Analysts’ Viewpoint

Growth in insect-borne diseases, and awareness about the adverse impact of using products which contain toxic chemicals such as DEET or Picaridin are expected to fuel the natural ingredient insect repellent market size during the forecast period. Effectiveness of natural ingredient insect repellents made from plant-based, organic, and herbal ingredients in repelling mosquitoes and other insects is expected to drive market development during the forecast period.

Additionally, increase in participation in hiking, and camping is expected to expand the natural ingredient insect repellent market share as people opt for natural repellents to avoid insect bites during outdoor activities.

Natural ingredient insect repellent manufacturers are focusing on research and development activities to accelerate the roll out of new products and thus strengthen their foothold in the global industry.

A natural ingredient insect repellent is applied on skin, clothes, and other surfaces to prevent insects from landing on that surface. Insect repellents help control the outbreak of insect-borne diseases such as malaria, dengue fever, and river blindness. It usually contains an active ingredient that repels insects such as mosquitoes, ticks, and flies. Sprays/aerosols, creams, essential oils, liquid vaporizers, and patches & incense sticks are the different types of natural ingredient insect repellents.

Products with organic mosquito repellent ingredients, herbal mosquito repellent ingredients, natural bug spray ingredients, and natural bug repellent ingredients are increasingly favored rather than synthetic products that contain toxic chemicals such as DEET. These natural products are safe and eco-friendly and offer protection against hazardous diseases.

Demand for natural ingredient insect repellent has increased with the rise in occurrence of insect-borne diseases such as dengue, malaria, and other viral diseases. According to the World Health Organization (WHO), more than 700,000 deaths are recorded due to vector-borne diseases such as malaria, and dengue. Vector-borne diseases account for more than 17% of all infectious diseases. Furthermore, 219 million cases are recorded globally and resulted in more than 400,000 deaths every year due to malaria. All these diseases are preventable through protective and control measures such as usage of natural ingredient insect repellents. Heightened awareness about the need for effective insect repellents is expected to propel the natural ingredient insect repellent market growth.

Usage of plant-based, organic, and herbal ingredients in the manufacture of natural repellents which are harmless to consumers is projected to drive natural ingredient insect repellent market demand. The trend toward plant-based products is on the rise, with many consumers opting for natural ingredients, as synthetic products contain toxic chemicals that are harmful, causing skin infections, nervous system disorders, and several other health related issues. This is expected to drive the natural ingredient insect repellent market value during the forecast period.

Furthermore, natural ingredient insect repellent industry growth is influenced by consumers becoming more aware of potential environmental hazards associated with synthetic insect repellents, resulting in growth in demand for natural alternatives that are safe and eco-friendly.

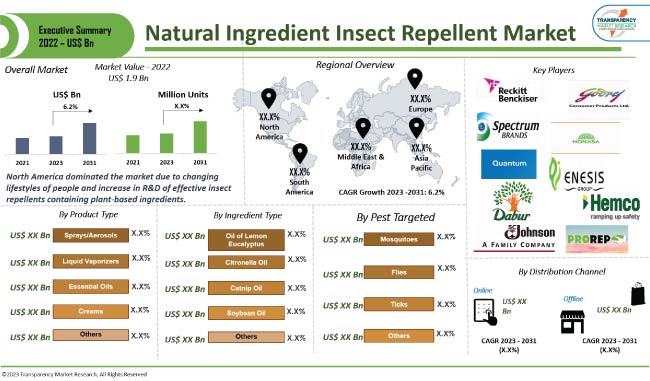

The natural ingredient insect repellent market segmentation, based on product type, includes sprays/aerosols, creams, essential oils, liquid vaporizers, and others. The sprays/aerosols segment is estimated to lead the global market in the next few years. Sprays/aerosols provide protection for a longer period of time. Rise in camping and recreational activities is driving the demand for sprays/aerosols as these products are easy to carry & use, and are the most effective compared to the other product types.

Based on ingredient type, the market is bifurcated into oil of lemon eucalyptus, citronella oil, catnip oil, soybean oil, and others. According to the natural ingredient insect repellent market forecast, the oil of lemon eucalyptus ingredient segment is likely to lead the global market during the forecast period. Oil of lemon eucalyptus is one of the prominent active ingredients in natural insect repellents. The ingredient is less volatile compared to other natural insect repellents. Moreover, it has better efficiency as it does not evaporate quickly and also lasts up to 6 to 7 hours.

North America is likely to dominate the global natural ingredient insect repellent market during the forecast period, ascribed to the rise in awareness of the benefits of using mosquito repellents, changing lifestyles of people, and increase in R&D of efficient insect repellents containing plant-based ingredients. These factors are projected to augment market expansion in the region in the near future.

The natural ingredient insect repellent market in Asia Pacific is showing steady progress due to environmental concerns and an increase in vector-borne diseases such as malaria and dengue which are very frequent in this region.

The natural ingredient insect repellent market is fragmented due to the presence of many local and global players. Competition is expected to intensify in the next few years due to the entry of local players.

Observing the natural ingredient insect repellent market trends, key suppliers and manufacturers are focusing on product developments and striving to meet the demands of customers by introducing more efficient natural ingredient insect repellents at reasonable prices.

Prominent players operating in the global natural ingredient insect repellent industry include Reckitt Benckiser Group PLC, Godrej Consumer Products Limited, Spectrum Brands Holdings Inc., Honasa Consumer Pvt. Ltd., Quantum Inc., Dabur International, Enesis Group, HEMCO Corporation, S.C. Johnson & Son Inc., and Prorep Brands Inc.

Each of these players has been profiled in the natural ingredient insect repellent market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 1.9 Bn |

|

Market Value in 2031 |

US$ 3.5 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

USD Bn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 1.9 Bn in 2022

It is expected to reach US$ 3.5 Bn by 2031

It is likely to grow at a CAGR of 6.2% from 2023 to 2031

Adding plant-based, organic, herbal, and other natural ingredients in the manufacturing of natural repellents, and rise in vector-borne diseases

The sprays/aerosols segment leads in terms of product type

North America is a more attractive region for vendors, followed by Europe and Asia Pacific.

Reckitt Benckiser Group PLC, Godrej Consumer Products Limited, Spectrum Brands Holdings Inc., Honasa Consumer Pvt. Ltd., Quantum Inc., Dabur International, Enesis Group, HEMCO Corporation, S.C. Johnson & Son Inc., and Prorep Brands Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Natural Ingredient Insect Repellant Market Analysis and Forecast, 2017 – 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Million Units)

6. Global Natural Ingredient Insect Repellant Market Analysis and Forecast, By Product Type

6.1. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Product Type, 2017 – 2031

6.1.1. Sprays/Aerosols

6.1.2. Creams

6.1.3. Essential Oils

6.1.4. Liquid Vaporizers

6.1.5. Others (patches, incense sticks etc).

6.2. Incremental Opportunity, By Product Type

7. Global Natural Ingredient Insect Repellant Market Analysis and Forecast, By Ingredient Type

7.1. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Ingredient Type, 2017 – 2031

7.1.1. Oil of Lemon Eucalyptus

7.1.2. Citronella Oil

7.1.3. Catnip Oil

7.1.4. Soybean Oil

7.1.5. Others (tea tree oil, neem oil etc).

7.2. Incremental Opportunity, By Ingredient Type

8. Global Natural Ingredient Insect Repellant Market Analysis and Forecast, By Pest Targeted

8.1. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Pest Targeted, 2017 – 2031

8.1.1. Mosquitoes

8.1.2. Flies

8.1.3. Ticks

8.1.4. Others (Moth, Mites etc.)

8.2. Incremental Opportunity, By Pest Targeted

9. Global Natural Ingredient Insect Repellant Market Analysis and Forecast, By Distribution Channel

9.1. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

9.1.1. Online

9.1.1.1. E-commerce Websites

9.1.1.2. Company owned Websites

9.1.2. Offline

9.1.2.1. Specialty Stores

9.1.2.2. Supermarkets & Hypermarkets

9.1.2.3. Other Retail Stores

9.2. Incremental Opportunity, By Distribution Channel

10. Global Natural Ingredient Insect Repellant Market Analysis and Forecast, By Region

10.1. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Region, 2017 – 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Natural Ingredient Insect Repellant Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Price

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Product Type, 2017 – 2031

11.6.1. Sprays/Aerosols

11.6.2. Creams

11.6.3. Essential Oils

11.6.4. Liquid Vaporizers

11.6.5. Others (patches, incense sticks etc).

11.7. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Ingredient Type, 2017 – 2031

11.7.1. Oil of Lemon Eucalyptus

11.7.2. Citronella Oil

11.7.3. Catnip Oil

11.7.4. Soybean Oil

11.7.5. Others (tea tree oil, neem oil etc).

11.8. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Pest Targeted, 2017 – 2031

11.8.1. Mosquitoes

11.8.2. Flies

11.8.3. Ticks

11.8.4. Others (Moth, Mites etc.)

11.9. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

11.9.1. Online

11.9.1.1. E-commerce Websites

11.9.1.2. Company owned Websites

11.9.2. Offline

11.9.2.1. Specialty Stores

11.9.2.2. Supermarkets & Hypermarkets

11.9.2.3. Other Retail Stores

11.10. Natural Ingredient Insect Repellant Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 – 2027

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Natural Ingredient Insect Repellant Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Price

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Product Type, 2017 – 2031

12.6.1. Sprays/Aerosols

12.6.2. Creams

12.6.3. Essential Oils

12.6.4. Liquid Vaporizers

12.6.5. Others (patches, incense sticks etc).

12.7. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Ingredient Type, 2017 – 2031

12.7.1. Oil of Lemon Eucalyptus

12.7.2. Citronella Oil

12.7.3. Catnip Oil

12.7.4. Soybean Oil

12.7.5. Others (tea tree oil, neem oil etc).

12.8. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Pest Targeted, 2017 – 2031

12.8.1. Mosquitoes

12.8.2. Flies

12.8.3. Ticks

12.8.4. Others (Moth, Mites etc.)

12.9. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

12.9.1. Online

12.9.1.1. E-commerce Websites

12.9.1.2. Company owned Websites

12.9.2. Offline

12.9.2.1. Specialty Stores

12.9.2.2. Supermarkets & Hypermarkets

12.9.2.3. Other Retail Stores

12.10. Natural Ingredient Insect Repellant Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 – 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Natural Ingredient Insect Repellant Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Product Type, 2017 – 2031

13.6.1. Sprays/Aerosols

13.6.2. Creams

13.6.3. Essential Oils

13.6.4. Liquid Vaporizers

13.6.5. Others (patches, incense sticks etc).

13.7. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Ingredient Type, 2017 – 2031

13.7.1. Oil of Lemon Eucalyptus

13.7.2. Citronella Oil

13.7.3. Catnip Oil

13.7.4. Soybean Oil

13.7.5. Others (tea tree oil, neem oil etc).

13.8. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Pest Targeted, 2017 – 2031

13.8.1. Mosquitoes

13.8.2. Flies

13.8.3. Ticks

13.8.4. Others (Moth, Mites etc.)

13.9. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

13.9.1. Online

13.9.1.1. E-commerce Websites

13.9.1.2. Company owned Websites

13.9.2. Offline

13.9.2.1. Specialty Stores

13.9.2.2. Supermarkets & Hypermarkets

13.9.2.3. Other Retail Stores

13.10. Natural Ingredient Insect Repellant Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 – 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Natural Ingredient Insect Repellant Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Product Type, 2017 – 2031

14.6.1. Sprays/Aerosols

14.6.2. Creams

14.6.3. Essential Oils

14.6.4. Liquid Vaporizers

14.6.5. Others (patches, incense sticks etc).

14.7. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Ingredient Type, 2017 – 2031

14.7.1. Oil of Lemon Eucalyptus

14.7.2. Citronella Oil

14.7.3. Catnip Oil

14.7.4. Soybean Oil

14.7.5. Others (tea tree oil, neem oil etc).

14.8. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Pest Targeted, 2017 – 2031

14.8.1. Mosquitoes

14.8.2. Flies

14.8.3. Ticks

14.8.4. Others (Moth, Mites etc.)

14.9. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

14.9.1. Online

14.9.1.1. E-commerce Websites

14.9.1.2. Company owned Websites

14.9.2. Offline

14.9.2.1. Specialty Stores

14.9.2.2. Supermarkets & Hypermarkets

14.9.2.3. Other Retail Stores

14.10. Natural Ingredient Insect Repellant Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 – 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Natural Ingredient Insect Repellant Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Product Type, 2017 – 2031

15.6.1. Sprays/Aerosols

15.6.2. Creams

15.6.3. Essential Oils

15.6.4. Liquid Vaporizers

15.6.5. Others (patches, incense sticks etc).

15.7. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Ingredient Type, 2017 – 2031

15.7.1. Oil of Lemon Eucalyptus

15.7.2. Citronella Oil

15.7.3. Catnip Oil

15.7.4. Soybean Oil

15.7.5. Others (tea tree oil, neem oil etc).

15.8. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Pest Targeted, 2017 – 2031

15.8.1. Mosquitoes

15.8.2. Flies

15.8.3. Ticks

15.8.4. Others (Moth, Mites etc.)

15.9. Natural Ingredient Insect Repellant Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

15.9.1. Online

15.9.1.1. E-commerce Websites

15.9.1.2. Company owned Websites

15.9.2. Offline

15.9.2.1. Specialty Stores

15.9.2.2. Supermarkets & Hypermarkets

15.9.2.3. Other Retail Stores

15.10. Natural Ingredient Insect Repellant Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 – 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis – 2022 (%)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Reckitt Benckiser Group PLC

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Godrej Consumer Products Limited

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Spectrum Brands Holdings Inc.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Honasa Consumer Pvt. Ltd.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Quantum Inc.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Dabur International

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Enesis Group and Homes LLC.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. HEMCO Corporation

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. S.C. Johnson & Son Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Prorep Brands Inc.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Ingredient Type

17.1.3. Pest Targeted

17.1.4. Distribution channel

17.1.5. Region

17.2. Understanding the Procurement Process of End-users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Natural Ingredient Insect Repellent Market by Product Type, Million Units 2017-2031

Table 2: Global Natural Ingredient Insect Repellent Market by Product Type, US$ Mn 2017-2031

Table 3: Global Natural Ingredient Insect Repellent Market by Ingredient Type, Million Units 2017-2031

Table 4: Global Natural Ingredient Insect Repellent Market by Ingredient Type, US$ Mn 2017-2031

Table 5: Global Natural Ingredient Insect Repellent Market by Pest Targeted, Million Units 2017-2031

Table 6: Global Natural Ingredient Insect Repellent Market by Pest Targeted, US$ Mn 2017-2031

Table 7: Global Natural Ingredient Insect Repellent Market by Distribution Channel, Million Units, 2017-2031

Table 8: Global Natural Ingredient Insect Repellent Market by Distribution Channel, US$ Mn 2017-2031

Table 9: Global Natural Ingredient Insect Repellent Market by Region, Million Units, 2017-2031

Table 10: Global Natural Ingredient Insect Repellent Market by Region, US$ Mn 2017-2031

Table 11: North America Natural Ingredient Insect Repellent Market by Product Type, Million Units 2017-2031

Table 12: North America Natural Ingredient Insect Repellent Market by Product Type, US$ Mn 2017-2031

Table 13: North America Natural Ingredient Insect Repellent Market by Ingredient Type, Million Units 2017-2031

Table 14: North America Natural Ingredient Insect Repellent Market by Ingredient Type, US$ Mn 2017-2031

Table 15: North America Natural Ingredient Insect Repellent Market by Pest Targeted, Million Units 2017-2031

Table 16: North America Natural Ingredient Insect Repellent Market by Pest Targeted, US$ Mn 2017-2031

Table 17: North America Natural Ingredient Insect Repellent Market by Distribution Channel, Million Units, 2017-2031

Table 18: North America Natural Ingredient Insect Repellent Market by Distribution Channel, US$ Mn 2017-2031

Table 19: Europe Natural Ingredient Insect Repellent Market by Product Type, Million Units 2017-2031

Table 20: Europe Natural Ingredient Insect Repellent Market by Product Type, US$ Mn 2017-2031

Table 21: Europe Natural Ingredient Insect Repellent Market by Ingredient Type, Million Units 2017-2031

Table 22: Europe Natural Ingredient Insect Repellent Market by Ingredient Type, US$ Mn 2017-2031

Table 23: Europe Natural Ingredient Insect Repellent Market by Pest Targeted, Million Units 2017-2031

Table 24: Europe Natural Ingredient Insect Repellent Market by Pest Targeted, US$ Mn 2017-2031

Table 25: Europe Natural Ingredient Insect Repellent Market by Distribution Channel, Million Units, 2017-2031

Table 26: Europe Natural Ingredient Insect Repellent Market by Distribution Channel, US$ Mn 2017-2031

Table 27: Asia Pacific Natural Ingredient Insect Repellent Market by Product Type, Million Units 2017-2031

Table 28: Asia Pacific Natural Ingredient Insect Repellent Market by Product Type, US$ Mn 2017-2031

Table 29: Asia Pacific Natural Ingredient Insect Repellent Market by Ingredient Type, Million Units 2017-2031

Table 30: Asia Pacific Natural Ingredient Insect Repellent Market by Ingredient Type, US$ Mn 2017-2031

Table 31: Asia Pacific Natural Ingredient Insect Repellent Market by Pest Targeted, Million Units 2017-2031

Table 32: Asia Pacific Natural Ingredient Insect Repellent Market by Pest Targeted, US$ Mn 2017-2031

Table 33: Asia Pacific Natural Ingredient Insect Repellent Market by Distribution Channel, Million Units, 2017-2031

Table 34: Asia Pacific Natural Ingredient Insect Repellent Market by Distribution Channel, US$ Mn 2017-2031

Table 35: Middle East & Africa Natural Ingredient Insect Repellent Market by Product Type, Million Units 2017-2031

Table 36: Middle East & Africa Natural Ingredient Insect Repellent Market by Product Type, US$ Mn 2017-2031

Table 37: Middle East & Africa Natural Ingredient Insect Repellent Market by Ingredient Type, Million Units 2017-2031

Table 38: Middle East & Africa Natural Ingredient Insect Repellent Market by Ingredient Type, US$ Mn 2017-2031

Table 39: Middle East & Africa Natural Ingredient Insect Repellent Market by Pest Targeted, Million Units 2017-2031

Table 40: Middle East & Africa Natural Ingredient Insect Repellent Market by Pest Targeted, US$ Mn 2017-2031

Table 41: Middle East & Africa Natural Ingredient Insect Repellent Market by Distribution Channel, Million Units, 2017-2031

Table 42: Middle East & Africa Natural Ingredient Insect Repellent Market by Distribution Channel, US$ Mn 2017-2031

Table 43: South America Natural Ingredient Insect Repellent Market by Product Type, Million Units 2017-2031

Table 44: South America Natural Ingredient Insect Repellent Market by Product Type, US$ Mn 2017-2031

Table 45: South America Natural Ingredient Insect Repellent Market by Ingredient Type, Million Units 2017-2031

Table 46: South America Natural Ingredient Insect Repellent Market by Ingredient Type, US$ Mn 2017-2031

Table 47: South America Natural Ingredient Insect Repellent Market by Pest Targeted, Million Units 2017-2031

Table 48: South America Natural Ingredient Insect Repellent Market by Pest Targeted, US$ Mn 2017-2031

Table 49: South America Natural Ingredient Insect Repellent Market by Distribution Channel, Million Units, 2017-2031

Table 50: South America Natural Ingredient Insect Repellent Market by Distribution Channel, US$ Mn 2017-2031

List of Figures

Figure 1: Global Natural Ingredient Insect Repellent Market Projections, by Product Type, Million Units 2017-2031

Figure 2: Global Natural Ingredient Insect Repellent Market Projections, by Product Type, US$ Mn 2017-2031

Figure 3: Global Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 4: Global Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, Million Units 2017-2031

Figure 5: Global Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, US$ Mn 2017-2031

Figure 6: Global Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Ingredient Type, US$ Mn 2023 -2031

Figure 7: Global Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, Million Units 2017-2031

Figure 8: Global Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, US$ Mn 2017-2031

Figure 9: Global Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Pest Targeted, US$ Mn 2023 -2031

Figure 10: Global Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 11: Global Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 12: Global Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 13: Global Natural Ingredient Insect Repellent Market Projections, by Region, Million Units, 2017-2031

Figure 14: Global Natural Ingredient Insect Repellent Market Projections, by Region, US$ Mn 2017-2031

Figure 15: Global Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Region, US$ Mn 2023 -2031

Figure 16: North America Natural Ingredient Insect Repellent Market Projections, by Product Type, Million Units 2017-2031

Figure 17: North America Natural Ingredient Insect Repellent Market Projections, by Product Type, US$ Mn 2017-2031

Figure 18: North America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 19: North America Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, Million Units 2017-2031

Figure 20: North America Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, US$ Mn 2017-2031

Figure 21: North America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Ingredient Type, US$ Mn 2023 -2031

Figure 22: North America Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, Million Units 2017-2031

Figure 23: North America Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, US$ Mn 2017-2031

Figure 24: North America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Pest Targeted, US$ Mn 2023 -2031

Figure 25: North America Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 26: North America Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 27: North America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 28: Europe Natural Ingredient Insect Repellent Market Projections, by Product Type, Million Units 2017-2031

Figure 29: Europe Natural Ingredient Insect Repellent Market Projections, by Product Type, US$ Mn 2017-2031

Figure 30: Europe Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 31: Europe Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, Million Units 2017-2031

Figure 32: Europe Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, US$ Mn 2017-2031

Figure 33: Europe Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Ingredient Type, US$ Mn 2023 -2031

Figure 34: Europe Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, Million Units 2017-2031

Figure 35: Europe Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, US$ Mn 2017-2031

Figure 36: Europe Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Pest Targeted, US$ Mn 2023 -2031

Figure 37: Europe Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 38: Europe Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 39: Europe Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 40: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Product Type, Million Units 2017-2031

Figure 41: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Product Type, US$ Mn 2017-2031

Figure 42: Asia Pacific Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 43: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, Million Units 2017-2031

Figure 44: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, US$ Mn 2017-2031

Figure 45: Asia Pacific Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Ingredient Type, US$ Mn 2023 -2031

Figure 46: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, Million Units 2017-2031

Figure 47: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, US$ Mn 2017-2031

Figure 48: Asia Pacific Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Pest Targeted, US$ Mn 2023 -2031

Figure 49: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 50: Asia Pacific Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 51: Asia Pacific Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 52: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Product Type, Million Units 2017-2031

Figure 53: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Product Type, US$ Mn 2017-2031

Figure 54: Middle East & Africa Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 55: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, Million Units 2017-2031

Figure 56: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, US$ Mn 2017-2031

Figure 57: Middle East & Africa Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Ingredient Type, US$ Mn 2023 -2031

Figure 58: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, Million Units 2017-2031

Figure 59: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, US$ Mn 2017-2031

Figure 60: Middle East & Africa Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Pest Targeted, US$ Mn 2023 -2031

Figure 61: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 62: Middle East & Africa Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 63: Middle East & Africa Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 64: South America Natural Ingredient Insect Repellent Market Projections, by Product Type, Million Units 2017-2031

Figure 65: South America Natural Ingredient Insect Repellent Market Projections, by Product Type, US$ Mn 2017-2031

Figure 66: South America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 67: South America Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, Million Units 2017-2031

Figure 68: South America Natural Ingredient Insect Repellent Market Projections, by Ingredient Type, US$ Mn 2017-2031

Figure 69: South America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Ingredient Type, US$ Mn 2023 -2031

Figure 70: South America Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, Million Units 2017-2031

Figure 71: South America Natural Ingredient Insect Repellent Market Projections, by Pest Targeted, US$ Mn 2017-2031

Figure 72: South America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Pest Targeted, US$ Mn 2023 -2031

Figure 73: South America Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 74: South America Natural Ingredient Insect Repellent Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 75: South America Natural Ingredient Insect Repellent Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031