device Industry

Table 02: Key Mergers & Acquisition in NICU Medical Device Industry

Table 03: Number of Neonatal Intensive Care Beds, by Key Country, 2016 (1/3)

Table 04: Number of Neonatal Intensive Care Beds, by Key Country, 2016 (2/3)

Table 05: Number of Neonatal Intensive Care Beds, by Key Country, 2016 (3/3)

Table 06: Global Neonatal Intensive Care Respiratory Devices Size (US$ Mn) Forecast, by Device Type, 2016–2026

Table 07: Global Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Nebulizers, 2016–2026

Table 08: Global Neonatal Intensive Care Respiratory Devices Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 09: Global Neonatal Intensive Care Respiratory Devices Market Value (US$ Mn) Forecast, by Region, 2016–2026

Table 10: North America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Country, 2016–2026

Table 11: North America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Device Type, 2016–2026

Table 12: North America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Nebulizers, 2016–2026

Table 13: North America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 14: Europe Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 15: Europe Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Device Type, 2016–2026

Table 16: Europe Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Nebulizers, 2016–2026

Table 17: Europe Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 18: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 19: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Device Type, 2016–2026

Table 20: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Nebulizers, 2016–2026

Table 21: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 22: Latin America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 23: Latin America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Device Type, 2016–2026

Table 24: Latin America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Nebulizers, 2016–2026

Table 25: Latin America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 26: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 27: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Device Type, 2016–2026

Table 28: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by Nebulizers, 2016–2026

Table 29: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Figure 01: Global Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) and Distribution, by Region, 2018 and 2026

Figure 02: Market Snapshot of Global Neonatal Intensive Care Respiratory Devices Market

Figure 03: Market Opportunity Map, Revenue Share, by Device Type

Figure 04: Market Opportunity Map, Revenue Share, by End-user

Figure 05: Key Industry Developments (Neonatal Medical Device)

Figure 06: Global Neonatal Intensive Care Market Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 07: Global Neonatal Intensive Care Respiratory Devices Market Value Share, by Device Type (2017)

Figure 08: Global Neonatal Intensive Care Respiratory Devices Market Value Share, by End-user (2017)

Figure 09: Global Neonatal Intensive Care Respiratory Devices Market Value Share, by Region (2017)

Figure 10: Causes of Death among Children Under 5 Years, 2015

Figure 11: Global Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type, 2018 and 2026

Figure 12: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Nebulizers, 2016–2026

Figure 13: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Inhalers, 2016–2026

Figure 14: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Ventilators, 2016–2026

Figure 15: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by CPAP Devices, 2016–2026

Figure 16: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Apnea Monitors, 2016–2026

Figure 17: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 18: Global Neonatal Intensive Care Respiratory Devices Market Attractiveness, by Device Type, 2018–2026

Figure 19: Global Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by End-user, 2018 and 2026

Figure 20: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by NICU Hospitals, 2016–2026

Figure 21: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Specialty Clinics, 2016–2026

Figure 22: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Nursing Homes, 2016–2026

Figure 23: Global Neonatal Intensive Care Respiratory Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 24: Global Neonatal Intensive Care Respiratory Devices Market Attractiveness, by End-user, 2018–2026

Figure 25: Global Neonatal Intensive Care Respiratory Devices Market Value Share (%), by Region, 2018 and 2026

Figure 26: Global Neonatal Intensive Care Respiratory Devices Market Attractiveness, by Region, 2018–2026

Figure 27: North America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 28: North America Neonatal Intensive Care Respiratory Devices Market Value Share, by Country, 2017 and 2026

Figure 29: North America Neonatal Intensive Care Respiratory Devices Market Attractiveness, by Country, 2017–2026

Figure 30: North America Acute Lymphoblastic Leukemia Market Value Share Analysis, by Device Type, 2018 and 2026

Figure 31: North America Acute Lymphoblastic Leukemia Market Attractiveness Analysis, by Device Type, 2018–2026

Figure 32: North America Neonatal Intensive Care Respiratory Devices Market Value Share, by End-user, 2018 and 2026

Figure 33: North America Neonatal Intensive Care Respiratory Devices Market Attractiveness, by End-user, 2018–2026

Figure 34: Europe Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 35: Europe Neonatal Intensive Care Respiratory Devices Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 36: Europe Neonatal Intensive Care Respiratory Devices Market Attractiveness, by Country/Sub-region, 2017–2026

Figure 37: Europe Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type, 2018 and 2026

Figure 38: Europe Neonatal Intensive Care Respiratory Devices Market Attractiveness Analysis, by Device Type, 2018–2026

Figure 39: Europe Neonatal Intensive Care Respiratory Devices Market Value Share, by End-user, 2018 and 2026

Figure 40: Europe Neonatal Intensive Care Respiratory Devices Market Attractiveness, by End-user, 2018–2026

Figure 41: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 42: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Value Share, by Country/Sub-region, 2018 and 2026

Figure 43: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 44: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type, 2018 and 2026

Figure 45: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Attractiveness Analysis, by Device Type, 2018–2026

Figure 46: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Value Share, by End-user, 2018 and 2026

Figure 47: Asia Pacific Neonatal Intensive Care Respiratory Devices Market Attractiveness, by End-user, 2018–2026

Figure 48: Latin America Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 49: Latin America Neonatal Intensive Care Respiratory Devices Market Value Share, by Country/Sub-region, 2018 and 2026

Figure 50: Latin America Neonatal Intensive Care Respiratory Devices Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 51: Latin America Neonatal Intensive Care Respiratory Devices Market Value Share Analysis, by Device Type, 2018 and 2026

Figure 52: Latin America Neonatal Intensive Care Respiratory Devices Market Attractiveness Analysis, by Device Type, 2018–2026

Figure 53: Latin America Neonatal Intensive Care Respiratory Devices Market Value Share, by End-user, 2018 and 2026

Figure 54: Latin America Neonatal Intensive Care Respiratory Devices Market Attractiveness, by End-user, 2018–2026

Figure 55: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 56: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Value Share, by Country/Sub-region, 2018 and 2026

Figure 57: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 58: Middle East & Africa Acute Lymphoblastic Leukemia Market Value Share Analysis, by Device Type, 2018 and 2026

Figure 59: Middle East & Africa Acute Lymphoblastic Leukemia Market Attractiveness Analysis, by Device Type, 2018–2026

Figure 60: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Value Share, by End-user, 2018 and 2026

Figure 61: Middle East & Africa Neonatal Intensive Care Respiratory Devices Market Attractiveness, by End-user, 2018–2026

Figure 62: Getinge AB Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2017

Figure 63: Getinge AB Breakdown of Net Revenue (%), by Business Segment, 2017

Figure 64: BD Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 65: BD Breakdown of Net Sales, by Region, 2017

Figure 66: Medical Division of BD Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 67: Revenue (US$ Mn) and Y-o-Y Growth (%), by Respiratory Solutions, 2016-2017

Figure 68: GE Healthcare Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 69: GE Healthcare R&D Expenditure (US$ Mn) and Y-o-Y Growth (%), 2016–2017

Figure 70: GE Healthcare Breakdown of Net Sales (% Share), by Segment, 2017

Figure 71: GE Healthcare Breakdown of Net Sales (% Share), by Region, 2017

Figure 72: Teleflex Incorporated Breakdown of Net Sales, by Region, 2017

Figure 73: Teleflex Incorporated, Revenue (US$ Bn) and Y-o-Y Growth (%), 2013–2017

Figure 74: Teleflex Incorporated R&D Intensity and Sales & Marketing Intensity - Company Level, (US$ Mn) 2016–2017

Figure 75: Drägerwerk AG & Co. KGaA, Breakdown of Net Sales, by Region, 2017

Figure 76: Drägerwerk AG & Co. KGaA, Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2017

Figure 77: Drägerwerk AG & Co. KGaA, R&D Intensity and Sales & Marketing Intensity - Company Level, (US$ Mn) 2016–2017

Figure 78: Medtronic plc, Breakdown of Net Sales, by Region, 2017

Figure 79: Medtronic plc, Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2017

Figure 79: Medtronic plc, Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2017

Figure 80: Medtronic plc, Breakdown of Net Sales, by Business Segment, 2017

Figure 81: Medtronic plc, R&D Intensity (%) - Company Level or Segment Level, 2015–2017

Figure 82: Inspiration Healthcare Group plc, Revenue (US$ Thousand) and Y-o-Y Growth (%), 2015–2017

Figure 82: Inspiration Healthcare Group plc, Revenue (US$ Thousand) and Y-o-Y Growth (%), 2015–2017