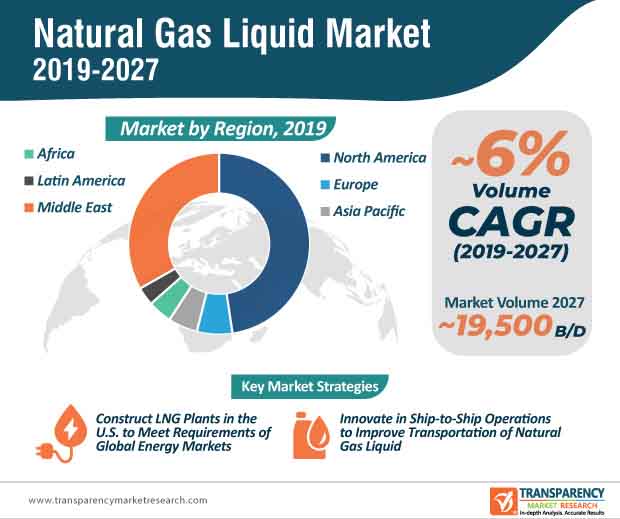

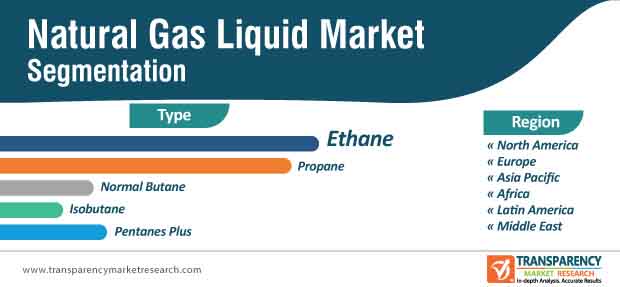

The global natural gas liquid market is projected to register a CAGR of 6% from 2019 to 2027 (forecast period). Natural gas liquids (NGL) are liquid components of natural gas that have been separated from the gas state. Condensation, absorption, and other methods are used in the gas processing facility to separate NGLs from gas. Butane, propane, ethane, and pentanes are the most common NGLs.

The worldwide natural gas liquid market has experienced rapid growth in recent years. Natural gas liquids are increasingly being consumed in the residential, commercial, and industrial sectors, which is boosting the natural gas liquid market. Domestic applications of these liquids have aided in growing sales around the globe. Moreover, plastics, detergent production, and anti-freeze agents are some of the most common sectors that use natural gas liquids.

With increasing standards of living and environmental concerns, the usage of NGLs products is on the rise. NGLs products such as propane and butane are widely used as a fuel in furnaces for heating, cooking, as an energy source for heating systems, laundry dryers, grills, and portable stoves. The upsurge in consumption of such products for cooking, heating, and burning purposes is expected to boost the natural gas liquid market.

Natural gas prices have been declining since 2009, but they fell dramatically in 2012. With a few exceptions, this lower trend in natural gas prices is likely to continue throughout the projection period. Natural gas prices have fallen due to oversupply and poor demand. However, natural gas output has not declined and is not expected to decline throughout the projection period. Natural gas processing plant operators and natural gas producers have begun to focus on natural gas liquids in order to increase profitability and maintain company operations stable, as NGLs have higher pricing and are in more demand. Thus, reduced natural gas prices and poor demand for natural gas are expected to propel the natural gas liquid market throughout the projected period.

Crude oil prices are influenced by events that might impair oil and gas supply. These include geopolitical events and weather-related difficulties. Geopolitical events are a key element that might cause uncertainty regarding future supply or demand for oil and gas. This might lead to increased volatility in oil and gas prices. The Middle East accounts for a sizable portion of the worldwide oil and gas business. It is an extremely volatile region due to political difficulties that generate concern among investors interested in oil and gas development. Since the drop in crude oil prices in 2014, oil and gas costs have steadily risen. The fluctuation in crude oil prices has an impact on oil and gas output. This, in turn, is likely to constrain the worldwide natural gas liquid market from 2019 to 2027.

North America is expected to be a promising region of the worldwide market during the projected period. The North American natural gas liquid market is expected to grow rapidly during the forecast period, owing to a large overall increase in NGL output levels (from refineries and gas plants combined). The fast expansion in natural gas output from alternative sources, including tight, shale, and coal-bed methane deposits, has increased the natural gas liquids output from gas plants in the United States.

By 2025, the U.S. market is expected to surpass 3 million barrels per day in annual consumption. The fast growth of the shale gas sector, low natural gas liquids costs and decreasing reliance on other nations for energy imports have all contributed to a significant increase in NGL usage. Additionally, supply cost savings, currency exchange rate volatility, and product monetization are expected to influence natural gas liquid market growth positively.

Key players active in the worldwide natural gas liquid market are ConocoPhillips Company, Exxon Mobil Corporation, Equinor ASA, BP Plc., SM Energy, Silver BoW resources, and Royal Dutch Shell Plc.

Natural Gas Liquid Market is expected to reach 19,500 Thousand B/D By 2027

Natural Gas Liquid Market is estimated to rise at a CAGR of 6% during forecast period

Increasing use of natural gas liquids (NGLs) in petrochemical applications is expected to drive the global natural gas liquid market during the forecast period

North America is more attractive for vendors in the Natural Gas Liquid Market

Key players of Natural Gas Liquid Market are ConocoPhillips Company, Exxon Mobil Corporation, Equinor ASA, BP Plc., SM Energy, Silver BoW resources, and Royal Dutch Shell Plc

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1.1. Drivers

3.1.1.2. Restraints

3.1.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Volume Chain Analysis

4. Global Natural Gas Liquid Market Volume (Thousand B/D) Analysis, by Type

4.1. Key Findings and Introduction

4.2. Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

4.2.1. Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Ethane, 2018–2027

4.2.2. Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Propane, 2018–2027

4.2.3. Global Natural gas liquid s Market Volume (Thousand B/D) Forecast, by Normal Butane, 2018–2027

4.2.4. Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Isobutane, 2018–2027

4.2.5. Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Pentanes Plus, 2018–2027

4.3. Global Natural Gas Liquid Market Attractiveness Analysis, by Type

5. Global Natural Gas Liquid Market Analysis, by Region

5.1. Key Findings

5.2. Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Africa

5.2.5. Latin America

5.2.6. Middle East

5.3. Global Natural Gas Liquid Market Attractiveness Analysis, by Region

6. North America Natural Gas Liquid Market Overview

6.1. Key Findings

6.2. North America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

6.3. North America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country

6.3.1. U.S. Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

6.3.2. Canada Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

6.4. North America Natural Gas Liquid Market Attractiveness Analysis, by Type

6.5. North America Natural Gas Liquid Market Attractiveness Analysis, by Country

7. Europe Natural Gas Liquid Market Overview

7.1. Key Findings

7.2. Europe Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

7.3. Europe Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

7.3.1. Norway Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

7.3.2. Russia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

7.3.3. U.K. Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

7.3.4. Netherlands Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

7.3.5. Rest of Europe Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

7.4. Europe Natural Gas Liquid Market Attractiveness Analysis, by Type

7.5. Europe Natural Gas Liquid Market Attractiveness Analysis, by Country and Sub-region

8. Asia Pacific Natural Gas Liquid Market Overview

8.1. Key Findings

8.2. Asia Pacific Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

8.3. Asia Pacific Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

8.3.1. Indonesia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

8.3.2. Australia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type

8.3.3. India Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type

8.3.4. Rest of Asia Pacific Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type

8.4. Asia Pacific Natural Gas Liquid Market Attractiveness Analysis, by Type

8.5. Asia Pacific Natural Gas Liquid Market Attractiveness Analysis, by Country and Sub-region

9. Africa Natural Gas Liquid Market Overview

9.1. Key Findings

9.2. Africa Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

9.3. Africa Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

9.3.1. Algeria Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

9.3.2. Nigeria Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type

9.3.3. Rest of Africa Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type

9.4. Africa Pacific Natural Gas Liquid Market Attractiveness Analysis, by Type

9.5. Africa Pacific Natural Gas Liquid Market Attractiveness Analysis, by Country and Sub-region

10. Latin America Natural Gas Liquid Market Overview

10.1. Key Findings

10.2. Latin America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

10.3. Latin America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

10.3.1. Argentina Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

10.3.2. Brazil Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

10.3.3. Venezuela Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

10.3.4. Rest of Latin America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

10.4. Latin America Natural Gas Liquid Market Attractiveness Analysis, by Type

10.5. Latin America Natural Gas Liquid Market Attractiveness Analysis, by Country and Sub-region

11. Middle East Natural Gas Liquid Market Overview

11.1. Key Findings

11.2. Middle East Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

11.3. Middle East Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

11.3.1. Qatar Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

11.3.2. Iran Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

11.3.3. Saudi Arabia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

11.3.4. UAE Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

11.3.5. Rest of Middle East Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

11.4. Middle East Natural Gas Liquid Market Attractiveness Analysis, by Type

11.5. Middle East Natural Gas Liquid Market Attractiveness Analysis, by Country and Sub-region

12. Competition Landscape

12.1. Competition Matrix

12.2. Global Natural Gas Liquid Market Share Analysis, by Company (2018)

12.3. Market Footprint Analysis

12.4. Company Profiles

12.4.1. BP Plc.

12.4.1.1. Company Details

12.4.1.2. Company Description

12.4.1.3. Business Overview

12.4.1.4. Financial Details

12.4.1.5. Strategic Overview/Recent Developments

12.4.2. ExxonMobil Corporation

12.4.2.1. Company Details

12.4.2.2. Company Description

12.4.2.3. Business Overview

12.4.2.4. Strategic Overview/Recent Developments

12.4.3. Royal Dutch Shell Plc.

12.4.3.1. Company Details

12.4.3.2. Company Description

12.4.3.3. Business Overview

12.4.3.4. Financial Details

12.4.3.5. Strategic Overview/Recent Developments

12.4.4. Range Resources Corporation

12.4.4.1. Company Details

12.4.4.2. Company Description

12.4.4.3. Business Overview

12.4.4.4. Financial Details

12.4.4.5. Strategic Overview/Recent Developments

12.4.5. SM Energy

12.4.5.1. Company Details

12.4.5.2. Company Description

12.4.5.3. Business Overview

12.4.5.4. Financial Details

12.4.5.5. Strategic Overview/Recent Developments

12.4.6. Equinor ASA

12.4.6.1. Company Details

12.4.6.2. Company Description

12.4.6.3. Business Overview

12.4.6.4. Strategic Overview/Recent Developments

12.4.7. Silver BoW Resources

12.4.7.1. Company Details

12.4.7.2. Company Description

12.4.7.3. Business Overview

12.4.7.4. Financial Details

12.4.7.5. Strategic Overview/Recent Developments

12.4.8. Linn Energy LLC.

12.4.8.1. Company Details

12.4.8.2. Company Description

12.4.8.3. Business Overview

12.4.8.4. Financial Details

12.4.8.5. Strategic Overview/Recent Developments

12.4.9. Occidental Petroleum

12.4.9.1. Company Details

12.4.9.2. Company Description

12.4.9.3. Business Overview

12.4.9.4. Financial Details

12.4.9.5. Strategic Overview/Recent Developments

12.4.10. ConocoPhillips Company

12.4.10.1. Company Details

12.4.10.2. Company Description

12.4.10.3. Business Overview

12.4.11. Cheaspeake Energy Corporation

12.4.11.1. Company Details

12.4.11.2. Company Description

12.4.11.3. Business Overview

12.4.11.4. Strategic Overview/Recent Developments

13. Primary Research – Key Insights

14. Appendix

14.1. Research Methodology and Assumptions

List of Tables

Table 01: Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 02: Global Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Region, 2018–2027

Table 03: North America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 04: North America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country, 2018–2027

Table 05: U.S. Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 06: Canada Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 07: Europe Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 08: Europe Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

Table 09: Norway Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 10: Russia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 11: U.K. Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 12: Netherlands Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 13: Rest of Europe Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 14: Asia Pacific Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 15: Asia Pacific Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

Table 16: Indonesia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 17: Australia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 18: India Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 19: Rest of Asia Pacific Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 20: Africa Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 21: Africa Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

Table 22: Algeria Pacific Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 23: Nigeria Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 24: Rest of Africa Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 25: Latin America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 26: Latin America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

Table 27: Argentina Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 28: Brazil Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 29: Venezuela Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 30: Rest of Latin America Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 31: Middle East Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 32: Middle East Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Country and Sub-region, 2018–2027

Table 33: Qatar Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 34: Iran Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 35: Saudi Arabia Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 36: UAE Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027

Table 37: Rest of Middle East Natural Gas Liquid Market Volume (Thousand B/D) Forecast, by Type, 2018–2027?

List of Figures

Figure 01: Net Sales (US$ Mn) and Y-o-Y Growth (%), 2015–2019

Figure 02: Breakdown of Revenue, by Business Segment, 2018

Figure 03: Net Sales (US$ Mn) and Y-o-Y Growth (%), 2015–2019

Figure 04: Breakdown of Revenue, by Business Segment, 2018

Figure 05: Net Sales (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 06: Breakdown of Revenue, by Business Segment, 2018

Figure 07: Net Sales (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 08: Breakdown of Revenue, by Business Segment, 2018

Figure 09: Net Sales (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 10: Net Sales (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 11: Net Sales (US$ Mn) and Y-o-Y Growth (%), 2015–2018