Analysts’ Viewpoint

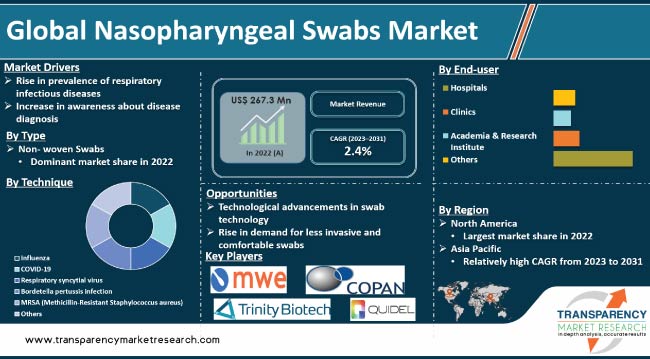

Increase in incidence of respiratory infectious diseases is driving the global nasopharyngeal swabs industry. Nasopharyngeal swabs are commonly utilized in diagnostic testing of respiratory diseases, as they are non-invasive and readily available. During the COVID-19 pandemic, increase in diagnosis rate of the disease led to surge in nasopharyngeal swabs market demand. Rise in awareness about the importance of early disease detection is expected to bolster market expansion during the forecast period.

Government bodies across the world implemented initiatives to increase the availability of diagnostic tests, including nasopharyngeal swabs. These initiatives helped to drive demand for the swabs and have led to an increase in investment in the market. Technological advancements in nasopharyngeal swab manufacturing technology offers lucrative opportunities to market players. Companies are focusing on the development of more efficient, accurate, and reliable nasopharyngeal swabs in order to increase revenue.

A nasopharyngeal swab is used in clinical diagnostic procedure that entails taking a sample of nasal secretion from the nasopharynx region. This sample is analyzed to identify any organisms or clinical markers that may be responsible for a particular disease. This diagnostic method is commonly used for collecting samples for testing influenza, diphtheria, whooping cough, and other diseases caused by viruses such as MERS and COVID-19.

Nasopharyngeal swabs, also called NP swabs, provide a comprehensive analysis of the sample, allowing healthcare professionals to detect the presence of any organism or rule out potential causes.

According to the Lancet Microbe journal published in January 2023, nasal swab testing can identify previously undetected viruses by checking for the presence of a single immune system molecule, which is not typically included in standard tests.

Respiratory infectious diseases are a group of illness that primarily affect the respiratory system, including the lungs and airways. These are caused by various pathogens, including viruses, bacteria, fungi, and other microorganisms. These diseases can range from mild, self-limiting condition to severe, life threatening infections.

These infections mostly manifest as an acute condition with symptoms that can appear hours or days after the infection, including fever, coughing, sore throats, coryza, shortness of breath, wheezing, and/or breathing difficulties, following fast sociodemographic changes and undoubtedly climatic change.

Respiratory infectious diseases are a significant global health concern, as these lead to substantial morbidity, mortality, and economic impact. According to the World Health Organization (WHO), both in communicable and non-communicable diseases, respiratory infectious diseases rank number one, after heart and encephalic vascular diseases. Lower respiratory tract infections are the third largest cause of death globally; however, in countries with low economic standing, they rank first.

Respiratory infectious diseases pose significant challenges to public health worldwide. Prevention, early detection, and appropriate management are essential in controlling their spread. Increase in cases of respiratory infectious diseases has induced regulatory bodies to initiate early diagnosis program, leading to rise in demand for nasopharyngeal swabs.

In terms of type, the non-woven swabs segment dominated the global nasopharyngeal swabs market in 2022. The trend is expected to continue during the forecast period. Non-woven nasopharyngeal swabs are designed to be softer and more comfortable for patients during nasopharyngeal sampling process. They are engineered to provide better collection efficiency, ensuring the sample contains an adequate amount of biological material for accurate diagnostic testing and improve the reliability of test results.

Based on application, the COVID-19 segment led the global nasopharyngeal swabs market in 2022. The COVID-19 (coronavirus) pandemic increased the demand for nasopharyngeal swabs for testing during the preceding years. Research facilities and labs have stepped up their development-related experiments. Consequently, manufacturers have enhanced their capacity to provide nasopharyngeal swabs that are helpful for viral collection, maintenance, and culture.

Consumption of nasal swabs for COVID-test was high till 2022. The segment is likely to lose market share in the next few years, as the COVID-19 cases are continuously declining. However, the influenza segment is likely to grow at a rapid pace during the forecast period and dominate the market by the end of 2031.

Seasonal influenza an acute respiratory infection caused by influenza viruses due to a range of infections. The influenza A and B viruses spread and produce seasonal outbreaks of sickness during different seasons that prevail in several regions of the world.

According to a report published by WHO, in January 2023, annual epidemics such as seasonal influenza are predicted to cause 3 million to 5 million cases of severe disease and 290,000 to 650,000 respiratory deaths worldwide. Thus, demand for molecular testing to detect influenza viruses that cause severe diseases is continuously increasing, which boosts the usage of nasopharyngeal swabs across the globe.

In terms of end-user, the hospitals segment accounted for the largest global nasopharyngeal swabs market share in 2022. Hospitals are the major hubs for medical diagnostic testing, including respiratory virus testing. With a large number of patients seeking medical care during infectious disease outbreaks, hospitals have a substantial demand for nasopharyngeal swabs to conduct diagnostic tests efficiently.

Nasopharyngeal swabs have become the preferred method for respiratory infectious disease testing among healthcare providers due to their accuracy and reliability.

According to nasopharyngeal swabs market report, North America accounted for significant share in 2022. The region has innovative strategies for development of technologically advanced nasopharyngeal swabs. It has a well-developed healthcare infrastructure, which includes advanced diagnostic facilities and well-trained healthcare professionals. This has helped to support the adoption of nasopharyngeal swabs in the region.

As per nasopharyngeal swabs market forecast, Asia Pacific is expected to witness significant industry growth during the forecast period. This is ascribed to large and growing population and high prevalence of respiratory infectious diseases.

According to the Indian Council of Medical Research (ICMR) (March 2023), influenza A subtype H3N2 was the leading cause of growing respiratory illnesses in India. According to ICMR statistics, pan-respiratory virus surveillance has been implemented across 30 VRDLs by ICMR/DHR.

The surveillance results show an increase in the number of influenza A H3N2 cases. H3N2 was shown to have affected around half of all inpatient severe acute respiratory infections (SARI) and outpatient influenza-like diseases. Development of advanced diagnostic facilities, increase in number of trained healthcare professionals, rise in government investment in healthcare infrastructure, and high healthcare spending are driving the nasopharyngeal swabs market size in Asia Pacific.

Leading companies in the global nasopharyngeal swabs market are Medical Wire & Equipment (MWE), C. R. Bard, Inc. (Becton, Dickinson and Company), Titan Biotech Ltd., Miraclean Technology Co., Ltd., Thermo Fisher Scientific, Inc., Quidel Corporation, COPAN Diagnostics, Inc., YOCON Biology, Trinity Biotech, VIRCELL S.L, and Puritan Medical Products. These companies are increasingly focusing on strategic acquisitions and partnerships to expand product portfolio.

Each of these players has been profiled in the nasopharyngeal swabs market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 267.3 Mn |

|

Forecast (Value) in 2031 |

More than US$ 328.6 Mn |

|

Growth Rate (CAGR) |

2.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 267.3 Mn in 2022.

It is projected to reach US$ 328.6 Mn by 2031.

It is anticipated to expand at a CAGR of 2.4% from 2023 to 2031.

Rise in prevalence of respiratory infectious diseases, increase in awareness about disease diagnosis, and surge in demand for non-invasive and accurate sampling procedures.

North America is expected to account for the largest share of the market from 2023 to 2031.

Medical Wire & Equipment (MWE), C. R. Bard, Inc. (Becton, Dickinson and Company), Titan Biotech Ltd., Miraclean Technology Co., Ltd., Thermo Fisher Scientific, Inc., Quidel Corporation, COPAN Diagnostics, Inc., YOCON Biology, Trinity Biotech, VIRCELL S.L, Puritan Medical Products.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Nasopharyngeal Swabs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Nasopharyngeal Swabs Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events

5.2. Technological Advancements

5.3. Epidemiology of Infectious Diseases, by Country/Region

5.4. COVID-19 Pandemic Impact on Industry

6. Global Nasopharyngeal Swabs Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Foam Tipped Swabs

6.3.2. Non-woven Swabs

6.3.3. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Nasopharyngeal Swabs Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Influenza

7.3.2. COVID-19

7.3.3. Respiratory Syncytial Virus

7.3.4. Bordetella Pertussis Infection

7.3.5. MRSA (Methicillin-Resistant Staphylococcus aureus)

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Nasopharyngeal Swabs Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Academia & Research Institutes

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Nasopharyngeal Swabs Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Nasopharyngeal Swabs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017-2031

10.2.1. Foam Tipped Swabs

10.2.2. Non-woven Swabs

10.2.3. Others

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Influenza

10.3.2. COVID-19

10.3.3. Respiratory Syncytial Virus

10.3.4. Bordetella Pertussis Infection

10.3.5. MRSA (Methicillin-Resistant Staphylococcus aureus)

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Clinics

10.4.3. Academia & Research Institutes

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Nasopharyngeal Swabs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017-2031

11.2.1. Foam Tipped Swabs

11.2.2. Non-woven Swabs

11.2.3. Others

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Influenza

11.3.2. COVID-19

11.3.3. Respiratory Syncytial Virus

11.3.4. Bordetella Pertussis Infection

11.3.5. MRSA (Methicillin-Resistant Staphylococcus aureus)

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Clinics

11.4.3. Academia & Research Institutes

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Nasopharyngeal Swabs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2031

12.2.1. Foam Tipped Swabs

12.2.2. Non-woven Swabs

12.2.3. Others

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Influenza

12.3.2. COVID-19

12.3.3. Respiratory Syncytial Virus

12.3.4. Bordetella Pertussis Infection

12.3.5. MRSA (Methicillin-Resistant Staphylococcus aureus)

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Clinics

12.4.3. Academia & Research Institutes

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Nasopharyngeal Swabs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017-2031

13.2.1. Foam Tipped Swabs

13.2.2. Non-woven Swabs

13.2.3. Others

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Influenza

13.3.2. COVID-19

13.3.3. Respiratory Syncytial Virus

13.3.4. Bordetella Pertussis Infection

13.3.5. MRSA (Methicillin-Resistant Staphylococcus aureus)

13.3.6. Others

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Clinics

13.4.3. Academia & Research Institutes

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Nasopharyngeal Swabs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017-2031

14.2.1. Foam Tipped Swabs

14.2.2. Non-woven Swabs

14.2.3. Others

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Influenza

14.3.2. COVID-19

14.3.3. Respiratory Syncytial Virus

14.3.4. Bordetella Pertussis Infection

14.3.5. MRSA (Methicillin-Resistant Staphylococcus aureus)

14.3.6. Others

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Clinics

14.4.3. Academia & Research Institutes

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Thermo Fisher Scientific, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. C. R. Bard, Inc. (Becton, Dickinson and Company)

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Medical Wire & Equipment (MWE)

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Titan Biotech Ltd.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. COPAN Diagnostics, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Miraclean Technology Co., Ltd.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Puritan Medical Products

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. YOCON Biology

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Trinity Biotech

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. VIRCELL S.L.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Quidel Corporation

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

List of Tables

Table 1: Global Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 2: Global Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 3: Global Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 4: Global Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 5: North America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 6: North America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 7: North America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 8: North America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 9: Europe Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 10: Europe Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 11: Europe Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 12: Europe Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 13: Asia Pacific Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 14: Asia Pacific Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 15: Asia Pacific Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 17: Latin America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 18: Latin America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Latin America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 20: Latin America Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 21: Middle East and Africa Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 22: Middle East and Africa Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 23: Middle East and Africa Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 24: Middle East and Africa Nasopharyngeal Swabs Market Size (US$ Mn) Forecast, by Region, 2017-2031

List of Figures

Figure 01: Global Nasopharyngeal Swabs Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Nasopharyngeal Swabs Market Value Share, by Type, 2022

Figure 03: Global Nasopharyngeal Swabs Market Value Share, by Application, 2022

Figure 04: Global Nasopharyngeal Swabs Market Value Share, by End-user, 2022

Figure 05: Global Nasopharyngeal Swabs Market Value Share Analysis, by Type, 2022 and 2031

Figure 06: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Foam Tipped Swabs, 2017-2031

Figure 07: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Non-woven Swabs, 2017-2031

Figure 08: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 09: Global Nasopharyngeal Swabs Market Attractiveness Analysis, by Type, 2023-2031

Figure 10: Global Nasopharyngeal Swabs Market Value Share Analysis, by Application, 2022 and 2031

Figure 11: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Influenza, 2017-2031

Figure 12: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by COVID-19, 2017-2031

Figure 13: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Respiratory Syncytial Virus, 2017-2031

Figure 14: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Bordetella Pertussis Infection, 2017-2031

Figure 15: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by MRSA (Methicillin-Resistant Staphylococcus aureus), 2017-2031

Figure 16: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 17: Global Nasopharyngeal Swabs Market Attractiveness Analysis, by Application, 2023-2031

Figure 18: Global Nasopharyngeal Swabs Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Hospitals, 2017-2031

Figure 20: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Clinics 2017-2032

Figure 21: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 22: Global Nasopharyngeal Swabs Market Revenue (US$ Mn), by Academia & Research Institutes

Figure 23: Global Nasopharyngeal Swabs Market Attractiveness Analysis, by End-user 2023-2031

Figure 24: Global Nasopharyngeal Swabs Market Value Share Analysis, by Region 2022 and 2031

Figure 25: Global Nasopharyngeal Swabs Market Attractiveness Analysis, by Region 2023-2031

Figure 26: North America Nasopharyngeal Swabs Market Value (US$ Mn) Forecast, 2017-2031

Figure 27: North America Nasopharyngeal Swabs Market Value Share Analysis, by Country 2022 and 2031

Figure 28: North America Nasopharyngeal Swabs Market Attractiveness Analysis, by Country 2023-2031

Figure 29: North America Nasopharyngeal Swabs Market Value Share Analysis, by Type 2022 and 2031

Figure 30: North America Nasopharyngeal Swabs Market Attractiveness Analysis, by Type 2023-2031

Figure 31: North America Nasopharyngeal Swabs Market Value Share Analysis, by Application 2022 and 2031

Figure 32: North America Nasopharyngeal Swabs Market Attractiveness Analysis, by Application 2023-2031

Figure 33: North America Nasopharyngeal Swabs Market Value Share Analysis, by End-user 2022 and 2031

Figure 34: North America Nasopharyngeal Swabs Market Attractiveness Analysis, by End-user 2023-2031

Figure 35: Europe Nasopharyngeal Swabs Market Value (US$ Mn) Forecast, 2017-2031

Figure 36: Europe Nasopharyngeal Swabs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Europe Nasopharyngeal Swabs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 38: Europe Nasopharyngeal Swabs Market Value Share Analysis, by Type 2022 and 2031

Figure 39: Europe Nasopharyngeal Swabs Market Attractiveness Analysis, by Type 2023-2031

Figure 40: Europe Nasopharyngeal Swabs Market Value Share Analysis, by Application 2022 and 2031

Figure 41: Europe Nasopharyngeal Swabs Market Attractiveness Analysis, by Application 2023-2031

Figure 42: Europe Nasopharyngeal Swabs Market Value Share Analysis, by End-user 2022 and 2031

Figure 43: Europe Nasopharyngeal Swabs Market Attractiveness Analysis, by End-user 2023-2031

Figure 44: Asia Pacific Nasopharyngeal Swabs Market Value (US$ Mn) Forecast, 2017-2031

Figure 45: Asia Pacific Nasopharyngeal Swabs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 46: Asia Pacific Nasopharyngeal Swabs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 47: Asia Pacific Nasopharyngeal Swabs Market Value Share Analysis, by Type 2022 and 2031

Figure 48: Asia Pacific Nasopharyngeal Swabs Market Attractiveness Analysis, by Type 2023-2031

Figure 49: Asia Pacific Nasopharyngeal Swabs Market Value Share Analysis, by Application 2022 and 2031

Figure 50: Asia Pacific Nasopharyngeal Swabs Market Attractiveness Analysis, by Application 2023-2031

Figure 51: Asia Pacific Nasopharyngeal Swabs Market Value Share Analysis, by End-user 2022 and 2031

Figure 52: Asia Pacific Nasopharyngeal Swabs Market Attractiveness Analysis, by End-user 2023-2031

Figure 53: Latin America Nasopharyngeal Swabs Market Value (US$ Mn) Forecast, 2017-2031

Figure 54: Latin America Nasopharyngeal Swabs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55: Latin America Nasopharyngeal Swabs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 56: Latin America Nasopharyngeal Swabs Market Value Share Analysis, by Type 2022 and 2031

Figure 57: Latin America Nasopharyngeal Swabs Market Attractiveness Analysis, by Type 2023-2031

Figure 58: Latin America Nasopharyngeal Swabs Market Value Share Analysis, by Application 2022 and 2031

Figure 59: Latin America Nasopharyngeal Swabs Market Attractiveness Analysis, by Application 2023-2031

Figure 60: Latin America Nasopharyngeal Swabs Market Value Share Analysis, by End-user 2022 and 2031

Figure 61: Latin America Nasopharyngeal Swabs Market Attractiveness Analysis, by End-user 2023-2031

Figure 62: Middle East and Africa Nasopharyngeal Swabs Market Value (US$ Mn), 2017-2031

Figure 63: Middle East and Africa Nasopharyngeal Swabs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 64: Middle East and Africa Nasopharyngeal Swabs Market Attractiveness, by Country/Sub-region, 2023-2031

Figure 65: Middle East and Africa Nasopharyngeal Swabs Market Value Share Analysis, by Type 2022 and 2031

Figure 66: Middle East and Africa Nasopharyngeal Swabs Market Attractiveness, by Type 2023-2031

Figure 67: Middle East and Africa Nasopharyngeal Swabs Market Value Share Analysis, by Application 2022 and 2031

Figure 68: Middle East and Africa Nasopharyngeal Swabs Market Attractiveness, by Application 2023-2031

Figure 69: Middle East and Africa Nasopharyngeal Swabs Market Value Share Analysis, by End-user 2022 and 2031

Figure 70: Middle East and Africa Nasopharyngeal Swabs Market Attractiveness by End-user 2023-2031

Figure 71: Company Share Analysis Nasopharyngeal Swabs, 2022